Home > Comparison > Technology > GOOGL vs DASH

The strategic rivalry between Alphabet Inc. and DoorDash, Inc. shapes the evolving landscape of the Internet Content & Information sector. Alphabet operates as a diversified technology powerhouse with strong cloud and advertising platforms. DoorDash, by contrast, runs a high-growth logistics marketplace centered on delivery services and merchant solutions. This analysis will evaluate which company’s business model offers the superior risk-adjusted return potential for a diversified investor in 2026.

Table of contents

Companies Overview

Alphabet Inc. and DoorDash, Inc. dominate distinct segments within the Internet Content & Information space, each shaping digital interaction on a massive scale.

Alphabet Inc.: Global Tech Titan

Alphabet Inc. stands as a global technology leader driving revenue through its expansive Google Services ecosystem. This includes advertising, Android, YouTube, and hardware sales like Pixel phones. In 2026, its strategic focus sharpens on growing Google Cloud and diversifying Other Bets, enhancing enterprise solutions and innovation beyond core ad revenues.

DoorDash, Inc.: Logistics Innovator

DoorDash, Inc. operates a dynamic logistics platform connecting merchants, consumers, and dashers primarily in the US. Its revenue stems from marketplace fees, membership subscriptions, and white-label delivery services. The company’s 2026 strategy emphasizes expanding e-commerce capabilities and enhancing digital ordering solutions to solidify merchant relationships and streamline delivery fulfillment.

Strategic Collision: Similarities & Divergences

Alphabet pursues a closed ecosystem leveraging vast data and diversified services, while DoorDash embraces an open infrastructure model focused on logistics and merchant empowerment. Their competitive battleground lies in adapting to evolving digital commerce demands. Alphabet offers broad enterprise tech exposure, whereas DoorDash provides focused growth in on-demand delivery logistics, reflecting distinct risk and growth profiles.

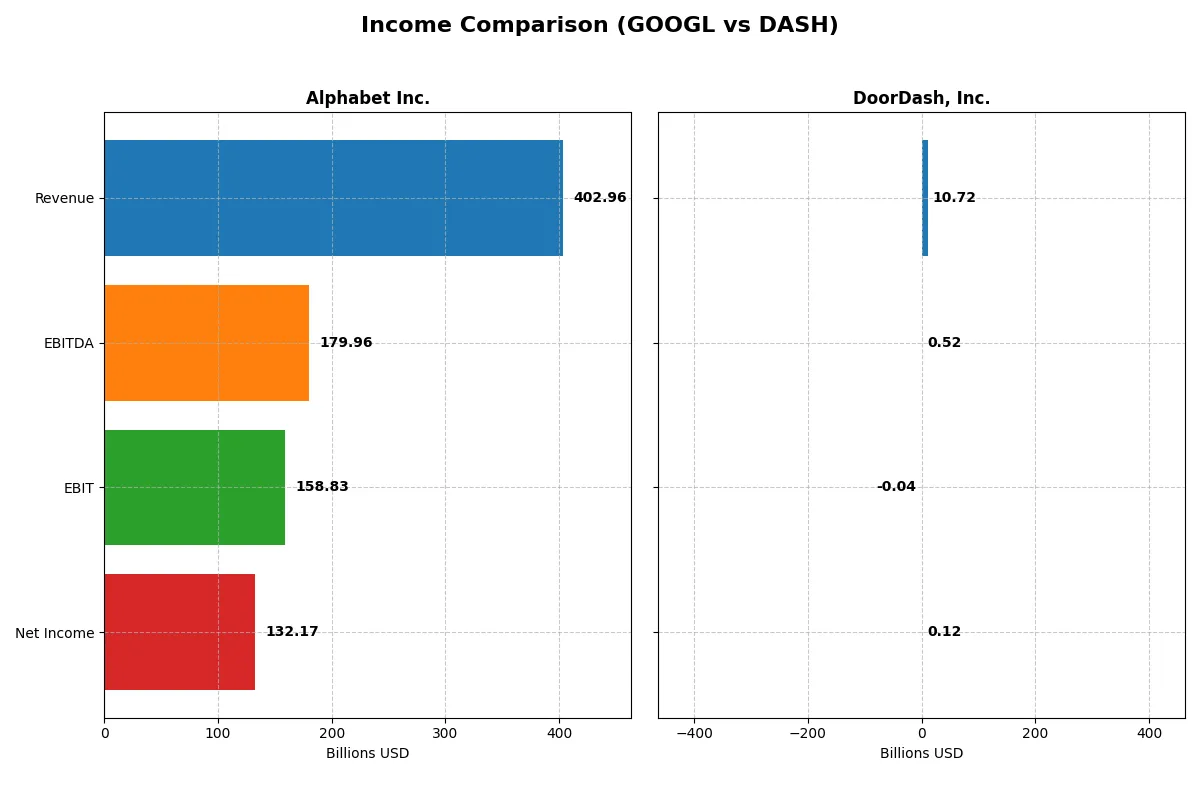

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Alphabet Inc. (GOOGL) | DoorDash, Inc. (DASH) |

|---|---|---|

| Revenue | 403B | 10.7B |

| Cost of Revenue | 163B | 5.54B |

| Operating Expenses | 111B | 5.22B |

| Gross Profit | 240B | 5.18B |

| EBITDA | 180B | 523M |

| EBIT | 159B | -38M |

| Interest Expense | 143M | 0 |

| Net Income | 132B | 123M |

| EPS | 10.91 | 0.30 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently Alphabet Inc. and DoorDash, Inc. convert revenue into profit and sustain margin strength.

Alphabet Inc. Analysis

Alphabet’s revenue climbed from $258B in 2021 to $403B in 2025, a 56% growth, with net income rising 74% to $132B. The company maintains robust gross and net margins at 60% and 33%, respectively. In 2025, its operating efficiency accelerated, with EBIT surging 32% year-over-year, reflecting strong momentum and cost control despite rising expenses.

DoorDash, Inc. Analysis

DoorDash expanded revenue impressively by 271% over five years, reaching $10.7B in 2024. However, it struggles with profitability, reporting only a 1.15% net margin and a slight positive net income of $123M in 2024 after years of losses. Despite a sharp improvement in EBIT and net margin last year, its negative EBIT margin indicates ongoing operational challenges.

Verdict: Scale Dominance vs. Emerging Profitability

Alphabet commands superior scale and margin power, delivering sizable and growing profits with stable expense management. DoorDash shows remarkable top-line growth and recent profitability gains but remains a smaller, less efficient operator. For investors, Alphabet offers a proven profit engine, while DoorDash represents a higher-risk growth profile still refining its path to sustainable earnings.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Alphabet Inc. (GOOGL) | DoorDash, Inc. (DASH) |

|---|---|---|

| ROE | 31.8% | 1.6% |

| ROIC | 21.8% | -0.3% |

| P/E | 28.7 | 561.3 |

| P/B | 9.13 | 8.85 |

| Current Ratio | 2.01 | 1.66 |

| Quick Ratio | 2.01 | 1.66 |

| D/E | 0.14 | 0.07 |

| Debt-to-Assets | 9.96% | 4.17% |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.68 | 0.83 |

| Fixed Asset Turnover | 1.54 | 9.19 |

| Payout ratio | 7.6% | 0% |

| Dividend yield | 0.26% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and operational strengths that inform investment decisions.

Alphabet Inc.

Alphabet delivers strong profitability with a 31.8% ROE and a 32.8% net margin, signaling efficient capital use. However, its P/E ratio near 29 and P/B above 9 suggest the stock is pricey relative to earnings and book value. Shareholders benefit from modest dividends, while the company channels significant funds into R&D for growth.

DoorDash, Inc.

DoorDash’s profitability lags with a 1.6% ROE and a slim 1.2% net margin, reflecting operational struggles. Its P/E ratio exceeds 560, indicating extreme valuation stretch. Despite no dividends, DoorDash reinvests heavily in expansion and R&D. The firm maintains a healthy current ratio and low leverage but faces risks from unprofitable operations.

Premium Valuation vs. Operational Safety

Alphabet balances strong returns and operational efficiency despite a stretched valuation. DoorDash’s elevated multiples and weak profitability raise caution despite solid liquidity. Alphabet’s profile fits investors prioritizing stable returns, while DoorDash suits those tolerating high risk for potential growth.

Which one offers the Superior Shareholder Reward?

I see Alphabet Inc. (GOOGL) pays a modest dividend yield near 0.3% with a low payout ratio around 7.6%, well-covered by free cash flow (FCF coverage ratio ~1.62). It also executes steady buybacks, boosting total returns sustainably. DoorDash (DASH) pays no dividend but aggressively reinvests in growth, reflected in negative or minimal profits and high price multiples. Its buyback activity is limited, signaling less immediate shareholder reward. Alphabet’s balanced dividend and buyback model offers a more reliable and attractive total return profile in 2026 compared to DoorDash’s speculative reinvestment strategy.

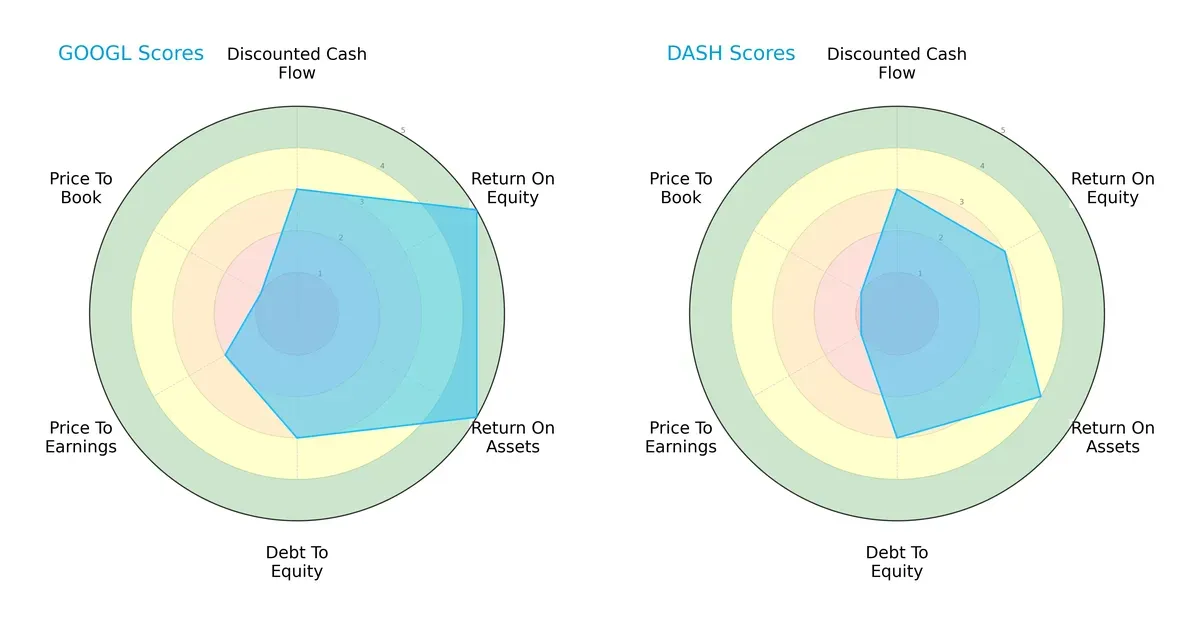

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Alphabet Inc. and DoorDash, Inc., highlighting their financial strengths and valuation challenges:

Alphabet Inc. excels with very favorable ROE and ROA scores, signaling superior capital efficiency and asset utilization. DoorDash shows a decent ROA but lags on ROE, indicating less equity profitability. Both have moderate DCF and debt-to-equity scores, reflecting balanced cash flow and leverage. However, Alphabet faces unfavorable valuation metrics (P/E and P/B), while DoorDash suffers even more, suggesting market skepticism despite growth prospects. Alphabet’s profile is more balanced; DoorDash relies heavily on operational efficiency without valuation support.

Bankruptcy Risk: Solvency Showdown

Alphabet’s Altman Z-Score of 16.0 vastly outperforms DoorDash’s 6.4, both safely above the distress threshold, but Alphabet’s score implies exceptional resilience for long-term survival in volatile cycles:

Financial Health: Quality of Operations

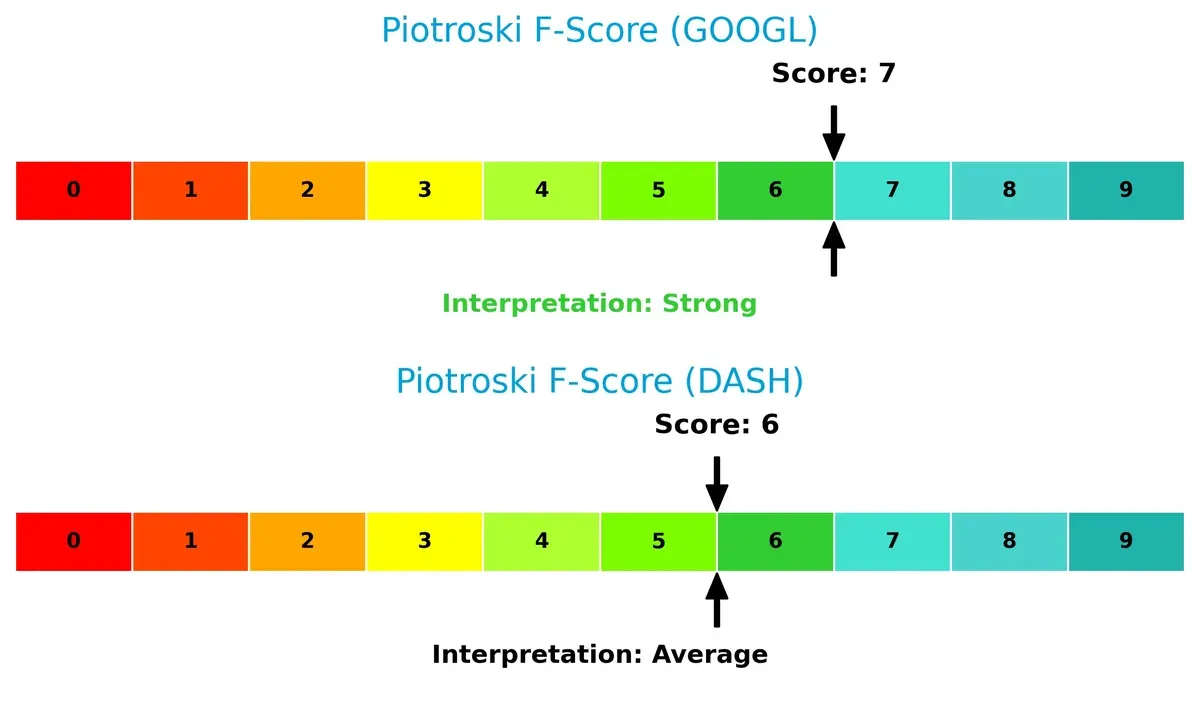

Alphabet’s Piotroski F-Score of 7 surpasses DoorDash’s 6, indicating stronger internal financial health. DoorDash’s slightly lower score flags minor operational risks compared to Alphabet’s solid fundamentals:

How are the two companies positioned?

This section dissects Alphabet and DoorDash’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the most resilient and sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

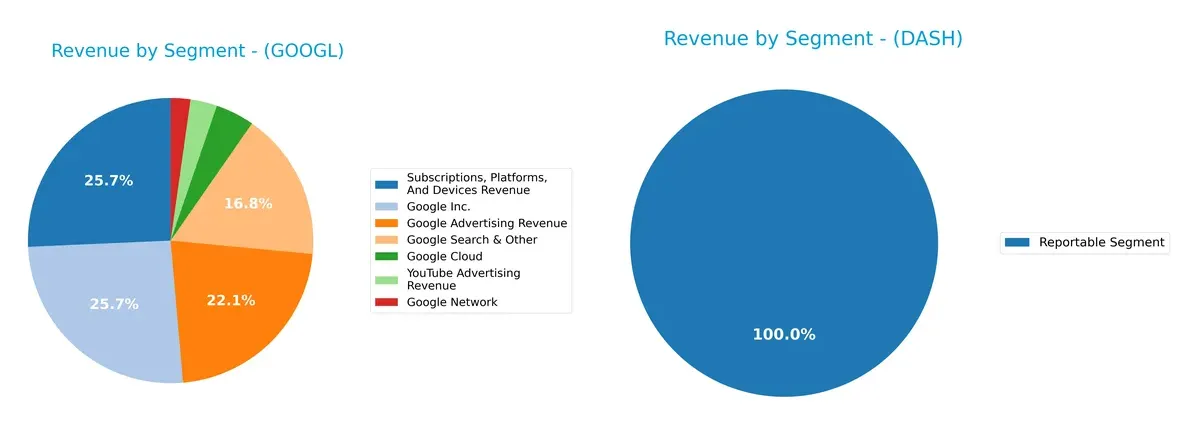

This visual comparison dissects how Alphabet Inc. and DoorDash, Inc. diversify their income streams and where their primary sector bets lie:

Alphabet Inc. dwarfs DoorDash with a broad revenue mix including $295B in Google Advertising and $59B in Google Cloud. Alphabet pivots on multiple streams, reducing concentration risk and leveraging ecosystem lock-in. DoorDash relies almost entirely on a single segment, Marketplaces and Platform Services, totaling around $10.7B, anchoring its revenue to platform dominance but exposing it to higher concentration risk.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Alphabet Inc. and DoorDash, Inc.:

Alphabet Inc. Strengths

- Strong profitability with 32.81% net margin and 31.83% ROE

- Solid financial health shown by 2.01 current and quick ratios

- Low debt levels and high interest coverage

- Diverse revenue streams including advertising, cloud, and subscriptions

- Global presence across US, EMEA, Asia Pacific, and Americas Ex US

DoorDash, Inc. Strengths

- Favorable liquidity with 1.66 current and quick ratios

- Low debt-to-assets at 4.17% and low debt-to-equity ratio

- High fixed asset turnover indicating efficient asset use

- Concentrated US market leadership with growing revenue

- Focused business model on marketplaces and platform services

Alphabet Inc. Weaknesses

- High valuation metrics with PE of 28.69 and PB of 9.13

- Low dividend yield at 0.26%

- Moderate asset turnover ratios reflecting capital intensity

- Limited growth indications in Other Bets segment

DoorDash, Inc. Weaknesses

- Weak profitability with 1.15% net margin and negative ROIC

- High WACC at 12.17% increasing capital costs

- Extremely high PE ratio at 561.28 and unfavorable PB

- Zero interest coverage raising solvency concerns

- No dividend yield and limited geographic diversification outside US

Alphabet’s strengths lie in robust profitability, diversified revenues, and global scale, while valuation and dividend yield pose challenges. DoorDash shows strong liquidity and asset efficiency but struggles with profitability, solvency, and narrow market exposure. These factors shape their strategic priorities in capital allocation and growth focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat uniquely protects long-term profits from relentless competitive erosion. Here’s how Alphabet and DoorDash defend their franchises:

Alphabet Inc.: Dominant Network Effects and Intangible Assets

Alphabet’s moat stems from massive network effects and rich intangible assets like Google’s search dominance and YouTube’s scale. Its high ROIC (13% above WACC) underpins stable margins near 33%. In 2026, cloud expansion and AI innovations could deepen this advantage—or face regulatory scrutiny.

DoorDash, Inc.: Emerging Scale and Logistics Cost Advantage

DoorDash’s moat relies on logistics scale and growing market penetration, unlike Alphabet’s entrenched digital ecosystem. Despite a negative ROIC vs. WACC, its rapid ROIC improvement and 271% revenue growth signal strengthening moats. Expansion into new markets and white-label delivery services could disrupt incumbents.

Network Dominance vs. Logistics Scale: The Moat Face-Off

Alphabet holds the wider, more entrenched moat through superior profitability and network effects. DoorDash shows promise with accelerating ROIC and growth but remains vulnerable. Alphabet is better positioned to defend its market share against competitive threats in 2026.

Which stock offers better returns?

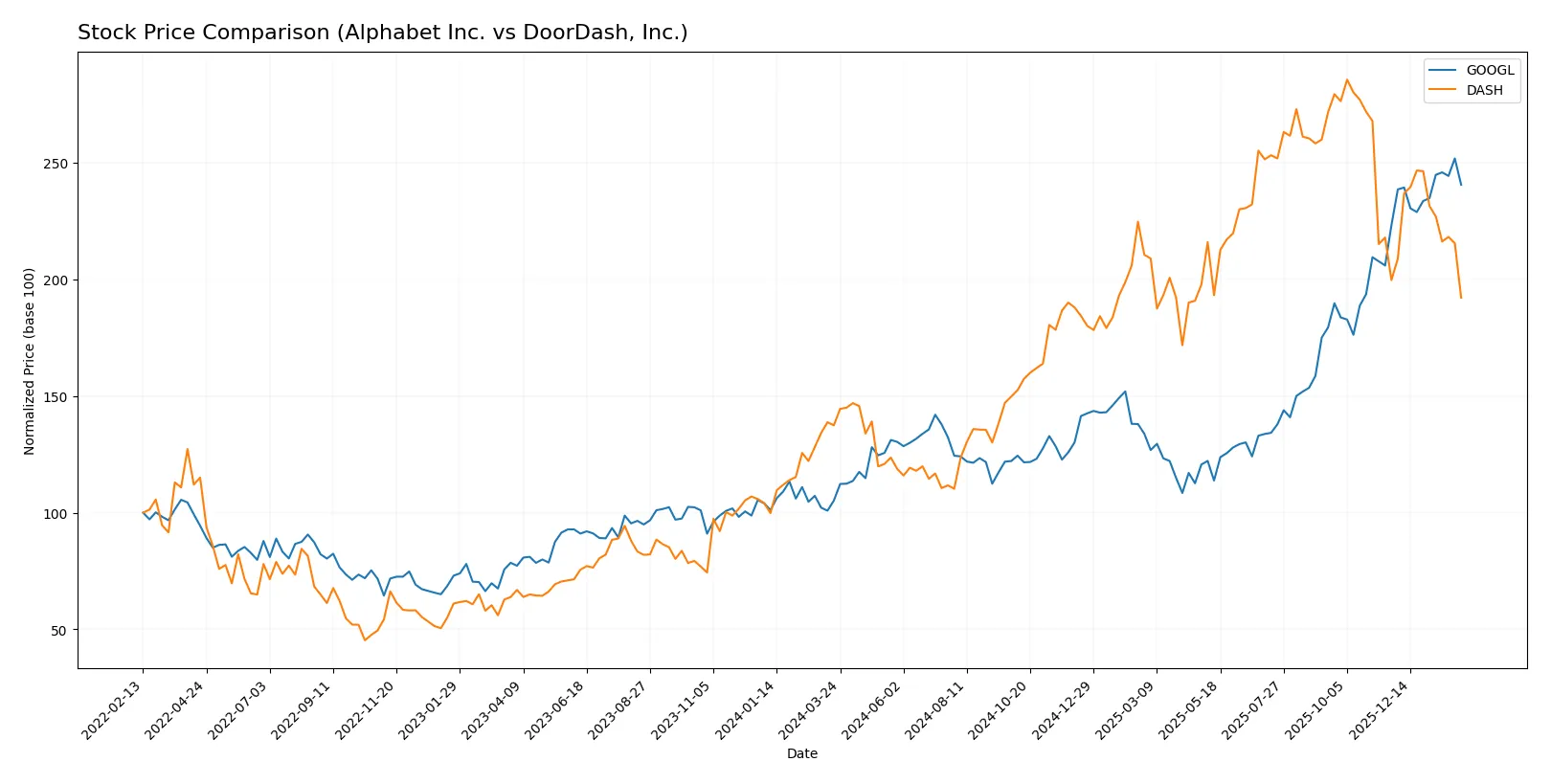

The past year saw Alphabet Inc. surge sharply, with DoorDash, Inc. posting solid gains before recent softness, reflecting differing momentum and trading dynamics.

Trend Comparison

Alphabet Inc. gained 129% over 12 months, showing a bullish trend with acceleration and high volatility (53.1 std deviation). Its price ranged from 141.18 to 338.

DoorDash, Inc. rose 39.8% over the same period, also bullish but with deceleration. Volatility was slightly lower (48.3 std deviation), and the recent trend turned mildly bearish.

Alphabet’s stock outperformed DoorDash by a wide margin, delivering the highest market returns and stronger recent momentum despite DoorDash’s initial gains.

Target Prices

Analysts present a moderate optimism in target prices for Alphabet Inc. and DoorDash, Inc., reflecting cautious confidence.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Alphabet Inc. | 270 | 415 | 351.77 |

| DoorDash, Inc. | 224 | 350 | 281.42 |

The consensus targets for both companies exceed current prices, indicating expected upside potential. Alphabet’s target sits about 9% above its $322.86 price, while DoorDash’s target suggests a strong 54% gain from $182.47.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Alphabet Inc. Grades

Here are the recent grades from reputable financial institutions for Alphabet Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-06 |

| Argus Research | Maintain | Buy | 2026-02-06 |

| Citizens | Maintain | Market Outperform | 2026-02-05 |

| Mizuho | Maintain | Outperform | 2026-02-05 |

| Keybanc | Maintain | Overweight | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| Stifel | Maintain | Buy | 2026-02-05 |

| UBS | Maintain | Neutral | 2026-02-05 |

| Wedbush | Maintain | Outperform | 2026-02-05 |

| Pivotal Research | Maintain | Buy | 2026-02-05 |

DoorDash, Inc. Grades

Below are the recent grades issued by recognized analysts for DoorDash, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Hold | 2026-01-27 |

| Keybanc | Maintain | Overweight | 2026-01-20 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-08 |

| Wedbush | Maintain | Outperform | 2025-12-19 |

| Argus Research | Maintain | Buy | 2025-12-12 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Guggenheim | Maintain | Buy | 2025-11-19 |

| Jefferies | Upgrade | Buy | 2025-11-19 |

Which company has the best grades?

Alphabet Inc. consistently receives strong buy and outperform ratings from top-tier firms, reflecting broad institutional confidence. DoorDash shows a mix of buy and hold ratings with fewer top-tier grades, indicating more cautious sentiment among investors. This divergence may impact risk assessments and portfolio positioning.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Alphabet Inc.

- Dominates with vast scale and brand strength but faces intense tech and ad market competition.

DoorDash, Inc.

- Operates in a crowded delivery space with aggressive pricing and market share battles.

2. Capital Structure & Debt

Alphabet Inc.

- Maintains a conservative debt-to-equity ratio at 0.14, low leverage minimizes financial risk.

DoorDash, Inc.

- Very low leverage at 0.07 but weak interest coverage signals potential difficulty servicing debt.

3. Stock Volatility

Alphabet Inc.

- Beta at 1.086 indicates moderate volatility, in line with large-cap tech peers.

DoorDash, Inc.

- High beta of 1.795 suggests elevated stock price swings, increasing investor risk.

4. Regulatory & Legal

Alphabet Inc.

- Faces regulatory scrutiny on antitrust and privacy globally, a persistent overhang.

DoorDash, Inc.

- Subject to labor laws and gig economy regulations, which could raise costs and operational complexity.

5. Supply Chain & Operations

Alphabet Inc.

- Robust global infrastructure supports diversified product lines but vulnerable to chip shortages.

DoorDash, Inc.

- Relies heavily on local delivery drivers and merchant partnerships, exposed to logistical disruptions.

6. ESG & Climate Transition

Alphabet Inc.

- Aggressive carbon neutrality goals; strong ESG initiatives bolster reputation and compliance.

DoorDash, Inc.

- Faces pressure to improve sustainability in delivery fleet and packaging to meet rising standards.

7. Geopolitical Exposure

Alphabet Inc.

- Operates worldwide, exposed to trade tensions and data localization laws, especially in Asia.

DoorDash, Inc.

- Primarily US-focused but expanding internationally, vulnerable to geopolitical disruptions in new markets.

Which company shows a better risk-adjusted profile?

Alphabet’s dominant market position, strong balance sheet, and stellar Altman Z-score (16) signal a robust risk profile. Its biggest risk remains regulatory pressures that could dent growth. DoorDash’s key vulnerability is operational risk from regulatory changes in labor laws and weak interest coverage. Elevated stock volatility and high valuation multiples amplify DoorDash’s risk. Overall, Alphabet offers a safer, more balanced risk-adjusted investment in 2026.

Final Verdict: Which stock to choose?

Alphabet Inc. demonstrates a formidable superpower in delivering consistent, high returns on invested capital, underscoring its status as a value creator with a durable competitive moat. Its point of vigilance is the premium valuation multiples, which suggest limited margin for error. This stock suits portfolios seeking steady, long-term growth with proven financial resilience.

DoorDash, Inc. leverages a strategic moat rooted in rapid market expansion and strong revenue growth, reflecting its position in the dynamic food delivery sector. Compared to Alphabet, it carries higher operational risk and less stable profitability, but its improving ROIC signals potential value creation ahead. This stock fits investors open to growth opportunities with a tolerance for volatility.

If you prioritize capital efficiency and a strong economic moat, Alphabet outshines as the compelling choice due to its robust profitability and financial stability. However, if you seek aggressive growth with a focus on emerging market leadership, DoorDash offers superior upside potential, albeit with elevated risk. Each presents a distinct analytical scenario tailored to different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Alphabet Inc. and DoorDash, Inc. to enhance your investment decisions: