In today’s fast-evolving technology landscape, GoDaddy Inc. and Akamai Technologies, Inc. stand out as influential players in the software infrastructure sector. Both companies serve global markets with cloud-based solutions, yet they target different niches—GoDaddy focuses on empowering small businesses with digital identity and online presence tools, while Akamai specializes in securing and optimizing internet content delivery. This article will help you decide which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between GoDaddy and Akamai by providing an overview of these two companies and their main differences.

GoDaddy Overview

GoDaddy Inc. focuses on cloud-based technology products, primarily serving small businesses, individuals, and developers. Its offerings include domain registration, website hosting, security tools, marketing services, and business applications. Headquartered in Tempe, Arizona, GoDaddy aims to help customers establish and grow their digital presence with a broad suite of online services and tools.

Akamai Overview

Akamai Technologies, Inc. specializes in cloud services that secure, deliver, and optimize content and business applications globally. Its portfolio includes cybersecurity, web and mobile performance, media delivery, edge computing, and carrier solutions. Based in Cambridge, Massachusetts, Akamai targets enterprises and developers looking to protect and enhance their online infrastructure and digital experiences.

Key similarities and differences

Both companies operate in the software infrastructure sector, providing cloud-based solutions to improve online presence and security. GoDaddy emphasizes tools for website creation and small business marketing, while Akamai focuses more on cybersecurity, content delivery, and edge computing for enterprises. GoDaddy serves a broader range of smaller clients, whereas Akamai targets larger organizations requiring advanced internet security and performance services.

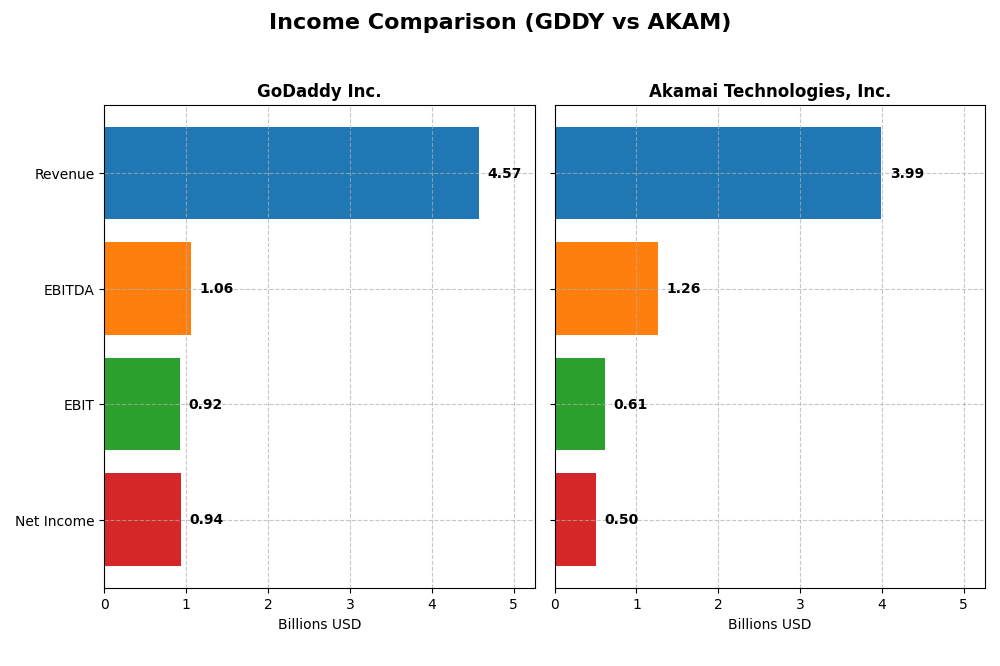

Income Statement Comparison

The table below provides a side-by-side comparison of key income statement metrics for GoDaddy Inc. and Akamai Technologies, Inc. for the fiscal year 2024.

| Metric | GoDaddy Inc. (GDDY) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Cap | 14.5B | 13.4B |

| Revenue | 4.57B | 3.99B |

| EBITDA | 1.06B | 1.26B |

| EBIT | 924M | 614M |

| Net Income | 937M | 505M |

| EPS | 6.63 | 3.34 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GoDaddy Inc.

GoDaddy’s revenue increased steadily from $3.3B in 2020 to $4.6B in 2024, with net income rebounding sharply from a -$495M loss in 2020 to $937M in 2024. Margins generally improved, with a gross margin of 63.9% and net margin of 20.5% in 2024. However, net margin and EPS declined in the latest year despite strong EBIT growth, indicating some margin pressure.

Akamai Technologies, Inc.

Akamai’s revenue rose from $3.2B in 2020 to $4.0B in 2024, while net income showed volatility, peaking at $652M in 2021 before falling to $505M in 2024. Margins remained stable but lower than GoDaddy’s, with a 59.4% gross margin and 12.7% net margin in 2024. Recent growth slowed, with EBIT and net margin contracting, reflecting operational challenges.

Which one has the stronger fundamentals?

GoDaddy demonstrates stronger fundamentals with sustained revenue and net income growth over five years, alongside favorable margin improvements and a solid EBIT increase in 2024. Akamai, while maintaining stable revenue, faced declines in net income and margins, leading to an overall unfavorable income statement evaluation. GoDaddy’s higher margin profile and positive long-term trends suggest more robust earnings quality.

Financial Ratios Comparison

The table below presents the most recent financial ratios for GoDaddy Inc. and Akamai Technologies, Inc. as of fiscal year 2024, providing a side-by-side view of key performance and financial health indicators.

| Ratios | GoDaddy Inc. (GDDY) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| ROE | 135.4% | 10.4% |

| ROIC | 16.0% | 4.7% |

| P/E | 29.8 | 28.7 |

| P/B | 40.3 | 3.0 |

| Current Ratio | 0.72 | 1.23 |

| Quick Ratio | 0.72 | 1.23 |

| D/E (Debt-to-Equity) | 5.63 | 0.95 |

| Debt-to-Assets | 47.3% | 44.7% |

| Interest Coverage | 5.64 | 19.7 |

| Asset Turnover | 0.56 | 0.38 |

| Fixed Asset Turnover | 22.2 | 1.33 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

GoDaddy Inc.

GoDaddy shows strong profitability with a net margin of 20.49% and an exceptionally high return on equity at 135.37%, indicating efficient equity use. However, concerns arise from a low current ratio of 0.72 and a high debt-to-equity ratio of 5.63, suggesting liquidity and leverage risks. The company does not pay dividends, likely prioritizing reinvestment or growth.

Akamai Technologies, Inc.

Akamai presents a favorable net margin of 12.65% and solid interest coverage of 22.65, reflecting good operating income relative to interest expenses. Its return on invested capital at 4.74% is weak, and asset turnover at 0.38 is low, pointing to less efficient asset use. Akamai also does not pay dividends, possibly focusing on reinvestment and innovation.

Which one has the best ratios?

Both companies receive a neutral global ratios opinion with a balanced number of favorable and unfavorable metrics. GoDaddy excels in profitability and leverage but struggles with liquidity, while Akamai shows better liquidity and interest coverage but weaker returns on capital. Neither stands out decisively, reflecting trade-offs in their financial profiles.

Strategic Positioning

This section compares the strategic positioning of GoDaddy Inc. and Akamai Technologies, Inc. regarding Market position, Key segments, and Exposure to technological disruption:

GoDaddy Inc.

- Leading domain registrar and web hosting provider facing moderate competitive pressure in software infrastructure.

- Key segments include Core Platform ($2.9B) and Applications and Commerce ($1.65B) focusing on small businesses and individuals.

- Exposure to disruption through evolving cloud technologies and cybersecurity demands in digital presence management.

Akamai Technologies, Inc.

- Provides cloud services for security, delivery, and optimization with competitive pressure in cloud security and edge computing.

- Single reportable segment ($3.99B) emphasizing cloud security, media delivery, and edge compute for enterprise clients.

- High exposure due to rapid innovations in cloud security, edge computing, and content delivery networks.

GoDaddy Inc. vs Akamai Technologies, Inc. Positioning

GoDaddy pursues a diversified strategy targeting small businesses with domain registration, hosting, and commerce solutions. Akamai concentrates on cloud security and content delivery for enterprises, focusing on performance and edge computing. GoDaddy’s broad product mix contrasts with Akamai’s specialized cloud services.

Which has the best competitive advantage?

GoDaddy demonstrates a very favorable moat with growing ROIC and value creation, indicating durable competitive advantage. Akamai shows a very unfavorable moat with declining ROIC, signaling value destruction and weaker competitive positioning.

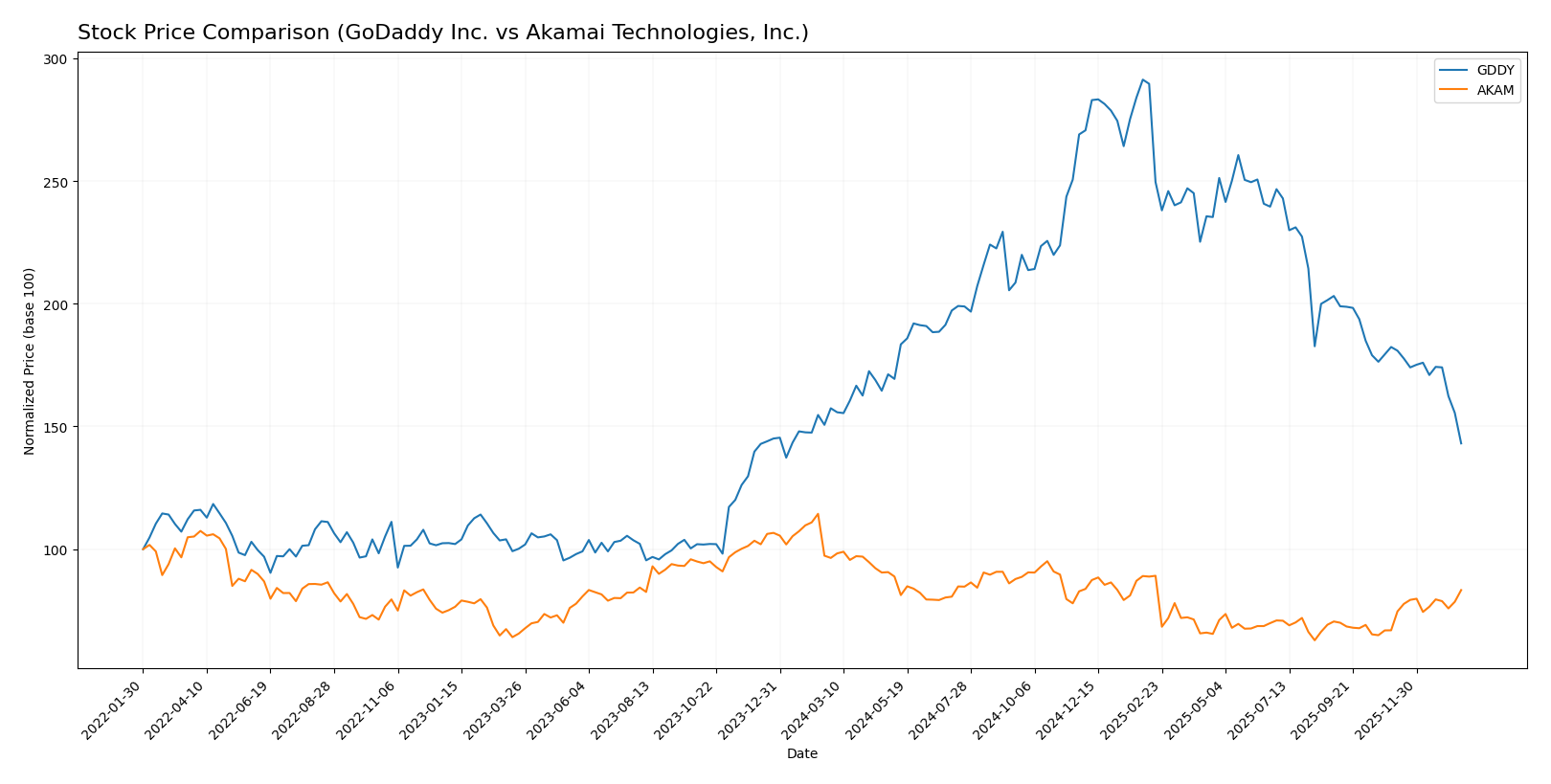

Stock Comparison

The stock price movements of GoDaddy Inc. and Akamai Technologies, Inc. over the past 12 months reveal contrasting dynamics, with both companies experiencing overall declines but showing differing recent momentum and trading activity.

Trend Analysis

GoDaddy Inc. exhibited a bearish trend with a -9.09% price change over the past year, accompanied by deceleration in the downtrend. The stock’s price ranged between 104.46 and 212.65, with significant volatility indicated by a 27.35 standard deviation.

Akamai Technologies, Inc. also showed a bearish trend over the year, declining by -13.57%, but with accelerating downward momentum. The stock’s price fluctuated from 70.53 to 111.00, with lower volatility at a 10.92 standard deviation.

Comparing recent trends, Akamai outperformed GoDaddy with a strong bullish reversal of +24.49%, while GoDaddy continued a bearish descent of -21.54%. Akamai’s volume dominance and positive slope indicate a higher market performance in the short term.

Target Prices

Analysts present a clear target price consensus for GoDaddy Inc. and Akamai Technologies, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GoDaddy Inc. | 182 | 70 | 143.33 |

| Akamai Technologies, Inc. | 115 | 89 | 104.8 |

The target consensus for GoDaddy at 143.33 suggests a significant upside compared to its current price of 104.46, indicating positive analyst expectations. Akamai’s consensus target of 104.8 also implies potential growth from its current 93.49, reflecting moderately bullish sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GoDaddy Inc. and Akamai Technologies, Inc.:

Rating Comparison

GoDaddy Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 5, indicating very favorable valuation based on future cash flows.

- ROE Score: 5, showing very efficient profit generation from shareholders’ equity.

- ROA Score: 4, favorable asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable due to high financial risk.

- Overall Score: 3, moderate overall financial standing.

Akamai Technologies, Inc. Rating

- Rating: B, also considered very favorable by analysts.

- Discounted Cash Flow Score: 5, equally very favorable valuation.

- ROE Score: 3, moderate efficiency in profit generation.

- ROA Score: 3, moderate effectiveness in asset use.

- Debt To Equity Score: 1, very unfavorable, indicating similar financial risk.

- Overall Score: 3, also moderate overall financial standing.

Which one is the best rated?

GoDaddy holds a slightly better rating with a B+ compared to Akamai’s B. It excels notably in ROE and ROA scores, while both share similar debt-to-equity challenges and identical overall moderate scores.

Scores Comparison

The comparison of GoDaddy and Akamai scores highlights their financial stability and strength as follows:

GoDaddy Scores

- Altman Z-Score of 1.53 places GoDaddy in the distress zone, indicating higher bankruptcy risk.

- Piotroski Score of 8 indicates GoDaddy has very strong financial health and value potential.

Akamai Scores

- Altman Z-Score of 2.46 places Akamai in the grey zone, showing moderate bankruptcy risk.

- Piotroski Score of 7 reflects Akamai’s strong financial health and good investment value.

Which company has the best scores?

GoDaddy shows a higher Piotroski Score, suggesting stronger financial health, but a lower Altman Z-Score in the distress zone. Akamai scores better on the Altman Z-Score, indicating lower bankruptcy risk but has a slightly lower Piotroski Score.

Grades Comparison

The following section presents a detailed comparison of the latest reliable grades for GoDaddy Inc. and Akamai Technologies, Inc.:

GoDaddy Inc. Grades

This table summarizes recent grade actions from reputable grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

Overall, GoDaddy’s grades reflect a balanced outlook with several buy and overweight ratings alongside neutral and hold positions, indicating a mixed but generally positive sentiment.

Akamai Technologies, Inc. Grades

This table summarizes recent grade actions from reputable grading companies for Akamai Technologies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

Akamai’s grades show a trend of recent upgrades to overweight alongside steady sector outperform and neutral ratings, indicating improving sentiment and confidence from analysts.

Which company has the best grades?

GoDaddy Inc. has a consensus rating of Buy with a majority of buy and overweight grades, while Akamai Technologies holds a Hold consensus with a mix of neutral and sector outperform grades. GoDaddy’s stronger buy consensus may signal higher analyst conviction, whereas Akamai’s upgrades suggest a positive momentum but more cautious outlook for investors.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of GoDaddy Inc. (GDDY) and Akamai Technologies, Inc. (AKAM) based on the latest data available for 2024-2026.

| Criterion | GoDaddy Inc. (GDDY) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Diversification | Strong: Core Platform & Applications and Commerce segments with growing revenues (4.6B total in 2024) | Limited: Revenue concentrated in one main segment (~4B in 2024) |

| Profitability | High profitability: ROIC 16.02%, Net Margin 20.49%, ROE 135.37% | Moderate profitability: ROIC 4.74%, Net Margin 12.65%, ROE 10.35% |

| Innovation | Very Favorable economic moat with growing ROIC (+147%) indicating innovation and competitive advantage | Very Unfavorable moat with declining ROIC (-44%) indicating challenges in maintaining innovation |

| Global presence | Strong global presence supported by broad platform services | Established global CDN and cloud security provider but facing value erosion |

| Market Share | Leading in domain registration and web services sectors | Significant player in content delivery and cloud security but losing competitive edge |

Key takeaways: GoDaddy demonstrates robust value creation with strong profitability, diversification, and an expanding economic moat. Akamai faces profitability and growth challenges, reflected by its declining ROIC and weaker innovation stance, which warrants cautious consideration.

Risk Analysis

Below is a comparative risk assessment table for GoDaddy Inc. (GDDY) and Akamai Technologies, Inc. (AKAM) based on the most recent data from 2024:

| Metric | GoDaddy Inc. (GDDY) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Risk | Moderate (Beta: 0.948) | Lower (Beta: 0.685) |

| Debt Level | High (Debt-to-Equity: 5.63, Unfavorable) | Moderate (Debt-to-Equity: 0.95, Neutral) |

| Regulatory Risk | Moderate, tech sector exposure | Moderate, cybersecurity regulations impact |

| Operational Risk | Moderate, reliant on cloud infrastructure | Moderate, complex service delivery operations |

| Environmental Risk | Low, primarily digital services | Low, primarily digital services |

| Geopolitical Risk | Moderate, US-based with international exposure | Moderate, US-based with international exposure |

The most impactful risks are GoDaddy’s high debt level, which increases financial vulnerability despite strong profitability, and Akamai’s operational complexity in cybersecurity services amid evolving regulations. Market risk is moderate for both, with GoDaddy slightly more sensitive. Both companies have low environmental risk but face similar geopolitical exposures.

Which Stock to Choose?

GoDaddy Inc. shows strong income growth with a favorable global income statement and very favorable MOAT evaluation, indicating durable competitive advantage. Its financial ratios are mixed, balancing favorable profitability with some liquidity and valuation concerns. The company holds a very favorable B+ rating, despite certain unfavorable ratio metrics.

Akamai Technologies, Inc. presents a neutral global financial ratios evaluation and an unfavorable income statement trend, alongside a very unfavorable MOAT status reflecting declining profitability. Its rating is very favorable at B, though key profitability and growth indicators remain moderate or unfavorable.

Investors seeking growth and durable competitive advantage might find GoDaddy’s metrics suggestive of value creation potential, while those prioritizing moderate financial stability and recent positive price momentum could interpret Akamai’s profile as more fitting. The choice may hinge on individual risk tolerance and investment strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GoDaddy Inc. and Akamai Technologies, Inc. to enhance your investment decisions: