In the rapidly evolving world of cloud infrastructure, Cloudflare, Inc. (NET) and Akamai Technologies, Inc. (AKAM) stand out as key players driving innovation in security, content delivery, and performance optimization. Both companies operate in the software infrastructure industry, targeting overlapping markets with cutting-edge solutions for businesses globally. This article will help you uncover which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and Akamai by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider offering integrated cloud-based security and performance solutions globally. Its mission encompasses securing platforms including public and private clouds, SaaS, and IoT devices. The company delivers a broad range of products such as cloud firewalls, DDoS protection, content delivery, and developer tools. Headquartered in San Francisco, Cloudflare serves diverse industries including technology, healthcare, and government.

Akamai Overview

Akamai Technologies, Inc. provides cloud services focused on securing, delivering, and optimizing internet content and business applications worldwide. The company offers cybersecurity, web and mobile performance, media delivery, and edge computing solutions. Akamai supports customers through direct sales and channel partners, emphasizing protection from cyberattacks and enhancing digital experiences. It is based in Cambridge, Massachusetts, and has a strong presence in global markets.

Key similarities and differences

Both Cloudflare and Akamai operate in the Software – Infrastructure industry, providing cloud-based security and performance services. While Cloudflare emphasizes integrated solutions across diverse platforms including IoT and offers developer-centric tools, Akamai focuses on broad content delivery, cybersecurity, and edge computing with a larger workforce. Market caps differ significantly, with Cloudflare valued at approximately 64.5B and Akamai at 13.4B, reflecting scale and market positioning variations.

Income Statement Comparison

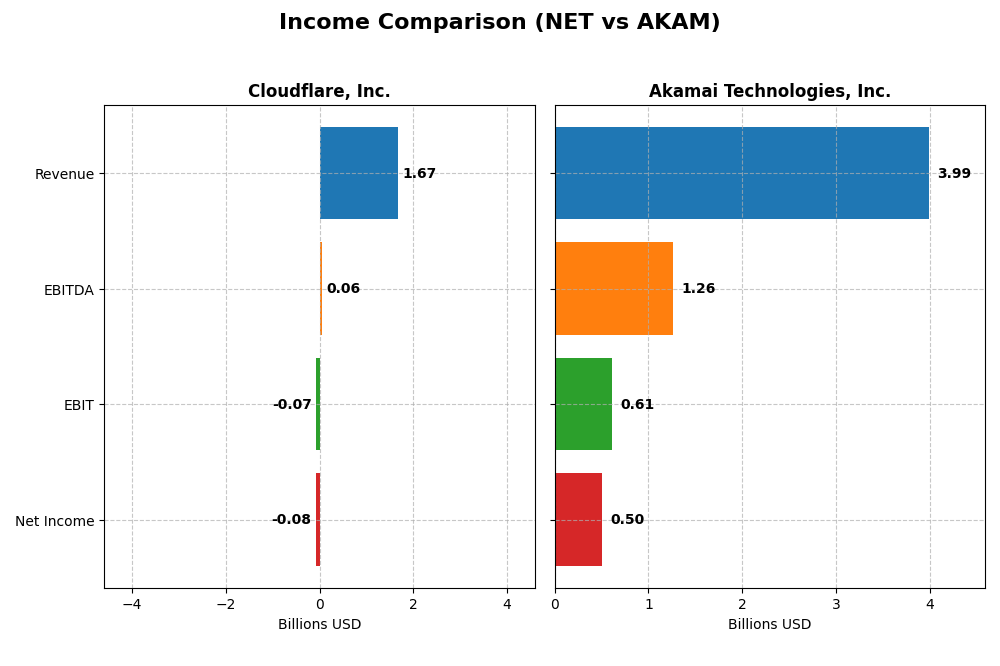

This table compares key income statement metrics for Cloudflare, Inc. and Akamai Technologies, Inc. for the fiscal year 2024.

| Metric | Cloudflare, Inc. (NET) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Cap | 64.5B | 13.4B |

| Revenue | 1.67B | 3.99B |

| EBITDA | 62.0M | 1.26B |

| EBIT | -65.7M | 614.1M |

| Net Income | -78.8M | 505.0M |

| EPS | -0.23 | 3.34 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue showed strong growth from 2020 to 2024, rising from $431M to $1.67B, with net income losses narrowing significantly from -$260M in 2021 to -$78.8M in 2024. Gross margins remained robust around 77%, while operating losses decreased notably. The latest year showed a 28.8% revenue rise and a 66.7% improvement in net margin, indicating operational progress despite negative profitability.

Akamai Technologies, Inc.

Akamai’s revenue increased steadily by 24.8% over five years, reaching $3.99B in 2024. Net income, however, declined over the same period, falling to $505M in 2024 from $557M in 2020. Margins are healthy, with a 59.4% gross margin and a 12.7% net margin in 2024, but recent trends show slower revenue growth (4.7%) and deteriorating net margin (-11.9%) and EPS (-7.1%) compared to prior years.

Which one has the stronger fundamentals?

Cloudflare exhibits favorable overall income statement trends with strong revenue growth, improving margins, and narrowing losses, signaling operational scaling. In contrast, Akamai maintains positive profitability and margins but faces declining net income and margin contraction recently. Cloudflare’s growth momentum contrasts with Akamai’s more stable but less dynamic performance, reflecting differing fundamental strengths.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cloudflare, Inc. and Akamai Technologies, Inc. based on their most recent fiscal year 2024 data.

| Ratios | Cloudflare, Inc. (NET) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| ROE | -7.53% | 10.35% |

| ROIC | -6.06% | 4.74% |

| P/E | -467 | 28.68 |

| P/B | 35.14 | 2.97 |

| Current Ratio | 2.86 | 1.23 |

| Quick Ratio | 2.86 | 1.23 |

| D/E (Debt to Equity) | 1.40 | 0.95 |

| Debt-to-Assets | 44.32% | 44.70% |

| Interest Coverage | -29.78 | 19.67 |

| Asset Turnover | 0.51 | 0.38 |

| Fixed Asset Turnover | 2.63 | 1.33 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare’s financial ratios show significant weaknesses: negative net margin (-4.72%) and return on equity (-7.53%) indicate profitability challenges. High price-to-book ratio (35.14) and poor interest coverage (-12.64) raise concerns about valuation and debt servicing. The company maintains strong liquidity with a current ratio of 2.86. Cloudflare does not pay dividends, likely due to ongoing reinvestment and growth priorities.

Akamai Technologies, Inc.

Akamai presents a mixed ratio profile with favorable net margin (12.65%) and strong interest coverage (22.65), signaling solid profitability and debt management. However, its return on invested capital (4.74%) and asset turnover (0.38) are less impressive. Liquidity ratios are moderate, with a current ratio of 1.23. Like Cloudflare, Akamai pays no dividends, focusing instead on reinvestment and growth strategies.

Which one has the best ratios?

Akamai holds a more balanced ratio profile with a neutral overall rating and better profitability metrics, while Cloudflare’s ratios are predominantly unfavorable, reflecting higher risk. Akamai’s stronger interest coverage and positive margins contrast with Cloudflare’s negative returns and high valuation multiples, suggesting Akamai’s financials are comparatively more stable.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and Akamai Technologies, Inc. in terms of market position, key segments, and exposure to technological disruption:

Cloudflare, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

Akamai Technologies, Inc.

- MarketCap $64.5B, operates in infrastructure software, faces typical industry competition.

- Offers integrated cloud security, performance, reliability, and developer solutions globally.

- Cloud-based security and performance solutions across cloud, SaaS, IoT, emphasizing innovation.

Cloudflare, Inc. vs Akamai Technologies, Inc. Positioning

Cloudflare pursues a diversified cloud-based security and performance model across multiple platforms, while Akamai concentrates on cloud security, content delivery, and edge compute. Cloudflare’s offerings emphasize innovation and developer solutions; Akamai leverages extensive media and carrier services.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC, but Cloudflare shows a growing ROIC trend, indicating improving profitability, whereas Akamai exhibits declining ROIC and decreasing profitability, reflecting a weaker competitive advantage.

Stock Comparison

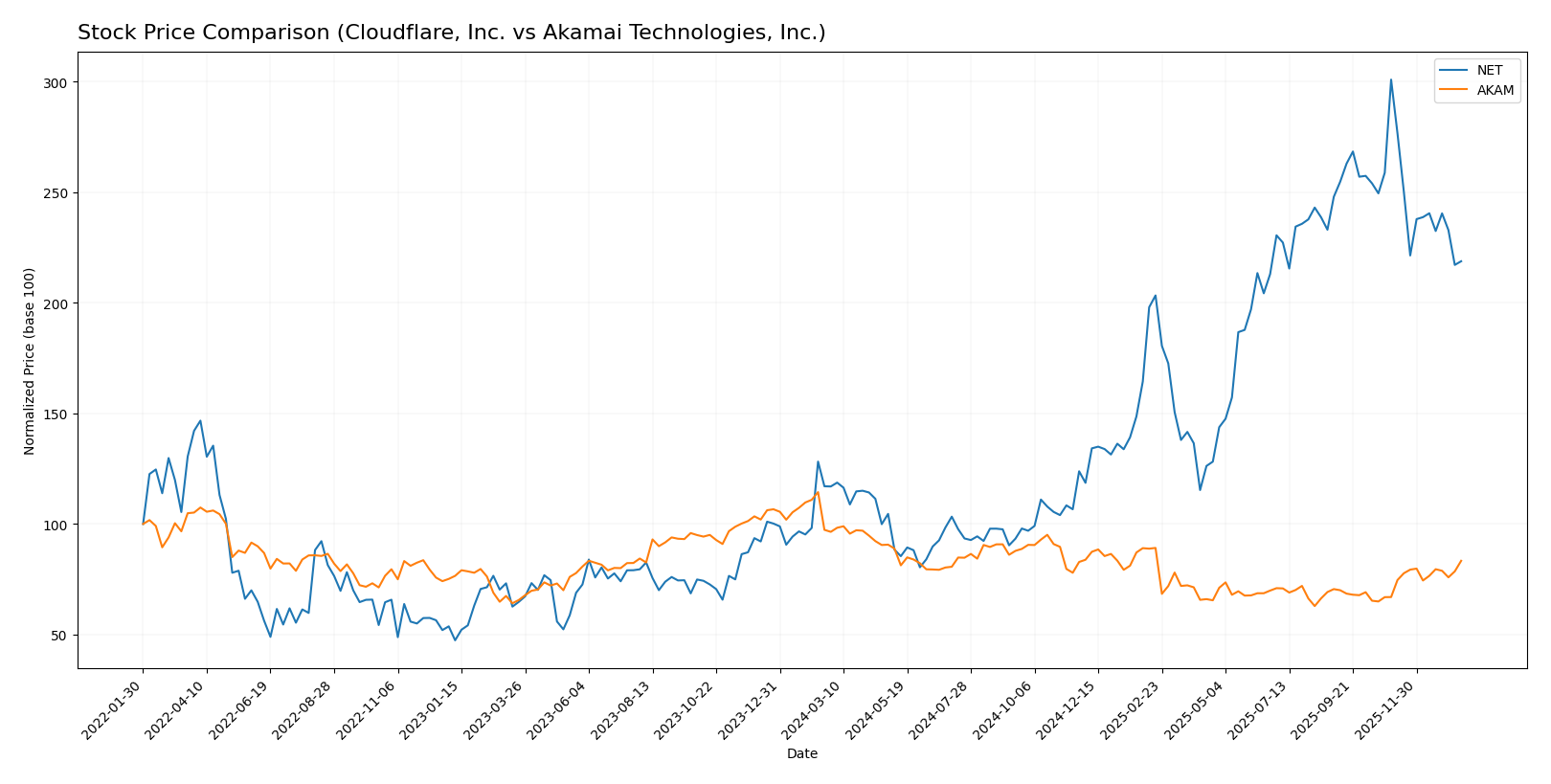

The past year has seen Cloudflare, Inc. (NET) exhibit a strong bullish trend with significant price appreciation, while Akamai Technologies, Inc. (AKAM) faced a bearish trend but showed recent signs of price recovery and increased buyer dominance.

Trend Analysis

Cloudflare, Inc. (NET) experienced an 87.07% price increase over the past 12 months, indicating a bullish trend with decelerating momentum. The stock showed high volatility, ranging from 67.69 to 253.3, with recent declines of 27.29%.

Akamai Technologies, Inc. (AKAM) recorded a -13.57% price change over the last year, marking a bearish trend that accelerated. The stock price fluctuated between 70.53 and 111.0, but recent gains of 24.49% suggest a potential reversal.

NET’s overall market performance outpaced AKAM’s, delivering the highest returns despite recent short-term weakness, while AKAM’s recent positive trend reflects improving investor sentiment.

Target Prices

Analyst consensus target prices suggest considerable upside potential for both Cloudflare, Inc. and Akamai Technologies, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| Akamai Technologies, Inc. | 115 | 89 | 104.8 |

Cloudflare’s target consensus of $248.86 is significantly above its current price of $184.17, indicating positive analyst expectations. Similarly, Akamai’s consensus target of $104.8 exceeds its current price of $93.49, suggesting moderate upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and Akamai Technologies, Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+, indicating a very favorable rating status.

- Discounted Cash Flow Score: 1, considered very unfavorable.

- ROE Score: 1, very unfavorable in terms of profitability efficiency.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 1, very unfavorable overall assessment.

Akamai Technologies, Inc. Rating

- Rating: B, also classified as very favorable by analysts.

- Discounted Cash Flow Score: 5, rated very favorable.

- ROE Score: 3, moderate efficiency in generating returns.

- ROA Score: 3, moderate effectiveness in asset use.

- Debt To Equity Score: 1, also very unfavorable financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Akamai Technologies, Inc. holds a superior rating with a B grade and higher scores in discounted cash flow, ROE, ROA, and overall score compared to Cloudflare, Inc.’s consistently low scores and D+ rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cloudflare, Inc. and Akamai Technologies, Inc.:

Cloudflare Scores

- Altman Z-Score: 9.47, indicating a safe zone status.

- Piotroski Score: 2, classified as very weak financial strength.

Akamai Scores

- Altman Z-Score: 2.46, indicating a grey zone status.

- Piotroski Score: 7, classified as strong financial strength.

Which company has the best scores?

Cloudflare has a much higher Altman Z-Score, placing it firmly in the safe zone, while Akamai is in the grey zone. Conversely, Akamai’s Piotroski Score is significantly stronger than Cloudflare’s very weak rating.

Grades Comparison

The following presents a comparison of recent grades assigned by reputable financial institutions for Cloudflare, Inc. and Akamai Technologies, Inc.:

Cloudflare, Inc. Grades

This table summarizes the latest grades from major financial analysts for Cloudflare, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades consistently trend towards Buy and Neutral ratings, reflecting a generally positive consensus with no recent downgrades.

Akamai Technologies, Inc. Grades

This table summarizes the latest grades from major financial analysts for Akamai Technologies, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

Akamai’s grades show a mixture of Neutral, Hold, and Sector Outperform ratings, with recent upgrades indicating improved outlooks from some analysts.

Which company has the best grades?

Cloudflare holds a stronger consensus with a majority of Buy ratings and an overall Buy consensus, while Akamai’s consensus leans toward Hold despite some upgrades. For investors, Cloudflare’s more favorable grades suggest comparatively higher analyst confidence in near-term performance.

Strengths and Weaknesses

Below is a comparative overview of Cloudflare, Inc. (NET) and Akamai Technologies, Inc. (AKAM), highlighting their key strengths and weaknesses based on the most recent financial and strategic data.

| Criterion | Cloudflare, Inc. (NET) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Diversification | Moderate revenue focus on cloud services (1.67B USD in 2024) | Higher revenue diversification with 3.99B USD in 2024 |

| Profitability | Negative net margin (-4.72%), ROIC unfavorable (-6.06%) | Positive net margin (12.65%), ROIC slightly unfavorable (4.74%) |

| Innovation | Growing ROIC trend (+22.1%) suggests improving innovation impact | Declining ROIC trend (-44.2%) indicates challenges in innovation effectiveness |

| Global presence | Strong global footprint but value destroying (ROIC < WACC) | Established global presence with better value retention but declining profitability |

| Market Share | Smaller market share compared to Akamai; shedding value currently | Larger market share with stable profitability, but facing growth pressures |

Key takeaways: Cloudflare shows promising growth in profitability trends despite current losses, suggesting potential for future value creation. Akamai maintains positive profitability and market position but faces declining returns, signaling caution for investors seeking growth.

Risk Analysis

Below is a comparison table of key risks for Cloudflare, Inc. (NET) and Akamai Technologies, Inc. (AKAM) based on 2024 data:

| Metric | Cloudflare, Inc. (NET) | Akamai Technologies, Inc. (AKAM) |

|---|---|---|

| Market Risk | High beta (1.97) indicating higher volatility | Low beta (0.69) indicating lower volatility |

| Debt level | Debt-to-equity 1.4 (unfavorable), interest coverage negative (-12.64) | Debt-to-equity 0.95 (neutral), interest coverage strong (22.65) |

| Regulatory Risk | Moderate, operates globally with cloud security compliance needs | Moderate, international cloud service regulations apply |

| Operational Risk | Relies on complex cloud infrastructure; unfavorable net margin and ROE | Established infrastructure; favorable net margin but moderate ROIC |

| Environmental Risk | Moderate, typical of tech sector with data center energy use | Moderate, similar sector risks with global operations |

| Geopolitical Risk | Exposure due to global customer base and data privacy laws | Exposure to international markets and geopolitical tensions |

In synthesis, Cloudflare shows elevated market and financial risks with its high volatility and weak profitability metrics, alongside heavier debt burden and negative interest coverage. Akamai, while more stable financially and operationally, faces moderate risks from debt and some operational efficiency concerns. Investors should weigh Cloudflare’s growth potential against its financial fragility and Akamai’s steadier but slower growth profile.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 28.76% in 2024 with mostly unfavorable financial ratios, including negative profitability and high debt levels. Its overall rating is very unfavorable despite a favorable income statement and a slightly unfavorable moat due to value destruction but improving profitability.

Akamai Technologies, Inc. (AKAM) reports moderate revenue growth at 4.7% with a more balanced financial profile featuring favorable net margin and interest coverage but some unfavorable ratios like ROIC and debt-to-equity. AKAM’s rating is moderate with a very unfavorable moat reflecting declining profitability and value destruction.

Investors seeking growth might see potential in Cloudflare given its robust income growth and improving profitability, while those prioritizing financial stability and moderate income generation may find Akamai’s more neutral rating and steadier ratios more appealing. The choice could depend on an investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Akamai Technologies, Inc. to enhance your investment decisions: