In the rapidly evolving software infrastructure sector, Rubrik, Inc. and Akamai Technologies, Inc. stand out as key players driving innovation in data security and cloud services. Both companies address critical needs in protecting and optimizing digital assets, yet they differ in scale and approach. This comparison will guide you through their market positions and innovation strategies to reveal which stock might be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Rubrik, Inc. and Akamai Technologies, Inc. by providing an overview of these two companies and their main differences.

Rubrik, Inc. Overview

Rubrik, Inc. focuses on delivering comprehensive data security solutions worldwide, including enterprise, unstructured, cloud, and SaaS data protection. The company also offers data threat analytics, security posture management, and cyber recovery services. Operating since 2013 and based in Palo Alto, California, Rubrik serves sectors such as financial, healthcare, education, and technology with a workforce of 3,200 employees.

Akamai Technologies, Inc. Overview

Akamai Technologies, Inc. provides cloud services aimed at securing, delivering, and optimizing internet content and business applications globally. Its offerings include cybersecurity, web and mobile performance, media delivery, edge computing, and carrier services. Founded in 1998 and headquartered in Cambridge, Massachusetts, Akamai employs over 10,800 people and supports customers through direct and channel sales.

Key similarities and differences

Both companies operate in the Software – Infrastructure industry with a focus on cybersecurity and cloud solutions. Rubrik concentrates on data protection and recovery, while Akamai emphasizes content delivery, internet security, and performance optimization. Akamai’s larger scale and broader service portfolio contrast with Rubrik’s specialized data security approach, reflecting differing strategic focuses within the technology sector.

Income Statement Comparison

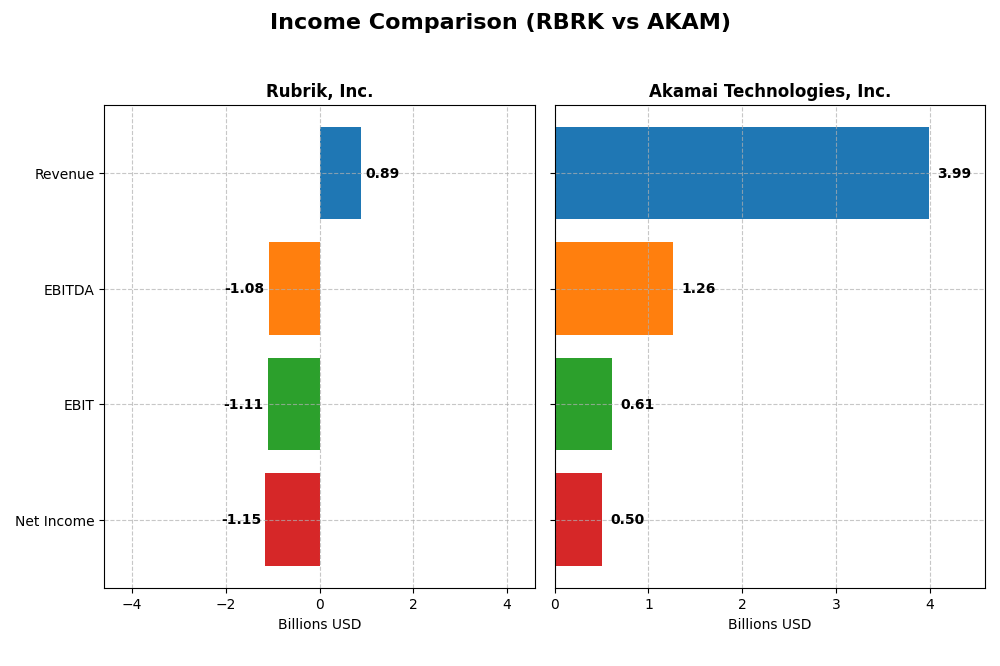

The table below compares key income statement metrics for Rubrik, Inc. and Akamai Technologies, Inc. for their most recent fiscal years, highlighting their financial scale and profitability.

| Metric | Rubrik, Inc. (RBRK) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Cap | 13.4B | 13.4B |

| Revenue | 887M | 3.99B |

| EBITDA | -1.08B | 1.26B |

| EBIT | -1.11B | 614M |

| Net Income | -1.15B | 505M |

| EPS | -7.48 | 3.34 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Rubrik, Inc.

Rubrik’s revenue has shown strong growth, rising from $388M in 2021 to $887M in 2025, a 129% increase over five years. However, net income remains deeply negative, declining further to -$1.15B in 2025. While the gross margin improved to 70%, operating and net margins have worsened, reflecting heavy expenses and a significant net loss in the latest year despite solid revenue gains.

Akamai Technologies, Inc.

Akamai’s revenue grew steadily from $3.2B in 2020 to $4.0B in 2024, a 25% increase over the period. Net income declined modestly to $505M in 2024, with stable gross margins near 59% and positive EBIT and net margins around 15% and 13%, respectively. The latest year saw a slight slowdown in growth and margin compression, with EBIT and net margin decreasing compared to prior years.

Which one has the stronger fundamentals?

Both companies exhibit revenue growth, but Akamai maintains positive profitability and healthier margins, contrasted with Rubrik’s substantial losses and negative margins. Rubrik’s gross margin is favorable, yet its worsening EBIT and net income weigh heavily. Akamai’s steady earnings and margin stability suggest comparatively stronger fundamentals despite recent margin pressure.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Rubrik, Inc. and Akamai Technologies, Inc., offering a snapshot of their financial health and performance for fiscal year 2025 and 2024 respectively.

| Ratios | Rubrik, Inc. (2025) | Akamai Technologies, Inc. (2024) |

|---|---|---|

| ROE | 2.09% | 10.35% |

| ROIC | -2.35% | 4.74% |

| P/E | -9.79 | 28.68 |

| P/B | -20.42 | 2.97 |

| Current Ratio | 1.13 | 1.23 |

| Quick Ratio | 1.13 | 1.23 |

| D/E | -0.63 | 0.95 |

| Debt-to-Assets | 24.65% | 44.70% |

| Interest Coverage | -27.49 | 19.67 |

| Asset Turnover | 0.62 | 0.38 |

| Fixed Asset Turnover | 16.67 | 1.33 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Rubrik, Inc.

Rubrik displays a mixed set of ratios with strengths in return on equity (208.55%) and conservative leverage, reflected by a favorable debt-to-equity ratio (-0.63) and debt-to-assets at 24.65%. However, its negative net margin (-130.26%) and interest coverage (-26.84) are concerning. The current ratio (1.13) is neutral, indicating adequate liquidity. Rubrik does not pay dividends, likely due to its early stage and reinvestment focus.

Akamai Technologies, Inc.

Akamai shows favorable net margin (12.65%) and interest coverage (22.65), suggesting sound profitability and ability to meet debt obligations. Yet, its return on invested capital (4.74%) and asset turnover (0.38) are weak, while the price-to-earnings ratio (28.68) is relatively high and unfavorable. The current (1.23) and quick ratios (1.23) are stable. Akamai also does not pay dividends, possibly prioritizing growth and R&D.

Which one has the best ratios?

Rubrik’s ratios are overall favorable (57.14%) but come with serious profitability and interest coverage concerns, reflecting risk. Akamai’s ratios are more balanced but less favorable overall (28.57%), with neutral liquidity and profitability metrics. Neither pays dividends, indicating reinvestment strategies. Rubrik edges out slightly on favorable metrics but with greater risks, while Akamai remains stable yet less robust.

Strategic Positioning

This section compares the strategic positioning of Rubrik, Inc. and Akamai Technologies, Inc., including Market position, Key segments, and disruption:

Rubrik, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

Akamai Technologies, Inc.

- Mid-sized player with $13.4B market cap, operating in software infrastructure with moderate competitive pressure.

- Focuses on data security solutions: enterprise, cloud, SaaS data protection, and cyber recovery across multiple sectors.

- Positioned in data security, a rapidly evolving field requiring constant innovation to address cyber threats.

Rubrik, Inc. vs Akamai Technologies, Inc. Positioning

Rubrik concentrates on data security with diversified sector coverage, while Akamai offers broader cloud and content delivery solutions. Rubrik’s narrower focus contrasts with Akamai’s wide-ranging cloud infrastructure, each with distinct advantages and challenges based on their industry scope.

Which has the best competitive advantage?

Both companies show declining ROIC trends and are currently shedding value, indicating very unfavorable moats. Neither demonstrates a strong sustainable competitive advantage based on their financial capital efficiency.

Stock Comparison

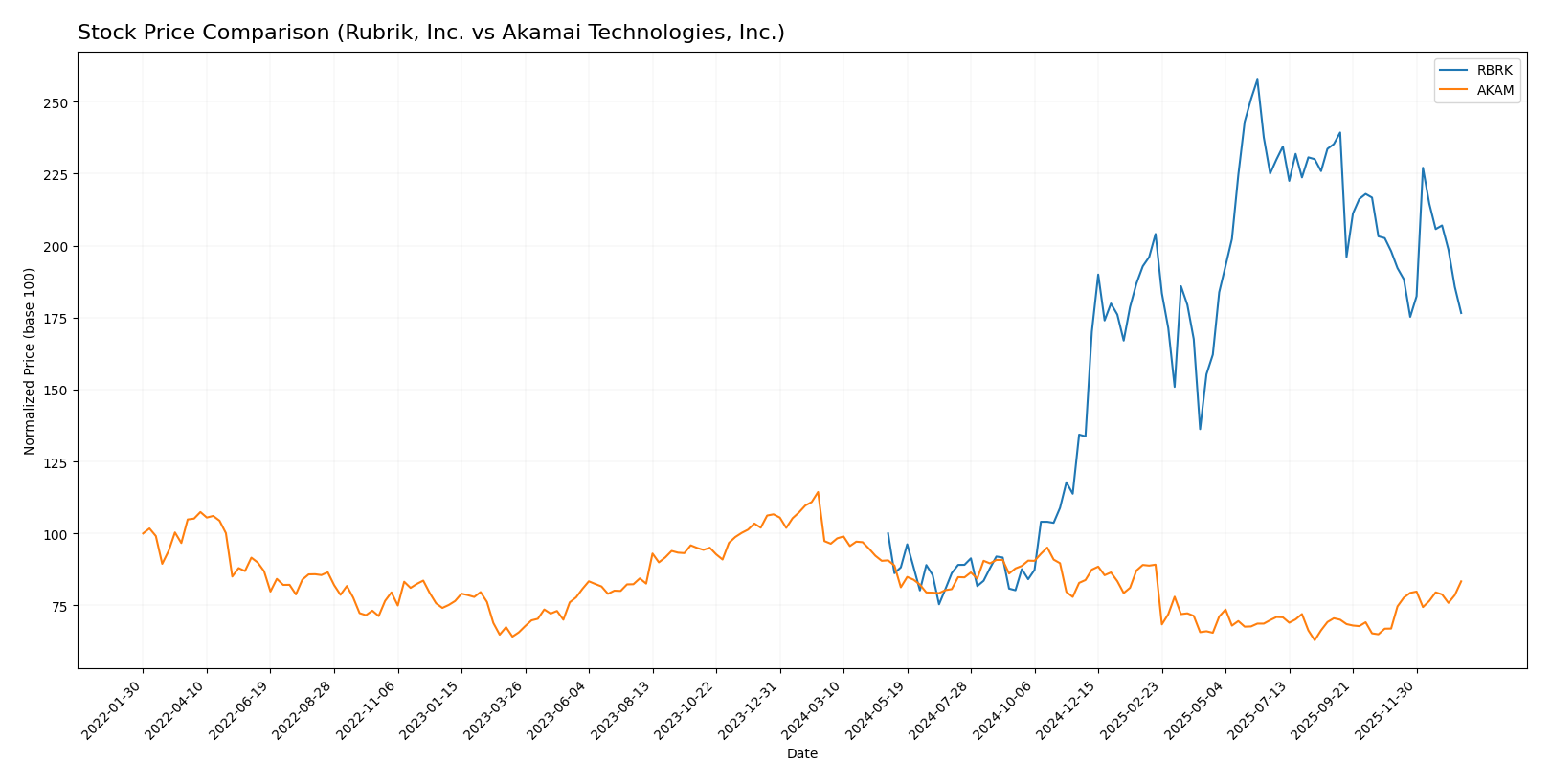

The past year showed divergent price movements between Rubrik, Inc. (RBRK) and Akamai Technologies, Inc. (AKAM), with RBRK exhibiting a strong overall upward trend and AKAM facing a general decline, despite recent bullish momentum.

Trend Analysis

Rubrik, Inc. (RBRK) experienced a 76.58% price increase over the past 12 months, indicating a bullish trend with decelerating momentum. The stock traded between 28.65 and 97.91, showing high volatility with a 21.4 std deviation.

Akamai Technologies, Inc. (AKAM) saw a 13.57% decrease in price over the last year, marking a bearish trend with accelerating downward movement. Prices ranged from 70.53 to 111.0, accompanied by moderate volatility at 10.92 std deviation.

Comparing both stocks, Rubrik, Inc. delivered the highest market performance with a strong bullish trend, while Akamai Technologies showed a bearish trend despite recent short-term gains.

Target Prices

The current analyst consensus for target prices shows positive outlooks for both Rubrik, Inc. and Akamai Technologies, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 113 | 105 | 109.33 |

| Akamai Technologies, Inc. | 115 | 89 | 104.8 |

Analysts expect Rubrik’s price to rise significantly from its current 67.1 USD, indicating strong growth potential. Akamai’s consensus target of 104.8 USD also suggests upside from the current 93.49 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Rubrik, Inc. and Akamai Technologies, Inc.:

Rating Comparison

Rubrik, Inc. Rating

- Rating: C, categorized as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable outlook on cash flow valuation.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 1, suggesting very poor asset utilization.

- Debt To Equity Score: 1, reflecting a Very Unfavorable financial risk position.

- Overall Score: 2, considered Moderate overall financial standing.

Akamai Technologies, Inc. Rating

- Rating: B, also categorized as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, reflecting a Very Favorable cash flow valuation.

- ROE Score: 3, indicating moderate efficiency in profit generation.

- ROA Score: 3, indicating moderate asset utilization efficiency.

- Debt To Equity Score: 1, also reflecting Very Unfavorable financial risk.

- Overall Score: 3, indicating a Moderate but higher overall rating.

Which one is the best rated?

Based strictly on the provided data, Akamai Technologies holds a better rating and overall score compared to Rubrik. Akamai’s strengths lie in its discounted cash flow and balanced profitability scores, despite similar debt risk levels.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

Rubrik, Inc. Scores

- Altman Z-Score: 1.41, in distress zone, high bankruptcy risk

- Piotroski Score: 4, average financial strength

Akamai Technologies, Inc. Scores

- Altman Z-Score: 2.46, in grey zone, moderate bankruptcy risk

- Piotroski Score: 7, strong financial strength

Which company has the best scores?

Akamai shows better scores with a higher Altman Z-Score in the grey zone and a strong Piotroski Score of 7. Rubrik’s Altman Z-Score is in the distress zone with a lower Piotroski Score of 4, indicating comparatively weaker financial health.

Grades Comparison

The following presents a comparison of recent grades assigned to Rubrik, Inc. and Akamai Technologies, Inc.:

Rubrik, Inc. Grades

This table summarizes recent grades from recognized financial institutions for Rubrik, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik’s grades show a consistent positive outlook with several “Outperform” and “Buy” ratings, including an upgrade to “Outperform” from William Blair.

Akamai Technologies, Inc. Grades

This table summarizes recent grades from recognized financial institutions for Akamai Technologies, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

Akamai’s grades reflect a more mixed view with several “Neutral” and “Hold” ratings, but also some upgrades to “Overweight” and consistent “Sector Outperform” ratings.

Which company has the best grades?

Rubrik, Inc. has received consistently stronger grades with multiple “Buy” and “Outperform” ratings, while Akamai shows more mixed assessments with many “Neutral” and “Hold” ratings. For investors, Rubrik’s stronger consensus may indicate more confidence from analysts in its growth potential or value.

Strengths and Weaknesses

Below is a comparison table of key strengths and weaknesses for Rubrik, Inc. and Akamai Technologies, Inc. based on their most recent financial and strategic data.

| Criterion | Rubrik, Inc. (RBRK) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Diversification | Moderate; relies heavily on subscription revenue (828M USD), with smaller segments in maintenance and other products | High; large diversified revenue stream of 3.99B USD covering broad segments in cloud and edge services |

| Profitability | Weak net margin (-130%) and declining ROIC (-235%), value destroying | Positive net margin (12.65%), but ROIC (4.74%) below WACC, indicating limited value creation |

| Innovation | Strong in cloud data management but struggling to translate into profitability | Established leader in content delivery and security with ongoing innovation in edge computing |

| Global presence | Limited public data on global reach; likely smaller scale | Extensive global presence with significant market penetration worldwide |

| Market Share | Emerging player with niche focus, market share constrained by financial struggles | Well-established with substantial market share in CDN and cybersecurity markets |

Key takeaways: Rubrik shows potential in innovation and product subscription growth but faces significant profitability challenges and value destruction. Akamai maintains solid profitability and market presence but struggles to generate returns above its cost of capital, suggesting cautious optimism for investors. Risk management is essential when considering either stock.

Risk Analysis

Below is a comparison of key risks for Rubrik, Inc. (RBRK) and Akamai Technologies, Inc. (AKAM) based on their latest financial and operational data from 2025 and 2024 respectively.

| Metric | Rubrik, Inc. (RBRK) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Risk | Low beta (0.28) indicates lower volatility; however, negative margins suggest sensitivity to market downturns | Moderate beta (0.69) with stable profitability; exposed to tech sector cyclicality |

| Debt Level | Low debt-to-assets (24.7%) and negative debt-to-equity ratio signal conservative leverage | Moderate debt-to-assets (44.7%) and debt-to-equity near 1 highlight moderate leverage risk |

| Regulatory Risk | Operating in cybersecurity with potential compliance challenges globally | Cloud services subject to evolving data privacy and cybersecurity regulations worldwide |

| Operational Risk | Negative net margin and weak interest coverage (-26.8) highlight operational inefficiencies | Positive margins and strong interest coverage (22.65) reflect operational stability |

| Environmental Risk | Limited direct exposure; data center energy use could increase costs | Similar exposure; increasing focus on sustainable cloud infrastructure required |

| Geopolitical Risk | US-based with global clients; potential risks from international data laws and trade tensions | US-headquartered; global operations exposed to geopolitical tensions affecting cloud infrastructure |

Rubrik’s most impactful risks are its operational losses and financial distress indicated by its low Altman Z-score (1.41), signaling potential bankruptcy risk. Akamai shows stronger financial health but carries moderate leverage and regulatory risks in a competitive cloud environment. Investors should weigh Rubrik’s growth potential against its financial vulnerabilities, while Akamai offers more stability with moderate market and regulatory exposures.

Which Stock to Choose?

Rubrik, Inc. (RBRK) shows strong revenue growth of 41.2% in 2025 but suffers from negative net margin and declining profitability. Its financial ratios are mixed, with a favorable ROE of 208.6% contrasting unfavorable net margin and ROIC, while debt metrics and quick ratio remain positive. The rating is very favorable overall.

Akamai Technologies, Inc. (AKAM) reports stable income with modest 4.7% revenue growth and positive profitability metrics, including a 12.7% net margin and a favorable interest coverage ratio. Financial ratios are mostly neutral or favorable except for debt levels, and its rating is very favorable with a moderate overall score.

For investors, RBRK’s rapid revenue growth and high ROE might appeal to risk-tolerant or growth-focused profiles, while AKAM’s stable profitability and moderate growth could be more suitable for those seeking quality and income stability. Both companies show value destruction in MOAT analysis, suggesting caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and Akamai Technologies, Inc. to enhance your investment decisions: