In the ever-evolving tech landscape, two giants stand out: Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK). Both companies operate in the software sector but cater to different niches—Adobe focuses on digital media and experience, while Autodesk specializes in design and engineering solutions. Their overlapping innovation strategies and market presence make them prime candidates for comparison. In this article, I will help you determine which of these companies presents the most compelling investment opportunity.

Table of contents

Company Overview

Adobe Inc. Overview

Adobe Inc. is a leading diversified software company that operates globally, primarily focusing on three key segments: Digital Media, Digital Experience, and Publishing and Advertising. Its flagship product, Creative Cloud, offers a subscription-based platform for creators to access a suite of creative tools. Adobe’s mission is to empower individuals and businesses to create, publish, and promote content efficiently. With a market capitalization of approximately $144B, the company continues to leverage its technological expertise to enhance customer experiences through innovative solutions in analytics, e-commerce, and advertising. As a significant player in the software infrastructure industry, Adobe is headquartered in San Jose, California, and has been a staple in digital creativity since its founding in 1982.

Autodesk, Inc. Overview

Autodesk, Inc. is renowned for its 3D design, engineering, and entertainment software, catering to various industries including architecture, manufacturing, and media. Established in 1982 and headquartered in San Rafael, California, Autodesk offers a diverse range of software products such as AutoCAD and Fusion 360. Its mission is to enable users to design and create more efficiently, thereby driving innovation across sectors. With a market cap of about $64B, Autodesk continues to grow its cloud-based solutions, solidifying its position in the application software market. The company’s focus on delivering high-quality design tools underscores its commitment to enhancing productivity for professionals worldwide.

Key similarities and differences

Both Adobe and Autodesk operate within the technology sector and emphasize subscription-based models, catering to creative and design professionals. However, Adobe focuses more on digital media and customer experience solutions, while Autodesk specializes in engineering and design software, highlighting their distinct market niches and varying customer bases.

Income Statement Comparison

Below is a comparison of the latest income statement metrics for Adobe Inc. and Autodesk, Inc. to aid in evaluating their financial performance.

| Metric | Adobe Inc. (ADBE) | Autodesk, Inc. (ADSK) |

|---|---|---|

| Market Cap | 144B | 64.1B |

| Revenue | 23.77B | 6.13B |

| EBITDA | 8.71B | 1.55B |

| EBIT | 8.71B | 1.37B |

| Net Income | 7.13B | 1.11B |

| EPS | 16.73 | 5.17 |

| Fiscal Year | 2025 | 2025 |

Interpretation of Income Statement

In 2025, Adobe Inc. reported a revenue increase of 12% year-over-year, alongside a significant rise in net income of 28% compared to 2024. This reflects strong demand for its digital media products. Autodesk, while experiencing a revenue growth of 12% as well, saw a more modest net income increase of 23%. Margins for both companies have remained stable, indicating effective cost management strategies. Adobe’s performance highlights its robust market position, while Autodesk is steadily improving its profitability amidst competitive pressures.

Financial Ratios Comparison

The following table provides a comparative overview of the most recent revenue and key financial ratios for Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK).

| Metric | Adobe Inc. (ADBE) | Autodesk, Inc. (ADSK) |

|---|---|---|

| ROE | 39.42% | 42.43% |

| ROIC | 25.41% | 18.01% |

| P/E | 19.13 | 60.20 |

| P/B | 16.35 | 25.54 |

| Current Ratio | 1.07 | 0.68 |

| Quick Ratio | 1.07 | 0.68 |

| D/E | 0.43 | 0.98 |

| Debt-to-Assets | 20.03% | 26.42% |

| Interest Coverage | 41.10 | 0 |

| Asset Turnover | 0.71 | 0.56 |

| Fixed Asset Turnover | 9.70 | 21.44 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Adobe demonstrates strong financial health with a high return on equity (ROE) and return on invested capital (ROIC), indicating efficient use of equity and capital. Its current and quick ratios are above 1, suggesting good short-term liquidity. Autodesk, while having a higher ROE, is burdened by a higher debt-to-equity ratio and a low current ratio, raising concerns about its financial stability. The interest coverage ratio of Autodesk is alarming, indicating potential difficulties in meeting its interest obligations.

Dividend and Shareholder Returns

Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK) do not pay dividends, opting instead to reinvest in growth and innovation. Both companies engage in share buyback programs, with Adobe focusing on capitalizing on free cash flow for shareholder returns. This strategy, while potentially beneficial for long-term value creation, carries risks such as market volatility and the need for sustainable profit margins. Overall, their approaches may align with the goal of enhancing shareholder value over the long run.

Strategic Positioning

Adobe Inc. (ADBE) holds a commanding market share in the Digital Media segment, driven by its flagship Creative Cloud service, which caters to a wide range of users from individuals to enterprises. Meanwhile, Autodesk, Inc. (ADSK) specializes in 3D design and engineering software, facing competitive pressure from emerging technologies and industry players. Both companies are navigating a landscape of rapid technological disruption, requiring them to continuously innovate and adapt their product offerings to maintain their competitive edge.

Stock Comparison

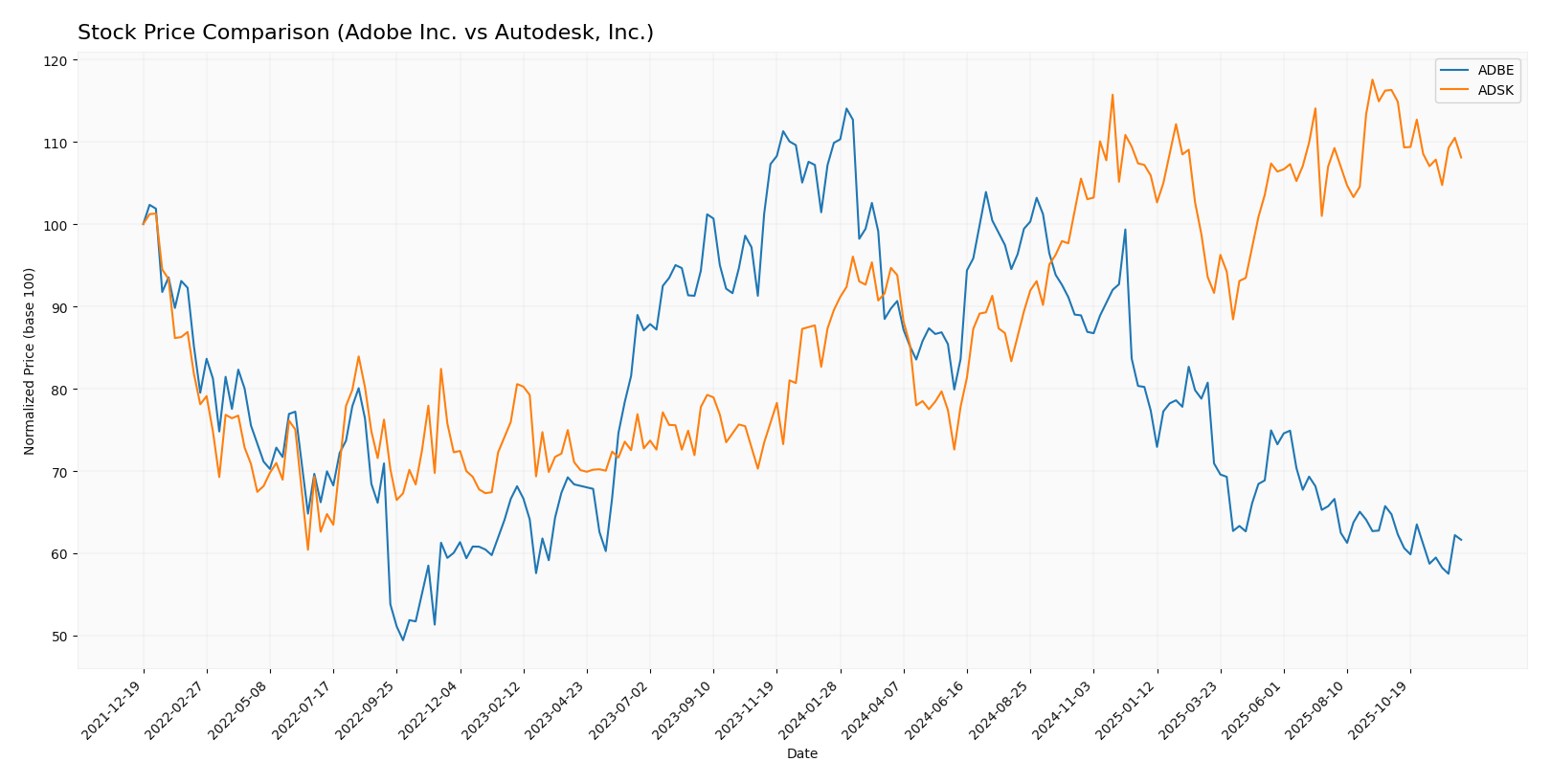

In this section, I will analyze the stock price movements and trading dynamics of Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK) over the past year, highlighting significant price fluctuations and trends.

Trend Analysis

Adobe Inc. (ADBE) Over the past year, ADBE’s stock price has experienced a significant decline, with a percentage change of -43.89%. This indicates a bearish trend. The stock has seen notable volatility, with a standard deviation of 83.29. The highest price recorded was 634.76, while the lowest was 320.13. The recent trend from September 28, 2025, to December 14, 2025, shows a further decline of -4.78%, reflecting an acceleration in the bearish trend.

Autodesk, Inc. (ADSK) In contrast, ADSK has demonstrated a positive performance over the past year with a percentage change of +20.7%, indicating a bullish trend. However, the trend has recently shown signs of deceleration. The highest price reached was 326.37, and the lowest was 201.6. From September 28, 2025, to December 14, 2025, the stock experienced a decline of -7.06%, suggesting a potential shift in momentum despite the overall bullish trend.

Analyst Opinions

Recent analyst recommendations show a strong inclination towards Adobe Inc. (ADBE), with a consensus rating of “Buy.” Analysts appreciate its robust return on equity and assets, noting a solid overall score of 4, particularly highlighted by its discounted cash flow score of 4. Conversely, Autodesk, Inc. (ADSK) holds a “Hold” rating with a score of 3. Analysts point out its strengths in return metrics but express concerns over its debt-to-equity ratio and price-to-earnings score. Thus, the consensus for ADBE is a clear buy, while ADSK is viewed more cautiously.

Stock Grades

I have gathered the latest stock grades from reputable grading companies for two companies: Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK). Here’s what the analysts are saying:

Adobe Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2025-12-09 |

| Citigroup | maintain | Neutral | 2025-12-04 |

| DA Davidson | maintain | Buy | 2025-11-20 |

| Mizuho | maintain | Outperform | 2025-11-20 |

| Wells Fargo | maintain | Overweight | 2025-11-20 |

| Morgan Stanley | downgrade | Equal Weight | 2025-09-24 |

| DA Davidson | maintain | Buy | 2025-09-12 |

| JMP Securities | maintain | Market Perform | 2025-09-12 |

| Evercore ISI Group | maintain | Outperform | 2025-09-12 |

| Piper Sandler | maintain | Overweight | 2025-09-12 |

Autodesk, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-26 |

| BMO Capital | maintain | Market Perform | 2025-11-26 |

| Wells Fargo | maintain | Overweight | 2025-11-26 |

| Deutsche Bank | upgrade | Buy | 2025-11-26 |

| Macquarie | maintain | Outperform | 2025-11-26 |

| B of A Securities | maintain | Neutral | 2025-11-26 |

| Barclays | maintain | Overweight | 2025-11-26 |

| Baird | maintain | Outperform | 2025-11-26 |

| Rosenblatt | maintain | Buy | 2025-11-24 |

| Baird | maintain | Outperform | 2025-11-18 |

Overall, the trend for both companies indicates a strong sentiment with multiple “Buy” and “Outperform” ratings, particularly for Autodesk, where several analysts have maintained their positive outlook. However, Adobe has seen a recent downgrade from Morgan Stanley, which may warrant caution for investors.

Target Prices

The consensus target prices from analysts indicate a strong outlook for both Adobe Inc. and Autodesk, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Adobe Inc. | 500 | 280 | 420 |

| Autodesk, Inc. | 400 | 343 | 373.4 |

Analysts expect Adobe Inc. to reach a consensus target price of 420, significantly higher than its current price of 343.13. Similarly, Autodesk, Inc. has a consensus target of 373.4, compared to its current price of 300.1, signaling potential upside in both stocks.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK).

| Criterion | Adobe Inc. (ADBE) | Autodesk, Inc. (ADSK) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (30%) | Moderate (18%) |

| Innovation | High | Moderate |

| Global presence | Wide | Moderate |

| Market Share | Strong | Growing |

| Debt level | Low | High |

Key takeaways: Adobe shows strong profitability and innovation, while Autodesk is expanding its market presence but carries a higher debt level. Diversification is more pronounced in Adobe’s business model, which mitigates risk effectively.

Risk Analysis

The following table outlines the key risks associated with Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK).

| Metric | Adobe Inc. | Autodesk, Inc. |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

Both companies face significant market and geopolitical risks due to fluctuating demand and trade tensions. Adobe’s strong market position may mitigate some risk, but Autodesk’s operational challenges could lead to greater volatility.

Which one to choose?

When comparing Adobe Inc. (ADBE) and Autodesk, Inc. (ADSK), Adobe shows stronger fundamentals with a net profit margin of 30% and a higher rating of “A” compared to Autodesk’s “B”. Adobe’s price-to-earnings ratio stands at 19.13, indicating a more attractive valuation relative to its earnings growth potential, while Autodesk’s ratio is significantly higher at approximately 60.51.

Recent stock trends highlight a bearish trajectory for Adobe, with a price drop of 43.89%, whereas Autodesk’s stock has experienced a bullish trend with a 20.7% increase, though it has also shown recent signs of deceleration.

For investors focused on growth and potential upside, I recommend Autodesk, while those who value stability and solid fundamentals may prefer Adobe. It’s crucial to consider risks such as market dependence and competition in the tech sector, which can impact both companies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Adobe Inc. and Autodesk, Inc. to enhance your investment decisions: