In the dynamic world of semiconductors, two prominent players stand out: Advanced Micro Devices, Inc. (AMD) and Arm Holdings plc. Both companies are at the forefront of innovation, shaping technologies that power everything from personal computers to cutting-edge automotive systems. Their overlapping market segments and distinct strategic approaches to innovation make them intriguing subjects for comparison. Join me as we delve into their strengths and weaknesses to determine which company may be the more compelling investment opportunity.

Table of contents

Company Overview

Advanced Micro Devices, Inc. Overview

Advanced Micro Devices, Inc. (AMD) is a leading semiconductor company known for its innovative microprocessors and graphics solutions. Headquartered in Santa Clara, California, AMD operates primarily in two segments: Computing and Graphics, and Enterprise, Embedded and Semi-Custom. The company has carved out a significant presence in the markets for desktop and notebook processors, as well as professional graphics products, serving a diverse clientele that includes original equipment manufacturers and public cloud service providers. With a market capitalization of approximately $353B, AMD is recognized for its competitive edge in high-performance computing, particularly with its Ryzen and EPYC product lines. The company’s commitment to research and development has propelled it to the forefront of the semiconductor industry.

Arm Holdings plc American Depositary Shares Overview

Arm Holdings plc, based in Cambridge, United Kingdom, specializes in designing and licensing central processing unit (CPU) products and related technologies. Founded in 1990, Arm provides essential intellectual property for semiconductor companies and original equipment manufacturers, enabling them to create advanced products across various sectors, including automotive, computing, and IoT. With a market capitalization of around $143B, Arm’s influence is significant in the tech landscape, particularly in mobile and embedded systems. The company’s licensing model allows it to operate globally while focusing on innovation and collaboration to meet the evolving demands of technology.

Key similarities and differences

Both AMD and Arm operate in the semiconductor industry and are influential players in CPU and GPU technology. However, their business models differ significantly; AMD manufactures and sells its own chips, while Arm licenses its designs to other companies, allowing them to produce customized solutions. This distinction highlights AMD’s role as a hardware manufacturer compared to Arm’s focus on intellectual property and design.

Income Statement Comparison

The table below compares the income statements of Advanced Micro Devices, Inc. (AMD) and Arm Holdings plc for the most recent fiscal year, providing key financial metrics that are essential for evaluating their performance.

| Metric | AMD | ARM |

|---|---|---|

| Market Cap | 353.04B | 142.68B |

| Revenue | 25.79B | 4.01B |

| EBITDA | 5.26B | 902.90M |

| EBIT | 2.08B | 720.00M |

| Net Income | 1.64B | 792.00M |

| EPS | 1.01 | 0.75 |

| Fiscal Year | 2024 | 2025 |

Interpretation of Income Statement

In the latest fiscal year, AMD showed a significant revenue increase to 25.79B, up from 22.68B in the previous year, indicating strong market demand. Meanwhile, Arm’s revenue rose to 4.01B, a notable increase from 3.23B, showcasing its continued growth trajectory. AMD’s net income also improved to 1.64B, reflecting efficient cost management despite rising costs, while Arm’s net income of 792M indicates a healthy profit margin. Both companies have successfully maintained solid EBITDA margins, with AMD’s improving slightly, suggesting effective operational efficiency.

Financial Ratios Comparison

In this section, I provide a comparative analysis of the most recent financial ratios for Advanced Micro Devices (AMD) and Arm Holdings (ARM). These metrics are essential for evaluating the companies’ performances and making informed investment decisions.

| Metric | AMD | ARM |

|---|---|---|

| ROE | 2.85% | 11.58% |

| ROIC | 2.49% | 11.31% |

| P/E | 123.59 | 141.58 |

| P/B | 3.52 | 16.40 |

| Current Ratio | 2.62 | 5.20 |

| Quick Ratio | 1.83 | 5.20 |

| D/E | 0.038 | 0.052 |

| Debt-to-Assets | 0.032 | 0.040 |

| Interest Coverage | 20.65 | 0.00 |

| Asset Turnover | 0.37 | 0.45 |

| Fixed Asset Turnover | 10.63 | 5.61 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios reveal contrasting performances between AMD and ARM. AMD’s low ratios, such as ROE and ROIC, indicate challenges in profitability relative to equity and invested capital. Conversely, ARM shows robust performance with higher ROE and ROIC, reflecting effective capital utilization. However, ARM’s extremely high P/E ratio suggests potential overvaluation, meriting caution for investors. Both companies maintain low debt levels, a positive sign for financial stability.

Dividend and Shareholder Returns

Advanced Micro Devices, Inc. (AMD) does not currently pay dividends, reflecting its focus on reinvestment for growth rather than immediate shareholder returns. The company emphasizes share buybacks, which can enhance shareholder value if executed prudently. Conversely, Arm Holdings plc also does not distribute dividends, prioritizing growth and innovation over immediate cash returns. Both companies’ strategies appear aligned with long-term value creation, although I remain cautious about the risks associated with foregoing dividends in favor of reinvestment.

Strategic Positioning

In the semiconductor industry, Advanced Micro Devices, Inc. (AMD) holds a significant market share, particularly in the computing and graphics sectors, with a market cap of 353B. On the other hand, Arm Holdings plc, with a market cap of 143B, focuses on microprocessor architecture licensing, positioning itself as a critical technology provider. Both companies face competitive pressure from established players and emerging technologies, necessitating continuous innovation and strategic partnerships to mitigate risks from technological disruption.

Stock Comparison

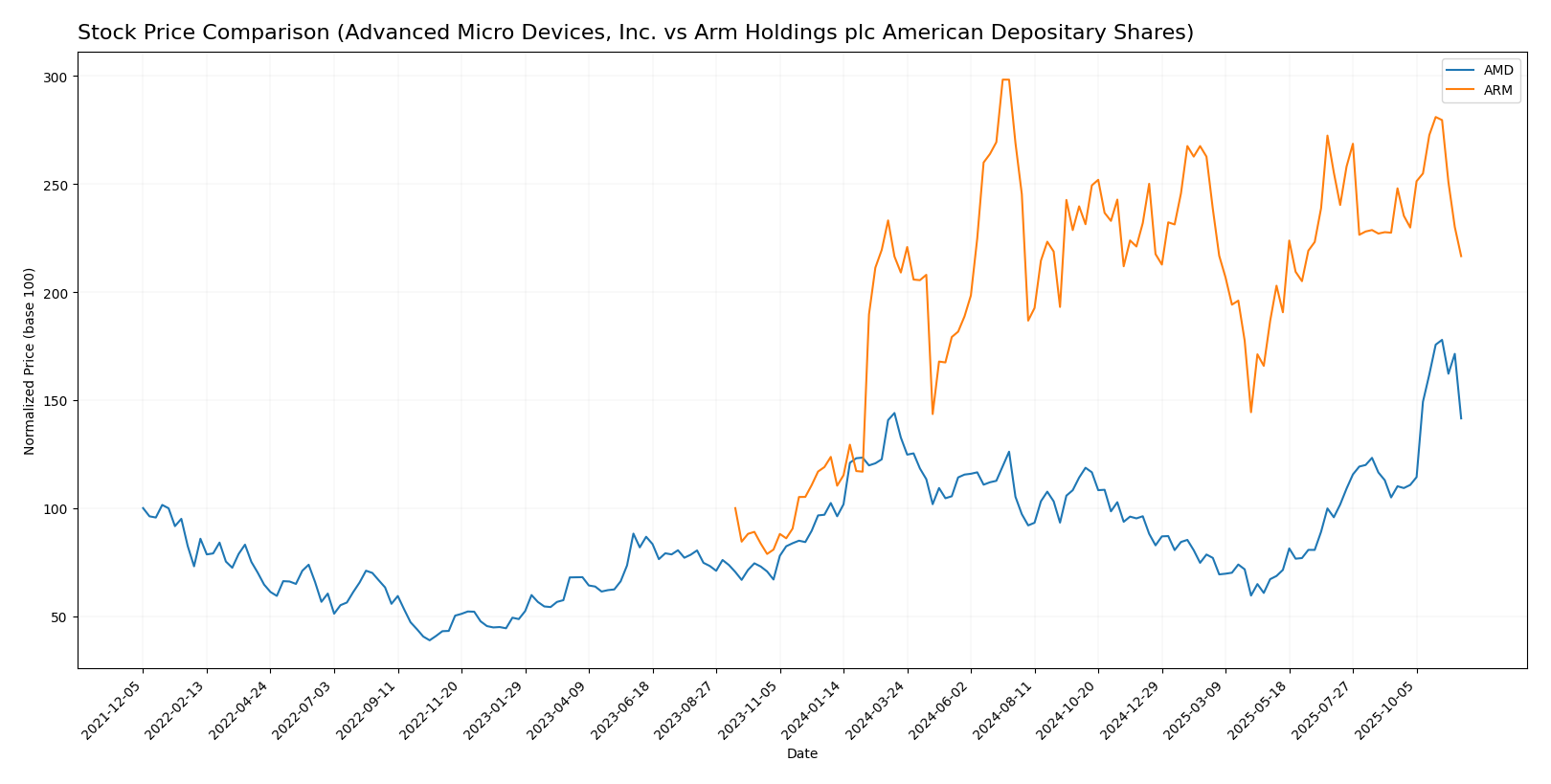

In this analysis, I will evaluate the stock price movements of Advanced Micro Devices, Inc. (AMD) and Arm Holdings plc (ARM) over the past year, highlighting key price dynamics and trends that may influence investment decisions.

Trend Analysis

Advanced Micro Devices, Inc. (AMD) Over the past year, AMD has experienced a significant price increase of 56.97%, indicating a bullish trend. The stock has shown acceleration in its upward movement, with notable highs reaching $256.12 and lows at $85.76. The standard deviation of 35.8 suggests a relatively high level of volatility, reflecting a dynamic trading environment.

In the recent period (from September 14, 2025, to November 30, 2025), AMD’s price increased by 37.18%, with a standard deviation of 37.1, indicating ongoing strong price movement. The trend slope of 7.57 further supports the bullish outlook.

Arm Holdings plc (ARM) ARM has also demonstrated a substantial price increase of 102.18% over the past year, categorizing it as a bullish trend. However, the acceleration status indicates a deceleration in the upward momentum during this period. The stock recorded highs of $181.19 and lows of $67.05, with a standard deviation of 23.44, reflecting moderate volatility.

In the recent analysis period, ARM’s price has declined by 10.01%, which indicates a bearish trend with a trend slope of -0.76. The standard deviation of 12.61 suggests less volatility compared to AMD, pointing to a more stable price environment during this recent downturn.

In summary, while AMD shows a strong bullish trend with accelerating price movements, ARM has experienced a price decline recently despite a strong overall annual performance. Investors should consider these trends and volatility metrics when making decisions regarding their portfolios.

Analyst Opinions

Recent analyst recommendations for Advanced Micro Devices, Inc. (AMD) indicate a “Buy” rating, reflecting strong fundamentals with a particular emphasis on its return on assets and equity, despite a lower price-to-earnings score. Analysts suggest that AMD’s growth potential justifies the investment. Conversely, Arm Holdings plc (ARM) has received a “Hold” rating, as analysts express concerns over its valuation metrics, particularly the price-to-book ratio. The current consensus for AMD is a buy, while ARM leans towards hold.

Stock Grades

In the current market landscape, I have gathered recent stock ratings for two prominent companies: Advanced Micro Devices, Inc. (AMD) and Arm Holdings plc (ARM). Below are the evaluations provided by reputable grading companies.

Advanced Micro Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-12 |

| Evercore ISI Group | maintain | Outperform | 2025-11-12 |

| Rosenblatt | maintain | Buy | 2025-11-12 |

| B of A Securities | maintain | Buy | 2025-11-12 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-12 |

| Piper Sandler | maintain | Overweight | 2025-11-12 |

| Wells Fargo | maintain | Overweight | 2025-11-12 |

| Roth Capital | maintain | Buy | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-10 |

Arm Holdings plc Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Benchmark | maintain | Hold | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Needham | maintain | Hold | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| JP Morgan | maintain | Overweight | 2025-11-06 |

Overall, both AMD and ARM continue to receive strong ratings from multiple reputable sources, indicating a stable outlook for these stocks. The consistent “Buy” and “Outperform” ratings suggest that investors may find opportunities for growth in these companies.

Target Prices

The consensus target prices for the following companies provide insight into analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Advanced Micro Devices, Inc. (AMD) | 380 | 200 | 295.24 |

| Arm Holdings plc (ARM) | 210 | 190 | 200 |

Analysts are optimistic about AMD with a consensus target of 295.24, suggesting substantial upside from its current price of 217.52. Meanwhile, ARM’s consensus target of 200 indicates potential growth from its current price of 135.11.

Strengths and Weaknesses

The following table outlines the key strengths and weaknesses of Advanced Micro Devices, Inc. (AMD) and Arm Holdings plc (ARM) based on the most recent data available.

| Criterion | AMD | ARM |

|---|---|---|

| Diversification | Moderate (2 segments) | High (Multiple markets) |

| Profitability | Moderate (6.36% margin) | High (19.77% margin) |

| Innovation | Strong (Semiconductor R&D) | Strong (IP licensing) |

| Global presence | High (Worldwide) | High (International) |

| Market Share | Significant (Tech sector) | Growing (Emerging markets) |

| Debt level | Low (3.20% of assets) | Very low (3.99% of assets) |

Key takeaways indicate that while both companies show strong global presence and innovation, ARM leads in profitability and market share, suggesting a more favorable operational efficiency. Meanwhile, AMD maintains a solid but moderate diversification strategy.

Risk Analysis

In the following table, I outline the key risks associated with Advanced Micro Devices, Inc. (AMD) and Arm Holdings plc (ARM) as of the most recent fiscal year.

| Metric | AMD | ARM |

|---|---|---|

| Market Risk | High | High |

| Regulatory Risk | Medium | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | High | Medium |

Both companies face significant market risks due to their positions in the highly competitive semiconductor industry, with AMD being particularly influenced by fluctuations in demand and pricing pressures. Additionally, geopolitical tensions, especially regarding supply chains and trade regulations, pose a considerable threat to their operations.

Which one to choose?

When comparing Advanced Micro Devices (AMD) and Arm Holdings (ARM), both companies exhibit strong growth potential, yet differing fundamentals. AMD showcases a robust gross profit margin of 49.4% and a net profit margin of 6.4%, alongside a higher market cap of $203B. Its stock trend is bullish with a 56.97% price change over the past year. Conversely, ARM boasts a remarkable gross profit margin of 94.9% but a lower net profit margin of 19.8%, with a market cap of $112B. Despite a significant 102.18% price change, ARM’s recent trend has seen a decline of 10.01%.

Analysts rate AMD with a “B” while ARM is rated “B-.” For growth-focused investors, AMD appears more favorable due to its higher growth metrics and market position. However, those prioritizing high margins may lean toward ARM.

Risks include competition and valuation concerns in the tech sector, which may impact both companies’ performances.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Advanced Micro Devices, Inc. and Arm Holdings plc American Depositary Shares to enhance your investment decisions: