Choosing the right technology stock requires careful analysis, especially in the competitive software infrastructure sector. Akamai Technologies, Inc. and Arqit Quantum Inc. both offer innovative cybersecurity and cloud services, yet differ greatly in scale, market approach, and technology focus. This comparison explores their strengths and strategies to help you decide which company better suits your investment portfolio. Let’s uncover which stock presents the most compelling opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Akamai Technologies, Inc. and Arqit Quantum Inc. by providing an overview of these two companies and their main differences.

Akamai Overview

Akamai Technologies, Inc. is a US-based provider of cloud services focused on securing, delivering, and optimizing content and business applications over the internet. Founded in 1998 and headquartered in Cambridge, Massachusetts, Akamai serves global clients with solutions including cybersecurity protection, media delivery, edge compute, and performance optimization. The company operates in the software infrastructure industry with over 10,800 employees.

Arqit Overview

Arqit Quantum Inc. is a UK-based cybersecurity firm specializing in quantum encryption technology delivered via satellite and terrestrial platforms. Founded more recently, the company offers its QuantumCloud solution enabling device-level encryption key creation through lightweight software agents. Based in London and operating within the software infrastructure sector, Arqit employs around 80 people and targets advanced cybersecurity markets.

Key similarities and differences

Both companies operate in the software infrastructure industry with a focus on cybersecurity solutions. Akamai offers a broad portfolio including cloud services, content delivery, and edge computing, with a large global workforce. In contrast, Arqit has a niche focus on quantum encryption technology using satellite platforms and a much smaller employee base. Their geographical bases and market scales also differ significantly, reflecting distinct business models and growth stages.

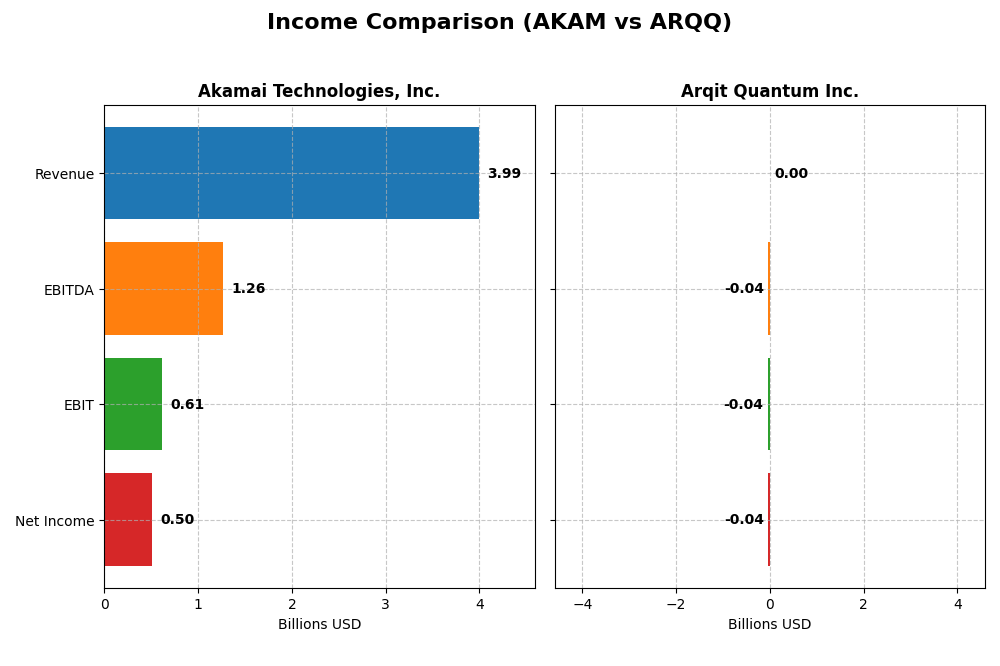

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Akamai Technologies, Inc. and Arqit Quantum Inc. for their most recent fiscal years.

| Metric | Akamai Technologies, Inc. | Arqit Quantum Inc. |

|---|---|---|

| Market Cap | 13.4B | 416M |

| Revenue | 3.99B | 530K |

| EBITDA | 1.26B | -36.8M |

| EBIT | 614M | -37.6M |

| Net Income | 505M | -35.3M |

| EPS | 3.34 | -2.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Akamai Technologies, Inc.

From 2020 to 2024, Akamai’s revenue grew steadily by 24.8%, while net income declined by 9.36%. Gross and net margins remain strong but showed a contraction over the period, with net margin falling to 12.65% in 2024. The most recent year saw a modest 4.7% revenue increase but declines in EBIT (-8.37%) and net margin (-11.94%), indicating margin pressures despite revenue growth.

Arqit Quantum Inc.

Between 2021 and 2025, Arqit’s revenue surged over 1000%, with net income growing by 86.99%. However, the company reported negative gross and EBIT margins in 2025, at -43.4% and -7088.3% respectively, reflecting ongoing unprofitability. The latest year showed strong revenue and gross profit growth, improving net margin and EPS, but margins remain deeply negative overall.

Which one has the stronger fundamentals?

Akamai displays favorable margin levels and stable revenue growth but faces declining net income and profitability margins, leading to an overall unfavorable income statement trend. Conversely, Arqit shows rapid revenue and net income growth with more favorable recent margin improvements despite deep losses. Based purely on these income statements, Arqit’s growth is more dynamic, while Akamai’s financials are more stable but under pressure.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Akamai Technologies, Inc. and Arqit Quantum Inc., providing a snapshot of their key performance and financial health metrics as of their latest fiscal year-end.

| Ratios | Akamai Technologies, Inc. (2024) | Arqit Quantum Inc. (2025) |

|---|---|---|

| ROE | 10.35% | -129.77% |

| ROIC | 4.74% | -127.45% |

| P/E | 28.68 | -15.12 |

| P/B | 2.97 | 19.62 |

| Current Ratio | 1.23 | 2.69 |

| Quick Ratio | 1.23 | 2.69 |

| D/E (Debt-to-Equity) | 0.95 | 0.03 |

| Debt-to-Assets | 44.70% | 1.68% |

| Interest Coverage | 19.67 | -802.90 |

| Asset Turnover | 0.38 | 0.01 |

| Fixed Asset Turnover | 1.33 | 0.74 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Akamai Technologies, Inc.

Akamai shows a mixed financial profile with favorable net margin (12.65%) and interest coverage (22.65), but weaker returns on invested capital (4.74%) and asset turnover (0.38). Its dividend yield is zero, indicating no dividend payments, likely reflecting a focus on reinvestment or other capital allocation priorities. The company maintains a solid quick ratio (1.23), signaling reasonable liquidity.

Arqit Quantum Inc.

Arqit Quantum faces significant challenges with highly unfavorable profitability ratios: net margin at -6668.49%, ROE at -129.77%, and ROIC at -127.45%. Liquidity ratios like current and quick ratios are strong (2.69), and debt levels are low (D/E 0.03). The absence of dividends aligns with its negative earnings and investment in growth, typical for a high-risk tech firm.

Which one has the best ratios?

Akamai presents a more balanced ratio profile with some favorable profitability and liquidity metrics, despite moderate weaknesses. Arqit Quantum’s ratios are predominantly unfavorable, reflecting high risk and operational struggles. Based on ratio quality alone, Akamai offers a more stable financial footing, while Arqit’s profile suggests caution due to persistent losses and high volatility.

Strategic Positioning

This section compares the strategic positioning of Akamai Technologies, Inc. and Arqit Quantum Inc. in terms of market position, key segments, and exposure to technological disruption:

Akamai Technologies, Inc.

- Large market cap of 13.4B, established with competitive pressure from global cloud service providers.

- Focuses on cloud security, content delivery, web/mobile performance, media streaming, and edge computing.

- Faces disruption risks from evolving cybersecurity threats and rapid cloud infrastructure innovation.

Arqit Quantum Inc.

- Smaller market cap of 416M, operating in a niche cybersecurity market with emerging competition.

- Specializes in quantum encryption technology delivered via satellite and terrestrial platforms.

- Positioned in a cutting-edge quantum encryption space, potentially benefiting from future tech advances.

Akamai Technologies, Inc. vs Arqit Quantum Inc. Positioning

Akamai maintains a diversified portfolio across cloud services and cybersecurity with broad international reach, while Arqit concentrates on quantum encryption technology with a focused product offering and smaller workforce, reflecting differing scale and specialization.

Which has the best competitive advantage?

Both companies currently shed value with ROIC below WACC; Akamai shows a declining ROIC trend, whereas Arqit’s ROIC is improving, suggesting Arqit may be developing a stronger economic moat over time despite smaller scale.

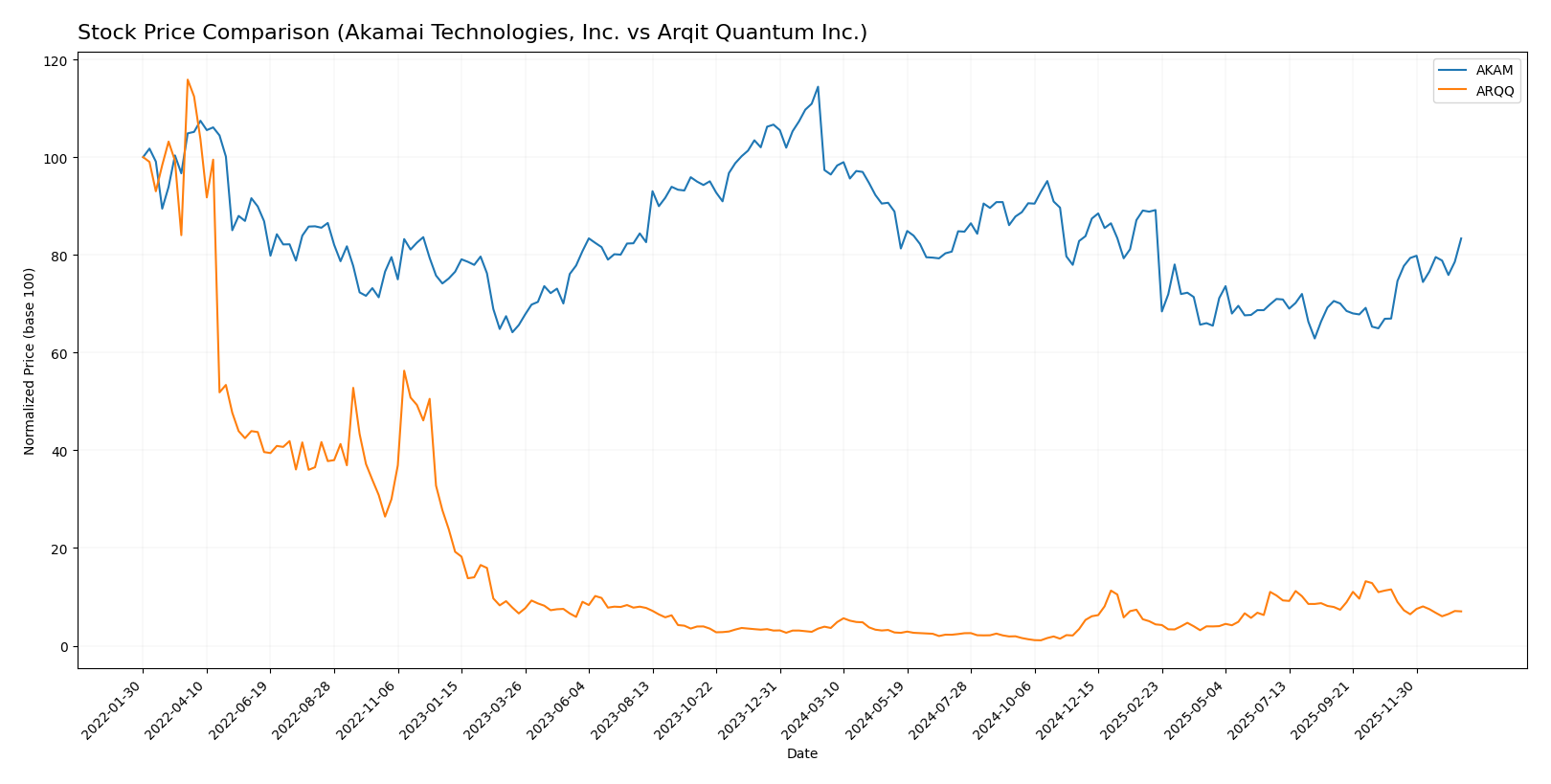

Stock Comparison

The stock price chart illustrates contrasting trajectories for Akamai Technologies, Inc. (AKAM) and Arqit Quantum Inc. (ARQQ) over the past 12 months, highlighting a bearish trend with recent acceleration for AKAM and a strong bullish trend with deceleration for ARQQ.

Trend Analysis

Akamai Technologies, Inc. (AKAM) experienced a 13.57% price decline over the past 12 months, indicating a bearish trend with acceleration. The stock hit a high of 111.0 and a low of 70.53, showing significant volatility with a standard deviation of 10.92.

Arqit Quantum Inc. (ARQQ) posted a 93.6% price increase over the same period, reflecting a bullish trend with deceleration. The stock ranged from 4.19 to 49.92, with a standard deviation of 11.75, indicating high volatility during the year.

Comparing the two, ARQQ delivered the highest market performance with a robust bullish trend, while AKAM showed a bearish trend despite recent gains, making ARQQ the stronger performer over the past year.

Target Prices

Here is the current analyst target consensus for Akamai Technologies, Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Akamai Technologies, Inc. | 115 | 89 | 104.8 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

Analysts expect Akamai’s stock to appreciate moderately from its current price of $93.49, indicating confidence in steady growth. Arqit’s target is significantly higher than its current price of $26.60, suggesting strong upside potential according to available forecasts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Akamai Technologies, Inc. and Arqit Quantum Inc.:

Rating Comparison

AKAM Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 5, very favorable, indicating strong cash flow.

- ROE Score: 3, moderate efficiency generating profit from equity.

- ROA Score: 3, moderate asset utilization efficiency.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 3, moderate financial standing.

ARQQ Rating

- Rating: C, considered very favorable overall.

- Discounted Cash Flow Score: 2, moderate, reflecting weaker future cash flows.

- ROE Score: 1, very unfavorable, indicating poor profit generation from equity.

- ROA Score: 1, very unfavorable, showing weak effectiveness in asset use.

- Debt To Equity Score: 4, favorable, suggesting lower financial risk.

- Overall Score: 2, moderate but lower than AKAM.

Which one is the best rated?

Based strictly on the data, Akamai Technologies holds a higher overall rating (B vs. C) with stronger cash flow and profitability scores, despite a weaker debt-to-equity score. Arqit Quantum shows better financial risk management but lower profitability and asset efficiency scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Akamai Technologies and Arqit Quantum Inc.:

Akamai Scores

- Altman Z-Score: 2.46, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health.

Arqit Scores

- Altman Z-Score: -0.22, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 2, reflecting very weak financial health.

Which company has the best scores?

Akamai exhibits stronger financial scores, with a grey zone Altman Z-Score and a strong Piotroski Score. Arqit is in distress with a very weak Piotroski Score, indicating higher financial risk.

Grades Comparison

Here is the comparison of recent grades from reliable grading companies for both Akamai Technologies, Inc. and Arqit Quantum Inc.:

Akamai Technologies, Inc. Grades

The table below presents recent grades from major financial institutions for Akamai Technologies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

Overall, grades for Akamai Technologies show a stable to slightly positive trend with several upgrades to “Overweight” and consistent “Neutral” to “Sector Outperform” ratings by reputable firms.

Arqit Quantum Inc. Grades

Recent grades for Arqit Quantum Inc. have been consistently provided by HC Wainwright & Co.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Arqit Quantum’s ratings remain uniformly positive with a stable “Buy” recommendation from a single grading company over multiple years.

Which company has the best grades?

Arqit Quantum Inc. holds consistently positive “Buy” grades from HC Wainwright & Co., while Akamai Technologies presents a more mixed but stable consensus with several “Neutral” and “Overweight” ratings. Investors might interpret Arqit’s uniform buy ratings as stronger endorsement compared to Akamai’s more varied but broadly neutral to positive outlook.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Akamai Technologies, Inc. (AKAM) and Arqit Quantum Inc. (ARQQ) based on their recent financial performance and market positioning.

| Criterion | Akamai Technologies, Inc. (AKAM) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate diversification with $3.99B revenue from core segment | Limited diversification; still developing revenue streams |

| Profitability | Positive net margin (12.65%), neutral ROE (10.35%), but unfavorable ROIC (4.74%) | Strongly negative profitability metrics; net margin -6668%, ROE -130%, ROIC -127% |

| Innovation | Established in content delivery and cloud security with ongoing R&D | Positioned in quantum encryption, promising technology but early-stage financials |

| Global presence | Strong global footprint with steady operations worldwide | Emerging global presence, still expanding |

| Market Share | Significant market share in CDN and cloud security sectors | Small market share due to nascent stage and niche focus |

Key takeaways: Akamai offers stability with solid revenue and moderate profitability but struggles with capital efficiency. Arqit shows potential through innovation and improving profitability trends, yet it faces high risks due to poor current financial health and limited market presence. Investors should weigh Akamai’s steadiness against Arqit’s growth prospects carefully.

Risk Analysis

Below is a comparative table highlighting key risks for Akamai Technologies, Inc. (AKAM) and Arqit Quantum Inc. (ARQQ) based on the most recent data available for 2025-2026.

| Metric | Akamai Technologies, Inc. (AKAM) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Moderate (Beta 0.685) | High (Beta 2.407) |

| Debt Level | Moderate (Debt/Assets 44.7%) | Low (Debt/Assets 1.68%) |

| Regulatory Risk | Moderate (US & global tech sector) | Elevated (UK quantum tech, evolving regulations) |

| Operational Risk | Moderate (large scale infrastructure) | High (early-stage quantum cybersecurity) |

| Environmental Risk | Low (tech infrastructure focus) | Low (software-based encryption) |

| Geopolitical Risk | Moderate (US-based, global operations) | High (UK-based, quantum tech sensitive to geopolitical tensions) |

The most impactful and likely risks differ notably: Akamai faces moderate market and operational risks tied to its global cloud infrastructure, while Arqit is exposed to high market volatility and operational uncertainties due to its nascent quantum cybersecurity technology and geopolitical sensitivities. Investors should weigh Arqit’s financial distress signals and high beta against Akamai’s more stable but moderately leveraged position.

Which Stock to Choose?

Akamai Technologies, Inc. (AKAM) shows moderate income growth over 2020-2024 but faces declining profitability and negative net margin trends. Its financial ratios are mixed with favorable margins yet unfavorable ROIC vs. WACC, indicating value destruction. The company holds a very favorable B rating but exhibits a bearish price trend.

Arqit Quantum Inc. (ARQQ) demonstrates strong revenue growth and improving income metrics despite negative margins and returns. Financial ratios reveal mostly unfavorable profitability metrics but favorable liquidity and low debt levels. It holds a very favorable C rating but remains in financial distress per Altman Z-Score, with a volatile bullish overall trend.

For investors, AKAM might appear more stable with moderate ratings and value-destroying trends, potentially suiting those prioritizing established business models. Conversely, ARQQ’s high growth and improving profitability could be seen as appealing for risk-tolerant investors seeking emerging opportunities despite financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Akamai Technologies, Inc. and Arqit Quantum Inc. to enhance your investment decisions: