In the dynamic technology sector, Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc. stand out as innovators in software infrastructure. Akamai excels in cloud security and content delivery, while CCC focuses on AI-driven solutions for the insurance economy. Both companies leverage cutting-edge technology to serve overlapping markets, making their investment potential worthy of comparison. In this article, I will help you decide which company offers the best opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

Akamai Technologies Overview

Akamai Technologies, Inc. specializes in cloud services aimed at securing, delivering, and optimizing internet content and business applications globally. The company focuses on cybersecurity, web and mobile performance, media delivery, and edge computing solutions. Incorporated in 1998 and headquartered in Cambridge, Massachusetts, Akamai is a significant player in the software infrastructure industry with a market cap of approximately 13.4B USD and over 10,800 employees.

CCC Intelligent Solutions Overview

CCC Intelligent Solutions Holdings Inc. offers cloud, AI, telematics, and hyperscale technologies for the property and casualty insurance economy. Its SaaS platform digitizes workflows and connects various stakeholders in insurance, including carriers and repairers. Founded in 1980 and based in Chicago, Illinois, CCC operates in software infrastructure with a market cap near 5.6B USD and a workforce of about 2,300 employees.

Key similarities and differences

Both companies operate in the technology sector within software infrastructure, focusing on cloud-based solutions. While Akamai emphasizes internet security, performance, and media delivery, CCC targets the insurance industry’s digital transformation through AI and telematics. Akamai is larger by market cap and employee count, reflecting broader global services, whereas CCC is more specialized in insurance-related applications and ecosystems.

Income Statement Comparison

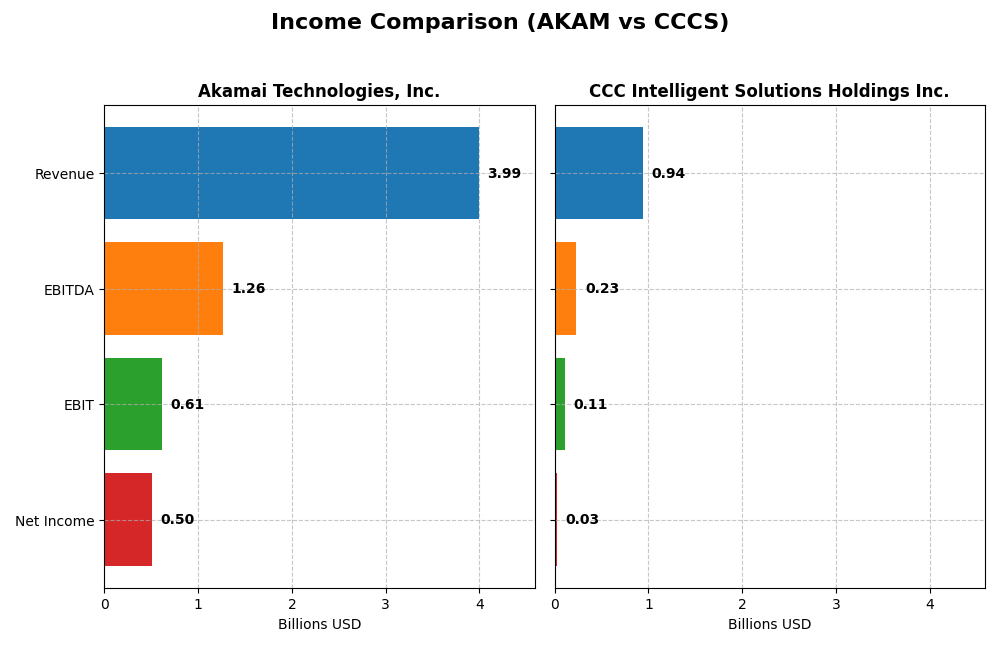

The table below provides a side-by-side comparison of the most recent full fiscal year income statement metrics for Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc.

| Metric | Akamai Technologies, Inc. | CCC Intelligent Solutions Holdings Inc. |

|---|---|---|

| Market Cap | 13.4B | 5.63B |

| Revenue | 3.99B | 945M |

| EBITDA | 1.26B | 233M |

| EBIT | 614M | 109M |

| Net Income | 505M | 26.1M |

| EPS | 3.34 | 0.0428 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Akamai Technologies, Inc.

Akamai’s revenue increased steadily from 3.2B in 2020 to nearly 4B in 2024, marking a 24.8% growth over the period. However, net income declined by 9.36%, and net margins contracted by 27.37%. In 2024, revenue growth slowed to 4.7%, while net margin and EPS both dipped, reflecting margin pressures and slightly weaker profitability.

CCC Intelligent Solutions Holdings Inc.

CCC’s revenue showed consistent growth, rising from 633M in 2020 to 945M in 2024, a 49.24% increase. Net income surged by 255% over this period, supported by expanding gross margins around 75.55% and improving EBIT margins. The 2024 fiscal year saw a 9.05% revenue rise and strong net margin growth of 125.93%, indicating enhanced operational efficiency.

Which one has the stronger fundamentals?

CCC demonstrates stronger fundamentals with largely favorable trends in revenue, net income, and margin growth, supported by a positive income statement evaluation. Akamai, despite higher absolute revenues, faces unfavorable net income and margin declines, signaling challenges in profitability. CCC’s consistent improvements present a more robust income statement profile based on recent financials.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc. based on their most recent fiscal year data (2024).

| Ratios | Akamai Technologies, Inc. | CCC Intelligent Solutions Holdings Inc. |

|---|---|---|

| ROE | 10.4% | 1.3% |

| ROIC | 4.7% | 1.9% |

| P/E | 28.7 | 274.0 |

| P/B | 3.0 | 3.6 |

| Current Ratio | 1.23 | 3.65 |

| Quick Ratio | 1.23 | 3.65 |

| D/E (Debt-to-Equity) | 0.95 | 0.42 |

| Debt-to-Assets | 44.7% | 26.7% |

| Interest Coverage | 19.7 | 1.24 |

| Asset Turnover | 0.38 | 0.30 |

| Fixed Asset Turnover | 1.33 | 4.68 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Akamai Technologies, Inc.

Akamai’s ratios show a mixed picture with a favorable net margin of 12.65% and strong interest coverage at 22.65, indicating good profitability and debt servicing ability. However, its return on invested capital (4.74%) and asset turnover (0.38) are weak, raising efficiency concerns. The company does not pay dividends, likely prioritizing reinvestment or growth, as indicated by a dividend yield of 0% and no payout data available.

CCC Intelligent Solutions Holdings Inc.

There is no available ratio data for CCC Intelligent Solutions Holdings Inc., which limits the ability to assess its financial health or operational efficiency. Additionally, the company does not pay dividends, suggesting it may be in a growth phase or focused on reinvestment and development rather than shareholder returns through dividends.

Which one has the best ratios?

Based solely on available data, Akamai demonstrates a more complete and balanced ratio profile with both strengths and weaknesses, while CCC Intelligent Solutions lacks sufficient data for comparison. Akamai’s neutral overall rating reflects mixed signals, but it provides more measurable financial insights than CCC Intelligent Solutions at this time.

Strategic Positioning

This section compares the strategic positioning of Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc., focusing on market position, key segments, and exposure to technological disruption:

Akamai Technologies, Inc.

- Leading cloud services provider with significant market cap and moderate competitive pressure.

- Focuses on cloud security, content delivery, edge computing, and media solutions driving revenue.

- Exposed to evolving cybersecurity threats and edge computing innovation impacting service offerings.

CCC Intelligent Solutions Holdings Inc.

- Mid-sized software infrastructure player focused on insurance economy with competitive pressures.

- Specializes in AI-enabled SaaS for property and casualty insurance workflows and ecosystem connectivity.

- Faces technological evolution in AI, telematics, and hyperscale technologies within insurance sector.

Akamai vs CCC Positioning

Akamai exhibits a diversified technology portfolio centered on cloud security and content delivery, benefiting from scale but facing intense competition. CCC concentrates on niche AI-driven insurance software, offering specialized solutions but with a narrower market focus and smaller scale.

Which has the best competitive advantage?

Based on available MOAT data, Akamai shows a very unfavorable economic moat with declining profitability, indicating value destruction. CCC lacks sufficient data for MOAT evaluation, preventing a clear competitive advantage assessment.

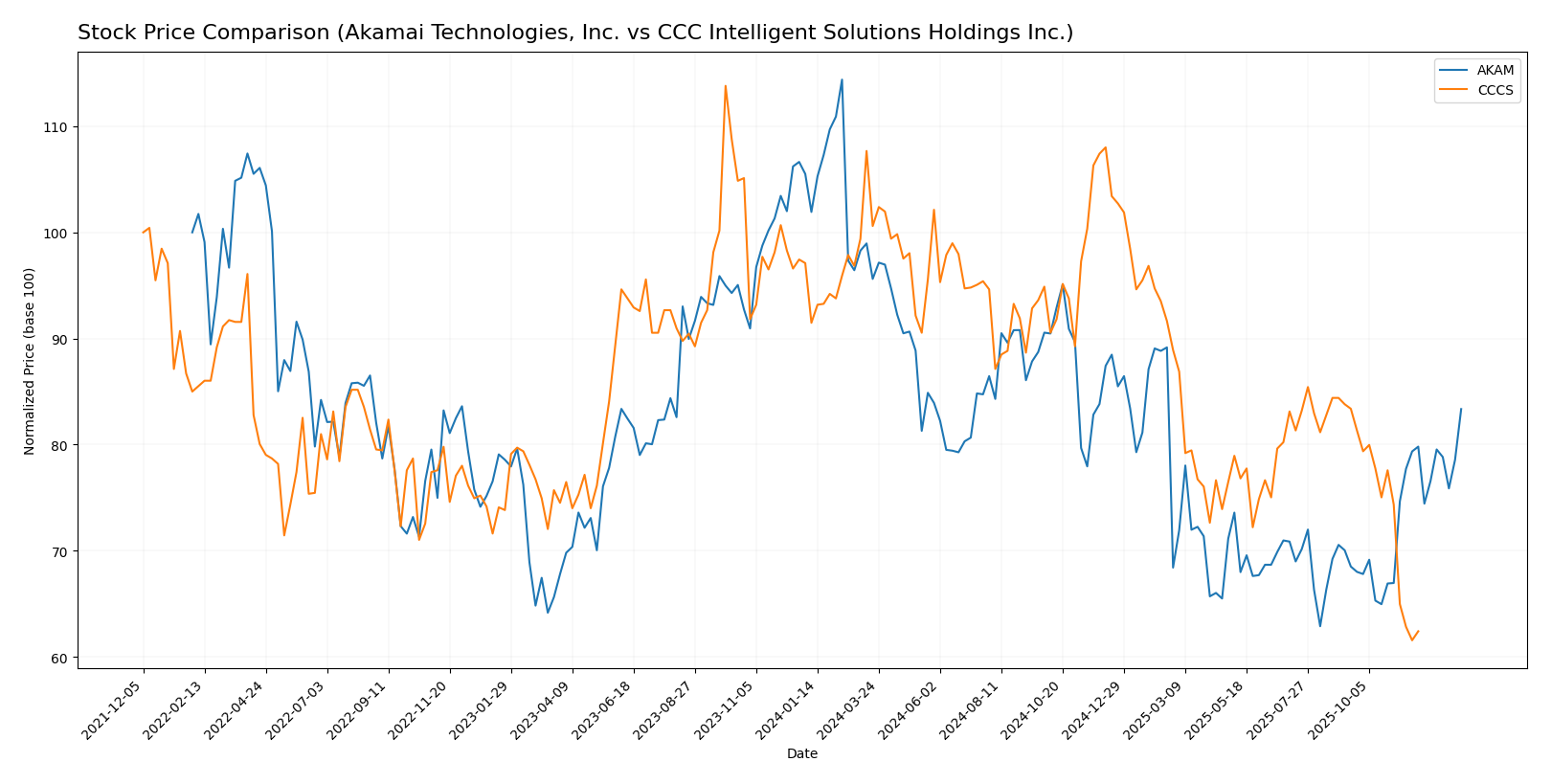

Stock Comparison

The stock price movements of Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc. over the past 12 months reveal contrasting bearish trends with differing volatility and recent momentum shifts.

Trend Analysis

Akamai Technologies, Inc. (AKAM) experienced a 13.57% price decline over the past year, indicating a bearish trend with acceleration. The stock showed significant volatility, reaching a high of 111.0 and a low of 70.53.

CCC Intelligent Solutions Holdings Inc. (CCCS) recorded a steeper 31.78% price drop during the same period, also bearish but with deceleration. Its price fluctuated less, with a high of 12.67 and a low of 7.22, reflecting lower volatility.

Comparing both, Akamai’s stock posted the highest market performance with a smaller decline and recent positive momentum, while CCCS showed a deeper loss and sustained negative trend.

Target Prices

The current analyst consensus presents a clear outlook for these technology infrastructure companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Akamai Technologies, Inc. | 115 | 89 | 104.8 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect Akamai’s stock to appreciate from its current price of $93.49 to around $105 on average, signaling moderate upside potential. CCC Intelligent Solutions’ consensus target of $11 suggests a modest increase above the current $8.75 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

AKAM Rating

- Rating: B, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 5, indicating very favorable valuation.

- ROE Score: 3, reflecting moderate efficiency in generating profit from equity.

- ROA Score: 3, showing moderate asset utilization efficiency.

- Debt To Equity Score: 1, viewed as very unfavorable due to high financial risk.

- Overall Score: 3, a moderate overall financial standing.

CCCS Rating

- No rating data available.

- No data available.

- No data available.

- No data available.

- No data available.

- No data available.

Which one is the best rated?

Based strictly on the available data, Akamai Technologies holds a clear advantage with a formal rating of B and detailed financial scores, while CCC Intelligent Solutions has no rating or scores to compare.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Akamai Technologies and CCC Intelligent Solutions:

Akamai Scores

- Altman Z-Score: 2.46, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 7, reflecting strong financial health.

CCC Scores

- Altman Z-Score: 2.18, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 3, indicating very weak financial strength.

Which company has the best scores?

Akamai has a higher Piotroski Score (7 vs. 3) indicating stronger financial health, while both companies share a similar Altman Z-Score in the grey zone. Overall, Akamai shows better financial strength based on these scores.

Grades Comparison

The grades of Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc. are compared below:

Akamai Technologies, Inc. Grades

The latest grades from major financial institutions for Akamai Technologies, Inc. are detailed in the table below.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

Overall, Akamai Technologies, Inc. shows a stable grade trend with a mix of neutral and sector outperform ratings, alongside recent upgrades to overweight by some firms.

The CCC Intelligent Solutions Holdings Inc. does not have any reliable grades available from verified grading companies.

Which company has the best grades?

Akamai Technologies, Inc. has received more comprehensive and stable grades from multiple reputable grading companies, showing a mixture of neutral, sector outperform, and overweight ratings. CCC Intelligent Solutions Holdings Inc. lacks verified grading data. Investors may find Akamai’s consistent and upgraded grades indicative of moderate confidence among analysts, while the absence of grades for CCC Intelligent Solutions implies less available third-party assessment.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Akamai Technologies, Inc. (AKAM) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | Akamai Technologies, Inc. (AKAM) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | Moderate, focused on content delivery and cloud security services with $3.99B revenue | Relatively focused, primarily software subscriptions ($906M) and other services |

| Profitability | Moderate profitability: Net margin 12.65%, ROE 10.35%, but ROIC below WACC (4.74% vs 6.14%) | Data unavailable, but growing revenue trend indicates potential improving profitability |

| Innovation | Moderate; industry leader but facing challenges with declining ROIC and value destruction | Unknown due to data limitations, but operates in tech-driven software solutions |

| Global presence | Strong global footprint as a major CDN and cloud services provider | Smaller scale and more niche, likely more regional or sector-focused |

| Market Share | Established leader in content delivery networks | Smaller player in specialized software subscription market |

Key takeaways: Akamai maintains a solid global presence and moderate profitability but is currently facing challenges with declining returns on invested capital and value destruction. Conversely, CCC Intelligent Solutions shows revenue growth but lacks sufficient data for a full financial and competitive assessment. Investors should weigh Akamai’s established position against its financial headwinds and monitor CCC’s progress closely.

Risk Analysis

Below is a comparative table highlighting key risk factors for Akamai Technologies, Inc. (AKAM) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent 2024 data.

| Metric | Akamai Technologies, Inc. (AKAM) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 0.685) | Moderate (Beta 0.721) |

| Debt Level | Moderate (Debt/Equity 0.95, Debt to Assets 44.7%) | Unknown (data missing) |

| Regulatory Risk | Moderate (Tech industry scrutiny) | Moderate (Insurance tech regulations) |

| Operational Risk | Moderate (Cloud service reliability critical) | Moderate (AI and SaaS platform dependency) |

| Environmental Risk | Low (Software sector, minimal direct impact) | Low (Software sector, minimal direct impact) |

| Geopolitical Risk | Moderate (Global internet infrastructure exposure) | Moderate (Global insurance markets exposure) |

Akamai’s most significant risks stem from moderate leverage and reliance on consistent cloud service performance amid evolving cybersecurity threats. CCCS has incomplete financial risk data but faces operational challenges tied to AI adoption and regulatory compliance in the insurance sector. Both exhibit moderate market and geopolitical risks due to their international business footprints. Investors should weigh Akamai’s balanced financial profile against CCCS’s data gaps and industry-specific uncertainties.

Which Stock to Choose?

Akamai Technologies, Inc. (AKAM) shows a mixed financial profile with a 2024 income statement marked by favorable gross and EBIT margins but declining net income and EPS over recent years. Financial ratios are neutral overall, with moderate profitability, manageable debt levels, and a very favorable rating despite a very unfavorable MOAT indicating value destruction.

CCC Intelligent Solutions Holdings Inc. (CCCS) exhibits strong income growth and favorable margins in 2024, alongside improving profitability metrics. However, data gaps limit a full financial ratio assessment. Its Altman Z-Score indicates moderate financial risk, and the Piotroski score suggests weak financial strength. The stock has experienced significant recent price declines.

For investors prioritizing stable financial ratings and moderate profitability, AKAM might appear more favorable despite some declining income trends and value erosion. Conversely, those focused on rapid income growth and potential turnaround scenarios might find CCCS’s improving income statement attractive, though with higher risk due to weaker financial strength indicators and price volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Akamai Technologies, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: