Alibaba Group Holding Limited (BABA) and MercadoLibre, Inc. (MELI) are two leading players in the specialty retail sector, dominating e-commerce in Asia and Latin America, respectively. Both companies excel in integrating technology and logistics to drive market growth and innovation. This comparison explores their strategic strengths and market positions to help you decide which company holds the most promising investment potential in 2026. Let’s dive into the details.

Table of contents

Companies Overview

I will begin the comparison between Alibaba and MercadoLibre by providing an overview of these two companies and their main differences.

Alibaba Overview

Alibaba Group Holding Limited focuses on providing technology infrastructure and marketing reach to support merchants, brands, and retailers primarily in China and internationally. The company operates various e-commerce platforms including Taobao and Tmall, along with logistics, cloud computing, digital media, and AI services. Founded in 1999 and based in Hangzhou, Alibaba serves a broad spectrum of online retail and technology needs with a market cap of 350B USD.

MercadoLibre Overview

MercadoLibre, Inc. operates online commerce platforms across Latin America, offering services such as an automated marketplace, financial technology through Mercado Pago, and logistics via Mercado Envios. It also provides classifieds, advertising, and digital storefront solutions. Founded in 1999 and headquartered in Montevideo, MercadoLibre has a market cap of 110B USD and emphasizes integrated commerce and fintech services for the region.

Key similarities and differences

Both Alibaba and MercadoLibre operate within the specialty retail sector focusing on e-commerce platforms and supporting services. Alibaba’s business model is more diversified with multiple segments including cloud, media, and AI, targeting a global market with a strong presence in China. MercadoLibre concentrates on Latin America, integrating fintech and logistics tightly with its marketplace, reflecting regional specialization and financial services emphasis. Their market caps and employee counts also differ significantly, illustrating scale variation.

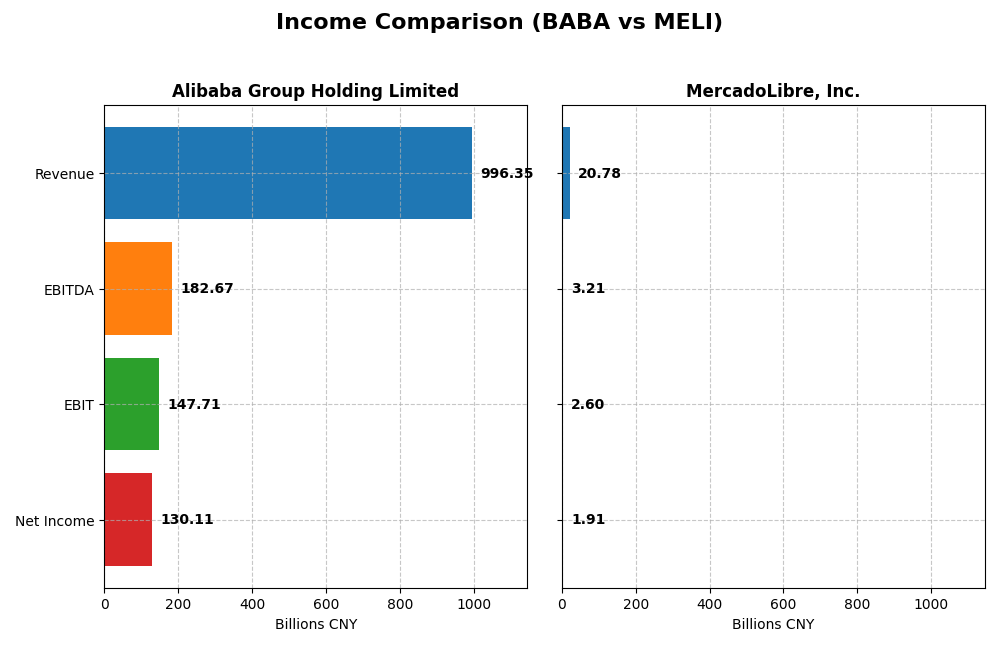

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for Alibaba Group Holding Limited and MercadoLibre, Inc.

| Metric | Alibaba Group Holding Limited | MercadoLibre, Inc. |

|---|---|---|

| Market Cap | 350B CNY | 110B USD |

| Revenue | 996B CNY | 20.8B USD |

| EBITDA | 183B CNY | 3.2B USD |

| EBIT | 148B CNY | 2.6B USD |

| Net Income | 130B CNY | 1.9B USD |

| EPS | 55.12 CNY | 37.69 USD |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Alibaba Group Holding Limited

Alibaba’s revenue showed a steady increase from 717B CNY in 2021 to nearly 996B CNY in 2025, with net income fluctuating and ending at about 130B CNY in 2025. Margins have generally been favorable, with a gross margin close to 40% and a strong EBIT margin around 15%. In 2025, revenue growth slowed to 5.9%, but net margin and EPS saw significant improvements, indicating enhanced profitability.

MercadoLibre, Inc.

MercadoLibre’s revenue expanded rapidly from 3.97B USD in 2020 to 20.8B USD in 2024, with net income surging from a slight loss to 1.91B USD. Margins remained healthy, with a gross margin above 46% and a net margin near 9.2%. The latest fiscal year reflected strong 37.5% revenue growth and over 40% net margin improvement, confirming accelerating operational efficiency and profitability gains.

Which one has the stronger fundamentals?

MercadoLibre demonstrates stronger fundamentals with consistent, robust revenue and net income growth, alongside improving margins and operational efficiency. Alibaba, while showing solid revenue growth, faces some margin compression and less consistent net income trends over the period. Both companies maintain favorable income statement profiles, but MercadoLibre’s growth momentum and margin expansion appear more pronounced.

Financial Ratios Comparison

This table compares the most recent key financial ratios of Alibaba Group Holding Limited and MercadoLibre, Inc. to provide a snapshot of their financial health and market valuation.

| Ratios | Alibaba Group Holding Limited (BABA) | MercadoLibre, Inc. (MELI) |

|---|---|---|

| ROE | 12.86% | 43.92% |

| ROIC | 7.87% | 17.73% |

| P/E | 17.32x | 45.11x |

| P/B | 2.23x | 19.81x |

| Current Ratio | 1.54 | 1.21 |

| Quick Ratio | 1.49 | 1.20 |

| D/E (Debt-to-Equity) | 0.25 | 1.57 |

| Debt-to-Assets | 13.75% | 27.19% |

| Interest Coverage | 14.68x | 17.20x |

| Asset Turnover | 0.55 | 0.82 |

| Fixed Asset Turnover | 3.99 | 8.38 |

| Payout Ratio | 22.35% | 0% |

| Dividend Yield | 1.29% | 0% |

Interpretation of the Ratios

Alibaba Group Holding Limited

Alibaba shows a favorable overall ratio profile, with strengths in net margin (13.06%), WACC (4.5%), current and quick ratios, debt metrics, and interest coverage, supporting solid financial stability. Neutral ratings on ROE (12.86%), ROIC (7.87%), and valuation multiples suggest room for improvement. The company pays dividends with a moderate 1.29% yield, reflecting balanced shareholder returns without excessive payout risks.

MercadoLibre, Inc.

MercadoLibre exhibits a mixed ratio profile, with favorable ROE (43.92%), ROIC (17.73%), interest coverage, and fixed asset turnover, but unfavorable PE (45.11), PB (19.81), and debt-to-equity (1.57) ratios indicating valuation and leverage concerns. The net margin is neutral at 9.2%. The company does not pay dividends, likely focusing on growth and reinvestment, consistent with its financial positioning.

Which one has the best ratios?

Alibaba presents a more balanced and favorable ratio set, with strong liquidity and manageable leverage, while MercadoLibre’s higher profitability ratios contrast with its unfavorable valuation and leverage metrics. Overall, Alibaba’s ratios suggest greater financial stability; MercadoLibre shows growth potential but with higher risk indicators.

Strategic Positioning

This section compares the strategic positioning of Alibaba and MercadoLibre, focusing on Market position, Key segments, and Exposure to technological disruption:

Alibaba

- Leading market player in China and internationally with diversified competition.

- Diverse segments including commerce, cloud, logistics, digital media, and innovation initiatives driving growth.

- Invests heavily in cloud, AI, and digital platforms to counter technological disruption.

MercadoLibre

- Strong regional presence in Latin America with competitive pressures.

- Key segments are online marketplace, fintech services, logistics, and advertising.

- Focus on fintech innovation and integrated commerce-logistics platform to address disruption.

Alibaba vs MercadoLibre Positioning

Alibaba exhibits a diversified business model across multiple sectors and technologies, offering broad market reach but facing complex management challenges. MercadoLibre is more concentrated on Latin American e-commerce and fintech, enabling focused growth but with regional dependency risks.

Which has the best competitive advantage?

Both companies show a very favorable moat with growing ROIC exceeding WACC, indicating durable competitive advantages; MercadoLibre’s ROIC growth is more pronounced, while Alibaba’s scale offers broad diversification benefits.

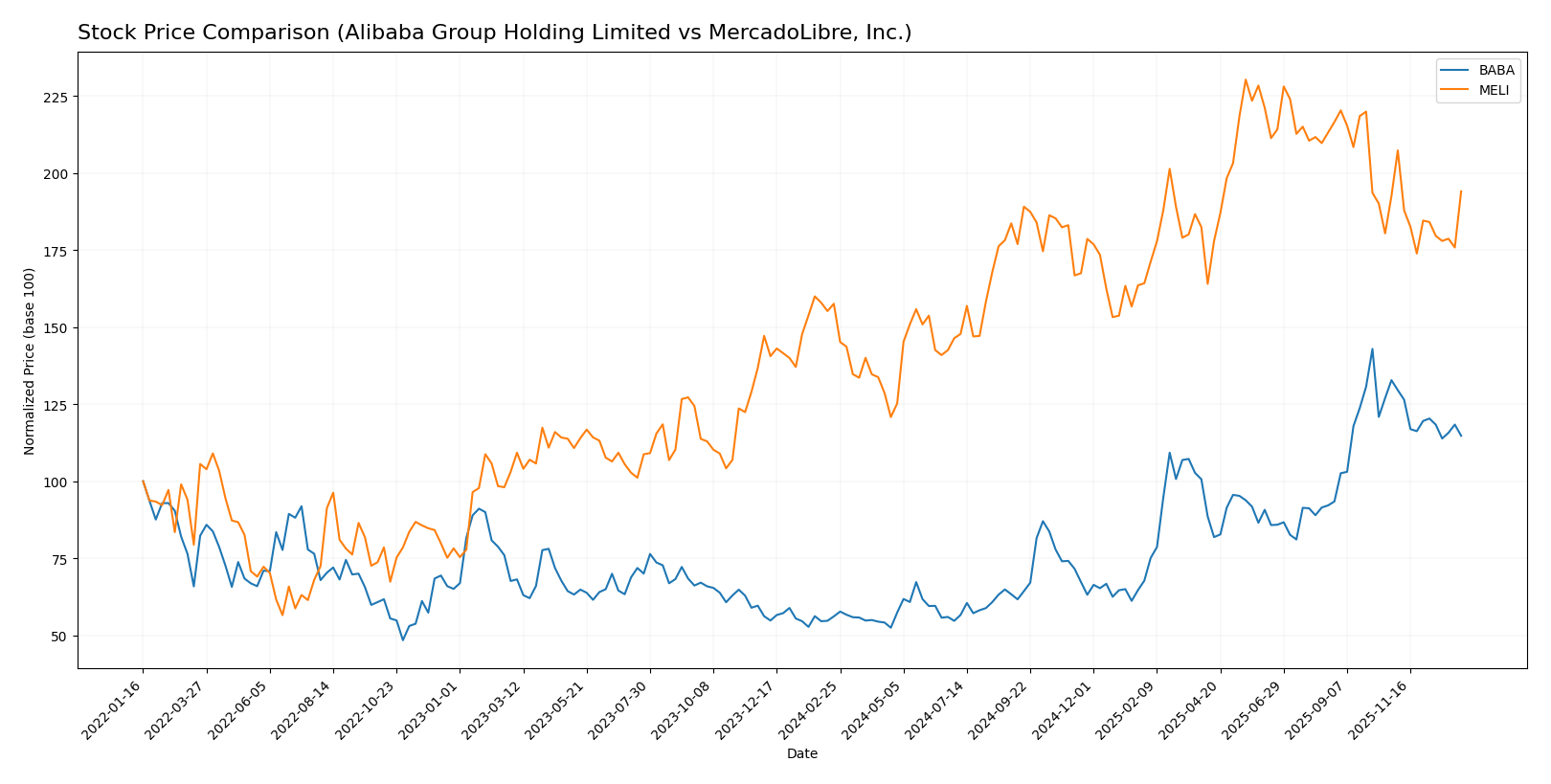

Stock Comparison

The stock price chart illustrates significant price appreciation for Alibaba and moderate gains for MercadoLibre over the past year, with recent shifts indicating some deceleration and seller dominance in trading activity.

Trend Analysis

Alibaba Group Holding Limited’s stock shows a strong bullish trend over the past 12 months with a 104.25% price increase, though the trend has decelerated recently with a 13.59% decline from October 2025 to January 2026.

MercadoLibre, Inc. experienced a bullish trend with a 23.16% gain over the past year, also decelerating recently with a minor 0.8% rise from October 2025 to January 2026, despite high volatility.

Comparing both, Alibaba delivered the highest market performance over the past year, showing significantly stronger gains than MercadoLibre despite recent downward pressure.

Target Prices

The current analyst consensus reflects optimistic target prices for Alibaba Group Holding Limited and MercadoLibre, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Alibaba Group Holding Limited | 225 | 140 | 186.98 |

| MercadoLibre, Inc. | 2900 | 2700 | 2830 |

Analysts expect Alibaba’s stock to appreciate from its current price of 150.96 USD toward the consensus target of 186.98 USD, indicating moderate upside potential. MercadoLibre shows a strong upward target consensus well above its current price of 2178.41 USD, signaling significant expected growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Alibaba Group Holding Limited and MercadoLibre, Inc.:

Rating Comparison

Alibaba Group Holding Limited Rating

- Rating: B+, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation status.

- ROE Score: 4, a Favorable measure of profit generation efficiency.

- ROA Score: 4, Favorable asset utilization efficiency.

- Debt To Equity Score: 3, Moderate financial risk level.

- Overall Score: 3, a Moderate overall financial standing.

MercadoLibre, Inc. Rating

- Rating: B-, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation.

- ROE Score: 5, a Very Favorable indicator of profit efficiency.

- ROA Score: 4, Favorable asset utilization efficiency.

- Debt To Equity Score: 1, Very Unfavorable due to high financial risk.

- Overall Score: 3, also Moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Alibaba holds a higher overall rating (B+) compared to MercadoLibre (B-). However, MercadoLibre outperforms Alibaba in ROE but shows significantly higher financial risk as reflected in its low debt-to-equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Alibaba and MercadoLibre:

Alibaba Scores

- Altman Z-Score: 1.72, indicating financial distress zone.

- Piotroski Score: 8, classified as very strong financial health.

MercadoLibre Scores

- Altman Z-Score: 3.46, indicating safe financial zone.

- Piotroski Score: 4, classified as average financial health.

Which company has the best scores?

MercadoLibre has a higher Altman Z-Score, placing it in the safe zone, while Alibaba is in distress. However, Alibaba’s Piotroski Score is much stronger than MercadoLibre’s, suggesting better financial strength on that metric.

Grades Comparison

Here is a detailed comparison of the latest available grades for Alibaba Group Holding Limited and MercadoLibre, Inc.:

Alibaba Group Holding Limited Grades

This table summarizes recent grades assigned to Alibaba by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-08 |

| Freedom Capital Markets | Downgrade | Hold | 2026-01-06 |

| Benchmark | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Citigroup | Maintain | Buy | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-10-10 |

| JP Morgan | Maintain | Overweight | 2025-10-09 |

| JP Morgan | Maintain | Overweight | 2025-10-01 |

Alibaba’s grades predominantly reflect positive analyst sentiment, with most firms maintaining Buy, Outperform, or Overweight recommendations and a single recent downgrade to Hold.

MercadoLibre, Inc. Grades

The following table presents MercadoLibre’s recent grades from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

MercadoLibre’s grades indicate a strong buy-side consensus with multiple Buy, Overweight, and Outperform ratings, alongside one Neutral grade.

Which company has the best grades?

Both Alibaba and MercadoLibre carry a consensus Buy rating, but Alibaba shows a broader range of positive grades with a minor recent downgrade, while MercadoLibre’s ratings are consistently positive with slightly more Neutral assessments. This suggests that investors may perceive MercadoLibre as having a steadier analyst outlook, potentially impacting portfolio risk and growth expectations.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Alibaba Group Holding Limited (BABA) and MercadoLibre, Inc. (MELI) based on their latest financial and operational data:

| Criterion | Alibaba Group Holding Limited (BABA) | MercadoLibre, Inc. (MELI) |

|---|---|---|

| Diversification | Highly diversified with strong segments in Customer Management (424B CNY), Logistics (123B CNY), and Cloud Services (85B CNY) | Moderately diversified; main revenue from Services (18.6B USD) and Products (2.1B USD) |

| Profitability | Net margin 13.1%, ROIC 7.9%, growing ROIC trend, favorable WACC (4.5%) | ROIC 17.7%, ROE 43.9%, growing ROIC trend, but lower net margin (9.2%) and higher WACC (9.95%) |

| Innovation | Strong investment in Cloud Services and value-added services | High innovation reflected in fintech and commerce growth; very high ROIC growth rate |

| Global presence | Dominant in China with expanding international logistics | Leading in Latin America with growing cross-border commerce focus |

| Market Share | Large market share in Chinese e-commerce and cloud markets | Leading market share in Latin American e-commerce and fintech sectors |

In summary, Alibaba shows strength in diversification and stable profitability with a solid balance sheet, while MercadoLibre excels in profitability metrics and innovation, though with higher valuation multiples and leverage, suggesting a higher risk-return profile. Both companies demonstrate durable competitive advantages with growing returns on invested capital.

Risk Analysis

Below is a comparative table of key risks for Alibaba Group Holding Limited (BABA) and MercadoLibre, Inc. (MELI) based on the most recent data available:

| Metric | Alibaba Group Holding Limited (BABA) | MercadoLibre, Inc. (MELI) |

|---|---|---|

| Market Risk | Moderate (Beta 0.36, lower volatility) | Higher (Beta 1.42, more volatile) |

| Debt level | Low (Debt-to-Equity 0.25, favorable) | High (Debt-to-Equity 1.57, unfavorable) |

| Regulatory Risk | High (Chinese regulatory scrutiny) | Moderate (Latin American regulatory variability) |

| Operational Risk | Moderate (Large scale, complex operations) | Moderate (Growing logistics and fintech platforms) |

| Environmental Risk | Moderate (E-commerce and logistics impact) | Moderate (Similar sector exposure) |

| Geopolitical Risk | High (China-US tensions, trade policies) | Moderate (Latin American economic/political instability) |

The most significant risks for Alibaba are regulatory and geopolitical due to ongoing Chinese government scrutiny and international trade tensions, impacting market confidence. MercadoLibre’s primary concerns are high debt levels and market volatility, although its operational focus on fintech and e-commerce growth moderates some risks. Both companies face moderate operational and environmental risks inherent to their sectors. Careful monitoring of regulatory changes and financial leverage is advised.

Which Stock to Choose?

Alibaba Group Holding Limited (BABA) shows steady income growth with a favorable net margin of 13.06% and improving profitability metrics such as ROE at 12.86%. The company maintains low debt levels, reflected in a debt-to-equity ratio of 0.25, and holds a very favorable overall rating of B+ supported by a strong economic moat and a durable competitive advantage.

MercadoLibre, Inc. (MELI) demonstrates robust income growth with a net margin of 9.2% and high profitability indicated by a 43.92% ROE. However, MELI carries higher leverage with a debt-to-equity ratio of 1.57 and shows mixed ratio evaluations, including unfavorable valuation multiples, despite a very favorable rating of B- and a strong economic moat with rapidly growing ROIC.

Investors focused on stability and value could find Alibaba’s favorable financial ratios, moderate debt, and strong rating to be more aligned with their profile, while those pursuing aggressive growth might interpret MercadoLibre’s higher profitability and income growth as attractive despite its higher financial risk and valuation concerns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Alibaba Group Holding Limited and MercadoLibre, Inc. to enhance your investment decisions: