Home > Comparison > Technology > ADBE vs RBRK

The strategic rivalry between Adobe Inc. and Rubrik, Inc. shapes the evolving landscape of software infrastructure. Adobe, a market-leading software giant, dominates with its diversified digital media and experience platforms. Rubrik, a nimble data security innovator, focuses on cloud and cyber recovery solutions. This head-to-head pits scale against specialization, offering investors a clear choice between entrenched leadership and disruptive growth. This analysis will reveal which trajectory delivers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Adobe Inc. and Rubrik, Inc. represent two powerful forces in the software infrastructure market, each shaping enterprise technology in unique ways.

Adobe Inc.: Leader in Creative and Digital Experience Software

Adobe dominates with its Creative Cloud subscription, powering content creation and digital marketing globally. Its revenue mainly comes from Digital Media, Digital Experience, and Publishing segments. In 2026, Adobe focuses strategically on integrating cloud-based document services and enhancing customer experience platforms to deepen enterprise engagement and drive recurring revenue streams.

Rubrik, Inc.: Innovator in Data Security Solutions

Rubrik specializes in enterprise data protection and cyber recovery, serving a broad range of industries. Its core revenue engine revolves around cloud and SaaS data security offerings. Rubrik’s 2026 strategy prioritizes expanding its data threat analytics and security posture tools to address rising cyber risks, aiming to capture market share in a growing, security-conscious environment.

Strategic Collision: Similarities & Divergences

Both firms operate in software infrastructure but diverge sharply: Adobe builds a broad, integrated ecosystem focused on content and customer experience, while Rubrik zeroes in on specialized, security-driven solutions. Their primary battleground lies in enterprise IT adoption, where data security increasingly complements digital transformation. Investors face distinct profiles: Adobe offers scale and diversification, while Rubrik presents growth potential amid intensifying cybersecurity demands.

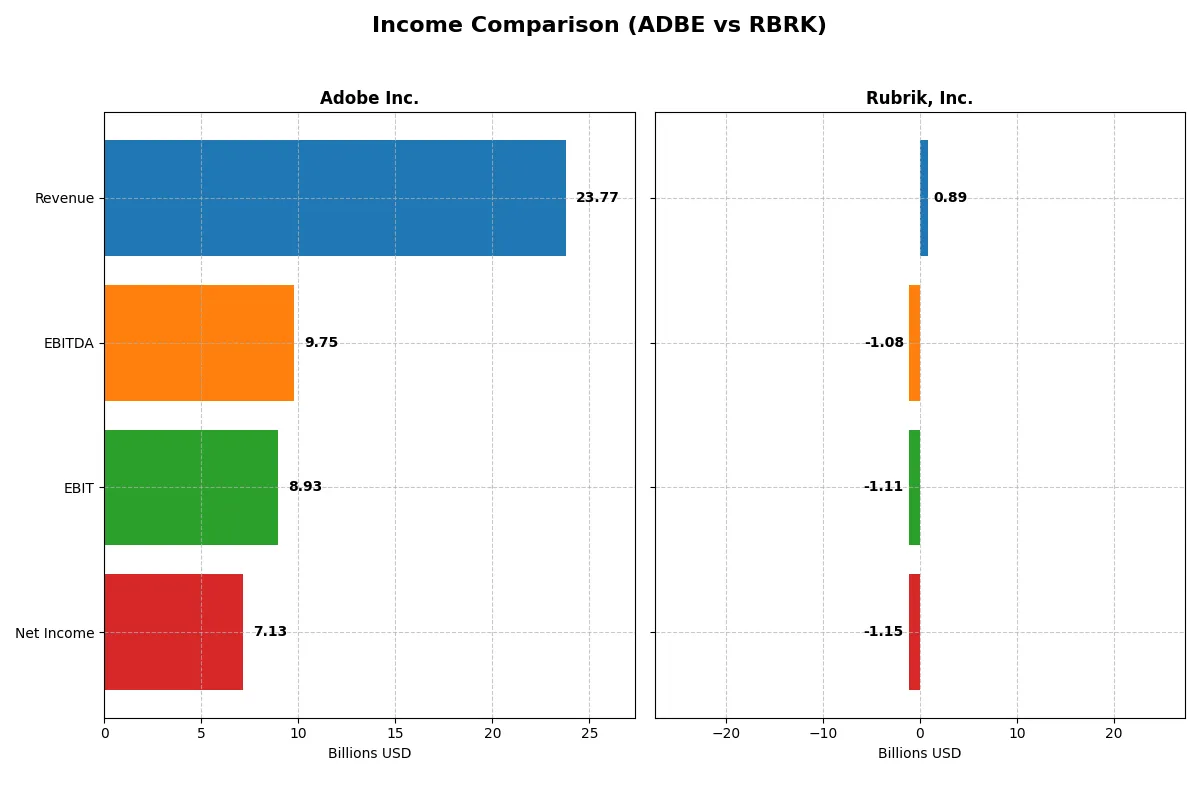

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Adobe Inc. (ADBE) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Revenue | 23.8B | 887M |

| Cost of Revenue | 2.71B | 266M |

| Operating Expenses | 12.4B | 1.75B |

| Gross Profit | 21.1B | 621M |

| EBITDA | 9.75B | -1.08B |

| EBIT | 8.93B | -1.11B |

| Interest Expense | 263M | 41M |

| Net Income | 7.13B | -1.15B |

| EPS | 16.73 | -7.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit most efficiently, exposing the true strength of their corporate engines.

Adobe Inc. Analysis

Adobe’s revenue rose steadily from 15.8B in 2021 to 23.8B in 2025, reflecting robust growth. Net income surged from 4.8B to 7.1B, with a solid 30% net margin in 2025. Gross margin held impressively high at 88.6%, while EBIT margin expanded to 37.6%, signaling exceptional operational efficiency and momentum.

Rubrik, Inc. Analysis

Rubrik’s revenue climbed rapidly from 388M in 2021 to 887M in 2025, showing strong top-line growth of 41% year-over-year. However, it posted consistent net losses, widening to -1.15B in 2025 with a negative net margin exceeding -130%. Despite improving gross margin at 70%, negative EBIT margin and rising expenses undermine profitability prospects.

Margin Strength vs. Growth Ambitions

Adobe clearly outperforms Rubrik on profitability and margin control, benefiting from a durable moat and disciplined capital allocation. Rubrik’s steep revenue growth contrasts with persistent losses and operational inefficiencies. For investors seeking stable returns and margin power, Adobe’s profile offers a more attractive risk-reward balance than Rubrik’s high-growth but unprofitable trajectory.

Financial Ratios Comparison

These vital ratios serve as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency for these companies:

| Ratios | Adobe Inc. (ADBE) | Rubrik, Inc. (RBRK) |

|---|---|---|

| ROE | 61.3% | 208.6% |

| ROIC | 36.7% | -234.8% |

| P/E | 19.1 | -9.8 |

| P/B | 11.7 | -20.4 |

| Current Ratio | 1.0 | 1.13 |

| Quick Ratio | 1.0 | 1.13 |

| D/E (Debt/Equity) | 0.57 | -0.63 |

| Debt-to-Assets | 22.5% | 24.7% |

| Interest Coverage | 33.1 | -27.5 |

| Asset Turnover | 0.81 | 0.62 |

| Fixed Asset Turnover | 10.9 | 16.7 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering operational strengths and hidden risks essential for investment insight.

Adobe Inc.

Adobe demonstrates robust core profitability with a 61.34% ROE and a 30% net margin, signaling operational excellence. Its P/E of 19.13 marks the stock as fairly valued, neither cheap nor stretched. Adobe reinvests heavily in R&D, allocating 18% of revenue, reflecting a growth-oriented capital allocation strategy with no dividend payout.

Rubrik, Inc.

Rubrik shows a striking 208.55% ROE, but a deeply negative net margin of -130.26%, indicating severe profitability challenges. Valuation metrics like negative P/E and P/B suggest high risk and market skepticism. The firm offers no dividends and invests aggressively in R&D (60% of revenue), aiming to fuel future growth despite current losses.

Profitability Triumph vs. Growth Gambit

Adobe balances strong profitability with reasonable valuation, offering operational safety. Rubrik’s profile is high-risk, driven by aggressive growth investments amid losses. Investors seeking stability may prefer Adobe, while those chasing turnaround potential might consider Rubrik’s growth gamble.

Which one offers the Superior Shareholder Reward?

I observe Adobe Inc. (ADBE) delivers superior shareholder reward through zero dividends but strong free cash flow (23.1/share in 2025) supporting aggressive buybacks. Rubrik, Inc. (RBRK) pays no dividends and generates negative earnings, with minimal free cash flow (0.2/share) and no meaningful buyback activity. Adobe’s distribution model is sustainable, backed by high margins (30% net profit) and solid cash flow coverage. Rubrik’s losses and poor operating cash flow present high risk and no shareholder returns. I conclude Adobe offers a far more attractive total return profile in 2026.

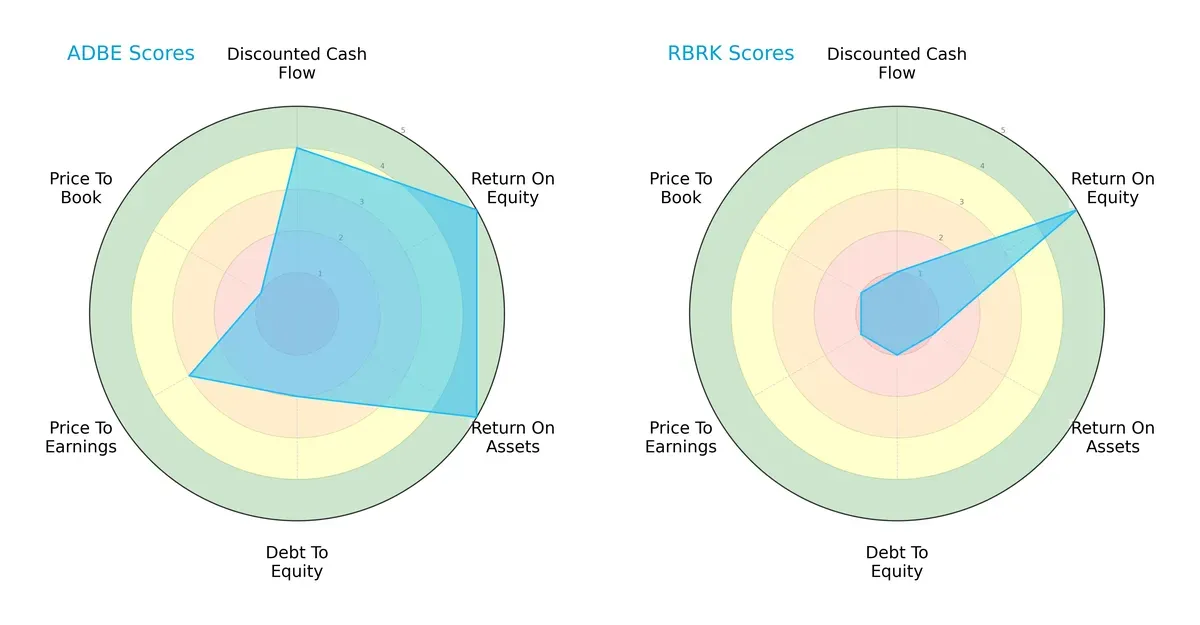

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Adobe Inc. and Rubrik, Inc., highlighting their financial strengths and valuation dynamics:

Adobe Inc. shows a balanced profile with strong ROE (5) and ROA (5) scores, reflecting efficient profit generation and asset utilization. Rubrik matches Adobe on ROE (5) but lags sharply on ROA (1) and debt-to-equity (1), signaling operational challenges and higher leverage risk. Adobe’s moderate valuation scores contrast Rubrik’s very unfavorable valuation metrics, indicating Adobe’s relative market confidence. Adobe relies on a broad-based strength, while Rubrik depends heavily on equity returns.

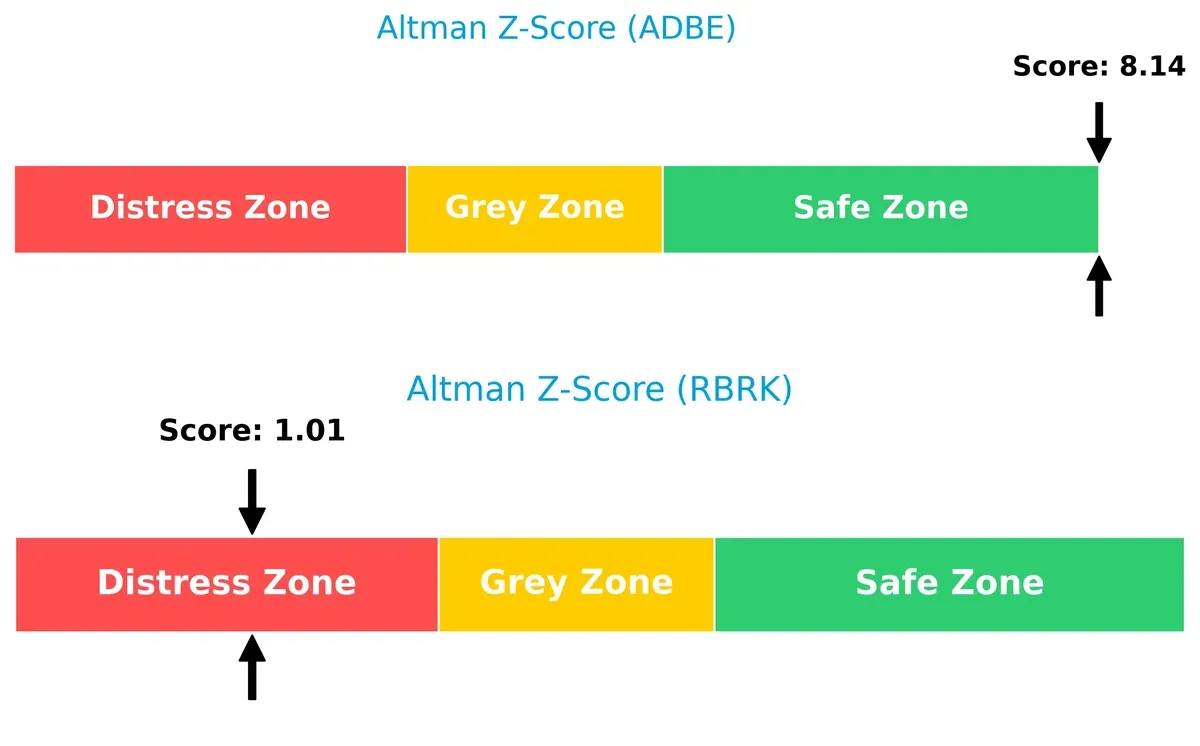

Bankruptcy Risk: Solvency Showdown

Adobe’s Altman Z-Score (8.14) versus Rubrik’s (1.01) reveals a stark contrast in bankruptcy risk:

Adobe sits comfortably in the safe zone, signaling strong solvency and a low likelihood of distress in this cycle. Rubrik’s distress zone score warns of high bankruptcy risk, reflecting weak liquidity and leverage metrics that investors must monitor carefully.

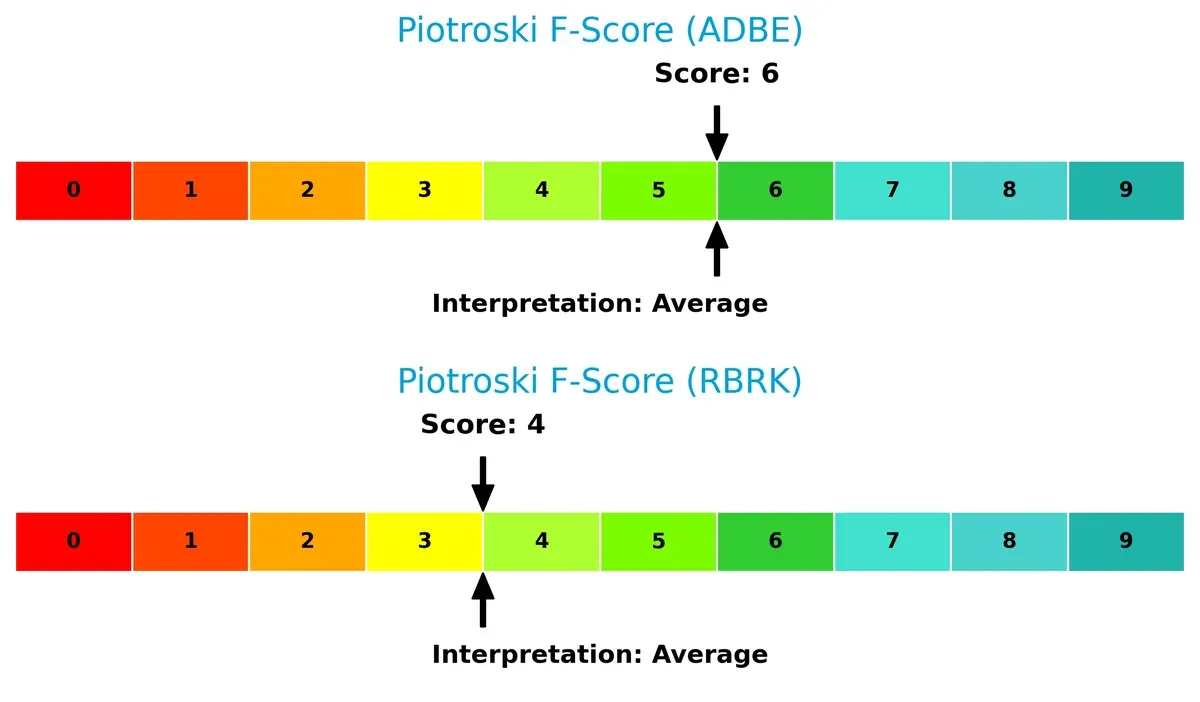

Financial Health: Quality of Operations

Piotroski F-Scores place Adobe (6) and Rubrik (4) in the average range, but the gap highlights operational quality differences:

Adobe demonstrates better internal financial health, with fewer red flags across profitability and efficiency. Rubrik’s lower score signals caution, as weaker operational metrics may hinder sustainable value creation. I see Adobe as the firmer choice on financial quality at this stage.

How are the two companies positioned?

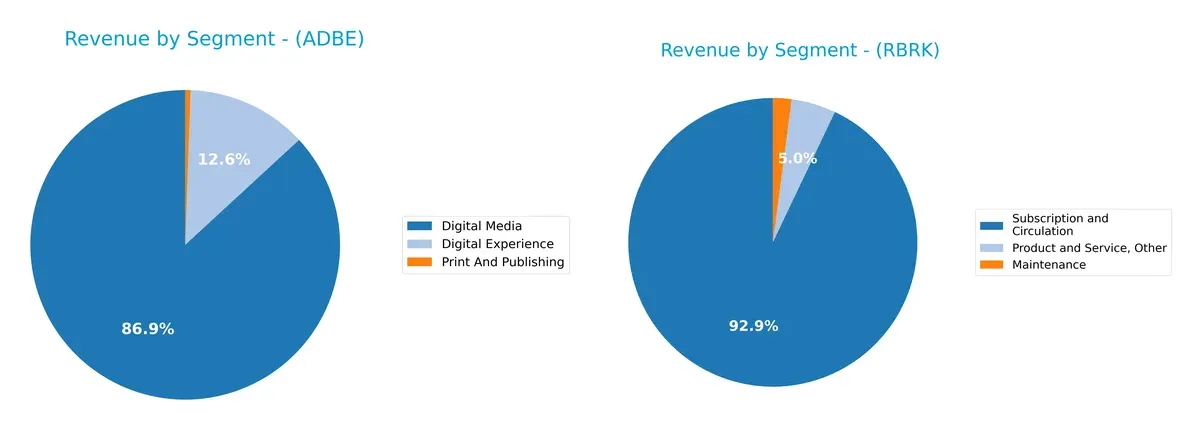

This section dissects the operational DNA of Adobe and Rubrik by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to identify which business model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Adobe Inc. and Rubrik, Inc. diversify their income streams and where their primary sector bets lie:

Adobe Inc. dwarfs Rubrik with $40.45B from Digital Media, anchoring its revenue. Adobe’s $5.86B Digital Experience adds diversification, while Print and Publishing is minor at $256M. Rubrik relies heavily on Subscription and Circulation at $829M, with smaller contributions from Product and Service ($45M) and Maintenance ($18M). Adobe’s diversified digital ecosystem reduces risk; Rubrik’s concentration pivots on subscription growth but faces concentration risk.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Adobe Inc. and Rubrik, Inc. based on diversification, profitability, financial statements, innovation, global presence, and market share:

Adobe Inc. Strengths

- Diverse revenue streams including Digital Experience and Media

- Strong profitability with 30% net margin and 61% ROE

- Favorable debt-to-assets and interest coverage ratios

- Solid global presence, especially in Americas and EMEA

- High fixed asset turnover indicating efficient asset use

Rubrik, Inc. Strengths

- Favorable weighted average cost of capital at 5.35%

- Positive ROE despite negative net margin

- Favorable current and quick ratios indicating liquidity

- Strong fixed asset turnover of 16.67

- Diversified geographic revenue including Americas, Asia Pacific, and EMEA

Adobe Inc. Weaknesses

- Unfavorable current ratio at 1.0 signals liquidity risk

- High price-to-book ratio at 11.73 may indicate overvaluation

- Zero dividend yield

- Unfavorable WACC at 10.6% increases capital cost

Rubrik, Inc. Weaknesses

- Negative net margin and ROIC indicate operational losses

- Negative interest coverage ratio signals risk in debt servicing

- Negative debt-to-equity ratio may reflect accounting anomalies

- Zero dividend yield

- Smaller absolute revenue base compared to Adobe

Adobe’s strengths lie in its diversified revenue and strong profitability backed by efficient capital use. Rubrik shows strengths in liquidity and cost of capital but suffers from operational losses. Each company faces clear financial challenges that will influence strategic decisions.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competition erosion. Without it, market share and margins quickly erode:

Adobe Inc.: Subscription Powerhouse with Intangible Asset Moat

Adobe’s moat stems from its dominant subscription model and strong brand loyalty. Its 88.6% gross margin and 37.6% EBIT margin reflect pricing power and margin stability. Expansion into AI-driven creative tools in 2026 could deepen this advantage.

Rubrik, Inc.: Emerging Innovator Facing Profitability Challenges

Rubrik relies on data security innovation and switching costs but lacks Adobe’s scale. Despite 41% revenue growth in 2025, negative EBIT margin signals weak capital efficiency. Expansion into cloud-native security offers upside but profitability remains a hurdle.

Market Dominance vs. Growth Gambit: Adobe’s Moat Outruns Rubrik’s

Adobe’s durable, growing ROIC exceeds WACC by 26%, signifying a wide, deep moat. Rubrik’s negative ROIC and shrinking profitability reveal a fragile competitive position. Adobe stands better equipped to defend and expand its market share in 2026.

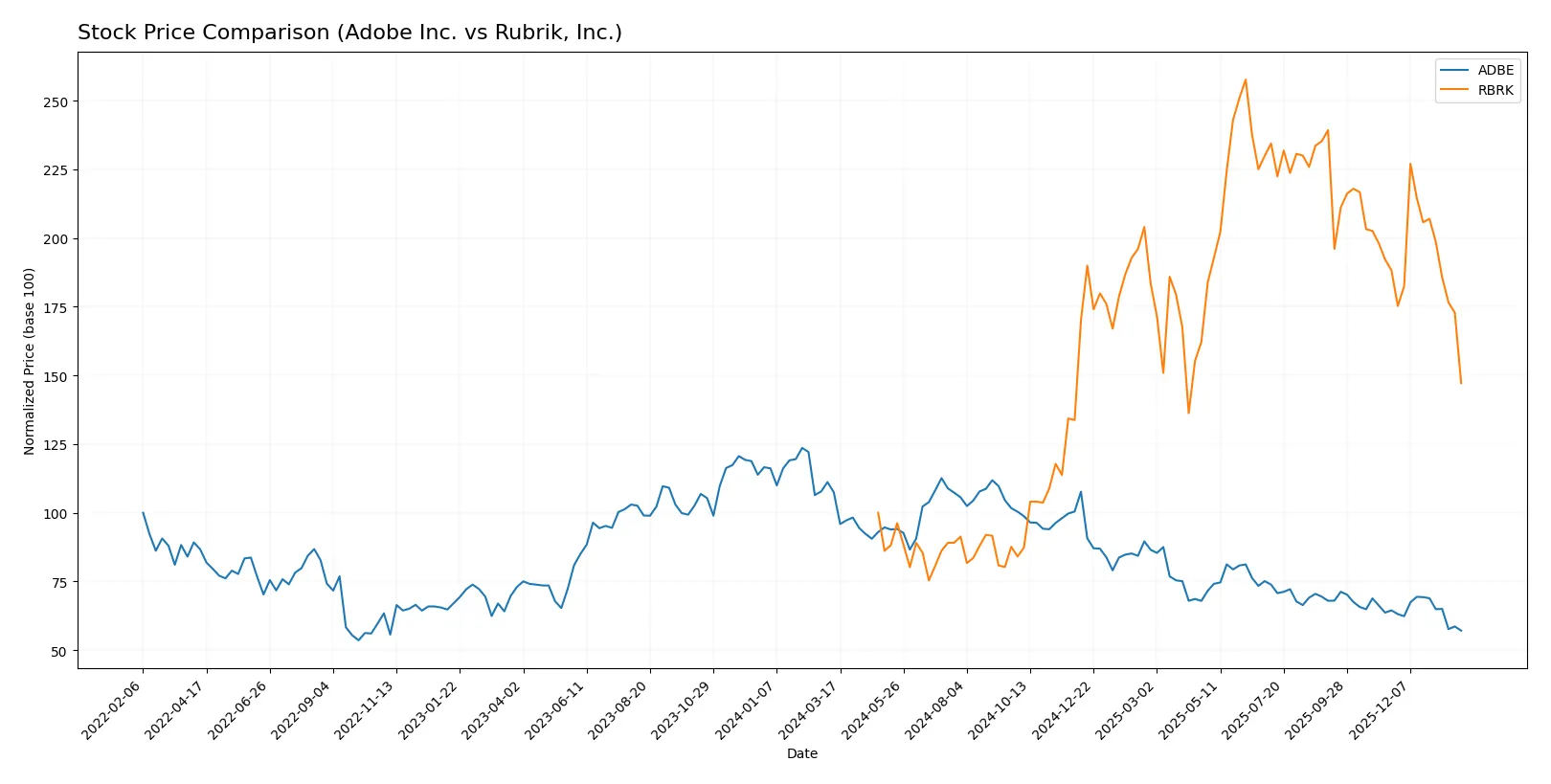

Which stock offers better returns?

Adobe Inc. and Rubrik, Inc. have exhibited contrasting price movements over the past 12 months, with Adobe facing sharp declines and Rubrik showing significant gains before recent weakness.

Trend Comparison

Adobe Inc.’s stock declined 46.85% over the past year, marking a bearish trend with decelerating losses. The price peaked at 578.34 and bottomed at 293.25, reflecting high volatility (78.57 std dev).

Rubrik, Inc.’s stock gained 47.24% over the same period, indicating a bullish but decelerating trend. The price ranged from 28.65 to 97.91, with moderate volatility (21.18 std dev).

Rubrik outperformed Adobe in market returns, delivering positive growth versus Adobe’s significant decline over the past year.

Target Prices

Analysts present a bullish consensus on Adobe Inc. and Rubrik, Inc., with target prices well above current market levels.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Adobe Inc. | 280 | 500 | 390.31 |

| Rubrik, Inc. | 105 | 113 | 109.33 |

Adobe’s target consensus of 390.31 exceeds its current price of 293.25 by 33%, signaling strong growth expectations. Rubrik’s targets imply nearly 95% upside from its 55.95 share price, reflecting high optimism despite its recent IPO.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Adobe Inc. Grades

The latest Adobe grades from major financial institutions are summarized below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-26 |

| Oppenheimer | Downgrade | Perform | 2026-01-13 |

| BMO Capital | Downgrade | Market Perform | 2026-01-09 |

| Jefferies | Downgrade | Hold | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| BMO Capital | Maintain | Outperform | 2025-12-15 |

| Keybanc | Downgrade | Underweight | 2025-12-15 |

| Wolfe Research | Maintain | Outperform | 2025-12-11 |

| TD Cowen | Maintain | Hold | 2025-12-11 |

| Oppenheimer | Maintain | Outperform | 2025-12-11 |

Rubrik, Inc. Grades

Rubrik’s most recent grades from recognized analysts are presented below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

Which company has the best grades?

Rubrik consistently earns higher grades like Buy, Outperform, and Overweight compared to Adobe’s more mixed Neutral, Hold, and Perform ratings. This suggests stronger analyst confidence in Rubrik’s near-term prospects. Investors may interpret Rubrik’s superior grades as a signal of more favorable growth or risk-reward balance.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Adobe Inc.

- Dominates with diversified software segments and strong brand presence. Faces intense competition in creative and digital media markets.

Rubrik, Inc.

- Emerging player focused on data security with narrow product scope. Competes in a crowded cybersecurity market with established rivals.

2. Capital Structure & Debt

Adobe Inc.

- Moderate debt-to-equity ratio of 0.57 signals balanced leverage. Interest coverage ratio at 33.96 indicates strong ability to service debt.

Rubrik, Inc.

- Negative debt-to-equity ratio and poor interest coverage (-26.84) highlight financial instability and potential liquidity risks.

3. Stock Volatility

Adobe Inc.

- High beta of 1.53 implies significant sensitivity to market swings, increasing price volatility risk.

Rubrik, Inc.

- Low beta of 0.28 suggests relative stock stability but possibly limited upside in bullish markets.

4. Regulatory & Legal

Adobe Inc.

- Operates globally with exposure to data privacy and intellectual property regulations. Compliance history is solid.

Rubrik, Inc.

- Faces evolving cybersecurity regulations; as a younger company, regulatory compliance frameworks may still be maturing.

5. Supply Chain & Operations

Adobe Inc.

- Extensive global distribution network supports resilience but exposes to supply chain disruptions.

Rubrik, Inc.

- Smaller scale and newer infrastructure may face operational scaling challenges and supply chain vulnerabilities.

6. ESG & Climate Transition

Adobe Inc.

- Established ESG programs with focus on sustainability and social responsibility. ESG risks are well-managed.

Rubrik, Inc.

- ESG initiatives are developing; limited track record increases uncertainty regarding climate transition risks.

7. Geopolitical Exposure

Adobe Inc.

- Global footprint exposes Adobe to geopolitical tensions and trade restrictions, especially in key markets like China.

Rubrik, Inc.

- Primarily US-based with lower international exposure, reducing direct geopolitical risk but limiting global growth potential.

Which company shows a better risk-adjusted profile?

Adobe’s most impactful risk is market competition amid high stock volatility. Rubrik’s critical risk is its fragile capital structure and financial distress signals. Adobe’s diversified operations and strong debt service capacity provide a more favorable risk-adjusted profile. Rubrik’s distress-zone Altman Z-score and negative profitability highlight elevated financial risk, demanding cautious investor scrutiny.

Final Verdict: Which stock to choose?

Adobe Inc. wields a powerful economic moat rooted in its consistently high and growing ROIC, signaling durable value creation. Its operational excellence drives robust profitability and cash flow generation. The key point of vigilance remains its stretched valuation metrics and tight liquidity ratio. Adobe suits investors targeting aggressive growth with a tolerance for premium pricing.

Rubrik, Inc. offers a strategic moat through its rapid revenue expansion and innovation pipeline, though profitability remains elusive. Its low leverage and moderate liquidity position suggest a safer financial profile than Adobe’s. Rubrik fits well in growth-at-a-reasonable-price (GARP) portfolios aiming for dynamic upside but with heightened operational risk.

If you prioritize stable, proven value creation and can navigate valuation premiums, Adobe outshines as the compelling choice due to its durable competitive advantage. However, if you seek higher growth potential with a more conservative balance sheet, Rubrik offers better stability despite its current profitability struggles. Each scenario reflects distinct investor profiles balancing risk and reward.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Adobe Inc. and Rubrik, Inc. to enhance your investment decisions: