Home > Comparison > Healthcare > PODD vs ALGN

The strategic rivalry between Insulet Corporation and Align Technology defines innovation in the medical devices sector. Insulet excels as a focused insulin delivery systems manufacturer, while Align leads with high-tech orthodontic solutions and digital scanning services. This analysis pits Insulet’s niche product growth against Align’s broad technological integration. I will assess which company offers superior risk-adjusted returns, guiding investors seeking balanced exposure within healthcare’s evolving landscape.

Table of contents

Companies Overview

Insulet Corporation and Align Technology, Inc. both shape the medical devices landscape with distinct, innovative solutions.

Insulet Corporation: Pioneer in Tubeless Insulin Delivery

Insulet dominates the insulin-dependent diabetes market with its Omnipod System, a tubeless, self-adhesive insulin pump worn for up to three days. The company generates revenue primarily through sales of this device and its wireless personal diabetes manager. In 2026, Insulet focuses on expanding distribution channels globally, emphasizing direct sales and partnerships in key markets like the US, Canada, and Europe.

Align Technology, Inc.: Leader in Clear Aligner Orthodontics

Align Technology commands the clear aligner segment with its flagship Invisalign system and iTero intraoral scanners. Revenue streams come from comprehensive orthodontic treatments and digital scanner hardware and services. In 2026, Align prioritizes enhancing its digital orthodontic ecosystem, integrating software innovations and expanding global market penetration, particularly in the US and China.

Strategic Collision: Similarities & Divergences

Both companies operate in medical devices but diverge sharply in product focus—Insulet offers a closed-system insulin delivery, while Align champions an open, digital orthodontic platform. Their primary battle lies in capturing global healthcare professionals and patient loyalty. Insulet’s niche insulin tech contrasts with Align’s broader digital dental ecosystem, creating distinct investment profiles centered on specialized device innovation versus integrated digital solutions.

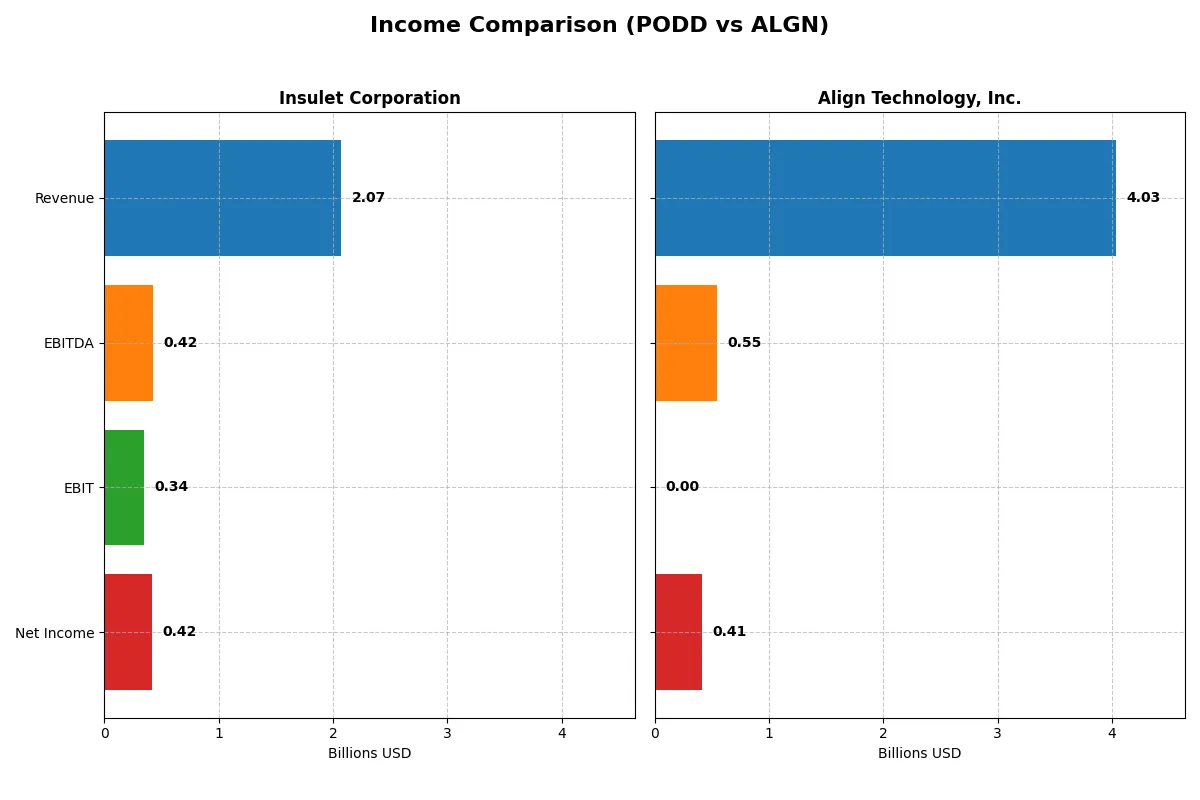

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Insulet Corporation (PODD) | Align Technology, Inc. (ALGN) |

|---|---|---|

| Revenue | 2.07B | 4.04B |

| Cost of Revenue | 626M | 1.20B |

| Operating Expenses | 1.14B | 2.19B |

| Gross Profit | 1.45B | 2.80B |

| EBITDA | 424M | 817M |

| EBIT | 343M | 672M |

| Interest Expense | 43M | 0 |

| Net Income | 418M | 421M |

| EPS | 5.97 | 5.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company demonstrates stronger operational efficiency and bottom-line performance through recent fiscal years.

Insulet Corporation Analysis

Insulet’s revenue surged from 904M in 2020 to 2.07B in 2024, with net income exploding from 6.8M to 418M. Gross and net margins remain robust at approximately 70% and 20%, respectively. The 2024 year highlights accelerating momentum, with net income nearly doubling and EBIT growing 37%, signaling efficient cost management and expanding profitability.

Align Technology, Inc. Analysis

Align’s revenue grew modestly from 3.95B in 2021 to 4.03B in 2025, but net income declined sharply from 772M to 410M. Gross margin stands solid at 67%, but EBIT margin collapsed to zero in 2025, reflecting rising operating expenses. The latest year shows deteriorating profitability and shrinking net margin, indicating challenges in sustaining earnings growth despite stable top-line revenue.

Strong Profit Growth vs. Margin Compression

Insulet clearly outperforms Align with superior revenue growth and margin expansion, delivering a far more impressive profit trajectory. Align’s stagnant revenue and falling net income contrast with Insulet’s dynamic earnings growth and healthy margin improvements. For investors, Insulet’s profile offers a compelling growth story backed by operational efficiency, while Align faces notable margin pressure and profitability risks.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Insulet Corporation (PODD) | Align Technology, Inc. (ALGN) |

|---|---|---|

| ROE | 34.5% | 10.9% |

| ROIC | 11.7% | 10.0% |

| P/E | 43.7 | 37.1 |

| P/B | 15.1 | 4.1 |

| Current Ratio | 3.54 | 1.22 |

| Quick Ratio | 2.73 | 1.10 |

| D/E | 1.17 | 0.03 |

| Debt-to-Assets | 46.1% | 1.9% |

| Interest Coverage | 7.23 | N/A |

| Asset Turnover | 0.67 | 0.64 |

| Fixed Asset Turnover | 2.73 | 2.89 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and revealing operational strengths essential for investment decisions.

Insulet Corporation

Insulet posts a strong 34.5% ROE and a 20.2% net margin, signaling robust profitability. Its valuation appears stretched with a high 43.7 P/E and 15.1 P/B ratio. The firm does not pay dividends, instead reinvesting heavily in R&D at over 10% of revenue, fueling future growth despite a leveraged balance sheet.

Align Technology, Inc.

Align shows moderate profitability with a 10.9% ROE and 10.5% net margin. Its valuation is also elevated, with a 37.0 P/E and 4.05 P/B, but less stretched than Insulet. Align carries minimal debt and maintains a stable current ratio of 1.22. It returns no dividends, focusing on operational efficiency and innovation to enhance shareholder value.

Valuation Stretch vs. Operational Discipline

Insulet delivers superior profitability but at a notably higher valuation and leverage, increasing risk. Align offers steadier returns with a more conservative balance sheet and moderate valuation. Investors seeking growth might prefer Insulet’s aggressive reinvestment, while those valuing financial stability may find Align’s profile more fitting.

Which one offers the Superior Shareholder Reward?

I observe that neither Insulet Corporation (PODD) nor Align Technology (ALGN) pays dividends. PODD reinvests heavily in growth, with zero payout ratio and no dividend yield. Its buyback activity is minimal, limiting direct shareholder returns. ALGN also has no dividends but combines solid free cash flow (8.3B estimated on share basis) with moderate buyback programs, reflected in a price-to-free-cash-flow ratio near 25x versus PODD’s 60x, signaling more efficient capital return. ALGN’s conservative debt profile (debt-to-equity ~0.03) and sustainable free cash flow coverage (84%) support ongoing buybacks, unlike PODD’s higher leverage and weaker buyback footprint. I conclude ALGN offers a superior total return profile due to balanced reinvestment and shareholder distributions in 2026.

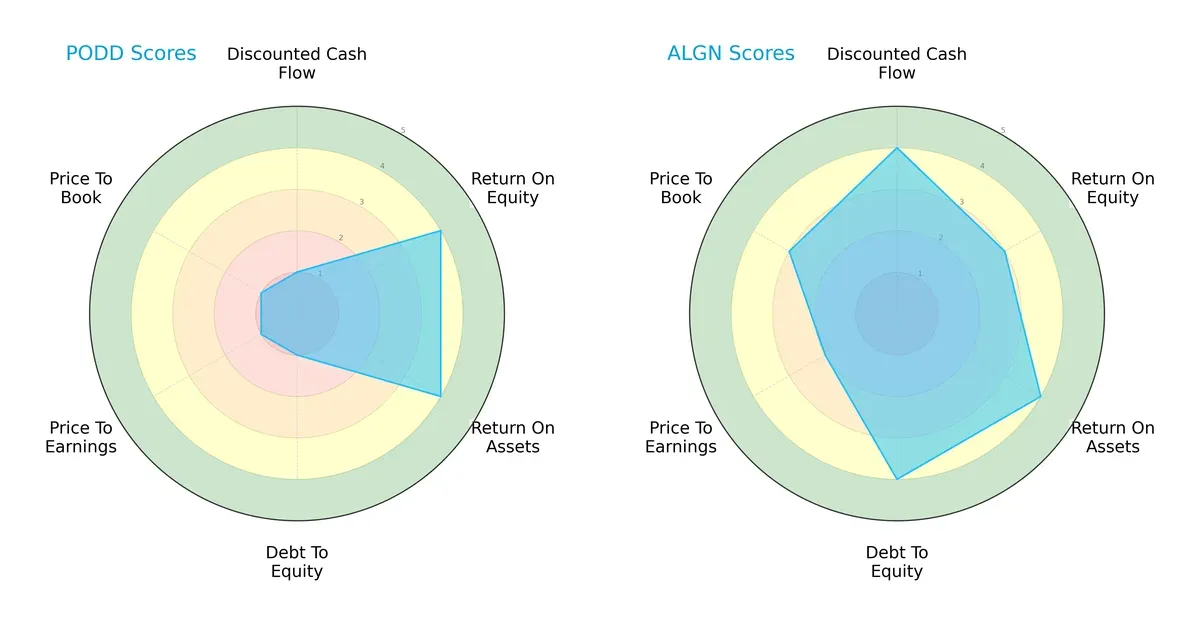

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Insulet Corporation and Align Technology, Inc., showcasing their financial strengths and vulnerabilities side by side:

Insulet Corporation (PODD) scores high on profitability metrics like ROE and ROA but suffers from poor valuation and debt management scores, indicating financial imbalances. Align Technology (ALGN) presents a more balanced profile with strong DCF, debt-to-equity, and valuation scores, signaling prudent capital allocation and market confidence. ALGN’s diversified strengths contrast with PODD’s reliance on operational efficiency amid financial risk.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap shows both companies in the safe zone, with Insulet at 8.24 and Align at 4.56, indicating robust solvency but differing financial resilience levels:

Insulet’s exceptionally high Z-Score suggests it is highly insulated from bankruptcy risk in this cycle, reflecting conservative leverage and strong earnings. Align’s lower yet safe score signals solid financial footing but comparatively higher risk exposure. This difference highlights Insulet’s superior buffer against economic downturns.

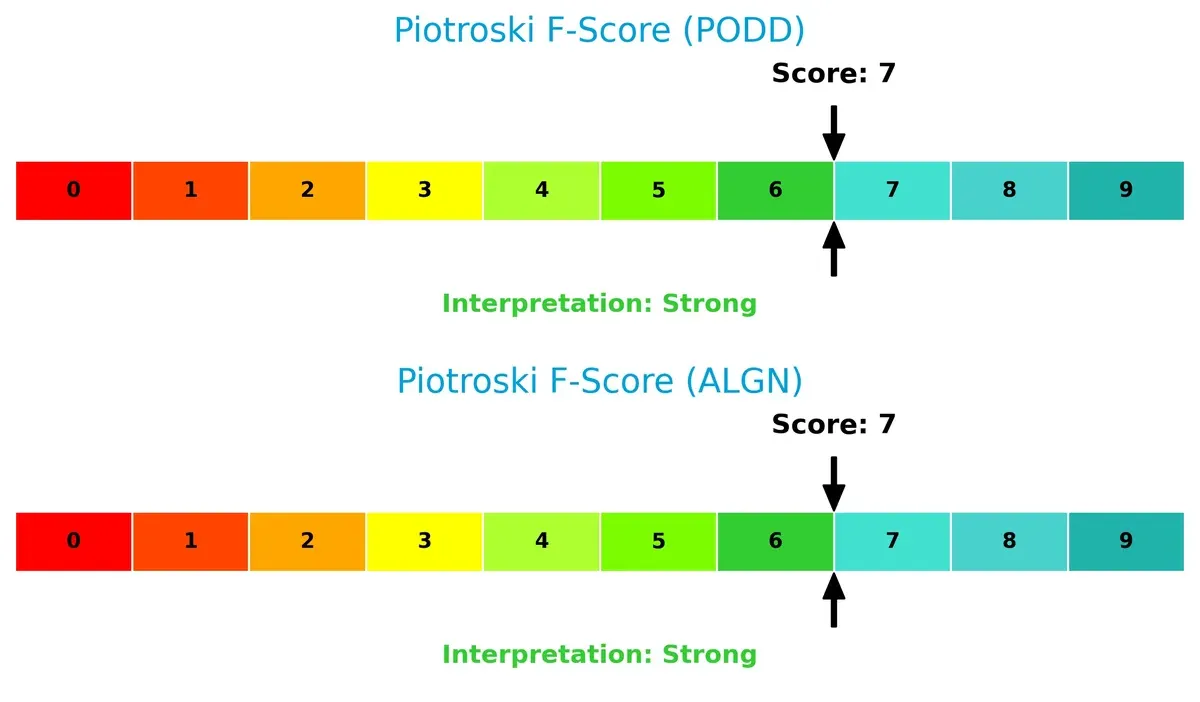

Financial Health: Quality of Operations

Both firms score a strong 7 on the Piotroski F-Score, affirming solid internal financial health and operational efficiency:

A Piotroski score of 7 indicates healthy profitability, liquidity, and leverage management without glaring red flags. Neither company shows internal metric weaknesses, suggesting both maintain robust financial controls and operational discipline. This parity underscores strong fundamentals supporting their market positions.

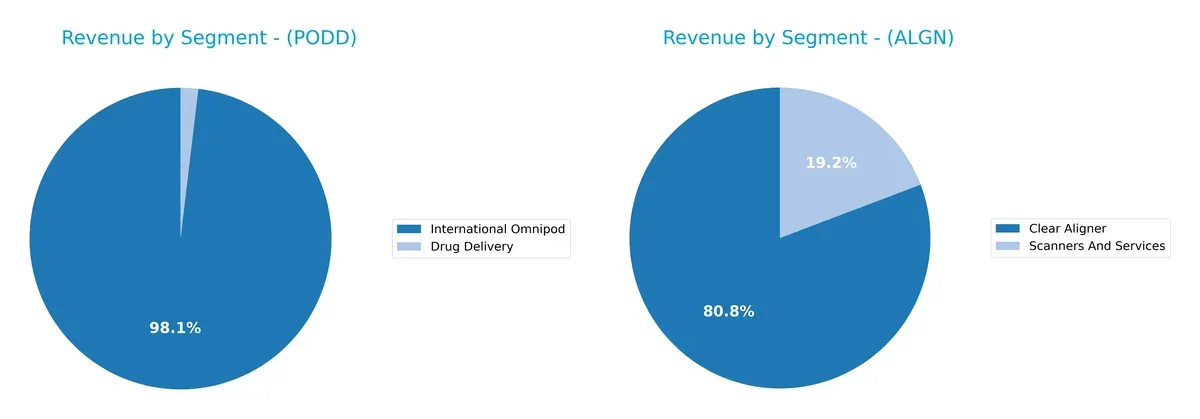

How are the two companies positioned?

This section dissects the operational DNA of Insulet and Align Technology by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Insulet Corporation and Align Technology diversify their income streams and where their primary sector bets lie:

Insulet’s revenue pivots heavily on International Omnipod at $2.03B, with a minor $39M from Drug Delivery, revealing concentration risk. Align Technology boasts a more diversified mix: Clear Aligner leads with $3.23B, while Scanners And Services contribute $769M. Align’s dual-segment approach supports ecosystem lock-in through device and service integration, contrasting with Insulet’s reliance on a singular core product. This impacts resilience and growth pathways distinctly.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Insulet Corporation and Align Technology, Inc.:

Insulet Corporation Strengths

- Strong net margin at 20.19%

- High ROE of 34.52% indicating efficient equity use

- Quick ratio favorable at 2.73, indicating liquidity

- Interest coverage solid at 8.03

- Diverse revenue streams including Drug Delivery and International Omnipod

- Significant US and Non-US sales showing global presence

Align Technology, Inc. Strengths

- Positive net margin at 10.54%

- Low debt-to-equity at 0.03 and debt-to-assets at 1.92%, signaling low leverage

- Favorable quick ratio at 1.1

- Diverse product mix with Clear Aligner and Scanners

- Strong geographic diversification including US, Switzerland, and other international markets

- Consistent revenue growth in Clear Aligner segment

Insulet Corporation Weaknesses

- Unfavorable PE at 43.74 and PB at 15.1, indicating expensive valuation

- Current ratio unfavorable at 3.54, suggesting possible asset inefficiency

- Debt-to-equity elevated at 1.17, increasing financial risk

- Zero dividend yield

- Moderate debt-to-assets at 46.05%

- Neutral WACC at 9.99%

Align Technology, Inc. Weaknesses

- Unfavorable PE at 37.05 and PB at 4.05, indicating valuation concerns

- Interest coverage at 0, raising solvency risk

- No dividend yield

- ROE and ROIC neutral, showing less capital efficiency

- Current ratio neutral at 1.22, limiting liquidity buffer

Insulet excels in profitability and liquidity but faces valuation and leverage challenges. Align benefits from low leverage and broad geographic reach but must address solvency risks and valuation pressures. Both companies show neutral overall financial health requiring strategic focus on their respective weaknesses.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits against relentless competition pressures. Only a durable advantage ensures sustained earnings power:

Insulet Corporation: Innovation-Driven Switching Costs

Insulet’s tubeless Omnipod creates high switching costs, reflected in its rising ROIC and stable 20% net margins. Expansion in international markets could deepen this advantage in 2026.

Align Technology, Inc.: Intangible Asset Powerhouse

Align’s moat lies in proprietary Invisalign technology and brand recognition, but declining ROIC signals pressure. Its broad scanner and services platform offers growth potential amid market disruption risks.

Omnipod’s Switching Costs vs. Invisalign’s Intangibles

Insulet’s growing ROIC and margin expansion indicate a deeper, more resilient moat than Align’s weakening profitability. Insulet stands better poised to defend and grow market share.

Which stock offers better returns?

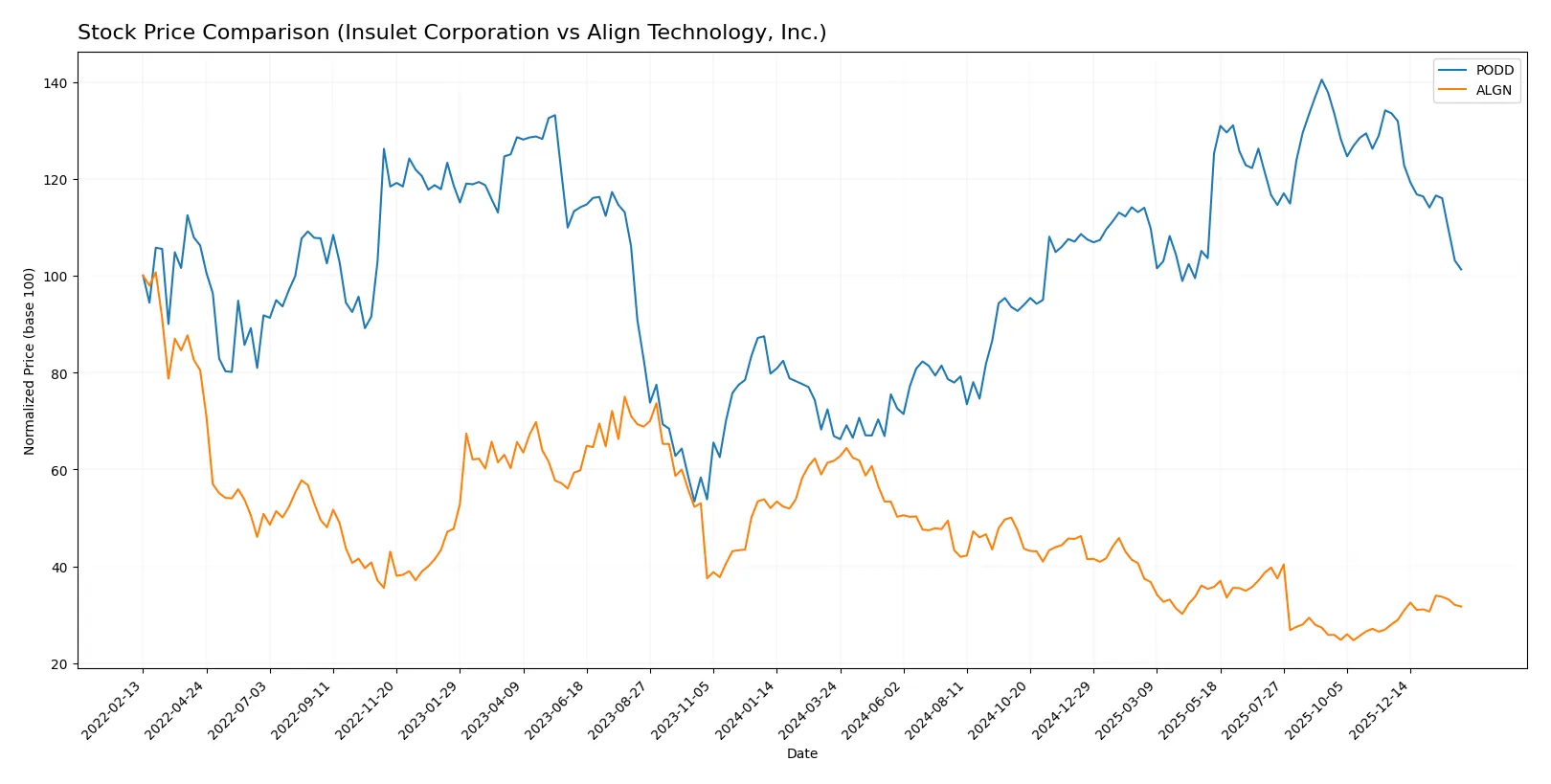

The past year saw Insulet’s stock surge over 50% before recent declines, while Align’s price fell sharply but gained momentum late in the period.

Trend Comparison

Insulet Corporation’s stock rose 51.48% over the past year, marking a bullish trend with decelerating momentum and a high volatility of 51.95%. The price peaked at 348.43 and troughed at 164.31.

Align Technology, Inc. experienced a 48.69% decline, indicating a bearish trend with accelerating downside pressure and volatility near 50.54%. The stock’s recent 13.15% gain signals a slight recovery.

Comparing trends, Insulet delivered the highest market performance overall despite recent weakness, outperforming Align’s prolonged downturn with partial late-stage recovery.

Target Prices

Analysts show a positive outlook with solid upside potential for both Insulet Corporation and Align Technology.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Insulet Corporation | 274 | 450 | 376.27 |

| Align Technology, Inc. | 140 | 200 | 176.43 |

Insulet’s consensus target sits about 50% above its current 251 price, signaling strong growth expectations. Align Technology’s target consensus offers roughly 9% upside from its 161 price, reflecting moderate optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Insulet Corporation Grades

The table below lists recent institutional grades for Insulet Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Underweight | 2026-01-12 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Canaccord Genuity | Maintain | Buy | 2025-12-17 |

| Canaccord Genuity | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-21 |

| Truist Securities | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| UBS | Upgrade | Buy | 2025-11-19 |

| BTIG | Maintain | Buy | 2025-11-13 |

Align Technology, Inc. Grades

The table below lists recent institutional grades for Align Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-20 |

| Piper Sandler | Maintain | Overweight | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-30 |

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-21 |

| UBS | Maintain | Neutral | 2025-10-16 |

| Mizuho | Maintain | Outperform | 2025-10-13 |

| Jefferies | Downgrade | Hold | 2025-10-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-08 |

Which company has the best grades?

Insulet shows a majority of Buy and Outperform ratings, with one recent downgrade. Align maintains consistent Outperform and Overweight grades but includes a Hold downgrade. Insulet’s stronger Buy consensus may suggest more bullish institutional sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Insulet Corporation and Align Technology in the 2026 market environment:

1. Market & Competition

Insulet Corporation

- Faces intense competition in insulin delivery devices with innovation pace pressures.

Align Technology, Inc.

- Competes aggressively in clear aligner and scanner markets amid rapid technological shifts.

2. Capital Structure & Debt

Insulet Corporation

- Elevated debt-to-equity ratio (1.17) signals higher financial leverage risk.

Align Technology, Inc.

- Maintains minimal debt burden (0.03 D/E), reflecting strong balance sheet discipline.

3. Stock Volatility

Insulet Corporation

- Beta of 1.42 indicates moderate-to-high sensitivity to market swings.

Align Technology, Inc.

- Higher beta at 1.83 shows greater stock price volatility and market exposure.

4. Regulatory & Legal

Insulet Corporation

- Subject to stringent FDA regulations on medical device safety and approvals.

Align Technology, Inc.

- Faces complex regulatory scrutiny on dental devices and international compliance.

5. Supply Chain & Operations

Insulet Corporation

- Supply chain disruptions could impact device manufacturing and distribution efficiency.

Align Technology, Inc.

- Relies on global manufacturing network vulnerable to geopolitical and logistic risks.

6. ESG & Climate Transition

Insulet Corporation

- Increasing pressure to improve environmental footprint in manufacturing processes.

Align Technology, Inc.

- Growing demand for ESG transparency amid investor focus on sustainable practices.

7. Geopolitical Exposure

Insulet Corporation

- Moderate international market exposure with potential tariff and trade risks.

Align Technology, Inc.

- Significant global sales, especially in China and EU, heightening geopolitical risks.

Which company shows a better risk-adjusted profile?

Insulet’s highest risk is its elevated leverage, exposing it to financial stress if revenue falters. Align’s primary risk stems from higher stock volatility and geopolitical exposure. I view Align as having a better risk-adjusted profile due to its conservative debt and stronger ratings suite. Notably, Align’s low debt-to-equity ratio (0.03) contrasts sharply with Insulet’s 1.17, underscoring Align’s superior financial stability in 2026.

Final Verdict: Which stock to choose?

Insulet Corporation’s superpower lies in its strong profitability and rapidly growing returns on invested capital. It operates like a cash machine in a niche medical device market. A point of vigilance is its relatively high leverage and stretched valuation multiples. It suits aggressive growth portfolios willing to tolerate balance sheet risks.

Align Technology commands a strategic moat through its recurring revenue model and established market position in dental imaging. It demonstrates better financial stability with low debt and consistent free cash flow. This profile fits investors seeking GARP—growth at a reasonable price—with a preference for steadier cash generation.

If you prioritize high-growth potential and can handle financial leverage, Insulet outshines with its expanding profitability and innovation momentum. However, if you seek better stability and a proven moat with recurring revenues, Align offers superior risk management and cash flow consistency. Both present analytical scenarios for distinct investor types in 2026’s evolving market landscape.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Insulet Corporation and Align Technology, Inc. to enhance your investment decisions: