Home > Comparison > Technology > AMD vs SKYT

The strategic rivalry between Advanced Micro Devices, Inc. (AMD) and SkyWater Technology, Inc. shapes the semiconductor industry’s evolving landscape. AMD operates as a global semiconductor powerhouse, focusing on high-performance computing and graphics solutions. In contrast, SkyWater Technology specializes in niche semiconductor manufacturing services, emphasizing innovation in analog and mixed-signal technologies. This analysis examines which operational model offers superior risk-adjusted returns amid sector dynamics, guiding investors toward the best portfolio fit in this competitive environment.

Table of contents

Companies Overview

Advanced Micro Devices, Inc. and SkyWater Technology, Inc. hold influential roles in the semiconductor industry.

Advanced Micro Devices, Inc.: Semiconductor Giant Innovating Computing

Advanced Micro Devices, Inc. dominates as a leading semiconductor company. It generates revenue through its Computing and Graphics, and Enterprise, Embedded and Semi-Custom segments. In 2026, AMD focuses on expanding high-performance processors and GPUs, targeting data centers, gaming, and professional graphics markets with its Ryzen and EPYC product lines.

SkyWater Technology, Inc.: Specialized Semiconductor Manufacturer

SkyWater Technology, Inc. operates as a semiconductor development and manufacturing service provider. Its core revenue stems from engineering, process development, and manufacturing services for analog, mixed-signal, and rad-hard integrated circuits. In 2026, SkyWater emphasizes co-creation with clients across aerospace, defense, automotive, and IoT sectors to enhance customized silicon solutions.

Strategic Collision: Similarities & Divergences

AMD pursues a product-driven model with proprietary high-performance chips, while SkyWater embraces a service-oriented, collaborative manufacturing approach. They primarily compete in advanced semiconductor technologies but occupy different niches—AMD targets mass-market processors, SkyWater focuses on specialized manufacturing. Their divergent models create distinct investment profiles: AMD as a global volume leader, SkyWater as a niche innovator with high beta risk.

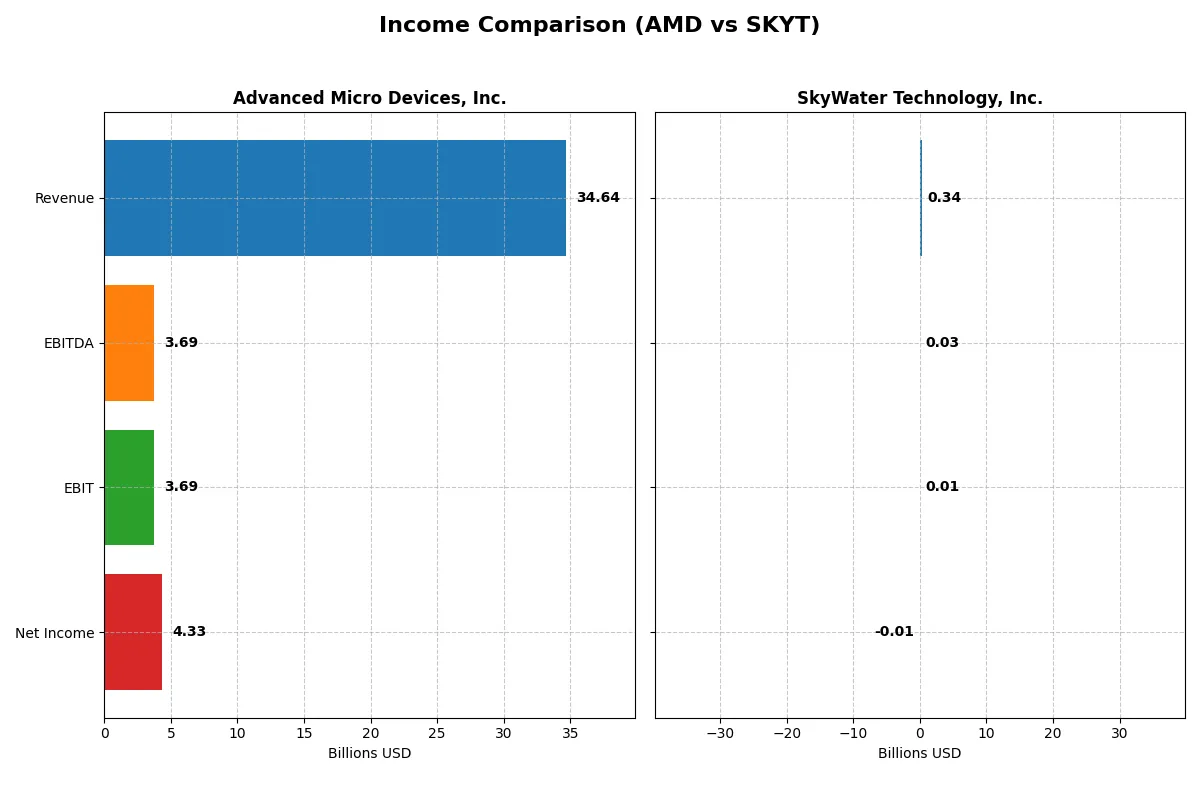

Income Statement Comparison

This table dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Advanced Micro Devices, Inc. (AMD) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Revenue | 34.6B | 342M |

| Cost of Revenue | 17.5B | 273M |

| Operating Expenses | 13.5B | 63M |

| Gross Profit | 17.2B | 70M |

| EBITDA | 3.7B | 25M |

| EBIT | 3.7B | 7M |

| Interest Expense | 131M | 9M |

| Net Income | 4.3B | -7M |

| EPS | 2.67 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine over recent years.

Advanced Micro Devices, Inc. Analysis

AMD’s revenue surged from $16.4B in 2021 to $34.6B in 2025, nearly doubling in five years. Net income followed suit, climbing from $3.16B to $4.34B, supported by a strong 49.5% gross margin and a healthy 12.5% net margin in 2025. The company’s EBIT margin jumped to 10.7%, reflecting improved operational efficiency and robust momentum.

SkyWater Technology, Inc. Analysis

SkyWater’s revenue advanced from $140M in 2020 to $342M in 2024, a remarkable 144% growth. However, it remains unprofitable with a net loss narrowing to $6.79M in 2024. The gross margin improved to 20.3%, but the net margin stays negative at -2.0%. EBIT turned positive at 1.9% in 2024, signaling early signs of operational leverage but pending sustained profitability.

Growth Scale vs. Margin Strength

AMD clearly dominates with superior scale and robust profitability metrics, delivering consistent net income and margin expansion. SkyWater impresses with rapid revenue growth and improving margins but remains loss-making. For investors prioritizing solid earnings and margin health, AMD’s profile offers a more attractive and proven investment foundation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Advanced Micro Devices, Inc. (AMD) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 2.85% (2024) | -11.79% (2024) |

| ROIC | 2.49% (2024) | 3.40% (2024) |

| P/E | 124 (2024) | -100.26 (2024) |

| P/B | 3.52 (2024) | 11.82 (2024) |

| Current Ratio | 2.62 (2024) | 0.86 (2024) |

| Quick Ratio | 1.83 (2024) | 0.76 (2024) |

| D/E | 3.84% (2024) | 133.23% (2024) |

| Debt-to-Assets | 3.20% (2024) | 24.46% (2024) |

| Interest Coverage | 20.65 (2024) | 0.74 (2024) |

| Asset Turnover | 0.37 (2024) | 1.09 (2024) |

| Fixed Asset Turnover | 10.63 (2024) | 2.07 (2024) |

| Payout ratio | 0% (2024) | 0% (2024) |

| Dividend yield | 0% (2024) | 0% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths crucial for investment decisions.

Advanced Micro Devices, Inc.

AMD shows a mixed profile with a favorable net margin of 12.51% but zero return on equity and invested capital, signaling weak profitability efficiency. Its P/E ratio stands at 80.54, indicating a stretched valuation. The company pays no dividend, instead directing substantial resources into R&D, suggesting a growth-focused reinvestment strategy.

SkyWater Technology, Inc.

SKYT exhibits negative profitability with a -1.98% net margin and -11.79% ROE, reflecting ongoing operational challenges. Despite an unusually favorable negative P/E due to losses, its P/B ratio of 11.82 signals overvaluation on book value. SKYT neither pays dividends nor generates positive free cash flow, implying reinvestment efforts with elevated financial risk.

Premium Valuation vs. Operational Safety

AMD trades at a high premium with weak returns but solid margins and strong R&D investment, while SKYT struggles with profitability and liquidity despite lower earnings multiples. AMD offers a better risk-reward balance for growth-oriented investors; SKYT fits those willing to endure volatility for turnaround potential.

Which one offers the Superior Shareholder Reward?

I compare AMD and SkyWater Technology’s shareholder rewards by focusing on dividends, payout ratios, and buybacks. Neither pays dividends, so I emphasize reinvestment and buyback intensity. AMD’s zero dividend yield aligns with its zero payout ratio, signaling full reinvestment. SkyWater also pays no dividend but suffers negative margins and weak free cash flow.

AMD’s buybacks are robust, supported by a strong free cash flow per share of $3.4 and an operating cash flow ratio near 0.42 in 2024. SkyWater’s free cash flow per share sits at $0.15 with lower operational efficiency and higher leverage (debt-to-equity above 1.3), limiting buyback capacity.

Historically, AMD’s reinvestment fuels innovation in a cyclical semiconductor market, enhancing its moat and capitalizing on growth opportunities. SkyWater’s fragile cash flow and debt burden undermine its long-term distribution sustainability.

I conclude AMD offers a superior total shareholder return profile in 2026 due to its sustainable reinvestment strategy and significant buyback potential, unlike SkyWater’s challenged financials and lack of shareholder distributions.

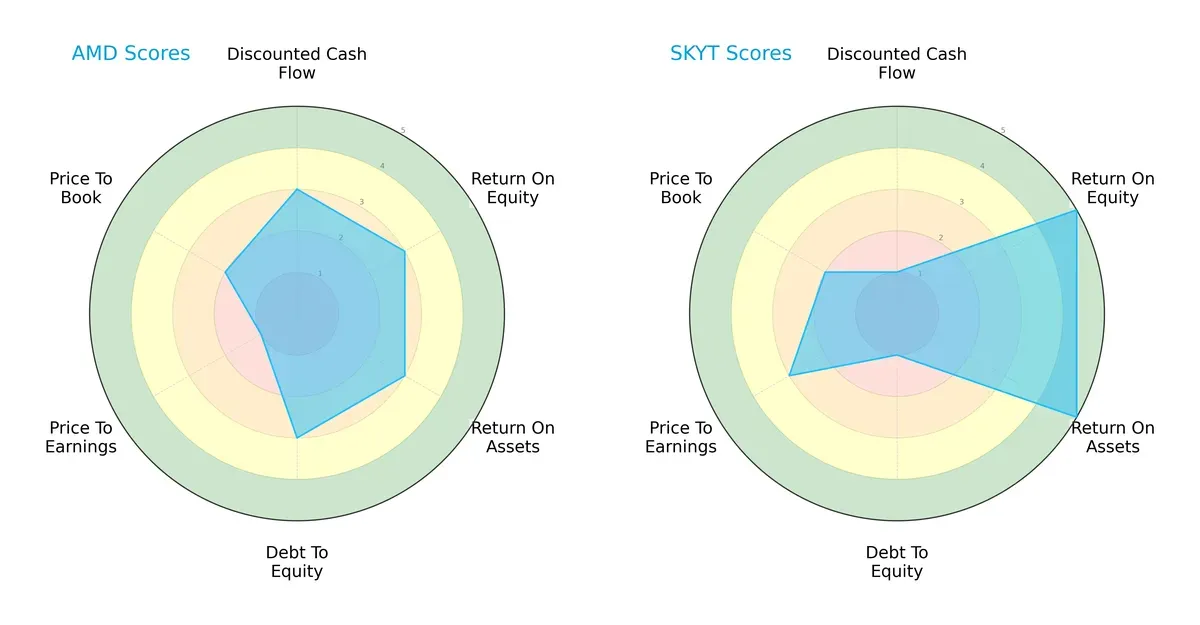

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Advanced Micro Devices, Inc. and SkyWater Technology, Inc., highlighting their core financial strengths and vulnerabilities:

Advanced Micro Devices shows a balanced profile with moderate scores across DCF, ROE, ROA, and Debt/Equity, yet suffers from a very unfavorable P/E valuation. SkyWater Technology excels in profitability metrics (ROE and ROA) but struggles with financial leverage and cash flow valuation. AMD relies on steadier fundamentals, while SkyWater banks heavily on superior operational efficiency.

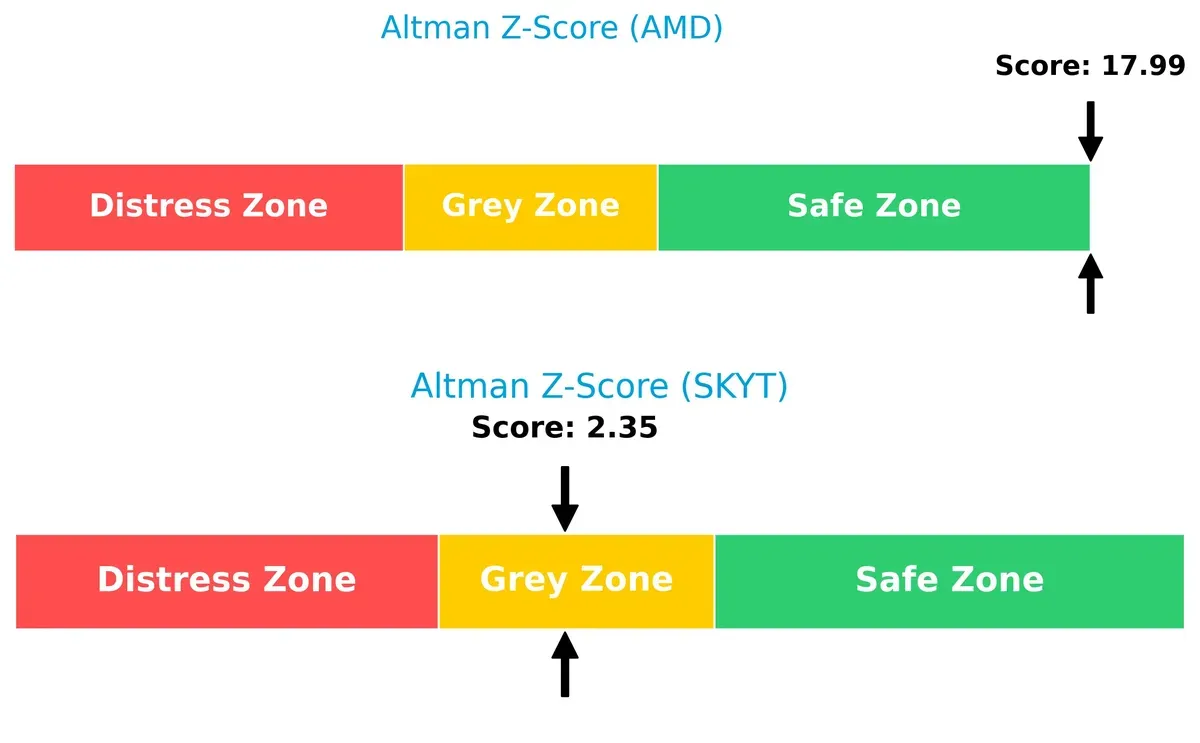

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap signals contrasting solvency outlooks: AMD’s score of 18 places it securely in the safe zone, while SkyWater’s 2.35 lands in the grey zone, suggesting moderate bankruptcy risk in this cycle:

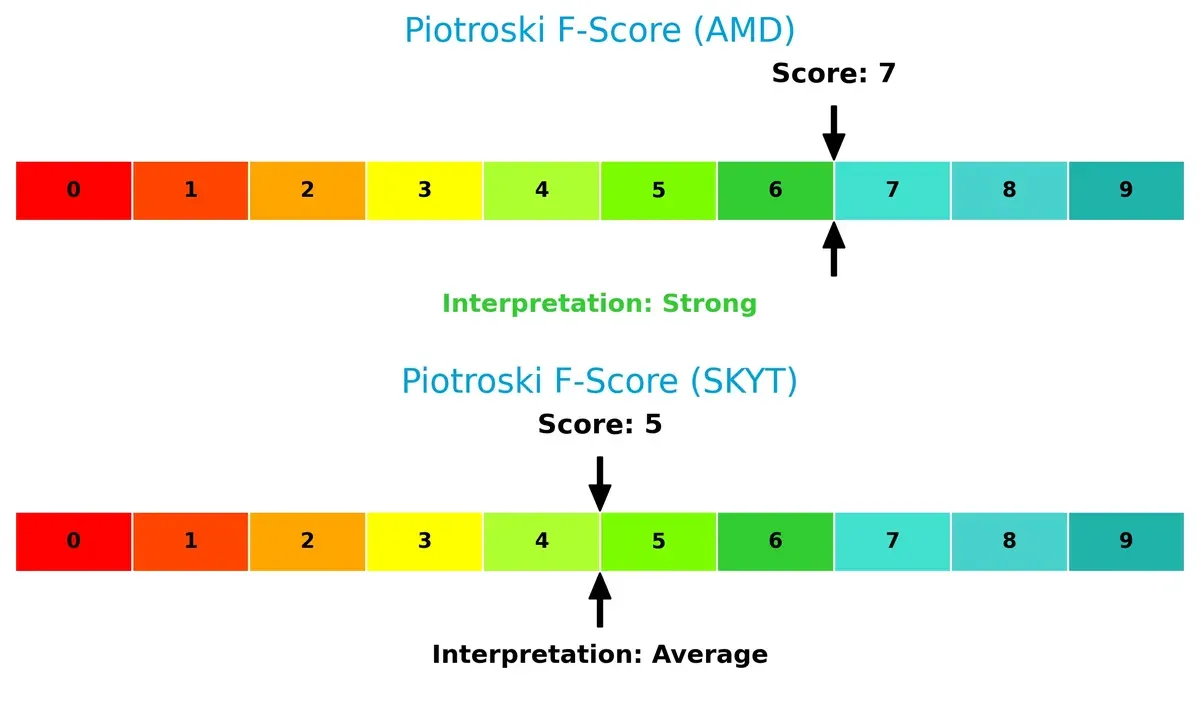

Financial Health: Quality of Operations

Advanced Micro Devices leads with a Piotroski F-Score of 7, indicating strong financial health and operational quality. SkyWater’s score of 5 signals average health, with potential red flags in internal metrics compared to AMD:

How are the two companies positioned?

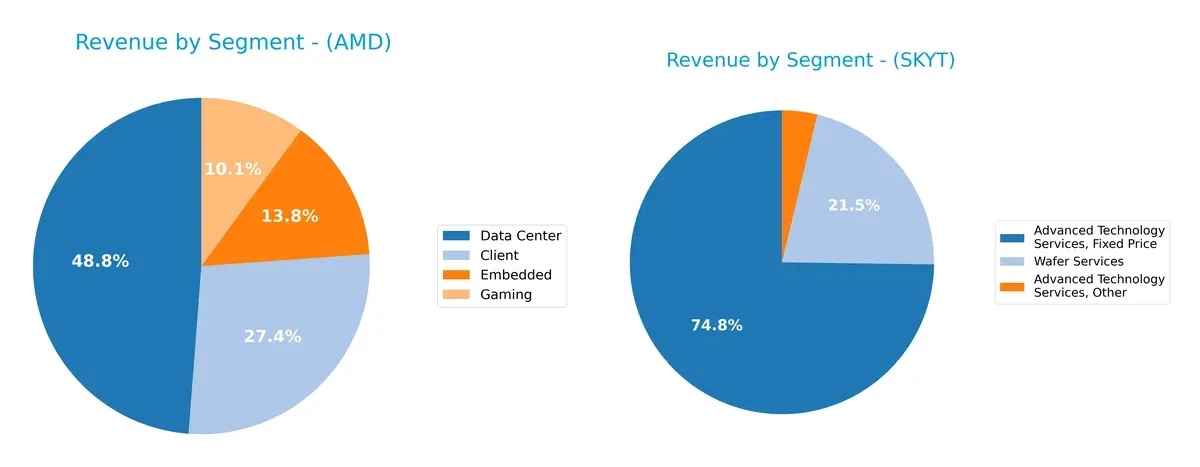

This section dissects the operational DNA of AMD and SKYT by comparing their revenue distribution and internal dynamics. The final objective confronts their economic moats to identify the most resilient and sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Advanced Micro Devices, Inc. and SkyWater Technology, Inc. diversify their income streams and where their primary sector bets lie:

AMD’s 2024 revenue mix dwarfs SkyWater’s in scale and scope, with Data Center leading at $12.6B, followed by Client at $7.1B. AMD balances four strong segments, showing strategic diversification and ecosystem lock-in. Conversely, SkyWater anchors $93M in Advanced Technology Services (Fixed Price) and $27M in Wafer Services, revealing high concentration risk. SkyWater’s narrower footprint contrasts with AMD’s infrastructure dominance and broader market reach.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of AMD and SKYT based on diversification, profitability, financials, innovation, global presence, and market share:

AMD Strengths

- Strong diversification across Client, Data Center, Embedded, and Gaming segments

- Favorable net margin at 12.51%

- Low debt-to-assets ratio indicating financial prudence

- High interest coverage at 28.2 suggests solid debt servicing ability

- Significant revenue in major markets like the US and China

SKYT Strengths

- Favorable price-to-earnings ratio despite negative earnings

- Favorable debt-to-assets metric at 24.46%

- Asset turnover above 1 indicates efficient asset use

- Growing revenue in Advanced Technology and Wafer Services

- Concentrated US market presence with steady revenue

AMD Weaknesses

- Unfavorable return on equity and ROIC versus high WACC of 12.94%

- Very high PE ratio at 80.54 suggests overvaluation risk

- Poor liquidity ratios including current and quick ratios at zero

- Unfavorable asset turnover metrics indicate inefficiency

- No dividend yield limits income appeal

SKYT Weaknesses

- Negative net margin at -1.98% and negative ROE at -11.79%

- WACC of 19.97% exceeds ROIC, signaling capital inefficiency

- Unfavorable leverage metrics including high debt-to-equity at 1.33

- Low interest coverage at 0.74 raises solvency concerns

- Weak liquidity with current ratio below 1

- High price-to-book ratio of 11.82 indicates possible overvaluation

Both companies face significant profitability and capital efficiency challenges, with AMD showing operational scale and diversification strengths. SKYT’s strengths lie in asset turnover and some financial metrics, but its losses and leverage raise caution. These factors shape strategic priorities around improving returns and managing risk.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting a company’s long-term profits from relentless competition erosion:

Advanced Micro Devices, Inc. (AMD): Innovation-Driven Intangible Asset Moat

AMD leverages cutting-edge chip design and brand reputation as its moat. This intangible asset drives superior margins and scalable revenue growth. However, declining ROIC warns of rising competitive pressure in 2026.

SkyWater Technology, Inc. (SKYT): Niche Manufacturing Capability Moat

SkyWater’s moat stems from specialized semiconductor manufacturing services, contrasting AMD’s product innovation focus. Its improving ROIC trend signals strengthening capital efficiency and potential to disrupt select markets.

Innovation Intensity vs. Manufacturing Specialization

AMD’s intangible asset moat is broader but weakened by falling capital returns. SkyWater’s niche manufacturing moat is narrower yet gaining strength. I see SkyWater better positioned to defend and grow its specialized market share in 2026.

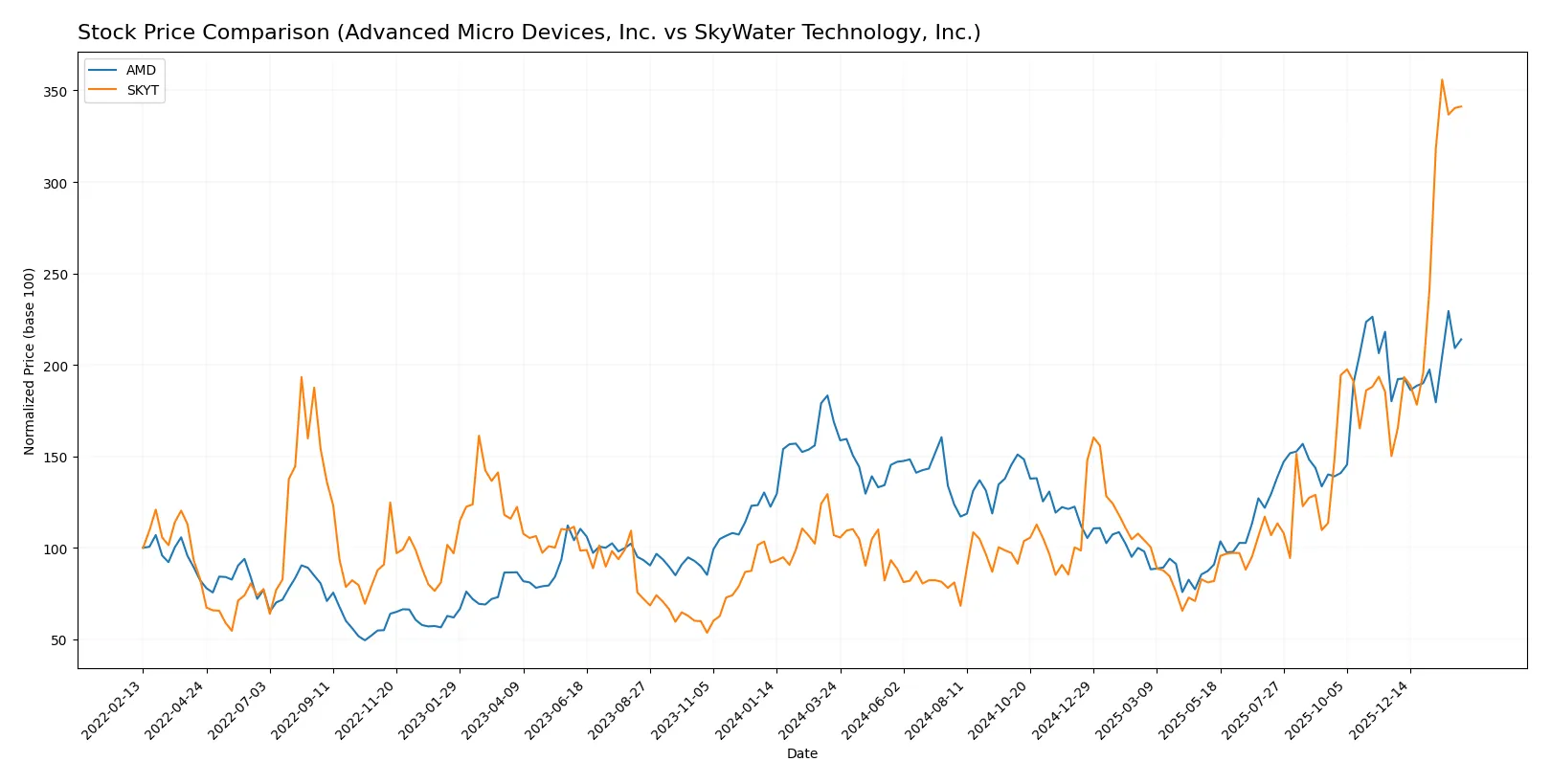

Which stock offers better returns?

Over the past 12 months, AMD and SkyWater Technology exhibited strong bullish trends with significant price appreciation and distinct trading volume dynamics.

Trend Comparison

Advanced Micro Devices, Inc. (AMD) delivered a 26.72% price increase over the past year with accelerating momentum and notable volatility, peaking at 259.68 and bottoming at 85.76.

SkyWater Technology, Inc. (SKYT) surged 219.22% over the same period, showing strong acceleration and low volatility, with a high of 33.1 and a low of 6.1.

SKYT outperformed AMD substantially, delivering the highest market returns with a more pronounced upward trend and stronger buyer dominance throughout the year.

Target Prices

Analysts present a bullish consensus for both Advanced Micro Devices, Inc. and SkyWater Technology, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Advanced Micro Devices, Inc. | 225 | 380 | 291.56 |

| SkyWater Technology, Inc. | 35 | 35 | 35 |

The consensus target for AMD stands about 20% above its current price of $242. SkyWater’s target price sits modestly above its current $31.73, signaling moderate upside expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

This section compares the latest institutional grades for Advanced Micro Devices, Inc. and SkyWater Technology, Inc.:

Advanced Micro Devices, Inc. Grades

The table below presents recent grades from reputable institutions for AMD:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-26 |

| UBS | Maintain | Buy | 2026-01-26 |

| Bernstein | Maintain | Market Perform | 2026-01-21 |

| Keybanc | Upgrade | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-16 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-12 |

SkyWater Technology, Inc. Grades

Recent institutional grades for SkyWater Technology, Inc. are shown below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Downgrade | Hold | 2026-01-27 |

| Piper Sandler | Downgrade | Neutral | 2026-01-27 |

| Needham | Downgrade | Hold | 2026-01-27 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

Which company has the best grades?

Advanced Micro Devices, Inc. consistently holds positive ratings such as Overweight and Buy, with recent upgrades. SkyWater Technology, Inc. faced downgrades to Hold and Neutral in early 2026. This divergence signals stronger institutional confidence in AMD, potentially impacting investor sentiment and capital flows.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Advanced Micro Devices, Inc.

- Competes in a highly volatile semiconductor sector with strong incumbents and rapid innovation cycles.

SkyWater Technology, Inc.

- Operates in niche semiconductor manufacturing with limited scale, facing fierce competition from larger foundries.

2. Capital Structure & Debt

Advanced Micro Devices, Inc.

- Maintains a strong interest coverage ratio of 28.2, signaling manageable debt despite some unfavorable liquidity metrics.

SkyWater Technology, Inc.

- Exhibits high debt-to-equity ratio (1.33) and weak interest coverage (0.74), indicating elevated financial risk.

3. Stock Volatility

Advanced Micro Devices, Inc.

- Beta near 1.95 suggests significant sensitivity to market swings, typical for tech leaders.

SkyWater Technology, Inc.

- Beta of 3.51 signals extreme volatility and higher investor risk exposure.

4. Regulatory & Legal

Advanced Micro Devices, Inc.

- Subject to global tech regulations and export controls, with broad compliance experience.

SkyWater Technology, Inc.

- Faces growing regulatory scrutiny in aerospace and defense sectors, with evolving compliance requirements.

5. Supply Chain & Operations

Advanced Micro Devices, Inc.

- Global supply chain complexity risks due to reliance on third-party fabs and geopolitical tensions.

SkyWater Technology, Inc.

- Smaller scale but vulnerable to supply disruptions given limited supplier diversification.

6. ESG & Climate Transition

Advanced Micro Devices, Inc.

- Increasing pressure to meet sustainability goals amid high energy demands of chip manufacturing.

SkyWater Technology, Inc.

- Emerging ESG programs but less mature, potentially lagging peers in climate transition efforts.

7. Geopolitical Exposure

Advanced Micro Devices, Inc.

- Exposed to US-China tensions impacting semiconductor trade and technology licensing.

SkyWater Technology, Inc.

- Primarily US-based with defense contracts, facing risks from shifting geopolitical defense priorities.

Which company shows a better risk-adjusted profile?

AMD’s most impactful risk is its high market volatility and exposure to global supply chain disruptions. SkyWater’s critical risk lies in its stretched capital structure and weak liquidity. Despite AMD’s large scale and strong interest coverage, SkyWater’s extreme stock volatility and financial fragility tip the scales. I observe AMD’s safer Altman Z-Score (17.99 vs. 2.35) and stronger Piotroski Score (7 vs. 5) confirm a better risk-adjusted profile. The recent surge in AMD’s beta and supply chain tensions heighten caution but remain less severe than SkyWater’s debt and operational vulnerabilities.

Final Verdict: Which stock to choose?

Advanced Micro Devices (AMD) wields unmatched scale and innovation power in semiconductors. Its rapid revenue and earnings growth demonstrate a cash-generating engine. The key point of vigilance lies in its declining ROIC, signaling potential challenges in capital efficiency. AMD suits investors targeting aggressive growth in a competitive tech landscape.

SkyWater Technology (SKYT) builds value on a niche manufacturing moat, emphasizing steady expansion and improving profitability metrics. While it lacks AMD’s scale, SKYT appears less volatile but faces liquidity risks and a weaker balance sheet. It fits investors who favor growth at a reasonable price with a higher tolerance for operational turnarounds.

If you prioritize robust scale and growth momentum, AMD is the compelling choice due to its dominant market position and cash flow strength. However, if you seek a smaller-cap growth play with improving fundamentals and a more cautious valuation, SKYT offers better stability despite its current financial headwinds. Both come with risks that require close monitoring of capital efficiency and liquidity.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Advanced Micro Devices, Inc. and SkyWater Technology, Inc. to enhance your investment decisions: