Home > Comparison > Consumer Cyclical > AMZN vs MELI

The strategic rivalry between Amazon.com, Inc. and MercadoLibre, Inc. shapes the evolving landscape of global specialty retail. Amazon operates as a vast, capital-intensive e-commerce and cloud services powerhouse, while MercadoLibre excels as a nimble, technology-driven marketplace and fintech platform in Latin America. This head-to-head highlights a contest between global scale and regional innovation. This analysis aims to identify which company offers a superior risk-adjusted return for diversified investors.

Table of contents

Companies Overview

Amazon.com, Inc. and MercadoLibre, Inc. define giants in global and Latin American e-commerce, respectively. Both command significant market influence and innovation in specialty retail.

Amazon.com, Inc.: Global E-Commerce and Cloud Powerhouse

Amazon dominates the global specialty retail sector by selling consumer products and subscriptions online and in stores. Its revenue streams span retail merchandise, third-party seller services, and Amazon Web Services (AWS) cloud computing. In 2026, the company sharpens focus on expanding AWS and enhancing its Prime membership ecosystem to drive customer loyalty and margin growth.

MercadoLibre, Inc.: Latin America’s E-Commerce and FinTech Leader

MercadoLibre leads Latin America’s e-commerce through its Marketplace platform, enabling seamless buying and selling. Its core revenue comes from transaction fees, financial services via Mercado Pago, and logistics solutions. The firm prioritizes strengthening its FinTech offerings and logistics network in 2026 to deepen market penetration and capture the region’s digital commerce growth.

Strategic Collision: Similarities & Divergences

Amazon and MercadoLibre both leverage platform-based ecosystems but differ in scope and focus. Amazon integrates retail and cloud services globally; MercadoLibre combines e-commerce with FinTech in Latin America. Their competition centers on customer engagement and fulfillment efficiency. Amazon’s scale offers diversification; MercadoLibre’s regional specialization presents unique growth dynamics for investors.

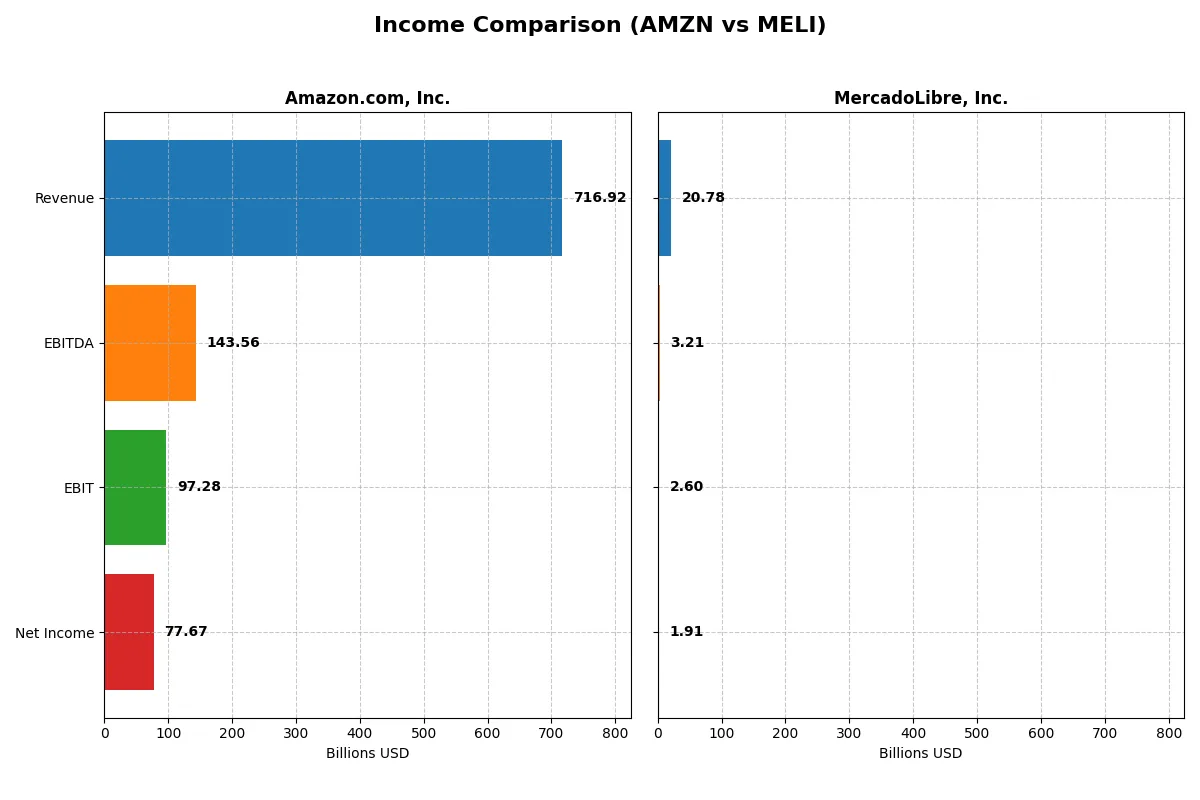

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Amazon.com, Inc. (AMZN) | MercadoLibre, Inc. (MELI) |

|---|---|---|

| Revenue | 717B | 20.8B |

| Cost of Revenue | 356.4B | 11.2B |

| Operating Expenses | 280.5B | 6.95B |

| Gross Profit | 360.5B | 9.58B |

| EBITDA | 143.6B | 3.21B |

| EBIT | 97.3B | 2.60B |

| Interest Expense | 2.27B | 153M |

| Net Income | 77.7B | 1.91B |

| EPS | 7.29 | 37.69 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and momentum in converting revenue into profit.

Amazon.com, Inc. Analysis

Amazon’s revenue rose from $470B in 2021 to $717B in 2025, showing consistent growth. Net income surged from $33B to $77.7B, reflecting robust margin expansion. Its gross margin stands at a healthy 50.3%, and net margin improved to 10.8%. The 2025 year highlights strong momentum with a 12.4% revenue increase and a 16.7% net margin rise, signaling operational leverage.

MercadoLibre, Inc. Analysis

MercadoLibre grew revenue from $7.1B in 2021 to $20.8B in 2024, exhibiting rapid expansion. Net income climbed dramatically from $83M to $1.91B, with net margin reaching 9.2%. Its gross margin remains solid at 46.1%. The latest year shows exceptional growth momentum: 37.5% revenue growth and a 40.8% jump in net margin, reflecting accelerating profitability and disciplined expense control.

Verdict: Scale Dominance vs. High Growth Agility

Amazon delivers scale and strong margin improvements with a $717B revenue base and 10.8% net margin. MercadoLibre, though smaller at $21B revenue, posts explosive growth and sharp margin gains. Amazon’s profile suits investors seeking stable, large-cap profitability. MercadoLibre appeals to those prioritizing rapid growth and margin expansion in emerging markets.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Amazon.com, Inc. (AMZN) | MercadoLibre, Inc. (MELI) |

|---|---|---|

| ROE | 18.9% | 43.9% |

| ROIC | 10.7% | 17.7% |

| P/E | 31.8 | 45.1 |

| P/B | 6.0 | 19.8 |

| Current Ratio | 1.05 | 1.21 |

| Quick Ratio | 0.88 | 1.20 |

| D/E | 0.37 | 1.57 |

| Debt-to-Assets | 18.7% | 27.2% |

| Interest Coverage | 35.2 | 17.2 |

| Asset Turnover | 0.88 | 0.82 |

| Fixed Asset Turnover | 2.01 | 8.38 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational excellence that raw numbers alone cannot reveal.

Amazon.com, Inc.

Amazon delivers solid profitability with an 18.9% ROE and a favorable 10.8% net margin, reflecting operational strength. However, its valuation appears stretched, marked by a high 31.8 P/E and a 6.0 P/B ratio. Amazon offers no dividends, instead reinvesting heavily in R&D and growth initiatives, signaling confidence in future expansion.

MercadoLibre, Inc.

MercadoLibre boasts a commanding 43.9% ROE and a robust 17.7% ROIC, showcasing superior capital efficiency. Yet, its valuation is expensive, with a 45.1 P/E and nearly 20 P/B, reflecting high growth expectations. The company returns no dividends, focusing on reinvesting free cash flow into technology and market expansion, consistent with its growth profile.

Valuation Discipline vs. Growth Efficiency

Amazon balances operational strength with a stretched valuation, while MercadoLibre excels in capital returns but trades at a premium. Amazon’s profile suits investors prioritizing steady reinvestment and moderate risk. MercadoLibre fits those seeking aggressive growth with higher valuation risk.

Which one offers the Superior Shareholder Reward?

I observe that neither Amazon nor MercadoLibre pays dividends, focusing instead on reinvestment and buybacks. Amazon’s payout ratio is zero, with minimal free cash flow per share (~0.7), limiting buyback potential. MercadoLibre shows stronger free cash flow (139B in 2024) and a more aggressive buyback capacity supported by higher operating cash flow. Amazon’s distribution philosophy leans on growth and capex, while MercadoLibre balances growth with cash returns through buybacks. Given MercadoLibre’s sustainable free cash flow and lower valuation multiples relative to its cash generation, I conclude MercadoLibre offers a more attractive total return profile for 2026 investors.

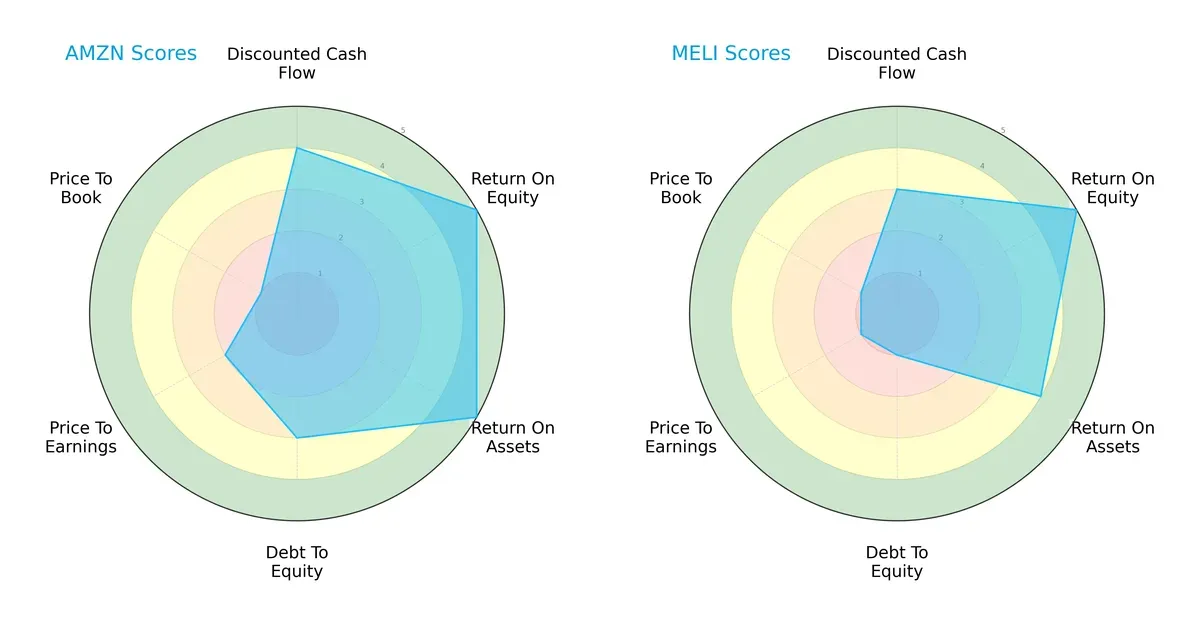

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Amazon.com, Inc. and MercadoLibre, Inc., highlighting their operational efficiencies and valuation challenges:

Amazon displays a balanced profile with strong ROE (5) and ROA (5), supported by a solid DCF score (4). Its moderate debt-to-equity score (3) contrasts with MercadoLibre’s weaker financial leverage (1). MercadoLibre matches Amazon’s ROE (5) but lags on DCF (3) and asset utilization (ROA 4). Both companies face valuation headwinds with low P/E and P/B scores, yet Amazon maintains a more diversified strength across metrics.

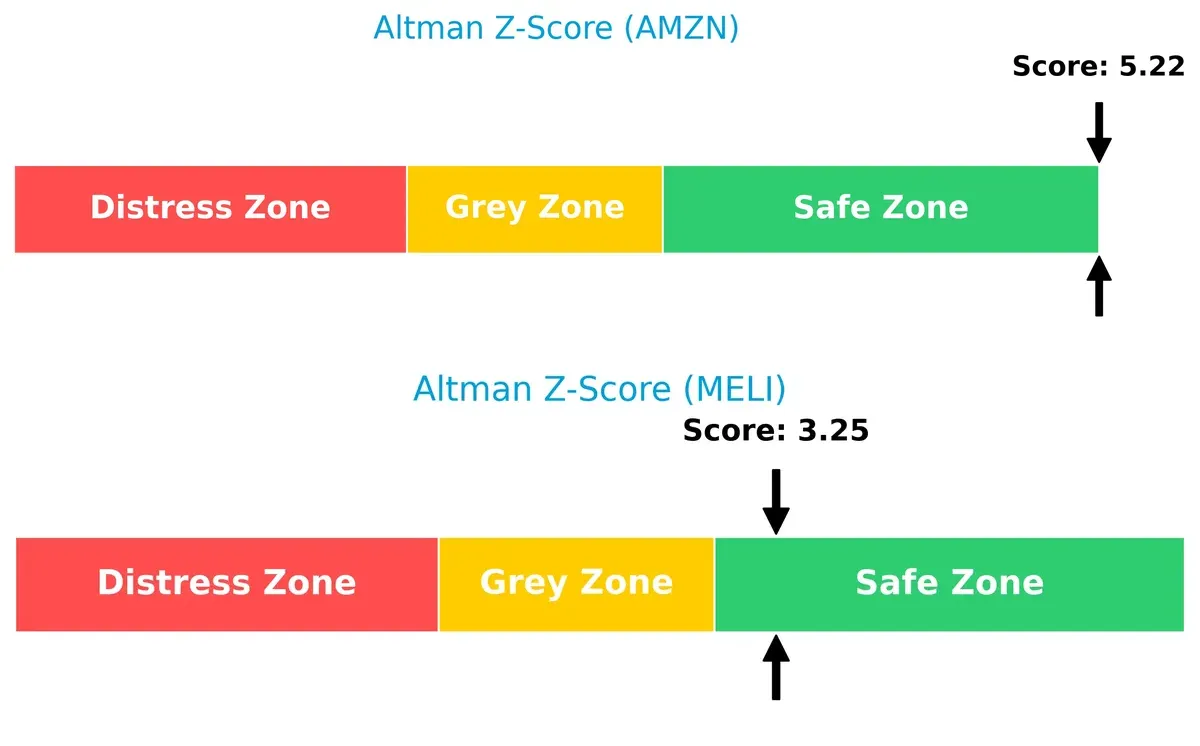

Bankruptcy Risk: Solvency Showdown

Amazon’s Altman Z-Score of 5.22 significantly surpasses MercadoLibre’s 3.25, placing both in the safe zone but underscoring Amazon’s superior solvency and lower bankruptcy risk in this cycle:

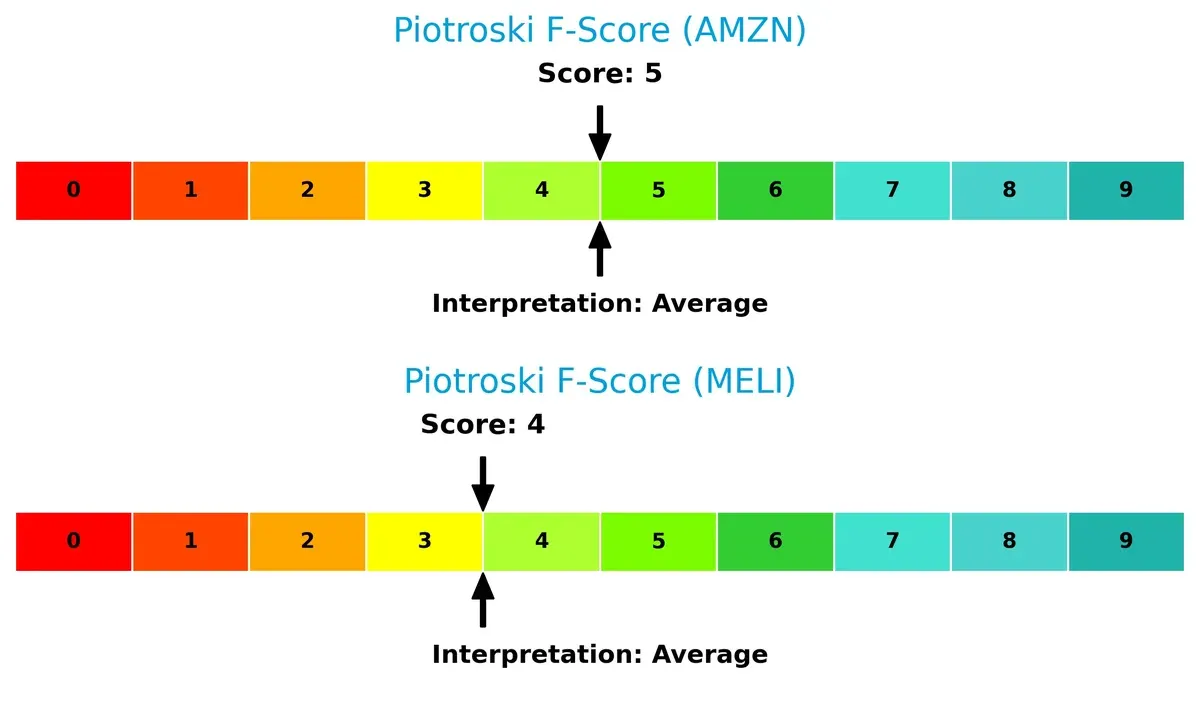

Financial Health: Quality of Operations

Amazon’s Piotroski F-Score of 5 edges out MercadoLibre’s 4, indicating slightly better operational quality. Neither company hits peak financial health, but Amazon’s internal metrics show fewer red flags:

How are the two companies positioned?

This section dissects the operational DNA of Amazon and MercadoLibre by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the more resilient, sustainable competitive advantage today.

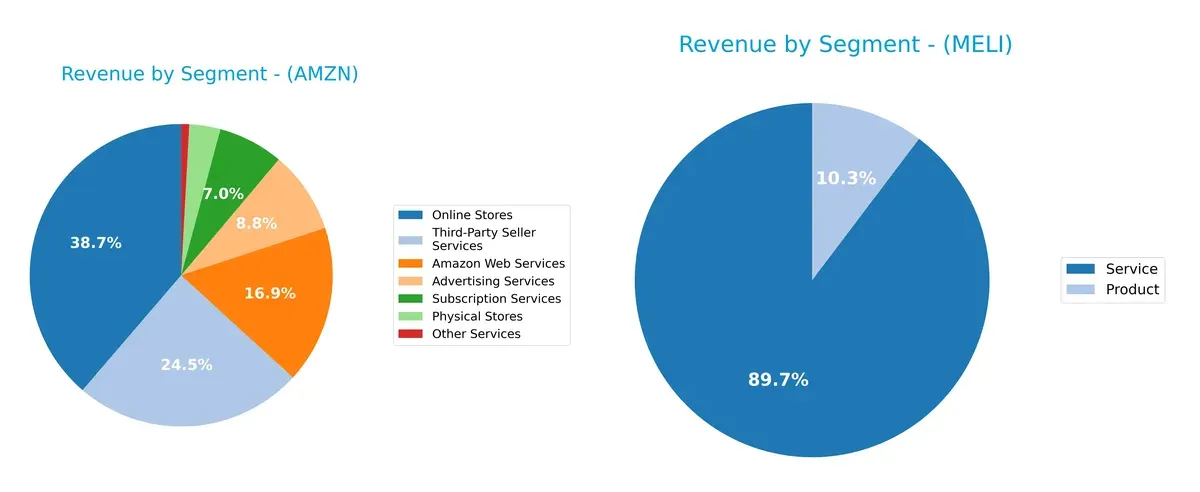

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

Amazon.com, Inc. exhibits a broad revenue base, anchored by Online Stores at $247B and complemented by AWS at $108B and Third-Party Seller Services at $156B. MercadoLibre, Inc. leans heavily on Services at $18.6B versus $2.1B in Products, reflecting a more concentrated strategy. Amazon’s mix suggests ecosystem lock-in and infrastructure dominance, while MercadoLibre’s focus on Services heightens exposure to single-segment risk amid evolving fintech and commerce dynamics.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Amazon.com, Inc. and MercadoLibre, Inc.:

Amazon Strengths

- Highly diversified revenue streams across e-commerce, cloud, ads, and subscriptions

- Strong global presence with significant North America and Europe sales

- Favorable profitability ratios including net margin and ROIC

- Low debt-to-equity ratio and strong interest coverage

MercadoLibre Strengths

- Strong profitability shown by high ROE and ROIC

- Favorable quick ratio indicating good liquidity

- High fixed asset turnover suggesting efficient use of assets

- Growing revenue in Latin America with focus on commerce and fintech

Amazon Weaknesses

- Unfavorable valuation metrics with high P/E and P/B ratios

- Neutral liquidity ratios may indicate tight working capital

- Zero dividend yield may deter income-focused investors

- Asset turnover is only neutral despite scale

MercadoLibre Weaknesses

- Unfavorable debt-to-equity ratio signaling higher leverage risk

- Elevated WACC and valuation multiples suggest expensive capital

- Narrow geographic focus limited to Latin American markets

- Net margin only neutral despite strong ROE

Both companies exhibit slightly favorable overall financial profiles with clear strengths in profitability and operational efficiency. Amazon’s broad global footprint and diversification contrast with MercadoLibre’s concentrated Latin American exposure and higher leverage, shaping distinct strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from competitive erosion. Only a durable advantage preserves value in evolving markets:

Amazon.com, Inc.: Scale and Ecosystem Synergy

Amazon’s moat stems from vast scale and integrated ecosystem, driving margin stability and strong ROIC trends despite shedding value versus WACC. Expansion in AWS and retail keeps this moat evolving in 2026.

MercadoLibre, Inc.: FinTech-Enabled Network Effect

MercadoLibre’s competitive edge relies on its FinTech platform amplifying marketplace network effects, reflected in ROIC well above WACC. Rapid growth and deepening financial services in Latin America reinforce its moat’s strength.

Verdict: Scale Ecosystem vs. FinTech Network Effect

MercadoLibre boasts a wider, more sustainable moat with ROIC far exceeding WACC and explosive growth. Amazon’s scale is immense but its economic profit margin remains thin. MercadoLibre appears better positioned to defend market share amid rising competition.

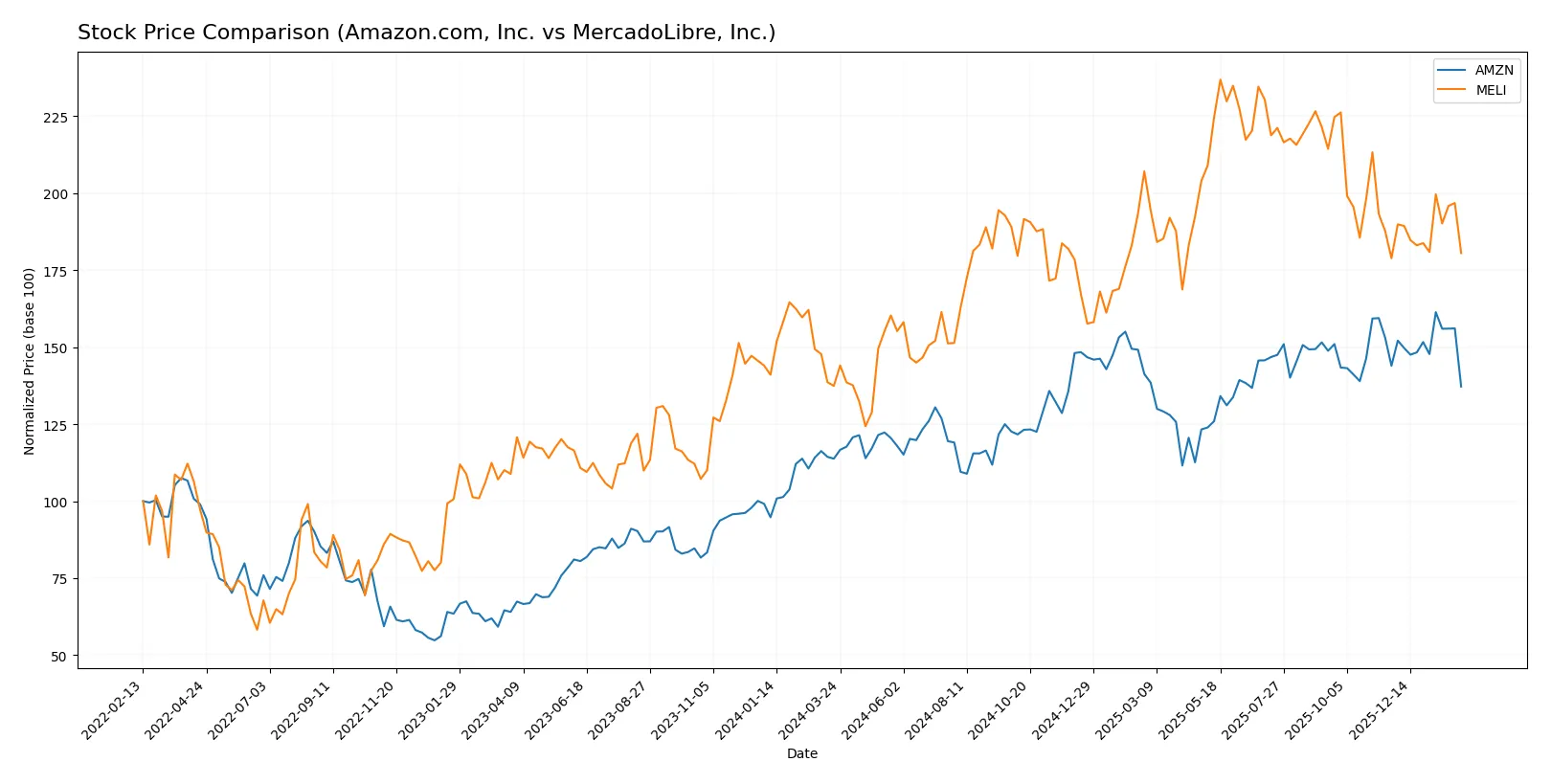

Which stock offers better returns?

The past year shows Amazon.com, Inc. and MercadoLibre, Inc. both with strong price gains but diverging momentum and volume patterns.

Trend Comparison

Amazon’s stock rose 20.58% over the past 12 months, marking a bullish trend with decelerating momentum and a high volatility of 21.86. It peaked at 247.38 and troughed at 166.94.

MercadoLibre gained 31.39% during the same period, sustaining a bullish trend with accelerating price gains and extreme volatility at 295.17. Its price ranged between 1356.43 and 2584.92.

MercadoLibre outperformed Amazon in total return over the year, showing stronger acceleration and higher volatility, despite both stocks posting bullish trends.

Target Prices

Analysts present a bullish consensus for both Amazon.com, Inc. and MercadoLibre, Inc., reflecting strong growth expectations.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Amazon.com, Inc. | 175 | 315 | 283.86 |

| MercadoLibre, Inc. | 2750 | 2900 | 2862.5 |

Amazon’s target consensus is roughly 35% above its current price of $210.32, signaling upside potential. MercadoLibre’s targets exceed its $1970 price by about 45%, indicating strong analyst confidence despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Amazon.com, Inc. Grades

The following table summarizes recent grades assigned to Amazon by reputable firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Maintain | Outperform | 2026-02-06 |

| Oppenheimer | Maintain | Outperform | 2026-02-06 |

| Wedbush | Maintain | Outperform | 2026-02-06 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-06 |

| Argus Research | Maintain | Buy | 2026-02-06 |

| Telsey Advisory Group | Maintain | Outperform | 2026-02-06 |

| Piper Sandler | Maintain | Overweight | 2026-02-06 |

| Citizens | Maintain | Market Outperform | 2026-02-06 |

| RBC Capital | Maintain | Outperform | 2026-02-06 |

| Wells Fargo | Maintain | Overweight | 2026-02-06 |

MercadoLibre, Inc. Grades

Below are the latest grades assigned to MercadoLibre by established grading institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-02-04 |

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-30 |

Which company has the best grades?

Amazon consistently receives “Outperform” and “Buy” grades, reflecting strong institutional confidence. MercadoLibre earns mostly “Buy” and “Outperform” ratings, with some “Neutral” views. Amazon’s slightly higher consensus grades may inspire greater investor conviction.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both Amazon.com, Inc. and MercadoLibre, Inc. in the 2026 market environment:

1. Market & Competition

Amazon.com, Inc.

- Faces intense global retail and cloud competition, with margin pressures despite scale advantages.

MercadoLibre, Inc.

- Competes in Latin America with regional rivals; growth constrained by economic volatility and emerging fintech challengers.

2. Capital Structure & Debt

Amazon.com, Inc.

- Maintains moderate debt levels (D/E 0.37), strong interest coverage (42.78x), signaling balanced leverage.

MercadoLibre, Inc.

- High debt ratio (D/E 1.57) raises financial risk, though interest coverage (16.97x) remains adequate.

3. Stock Volatility

Amazon.com, Inc.

- Beta at 1.39 indicates above-market volatility; large market cap buffers shocks.

MercadoLibre, Inc.

- Higher beta of 1.45 suggests elevated sensitivity to market swings and regional instability.

4. Regulatory & Legal

Amazon.com, Inc.

- Subject to stringent U.S. and EU regulations affecting data privacy, competition, and labor.

MercadoLibre, Inc.

- Faces complex Latin American regulatory environments with evolving fintech and e-commerce laws.

5. Supply Chain & Operations

Amazon.com, Inc.

- Large, diversified supply chain with robust logistics but vulnerable to global disruptions.

MercadoLibre, Inc.

- Reliant on third-party carriers and regional logistics providers; susceptible to infrastructure constraints.

6. ESG & Climate Transition

Amazon.com, Inc.

- Significant pressure to reduce carbon footprint; investments in renewable energy ongoing but costly.

MercadoLibre, Inc.

- Emerging ESG frameworks in Latin America create uncertainty; climate risks affect operations and financing.

7. Geopolitical Exposure

Amazon.com, Inc.

- Global footprint exposes it to trade tensions, tariffs, and geopolitical shifts, especially U.S.-China relations.

MercadoLibre, Inc.

- Concentrated in Latin America, faces political instability, currency volatility, and regulatory unpredictability.

Which company shows a better risk-adjusted profile?

Amazon’s moderate debt, stronger interest coverage, and diversified global presence offer more balanced risk management. MercadoLibre’s high leverage and regional concentration increase vulnerability, despite strong returns. Amazon’s safer Altman Z-Score (5.22 vs. 3.25) confirms superior financial stability. MercadoLibre’s debt-to-equity and valuation multiples signal heightened risk. The key concern for Amazon is intense global competition compressing margins. For MercadoLibre, financial leverage and geopolitical exposure remain the largest risk. Overall, Amazon presents a cleaner risk-adjusted profile amid 2026 uncertainties.

Final Verdict: Which stock to choose?

Amazon.com, Inc. (AMZN) excels as a cash-generating behemoth with steadily improving profitability. Its growing ROIC signals rising operational efficiency, yet investors should watch its stretched valuation multiples. AMZN suits portfolios aiming for large-cap growth with a tolerance for valuation premium and cyclical pressures.

MercadoLibre, Inc. (MELI) commands a robust strategic moat through its dominant Latin American e-commerce and fintech platforms. Its superior ROIC versus WACC and accelerating growth profile offer a powerful growth engine. MELI fits well in GARP portfolios seeking high growth but at a higher debt and valuation risk.

If you prioritize steady large-cap growth with expanding profitability, Amazon outshines with its improving operational metrics and strong cash flows. However, if you seek aggressive growth backed by a sustainable moat and market leadership in emerging markets, MercadoLibre offers better growth momentum despite elevated financial leverage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Amazon.com, Inc. and MercadoLibre, Inc. to enhance your investment decisions: