Investors seeking opportunities in the household and personal products sector often consider companies that blend innovation with market presence. Spectrum Brands Holdings, Inc. (SPB) and Acme United Corporation (ACU) both operate in this space, offering diverse product lines ranging from home care to safety and cutting tools. This comparison highlights their strategic approaches and market positions, helping you decide which stock could be the smarter addition to your portfolio. Let’s explore which company stands out for investors today.

Table of contents

Companies Overview

I will begin the comparison between Spectrum Brands Holdings, Inc. and Acme United Corporation by providing an overview of these two companies and their main differences.

Spectrum Brands Holdings, Inc. Overview

Spectrum Brands Holdings, Inc. operates globally as a branded consumer products company, focusing on three segments: Home and Personal Care, Global Pet Care, and Home and Garden. Its portfolio includes well-known brands like Black & Decker, Remington, and IAMS. The company sells through retailers, e-commerce, wholesalers, and distributors, positioning itself strongly in household and personal products markets worldwide.

Acme United Corporation Overview

Acme United Corporation supplies first aid, safety, cutting, sharpening, and measuring products primarily in the U.S., Canada, Europe, and other international markets. Key brands include Westcott, Clauss, and First Aid Only. The company serves diverse channels such as wholesale, retail, industrial, and e-commerce, focusing on school, home, office, hardware, and sporting goods sectors with a varied product range.

Key similarities and differences

Both companies operate in the household and personal products industry with diversified product lines and multiple distribution channels including e-commerce. Spectrum Brands has a broader global footprint and a wider brand portfolio spanning home care to pet products, whereas Acme United specializes more in first aid, safety, and cutting tools with a focus on North American and select international markets. Their scale and product segmentation differ, reflecting distinct market strategies.

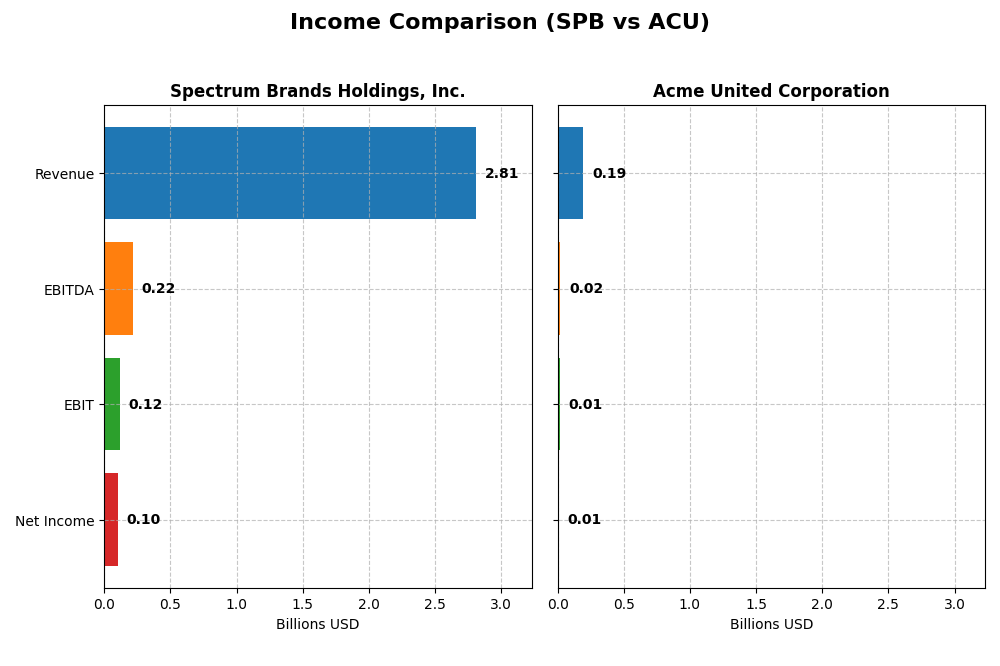

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Spectrum Brands Holdings, Inc. and Acme United Corporation for their most recent fiscal years.

| Metric | Spectrum Brands Holdings, Inc. (SPB) | Acme United Corporation (ACU) |

|---|---|---|

| Market Cap | 1.53B | 164M |

| Revenue | 2.81B | 194M |

| EBITDA | 215M | 20.4M |

| EBIT | 117M | 14.4M |

| Net Income | 100M | 10.0M |

| EPS | 3.88 | 2.71 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Spectrum Brands Holdings, Inc.

Spectrum Brands’ revenue and net income have declined over 2021–2025, with revenue dropping to $2.81B in 2025 and net income falling to $99.9M. Margins show mixed trends: a stable gross margin near 36.7% contrasts with a neutral EBIT margin of about 4.2%, while net margin remains low at 3.6%. The latest year reveals weakening growth and margin contraction, signaling unfavorable income dynamics.

Acme United Corporation

Acme United’s revenue rose modestly to $194.5M in 2024, alongside net income growth to $10M. Gross margin remains strong at 39.3%, with a neutral EBIT margin near 7.4%, and a favorable net margin of 5.15%. Despite a recent decline in EBIT and EPS, the overall period shows positive revenue and net income growth, reflecting a generally favorable income statement profile.

Which one has the stronger fundamentals?

Acme United demonstrates stronger fundamentals with favorable revenue and net income growth over the longer term, higher and stable gross and net margins, and a positive overall income statement evaluation. Spectrum Brands, by contrast, exhibits a declining income trend with multiple unfavorable growth metrics and pressure on profitability, resulting in an overall unfavorable income statement outlook.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Spectrum Brands Holdings, Inc. (SPB) and Acme United Corporation (ACU) based on their latest fiscal year data.

| Ratios | Spectrum Brands Holdings, Inc. (2025) | Acme United Corporation (2024) |

|---|---|---|

| ROE | 5.2% | 9.4% |

| ROIC | 4.9% | 8.2% |

| P/E | 13.5 | 13.8 |

| P/B | 0.71 | 1.29 |

| Current Ratio | 2.26 | 4.17 |

| Quick Ratio | 1.41 | 1.71 |

| D/E (Debt-to-Equity) | 0.34 | 0.31 |

| Debt-to-Assets | 19.4% | 20.3% |

| Interest Coverage | 4.16 | 6.79 |

| Asset Turnover | 0.83 | 1.20 |

| Fixed Asset Turnover | 8.55 | 5.33 |

| Payout Ratio | 48.2% | 22.2% |

| Dividend Yield | 3.57% | 1.61% |

Interpretation of the Ratios

Spectrum Brands Holdings, Inc.

Spectrum Brands shows a favorable overall ratio profile with 64% favorable metrics, including a strong current ratio of 2.26 and low debt ratios, indicating solid liquidity and manageable leverage. However, profitability ratios like ROE (5.23%) and net margin (3.56%) are unfavorable, suggesting limited profit efficiency. The company pays dividends with a 3.57% yield, supported by a reasonable payout ratio, but free cash flow coverage is weak, posing potential sustainability risks.

Acme United Corporation

Acme United also has 64% favorable ratios, highlighting strong asset turnover (1.2) and interest coverage (6.9), signaling operational efficiency and comfortable debt servicing. Its current ratio is high (4.17) but considered unfavorable, possibly due to excessive current assets. Profitability indicators are mixed with a neutral net margin (5.15%) and unfavorable ROE (9.37%). The dividend yield is moderate at 1.61%, reflecting cautious shareholder returns.

Which one has the best ratios?

Both companies present a comparable share of favorable ratios (64%), yet Spectrum Brands has stronger liquidity and lower leverage risks, while Acme United demonstrates better operational efficiency and interest coverage. Spectrum Brands’ weaker profitability contrasts with Acme United’s mixed margins and less conservative current ratio. The choice depends on the investor’s focus on liquidity versus operational metrics.

Strategic Positioning

This section compares the strategic positioning of Spectrum Brands Holdings, Inc. and Acme United Corporation in terms of Market position, Key segments, and Exposure to technological disruption:

Spectrum Brands Holdings, Inc.

- Established global player in household & personal products with NYSE listing, facing moderate competition.

- Diversified segments: Home & Personal Care, Global Pet Care, Home & Garden, driving revenue across multiple categories.

- Limited explicit mention of technological disruption exposure in the data provided.

Acme United Corporation

- Smaller market cap company in household & personal products on AMEX, with niche competitive pressures.

- Focused on first aid, cutting, sharpening, measuring products mainly in school, office, and industrial markets.

- No explicit indication of technological disruption exposure in the available information.

Spectrum Brands Holdings, Inc. vs Acme United Corporation Positioning

Spectrum Brands demonstrates a diversified business model across multiple consumer product segments, supporting varied revenue streams. Acme United maintains a more concentrated product focus within school and safety supplies, which may limit market breadth but provides specialization advantages.

Which has the best competitive advantage?

Both companies are rated slightly unfavorable in MOAT evaluation. Spectrum Brands shows growing ROIC despite value destruction, while Acme United experiences declining ROIC and unprofitable capital use, indicating Spectrum Brands may have a marginally stronger competitive position.

Stock Comparison

The stock price movements of Spectrum Brands Holdings, Inc. (SPB) and Acme United Corporation (ACU) over the past year reveal contrasting dynamics, with both experiencing notable declines followed by recent rebounds in trading activity and price momentum.

Trend Analysis

Spectrum Brands Holdings, Inc. (SPB) exhibited a bearish trend over the past 12 months, with a price decline of 20.57%. The trend showed acceleration and high volatility, ranging from a low of 50.35 to a high of 94.88. Recently, from November 2025 to January 2026, SPB’s price increased by 17.3%, indicating a short-term bullish reversal.

Acme United Corporation (ACU) also experienced a bearish trend over the same 12-month period, with a price drop of 13.65%. The stock showed accelerating decline but with lower volatility than SPB. In the recent period, ACU’s price rose by 13.13%, suggesting a moderate short-term recovery.

Comparing both stocks, SPB delivered the largest overall price decline but the strongest recent rebound, while ACU showed a smaller decline and a less pronounced recent price increase. SPB’s market performance remains more volatile and dynamic than ACU’s.

Target Prices

The consensus target price for Spectrum Brands Holdings, Inc. reflects a strong positive outlook.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Spectrum Brands Holdings, Inc. | 75 | 75 | 75 |

Analysts expect Spectrum Brands’ stock to reach $75, implying approximately 18.7% upside from the current $63.2 price. No verified target price data is available for Acme United Corporation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Spectrum Brands Holdings, Inc. (SPB) and Acme United Corporation (ACU):

Rating Comparison

SPB Rating

- Rating: B, considered very favorable overall by analysts.

- Discounted Cash Flow Score: 1, indicating a very unfavorable valuation.

- ROE Score: 2, showing moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 3, moderate financial risk exposure.

- Overall Score: 3, reflecting a moderate financial standing overall.

ACU Rating

- Rating: B, also considered very favorable overall by analysts.

- Discounted Cash Flow Score: 3, reflecting a moderate valuation.

- ROE Score: 3, indicating a moderate but slightly better profitability.

- ROA Score: 3, moderate effectiveness in asset utilization, same as SPB.

- Debt To Equity Score: 3, also moderate financial risk, matching SPB’s score.

- Overall Score: 3, similarly moderate overall financial standing.

Which one is the best rated?

Both SPB and ACU share the same overall rating of B and identical overall scores, reflecting moderate financial standing. ACU scores better on discounted cash flow and return on equity, while SPB has a higher price-to-book score not shown here. Based on provided scores, ACU is slightly better rated on key profitability and valuation metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

SPB Scores

- Altman Z-Score: 1.77, in the distress zone, high risk of bankruptcy

- Piotroski Score: 6, average financial strength

ACU Scores

- Altman Z-Score: 4.12, in the safe zone, low bankruptcy risk

- Piotroski Score: 7, strong financial strength

Which company has the best scores?

Based on the provided data, ACU shows better scores with a safer Altman Z-Score and a stronger Piotroski Score compared to SPB, which is in financial distress with average Piotroski results.

Grades Comparison

Here is a comparison of the recent grades assigned to Spectrum Brands Holdings, Inc. and Acme United Corporation by recognized grading companies:

Spectrum Brands Holdings, Inc. Grades

The table below summarizes recent grades from major financial institutions for Spectrum Brands Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2025-11-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

| Canaccord Genuity | Maintain | Buy | 2025-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-09 |

| Canaccord Genuity | Maintain | Buy | 2025-06-25 |

| UBS | Maintain | Buy | 2025-05-09 |

| UBS | Maintain | Buy | 2025-04-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-16 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-02 |

Overall, Spectrum Brands Holdings maintains consistent buy and equal weight ratings with no recent downgrades, indicating stable analyst confidence.

Acme United Corporation Grades

The table below shows the most recent available grade for Acme United Corporation from a recognized grading firm.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2016-07-01 |

Acme United Corporation has only one grade from 2016, showing limited recent analyst coverage.

Which company has the best grades?

Spectrum Brands Holdings, Inc. exhibits a broader and more current range of buy and hold ratings from multiple reputable firms, whereas Acme United Corporation has only an older buy rating. This suggests Spectrum Brands has more active analyst attention, which may provide investors with more up-to-date insights.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Spectrum Brands Holdings, Inc. (SPB) and Acme United Corporation (ACU) based on the most recent data:

| Criterion | Spectrum Brands Holdings, Inc. (SPB) | Acme United Corporation (ACU) |

|---|---|---|

| Diversification | Highly diversified with strong segments in Global Pet Supplies (1.08B), Home & Personal Care (1.15B), and Home & Garden (573M) | More concentrated product line focused on Product A (75M) and Product B (119M) |

| Profitability | Low net margin (3.56%), ROIC (4.95%) below WACC (5.45%), indicating value destruction though improving | Moderate net margin (5.15%), ROIC (8.16%) above WACC (6.95%), but showing declining profitability trend |

| Innovation | Moderate innovation with steady ROIC growth but overall slightly unfavorable moat status | Innovation appears limited with declining ROIC trend and slight value destruction |

| Global presence | Strong global presence especially in pet supplies and home care markets | Regional focus mainly in North America and Europe with smaller scale revenues |

| Market Share | Significant market share in multiple consumer segments due to diversified portfolio | Smaller market share with niche positioning and less diversification |

Key takeaways: Spectrum Brands offers broad diversification and solid global footprint but currently struggles with profitability and value creation. Acme United shows better profitability ratios but faces challenges with declining returns and limited diversification. Both companies require caution, with SPB improving profitability and ACU needing to address its shrinking returns.

Risk Analysis

Below is a comparative table summarizing key risk factors for Spectrum Brands Holdings, Inc. (SPB) and Acme United Corporation (ACU) based on the most recent data available:

| Metric | Spectrum Brands Holdings, Inc. (SPB) | Acme United Corporation (ACU) |

|---|---|---|

| Market Risk | Moderate (Beta 0.68, stable sector) | Moderate (Beta 0.74, niche market) |

| Debt Level | Low (Debt-to-Equity 0.34, favorable) | Low (Debt-to-Equity 0.31, favorable) |

| Regulatory Risk | Moderate (Consumer products sector) | Moderate (Safety & first aid products) |

| Operational Risk | Moderate (Diverse product lines) | Low (Focused product range) |

| Environmental Risk | Moderate (Household chemicals, pest control) | Low (Less environmentally sensitive products) |

| Geopolitical Risk | Low (Primarily US market) | Low (Primarily US market) |

The most impactful and likely risks are market fluctuations and regulatory pressures for both companies. Spectrum Brands faces moderate operational and environmental risks due to its broader product portfolio involving pesticides and chemicals, while Acme United’s focused niche reduces operational and environmental exposures. Both maintain low debt levels, supporting financial stability.

Which Stock to Choose?

Spectrum Brands Holdings, Inc. (SPB) shows a declining income trend with unfavorable overall income statement growth but maintains a favorable global financial ratios evaluation at 64%, supported by a moderate debt level and a strong rating of B. The company’s profitability is low with ROE at 5.23%, and it is shedding value as ROIC remains below WACC, despite a growing ROIC trend.

Acme United Corporation (ACU) presents a favorable income statement evaluation marked by positive revenue and net income growth over the period, alongside a favorable global ratios score of 64%, with moderate debt and a strong B rating. Profitability is moderate with an ROE at 9.37%, yet the company is also slightly unfavorable in value creation due to ROIC below WACC and a declining ROIC trend.

Investors focused on value and financial stability might find SPB’s improving profitability and favorable financial ratios suggestive, while those with a growth orientation could view ACU’s positive income growth and strong ratios as indicative of potential, despite its declining profitability trend. The choice may appear to depend on an investor’s tolerance for risk and preference for income stability versus growth prospects.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Spectrum Brands Holdings, Inc. and Acme United Corporation to enhance your investment decisions: