Home > Comparison > Technology > GOOGL vs BIDU

The strategic rivalry between Alphabet Inc. and Baidu, Inc. defines the current trajectory of global internet content and information services. Alphabet operates as a sprawling technology conglomerate with diversified platforms across cloud, advertising, and hardware. Baidu focuses on China’s communication services, blending AI-driven marketing with entertainment content. This analysis contrasts their distinct operating models to identify which offers better risk-adjusted returns for a diversified portfolio amid evolving sector dynamics.

Table of contents

Companies Overview

Alphabet Inc. and Baidu, Inc. stand as leading digital giants shaping global internet landscapes.

Alphabet Inc.: The Global Digital Ecosystem Powerhouse

Alphabet dominates as a global leader in internet content and information. Its core revenue derives from Google Services, including ads, Android, YouTube, and cloud platforms. In 2026, Alphabet strategically emphasizes expanding Google Cloud and diversifying Other Bets to capture emerging tech opportunities and solidify its competitive moat.

Baidu, Inc.: The China-Centric AI & Content Innovator

Baidu anchors its position as a key player in China’s online marketing and AI-driven services. Its revenue streams focus on Baidu Core’s advertising and cloud offerings combined with iQIYI’s video content platform. In 2026, Baidu prioritizes AI integration and video content growth to deepen user engagement and strengthen digital advertising dominance within China.

Strategic Collision: Similarities & Divergences

Both companies leverage internet-based advertising and cloud services, but Alphabet operates a broader global ecosystem while Baidu focuses on China’s market with AI-heavy enhancements. Their primary battleground lies in cloud infrastructure and digital content. Alphabet’s diversified global reach contrasts with Baidu’s concentrated regional dominance, creating distinct risk and growth profiles for investors.

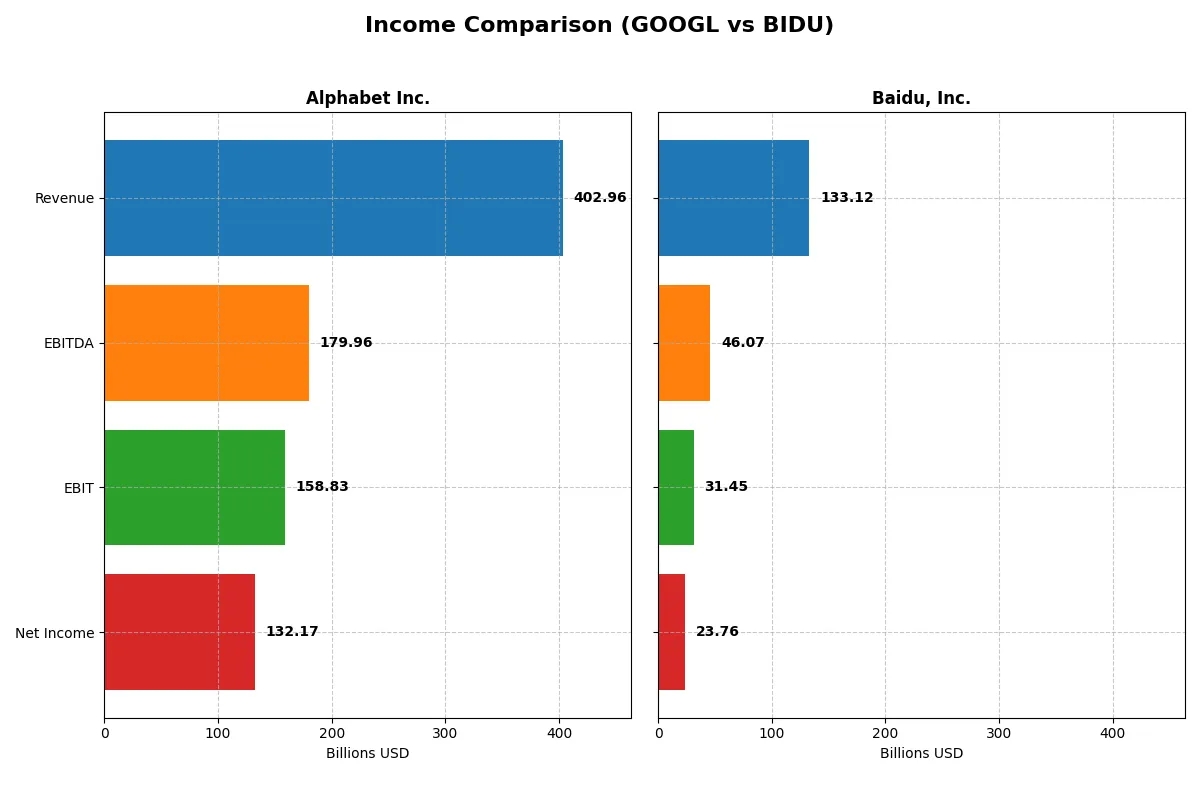

Income Statement Comparison

This table dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Alphabet Inc. (GOOGL) | Baidu, Inc. (BIDU) |

|---|---|---|

| Revenue | 403B | 133B |

| Cost of Revenue | 163B | 66B |

| Operating Expenses | 111B | 46B |

| Gross Profit | 240B | 67B |

| EBITDA | 180B | 46B |

| EBIT | 159B | 31B |

| Interest Expense | 143M | 2.8B |

| Net Income | 132B | 24B |

| EPS | 10.91 | 66.48 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its business more efficiently and generates stronger profitability from its core operations.

Alphabet Inc. Analysis

Alphabet’s revenue surged from $258B in 2021 to $403B in 2025, with net income climbing from $76B to $132B. The company sustains robust gross margins near 60% and a net margin topping 32%, reflecting disciplined cost control despite rising R&D and operating expenses. In 2025, Alphabet’s profitability momentum accelerated, driven by a 32% jump in EBIT and a 15% revenue increase, signaling strong operational leverage.

Baidu, Inc. Analysis

Baidu’s revenue grew from CNY 107B in 2020 to CNY 133B in 2024, with net income fluctuating, ending at CNY 24B. Its gross margin hovers around 50%, and net margins remain modest at 18%. Baidu faced a slight revenue decline in 2024 but posted a 10.5% EBIT increase and 18% net margin growth, indicating improving operational efficiency despite top-line pressure and elevated interest expenses.

Margin Power vs. Revenue Scale

Alphabet clearly dominates in scale and margin expansion, posting superior revenue growth (+56% over five years) and expanding net margins by over 11 percentage points. Baidu shows resilience with positive EBIT gains and margin improvement but lags in revenue growth and overall profitability. For investors, Alphabet’s profile offers a more compelling combination of scale, margin strength, and growth momentum.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Alphabet Inc. (GOOGL) | Baidu, Inc. (BIDU) |

|---|---|---|

| ROE | 31.8% | 9.0% |

| ROIC | 21.8% | 4.9% |

| P/E | 28.7x | 9.0x |

| P/B | 9.13x | 0.81x |

| Current Ratio | 2.01 | 2.09 |

| Quick Ratio | 2.01 | 2.01 |

| D/E | 0.14 | 0.30 |

| Debt-to-Assets | 10.0% | 18.5% |

| Interest Coverage | N/A | 7.53x |

| Asset Turnover | 0.68 | 0.31 |

| Fixed Asset Turnover | 1.54 | 3.25 |

| Payout ratio | 7.6% | 0% |

| Dividend yield | 0.26% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence beyond surface-level financials.

Alphabet Inc.

Alphabet delivers robust profitability with a 31.8% ROE and a strong 32.8% net margin, signaling operational efficiency. However, its valuation looks stretched, trading at a high P/E of 28.7 and P/B of 9.1. Dividend yield remains minimal at 0.26%, with capital primarily reinvested in growth and R&D.

Baidu, Inc.

Baidu shows modest profitability, with a 9.0% ROE and a 17.9% net margin, indicating room for improvement. The stock trades at a low P/E of 9.0 and P/B of 0.8, reflecting an attractive valuation. Baidu offers no dividend, focusing on reinvestment in R&D to fuel future expansion.

Premium Valuation vs. Operational Safety

Alphabet commands a premium valuation fueled by high profitability and reinvestment, while Baidu trades cheaper with weaker returns but solid balance sheet ratios. Alphabet suits investors prioritizing operational strength, whereas Baidu appeals to those seeking value with growth potential.

Which one offers the Superior Shareholder Reward?

I compare Alphabet Inc. (GOOGL) and Baidu, Inc. (BIDU) on shareholder rewards. Alphabet pays a modest dividend yield of 0.32% with a low payout ratio near 7.6%, supported by strong free cash flow of 6B USD. Its buybacks are aggressive, enhancing total returns sustainably. Baidu pays no dividends but reinvests heavily in growth and acquisitions, reflected in 37B CNY free cash flow and solid operating margins. However, Baidu’s higher leverage and lower cash flow coverage raise sustainability concerns. I find Alphabet’s balanced dividends plus buybacks deliver a more attractive, reliable total return profile in 2026.

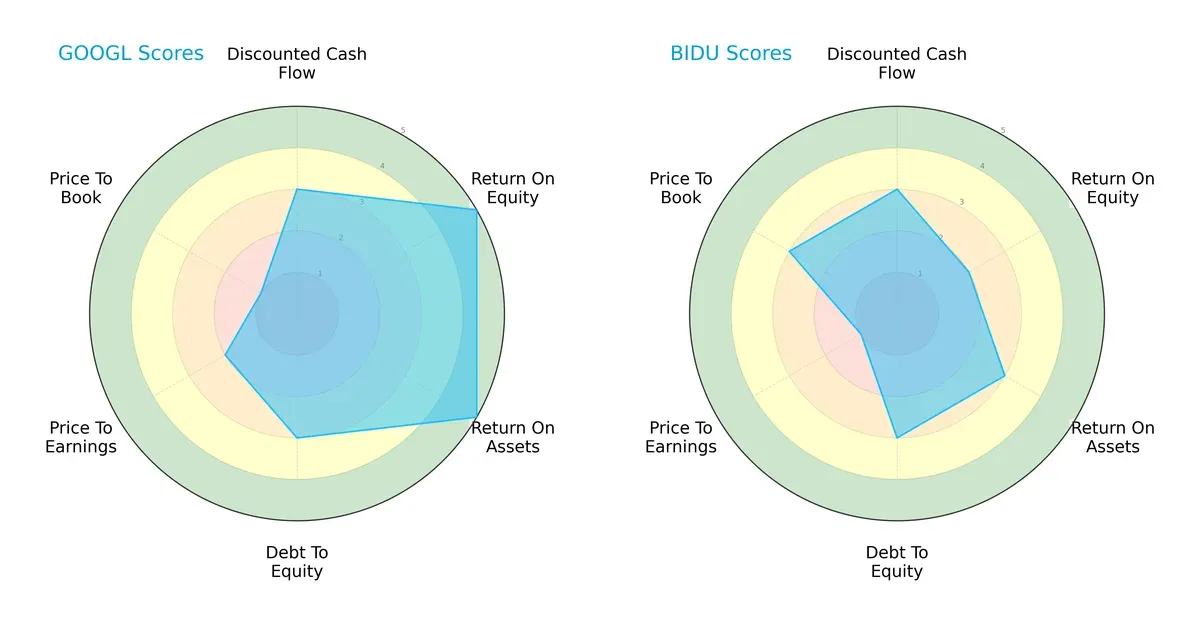

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Alphabet Inc. and Baidu, Inc., highlighting their respective financial strengths and weaknesses:

Alphabet demonstrates superior profitability with very favorable ROE and ROA scores (5 each) compared to Baidu’s moderate to unfavorable scores (2 and 3). Both firms share moderate DCF and debt-to-equity scores, indicating similar valuation discipline and financial risk. However, Alphabet’s valuation metrics (P/E and P/B scores) are markedly unfavorable, suggesting market concerns or premium pricing. Baidu relies more on valuation advantages but lags in profitability, making Alphabet’s profile more balanced and robust.

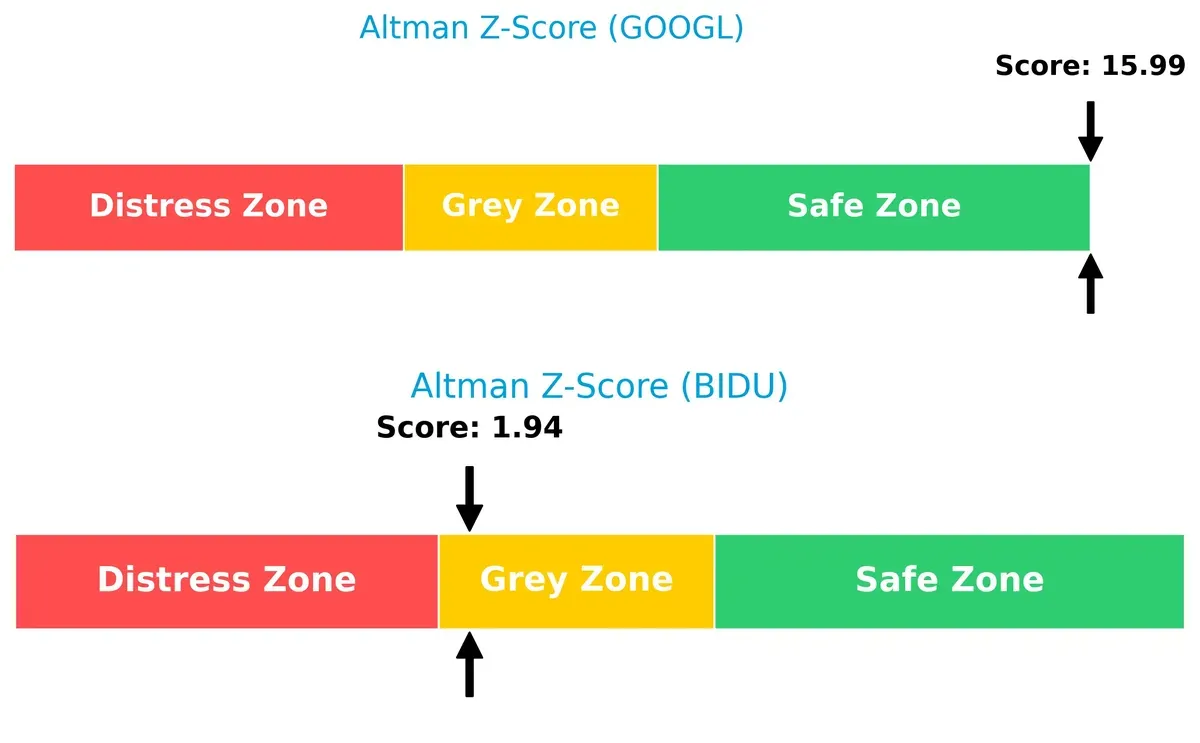

Bankruptcy Risk: Solvency Showdown

Alphabet’s Altman Z-Score of 16 places it firmly in the safe zone, signaling strong solvency and low bankruptcy risk. Baidu’s score of 1.9 sits in the grey zone, indicating potential financial distress risk in this market cycle:

Financial Health: Quality of Operations

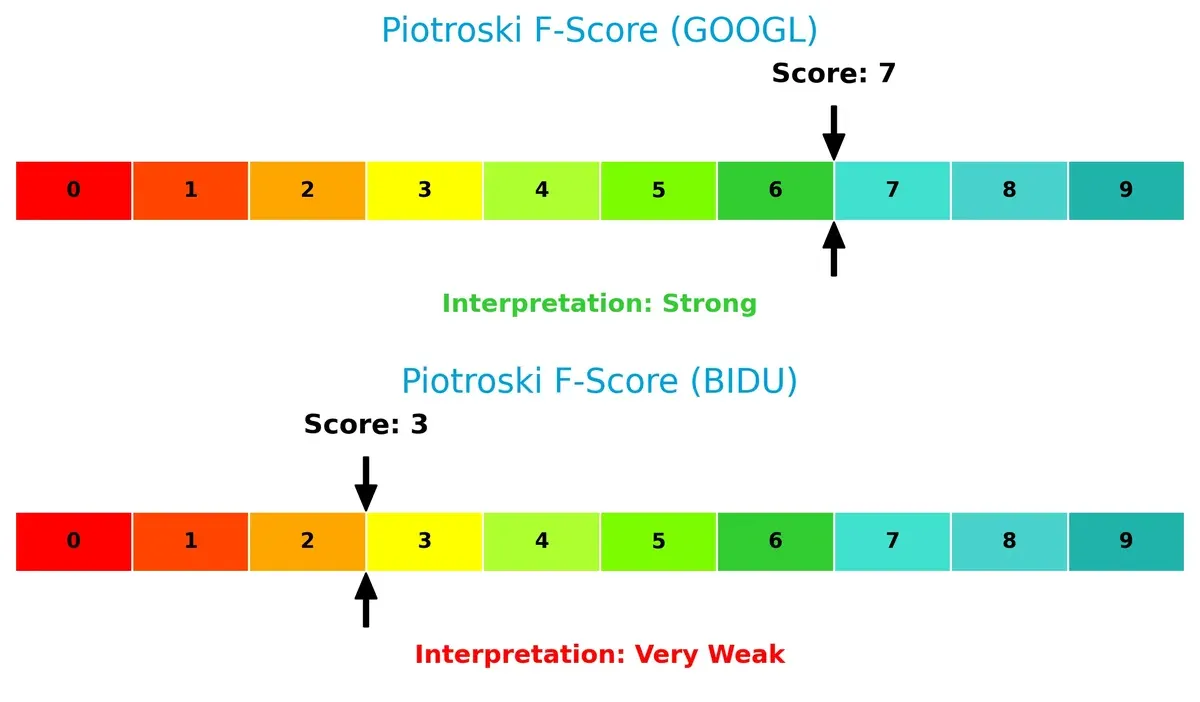

Alphabet scores a strong 7 on the Piotroski F-Score, reflecting solid operational quality and financial health. Baidu’s weak score of 3 raises red flags about its internal financial metrics and operational efficiency:

How are the two companies positioned?

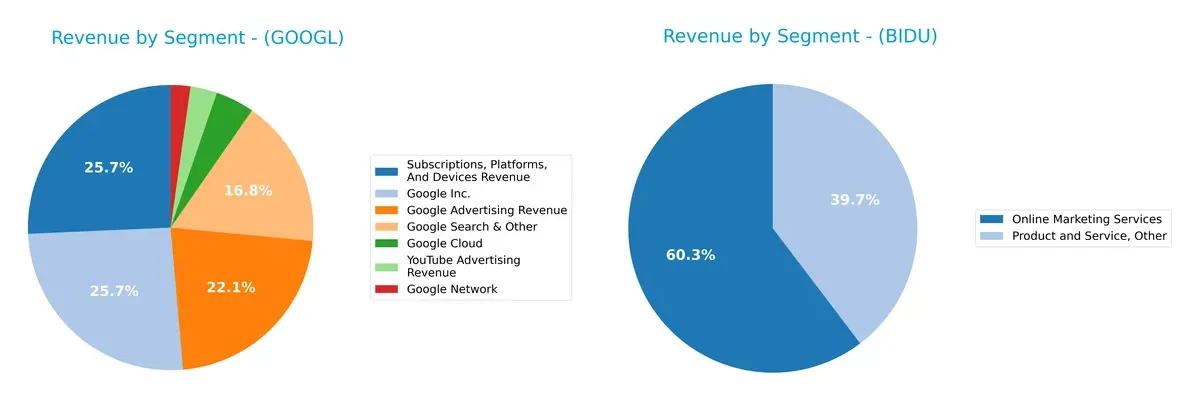

This section dissects the operational DNA of Alphabet and Baidu by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Alphabet Inc. and Baidu, Inc. diversify their income streams and highlights their primary sector bets for 2025:

Alphabet Inc. anchors revenue in Google Search & Other at $225B, complemented by YouTube Ads and Google Cloud, showcasing a diversified digital ecosystem. Baidu relies heavily on Online Marketing Services, exposing concentration risk but leveraging strong core demand. Alphabet’s broader mix supports infrastructure dominance and ecosystem lock-in, while Baidu’s focus signals vulnerability if advertising patterns shift or regulatory pressures intensify.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Alphabet Inc. and Baidu, Inc.:

Alphabet Inc. Strengths

- Diversified revenue streams across advertising, cloud, subscriptions, and platforms

- High net margin of 32.81% indicating strong profitability

- Strong global presence with significant revenues in the US, EMEA, Asia Pacific

- Favorable liquidity and low debt ratios supporting financial stability

- Innovation reflected by robust Google Cloud growth

Baidu, Inc. Strengths

- Favorable valuation multiples with PE at 9.03 and PB at 0.81

- Solid current and quick ratios indicating good short-term financial health

- Favorable cost of capital with WACC at 4.78%

- Focused revenue generation from online marketing and other services in China

- Strong fixed asset turnover at 3.25 showing efficient asset use

Alphabet Inc. Weaknesses

- Unfavorable PE and PB ratios could signal overvaluation risk

- Dividend yield is low at 0.26%, limiting income for investors

- Asset turnover neutral at 0.68, indicating room for efficiency improvement

Baidu, Inc. Weaknesses

- Lower profitability with net margin at 17.85% and ROE at 9.01%

- ROIC at 4.87% below WACC suggests suboptimal capital returns

- Asset turnover weak at 0.31, indicating less efficient asset utilization

- No dividend yield reduces appeal to income-focused investors

Alphabet’s strengths lie in diversified global revenue and superior profitability metrics, yet valuation presents caution. Baidu shows strong asset efficiency and favorable valuation but faces challenges in profitability and capital returns. Both companies’ financial profiles suggest distinct strategic priorities in growth and capital management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from relentless competition and market erosion. Let’s examine how Alphabet and Baidu defend their turf:

Alphabet Inc.: Dominant Network Effects Moat

Alphabet’s primary moat is its vast network effects, anchored by Google’s search dominance and sprawling ecosystem. This manifests in high ROIC (13% above WACC) and stable margins near 40%. In 2026, new AI-driven services and cloud expansions could deepen this moat, although declining ROIC signals caution.

Baidu, Inc.: Emerging AI Innovation Moat

Baidu leans on AI and cloud services to build a technological moat distinct from Alphabet’s scale. Its ROIC barely exceeds WACC, reflecting value shedding, but a strong upward ROIC trend shows improving efficiency. Baidu’s AI platform and content ecosystem offer growth avenues in the Chinese market.

Network Effects vs. AI Innovation: Who Holds the Moat Crown?

Alphabet’s wider and historically proven network effects moat currently outmatches Baidu’s nascent AI-driven position. However, Baidu’s accelerating ROIC signals a potential future challenger. For now, Alphabet remains better equipped to defend and grow its market share globally.

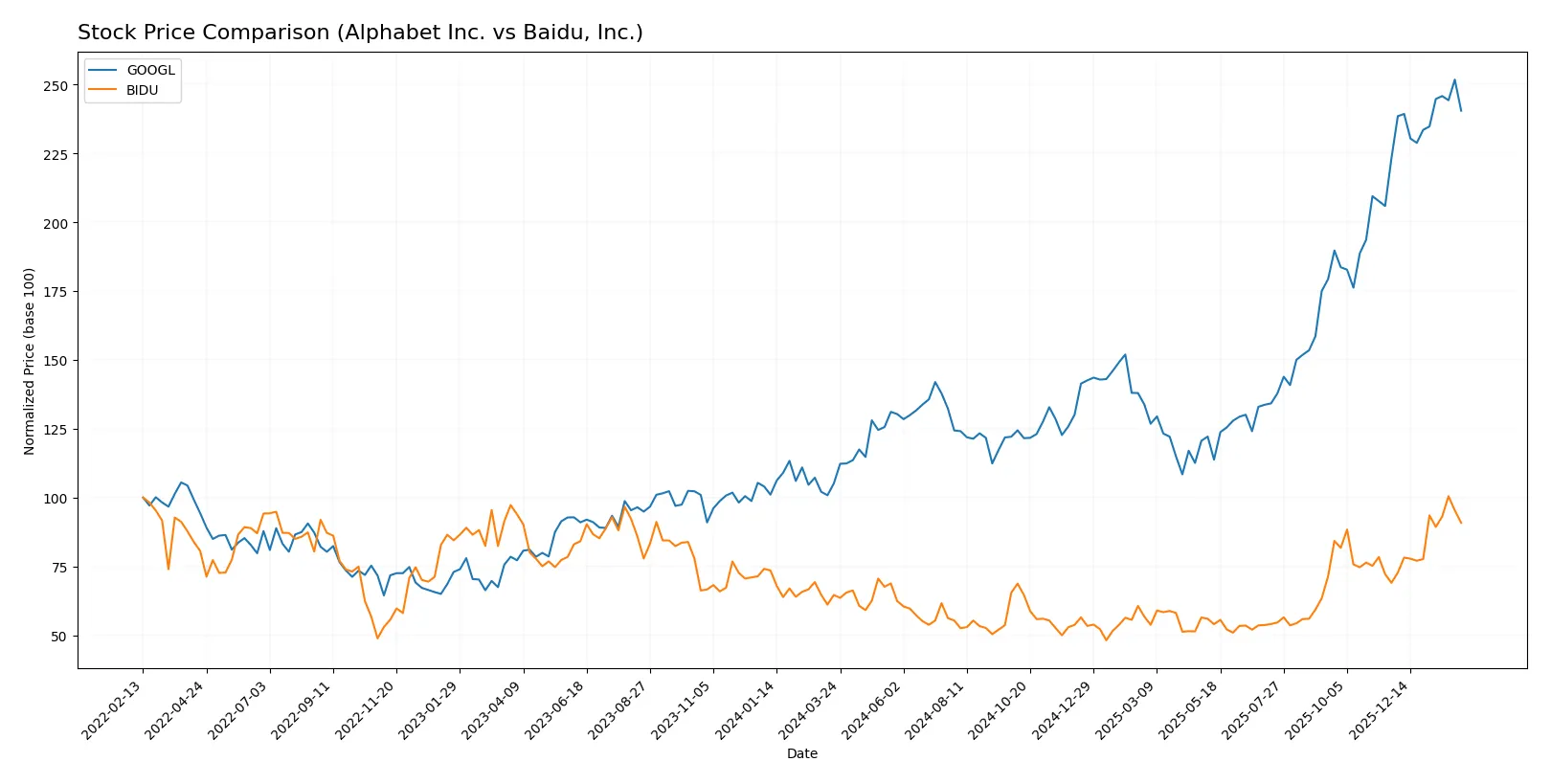

Which stock offers better returns?

The stock price charts reveal strong upward momentum for both companies over the past year, with Alphabet showing significant acceleration and Baidu maintaining steady gains amid varying buyer activity.

Trend Comparison

Alphabet Inc. (GOOGL) posted a robust 129% price increase over the past 12 months, signaling a bullish trend with accelerating gains and a high volatility level of 53.1%. The recent 7.7% rise confirms continued positive momentum.

Baidu, Inc. (BIDU) delivered a 40.5% price gain over the same period, also bullish with accelerating growth and lower volatility at 19.1%. Recent gains accelerated sharply by 31.5%, reflecting renewed investor interest.

Alphabet’s significantly higher total return outpaced Baidu’s, despite Baidu’s recent acceleration; Alphabet remains the stronger performer over the full year.

Target Prices

Analysts present a broad but constructive target consensus for Alphabet Inc. and Baidu, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Alphabet Inc. | 270 | 415 | 351.77 |

| Baidu, Inc. | 110 | 215 | 158.55 |

The consensus targets suggest upside potential for both stocks versus current prices of 323 for Alphabet and 146 for Baidu. Analysts expect Alphabet to outperform Baidu in absolute terms but both remain attractive within their sectors.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following grades summarize recent institutional assessments for Alphabet Inc. and Baidu, Inc.:

Alphabet Inc. Grades

This table presents Alphabet Inc.’s latest grades from major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-06 |

| Argus Research | Maintain | Buy | 2026-02-06 |

| Citizens | Maintain | Market Outperform | 2026-02-05 |

| Mizuho | Maintain | Outperform | 2026-02-05 |

| Keybanc | Maintain | Overweight | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| Stifel | Maintain | Buy | 2026-02-05 |

| UBS | Maintain | Neutral | 2026-02-05 |

| Wedbush | Maintain | Outperform | 2026-02-05 |

| Pivotal Research | Maintain | Buy | 2026-02-05 |

Baidu, Inc. Grades

Below are the most recent institutional grades for Baidu, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-26 |

| Freedom Capital Markets | Maintain | Buy | 2026-01-07 |

| Jefferies | Maintain | Buy | 2026-01-02 |

| JP Morgan | Upgrade | Overweight | 2025-11-24 |

| Goldman Sachs | Maintain | Buy | 2025-11-19 |

| Benchmark | Maintain | Buy | 2025-11-19 |

| B of A Securities | Maintain | Buy | 2025-11-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-19 |

| Barclays | Maintain | Equal Weight | 2025-11-19 |

| Macquarie | Upgrade | Outperform | 2025-10-10 |

Which company has the best grades?

Alphabet Inc. consistently receives strong Buy and Outperform ratings from diverse institutions. Baidu shows a mix of Buy and Equal Weight grades with some upgrades but less uniform enthusiasm. Alphabet’s superior grades suggest stronger institutional confidence, potentially influencing investor perception positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Alphabet Inc.

- Dominates global internet services with diverse platforms, facing intense US and global tech competition.

Baidu, Inc.

- Strong in China’s internet space but faces regulatory hurdles and fierce local competition.

2. Capital Structure & Debt

Alphabet Inc.

- Maintains low debt-to-equity (0.14), excellent interest coverage (1110x), signaling strong financial stability.

Baidu, Inc.

- Higher leverage (0.3 D/E) and moderate interest coverage (11x) increase financial risk moderately.

3. Stock Volatility

Alphabet Inc.

- Beta 1.086 implies market-aligned volatility, typical for large tech giants.

Baidu, Inc.

- Beta 0.288 indicates low price volatility, possibly due to less global investor sensitivity.

4. Regulatory & Legal

Alphabet Inc.

- Faces ongoing antitrust scrutiny in US and EU, regulatory risk is a persistent challenge.

Baidu, Inc.

- Subject to stringent Chinese government internet regulations, posing significant compliance risks.

5. Supply Chain & Operations

Alphabet Inc.

- Global supply chains vulnerable to geopolitical tensions but benefits from strong operational scale.

Baidu, Inc.

- Operates mainly in China, less exposed globally but dependent on domestic infrastructure stability.

6. ESG & Climate Transition

Alphabet Inc.

- Strong ESG initiatives, but high energy use in data centers remains a challenge.

Baidu, Inc.

- ESG disclosures less comprehensive, climate transition risks less transparent.

7. Geopolitical Exposure

Alphabet Inc.

- Global presence exposes it to US-China tensions and trade uncertainties.

Baidu, Inc.

- Primarily China-focused, risks tied to domestic policy shifts and US-China relations impact indirectly.

Which company shows a better risk-adjusted profile?

Alphabet Inc. faces significant regulatory and geopolitical risks but boasts superior capital structure and financial health. Baidu’s main risks lie in regulatory uncertainty and weaker financial metrics, despite lower stock volatility. Alphabet’s robust Altman Z-Score (16, safe zone) and strong Piotroski score (7) contrast sharply with Baidu’s borderline financial distress signals. I see Alphabet as having a better risk-adjusted profile, supported by its financial strength despite external pressures. Baidu’s lower ROIC (4.87%) versus Alphabet’s 21.8% highlights operational challenges and risk exposure in a volatile regulatory environment.

Final Verdict: Which stock to choose?

Alphabet Inc. wields unmatched operational efficiency and a commanding economic moat, consistently generating strong returns on invested capital well above its cost of capital. Its main point of vigilance lies in a high valuation that might temper near-term upside. This stock suits investors with an appetite for aggressive growth fueled by innovation and scale.

Baidu, Inc. impresses with a strategic moat rooted in its improving profitability and attractive valuation multiples. It offers a sturdier safety profile than Alphabet in terms of valuation and balance sheet metrics, though its return metrics lag. Baidu could fit well in a GARP (Growth at a Reasonable Price) portfolio seeking growth tempered by relative value.

If you prioritize sustained economic value creation and dominant market efficiency, Alphabet outshines Baidu despite its premium. However, if you seek growth exposure with a more conservative valuation and improving profitability, Baidu offers better stability and upside potential. Each presents a distinct analytical scenario tailored to specific risk tolerances and investment horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Alphabet Inc. and Baidu, Inc. to enhance your investment decisions: