Home > Comparison > Technology > ADBE vs VERI

The strategic rivalry between Adobe Inc. and Veritone, Inc. shapes the evolving landscape of software infrastructure. Adobe, a market-leading software giant, excels with diversified cloud-based creative and digital experience solutions. Veritone operates as an innovative AI platform developer with a niche in cognitive computing services. This analysis contrasts Adobe’s scale and stability against Veritone’s growth potential to identify which offers a superior risk-adjusted return for a diversified portfolio in 2026.

Table of contents

Companies Overview

Adobe Inc. and Veritone, Inc. stand as key players in the software infrastructure market, each shaping distinct technological frontiers.

Adobe Inc.: Leading Creative and Experience Software

Adobe dominates as a diversified software company with a market cap of 122.7B. Its core revenue derives from Digital Media, mainly via Creative Cloud subscriptions powering content creation. In 2026, Adobe’s strategic focus centers on expanding its Digital Experience segment, integrating analytics and commerce tools to optimize customer journeys for enterprise clients globally.

Veritone, Inc.: AI-Driven Cognitive Computing Specialist

Veritone operates as an AI software infrastructure provider with a market cap near 180M. It monetizes through its aiWARE platform, delivering machine learning and cognitive services like transcription and sentiment analysis. In 2026, Veritone advances its AI capabilities and media advertising services, targeting verticals such as government and entertainment with tailored intelligent solutions.

Strategic Collision: Similarities & Divergences

Both companies innovate within software infrastructure but differ sharply in scale and approach. Adobe leverages a closed ecosystem of creative and marketing tools, while Veritone embraces an open AI platform model. Their primary battleground is enterprise adoption of intelligent software, Adobe focusing on creative workflows, Veritone on AI-powered data insights. These distinctions define their unique investment profiles: Adobe as a mature industry giant, Veritone as a niche AI growth contender.

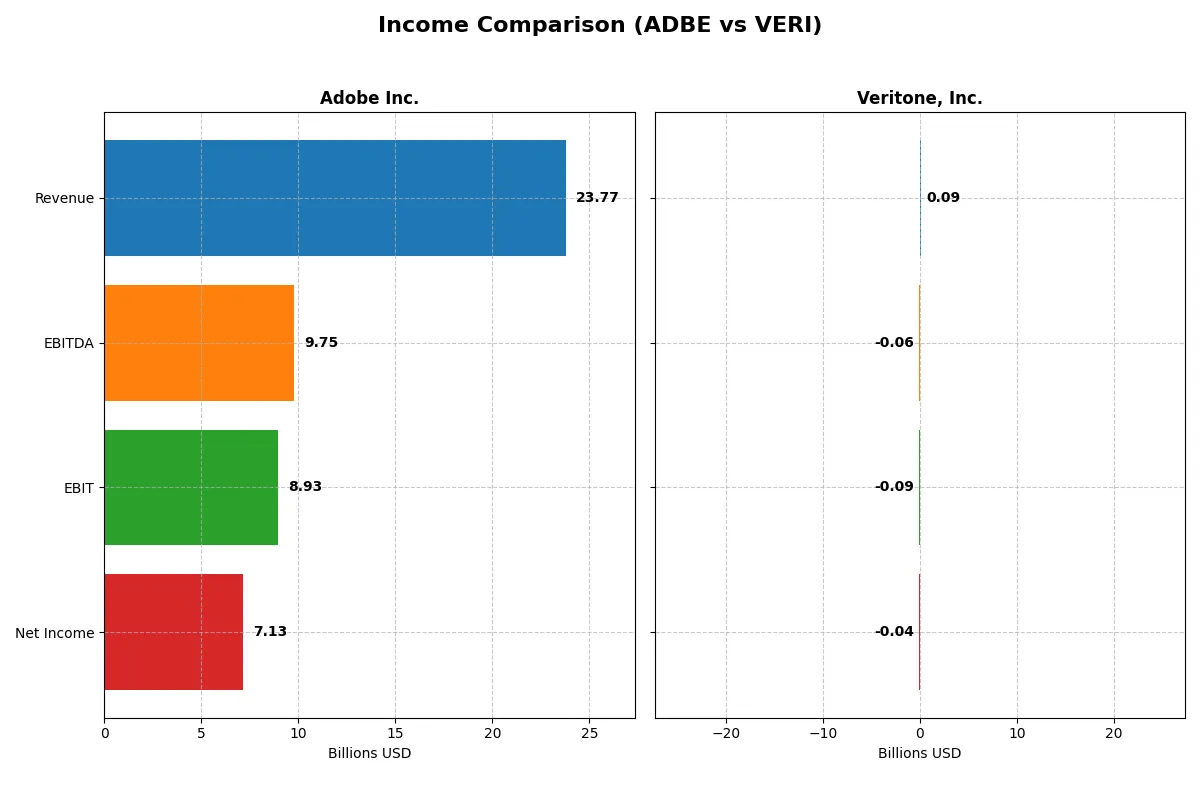

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Adobe Inc. (ADBE) | Veritone, Inc. (VERI) |

|---|---|---|

| Revenue | 23.8B | 93M |

| Cost of Revenue | 2.7B | 27M |

| Operating Expenses | 12.4B | 154M |

| Gross Profit | 21.1B | 65M |

| EBITDA | 9.7B | -59M |

| EBIT | 8.9B | -88M |

| Interest Expense | 263M | 12M |

| Net Income | 7.1B | -37M |

| EPS | 16.73 | -0.98 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of Adobe Inc. and Veritone, Inc. through recent fiscal performance.

Adobe Inc. Analysis

Adobe’s revenue grew steadily from $15.8B in 2021 to $23.8B in 2025, with net income rising from $4.8B to $7.1B. Its gross margin holds strong at 88.6%, and the net margin reached a healthy 30% in 2025. Adobe’s EBIT margin improved sharply by 25.8% year-over-year, signaling growing operational efficiency and robust profit momentum.

Veritone, Inc. Analysis

Veritone’s revenue peaked at $150M in 2022 but declined to $93M in 2024, reflecting recent contraction. The gross margin remains solid at 70.6%, yet the EBIT margin is deeply negative at -95.1%, indicating heavy operational losses. Despite improving net margin and EPS growth in 2024, the company still faces significant challenges in translating revenue into profit.

Margin Power vs. Revenue Scale

Adobe dominates with superior scale, margin health, and consistent profitability growth. Veritone shows promising revenue growth over five years but struggles with persistent operating losses. Adobe’s profile appeals to investors seeking stable, high-margin businesses; Veritone remains a higher-risk turnaround play requiring cautious scrutiny.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Adobe Inc. (ADBE) | Veritone, Inc. (VERI) |

|---|---|---|

| ROE | 61.3% | -277.9% |

| ROIC | 36.7% | -58.3% |

| P/E | 19.1 | -3.3 |

| P/B | 11.7 | 9.3 |

| Current Ratio | 1.0 | 1.0 |

| Quick Ratio | 1.0 | 1.0 |

| D/E | 0.57 | 8.91 |

| Debt-to-Assets | 22.5% | 60.5% |

| Interest Coverage | 33.1 | -7.3 |

| Asset Turnover | 0.81 | 0.47 |

| Fixed Asset Turnover | 10.9 | 8.5 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and signaling operational strength or weakness.

Adobe Inc.

Adobe commands strong profitability with a 61.3% ROE and a robust 30% net margin, signaling exceptional operational efficiency. Its P/E of 19.1 suggests a fairly valued stock amid a high WACC of 10.6%. Adobe reinvests heavily in R&D, forgoing dividends to fuel sustained growth and innovation.

Veritone, Inc.

Veritone struggles with deeply negative profitability metrics, including a -277.9% ROE and a -40.4% net margin, reflecting operational challenges. The stock’s negative P/E is technically favorable but masks poor earnings quality. Veritone retains earnings to support R&D, with no dividend payout, underscoring a high-risk growth bet.

Operational Efficiency Outweighs Valuation Risk

Adobe offers a superior balance of profitability and valuation, with efficient capital allocation and strong returns. Veritone’s negative profitability and elevated leverage highlight significant risk. Investors seeking operational safety should lean toward Adobe, while those pursuing speculative growth may consider Veritone’s profile.

Which one offers the Superior Shareholder Reward?

Adobe Inc. (ADBE) and Veritone, Inc. (VERI) both forgo dividends. Adobe delivers superior shareholder reward through robust free cash flow supporting aggressive buybacks, with a 2025 free cash flow per share of $23.1 and a payout ratio of zero, signaling reinvestment in growth. Veritone’s losses and negative margins reflect high leverage and unsustainable debt levels, undermining buyback potential. Adobe’s pristine operating margins (~37% EBIT) and low debt-to-equity (0.57) contrast sharply with Veritone’s persistent negative profitability and debt-to-equity exceeding 8.9. I conclude Adobe offers a more sustainable and attractive total return profile in 2026.

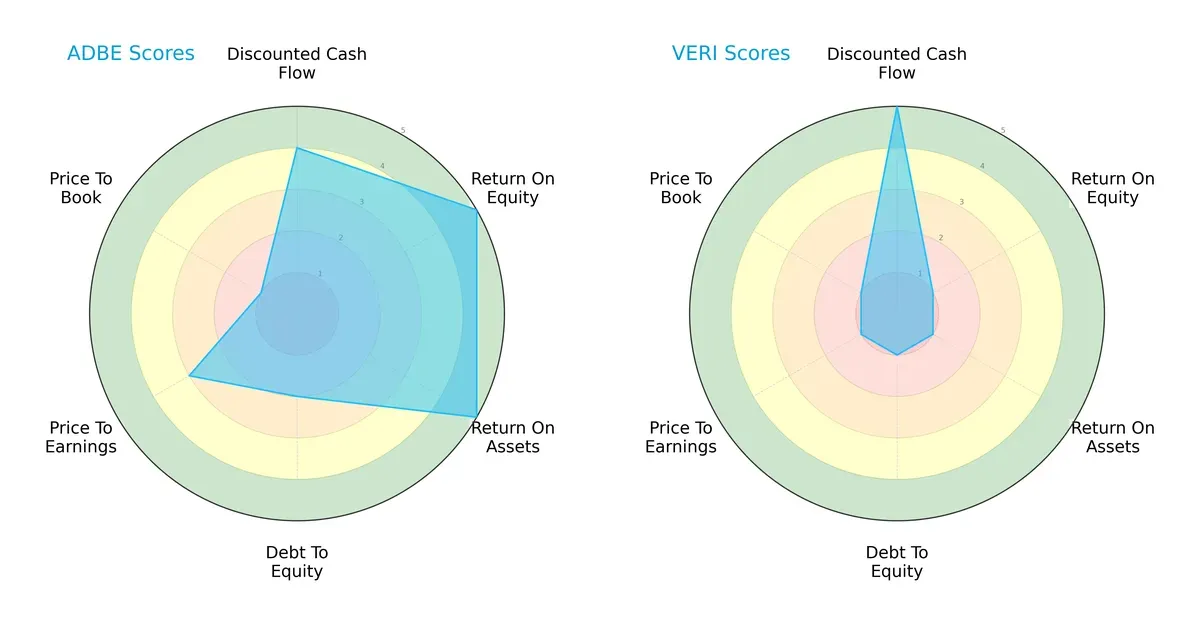

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Adobe Inc. and Veritone, Inc., highlighting their strategic strengths and vulnerabilities side by side:

Adobe Inc. shows a balanced profile with strong ROE and ROA scores (5 each), signaling efficient profit generation and asset utilization. Its moderate debt-to-equity (2) and valuation scores (P/E at 3, P/B at 1) indicate some leverage and potential overvaluation risks. Veritone, however, relies heavily on discounted cash flow (5) but scores very low across profitability (ROE 1, ROA 1), leverage (debt-to-equity 1), and valuation metrics (P/E and P/B at 1). Adobe’s diversified strengths contrast with Veritone’s singular edge in cash flow projections.

Bankruptcy Risk: Solvency Showdown

Adobe’s Altman Z-Score of 8.14 places it firmly in the safe zone, while Veritone’s -0.21 signals distress, implying a significant risk of bankruptcy for Veritone in this cycle:

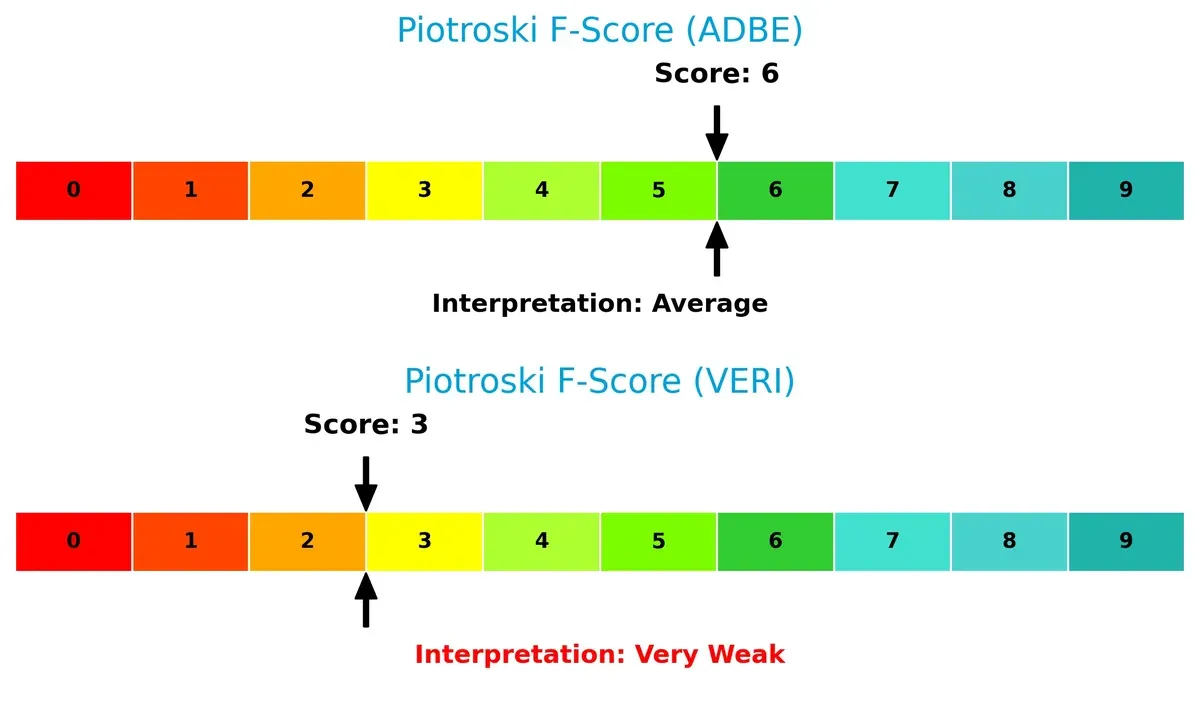

Financial Health: Quality of Operations

Adobe’s Piotroski F-Score of 6 suggests solid financial health with no glaring red flags. Veritone’s score of 3 indicates weak internal financial metrics, raising caution for investors:

How are the two companies positioned?

This section dissects Adobe and Veritone’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats, revealing which model offers a more resilient, sustainable competitive advantage.

Revenue Segmentation: The Strategic Mix

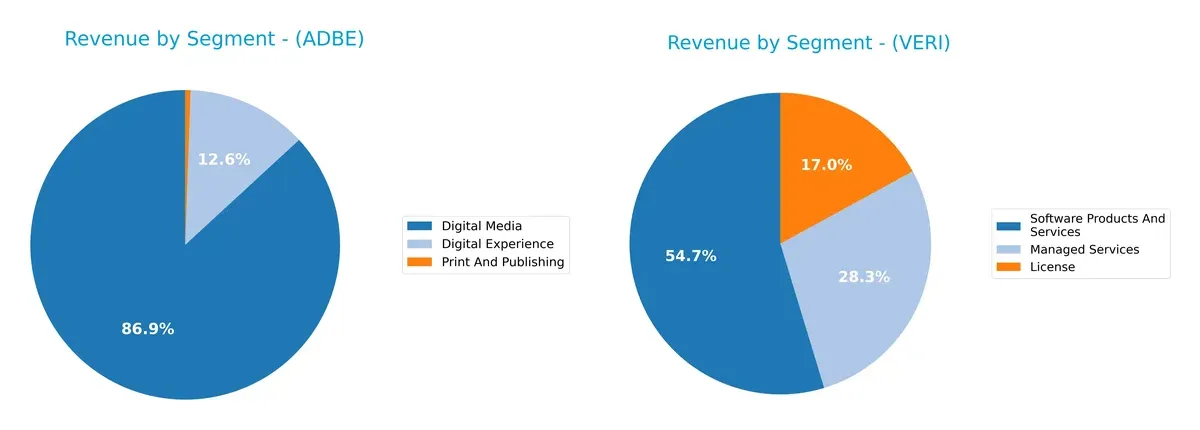

This comparison dissects how Adobe Inc. and Veritone, Inc. diversify their income streams and reveals where their primary sector bets lie:

Adobe Inc. dwarfs Veritone in scale, anchoring 40.4B in Digital Media and 5.9B in Digital Experience for 2025. Adobe’s mix shows a clear dominance in digital creative tools, signaling strong ecosystem lock-in. Veritone’s 2024 revenue spreads more evenly across Software Products (61M), Managed Services (32M), and License (19M), reflecting early-stage diversification but with far smaller scale, exposing it to higher concentration risk and market volatility.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Adobe Inc. and Veritone, Inc.:

Adobe Inc. Strengths

- Strong profitability with 30% net margin

- High ROE of 61.34% and ROIC of 36.69%

- Favorable debt-to-assets at 22.54%

- Solid interest coverage at 33.96x

- Diversified revenue streams across Digital Media and Experience

- Significant global presence with $14.1B Americas revenue

Veritone, Inc. Strengths

- Favorable PE valuation metric despite losses

- Some innovation shown by favorable fixed asset turnover of 8.51

- Product segments in License, Managed Services, and Software Products

- Presence in specialized AI and advertising markets

Adobe Inc. Weaknesses

- WACC at 10.6% exceeds threshold, indicating higher capital cost

- Unfavorable PB ratio at 11.73

- Current ratio at 1.0 signals tight liquidity

- No dividend yield

- Moderate asset turnover at 0.81

Veritone, Inc. Weaknesses

- Negative profitability with -40.36% net margin

- Extremely negative ROE and ROIC reflect operational losses

- High debt-to-equity of 8.91 and debt-to-assets at 60.54%

- Poor interest coverage at -7.3x

- Low current ratio below 1.0

- Unfavorable PB ratio and asset turnover of 0.47

- No dividend yield

Adobe demonstrates robust profitability and strong financial health but faces some liquidity and valuation challenges. Veritone struggles with severe profitability and leverage issues despite some niche market presence and valuation appeal. These contrasts shape each company’s strategic priorities and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable barrier protecting long-term profits from relentless competition erosion. Let’s dissect how two tech firms defend their turf:

Adobe Inc.: Subscription Ecosystem Moat

Adobe’s dominant moat stems from high switching costs linked to its Creative Cloud subscription model. This drives a stellar 30% net margin and growing ROIC, showcasing efficient capital use. Expansion into integrated digital experiences in 2026 should deepen its competitive edge.

Veritone, Inc.: Emerging AI Platform Moat

Veritone relies on AI model innovation as its moat, contrasting Adobe’s entrenched ecosystem. However, negative EBIT margins and declining ROIC signal weak capital efficiency. Future growth hinges on scaling AI adoption and monetization in new verticals, a risky yet potentially rewarding path.

Moat Strength Showdown: Subscription Lock-in vs. AI Innovation

Adobe’s wide, durable moat outclasses Veritone’s fragile AI platform moat. Adobe consistently creates value with expanding profitability. Veritone currently destroys value but holds optionality if it scales successfully. Adobe is better positioned to protect market share in 2026.

Which stock offers better returns?

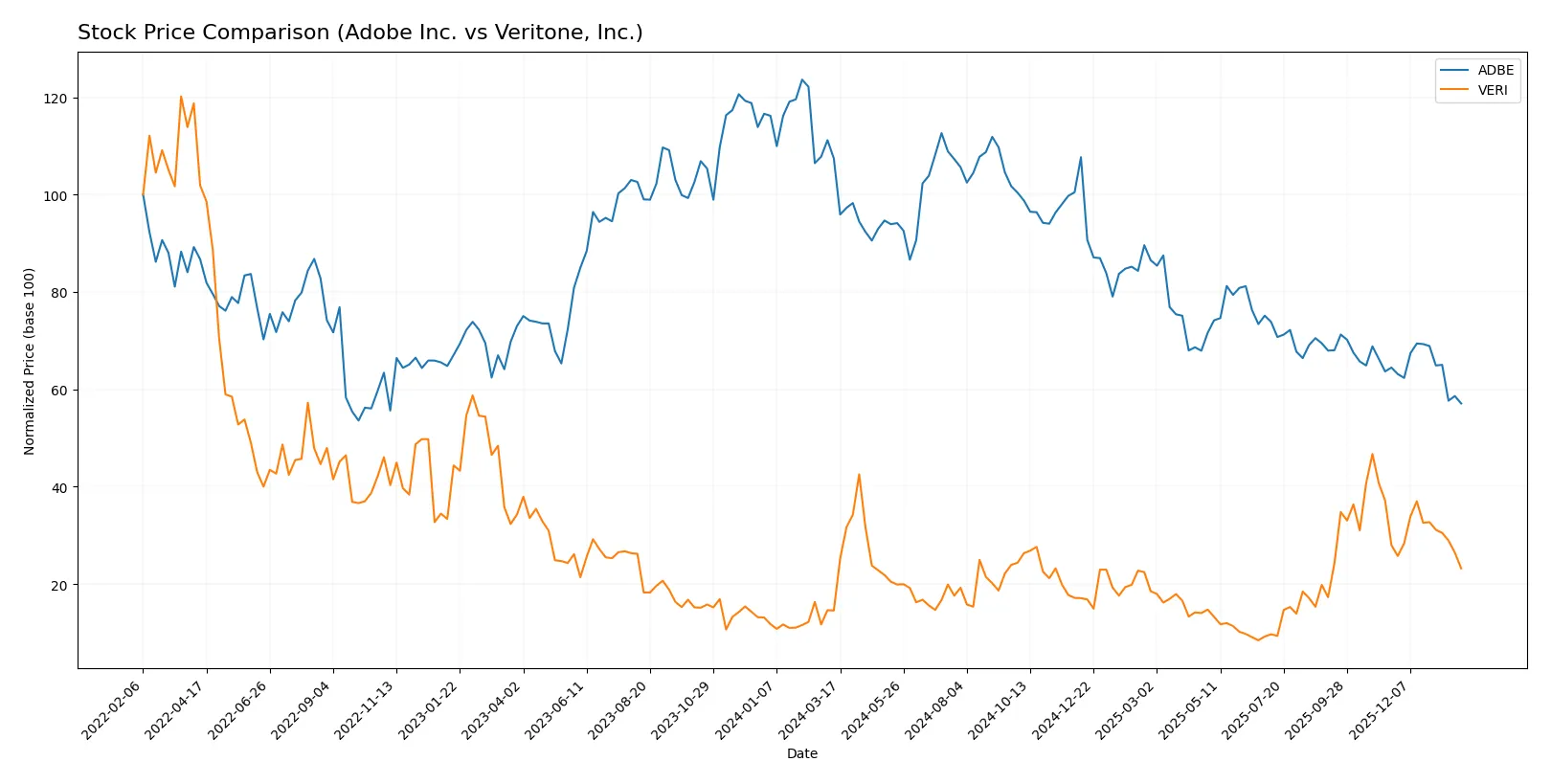

Over the past 12 months, Adobe Inc. experienced a sharp bearish trend with a 47% price decline. Veritone, Inc. showed a strong bullish trend, rising 59%, despite recent downward pressure.

Trend Comparison

Adobe’s stock fell 46.85% over the past year, marking a bearish trend with decelerating losses and significant volatility, hitting a high of 578.34 and a low of 293.25.

Veritone’s stock gained 59.37% over the same period, indicating a bullish trend with deceleration. The price fluctuated modestly between 1.3 and 7.18, showing low volatility.

Veritone outperformed Adobe in market returns, delivering the highest price appreciation despite recent short-term weakness.

Target Prices

Analysts present a broad but optimistic consensus on target prices for Adobe Inc. and Veritone, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Adobe Inc. | 280 | 500 | 390.31 |

| Veritone, Inc. | 9 | 10 | 9.5 |

Adobe’s target consensus sits roughly 33% above its current price of 293.25, signaling strong growth expectations. Veritone’s targets also exceed its current 3.57 price, suggesting significant upside potential but with higher volatility risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Adobe Inc. Grades

The following table summarizes recent grades from notable institutions for Adobe Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-26 |

| Oppenheimer | Downgrade | Perform | 2026-01-13 |

| BMO Capital | Downgrade | Market Perform | 2026-01-09 |

| Jefferies | Downgrade | Hold | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| BMO Capital | Maintain | Outperform | 2025-12-15 |

| Keybanc | Downgrade | Underweight | 2025-12-15 |

| Wolfe Research | Maintain | Outperform | 2025-12-11 |

| TD Cowen | Maintain | Hold | 2025-12-11 |

| Oppenheimer | Maintain | Outperform | 2025-12-11 |

Veritone, Inc. Grades

Below is a summary of recent grades from recognized firms for Veritone, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2026-01-30 |

| D. Boral Capital | Maintain | Buy | 2025-12-09 |

| D. Boral Capital | Maintain | Buy | 2025-12-04 |

| D. Boral Capital | Maintain | Buy | 2025-12-02 |

| Needham | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-11-07 |

| D. Boral Capital | Maintain | Buy | 2025-10-28 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-20 |

| D. Boral Capital | Maintain | Buy | 2025-10-15 |

| D. Boral Capital | Maintain | Buy | 2025-09-24 |

Which company has the best grades?

Veritone, Inc. consistently holds “Buy” ratings from multiple firms, signaling strong institutional confidence. Adobe Inc. shows a mixed trend with recent downgrades to “Neutral” and “Hold,” indicating more cautious sentiment. Investors might interpret Veritone’s stable Buy grades as a clearer positive signal relative to Adobe’s varied outlook.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Adobe Inc. and Veritone, Inc. in the 2026 market environment:

1. Market & Competition

Adobe Inc.

- Dominates established software infrastructure with strong Creative Cloud brand and diversified segments. Faces intense competition but maintains high ROIC.

Veritone, Inc.

- Operates in AI computing with niche market. Faces fierce competition and lower market cap; high beta signals volatility.

2. Capital Structure & Debt

Adobe Inc.

- Moderate debt-to-equity ratio (0.57) and favorable interest coverage (33.96) indicate sound capital structure.

Veritone, Inc.

- High debt-to-equity (8.91) and negative interest coverage (-7.3) reflect financial stress and risk of solvency issues.

3. Stock Volatility

Adobe Inc.

- Beta of 1.53 suggests moderate market sensitivity typical for tech giants.

Veritone, Inc.

- Beta of 2.05 indicates high volatility, increasing investment risk.

4. Regulatory & Legal

Adobe Inc.

- Faces standard regulatory scrutiny for software and data privacy but has established compliance frameworks.

Veritone, Inc.

- Emerging AI sector exposes to evolving and potentially stricter regulations, posing legal uncertainties.

5. Supply Chain & Operations

Adobe Inc.

- Robust global operations with diversified distribution channels reduce supply chain risks.

Veritone, Inc.

- Smaller scale and reliance on AI model development increase exposure to operational disruptions.

6. ESG & Climate Transition

Adobe Inc.

- Increasing focus on ESG initiatives aligned with investor expectations; large resources support climate transition.

Veritone, Inc.

- Limited disclosure and smaller resources may hinder ESG performance and adaptation to climate policies.

7. Geopolitical Exposure

Adobe Inc.

- Global footprint with US base; geopolitical tensions may affect international sales but mitigated by scale.

Veritone, Inc.

- Primarily US and UK focus; less diversified geopolitically but vulnerable to regional policy shifts.

Which company shows a better risk-adjusted profile?

Adobe’s dominant market position, prudent capital structure, and strong financial health provide a superior risk-adjusted profile versus Veritone. Veritone’s critical risks lie in its unstable capital structure, high volatility, and weak profitability metrics. Adobe’s Altman Z-Score of 8.14 confirms financial safety, unlike Veritone’s distress zone score of -0.21. This gap underscores Adobe’s resilience amid 2026’s market uncertainties.

Final Verdict: Which stock to choose?

Adobe Inc. showcases unmatched capital efficiency, consistently generating value well above its cost of capital. Its strong cash flow and durable competitive advantage fuel growth. However, a current ratio near 1 signals a liquidity point of vigilance. Adobe fits best in an Aggressive Growth portfolio aiming for robust, long-term value creation.

Veritone, Inc. benefits from a niche technological moat but struggles with negative profitability and high leverage. Its strategic edge lies in potential innovation rather than financial stability. Relative to Adobe, Veritone offers a riskier profile suited for speculative or turnaround-focused investors, aligning with GARP—Growth at a Reasonable Price—who tolerate volatility for upside.

If you prioritize durable financial strength and proven value creation, Adobe outshines with superior capital returns and stability. However, if you seek speculative growth fueled by emerging technology, Veritone offers a high-risk, high-reward scenario, though with significant financial headwinds. Each choice reflects distinct investor risk tolerances and strategic goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Adobe Inc. and Veritone, Inc. to enhance your investment decisions: