Home > Comparison > Basic Materials > IFF vs ALB

The strategic rivalry between International Flavors & Fragrances Inc. and Albemarle Corporation defines the current trajectory of the specialty chemicals sector. IFF operates as a diversified ingredient innovator for consumer products, while Albemarle focuses on engineered specialty chemicals, notably lithium and catalysts. This head-to-head pits broad-based consumer exposure against focused industrial applications. This analysis will reveal which corporate approach offers superior risk-adjusted returns for a balanced portfolio in 2026.

Table of contents

Companies Overview

International Flavors & Fragrances Inc. and Albemarle Corporation are pivotal players in the specialty chemicals sector, shaping diverse global markets.

International Flavors & Fragrances Inc.: Specialty Ingredients Innovator

International Flavors & Fragrances Inc. commands a leading position in specialty chemicals focused on flavor, fragrance, and health ingredients. Its core revenue comes from supplying natural and synthetic compounds to consumer products, including cosmetics and food. In 2026, the company emphasizes innovation in plant-based solutions and expanding its Health & Biosciences segment to meet rising consumer demand for natural ingredients.

Albemarle Corporation: Engineered Chemicals Leader

Albemarle Corporation specializes in engineered specialty chemicals with a strong foothold in lithium compounds vital for batteries, bromine-based fire safety products, and catalysts. Its revenue depends heavily on lithium for electric vehicles and electronics. The firm’s 2026 strategy centers on scaling lithium production to support the booming energy storage market while diversifying its chemical solutions across industries like pharmaceuticals and refining.

Strategic Collision: Similarities & Divergences

Both companies excel in specialty chemicals but diverge sharply in focus. International Flavors & Fragrances pursues a consumer-centric model with natural ingredients, whereas Albemarle targets industrial applications and energy materials. Their primary battleground is innovation, yet in distinct markets: consumer goods versus energy storage. These differences yield unique investment profiles—IFF offers exposure to consumer trends, while ALB aligns with the green energy transition.

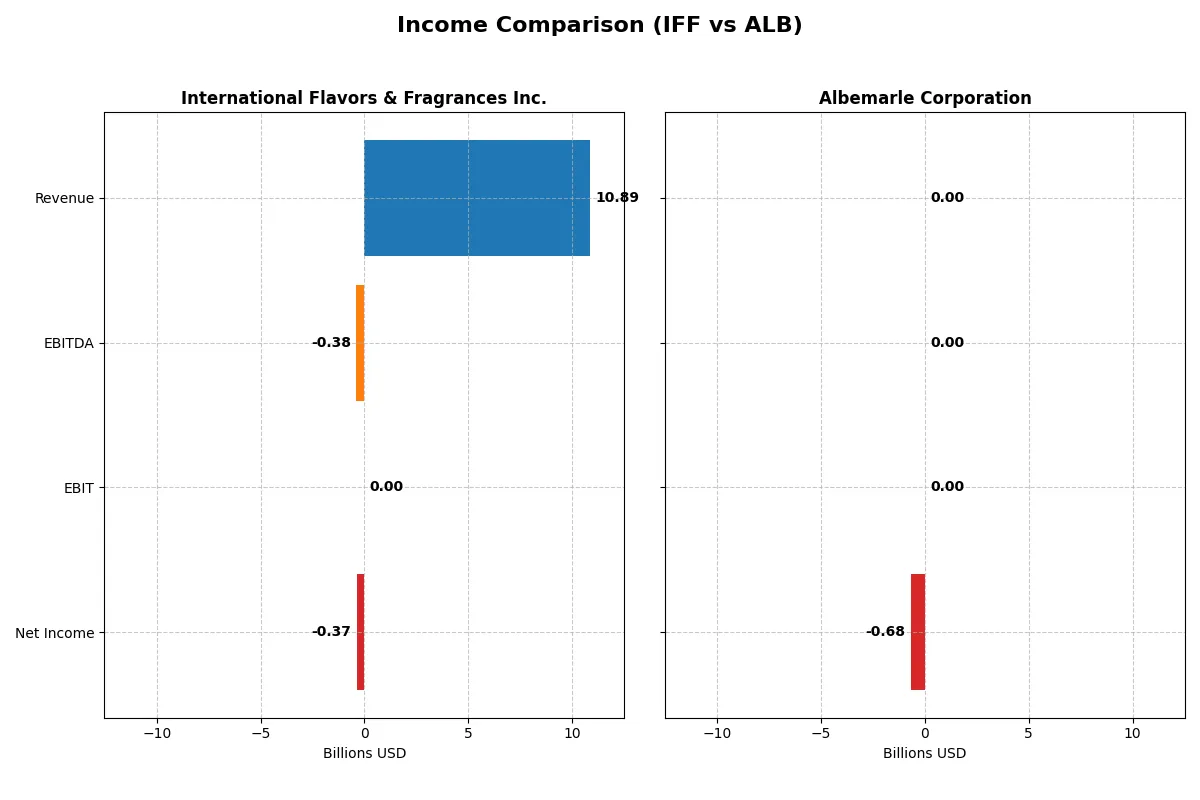

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | International Flavors & Fragrances Inc. (IFF) | Albemarle Corporation (ALB) |

|---|---|---|

| Revenue | 10.9B | 0 |

| Cost of Revenue | 6.95B | 0 |

| Operating Expenses | 2.53B | 0 |

| Gross Profit | 3.94B | 0 |

| EBITDA | -382M | 0 |

| EBIT | 0 | 0 |

| Interest Expense | 229M | 0 |

| Net Income | -374M | -677M |

| EPS | -1.46 | -5.76 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its business more efficiently and sustainably in recent years.

International Flavors & Fragrances Inc. Analysis

IFF’s revenue declined modestly by 5.2% in 2025 to $10.9B, with gross profit falling 4.5% to $3.94B. Its gross margin stays healthy at 36.2%, but net income swung to a loss of $374M, dragging net margin to -3.4%. This reflects a sharp deterioration from profitable years, signaling operational and cost pressures undermining earnings momentum.

Albemarle Corporation Analysis

Albemarle’s 2025 revenue collapsed to zero after $5.38B in 2024, wiping out gross profit and operating income. The company reported a net loss of $677M in 2025 versus a $-1.18B loss in 2024. This zero-revenue year distorts margins, but the prior year showed thin gross profitability and heavy operating expenses. Albemarle faces a volatile earnings profile with significant recent contraction.

Verdict: Margin Resilience vs. Revenue Collapse

IFF maintains a stronger revenue base and healthier gross margins despite recent net losses, while Albemarle’s revenue disappearance in 2025 raises red flags. IFF’s gradual margin erosion contrasts with Albemarle’s severe top-line collapse. For investors, IFF offers a more stable earnings profile, whereas Albemarle’s zero-revenue year signals critical operational risk.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | International Flavors & Fragrances Inc. (IFF) | Albemarle Corporation (ALB) |

|---|---|---|

| ROE | 1.75% (2024) | -11.84% (2024) |

| ROIC | 2.63% (2024) | -11.81% (2024) |

| P/E | 89.07 (2024) | -8.58 (2024) |

| P/B | 1.56 (2024) | 1.02 (2024) |

| Current Ratio | 1.84 (2024) | 1.95 (2024) |

| Quick Ratio | 1.32 (2024) | 1.19 (2024) |

| D/E | 0.69 (2024) | 0.36 (2024) |

| Debt-to-Assets | 33.56% (2024) | 21.77% (2024) |

| Interest Coverage | 2.51 (2024) | -10.73 (2024) |

| Asset Turnover | 0.40 (2024) | 0.32 (2024) |

| Fixed Asset Turnover | 2.65 (2024) | 0.57 (2024) |

| Payout ratio | 211.52% (2024) | -26.39% (2024) |

| Dividend yield | 2.37% (2024) | 3.08% (2024) |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and uncovering operational strengths critical to investment decisions.

International Flavors & Fragrances Inc.

IFF shows weak profitability with a negative net margin of -3.43% and zero ROE, signaling earnings struggles. Its P/E is favorable at -46.13, suggesting market pricing is attractive despite poor returns. A 2.37% dividend yield provides some shareholder return, balancing reinvestment in R&D, which remains steady at around 6% of revenue.

Albemarle Corporation

ALB posts a negative ROE of -110.73% and zero net margin, reflecting severe profitability challenges. The P/E ratio is unavailable but considered favorable by the benchmark. It lacks dividend payments, focusing instead on maintaining a strong quick ratio of 1.54 and reinvesting modestly in R&D, which is under 2% of revenue, indicating a cautious growth approach.

Risk and Reward: Dividend Stability vs. Growth Uncertainty

IFF offers a modest dividend and stable R&D investment despite weak profitability, reflecting a cautious but shareholder-friendly profile. ALB’s lack of dividend and extreme ROE volatility signal higher risk with uncertain operational efficiency. Investors prioritizing income and steady reinvestment may prefer IFF’s profile over ALB’s riskier stance.

Which one offers the Superior Shareholder Reward?

I compare International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB) on dividends, buybacks, and sustainability. IFF yields ~2.37% with a payout ratio over 100%, signaling dividend risk despite positive free cash flow of 1/share in 2025. Buybacks appear limited. ALB pays no dividend in 2025, focusing on reinvesting free cash flow though recent years show negative free cash flow per share, pressuring sustainability. ALB’s stronger operating cash flow ratio (11.0x) indicates financial flexibility for future returns. IFF’s dividend yield is attractive but payout sustainability is questionable. ALB’s reinvestment strategy suits growth investors despite short-term cash flow challenges. For 2026 total return, I favor ALB’s capital allocation discipline and cash flow strength over IFF’s risky dividend reliance.

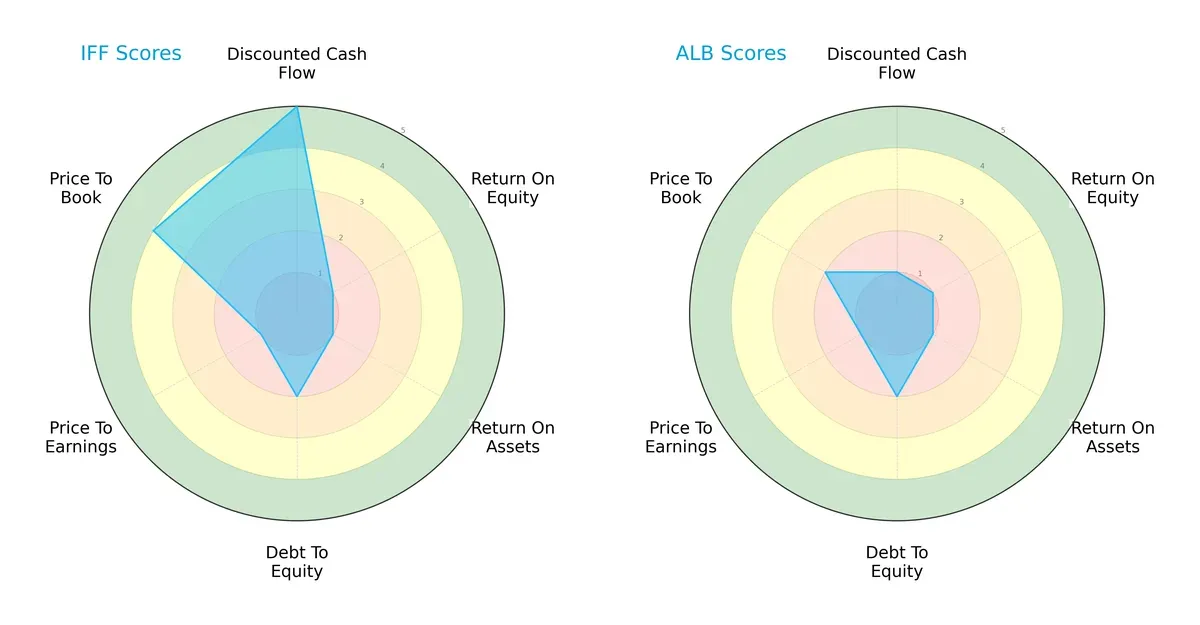

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of International Flavors & Fragrances Inc. and Albemarle Corporation:

IFF shows a distinct edge in discounted cash flow with a top score of 5, indicating strong future cash flow potential. However, its profitability metrics (ROE and ROA) are very weak at 1 each. ALB scores uniformly low across all metrics, reflecting a broadly unfavorable profile. IFF’s valuation metrics (P/B at 4) suggest better market recognition, while ALB struggles with lower scores. Overall, IFF presents a more balanced profile relying on cash flow strength, whereas ALB lacks a clear competitive advantage.

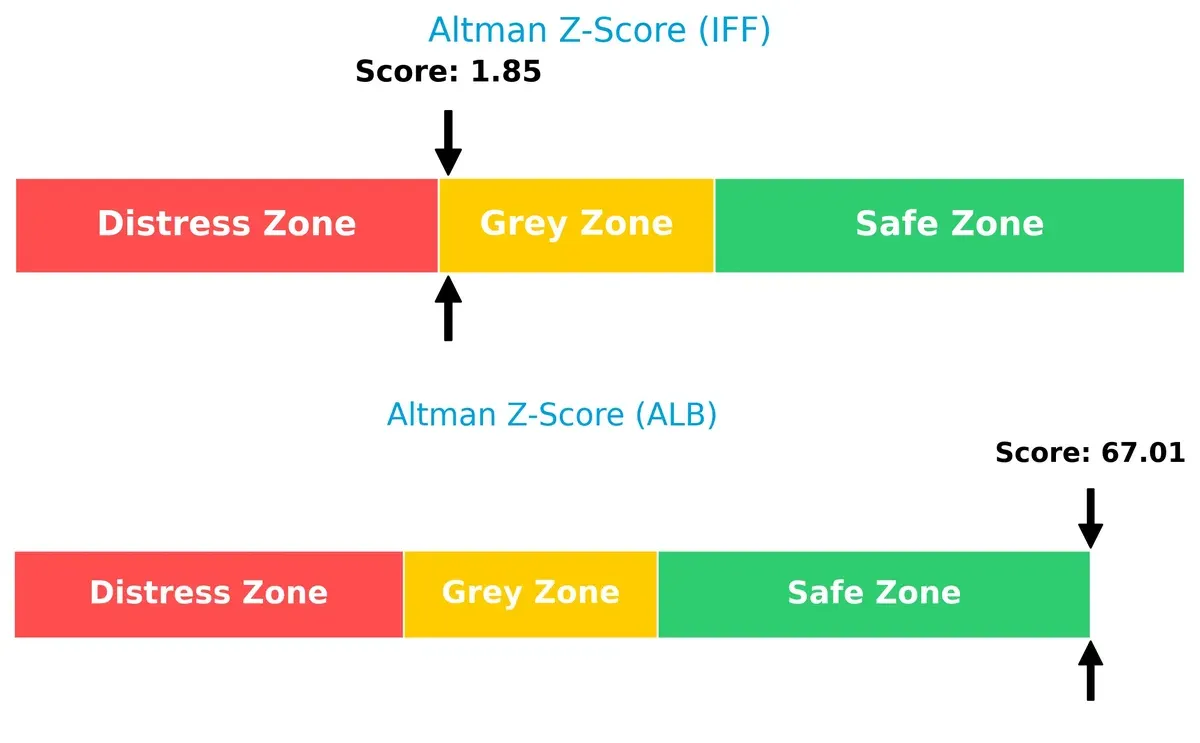

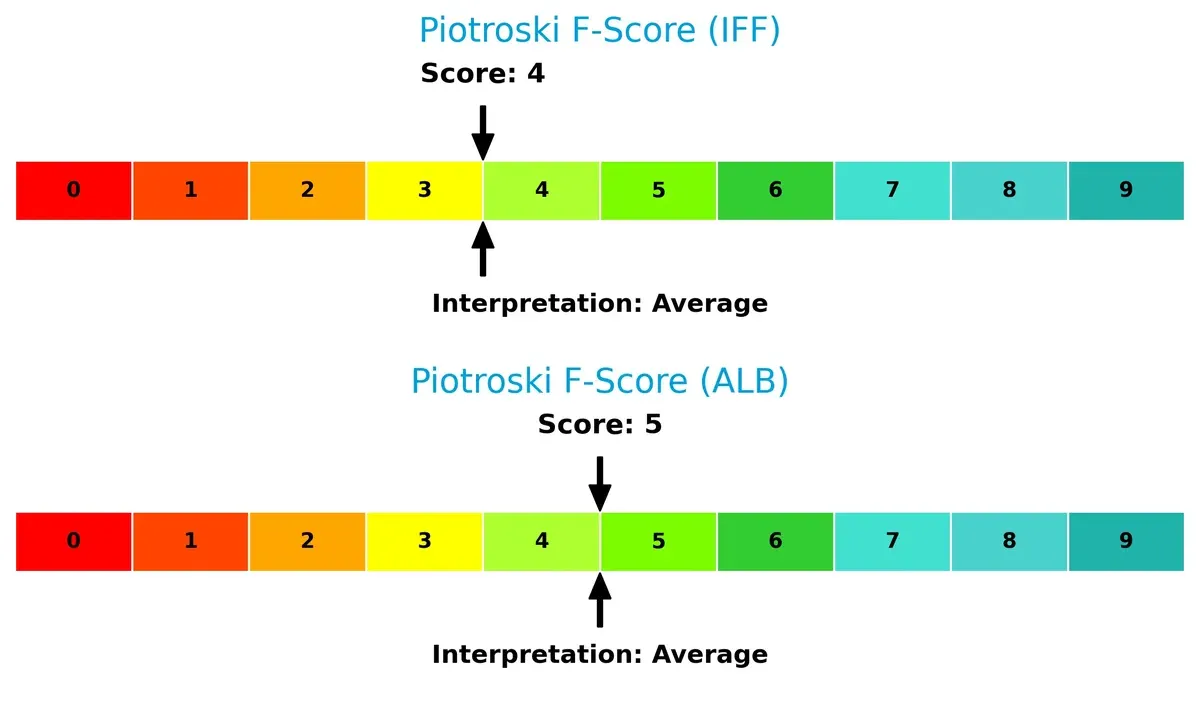

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score comparison highlights a stark solvency contrast between the two firms:

ALB’s score of 67 places it deep in the safe zone, indicating minimal bankruptcy risk. IFF’s score near 1.85 sits in the grey zone, signaling moderate financial distress risk. This gap underscores ALB’s superior balance sheet resilience amid current market pressures, while IFF requires closer monitoring for long-term survival.

Financial Health: Quality of Operations

The Piotroski F-Score comparison sheds light on operational quality differences:

Both firms score in the average range, with IFF at 4 and ALB slightly better at 5. Neither demonstrates peak financial health, but ALB’s marginally higher score suggests somewhat stronger internal metrics. IFF’s score flags potential red flags in profitability and efficiency, reinforcing the need for caution despite its cash flow strength.

How are the two companies positioned?

This section dissects the operational DNA of IFF and ALB by comparing their revenue distribution and internal dynamics. We confront their economic moats to identify which model delivers the most resilient competitive advantage today.

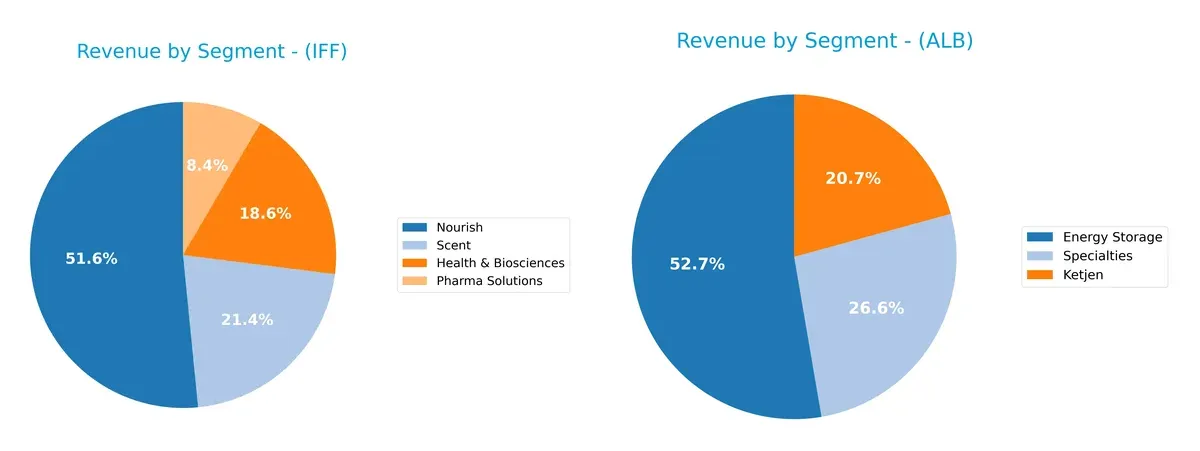

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how International Flavors & Fragrances Inc. and Albemarle Corporation diversify their income streams and where their primary sector bets lie:

IFF anchors its revenue in Nourish at $5.87B, with strong contributions from Health & Biosciences ($2.11B) and Scent ($2.44B), reflecting a balanced portfolio. Albemarle pivots heavily on Energy Storage at $3.02B, but Ketjen ($1.04B) and Specialties ($1.33B) provide meaningful diversification. IFF’s mix reduces concentration risk through varied end markets, while Albemarle’s reliance on Energy Storage underscores exposure to volatile lithium and battery sectors.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB):

IFF Strengths

- Diverse product segments including Nourish, Scent, Pharma Solutions, and Health & Biosciences

- Balanced geographic revenue across Asia, EMEA, North America, and Latin America

- Favorable valuation metrics (PE and PB)

- Dividend yield at 2.37% supports income

ALB Strengths

- Product diversification in Energy Storage, Ketjen, and Specialties

- Significant foreign revenue base complements U.S. sales

- Favorable valuation metrics (PE and PB)

- Strong quick ratio indicates better short-term liquidity

IFF Weaknesses

- Negative net margin and zero ROE and ROIC indicate weak profitability

- Poor liquidity ratios (current and quick ratio at 0) raise solvency concerns

- Low asset turnover and interest coverage imply inefficient capital use

- Global ratios overall unfavorable

ALB Weaknesses

- Negative ROE and zero ROIC reflect profitability challenges

- Unfavorable net margin and interest coverage ratios suggest financial stress

- Dividend yield is unfavorable, limiting income appeal

- Asset turnover metrics are weak

Both companies show strong product and geographic diversification with favorable valuation metrics. However, each faces significant profitability and operational efficiency challenges, highlighting areas for strategic financial improvement.

The Moat Duel: Analyzing Competitive Defensibility

A strong structural moat alone protects long-term profits from relentless competition and market pressures. Here’s how two specialty chemical giants stack up:

International Flavors & Fragrances Inc. (IFF): Intangible Assets Moat

IFF’s moat relies on deep intangible assets—proprietary scents and natural ingredients. This yields stable gross margins near 36%, despite recent revenue and profit declines. Innovation in cosmetic actives and natural health ingredients could broaden its moat in 2026 but margin pressure signals caution.

Albemarle Corporation (ALB): Cost Advantage Moat

ALB’s moat centers on cost leadership in lithium and specialty chemicals, critical for EV batteries. Its volatile revenue and profit trends contrast IFF’s stability, but operational improvements and expanding lithium demand may strengthen ALB’s position by 2026.

Moat Battle: Intangible Assets vs. Cost Leadership

IFF’s intangible asset moat offers deeper brand-driven defensibility, while ALB’s cost advantage faces raw material volatility. I see IFF better equipped to protect market share long term, given its diversified product base and steady margins.

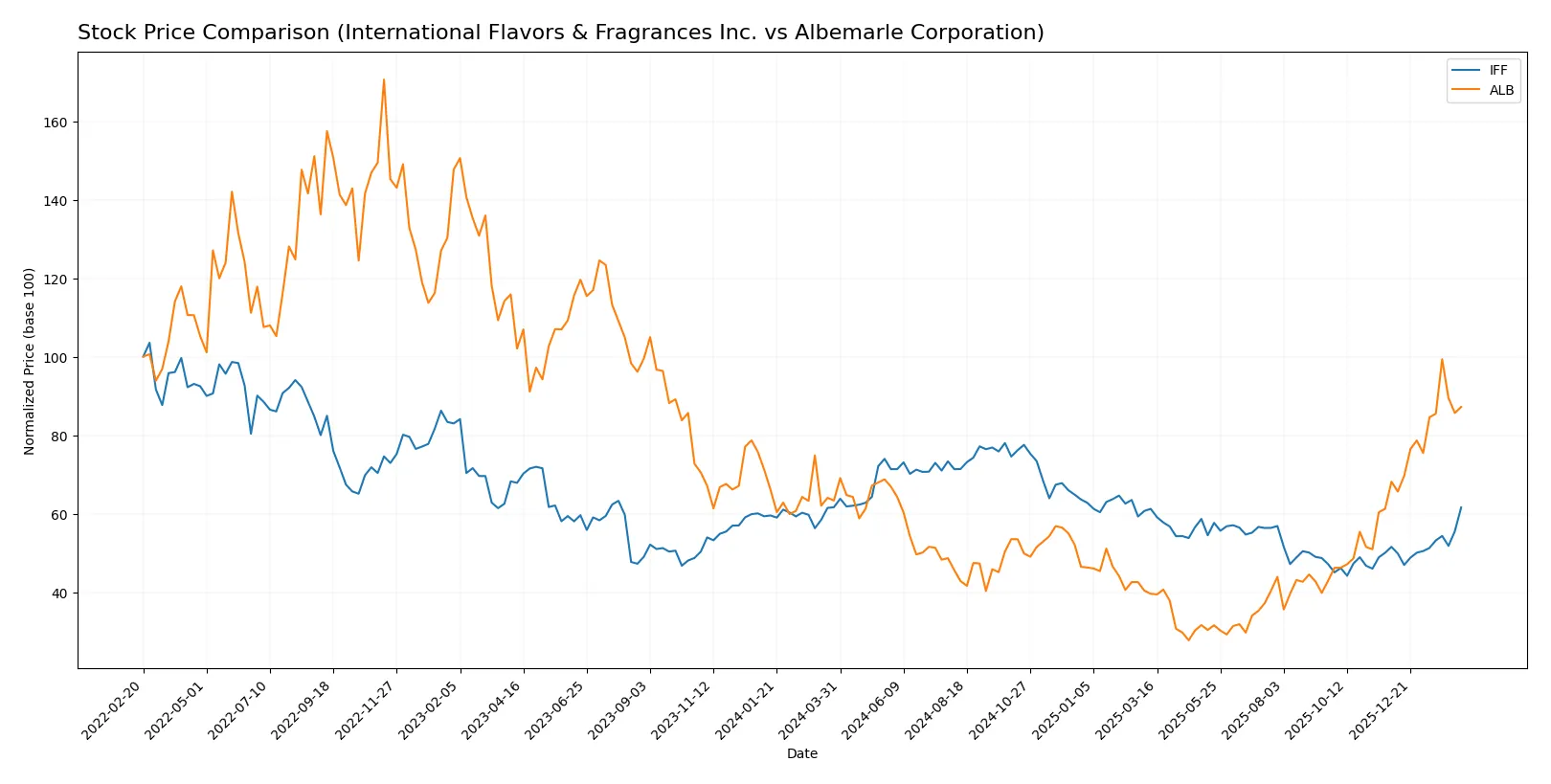

Which stock offers better returns?

The past year highlights distinct price moves and trading dynamics between International Flavors & Fragrances Inc. and Albemarle Corporation, with Albemarle showing stronger gains and buyer interest.

Trend Comparison

International Flavors & Fragrances Inc. shows a slight bearish trend over 12 months with a -0.1% price change and accelerating momentum despite high volatility (12.82 std dev). Recent gains reached 19.46%.

Albemarle Corporation displays a clear bullish trend with a 37.64% price increase over 12 months and accelerating momentum, but with higher volatility (28.67 std dev). Recent gains stand at 27.97%.

Albemarle outperforms International Flavors & Fragrances with a significantly higher total price increase and stronger recent upward momentum.

Target Prices

Analysts present a confident target price consensus for International Flavors & Fragrances Inc. and Albemarle Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| International Flavors & Fragrances Inc. | 80 | 97 | 88.71 |

| Albemarle Corporation | 136 | 210 | 188 |

The consensus target for IFF at $88.71 slightly exceeds its current price of $83, signaling moderate upside. Albemarle’s $188 consensus is well above its $166.35 share price, reflecting strong analyst optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for International Flavors & Fragrances Inc. and Albemarle Corporation:

International Flavors & Fragrances Inc. Grades

This table shows the latest grades assigned by reputable financial institutions to IFF:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-13 |

| Citigroup | Maintain | Buy | 2026-02-13 |

| Oppenheimer | Upgrade | Outperform | 2026-02-13 |

| Mizuho | Maintain | Outperform | 2026-02-12 |

| Argus Research | Maintain | Buy | 2026-01-22 |

| Citigroup | Maintain | Buy | 2026-01-21 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

Albemarle Corporation Grades

This table displays recent grades from leading analysts for ALB:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-13 |

| Mizuho | Maintain | Neutral | 2026-02-12 |

| JP Morgan | Maintain | Neutral | 2026-01-28 |

| Jefferies | Maintain | Buy | 2026-01-28 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-26 |

| Citigroup | Maintain | Neutral | 2026-01-21 |

| Truist Securities | Upgrade | Buy | 2026-01-21 |

| Oppenheimer | Maintain | Outperform | 2026-01-21 |

| Deutsche Bank | Upgrade | Buy | 2026-01-13 |

| UBS | Maintain | Buy | 2026-01-12 |

Which company has the best grades?

International Flavors & Fragrances generally receives stronger ratings, including multiple “Buy” and “Outperform” grades. Albemarle shows a mix of “Neutral” and “Buy” ratings with fewer top-tier upgrades. Investors may interpret IFF’s consistently higher grades as a signal of stronger analyst conviction.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

International Flavors & Fragrances Inc. (IFF)

- Faces intense competition in specialty chemicals with pressure on margins and innovation pace.

Albemarle Corporation (ALB)

- Operates in highly cyclical lithium and specialty chemicals markets, exposed to EV demand fluctuations.

2. Capital Structure & Debt

International Flavors & Fragrances Inc. (IFF)

- Maintains favorable debt-to-equity metrics but shows weak interest coverage, signaling potential liquidity stress.

Albemarle Corporation (ALB)

- Shows favorable leverage ratios but poor interest coverage, raising concerns about debt servicing capacity.

3. Stock Volatility

International Flavors & Fragrances Inc. (IFF)

- Beta near 1 indicates moderate market volatility aligned with general market movements.

Albemarle Corporation (ALB)

- Higher beta at 1.45 reflects elevated stock price volatility and sensitivity to market swings.

4. Regulatory & Legal

International Flavors & Fragrances Inc. (IFF)

- Subject to evolving regulations on chemical safety and sustainability in multiple jurisdictions.

Albemarle Corporation (ALB)

- Faces significant regulatory scrutiny related to mining, environmental impact, and lithium supply chain compliance.

5. Supply Chain & Operations

International Flavors & Fragrances Inc. (IFF)

- Complex global supply chain for natural ingredients vulnerable to geopolitical and climate risks.

Albemarle Corporation (ALB)

- Supply chain exposed to raw material scarcity and logistics constraints in lithium production.

6. ESG & Climate Transition

International Flavors & Fragrances Inc. (IFF)

- ESG initiatives underway, but natural resource sourcing and emissions remain challenges.

Albemarle Corporation (ALB)

- High exposure to climate transition risks due to lithium mining and energy-intensive processes.

7. Geopolitical Exposure

International Flavors & Fragrances Inc. (IFF)

- Operates globally with exposure to trade tensions and regional market instability.

Albemarle Corporation (ALB)

- Sensitive to geopolitical shifts affecting lithium supply from key countries and trade policies.

Which company shows a better risk-adjusted profile?

IFF’s most impactful risk is its weak profitability and liquidity, indicated by unfavorable margins and poor interest coverage. ALB’s greatest threat lies in its stock volatility and regulatory complexities tied to lithium markets. Despite both showing unfavorable financial ratios, ALB’s superior Altman Z-score and moderate Piotroski score signal stronger solvency. Still, I favor IFF’s more stable market positioning but warn of its operational liquidity risks. Recent data confirm ALB’s elevated beta and regulatory pressure justify cautious risk management.

Final Verdict: Which stock to choose?

International Flavors & Fragrances Inc. (IFF) wields a superpower in brand loyalty and product innovation, making it a resilient cash generator. Its main point of vigilance is the recent erosion in profitability and weakening returns, signaling a need for cautious monitoring. I see it fitting an Aggressive Growth portfolio that tolerates volatility for potential innovation-driven payoffs.

Albemarle Corporation (ALB) commands a strategic moat through its critical role in lithium supply for electric vehicles, underpinning recurring demand and pricing power. Relative to IFF, ALB offers better financial stability and a more bullish price momentum, albeit with its own operational challenges. It appeals to a GARP (Growth at a Reasonable Price) investor seeking exposure to green energy trends with moderate risk.

If you prioritize innovation-driven growth and brand strength, IFF is the compelling choice due to its product pipeline and market presence despite recent margin pressures. However, if you seek exposure to secular growth in clean energy with better stability and momentum, ALB offers superior strategic positioning and financial resilience. Both come with risks, so aligning choice to your risk tolerance and thematic conviction is essential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Flavors & Fragrances Inc. and Albemarle Corporation to enhance your investment decisions: