Investors seeking exposure to the specialty chemicals sector often consider International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB), two leaders innovating in diverse yet overlapping markets. IFF specializes in natural ingredients for consumer products, while Albemarle focuses on advanced materials like lithium for energy storage. This article will analyze their business models and growth strategies to help you decide which company holds the most promising investment potential.

Table of contents

Companies Overview

I will begin the comparison between International Flavors & Fragrances Inc. and Albemarle Corporation by providing an overview of these two companies and their main differences.

International Flavors & Fragrances Inc. Overview

IFF specializes in manufacturing and selling cosmetic active and natural health ingredients, serving diverse markets across Europe, Africa, Asia, North America, and Latin America. Its operations span Nourish, Scent, Health & Biosciences, and Pharma Solutions segments, offering natural food ingredients, fragrances, enzymes, and pharmaceutical excipients. Founded in 1833 and based in New York, IFF is a key player in the specialty chemicals industry with a market cap of $17.6B.

Albemarle Corporation Overview

Albemarle develops, manufactures, and markets engineered specialty chemicals worldwide through its Lithium, Bromine, and Catalysts segments. It supplies lithium compounds for batteries, bromine-based fire safety solutions, and catalysts for refining and chemical synthesis. Established in 1887 and headquartered in Charlotte, North Carolina, Albemarle operates in various industries including energy storage and pharmaceuticals, with a market cap of $18.6B.

Key similarities and differences

Both companies operate in the specialty chemicals sector, serving global markets with diversified product lines. IFF focuses on natural and cosmetic ingredients, food protection, and pharmaceutical excipients, while Albemarle emphasizes lithium compounds, bromine solutions, and catalysts for industrial and energy applications. IFF employs over 22K staff compared to Albemarle’s 8.3K, reflecting differences in scale and operational focus.

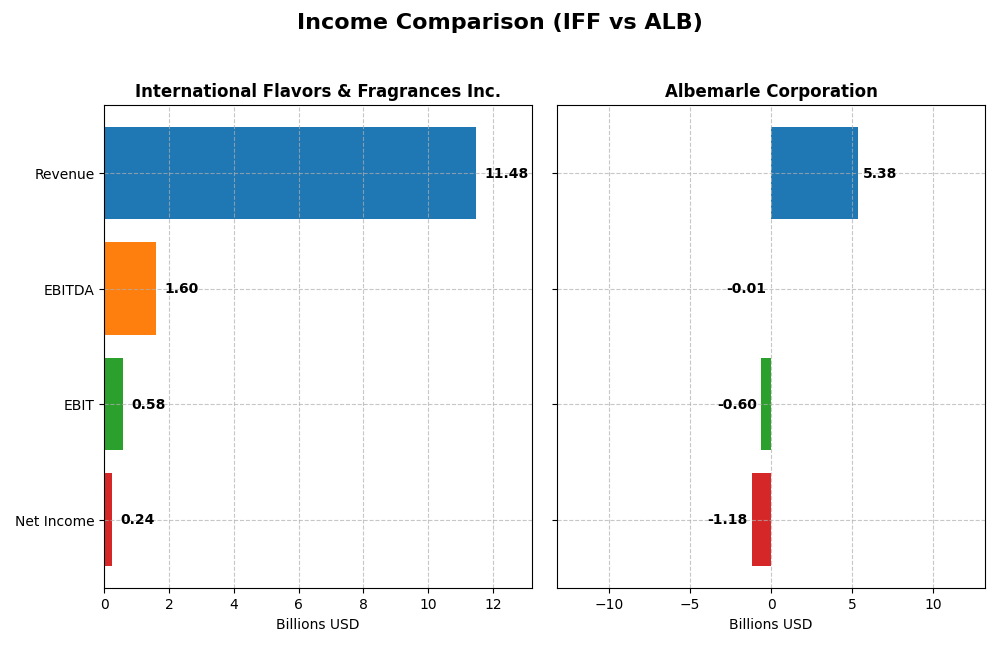

Income Statement Comparison

This table presents the key income statement figures for International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB) for the most recent fiscal year, 2024.

| Metric | International Flavors & Fragrances Inc. (IFF) | Albemarle Corporation (ALB) |

|---|---|---|

| Market Cap | 17.6B | 18.6B |

| Revenue | 11.5B | 5.38B |

| EBITDA | 1.60B | -9.11M |

| EBIT | 583M | -598M |

| Net Income | 243M | -1.32B |

| EPS | 0.95 | -11.2 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

International Flavors & Fragrances Inc.

International Flavors & Fragrances Inc. showed stable revenue near 11.48B in 2024, with a slight 0.04% growth, while net income rebounded to 243M after previous losses. Gross margin improved favorably to 35.91%, and EBIT margin remained neutral at 5.08%. The 2024 income reflected strong profitability recovery with a 127% EBIT growth and doubling net margin, indicating margin improvement and operational stabilization.

Albemarle Corporation

Albemarle Corporation experienced a sharp revenue decline of 44.08% to 5.38B in 2024, alongside a significant net loss of -1.32B. Gross margin dropped unfavorably to 1.57%, and EBIT margin was negative at -11.12%, reflecting operational challenges. The recent year saw deteriorating profitability, with steep falls in EBIT and net margin, signaling a pronounced earnings contraction and margin pressure.

Which one has the stronger fundamentals?

International Flavors & Fragrances demonstrates stronger fundamentals with favorable gross margin and operating income growth, alongside stable revenue and improved net margins. Albemarle’s fundamentals appear weaker given significant revenue contraction, negative margins, and large net losses. Overall, IFF shows a more resilient income statement profile compared to ALB’s challenged profitability and margin declines.

Financial Ratios Comparison

This table presents the most recent financial ratios for International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB) based on their 2024 fiscal year data, enabling a side-by-side comparison of key performance and financial health metrics.

| Ratios | International Flavors & Fragrances Inc. (IFF) | Albemarle Corporation (ALB) |

|---|---|---|

| ROE | 1.75% | -11.84% |

| ROIC | 2.63% | -12.79% |

| P/E | 89.07 | -8.58 |

| P/B | 1.56 | 1.02 |

| Current Ratio | 1.84 | 1.95 |

| Quick Ratio | 1.32 | 1.19 |

| D/E (Debt-to-Equity) | 0.69 | 0.36 |

| Debt-to-Assets | 33.56% | 21.77% |

| Interest Coverage | 2.51 | -10.73 |

| Asset Turnover | 0.40 | 0.32 |

| Fixed Asset Turnover | 2.65 | 0.57 |

| Payout Ratio | 211.52% | -26.39% |

| Dividend Yield | 2.37% | 3.08% |

Interpretation of the Ratios

International Flavors & Fragrances Inc. (IFF)

IFF shows several unfavorable profitability ratios, including a low net margin of 2.12% and a modest return on equity of 1.75%, indicating weak earnings performance. The company maintains a solid liquidity position with a current ratio of 1.84 and a favorable dividend yield of 2.37%. Dividend payouts appear sustainable given the moderate payout and free cash flow coverage, but some caution is warranted due to weaker operational efficiency.

Albemarle Corporation (ALB)

ALB displays significantly unfavorable profitability ratios, with a negative net margin of -21.93% and a return on equity of -11.84%, reflecting operational challenges. The capital structure and liquidity are relatively strong, with favorable debt-to-equity and current ratios. ALB also offers a higher dividend yield of 3.08%, though earnings weakness might pressure future distributions. Interest coverage is negative, indicating financial strain and risk.

Which one has the best ratios?

Comparing the two, ALB holds a slightly favorable overall ratio profile, supported by stronger liquidity and capital structure metrics despite profitability setbacks. IFF’s ratios lean slightly unfavorable due to low returns and efficiency concerns, though it benefits from a stable dividend yield. Both companies exhibit risks, but ALB’s better balance sheet metrics contribute to its more positive ratio assessment.

Strategic Positioning

This section compares the strategic positioning of International Flavors & Fragrances Inc. and Albemarle Corporation, focusing on market position, key segments, and exposure to technological disruption:

International Flavors & Fragrances Inc.

- Operates globally in specialty chemicals with moderate beta (1.056) and market cap of 17.6B USD. Faces typical industry competition.

- Diversified portfolio: Nourish (5.9B), Scent (2.4B), Health & Biosciences (2.1B), Pharma Solutions (0.96B) driving revenues.

- Exposure to disruption limited; no explicit mention of disruptive technologies affecting its diverse segments.

Albemarle Corporation

- Global specialty chemicals player, higher beta (1.412), market cap 18.6B USD, exposed to volatile markets and competitive pressure.

- Focused on Lithium (3.0B Energy Storage), Bromine, and Catalysts segments as primary business drivers.

- Exposure linked to lithium battery technologies and chemical catalysts, key for energy storage and automotive markets.

International Flavors & Fragrances Inc. vs Albemarle Corporation Positioning

IFF adopts a diversified approach with four distinct segments, spreading risk across food, fragrance, health, and pharma ingredients. ALB concentrates on engineered specialty chemicals, especially lithium and catalysts, focusing on energy storage and industrial applications. Diversification versus specialization shapes their market exposure and growth drivers.

Which has the best competitive advantage?

Both IFF and ALB show declining ROIC trends below WACC, indicating value destruction and weak competitive moats. Neither company currently demonstrates a sustainable competitive advantage based on MOAT evaluation.

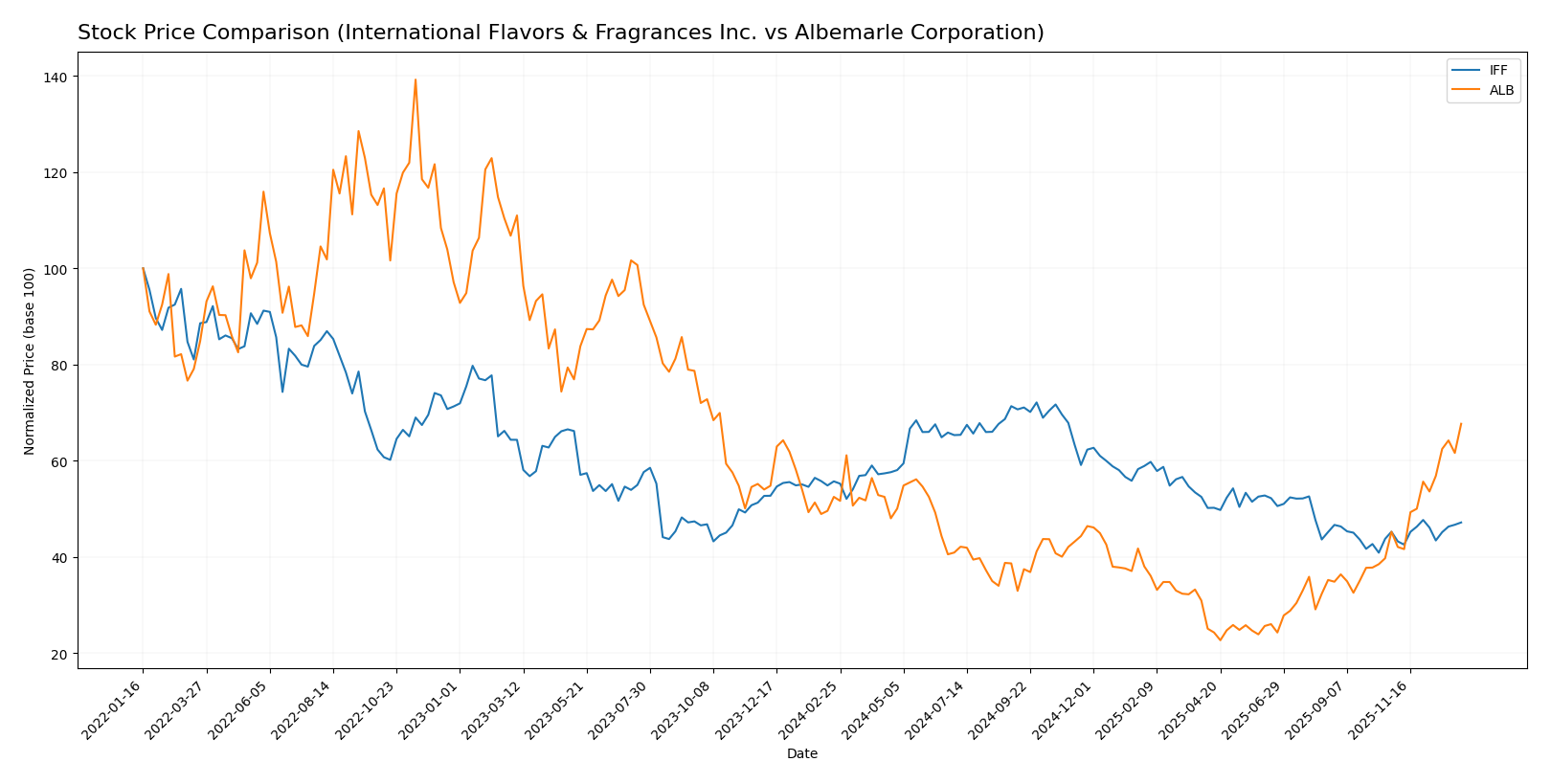

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics: International Flavors & Fragrances Inc. (IFF) experienced a bearish trend with accelerating losses, while Albemarle Corporation (ALB) showed a strong bullish acceleration marked by significant gains.

Trend Analysis

International Flavors & Fragrances Inc. (IFF) saw a 15.36% price decline over the past year, confirming a bearish trend with accelerating downward momentum and a high volatility reflected by a 12.69 standard deviation.

Albemarle Corporation (ALB) posted a 28.97% increase in stock price during the same period, indicating a bullish trend with accelerating gains and higher volatility at a 24.12 standard deviation.

Comparing both, ALB delivered the highest market performance with robust price appreciation, contrasting with IFF’s notable bearish performance over the past year.

Target Prices

Analysts provide a clear consensus on target prices for International Flavors & Fragrances Inc. and Albemarle Corporation, suggesting potential upside.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| International Flavors & Fragrances Inc. | 89 | 66 | 76.67 |

| Albemarle Corporation | 210 | 85 | 141.91 |

The consensus target prices for IFF and ALB indicate expected appreciation relative to their current prices of 68.79 and 158.4, respectively, reflecting analyst optimism within the specialty chemicals sector.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB):

Rating Comparison

IFF Rating

- Rating: C+, evaluated as Very Favorable

- Discounted Cash Flow Score: 5, rated Very Favorable

- ROE Score: 1, rated Very Unfavorable

- ROA Score: 1, rated Very Unfavorable

- Debt To Equity Score: 1, rated Very Unfavorable

- Overall Score: 2, rated Moderate

ALB Rating

- Rating: C, evaluated as Very Favorable

- Discounted Cash Flow Score: 1, rated Very Unfavorable

- ROE Score: 1, rated Very Unfavorable

- ROA Score: 1, rated Very Unfavorable

- Debt To Equity Score: 2, rated Moderate

- Overall Score: 2, rated Moderate

Which one is the best rated?

Both IFF and ALB share an identical overall score of 2 with a Moderate rating. IFF holds a higher Discounted Cash Flow score, while ALB has a better Debt to Equity score. Their ratings are both Very Favorable.

Scores Comparison

The scores comparison between International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB) is as follows:

IFF Scores

- Altman Z-Score: 1.20, in distress zone, high bankruptcy risk

- Piotroski Score: 5, average financial strength

ALB Scores

- Altman Z-Score: 1.98, in grey zone, moderate bankruptcy risk

- Piotroski Score: 4, average financial strength

Which company has the best scores?

Based on the provided data, ALB has a higher Altman Z-Score, placing it in a safer financial zone than IFF. Both companies have similar average Piotroski Scores, with IFF slightly ahead by one point.

Grades Comparison

Here is a comparison of the recent grades and ratings from established grading companies for the two companies:

International Flavors & Fragrances Inc. Grades

The following table summarizes recent grades and actions from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

| Argus Research | Maintain | Buy | 2025-10-07 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

| Mizuho | Maintain | Outperform | 2025-10-03 |

| Morgan Stanley | Maintain | Overweight | 2025-09-22 |

| Wolfe Research | Upgrade | Peer Perform | 2025-09-08 |

| Tigress Financial | Maintain | Buy | 2025-08-26 |

Grades for International Flavors & Fragrances Inc. show a generally positive trend, with multiple buy and overweight ratings maintained and one upgrade in September 2025.

Albemarle Corporation Grades

The following table details recent grades and actions from recognized grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-06 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-19 |

| Citigroup | Maintain | Neutral | 2025-12-18 |

| Mizuho | Maintain | Neutral | 2025-12-18 |

| UBS | Upgrade | Buy | 2025-12-05 |

| Deutsche Bank | Maintain | Hold | 2025-12-03 |

| Baird | Upgrade | Neutral | 2025-12-02 |

| BMO Capital | Maintain | Outperform | 2025-11-19 |

| Mizuho | Maintain | Neutral | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-11-13 |

Grades for Albemarle Corporation are mixed, with several neutral and hold ratings, but also notable buy and outperform ratings, including upgrades in late 2025.

Which company has the best grades?

International Flavors & Fragrances Inc. has received more consistent buy and overweight ratings compared to Albemarle Corporation’s mix of neutral and hold grades. This pattern suggests stronger analyst conviction in International Flavors & Fragrances’ prospects, which may influence investor confidence and portfolio decisions.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB) based on their recent financial performance, diversification, innovation, global presence, and market share.

| Criterion | International Flavors & Fragrances Inc. (IFF) | Albemarle Corporation (ALB) |

|---|---|---|

| Diversification | Diverse product portfolio including Nourish (5.87B), Health & Biosciences (2.11B), Scent (2.44B), and Pharma Solutions (961M). | Moderate diversification with Energy Storage (3.02B), Ketjen (1.04B), and Specialties (1.33B). |

| Profitability | Low profitability with ROIC at 2.63% vs. WACC 6.78%, net margin 2.12%, and declining ROIC trend; company is shedding value. | Negative profitability with ROIC -12.79%, net margin -21.93%, and steeply declining ROIC trend; value destruction. |

| Innovation | Strong presence in innovative segments like Health & Biosciences and Pharma Solutions, supporting future growth potential. | Innovation focused on Energy Storage and specialty chemicals, but financials suggest challenges in converting this to profits. |

| Global presence | Established global footprint with broad market reach in flavors and fragrances industries. | Global player especially in lithium and specialty chemicals markets, positioned in growing sectors like energy storage. |

| Market Share | Solid positions in flavors and fragrances with consistent revenues above 5B in key segments. | Leading market share in lithium and bromine specialties, but profitability issues may affect competitiveness. |

Key takeaways: Both companies face profitability challenges with declining ROIC, signaling value erosion. IFF benefits from stronger diversification and innovation in consumer-related products, while ALB is more exposed to volatile specialty chemicals and energy storage markets. Cautious evaluation is advised before investing.

Risk Analysis

Below is a comparison table highlighting key risks for International Flavors & Fragrances Inc. (IFF) and Albemarle Corporation (ALB) as of 2026:

| Metric | International Flavors & Fragrances Inc. (IFF) | Albemarle Corporation (ALB) |

|---|---|---|

| Market Risk | Moderate (Beta 1.056; stable consumer demand but sensitive to commodity prices) | Higher (Beta 1.412; exposed to volatile lithium and specialty chemicals markets) |

| Debt level | Neutral (Debt to equity 0.69; interest coverage 1.91, somewhat tight) | Favorable (Debt to equity 0.36; low leverage but negative interest coverage) |

| Regulatory Risk | Moderate (Chemical and cosmetic regulations globally) | High (Environmental and mining regulations impacting lithium and bromine production) |

| Operational Risk | Moderate (Global supply chain dependencies) | Moderate to High (Complex production processes, supply chain and raw material risks) |

| Environmental Risk | Moderate (Focus on natural ingredients but chemical exposure exists) | High (Mining operations and chemical production with significant environmental scrutiny) |

| Geopolitical Risk | Moderate (Operations span multiple regions with diverse political climates) | High (Lithium supply influenced by geopolitical tensions and export controls) |

Synthesis: Albemarle faces the most impactful risks due to its exposure to volatile lithium markets, environmental and regulatory pressures, and geopolitical factors affecting raw material supply. IFF’s risks are more moderate, centered on market sensitivity and operational factors but with tighter financial constraints given interest coverage. Investors should weigh Albemarle’s high market and environmental risks against its relatively low debt, while IFF shows moderate risks but tighter financial health.

Which Stock to Choose?

International Flavors & Fragrances Inc. (IFF) shows a favorable income statement with a 35.91% gross margin and improving earnings growth, though financial ratios are slightly unfavorable, with low returns and moderate debt. Its rating is very favorable (C+), despite some weak profitability metrics.

Albemarle Corporation (ALB) displays an unfavorable income statement marked by negative margins and declining earnings. However, its financial ratios are slightly favorable, with solid debt metrics and dividend yield; its rating is also very favorable (C), albeit with persistent profitability challenges.

For investors, IFF might appear more suitable for those prioritizing income growth and stable ratings, while ALB could be more aligned with profiles focusing on favorable financial ratios and dividend yield despite weaker income metrics. Both companies exhibit very unfavorable economic moats, indicating value destruction and declining profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Flavors & Fragrances Inc. and Albemarle Corporation to enhance your investment decisions: