In the fast-evolving world of technology, CrowdStrike Holdings, Inc. and Akamai Technologies, Inc. stand out as key players in the software infrastructure sector. Both companies deliver cloud-based security solutions, yet they approach innovation and market demands differently. This comparison highlights their strategies, market positions, and growth potential to help you decide which company deserves a place in your investment portfolio. Let’s explore which one offers the most compelling opportunity.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and Akamai by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. delivers cloud-based protection focused on endpoints, cloud workloads, identity, and data. Its Falcon platform offers threat intelligence, managed security services, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike operates globally and primarily sells subscriptions through direct sales and channel partners, positioning itself as a leader in cybersecurity infrastructure software.

Akamai Overview

Akamai Technologies, Inc. specializes in cloud services designed to secure, deliver, and optimize internet content and business applications. Founded in 1998 and headquartered in Cambridge, Massachusetts, Akamai provides cybersecurity, web and mobile performance, media delivery, and edge computing solutions. Its client base is served via direct sales and channel partners, emphasizing comprehensive cloud infrastructure and content delivery technology.

Key similarities and differences

Both CrowdStrike and Akamai operate in the software infrastructure sector, focusing on cloud-based security solutions and relying on direct sales and channel partners. CrowdStrike centers on cybersecurity for endpoints and identity protection, while Akamai emphasizes content delivery, web performance, and edge computing. Akamai’s business model includes a broader scope of cloud services, whereas CrowdStrike concentrates on threat intelligence and managed security subscriptions.

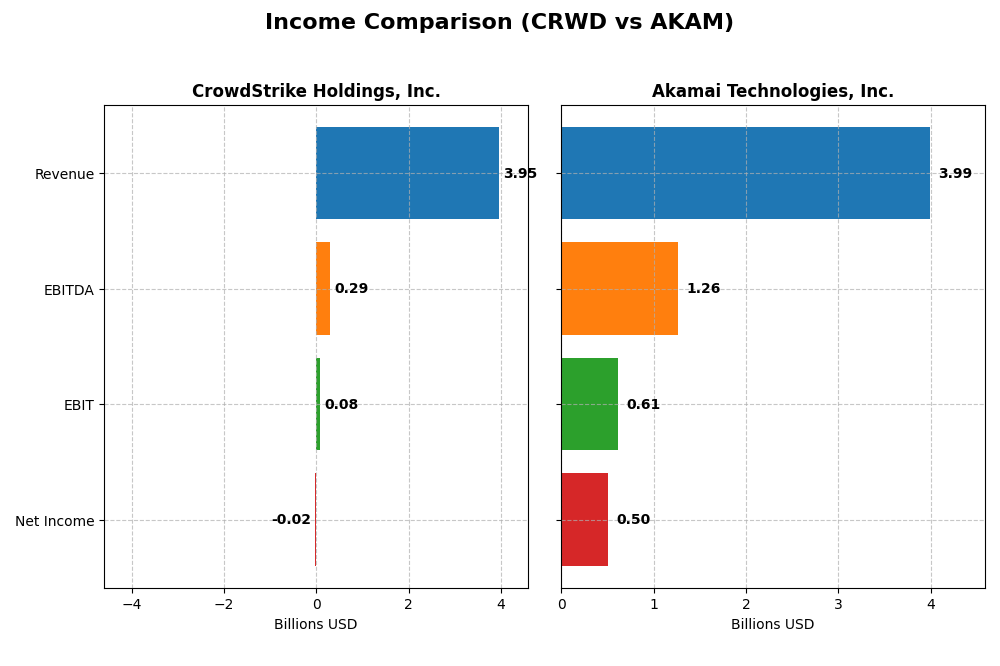

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for CrowdStrike Holdings, Inc. and Akamai Technologies, Inc. for their most recent fiscal years.

| Metric | CrowdStrike Holdings, Inc. | Akamai Technologies, Inc. |

|---|---|---|

| Market Cap | 114.4B | 13.4B |

| Revenue | 3.95B | 3.99B |

| EBITDA | 295M | 1.26B |

| EBIT | 81M | 614M |

| Net Income | -19.3M | 505M |

| EPS | -0.08 | 3.34 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike’s revenue surged strongly from 874M in 2021 to 3.95B in 2025, with net income turning from a loss of -93M to a slight loss of -19M in 2025. Gross margins remained robust around 75%, but net margins dipped negative in the most recent year. Despite a 29% revenue growth in 2025, net income and EPS declined, reflecting rising operating expenses and margin pressure.

Akamai Technologies, Inc.

Akamai displayed steady revenue growth from 3.2B in 2020 to 4.0B in 2024, while net income declined from 557M to 505M over the same period. Margins remained stable and favorable, with gross margin near 59% and net margin above 12% in 2024. However, Akamai’s growth slowed in the last year, with slight declines in EBIT, net margin, and EPS, indicating some operational challenges.

Which one has the stronger fundamentals?

CrowdStrike shows stronger revenue and net income growth over the overall period but struggles with negative net margins recently. Akamai maintains more consistent profitability and healthier margins, though with slower revenue and net income growth. CrowdStrike’s overall income statement evaluation is favorable, while Akamai’s is unfavorable, highlighting contrasting fundamentals between growth and profitability.

Financial Ratios Comparison

Below is a comparison of key financial ratios for CrowdStrike Holdings, Inc. (CRWD) and Akamai Technologies, Inc. (AKAM) for their most recent fiscal years.

| Ratios | CrowdStrike Holdings, Inc. (2025) | Akamai Technologies, Inc. (2024) |

|---|---|---|

| ROE | -0.59% | 10.35% |

| ROIC | 0.70% | 4.74% |

| P/E | -5055.7 | 28.68 |

| P/B | 29.71 | 2.97 |

| Current Ratio | 1.67 | 1.23 |

| Quick Ratio | 1.67 | 1.23 |

| D/E (Debt-to-Equity) | 0.24 | 0.95 |

| Debt-to-Assets | 9.07% | 44.70% |

| Interest Coverage | -4.58 | 19.67 |

| Asset Turnover | 0.45 | 0.38 |

| Fixed Asset Turnover | 4.76 | 1.33 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with favorable liquidity (current and quick ratios at 1.67) and low leverage (debt-to-equity 0.24), but weak profitability indicated by negative net margin (-0.49%) and ROE (-0.59%). Asset turnover is low at 0.45, raising efficiency concerns. The company does not pay dividends, likely due to its negative earnings and focus on reinvestment and growth.

Akamai Technologies, Inc.

Akamai presents solid profitability with a 12.65% net margin and a robust interest coverage ratio of 22.65, though ROE is neutral at 10.35%. Its leverage is moderate (debt-to-equity 0.95), and liquidity ratios are fair (current ratio 1.23). Akamai also does not pay dividends, which may reflect its reinvestment strategy or prioritization of growth initiatives over shareholder payouts.

Which one has the best ratios?

Both companies have a neutral global ratios opinion, balancing strengths and weaknesses. CrowdStrike excels in liquidity and low leverage but lags in profitability, while Akamai shows stronger profitability and interest coverage but bears higher debt and less liquidity. Neither pays dividends, reflecting different strategic focuses.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Akamai, including market position, key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Leading in cloud-delivered endpoint and workload protection, facing competitive pressure in cybersecurity.

- Key revenue driven by subscriptions to Falcon platform and cloud modules, supported by professional services.

- Positioned in cloud cybersecurity with evolving threat intelligence; moderate exposure to technological disruption.

Akamai Technologies, Inc.

- Provides cloud services for internet security and content delivery, with competitive pressure in cloud infrastructure.

- Revenue mainly from cloud security, content delivery, performance, and edge compute solutions.

- Focused on cloud optimization and security, exposed to disruption in internet infrastructure and edge computing.

CrowdStrike vs Akamai Positioning

CrowdStrike’s strategy centers on a concentrated offering in cloud endpoint security with strong subscription growth, while Akamai pursues a more diversified cloud services portfolio including security, content delivery, and edge computing. CrowdStrike benefits from focused innovation; Akamai leverages broad service integration but faces diverse technological challenges.

Which has the best competitive advantage?

Both companies are shedding value as ROIC is below WACC. CrowdStrike shows improving profitability trends, whereas Akamai experiences declining returns, suggesting a relatively stronger but still challenged competitive position for CrowdStrike.

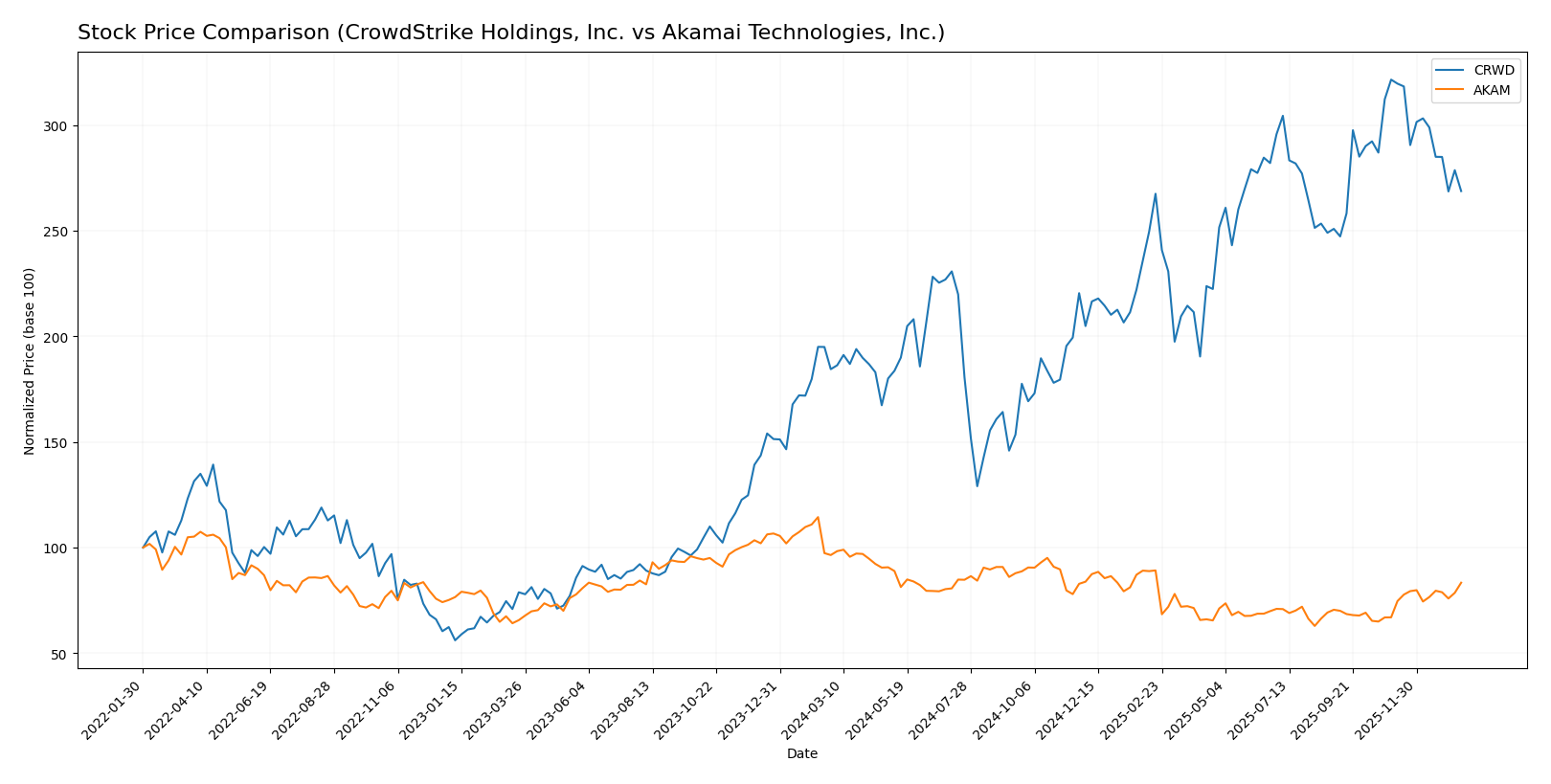

Stock Comparison

The stock price movements of CrowdStrike Holdings, Inc. and Akamai Technologies, Inc. over the past year reveal contrasting trends, with CrowdStrike showing strong gains followed by recent declines, while Akamai experienced an overall downturn but a recent recovery phase.

Trend Analysis

CrowdStrike Holdings, Inc. exhibited a bullish trend over the past 12 months with a 45.71% price increase, though this growth is decelerating. The stock reached a high of 543.01 and a low of 217.89, with high volatility (std deviation 80.53). Recently, it declined by 16.41%, indicating short-term bearish momentum.

Akamai Technologies, Inc. showed a bearish trend over the past year with a 13.57% price decrease and accelerating decline. Its price ranged between 70.53 and 111.00, with moderate volatility (std deviation 10.92). Recently, Akamai gained 24.49%, suggesting a nascent bullish reversal.

Comparing the two, CrowdStrike delivered the highest market performance over the year, despite recent weakness, while Akamai’s overall decline was partially offset by a strong recent upward movement.

Target Prices

Analysts present a positive consensus for CrowdStrike Holdings, Inc. and Akamai Technologies, Inc., suggesting potential upside from current prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Akamai Technologies, Inc. | 115 | 89 | 104.8 |

CrowdStrike’s consensus target price is about 22% above its current price of 453.88, indicating bullish analyst expectations. Akamai’s target consensus at 104.8 also implies upside potential from its present 93.49 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and Akamai Technologies, Inc.:

Rating Comparison

CRWD Rating

- Rating: C, assessed as Very Favorable overall.

- Discounted Cash Flow Score: 4, Favorable.

- Return on Equity Score: 1, Very Unfavorable.

- Return on Assets Score: 1, Very Unfavorable.

- Debt To Equity Score: 3, Moderate.

- Overall Score: 2, Moderate.

AKAM Rating

- Rating: B, also assessed as Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable.

- Return on Equity Score: 3, Moderate.

- Return on Assets Score: 3, Moderate.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 3, Moderate.

Which one is the best rated?

Based strictly on the provided data, Akamai holds a better overall rating (B vs. C) and scores higher on discounted cash flow, ROE, and ROA. CrowdStrike has a stronger debt-to-equity score but lags in other key metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CrowdStrike and Akamai:

CrowdStrike Scores

- Altman Z-Score: 12.38, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

Akamai Scores

- Altman Z-Score: 2.46, placing it in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 7, showing strong financial health.

Which company has the best scores?

CrowdStrike has a significantly higher Altman Z-Score, signaling very low bankruptcy risk, while Akamai has a stronger Piotroski Score, indicating better financial strength. Each company leads in a different score category based on the data provided.

Grades Comparison

The following sections present the latest reliable grades from established grading companies for CrowdStrike Holdings, Inc. and Akamai Technologies, Inc.:

CrowdStrike Holdings, Inc. Grades

This table summarizes recent grades and rating actions from major financial institutions for CrowdStrike Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

CrowdStrike shows a generally positive trend with multiple buy ratings and few downgrades, indicating moderate confidence from analysts.

Akamai Technologies, Inc. Grades

This table summarizes recent grades and rating actions from major financial institutions for Akamai Technologies, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

Akamai’s ratings reflect mixed but improving sentiment, with upgrades to overweight balanced by multiple neutral and hold grades.

Which company has the best grades?

Comparing both, CrowdStrike receives predominantly buy and outperform ratings, while Akamai’s consensus is more cautious with neutral and hold grades. This suggests CrowdStrike currently enjoys stronger analyst support, which may impact investor sentiment and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for CrowdStrike Holdings, Inc. (CRWD) and Akamai Technologies, Inc. (AKAM) based on the most recent data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Diversification | Moderate – Revenue mainly from Subscription and Services | Limited – Single main segment reported |

| Profitability | Unfavorable – Negative net margin and ROE; ROIC growing but below WACC | Favorable net margin; ROIC declining but above zero |

| Innovation | High – Strong revenue growth in subscription services | Moderate – Stable revenues with less innovation focus |

| Global presence | Strong – Cloud-based cybersecurity with global reach | Strong – Content delivery with global network |

| Market Share | Growing in cybersecurity market | Established in content delivery market |

Key takeaway: CrowdStrike shows rapid growth and innovation in cybersecurity but struggles with profitability and value creation. Akamai offers stable profitability and solid global presence but faces challenges with declining ROIC and less diversification. Investors should weigh growth potential against profitability risks in both cases.

Risk Analysis

Below is a risk comparison table for CrowdStrike Holdings, Inc. (CRWD) and Akamai Technologies, Inc. (AKAM) based on the most recent data from 2025 and 2024 respectively:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Risk | Beta 1.03, moderate volatility | Beta 0.69, lower volatility |

| Debt level | Low debt-to-assets 9.1%, DE 0.24 | Moderate debt-to-assets 44.7%, DE 0.95 |

| Regulatory Risk | Moderate, typical for US tech | Moderate, U.S. and global exposure |

| Operational Risk | Moderate; dependency on cloud services and innovation | Moderate; diverse cloud services and edge computing |

| Environmental Risk | Low; primarily software-based | Low; software and cloud infrastructure |

| Geopolitical Risk | Moderate; global clientele with data privacy concerns | Moderate; global internet infrastructure exposure |

Synthesis: CrowdStrike faces moderate market risk with a beta near 1 and maintains a strong balance sheet with low debt, reducing financial risk. Akamai has lower market volatility but carries higher leverage, increasing financial risk. Both companies operate in regulated tech sectors with moderate operational and geopolitical risks. CrowdStrike’s average Piotroski score and Akamai’s borderline Altman Z-score highlight the need for ongoing risk monitoring.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong income growth with a 29.4% revenue increase in 2025 and a favorable overall income statement. However, its profitability ratios are mostly unfavorable, with negative net margin and ROE, though debt levels remain low and liquidity is good. The company’s rating is very favorable overall despite some weaknesses in profitability metrics.

Akamai Technologies, Inc. (AKAM) presents a stable income evolution with a 4.7% revenue growth in 2024 but an unfavorable overall income statement due to declining profitability. Financial ratios are mixed, with a favorable net margin and interest coverage but moderate debt and neutral liquidity. Its rating is very favorable overall, supported by solid cash flow scores, despite some debt concerns.

For investors prioritizing growth potential and rapid revenue expansion, CRWD’s strong income growth and improving profitability might appear attractive, while those focused on stable earnings and stronger profitability metrics might find AKAM’s consistent margins and solid rating more aligned with their goals. Both companies have neutral global ratio evaluations, suggesting a balanced risk-return profile depending on investor preference.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Akamai Technologies, Inc. to enhance your investment decisions: