Home > Comparison > Technology > GOOGL vs TWLO

The strategic rivalry between Alphabet Inc. and Twilio Inc. shapes the evolving landscape of digital communication and cloud services. Alphabet, a technology behemoth with diversified internet platforms, contrasts sharply with Twilio’s focused cloud communications model within the communication services sector. This head-to-head pits expansive scale against nimble innovation. This analysis aims to identify which corporate trajectory offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

Alphabet Inc. and Twilio Inc. stand as pivotal players in the evolving digital communication and internet services landscape.

Alphabet Inc.: The Digital Ecosystem Giant

Alphabet dominates as a technology powerhouse with a vast ecosystem spanning Google Services, Cloud, and Other Bets. Its core revenue stems from advertising across platforms like Search and YouTube, alongside Google Cloud’s enterprise services. In 2026, Alphabet focuses strategically on expanding cloud infrastructure and AI integration to sustain its competitive edge.

Twilio Inc.: The Cloud Communications Enabler

Twilio leads in cloud communications, offering APIs that empower developers to embed voice, messaging, video, and email into software applications. Its revenue grows via scalable customer engagement solutions. In 2026, Twilio prioritizes broadening its platform capabilities and scaling globally to meet rising developer demand.

Strategic Collision: Similarities & Divergences

Both firms thrive on technology-driven innovation yet diverge in scope—Alphabet favors a closed ecosystem integrating diverse services, while Twilio champions open API infrastructure. Their primary conflict unfolds in cloud and communication services, targeting enterprise clients. Alphabet offers a vast, diversified portfolio, whereas Twilio presents a focused, scalable growth profile.

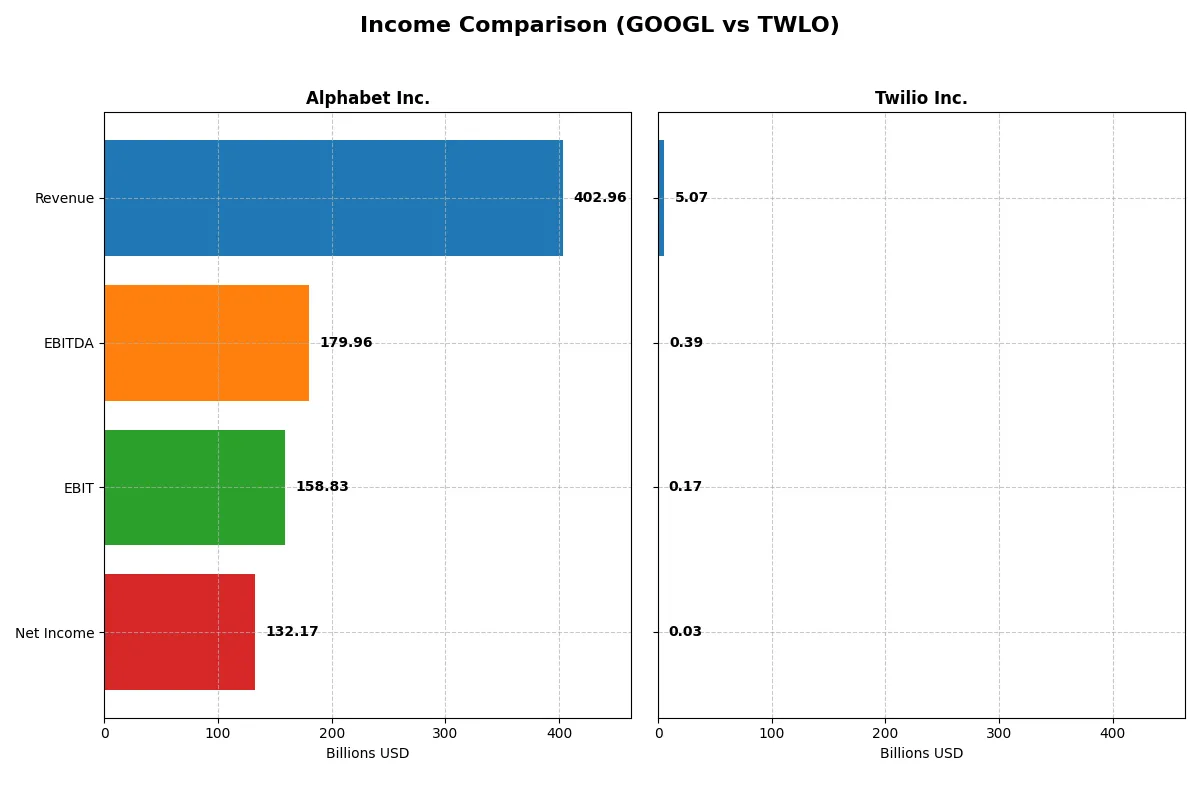

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Alphabet Inc. (GOOGL) | Twilio Inc. (TWLO) |

|---|---|---|

| Revenue | 403B | 5.1B |

| Cost of Revenue | 163B | 2.6B |

| Operating Expenses | 111B | 2.3B |

| Gross Profit | 240B | 2.4B |

| EBITDA | 180B | 392M |

| EBIT | 159B | 175M |

| Interest Expense | 143M | 0 |

| Net Income | 132B | 34M |

| EPS | 10.91 | 0.22 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison will uncover which company operates its business with superior efficiency and profitability over recent years.

Alphabet Inc. Analysis

Alphabet’s revenue surged from 258B in 2021 to 403B in 2025, with net income climbing from 76B to 132B. The company sustains a robust gross margin near 60% and a net margin improving to 32.8%, reflecting disciplined cost control despite higher operating expenses. In 2025, EBIT jumped 32%, signaling strong momentum and operational leverage.

Twilio Inc. Analysis

Twilio grew revenue from 2.8B in 2021 to 5.1B in 2025 while turning net losses into a modest 34M profit in 2025. Gross margins increased to 48%, but net margins remain slim at 0.67%. The company posted a significant EBIT turnaround with a 297% growth in 2025, underscoring improving operational efficiency, although profitability remains fragile.

Profitability Strength vs. Growth Recovery

Alphabet clearly leads in scale and margin quality, with consistent profit expansion and high returns on revenue. Twilio shows impressive growth and margin recovery but struggles to convert scale into meaningful net income. For investors, Alphabet’s profile offers steady, high-margin profit growth, while Twilio presents a higher-risk growth rebound with tentative profitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Alphabet Inc. (GOOGL) | Twilio Inc. (TWLO) |

|---|---|---|

| ROE | 31.8% | 0.4% |

| ROIC | 21.8% | 1.2% |

| P/E | 28.7 | 643.2 |

| P/B | 9.13 | 2.78 |

| Current Ratio | 2.01 | 4.03 |

| Quick Ratio | 2.01 | 4.03 |

| D/E | 0.17 | 0.15 |

| Debt-to-Assets | 12.1% | 11.6% |

| Interest Coverage | 903.3 | 0 |

| Asset Turnover | 0.68 | 0.52 |

| Fixed Asset Turnover | 1.54 | 23.46 |

| Payout ratio | 7.6% | 0% |

| Dividend yield | 0.26% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths critical for investment decisions.

Alphabet Inc.

Alphabet posts a robust 31.8% ROE and a strong 32.8% net margin, signaling efficient profitability. Its P/E of 28.7 appears stretched versus typical market levels, reflecting premium valuation. Shareholders receive minimal dividends (0.26% yield), with capital predominantly reinvested in R&D, fueling sustained growth and competitive moats.

Twilio Inc.

Twilio’s profitability metrics lag with a 0.43% ROE and a razor-thin 0.67% net margin, indicating weak operational returns. Its sky-high P/E of 643 signals an expensive, speculative valuation. The company pays no dividend, focusing heavily on R&D to drive future expansion, but current returns suggest heightened risk without immediate shareholder payback.

Premium Valuation vs. Operational Safety

Alphabet offers superior profitability and a balanced capital structure but trades at a premium multiple. Twilio’s valuation is richly stretched with poor current returns and high reinvestment risk. Investors seeking operational safety favor Alphabet, while those pursuing high-risk growth might consider Twilio’s profile.

Which one offers the Superior Shareholder Reward?

I compare Alphabet Inc. (GOOGL) and Twilio Inc. (TWLO) on shareholder rewards. Alphabet pays a modest dividend yielding 0.27%, backed by a sustainable payout ratio near 7.6%. Its steady buybacks enhance returns, reflecting strong free cash flow (6B+ FCF). Twilio pays no dividend but reinvests heavily in growth, evidenced by negative margins and no payout. Buybacks are minimal or absent, limiting immediate shareholder reward. Alphabet’s balanced distribution—dividends plus buybacks—offers more reliable, sustainable returns. I conclude Alphabet delivers superior total shareholder reward in 2026, combining income and capital appreciation potential.

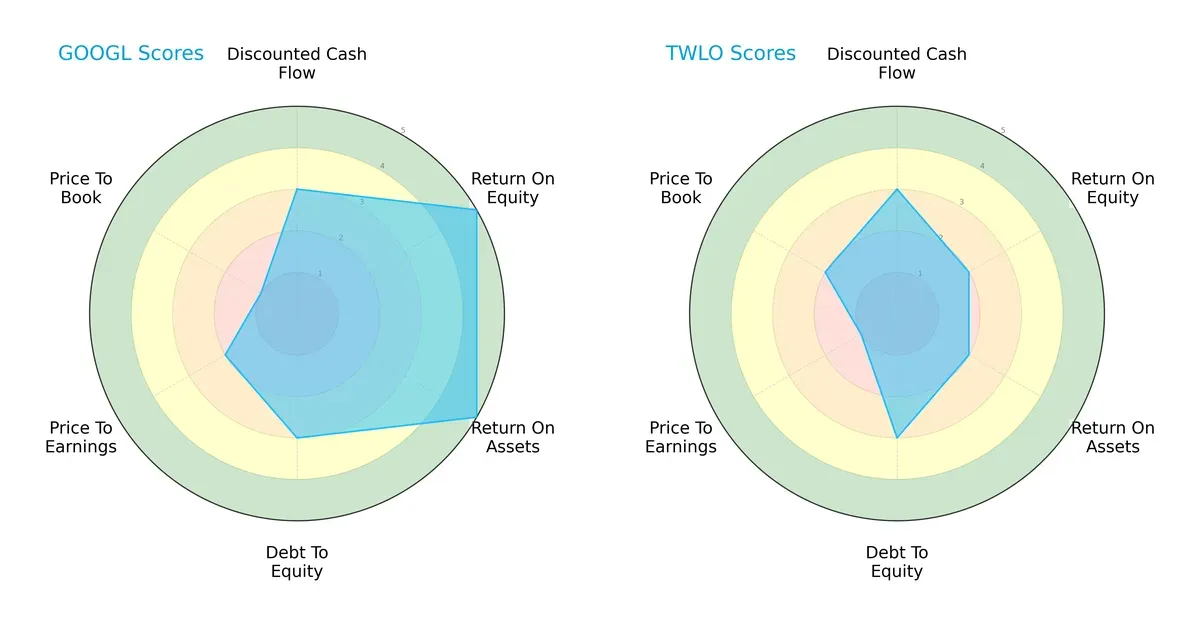

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Alphabet Inc. and Twilio Inc., highlighting their financial strengths and valuation challenges:

Alphabet displays a more balanced profile with very favorable returns on equity (5) and assets (5), moderate debt management (3), but suffers from valuation headwinds (PE 2, PB 1). Twilio relies on moderate discounted cash flow (3) but shows weaker profitability metrics (ROE 2, ROA 2) and less attractive valuation scores (PE 1, PB 2). Alphabet’s diversified strengths indicate stability, while Twilio depends on a narrower competitive edge.

Bankruptcy Risk: Solvency Showdown

Alphabet’s Altman Z-Score of 15.53 far surpasses Twilio’s 5.13, placing both firms in the safe zone but signaling Alphabet’s superior financial resilience in this cycle:

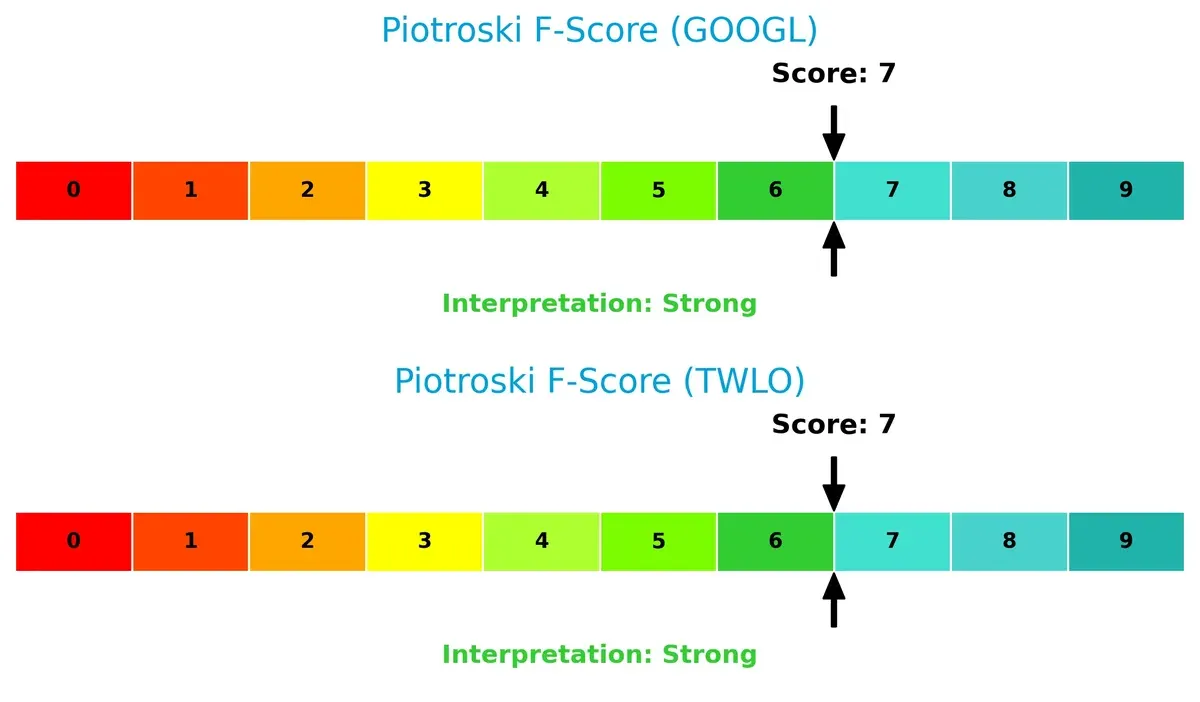

Financial Health: Quality of Operations

Both firms score 7 on the Piotroski F-Score, indicating strong financial health. Neither shows red flags, but Alphabet’s scale and market position suggest a more robust operational foundation:

How are the two companies positioned?

This section dissects the operational DNA of Alphabet and Twilio by comparing their revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

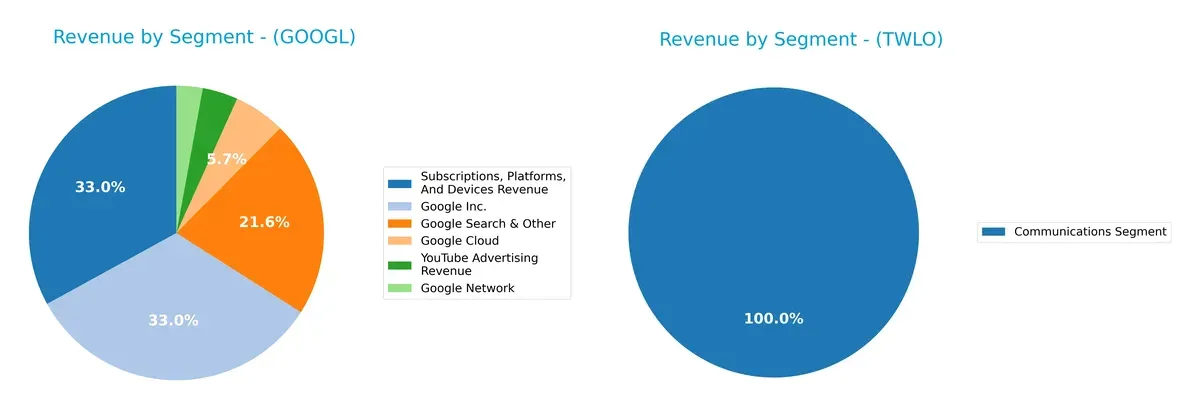

Revenue Segmentation: The Strategic Mix

This comparison dissects how Alphabet Inc. and Twilio Inc. diversify their income streams and highlights the primary sector bets defining their business models:

Alphabet’s revenue anchors on Google Search & Other at $225B, dwarfing its next largest segment, Google Cloud, at $59B. This concentration points to a dominant advertising and search ecosystem lock-in. Twilio, however, generates nearly all revenue—$4.16B—from its Communications Segment, showing a highly focused but less diversified model. Alphabet’s broad mix mitigates risk, while Twilio’s reliance on one segment elevates vulnerability to market shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Alphabet Inc. and Twilio Inc.:

Alphabet Inc. Strengths

- Diversified revenue streams including Google Search, YouTube Ads, and Cloud

- Strong profitability with net margin 32.8% and ROE 31.83%

- Solid global presence across US, EMEA, Asia Pacific

- Favorable debt levels and interest coverage

Twilio Inc. Strengths

- Favorable debt management and interest coverage

- High fixed asset turnover indicating efficient asset use

- Strong quick ratio shows liquidity strength

- Focused communications segment revenue growing steadily

Alphabet Inc. Weaknesses

- High P/E and P/B ratios may suggest overvaluation risk

- Low dividend yield limits income appeal

- Asset turnover neutral, signaling moderate asset efficiency

Twilio Inc. Weaknesses

- Low profitability with net margin 0.67% and ROE 0.43%

- Unfavorable P/E ratio indicates valuation concerns

- Current ratio unusually high, possibly indicating inefficient working capital use

- Zero dividend yield

Alphabet’s strength lies in its diversified, profitable model and global reach, yet valuation metrics raise caution. Twilio benefits from liquidity and asset efficiency but faces profitability and valuation challenges. These factors shape each company’s strategic focus on growth and financial health.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone shields long-term profits from relentless competition erosion. Let’s dissect the competitive defenses of two tech innovators:

Alphabet Inc.: Dominant Network Effects and Intangible Assets

Alphabet’s moat stems from massive network effects and proprietary data assets. This drives high ROIC around 13%, sustaining 39% EBIT margins. In 2026, Google Cloud expansion and AI integration could reinforce its moat but watch for regulatory risks.

Twilio Inc.: Emerging Switching Costs in Cloud Communications

Twilio’s moat relies on growing switching costs embedded in its developer-focused APIs, unlike Alphabet’s broad ecosystem. Although ROIC trails WACC, it’s improving sharply. Twilio’s expanding product suite and international growth offer upside but face fierce competition.

Verdict: Network Effects vs. Switching Costs

Alphabet’s deep network effects create a wider moat than Twilio’s nascent switching costs. Despite Twilio’s improving profitability, Alphabet remains better equipped to defend market share and sustain value creation in 2026.

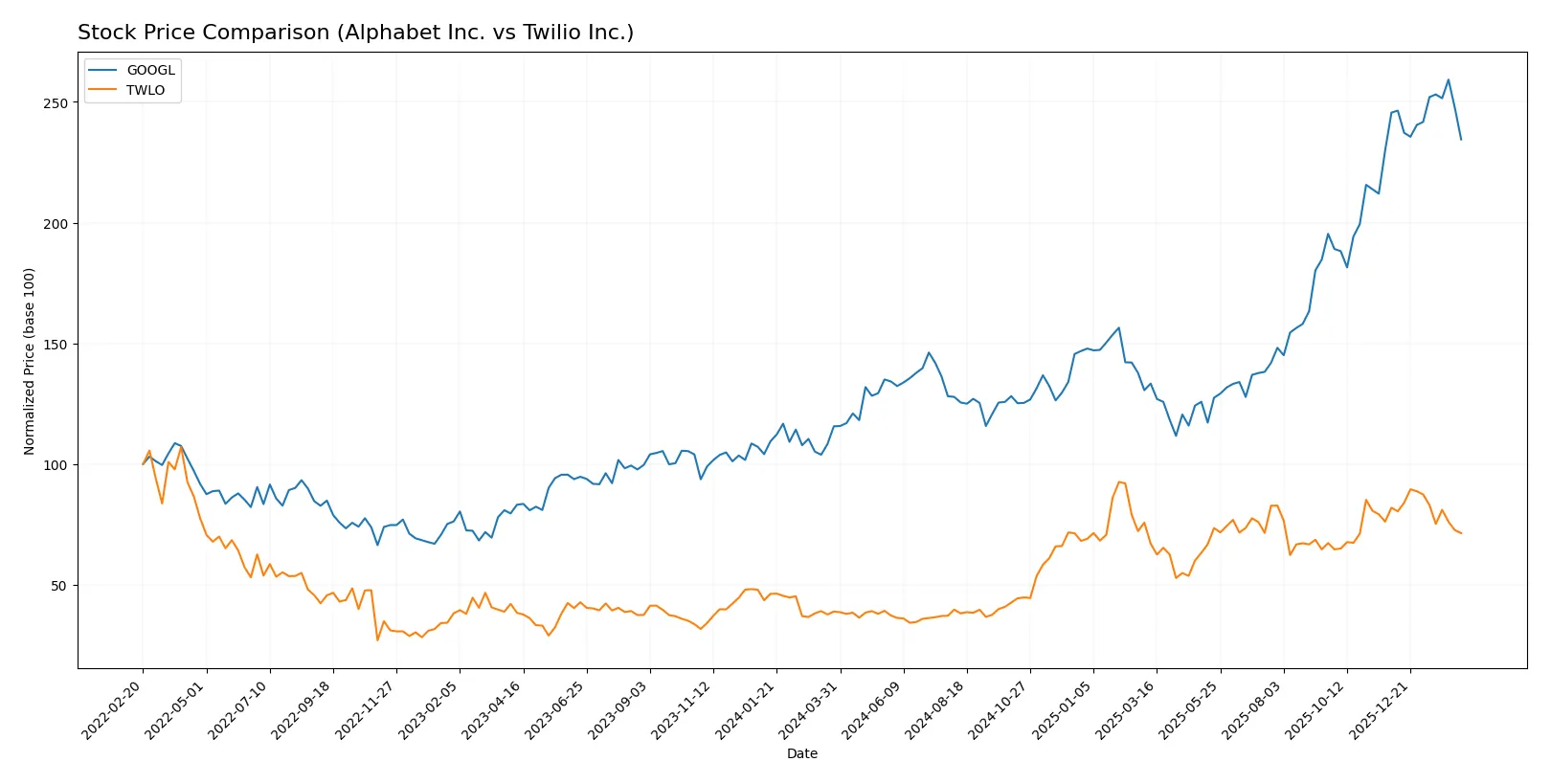

Which stock offers better returns?

The past year saw strong upward momentum for both stocks, with recent pullbacks reflecting shifting trading dynamics and buyer-seller balance.

Trend Comparison

Alphabet Inc. (GOOGL) shows a 102.77% price gain over 12 months, a bullish trend with decelerating acceleration. The stock’s volatility is high, with prices peaking at 338 and bottoming at 145.6.

Twilio Inc. (TWLO) gained 83.53% over the same period, also bullish but with decelerating momentum. Volatility is moderate, with a high of 146.58 and a low of 54.24.

GOOGL outperformed TWLO in absolute returns, delivering the highest market performance over the past year despite both experiencing recent downward corrections.

Target Prices

Analysts present a cautiously optimistic target consensus for Alphabet Inc. and Twilio Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Alphabet Inc. | 270 | 415 | 352 |

| Twilio Inc. | 100 | 170 | 143 |

Alphabet’s consensus target of 352 implies roughly 15% upside from the current 306 price, reflecting confidence in its diversified cloud and ad businesses. Twilio’s target near 143 suggests about 26% potential gain, signaling strong growth expectations despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Alphabet Inc. Grades

The following table summarizes recent grades from major grading companies for Alphabet Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-02-06 |

| Citigroup | Maintain | Buy | 2026-02-06 |

| DA Davidson | Maintain | Neutral | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| Stifel | Maintain | Buy | 2026-02-05 |

| Citizens | Maintain | Market Outperform | 2026-02-05 |

| Wedbush | Maintain | Outperform | 2026-02-05 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-05 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-05 |

| RBC Capital | Maintain | Outperform | 2026-02-05 |

Twilio Inc. Grades

Below is a summary of recent grades from reputable grading companies for Twilio Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-02-13 |

| Piper Sandler | Maintain | Neutral | 2026-02-13 |

| BTIG | Maintain | Buy | 2026-02-13 |

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| RBC Capital | Maintain | Underperform | 2026-01-05 |

| Piper Sandler | Downgrade | Neutral | 2026-01-05 |

| Citizens | Maintain | Market Outperform | 2025-12-30 |

| UBS | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Which company has the best grades?

Alphabet Inc. holds generally stronger and more consistent buy and outperform ratings across multiple firms. Twilio’s ratings show more variance, including underperform and neutral grades. This disparity may affect investor confidence and perceived risk.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Alphabet Inc.

- Dominates internet content with strong Google Services and Cloud segments but faces intense tech competition.

Twilio Inc.

- Operates in cloud communications with high growth potential but contends with emerging rivals and innovation risks.

2. Capital Structure & Debt

Alphabet Inc.

- Low debt-to-equity (0.17) and strong interest coverage (1110x) imply a conservative, stable capital structure.

Twilio Inc.

- Moderate debt-to-equity (0.15) with infinite interest coverage, but current ratio concerns suggest liquidity risks.

3. Stock Volatility

Alphabet Inc.

- Beta at 1.086 signals moderate volatility, aligned with large-cap tech peers like Nasdaq-100.

Twilio Inc.

- Higher beta of 1.309 indicates elevated stock volatility and sensitivity to market swings.

4. Regulatory & Legal

Alphabet Inc.

- Faces ongoing antitrust scrutiny globally, a systemic risk in Big Tech regulation.

Twilio Inc.

- Subject to evolving communications and data privacy regulations, increasing compliance costs.

5. Supply Chain & Operations

Alphabet Inc.

- Complex global hardware and cloud infrastructure supply chains vulnerable to geopolitical disruptions.

Twilio Inc.

- Relies on cloud infrastructure providers; operational scalability hinges on third-party service stability.

6. ESG & Climate Transition

Alphabet Inc.

- Invests in sustainable tech and clean energy but must manage large data center energy demands.

Twilio Inc.

- Emerging ESG profile with potential risks tied to data privacy and energy use in cloud operations.

7. Geopolitical Exposure

Alphabet Inc.

- Operates worldwide, exposed to trade tensions and regulatory shifts in US, EU, and Asia-Pacific.

Twilio Inc.

- Growth depends on international expansion; geopolitical instability may disrupt client markets and supply chains.

Which company shows a better risk-adjusted profile?

Alphabet’s most impactful risk is regulatory and antitrust pressures, threatening its dominant market position. Twilio’s key risk lies in market competition and operational scalability amid high volatility. Alphabet’s robust capital structure and regulatory experience give it a superior risk-adjusted profile. Twilio’s high beta and weaker profitability ratios warrant caution despite growth prospects. Recent data show Alphabet’s exceptional interest coverage (1110x) versus Twilio’s liquidity red flags, reinforcing my concern for Twilio’s financial resilience.

Final Verdict: Which stock to choose?

Alphabet Inc. showcases a superpower in its robust ability to generate cash and sustain high returns on invested capital, demonstrating a proven economic moat. Its main point of vigilance lies in its elevated valuation multiples, which could pressure future gains. It suits investors seeking steady, long-term growth within a quality core portfolio.

Twilio Inc. stands out with its strategic moat rooted in rapid revenue growth and an expanding developer ecosystem, driving recurring revenue potential. It carries higher operational risks and lacks Alphabet’s profitability margin, offering a riskier profile. This stock might fit well in a growth-at-a-reasonable-price (GARP) or thematic growth portfolio.

If you prioritize consistent value creation coupled with established cash flow, Alphabet outshines due to its superior profitability and financial stability. However, if you seek high-growth exposure with potential for operational turnaround, Twilio offers better upside despite its current challenges. Both choices reflect distinct investor archetypes demanding tailored risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Alphabet Inc. and Twilio Inc. to enhance your investment decisions: