Home > Comparison > Real Estate > DLR vs ARE

The strategic rivalry between Digital Realty Trust, Inc. and Alexandria Real Estate Equities, Inc. shapes the evolving landscape of the real estate sector. Digital Realty operates a vast global data center platform, emphasizing scale and connectivity. Alexandria focuses on high-value urban life science and technology campuses, pioneering niche innovation clusters. This analysis will assess which operational model delivers superior risk-adjusted returns, guiding investors toward the optimal real estate investment for a diversified portfolio.

Table of contents

Companies Overview

Digital Realty Trust and Alexandria Real Estate Equities dominate distinct niches within the REIT office sector.

Digital Realty Trust, Inc.: Global Data Center Powerhouse

Digital Realty Trust commands the global data center market with a robust portfolio of 284 facilities across 23 countries. Its core revenue stems from colocation and interconnection services under the PlatformDIGITAL brand. The company strategically focuses on scaling digital business and managing data gravity challenges in 2026, reinforcing its competitive advantage in digital infrastructure.

Alexandria Real Estate Equities, Inc.: Innovation Campus Specialist

Alexandria Real Estate Equities leads in urban life science and technology campuses, owning 49.7M SF of specialized properties across key innovation hubs. Its revenue engine revolves around developing and operating Class A collaborative campuses tailored to life science, tech, and agtech tenants. In 2026, Alexandria prioritizes expanding its venture capital platform and high-quality tenant base to drive long-term asset value.

Strategic Collision: Similarities & Divergences

Both companies excel in specialized real estate, yet Digital Realty pursues a global digital infrastructure model, while Alexandria focuses on niche urban innovation clusters. Their primary battleground lies in attracting enterprise tenants requiring cutting-edge facilities. Digital Realty’s scale contrasts Alexandria’s focus on high-touch, collaborative environments, resulting in distinctly different risk and growth profiles for investors.

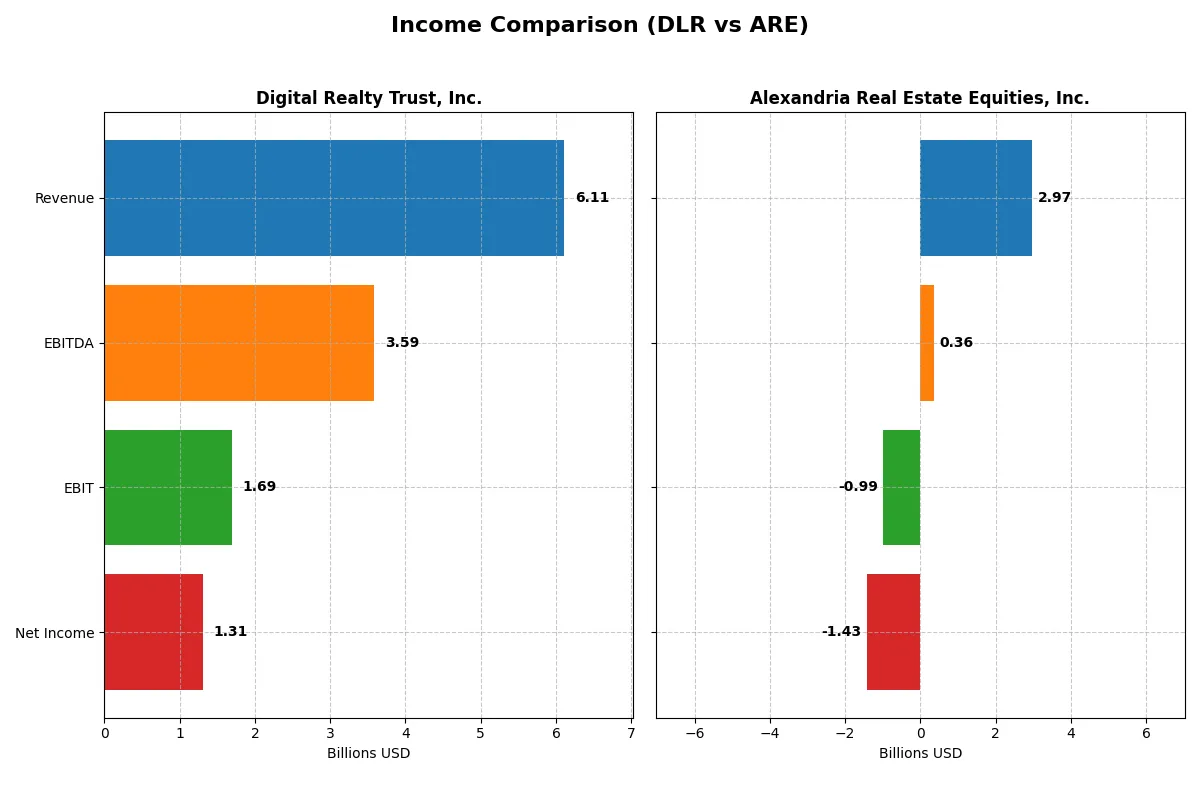

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Digital Realty Trust, Inc. (DLR) | Alexandria Real Estate Equities, Inc. (ARE) |

|---|---|---|

| Revenue | 6.11B | 2.97B |

| Cost of Revenue | 2.73B | 923M |

| Operating Expenses | 2.73B | 3.25B |

| Gross Profit | 3.39B | 2.05B |

| EBITDA | 3.59B | 360M |

| EBIT | 1.69B | -990M |

| Interest Expense | 438M | 227M |

| Net Income | 1.31B | -1.43B |

| EPS | 3.76 | -8.44 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

Comparing income statements reveals which company runs a more efficient and profitable business engine through revenue, margin, and bottom-line trends.

Digital Realty Trust, Inc. Analysis

Digital Realty’s revenue climbed steadily from 4.4B in 2021 to 6.1B in 2025, reflecting a 10% jump last year. Its gross margin holds strong above 55%, and net margin expanded to 21.4% in 2025. Net income nearly doubled last year to 1.3B, signaling rising operational efficiency and robust momentum.

Alexandria Real Estate Equities, Inc. Analysis

Alexandria’s revenue rose from 2.1B in 2021 to 3B in 2025 but declined 2.6% last year. Its gross margin remains healthy near 69%, yet net margin plunged into negative territory at -48.1% in 2025. The company swung to a 1.4B net loss, revealing severe challenges in controlling costs and sustaining profitability.

Margin Strength vs. Profit Sustainability

Digital Realty demonstrates clear superiority with expanding margins and positive net income growth, unlike Alexandria’s sharp losses despite solid gross margins. Digital Realty’s efficient cost control and bottom-line gains make it the fundamentally stronger performer. Investors seeking stable profits should find Digital Realty’s profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these companies:

| Ratios | Digital Realty Trust, Inc. (DLR) | Alexandria Real Estate Equities, Inc. (ARE) |

|---|---|---|

| ROE | 2.82% | -9.25% |

| ROIC | 1.02% | -3.73% |

| P/E | 95.17 | -5.83 |

| P/B | 2.69 | 0.54 |

| Current Ratio | 1.11 | 0.43 |

| Quick Ratio | 1.11 | 0.43 |

| D/E | 0.84 | 0.82 |

| Debt-to-Assets | 39.8% | 37.4% |

| Interest Coverage | 1.04 | -5.30 |

| Asset Turnover | 0.12 | 0.09 |

| Fixed Asset Turnover | 4.71 | 2.69 |

| Payout Ratio | 271.08% | -63.71% |

| Dividend Yield | 2.85% | 10.93% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational excellence that shape investor confidence and portfolio decisions.

Digital Realty Trust, Inc. (DLR)

DLR reveals modest profitability with a 2.82% ROE and a 10.85% net margin, indicating restrained earnings efficiency. Its P/E ratio at 95.17 signals an expensive valuation, while a 2.69 PB ratio remains neutral. The 2.85% dividend yield supports shareholder returns, balancing high valuation with steady income.

Alexandria Real Estate Equities, Inc. (ARE)

ARE faces significant profitability challenges, posting a -9.25% ROE and a -48.15% net margin, reflecting operational stress. Valuation appears attractive with a negative P/E and a low 0.54 PB ratio, suggesting the stock is undervalued. A strong 10.93% dividend yield attempts to offset performance weaknesses but comes with elevated financial risk.

Premium Valuation vs. Operational Strain

DLR’s high valuation contrasts with ARE’s undervalued but loss-making profile. DLR offers a steadier risk-reward balance through positive margins and dividends. ARE’s profile suits investors who tolerate volatility for potential value, while DLR fits those prioritizing operational stability and income.

Which one offers the Superior Shareholder Reward?

Digital Realty Trust, Inc. (DLR) and Alexandria Real Estate Equities, Inc. (ARE) follow distinct shareholder distribution models. DLR delivers a steady dividend yield near 2.8% with a payout ratio around 270%, supported by consistent free cash flow and moderate buybacks. ARE offers a higher dividend yield fluctuating up to 10.9%, but with negative or volatile net income and uneven payout ratios, signaling risk. ARE’s aggressive buyback efforts and reinvestment in growth contrast with DLR’s conservative capital allocation. I find DLR’s balanced dividend and buyback strategy more sustainable, offering a clearer path to stable total returns in 2026.

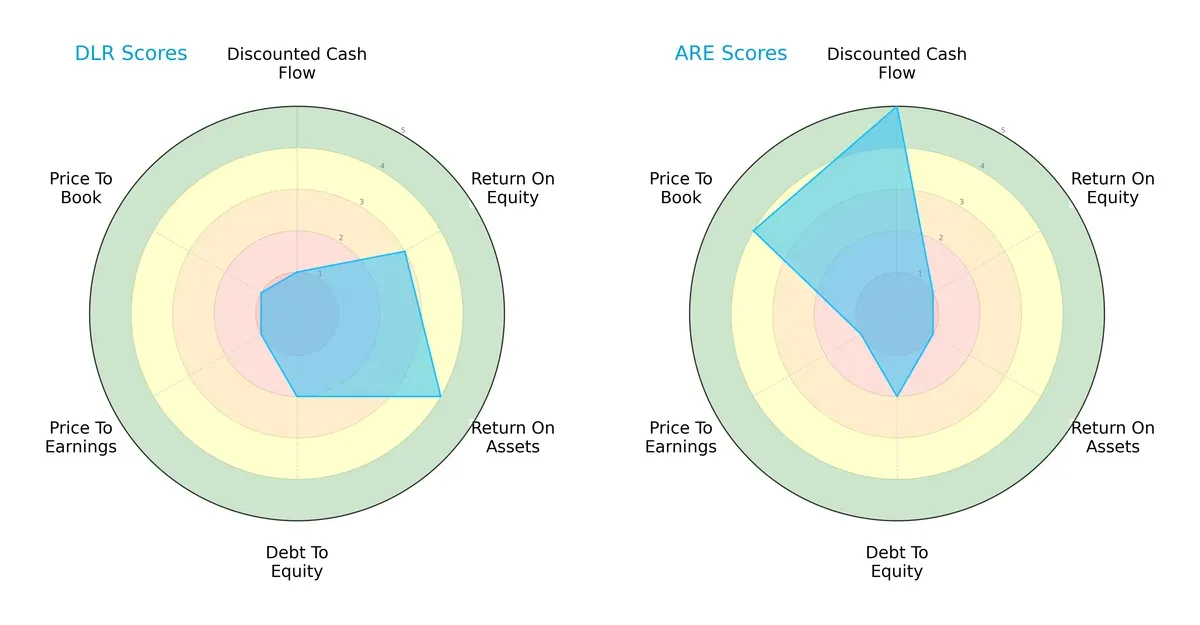

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Digital Realty Trust, Inc. and Alexandria Real Estate Equities, Inc.:

Digital Realty Trust (DLR) shows strength in return on assets (4) and moderate return on equity (3), but weak discounted cash flow (1) and valuation metrics (PE and PB scores of 1). Alexandria Real Estate Equities (ARE) excels in discounted cash flow (5) and price-to-book (4), indicating market favorability, but suffers from very low profitability scores (ROE and ROA at 1). DLR presents a more balanced operational profile, while ARE relies heavily on cash flow valuation advantages.

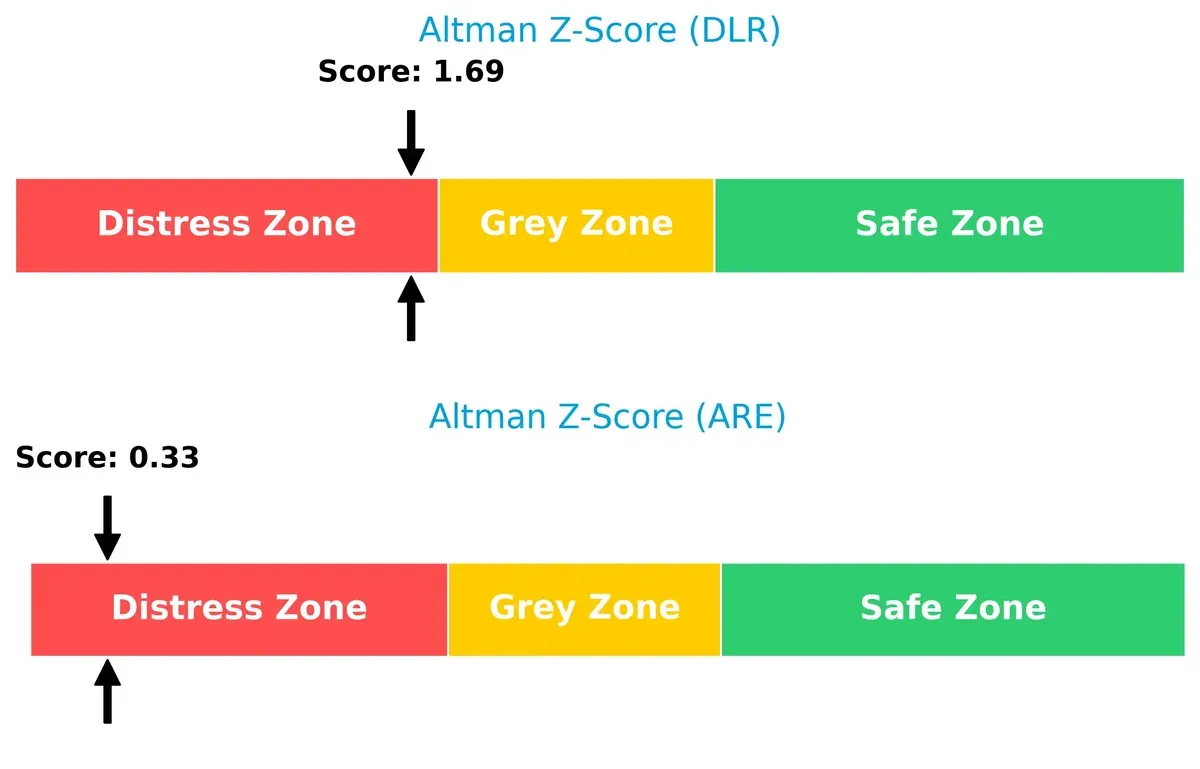

Bankruptcy Risk: Solvency Showdown

DLR’s Altman Z-Score of 1.69 slightly outperforms ARE’s 0.33, but both remain in distress zones, signaling elevated bankruptcy risk in this cycle:

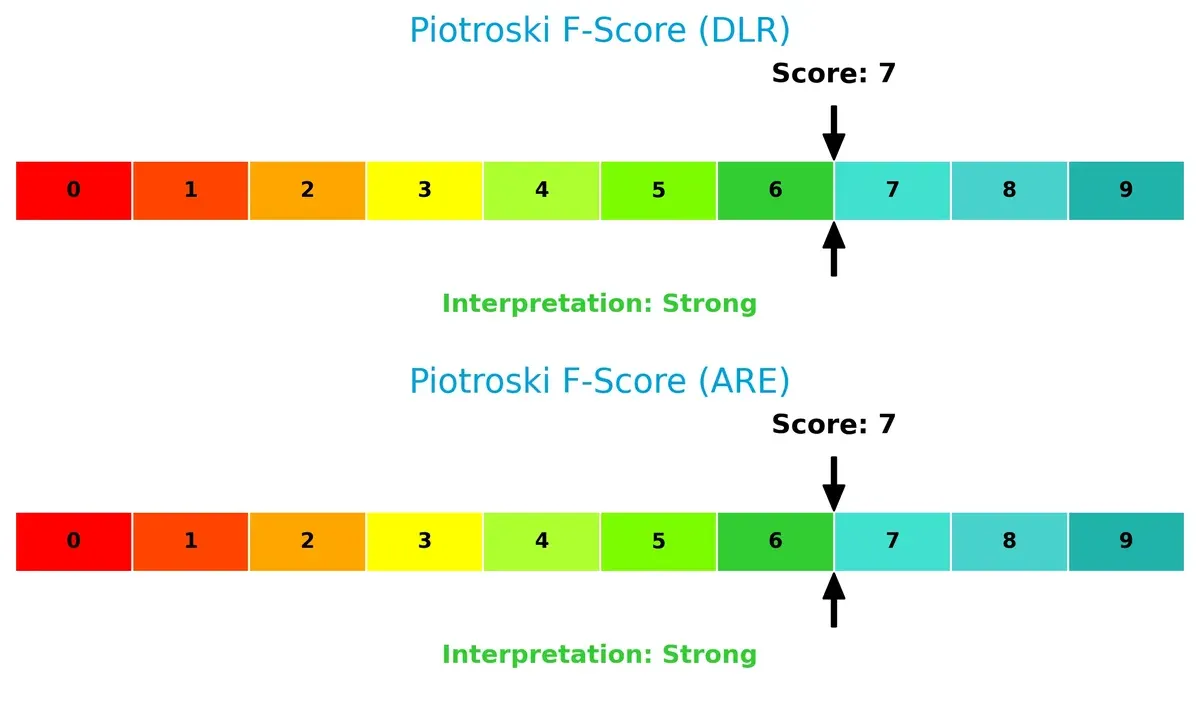

Financial Health: Quality of Operations

Both companies have strong Piotroski F-Scores of 7, reflecting solid internal financial health and operational quality without immediate red flags:

How are the two companies positioned?

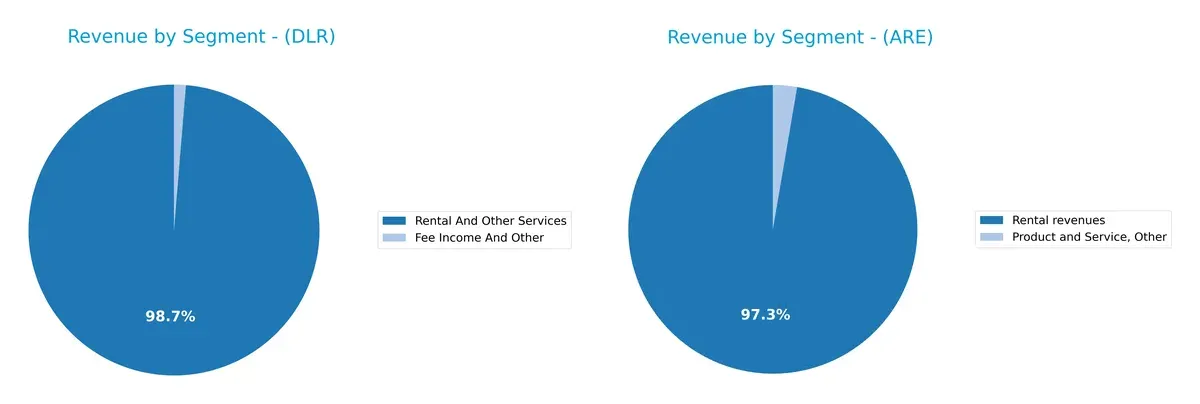

This section dissects Digital Realty Trust and Alexandria Real Estate Equities’ operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model delivers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Digital Realty Trust and Alexandria Real Estate Equities diversify their income streams and where their primary sector bets lie:

Digital Realty Trust anchors 5.48B in rental and other services, with 72M from fee income, showing a dominant single-segment focus. Alexandria Real Estate Equities generates 3.05B in rental revenues plus 67M from products and services, revealing a slightly more diversified mix. DLR’s concentration signals infrastructure dominance but exposes concentration risk. ARE’s smaller, more balanced streams suggest strategic flexibility and ecosystem lock-in potential.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Digital Realty Trust, Inc. (DLR) and Alexandria Real Estate Equities, Inc. (ARE):

DLR Strengths

- Balanced US and Non-US revenue near $2.9B and $2.6B in 2024

- Favorable net margin at 10.85%

- Strong quick ratio of 1.11 indicating liquidity

- Favorable fixed asset turnover at 4.71

- Dividend yield at 2.85% supports shareholder returns

ARE Strengths

- Favorable WACC at 5.85% implies efficient capital cost

- Low price-to-book ratio at 0.54 suggests undervaluation

- Favorable PE ratio despite negative earnings

- Neutral fixed asset turnover at 2.69

- High dividend yield of 10.93% attracts income investors

DLR Weaknesses

- Unfavorable ROE at 2.82% and ROIC at 1.02% signal weak profitability

- High PE ratio at 95.17 may indicate overvaluation

- Unfavorable asset turnover at 0.12 limits operational efficiency

- Neutral debt levels and interest coverage may constrain financial flexibility

ARE Weaknesses

- Negative net margin at -48.15% and ROE at -9.25% reflect poor profitability

- Unfavorable current and quick ratios at 0.43 indicate liquidity stress

- Negative interest coverage at -4.37 signals risk in meeting debt costs

- Unfavorable asset turnover at 0.09 reduces asset utilization efficiency

Both companies show strengths in different financial aspects. DLR’s global presence and operational efficiency contrast with ARE’s capital cost advantages and valuation metrics. Both face profitability and liquidity challenges that require strategic attention.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion in dynamic markets:

Digital Realty Trust, Inc. (DLR): Scale and Global Reach Moat

I see DLR’s primary moat in its vast global data center footprint and platform integration. This scale drives stable margins and a robust 55% gross margin. Expansion into new metros deepens this moat in 2026 but a declining ROIC trend signals caution.

Alexandria Real Estate Equities, Inc. (ARE): Specialized Life Science Campus Moat

ARE’s moat lies in its niche urban campuses for life sciences, creating high tenant switching costs. However, negative EBIT and net margins reflect operational challenges. The specialized focus offers growth potential but has yet to translate into financial strength.

Verdict: Scale Dominance vs. Niche Specialization

DLR’s broader scale and stable margin profile give it a wider moat than ARE’s specialized but financially strained niche. DLR is better positioned to defend market share amid evolving data demands in 2026.

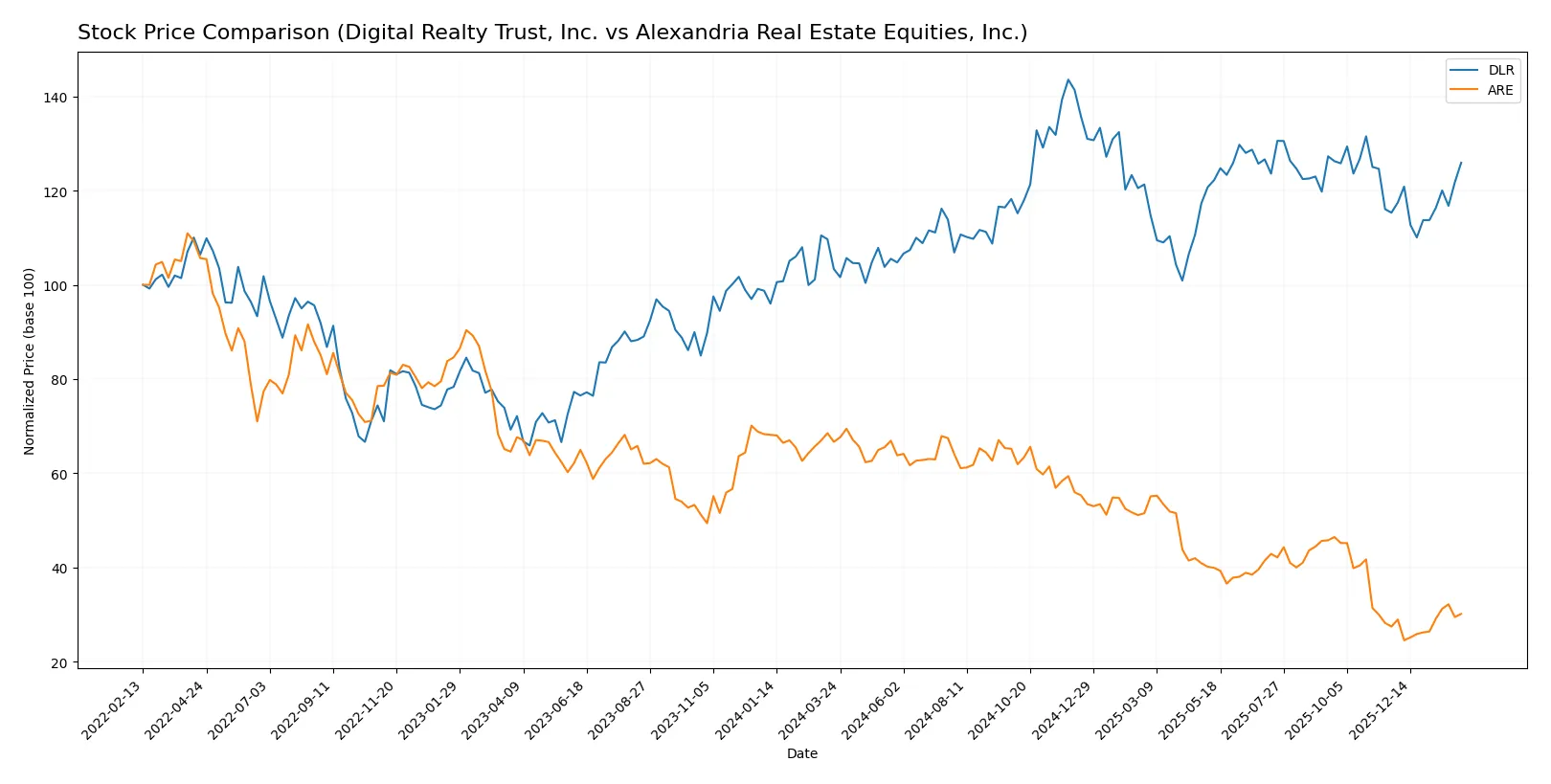

Which stock offers better returns?

Over the past year, Digital Realty Trust, Inc. surged 21.8% with accelerating gains, while Alexandria Real Estate Equities, Inc. plunged 54.8%, showing a sharp bearish trend despite recent recovery signs.

Trend Comparison

Digital Realty Trust, Inc. exhibits a strong bullish trend with a 21.84% price increase over 12 months and accelerating momentum, supported by moderate volatility (std. dev. 13.56). The price ranged from 136.83 to 195.69.

Alexandria Real Estate Equities, Inc. shows a pronounced bearish trend, dropping 54.83% over the same period with accelerating decline and high volatility (std. dev. 24.26). Price hit a low of 45.48 after peaking at 128.91.

Digital Realty Trust, Inc. clearly outperformed Alexandria Real Estate Equities, Inc. over the past year, delivering the highest market gains despite both stocks showing recent short-term upward moves.

Target Prices

Analysts present a mixed but generally constructive target consensus for these REITs.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Digital Realty Trust, Inc. | 164 | 210 | 188.3 |

| Alexandria Real Estate Equities, Inc. | 45 | 82 | 58.44 |

Digital Realty’s consensus target sits about 10% above its current price of 171.62, signaling moderate upside potential. Alexandria’s consensus target of 58.44 also suggests upside from the current 55.9, but with wider analyst divergence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Digital Realty Trust, Inc. Grades

The latest grades from major institutions for Digital Realty Trust, Inc. are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-06 |

| Stifel | Maintain | Buy | 2026-02-06 |

| HSBC | Upgrade | Buy | 2026-01-15 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-14 |

| Barclays | Upgrade | Equal Weight | 2026-01-13 |

| Mizuho | Maintain | Outperform | 2026-01-12 |

| B of A Securities | Downgrade | Neutral | 2026-01-08 |

| Truist Securities | Maintain | Buy | 2025-11-05 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| Barclays | Maintain | Underweight | 2025-10-27 |

Alexandria Real Estate Equities, Inc. Grades

The latest grades from major institutions for Alexandria Real Estate Equities, Inc. are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Hold | 2026-01-30 |

| JP Morgan | Maintain | Neutral | 2026-01-14 |

| Jefferies | Maintain | Hold | 2025-12-16 |

| Citigroup | Maintain | Neutral | 2025-12-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-04 |

| Baird | Maintain | Outperform | 2025-12-04 |

| BMO Capital | Maintain | Outperform | 2025-12-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-28 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Citizens | Downgrade | Market Perform | 2025-11-13 |

Which company has the best grades?

Digital Realty Trust, Inc. shows a stronger consensus with multiple Buy and Outperform ratings, including recent upgrades. Alexandria Real Estate Equities, Inc. holds mostly Neutral to Outperform grades but lacks Buy recommendations. Investors may interpret Digital Realty’s higher-grade momentum as a sign of greater institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Digital Realty Trust, Inc. (DLR) and Alexandria Real Estate Equities, Inc. (ARE) in the 2026 market environment:

1. Market & Competition

Digital Realty Trust, Inc. (DLR)

- Operates in a highly competitive global data center sector with strong demand but intense pricing pressure.

Alexandria Real Estate Equities, Inc. (ARE)

- Niche leader in urban life science and tech campuses, facing competition from emerging innovation hubs and tenant diversification risks.

2. Capital Structure & Debt

Digital Realty Trust, Inc. (DLR)

- Maintains moderate leverage (D/E 0.84) with interest coverage at 3.87x, reflecting manageable debt risk.

Alexandria Real Estate Equities, Inc. (ARE)

- Similar leverage (D/E 0.82) but negative interest coverage (-4.37x) signals heightened financial strain and default risk.

3. Stock Volatility

Digital Realty Trust, Inc. (DLR)

- Beta of 1.15 indicates moderate volatility, aligning closely with sector benchmarks.

Alexandria Real Estate Equities, Inc. (ARE)

- Higher beta of 1.32 suggests increased sensitivity to market swings and greater risk exposure.

4. Regulatory & Legal

Digital Realty Trust, Inc. (DLR)

- Faces standard REIT compliance and data center operational regulations across multiple countries.

Alexandria Real Estate Equities, Inc. (ARE)

- Subject to stringent urban development and environmental regulations impacting construction and leasing in innovation hubs.

5. Supply Chain & Operations

Digital Realty Trust, Inc. (DLR)

- Complex global data center footprint increases exposure to supply chain disruptions and technology upgrades.

Alexandria Real Estate Equities, Inc. (ARE)

- Concentrated geographic presence may limit supply chain risks but increases operational dependency on local infrastructure.

6. ESG & Climate Transition

Digital Realty Trust, Inc. (DLR)

- Global footprint demands proactive energy management and sustainability to meet tenant expectations and regulatory trends.

Alexandria Real Estate Equities, Inc. (ARE)

- Life science focus requires advanced ESG integration; climate transition poses operational and reputational challenges.

7. Geopolitical Exposure

Digital Realty Trust, Inc. (DLR)

- Operations span 23 countries, exposing DLR to geopolitical instability, trade tensions, and currency risks.

Alexandria Real Estate Equities, Inc. (ARE)

- Primarily North American exposure limits geopolitical risks but increases vulnerability to US policy shifts.

Which company shows a better risk-adjusted profile?

Digital Realty Trust’s most impactful risk is its extensive geopolitical exposure, which could disrupt global operations and increase costs. Alexandria’s critical risk lies in its poor capital structure health, with negative interest coverage signaling financial distress. Despite DLR’s global risks, its stronger financial footing and moderate volatility grant it a better risk-adjusted profile. Notably, ARE’s Altman Z-score deep in the distress zone and negative margins reinforce my caution toward its financial resilience.

Final Verdict: Which stock to choose?

Digital Realty Trust, Inc. (DLR) stands out as a cash-generating powerhouse with strong operating margins and a proven ability to grow revenue steadily. Its main point of vigilance is the declining return on invested capital, signaling caution on long-term value creation. It suits investors eyeing aggressive growth with a tolerance for operational challenges.

Alexandria Real Estate Equities, Inc. (ARE) offers a strategic moat in specialized real estate with a focus on life sciences, delivering niche market positioning and recurring revenue streams. Compared to DLR, it presents a higher risk profile given its negative profitability metrics but could appeal to portfolios seeking GARP (Growth at a Reasonable Price) with a patient capital approach.

If you prioritize steady cash flow and operational efficiency, DLR is the compelling choice due to its consistent revenue growth and favorable income metrics. However, if you seek strategic niche exposure and potential undervaluation despite current struggles, ARE offers better thematic stability and a differentiated moat. Both require careful risk management given their financial headwinds.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Digital Realty Trust, Inc. and Alexandria Real Estate Equities, Inc. to enhance your investment decisions: