Home > Comparison > Consumer Defensive > IPAR vs ACU

The strategic rivalry between Inter Parfums, Inc. and Acme United Corporation shapes the competitive landscape of the household and personal products sector. Inter Parfums operates as a luxury fragrance manufacturer with a global distribution network, while Acme United focuses on practical cutting and safety tools for diverse markets. This analysis explores their contrasting operational models to identify which offers a superior risk-adjusted return for a diversified investor portfolio.

Table of contents

Companies Overview

Inter Parfums and Acme United both hold pivotal roles in the household and personal products market in the US.

Inter Parfums, Inc.: Fragrance Powerhouse

Inter Parfums dominates the luxury fragrance segment with a portfolio boasting brands like Jimmy Choo and Coach. Its core revenue engine derives from manufacturing and distributing premium fragrances across department stores, specialty retailers, and e-commerce. In 2026, the company emphasizes expanding international reach while leveraging brand licensing to strengthen its competitive edge.

Acme United Corporation: Essential Tools Provider

Acme United leads in supplying first aid, cutting, and safety products to diverse markets including schools and industrials. The company’s revenue engine relies on direct and wholesale sales of branded tools like Westcott and Clauss. Its 2026 strategy focuses on broadening product lines and enhancing e-commerce to capture incremental market share amid evolving customer needs.

Strategic Collision: Similarities & Divergences

Both companies operate in consumer defensive sectors but diverge sharply in business philosophy. Inter Parfums pursues a luxury brand ecosystem while Acme United opts for broad-based, practical product diversity. Their primary battleground is retail distribution channels where brand prestige meets functional utility. These differences create distinct investment profiles: one driven by brand exclusivity, the other by product breadth and steady demand.

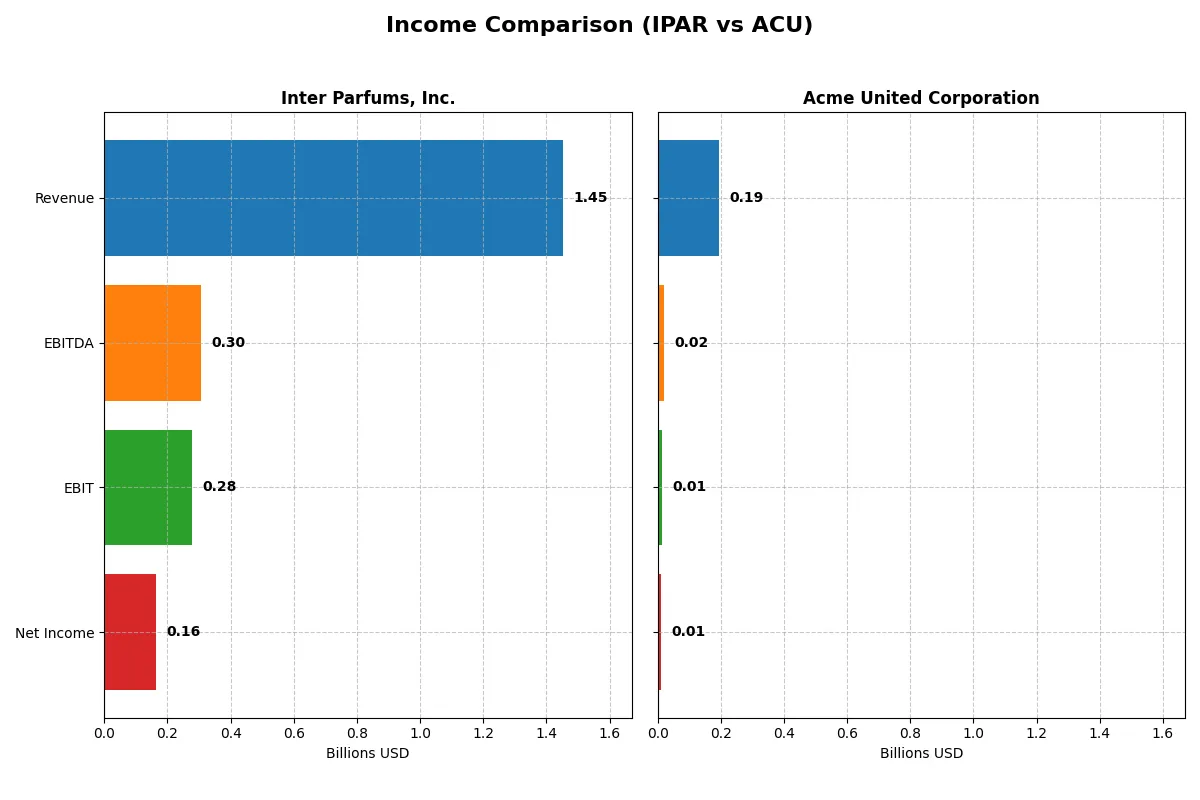

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Inter Parfums, Inc. (IPAR) | Acme United Corporation (ACU) |

|---|---|---|

| Revenue | 1.45B | 194.5M |

| Cost of Revenue | 525M | 118.1M |

| Operating Expenses | 653M | 62.2M |

| Gross Profit | 927M | 76.4M |

| EBITDA | 305M | 20.4M |

| EBIT | 276M | 14.4M |

| Interest Expense | 7.8M | 2.1M |

| Net Income | 164M | 10.0M |

| EPS | 5.13 | 2.71 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals each company’s true operational efficiency and profitability over recent years.

Inter Parfums, Inc. Analysis

Inter Parfums demonstrates robust revenue growth from $539M in 2020 to $1.45B in 2024. Net income surged from $38M to $164M, reflecting strong earnings momentum. The gross margin remains healthy at 63.85%, while the net margin stands at 11.32%. Despite a slight dip in net margin growth last year, overall profitability and EPS show consistent upward trends, signaling operational strength.

Acme United Corporation Analysis

Acme United’s revenue grew modestly from $164M in 2020 to $194M in 2024, with net income increasing from $8M to $10M. Gross margin holds at a lean 39.26%, and net margin at 5.15%. However, the latest year saw declines in EBIT (-44%) and net margin (-44%), indicating pressure on profitability despite stable revenue. Margin compression and EPS weakness reflect challenges in cost control or pricing power.

Margin Strength vs. Revenue Scale

Inter Parfums outperforms Acme United with superior revenue scale and stronger profitability metrics. IPAR’s high gross and net margins highlight operational efficiency, while ACU struggles with compressed margins and declining earnings last year. Investors favor IPAR’s growth and margin profile for a more resilient and scalable business model.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these companies:

| Ratios | Inter Parfums, Inc. (IPAR) | Acme United Corporation (ACU) |

|---|---|---|

| ROE | 22.1% | 9.4% |

| ROIC | 18.4% | 8.2% |

| P/E | 25.6 | 13.8 |

| P/B | 5.66 | 1.29 |

| Current Ratio | 2.75 | 4.17 |

| Quick Ratio | 1.63 | 1.71 |

| D/E | 0.26 | 0.31 |

| Debt-to-Assets | 13.6% | 20.3% |

| Interest Coverage | 35.1 | 6.79 |

| Asset Turnover | 1.03 | 1.20 |

| Fixed Asset Turnover | 8.14 | 5.33 |

| Payout Ratio | 58.4% | 22.2% |

| Dividend Yield | 2.28% | 1.61% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and strengths in profitability, valuation, and operational efficiency.

Inter Parfums, Inc.

Inter Parfums delivers robust profitability with a 22.07% ROE and an 11.32% net margin, signaling operational strength. The stock trades at a stretched 25.63 P/E and a high 5.66 P/B ratio, suggesting premium valuation. It rewards shareholders with a solid 2.28% dividend yield, reflecting steady cash return alongside disciplined capital allocation.

Acme United Corporation

Acme United posts a modest 9.37% ROE and 5.15% net margin, indicating moderate profitability. Its valuation appears attractive with a 13.78 P/E and a 1.29 P/B ratio, showing undervaluation relative to peers. The 1.61% dividend yield is moderate, balancing shareholder returns with reinvestment to support future growth and operational improvements.

Premium Valuation vs. Operational Safety

Inter Parfums commands a premium valuation justified by superior profitability and reliable dividends, while Acme United offers a more conservative valuation with lower profitability. Investors seeking growth paired with income may prefer Inter Parfums. Those prioritizing valuation safety and reinvestment might find Acme United’s profile more fitting.

Which one offers the Superior Shareholder Reward?

I see Inter Parfums, Inc. (IPAR) pays a higher dividend yield at 2.28% with a 58.4% payout, supported by strong free cash flow coverage near 1.87x. Its buybacks are consistent but moderate. Acme United Corporation (ACU) yields 1.61% with a lower 22.2% payout ratio and weaker free cash flow coverage at 1.28x, yet its buybacks and reinvestment into growth appear more aggressive. Historically, IPAR’s distribution model combines yield and cash flow safety better, offering a more sustainable total return. I conclude IPAR provides the superior shareholder reward in 2026 due to balanced dividends and buybacks underpinned by robust cash flow.

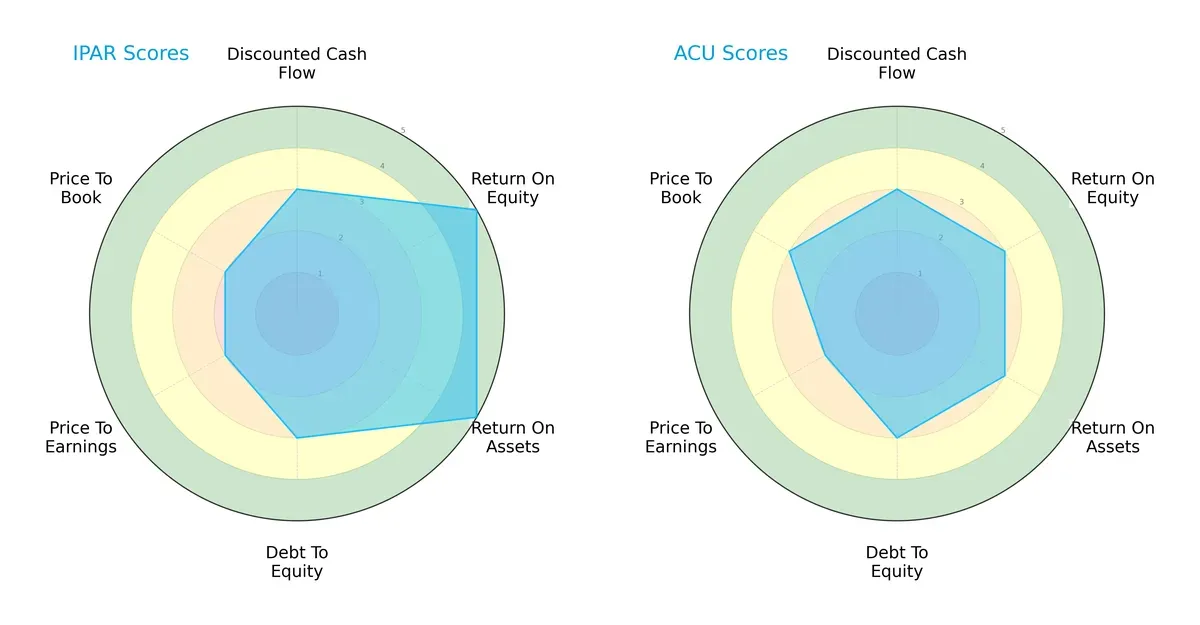

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Inter Parfums, Inc. and Acme United Corporation, highlighting their core financial strengths and weaknesses:

Inter Parfums leads with superior profitability metrics, scoring 5 in both ROE and ROA, indicating efficient capital and asset utilization. Acme United maintains a more moderate but consistent profile, with all scores clustering around 3, reflecting balanced but less pronounced strengths. IPAR’s lower valuation scores (PE and PB at 2) suggest potential overvaluation risks, whereas ACU’s higher price-to-book score (3) hints at better value. Overall, IPAR relies on a profitability edge, while ACU offers a steadier, diversified financial stance.

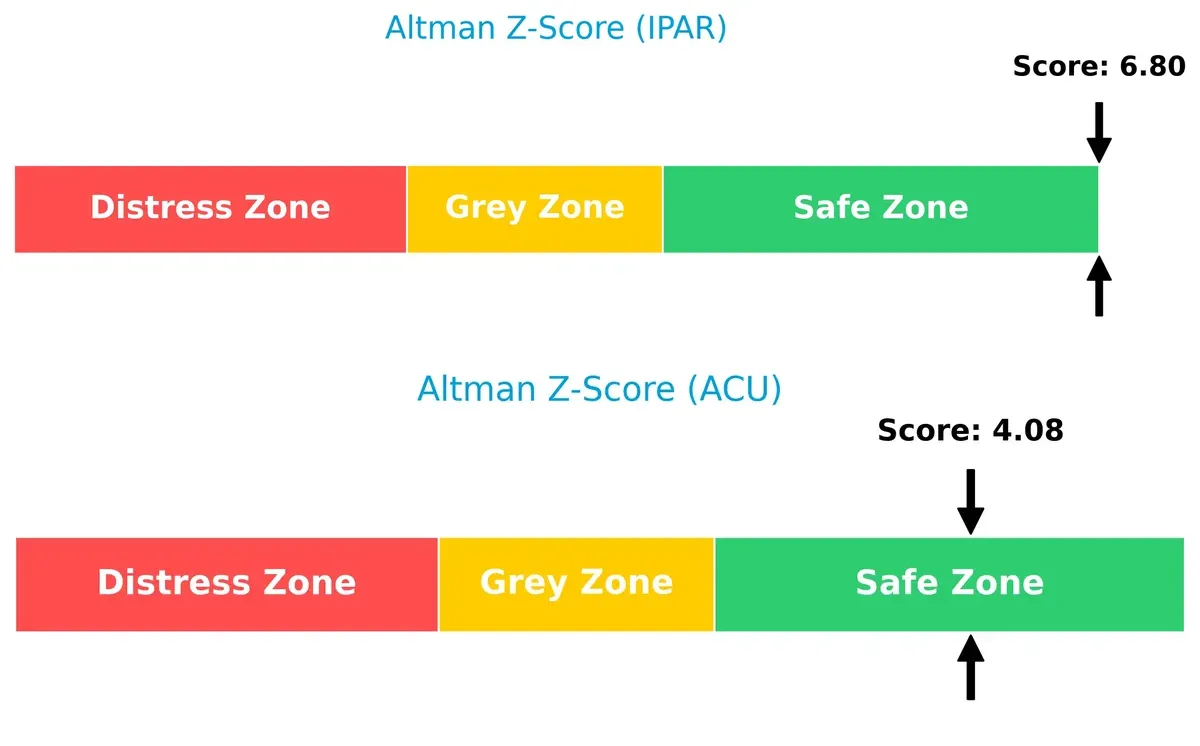

Bankruptcy Risk: Solvency Showdown

Inter Parfums posts a significantly higher Altman Z-Score (6.8) compared to Acme United’s 4.1, both well within the safe zone. This gap implies IPAR enjoys a stronger buffer against insolvency in volatile market cycles:

Financial Health: Quality of Operations

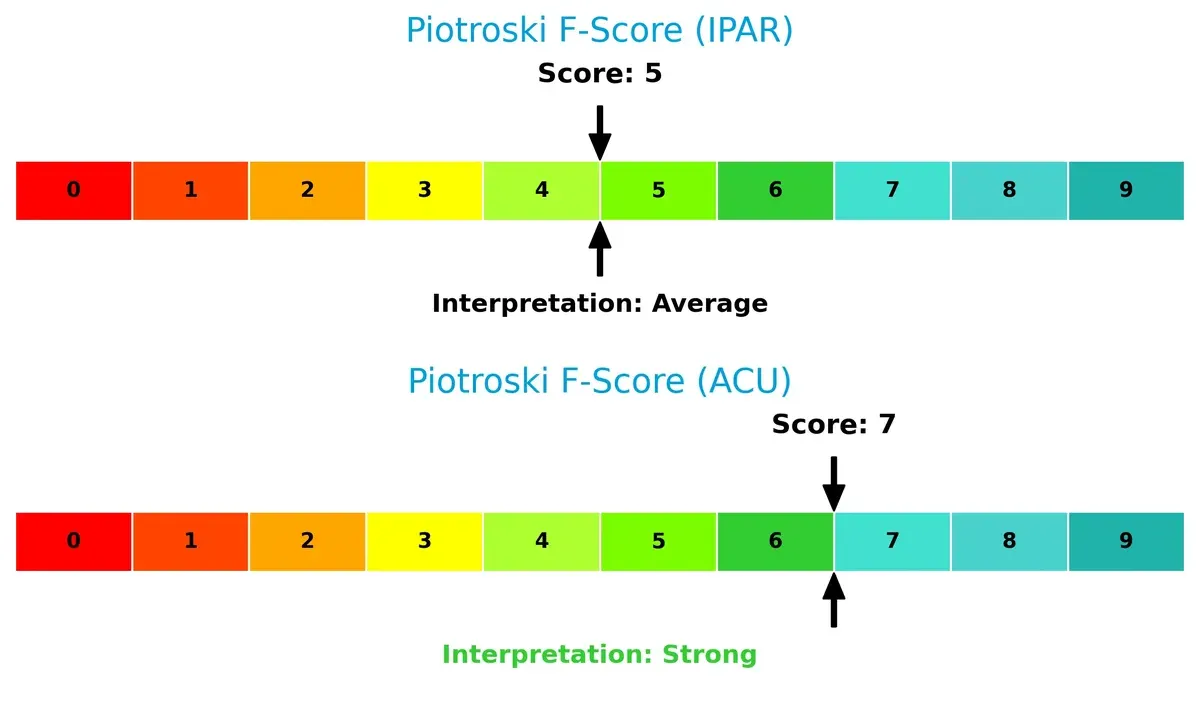

Acme United’s Piotroski F-Score of 7 surpasses Inter Parfums’ 5, signaling stronger internal financial controls and operational quality. IPAR’s lower score raises caution on some internal metrics relative to ACU’s robust standing:

How are the two companies positioned?

This section dissects the operational DNA of IPAR and ACU by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

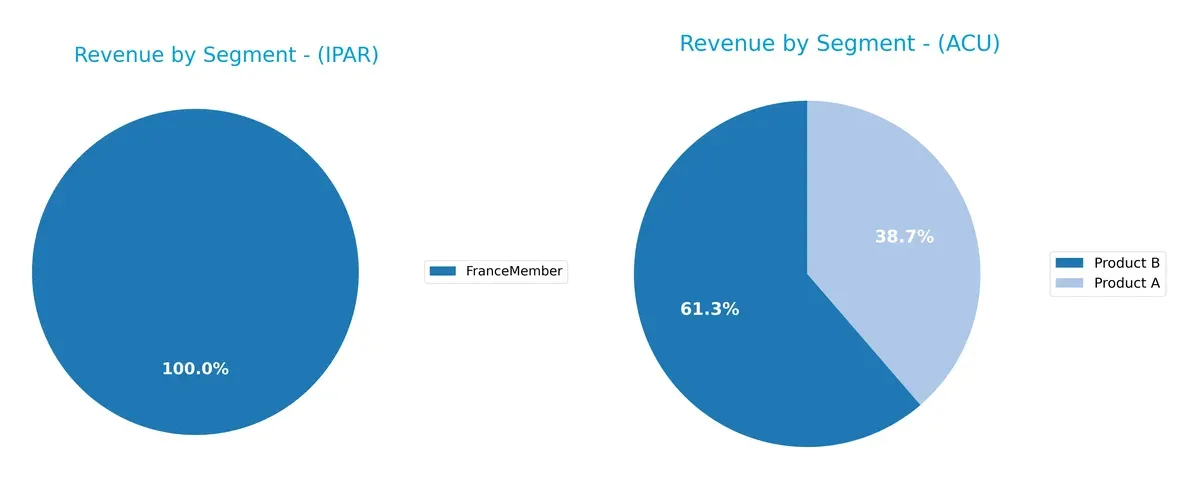

The following visual comparison dissects how Inter Parfums and Acme United diversify their income streams and where their primary sector bets lie:

Inter Parfums relies heavily on a single segment, FranceMember, generating $37.6M in 2020, signaling concentration risk. Acme United presents a diversified profile with Product A and Product B revenues exceeding $75M and $119M in 2024, respectively. Acme’s balanced mix anchors its resilience, while Inter Parfums’ narrow focus exposes it to market fluctuations in one region, limiting ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Inter Parfums, Inc. and Acme United Corporation:

Inter Parfums, Inc. Strengths

- Strong profitability with 11.32% net margin

- High ROE at 22.07% and ROIC at 18.35%

- Robust liquidity ratios including 2.75 current ratio

- Low debt levels with 0.26 debt/equity and 13.62% debt/assets

- High asset turnover ratios

- Global presence with diversified geographic revenue streams

Acme United Corporation Strengths

- Favorable valuation metrics with PE of 13.78 and PB of 1.29

- Solid asset turnover at 1.2

- Good interest coverage and manageable debt ratios

- Diverse revenue from multiple products

- Presence in North America, Europe, and Canada markets

Inter Parfums, Inc. Weaknesses

- Unfavorable valuation multiples with PE 25.63 and PB 5.66

- Reliance on North American and European markets may limit diversification

- Neutral WACC suggests moderate capital cost efficiency

Acme United Corporation Weaknesses

- Weaker profitability metrics: 5.15% net margin and 9.37% ROE

- Current ratio at 4.17 flagged unfavorable, possibly indicating inefficient asset use

- Limited global diversification compared to IPAR

Inter Parfums demonstrates superior profitability and financial health but faces valuation headwinds. Acme United shows strength in valuation and product diversity but lags in profitability and geographic reach. These contrasts shape distinct strategic priorities for each company.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s examine how these two firms defend their turf:

Inter Parfums, Inc.: Intangible Assets Powerhouse

Inter Parfums leverages strong brand portfolios and licensing agreements as its moat. This delivers a high ROIC 9% above WACC and stable 19% EBIT margins. Expansion into emerging markets in 2026 could deepen its intangible asset moat, but rising competition in luxury fragrances poses risks.

Acme United Corporation: Cost Advantage Challenger

Acme United relies on cost efficiency and diversified product lines, contrasting IPAR’s brand moat. However, its ROIC hovers near WACC with a declining trend, reflecting weaker capital efficiency. Opportunities exist in expanding safety products, but margin pressures and flat revenue growth limit moat durability.

Intangibles vs. Cost Efficiency: Who Holds the Stronger Moat?

Inter Parfums’ intangible asset moat is wider and more durable, evidenced by growing ROIC and margin stability over five years. Acme United’s cost advantage is narrower and eroding, with declining profitability signals. IPAR appears better equipped to defend and expand its market share in 2026.

Which stock offers better returns?

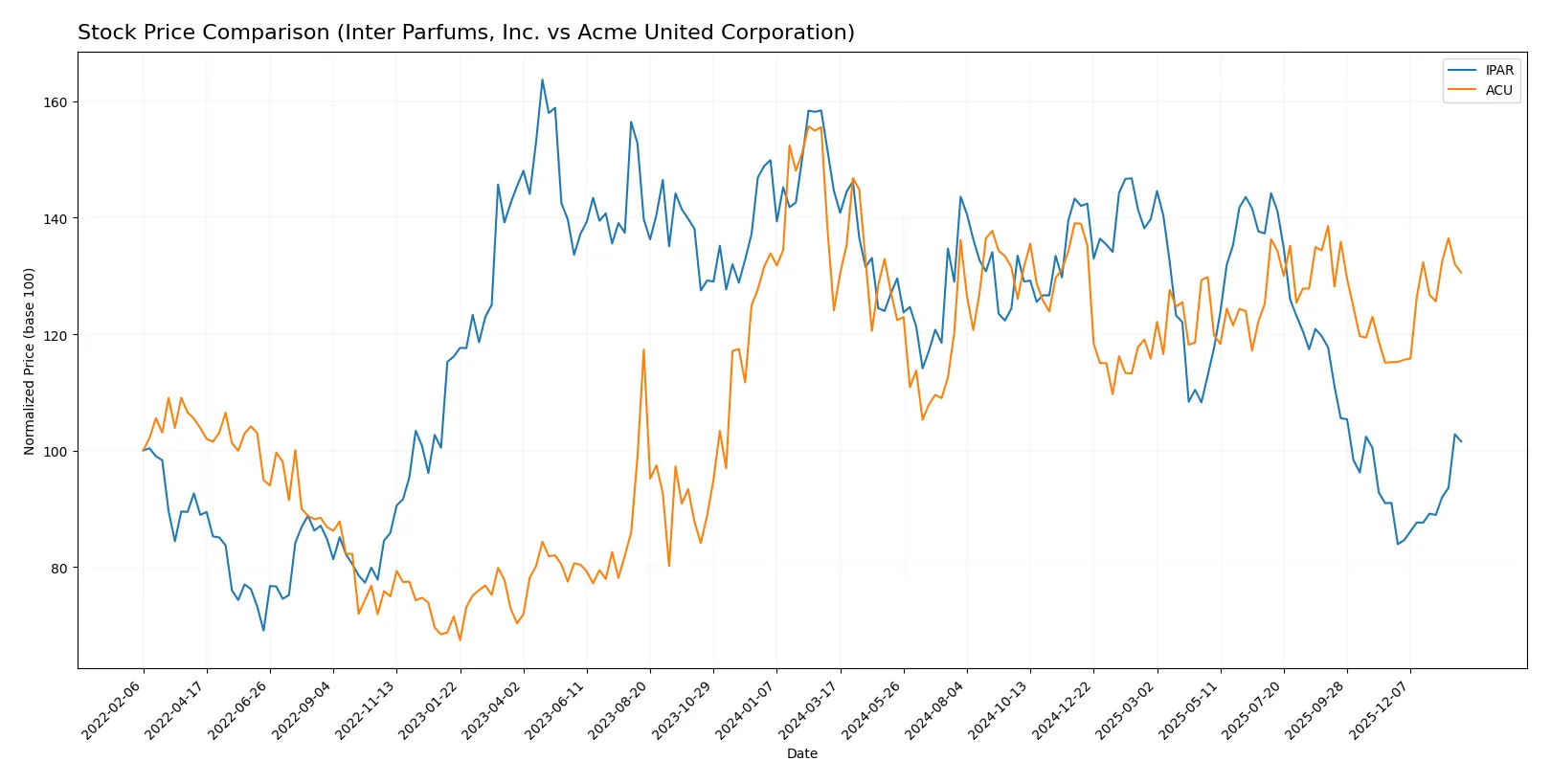

The past year featured divergent price paths: Inter Parfums, Inc. declined sharply but showed recent recovery, while Acme United Corporation exhibited steady gains with accelerating momentum.

Trend Comparison

Inter Parfums, Inc. endured a bearish trend with a -29.78% price decline over 12 months, marked by accelerating losses and significant volatility (16.83 std dev). Recently, it reversed course, gaining 11.6%.

Acme United Corporation posted a bullish 5.21% gain in the same period, showing acceleration and low volatility (2.76 std dev). Its recent 13.34% rise confirms sustained positive momentum.

Acme United outperformed Inter Parfums over the year, delivering the highest market returns despite Inter Parfums’ short-term rebound.

Target Prices

Inter Parfums, Inc. shows a solid target consensus, reflecting analyst confidence in its growth potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Inter Parfums, Inc. | 103 | 112 | 107.5 |

Analysts expect Inter Parfums’ stock to appreciate roughly 10% from its current 97.57 price, signaling strong upside potential. No verified target price data is available for Acme United Corporation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables show the latest institutional grades for Inter Parfums, Inc. and Acme United Corporation:

Inter Parfums, Inc. Grades

This table summarizes recent grades from reputable financial firms covering Inter Parfums, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Maintain | Neutral | 2026-01-29 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

Acme United Corporation Grades

This table shows the only available institutional grade for Acme United Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2016-07-01 |

Which company has the best grades?

Inter Parfums, Inc. has a broader and more recent set of grades, mostly Buy and Overweight, reflecting stronger and current institutional support. Acme United Corporation’s single, dated Buy rating limits insight into its recent performance. This disparity may affect investor confidence and decision-making.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Inter Parfums, Inc.

- Faces intense competition in luxury fragrances with premium brand positioning but strong brand loyalty.

Acme United Corporation

- Operates in a fragmented market for household and safety products, competing on price and innovation to maintain share.

2. Capital Structure & Debt

Inter Parfums, Inc.

- Maintains low debt-to-equity (0.26) and strong interest coverage (35.3), signaling robust capital structure.

Acme United Corporation

- Slightly higher leverage (0.31 D/E) but still manageable with decent interest coverage (6.9).

3. Stock Volatility

Inter Parfums, Inc.

- Beta of 1.243 indicates above-market volatility, reflecting luxury sector sensitivity to economic cycles.

Acme United Corporation

- Beta of 0.74 shows lower volatility, benefiting from defensive product lines and stable demand.

4. Regulatory & Legal

Inter Parfums, Inc.

- Subject to global cosmetic regulations and intellectual property risks in brand licensing.

Acme United Corporation

- Faces compliance risks related to product safety standards and international distribution regulations.

5. Supply Chain & Operations

Inter Parfums, Inc.

- Relies on complex global supply chains vulnerable to disruptions affecting raw materials for fragrances.

Acme United Corporation

- Supply chain risks mitigated by diverse product lines and regional supplier base but exposed to component shortages.

6. ESG & Climate Transition

Inter Parfums, Inc.

- Increasing pressure to adopt sustainable sourcing and reduce carbon footprint in luxury packaging.

Acme United Corporation

- Faces challenges integrating ESG practices in manufacturing and product materials with potential cost implications.

7. Geopolitical Exposure

Inter Parfums, Inc.

- Exposure to geopolitical tensions impacting international sales, especially in European and Asian markets.

Acme United Corporation

- Limited geopolitical risk with more US-centric operations but sensitive to trade policies and tariffs.

Which company shows a better risk-adjusted profile?

Inter Parfums’ greatest risk lies in market competition and luxury sector cyclicality, heightened by stock volatility. Acme United’s most significant risk centers on supply chain and regulatory compliance amid modest financial leverage. Inter Parfums demonstrates a stronger capital structure and profitability but faces higher market sensitivity. Acme’s lower volatility and favorable valuation metrics suggest a steadier risk-adjusted profile. Recent data shows Inter Parfums’ superior interest coverage (35.3 vs. 6.9) underscores its financial resilience despite cyclical headwinds.

Final Verdict: Which stock to choose?

Inter Parfums, Inc. (IPAR) excels as a cash-generating powerhouse with a durable competitive advantage. Its growing ROIC signals efficient capital deployment and value creation. A point of vigilance lies in its premium valuation, which may pressure returns. IPAR suits portfolios targeting aggressive growth with a tolerance for valuation risk.

Acme United Corporation (ACU) offers a strategic moat anchored in steady asset utilization and a strong balance sheet. Its lower valuation multiples provide a margin of safety relative to IPAR. ACU fits well in Growth at a Reasonable Price (GARP) portfolios focused on stability and moderate expansion.

If you prioritize rapid value creation and can weather valuation premiums, IPAR outshines with its proven capital efficiency and momentum. However, if you seek better stability and valuation discipline, ACU offers a safer profile with consistent financial health. Both represent distinct investor archetypes rather than a clear-cut winner.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Inter Parfums, Inc. and Acme United Corporation to enhance your investment decisions: