Home > Comparison > Healthcare > EW vs ALGN

The strategic rivalry between Edwards Lifesciences Corporation and Align Technology, Inc. shapes the future of the healthcare medical devices sector. Edwards operates as a capital-intensive innovator focused on structural heart disease and critical care technologies. In contrast, Align leads with high-margin, technology-driven orthodontic solutions and digital services. This analysis will evaluate which company offers a superior risk-adjusted opportunity, balancing growth potential and operational resilience for a diversified portfolio.

Table of contents

Companies Overview

Edwards Lifesciences and Align Technology stand as pivotal innovators in the global medical device market.

Edwards Lifesciences Corporation: Leader in Structural Heart Solutions

Edwards Lifesciences dominates the structural heart disease market with transcatheter valve replacement and repair technologies. Its core revenue comes from minimally invasive heart valve products and advanced surgical solutions. In 2026, the company emphasizes expanding critical care monitoring systems to enhance patient outcomes in surgical and intensive care settings.

Align Technology, Inc.: Pioneer in Digital Orthodontics

Align Technology leads the clear aligner and intraoral scanner segment, generating revenue through Invisalign aligners and iTero scanner systems. Its strategy focuses on broadening digital orthodontic solutions and expanding software services for restorative and orthodontic professionals worldwide. The company prioritizes innovation in treatment simulation and progress assessment tools in 2026.

Strategic Collision: Similarities & Divergences

Both companies compete in the medical device sector but diverge in focus—Edwards targets invasive cardiac therapies, while Align champions digital orthodontics. Their battleground lies in technological innovation and adoption within specialized niches. Investors should note Edwards’ focus on durable medical technologies contrasts with Align’s software-driven, scalable model, defining distinct risk and growth profiles.

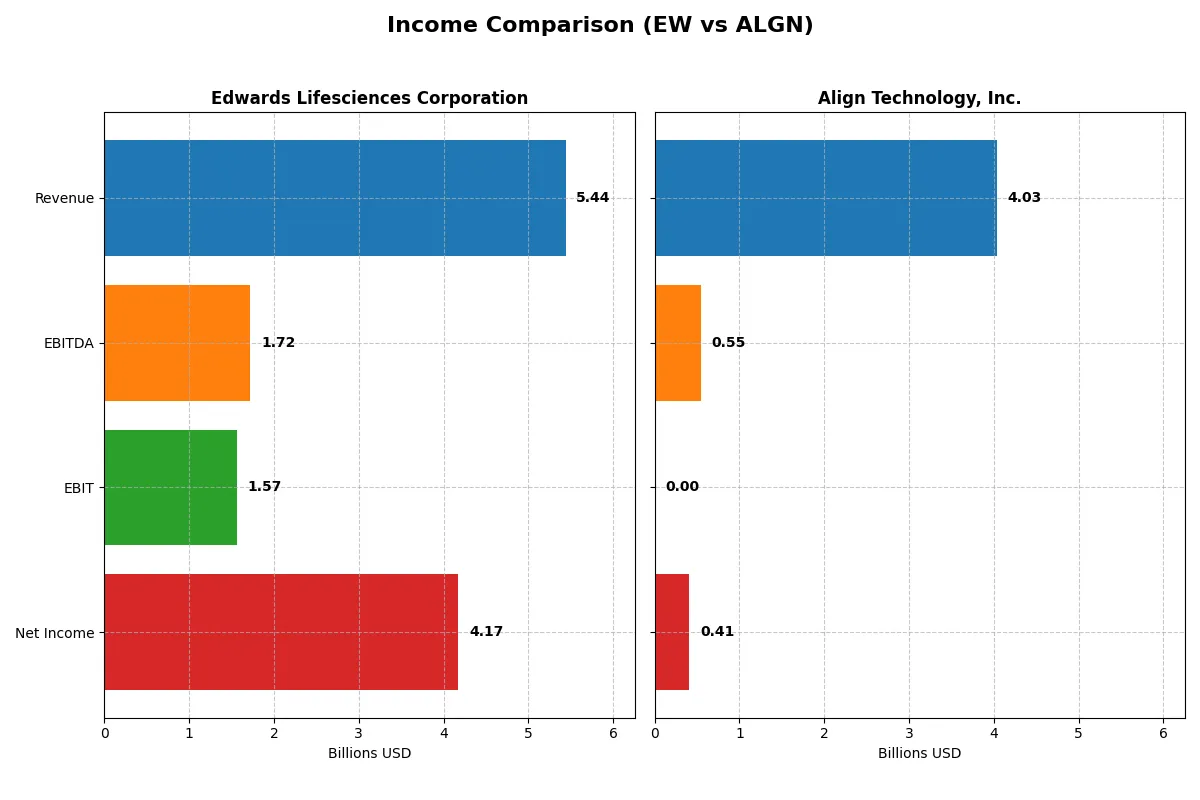

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Edwards Lifesciences Corporation (EW) | Align Technology, Inc. (ALGN) |

|---|---|---|

| Revenue | 5.44B | 4.04B |

| Cost of Revenue | 1.12B | 1.32B |

| Operating Expenses | 2.94B | 2.13B |

| Gross Profit | 4.32B | 2.79B |

| EBITDA | 1.72B | 546M |

| EBIT | 1.57B | — |

| Interest Expense | 20M | 0 |

| Net Income | 4.17B | 410M |

| EPS | 6.98 | 5.66 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine through recent financial performance.

Edwards Lifesciences Corporation Analysis

Edwards Lifesciences shows strong revenue growth, rising 8.6% to $5.44B in 2024, with net income surging 198% to $4.17B. The company maintains a healthy gross margin of 79.5% and a robust net margin of 76.8%, highlighting exceptional cost control and profitability. Momentum peaked in 2024, driven by a 12.8% EBIT increase and a remarkable EPS growth of 203%.

Align Technology, Inc. Analysis

Align Technology’s revenue grew marginally by 0.9% to $4.03B in 2025, while net income declined 3.5% to $410M. Its gross margin stands at a solid 67.2%, but net margin lags at 10.2%, reflecting higher operating costs and zero EBIT in 2025. The company faces pressure from declining profitability and stagnant top-line growth, signaling operational challenges.

Margin Dominance vs. Revenue Resilience

Edwards Lifesciences clearly outperforms Align with superior margin expansion and explosive net income growth, capitalizing on operational efficiency. Align’s flat revenue growth and shrinking margins indicate weaker financial health. For investors prioritizing profitability and growth momentum, Edwards represents the stronger, more compelling profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed below:

| Ratios | Edwards Lifesciences (EW) | Align Technology (ALGN) |

|---|---|---|

| ROE | 41.75% | 10.94% |

| ROIC | 10.74% | 9.99% |

| P/E | 10.60 | 37.05 |

| P/B | 4.43 | 4.05 |

| Current Ratio | 4.18 | 1.22 |

| Quick Ratio | 3.45 | 1.10 |

| D/E | 0.07 | 0.03 |

| Debt-to-Assets | 5.36% | 1.92% |

| Interest Coverage | 69.63 | 0 |

| Asset Turnover | 0.42 | 0.64 |

| Fixed Asset Turnover | 3.05 | 2.89 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, exposing hidden risks and operational strengths critical for assessing investment quality.

Edwards Lifesciences Corporation

Edwards delivers a stellar 42% ROE and a robust 77% net margin, signaling exceptional profitability. Its P/E of 10.6 marks the stock as attractively valued. Despite a high P/B ratio and a stretched current ratio, Edwards reinvests heavily in R&D (19% of revenue), prioritizing growth over dividends, which remain absent.

Align Technology, Inc.

Align posts a modest 11% ROE and a 10.5% net margin, reflecting more moderate profitability. The stock appears expensive with a P/E of 37.05 and a P/B of 4.05. Align shows prudent capital structure with low debt but pays no dividends. It reinvests in R&D (9% of revenue) to fuel future expansion, balancing growth with financial caution.

Value Efficiency vs. Growth Premium

Edwards offers superior profitability and a more attractive valuation, despite some liquidity concerns. Align trades at a premium with lower returns but maintains solid reinvestment discipline. Investors seeking operational efficiency may favor Edwards, while those betting on growth might prefer Align’s profile.

Which one offers the Superior Shareholder Reward?

Edwards Lifesciences (EW) and Align Technology (ALGN) both eschew dividends, focusing on growth and buybacks. EW’s free cash flow per share of $0.49 contrasts with ALGN’s robust $8.32. EW runs minimal buybacks, while ALGN’s aggressive repurchases amplify returns. ALGN’s lower payout ratio and stronger free cash flow support a more sustainable capital allocation. I see ALGN offering superior total shareholder returns in 2026 due to its disciplined buyback program and healthier free cash flow coverage.

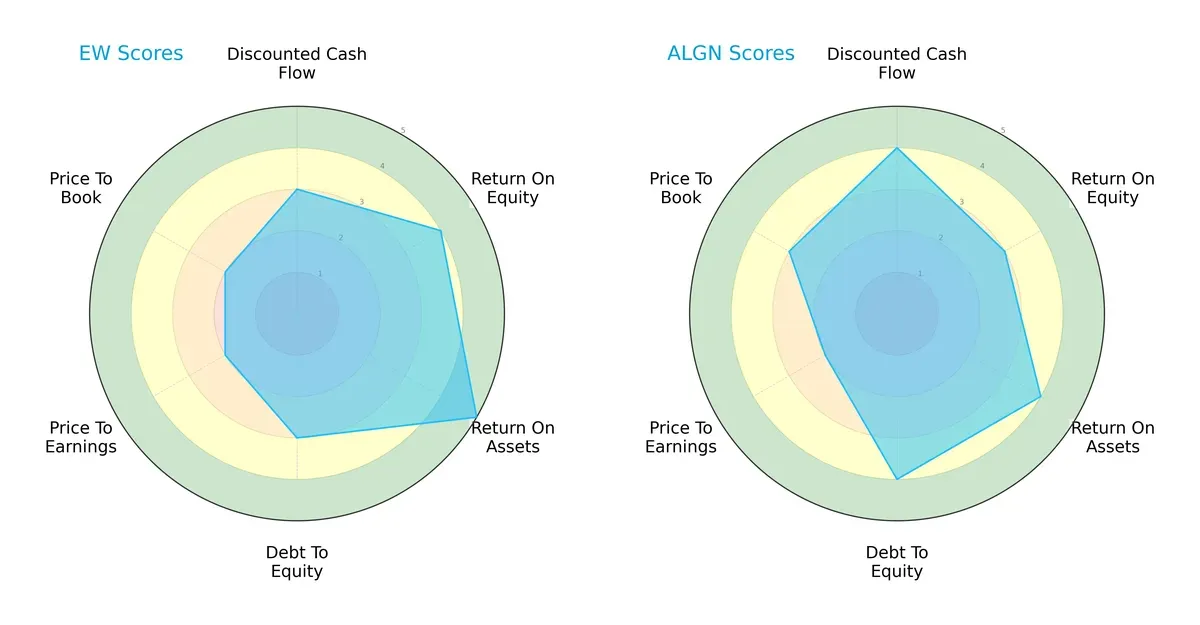

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Edwards Lifesciences and Align Technology, highlighting their distinct competitive advantages and financial balances:

Edwards shows strength in asset efficiency (ROA 5) and equity returns (ROE 4), but weaker valuation metrics (P/E and P/B scores 2). Align offers a more balanced profile with solid DCF, debt management, and valuation scores. Edwards relies on operational efficiency; Align leans on financial stability and moderate valuation.

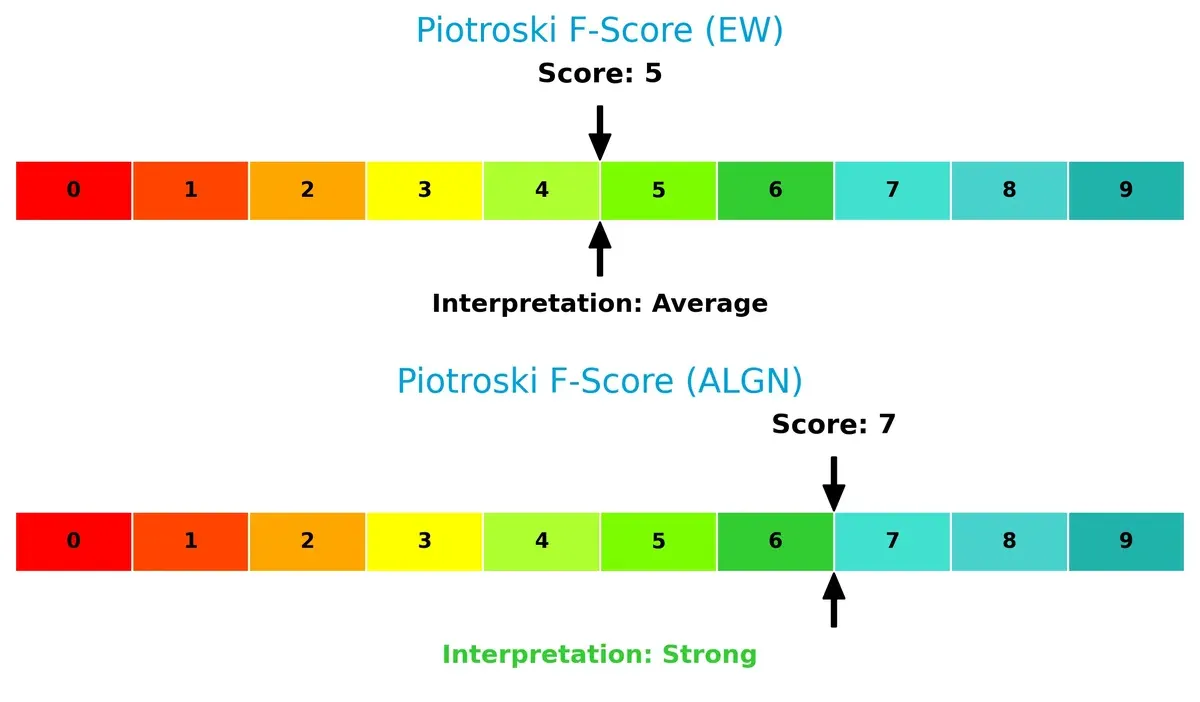

Bankruptcy Risk: Solvency Showdown

Edwards’ Altman Z-Score of 12.2 far exceeds Align’s 4.6, signaling superior long-term solvency and resilience in this economic cycle:

Financial Health: Quality of Operations

Align’s Piotroski F-Score of 7 indicates strong internal financial health, surpassing Edwards’ average score of 5, which signals some caution in operational metrics:

How are the two companies positioned?

This section dissects the operational DNA of EW and ALGN by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. The final objective is to confront their economic moats and identify which business model offers the most resilient and sustainable competitive advantage in today’s market landscape.

Revenue Segmentation: The Strategic Mix

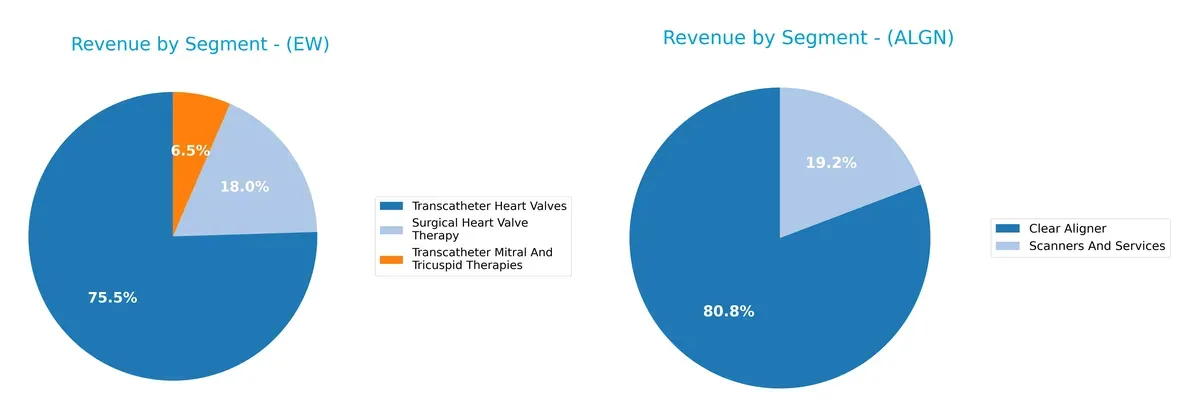

This visual comparison dissects how Edwards Lifesciences and Align Technology diversify their income streams and where their primary sector bets lie:

Edwards Lifesciences anchors revenue heavily on Transcatheter Heart Valves with $4.1B, dwarfing its other segments like Surgical Heart Valve Therapy at $981M. Align Technology pivots around Clear Aligner sales at $3.23B but maintains notable diversification with $769M from Scanners and Services. Edwards faces concentration risk tied to heart valve innovation, while Align leverages ecosystem lock-in through complementary hardware and software.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Edwards Lifesciences Corporation (EW) and Align Technology, Inc. (ALGN):

EW Strengths

- High net margin at 76.75%

- Strong ROE of 41.75%

- ROIC above WACC at 10.74%

- Low debt-to-assets at 5.36%

- Significant U.S. revenue of 3.21B

- Diversified product lines including heart valves and critical care

ALGN Strengths

- Positive net margin at 10.54%

- Favorable quick ratio at 1.1

- Low debt-to-assets at 1.92%

- Large U.S. revenue base at 1.7B

- Global presence including Switzerland and Other International regions

- Clear aligner segment generating 3.23B revenue

EW Weaknesses

- Unfavorable price-to-book at 4.43

- High current ratio at 4.18 may indicate inefficient asset use

- Unfavorable asset turnover at 0.42

- Zero dividend yield

- Smaller geographic diversification outside U.S. and Europe

- Dependency on heart valve therapies

ALGN Weaknesses

- Elevated price-to-earnings at 37.05

- Unfavorable interest coverage ratio at 0

- Neutral ROE and ROIC indicate moderate profitability

- Limited product diversification focused on aligners and scanners

- Lower geographic revenue outside U.S. and Switzerland

- Zero dividend yield

Overall, EW displays strong profitability and diversified product segments but faces efficiency and valuation challenges. ALGN shows solid U.S. market penetration and manageable debt but has valuation and coverage risks, with less diversification. These factors shape their strategic priorities and investor risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable barrier protecting long-term profits from relentless competitive erosion:

Edwards Lifesciences Corporation: Intangible Asset and Innovation Moat

Edwards leverages proprietary transcatheter valve technologies, sustaining high ROIC above WACC with stable margins. Innovation in minimally invasive therapies deepens its moat but declining ROIC signals caution.

Align Technology, Inc.: Switching Costs and Network Effects Moat

Align’s moat relies on its Invisalign ecosystem and digital scanner integration, locking in customers. However, recent margin pressure and stagnant revenue growth weaken its competitive foothold despite global presence.

Innovation Edge vs. Ecosystem Lock-in: The 2026 Moat Face-off

Edwards holds a wider, innovation-driven moat with proven value creation despite margin pressure. Align’s network effect is strong but currently less defensible amid financial softness. Edwards is better positioned to protect market share long term.

Which stock offers better returns?

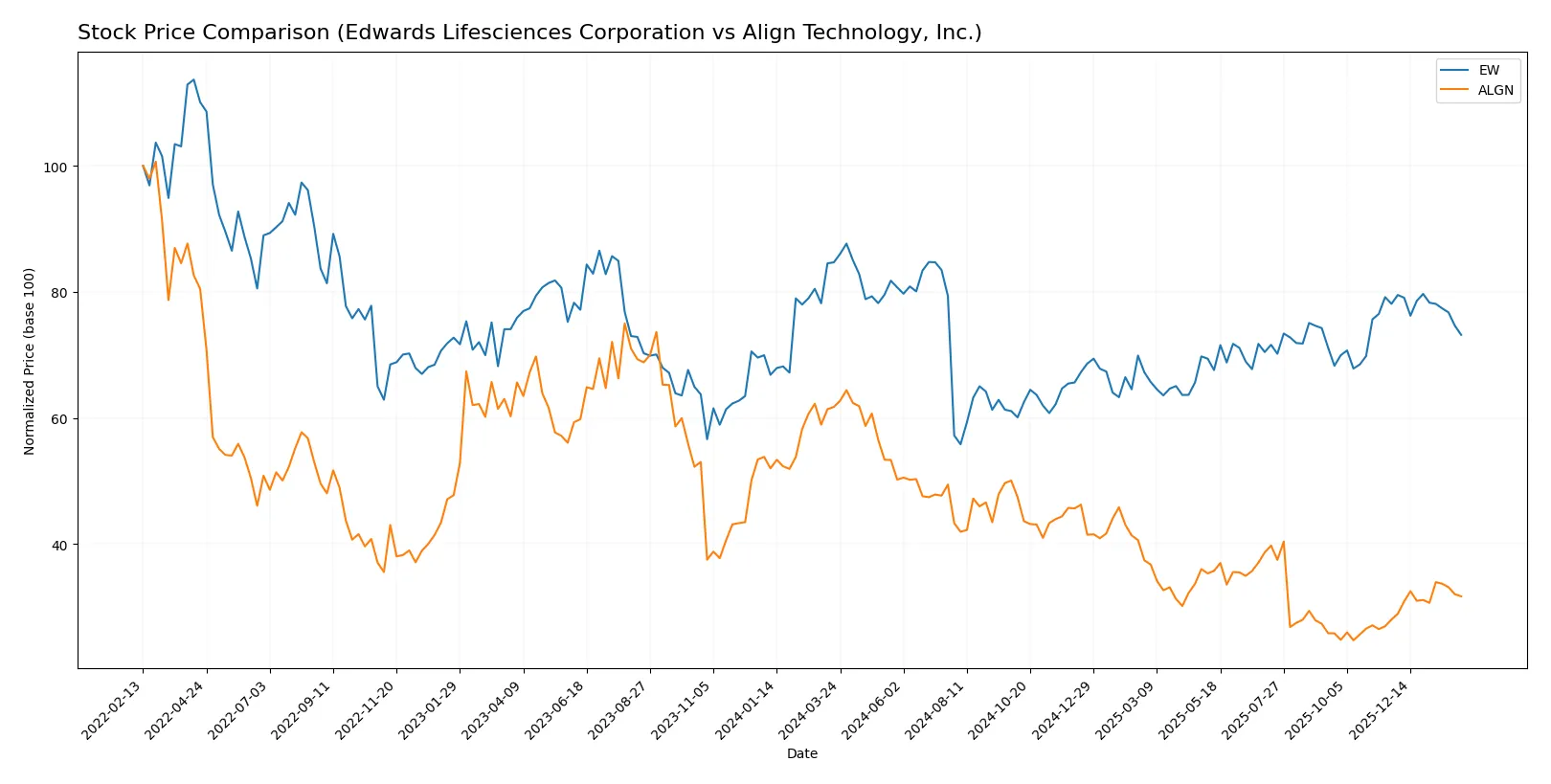

Over the past year, both stocks experienced notable price shifts, with Edwards Lifesciences showing a steady decline and Align Technology facing higher volatility but recent recovery signs.

Trend Comparison

Edwards Lifesciences (EW) shows a 13.58% decline over 12 months, marking a bearish trend with deceleration. The stock fell from 95.56 to 60.83, with volatility at 8.12.

Align Technology (ALGN) faced a sharper 48.69% drop over the same period, confirming a bearish trend but with accelerating losses. The price ranged from 327.92 to 125.79, showing extreme volatility at 50.54.

Comparing recent trends, ALGN gained 13.15% while EW dropped 6.3%, making ALGN the higher performer despite overall larger losses.

Target Prices

Analysts present a moderately bullish consensus for Edwards Lifesciences Corporation and Align Technology, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Edwards Lifesciences Corporation | 87 | 110 | 97.25 |

| Align Technology, Inc. | 140 | 200 | 176.43 |

Edwards Lifesciences’ consensus target exceeds its current 79.77 price by about 22%, signaling upside potential. Align Technology’s 176.43 target is nearly 9% above its 161.3 market price, indicating moderate analyst optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

This section compares the latest institutional grades for Edwards Lifesciences Corporation and Align Technology, Inc.:

Edwards Lifesciences Corporation Grades

Here are the recent grades from leading financial institutions for Edwards Lifesciences Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-01-20 |

| Piper Sandler | Maintain | Overweight | 2026-01-20 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| UBS | Maintain | Neutral | 2026-01-12 |

| TD Cowen | Upgrade | Buy | 2026-01-09 |

| Stifel | Maintain | Buy | 2026-01-07 |

| JP Morgan | Upgrade | Overweight | 2025-12-18 |

| Canaccord Genuity | Maintain | Hold | 2025-12-17 |

| Baird | Maintain | Neutral | 2025-12-16 |

| Citigroup | Maintain | Buy | 2025-12-11 |

Align Technology, Inc. Grades

Below are the latest institutional grades issued for Align Technology, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-20 |

| Piper Sandler | Maintain | Overweight | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-30 |

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-21 |

| UBS | Maintain | Neutral | 2025-10-16 |

| Mizuho | Maintain | Outperform | 2025-10-13 |

| Jefferies | Downgrade | Hold | 2025-10-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-08 |

Which company has the best grades?

Edwards Lifesciences has a broader range of Buy and Overweight ratings with recent upgrades. Align Technology predominantly receives Outperform and Overweight grades but includes downgrades to Hold. Investors may view Edwards’ consistent upgrades as stronger institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Edwards Lifesciences Corporation

- Dominates structural heart devices with strong innovation but faces competition from established medtech giants.

Align Technology, Inc.

- Leads clear aligner market but faces rising competition from new entrants and alternative orthodontic solutions.

2. Capital Structure & Debt

Edwards Lifesciences Corporation

- Low debt-to-equity (0.07) and high interest coverage (79.19) indicate a very strong balance sheet and low financial risk.

Align Technology, Inc.

- Very low debt-to-equity (0.03) but zero interest coverage signals potential liquidity concerns if debt servicing becomes necessary.

3. Stock Volatility

Edwards Lifesciences Corporation

- Beta near 1 (0.94) shows stock volatility aligned with the overall market, indicating moderate risk.

Align Technology, Inc.

- High beta (1.83) reflects significant stock volatility, increasing exposure to market swings.

4. Regulatory & Legal

Edwards Lifesciences Corporation

- Medical device regulations in multiple jurisdictions create compliance costs but also barriers to entry for competitors.

Align Technology, Inc.

- Orthodontic and dental device regulations require ongoing compliance, with potential liability from treatment outcomes.

5. Supply Chain & Operations

Edwards Lifesciences Corporation

- Complex manufacturing and global distribution expose it to supply disruptions but benefit from a direct sales force.

Align Technology, Inc.

- Relies on advanced manufacturing and digital services, vulnerable to tech supply chain bottlenecks and software delivery issues.

6. ESG & Climate Transition

Edwards Lifesciences Corporation

- Pressure to reduce carbon footprint in manufacturing and enhance sustainability in product lifecycle.

Align Technology, Inc.

- Faces growing investor scrutiny on sustainable practices and data privacy in digital health technologies.

7. Geopolitical Exposure

Edwards Lifesciences Corporation

- Global operations subject to trade tensions and regulatory changes, especially in Europe and Asia.

Align Technology, Inc.

- High international sales expose it to currency fluctuations and geopolitical risks in emerging markets.

Which company shows a better risk-adjusted profile?

Edwards Lifesciences confronts its largest risk in potential supply chain disruptions affecting complex device manufacturing. Align Technology’s biggest risk lies in elevated stock volatility and uncertain debt servicing capacity. Edwards’ superior balance sheet strength and moderate stock volatility provide a better risk-adjusted profile. Its Altman Z-Score of 12.19 confirms robust financial health, while Align’s higher beta (1.83) signals greater market risk. I remain cautious on Align’s zero interest coverage ratio, which could pressure liquidity in tighter credit conditions.

Final Verdict: Which stock to choose?

Edwards Lifesciences (EW) excels as a cash-generating powerhouse with a strong value-creation track record. Its superpower lies in efficiently deploying capital to deliver high returns despite a slightly declining profitability trend. The main point of vigilance is its stretched current ratio, suggesting cautious working capital management. EW fits well in an Aggressive Growth portfolio seeking robust operational leverage.

Align Technology (ALGN) commands a strategic moat through its recurring revenue and innovative dental tech niche. It offers a safer profile with solid balance sheet metrics and a strong Piotroski score, despite recent profitability headwinds. ALGN suits a GARP (Growth at a Reasonable Price) portfolio, appealing to investors valuing stability with moderate growth prospects.

If you prioritize aggressive capital efficiency and high returns amid some operational risk, Edwards Lifesciences outshines as the compelling choice. However, if you seek better stability and a defensible market position with moderate volatility, Align Technology offers superior safety and strategic resilience. Both present distinct analytical scenarios depending on your risk tolerance and growth expectations.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Edwards Lifesciences Corporation and Align Technology, Inc. to enhance your investment decisions: