Home > Comparison > Technology > ACN vs LDOS

The strategic rivalry between Accenture plc and Leidos Holdings, Inc. defines the current trajectory of the Technology sector. Accenture excels as a global professional services powerhouse, delivering broad digital transformation and consulting. Leidos operates as a specialized defense and civil IT solutions provider, focusing on national security and health markets. This analysis weighs their contrasting operational models to identify which corporate trajectory offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Accenture plc and Leidos Holdings, Inc. each play pivotal roles in the technology services market with distinct strategic priorities and client bases.

Accenture plc: Global Technology Consulting Powerhouse

Accenture commands a leading market position in technology services worldwide. It generates revenue primarily through strategy consulting, application services, intelligent automation, and cybersecurity. In 2026, Accenture focuses on digital transformation, cloud infrastructure, and advanced AI-driven innovation to sustain its competitive edge across industries.

Leidos Holdings, Inc.: Defense and Intelligence Systems Specialist

Leidos operates as a critical service provider in the defense, intelligence, and health sectors, emphasizing national security solutions. Its core revenue stems from defense systems integration, cybersecurity, and health IT services. In 2026, Leidos prioritizes expanding mission-critical technology platforms and enhancing cloud and data analytics capabilities for government and commercial clients.

Strategic Collision: Similarities & Divergences

Accenture and Leidos both thrive in technology services but diverge sharply in market focus—Accenture pursues broad digital transformation, while Leidos zeroes in on defense and health sectors. Their battleground centers on government and enterprise IT modernization projects. Investors face contrasting profiles: Accenture offers scale and diversification; Leidos delivers specialized, government-driven stability with niche complexity.

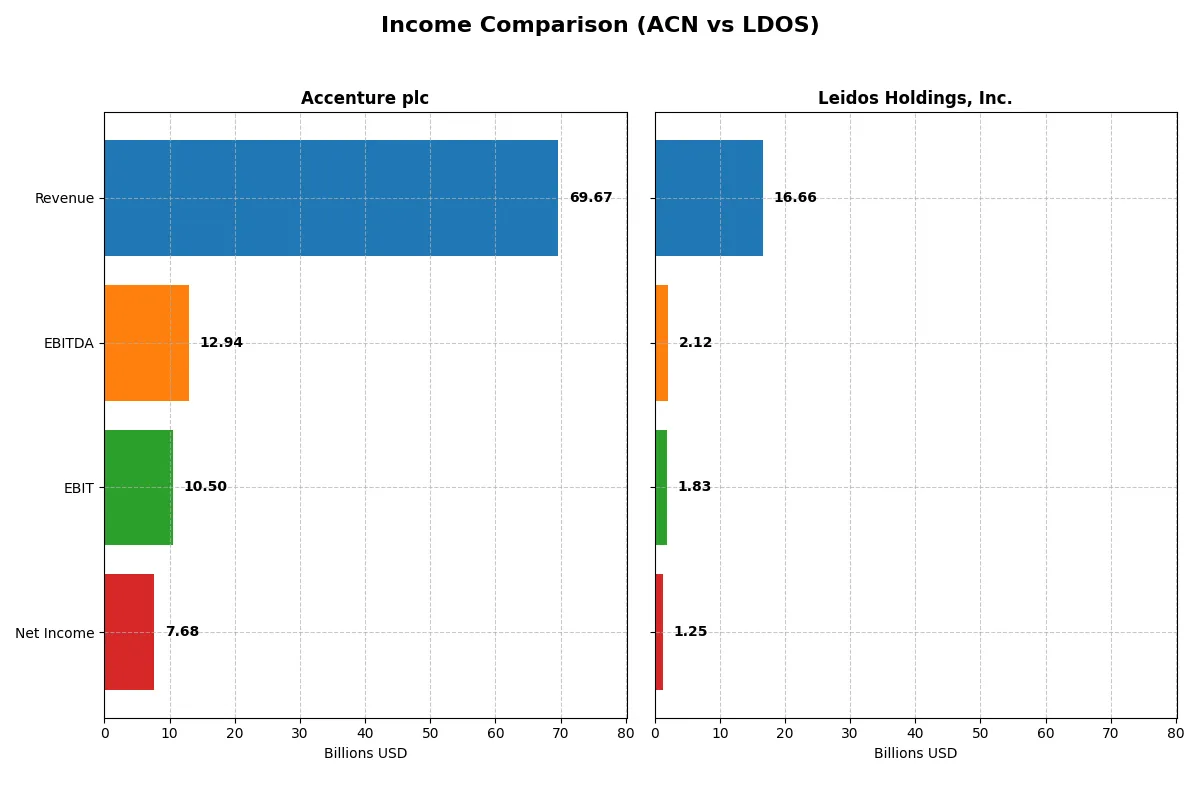

Income Statement Comparison

This table dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Accenture plc (ACN) | Leidos Holdings, Inc. (LDOS) |

|---|---|---|

| Revenue | 69.7B | 16.7B |

| Cost of Revenue | 47.4B | 13.9B |

| Operating Expenses | 12.0B | 971M |

| Gross Profit | 22.2B | 2.8B |

| EBITDA | 12.9B | 2.1B |

| EBIT | 10.5B | 1.8B |

| Interest Expense | 229M | 193M |

| Net Income | 7.7B | 1.3B |

| EPS | 12.29 | 9.36 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes the core efficiency and profitability dynamics driving each company’s financial engine.

Accenture plc Analysis

Accenture’s revenue grew steadily from 50.5B in 2021 to nearly 70B in 2025, with net income rising from 5.9B to 7.7B. Its gross margin remains healthy around 32%, while net margin holds firm near 11%, reflecting strong operational control. The 2025 results show sustained momentum with a 7.4% revenue growth and positive EPS expansion, despite a slight dip in net margin.

Leidos Holdings, Inc. Analysis

Leidos expanded revenue notably from 12.3B in 2020 to 16.7B in 2024, doubling net income from 628M to 1.25B. Its gross margin hovers at a moderate 17%, but it improved net margin substantially to 7.5%. The 2024 surge in EBIT and net margin growth—up nearly 200% and 484% respectively—demonstrates strong margin recovery and operational leverage gains.

Verdict: Scale Leadership vs. Margin Acceleration

Accenture delivers commanding scale with robust gross and net margins, underpinning steady profit growth and consistent capital efficiency. Leidos, though smaller, impresses with rapid margin improvement and exceptional bottom-line growth momentum. For investors, Accenture’s profile offers stability and scale, while Leidos presents a higher-growth, margin-recovery opportunity.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed below:

| Ratios | Accenture plc (ACN) | Leidos Holdings, Inc. (LDOS) |

|---|---|---|

| ROE | 24.6% | 28.4% |

| ROIC | 17.0% | 13.9% |

| P/E | 21.2 | 15.7 |

| P/B | 5.21 | 4.47 |

| Current Ratio | 1.42 | 1.21 |

| Quick Ratio | 1.42 | 1.13 |

| D/E (Debt to Equity) | 0.26 | 1.20 |

| Debt-to-Assets | 12.5% | 40.4% |

| Interest Coverage | 44.7 | 9.47 |

| Asset Turnover | 1.07 | 1.27 |

| Fixed Asset Turnover | 16.2 | 10.7 |

| Payout Ratio | 48.2% | 16.6% |

| Dividend Yield | 2.28% | 1.05% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence beneath headline numbers.

Accenture plc

Accenture posts a strong 24.6% ROE and 11.0% net margin, signaling robust profitability. Its P/E ratio at 21.16 reflects a fairly valued stock, while a high P/B of 5.21 raises a mild red flag. The company returns value with a 2.28% dividend yield, balancing shareholder rewards with growth investments.

Leidos Holdings, Inc.

Leidos lacks detailed ratio data for 2025, limiting analysis. Historical metrics show modest profitability with lower returns on equity and assets compared to Accenture. The firm carries higher leverage, evident in elevated net debt to EBITDA ratios. Dividend or buyback strategies are unclear, suggesting a focus on internal reinvestment or debt management.

Balanced Profitability vs. Limited Disclosure

Accenture offers clearer evidence of operational efficiency and shareholder returns, supported by favorable profitability and valuation metrics. Leidos’s incomplete data and higher debt levels introduce uncertainty. Investors seeking transparency and stable returns may favor Accenture, while Leidos suits those comfortable with less clarity and potentially higher risk.

Which one offers the Superior Shareholder Reward?

I see Accenture (ACN) delivers a more balanced distribution model with a 2.28% dividend yield and a 48% payout ratio, backed by robust free cash flow (FCF) coverage near 95%. Its aggressive buyback program enhances total shareholder return sustainably. Leidos (LDOS) pays a lower 1.05% yield with a modest 17% payout but carries higher debt, limiting buyback intensity. LDOS prioritizes reinvestment amid thinner margins, signaling a growth-focused strategy but with elevated financial risk. I conclude ACN offers a superior total return profile in 2026, blending steady dividends, strong buybacks, and healthy cash flow sustainability.

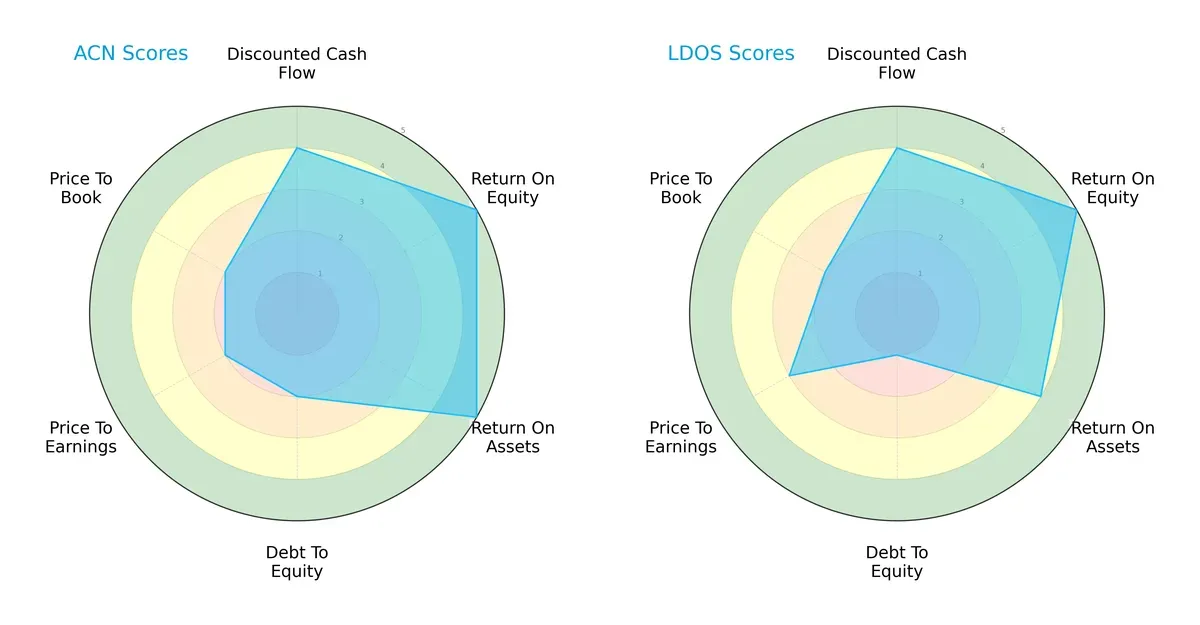

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Accenture plc and Leidos Holdings, Inc., highlighting their financial strengths and valuation strategies:

Accenture demonstrates a more balanced profile with very favorable ROE and ROA scores, but moderate debt and valuation metrics. Leidos leans on strong ROE and moderate DCF but suffers from a weak debt-to-equity position, indicating higher leverage risk. Accenture’s diversified strengths suggest steadier capital allocation, while Leidos relies on operational efficiency with financial risk trade-offs.

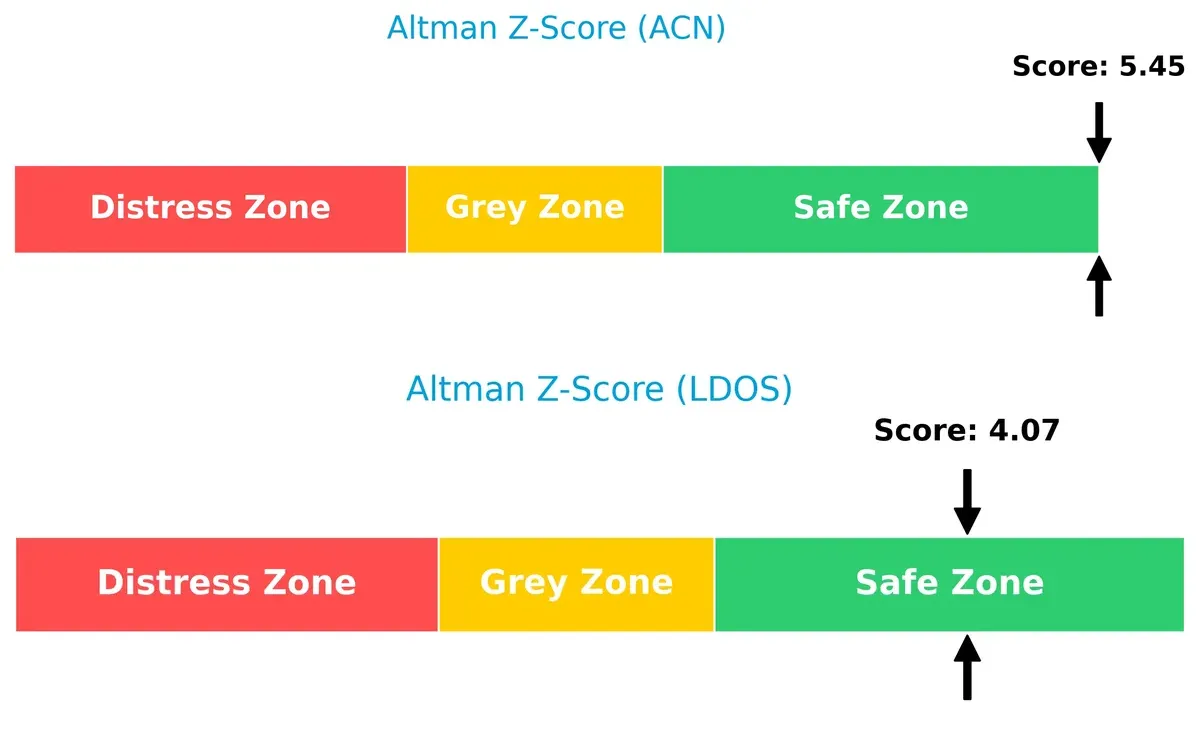

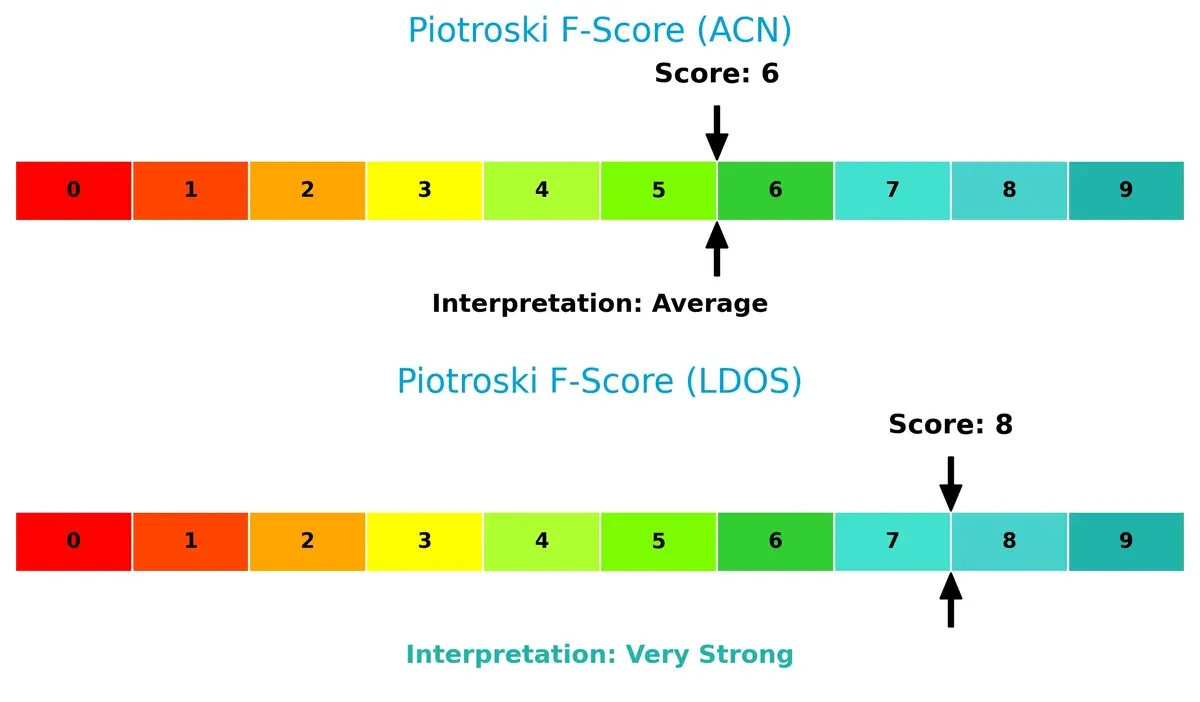

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap favors Accenture, signaling superior long-term solvency and lower bankruptcy risk amid market cycles:

Financial Health: Quality of Operations

Leidos scores an 8 versus Accenture’s 6 on the Piotroski scale, indicating stronger financial health and operational quality with fewer red flags:

How are the two companies positioned?

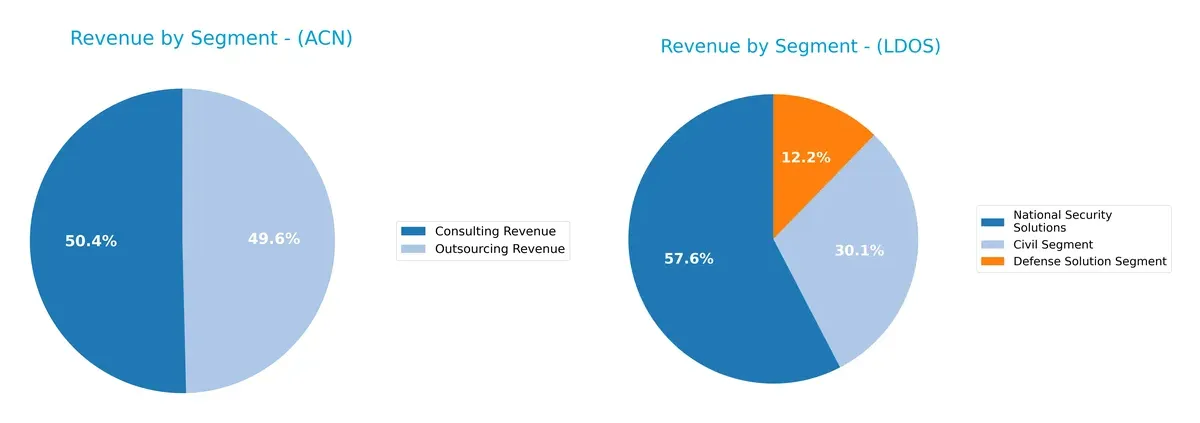

This section dissects the operational DNA of Accenture and Leidos by comparing their revenue distribution by segment and internal strengths and weaknesses. The goal is to confront their economic moats and identify which business model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Accenture plc and Leidos Holdings, Inc. diversify their income streams and where their primary sector bets lie:

Accenture pivots on two massive segments: Consulting at $35B and Outsourcing near $34.6B, showing a strong but balanced reliance on services. Leidos leans heavily on Defense Solutions and National Security, with $9.55B and $2.03B respectively, while Civil and Health segments provide modest diversification. Accenture’s dual-service focus shields it from sector shocks, whereas Leidos faces concentration risk tied to government defense spending and security infrastructure.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Accenture plc and Leidos Holdings, Inc.:

Accenture plc Strengths

- Diverse revenue streams across consulting, outsourcing, products, and multiple industries

- Strong profitability with ROIC at 17% and net margin above 11%

- Solid financial health indicated by favorable debt ratios and high interest coverage

- Large global footprint with significant revenues in North America, Europe, and growth markets

Leidos Holdings, Inc. Strengths

- Focused revenue segments in national security, defense, and civil markets

- Consistent revenue from core government contracts

- Strong US presence with over 93% of revenue generated domestically

Accenture plc Weaknesses

- High price-to-book ratio at 5.21 signals potential overvaluation

- Limited data on market share and innovation from provided information

Leidos Holdings, Inc. Weaknesses

- Limited geographic diversification with minimal international revenue

- Narrow product and service diversification compared to peer

- Lack of available profitability and financial ratio data restricts comprehensive evaluation

Accenture’s broad diversification and favorable financial metrics highlight its established market strength and global reach. Leidos’s concentrated focus on government contracts and domestic markets presents both stability and geographic risk, emphasizing a more specialized strategic approach.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone shields long-term profits from relentless competitive pressures and market entry threats:

Accenture plc: Intangible Asset Moat Anchored in Global Expertise

Accenture leverages deep consulting expertise and brand reputation, reflected in stable 31.9% gross margins and consistent value creation despite a recent ROIC decline. Expansion into digital and cloud services may reinforce its moat.

Leidos Holdings, Inc.: Defense-Focused Cost and Contractual Moat

Leidos secures government contracts and leverages specialized defense solutions, driving a strong upward ROIC trend and margin expansion. Its niche in national security creates a defensible position but limits diversification compared to Accenture.

Verdict: Expertise Brand vs. Defense Contract Moat

Leidos shows a deeper, growing moat with 7.9% ROIC above WACC and rising profitability. Accenture creates value but faces declining ROIC. Leidos is better positioned to defend market share through durable government partnerships.

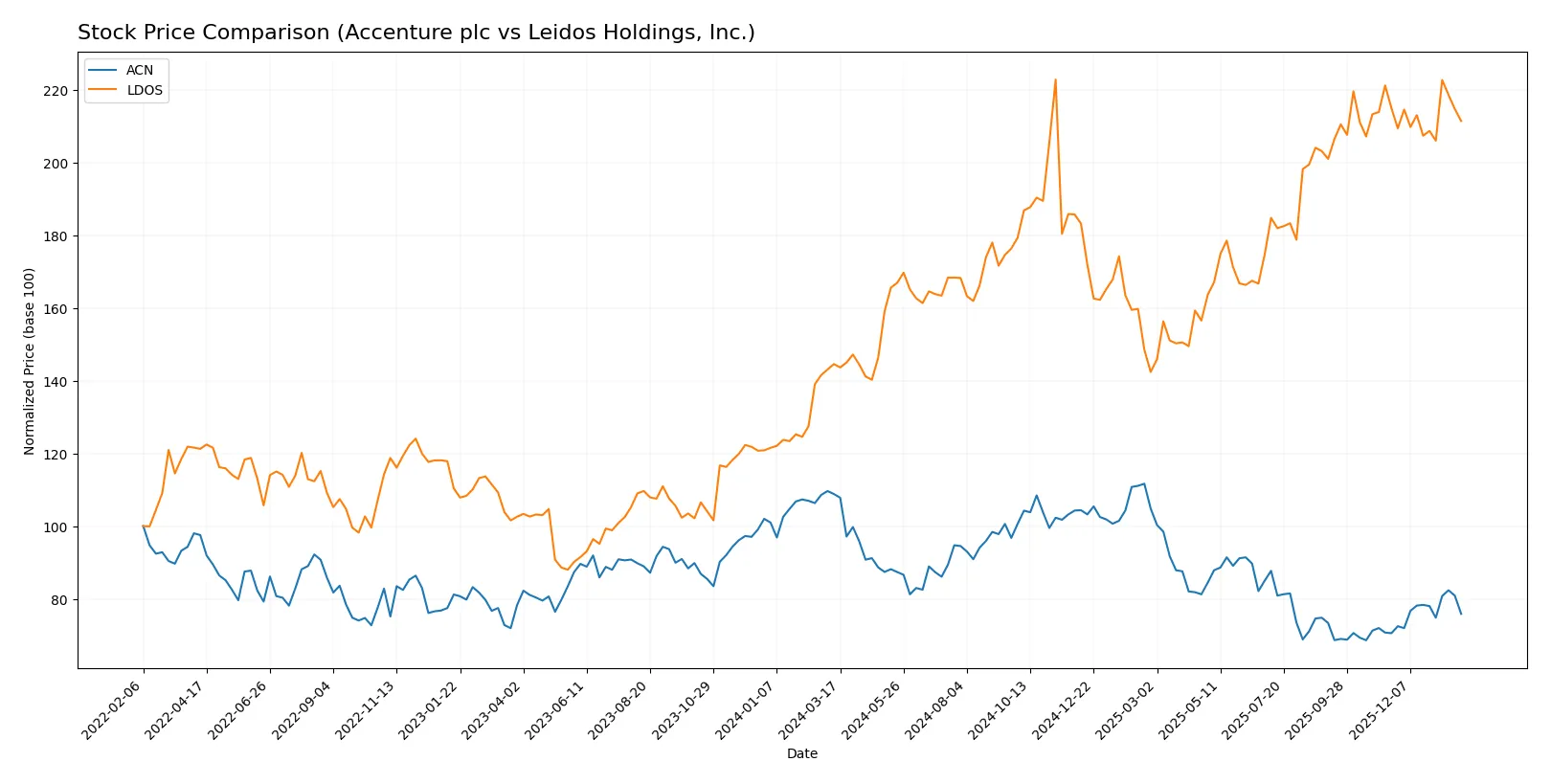

Which stock offers better returns?

The past year reveals contrasting dynamics: Accenture plc suffers a steep decline with recent recovery, while Leidos Holdings, Inc. climbs strongly but shows signs of recent cooling.

Trend Comparison

Accenture plc’s stock declined 30.29% over the past 12 months, indicating a bearish trend with accelerating losses. It reached a high of 388.0 and a low of 238.39.

Leidos Holdings, Inc. gained 46.23% in the same period, a clear bullish trend with decelerating momentum. The stock ranged between 124.91 and 198.42.

Leidos outperformed Accenture markedly, delivering the highest market return despite recent modest pullback versus Accenture’s recent positive slope after heavy losses.

Target Prices

Analysts present confident target price ranges for Accenture plc and Leidos Holdings, Inc., signaling positive outlooks.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Accenture plc | 265 | 330 | 302.93 |

| Leidos Holdings, Inc. | 204 | 230 | 219.8 |

The consensus targets for both companies exceed current prices, reflecting analyst expectations of solid upside potential in the coming months. Accenture’s target consensus is about 15% above its $263 price, while Leidos shows a nearly 17% premium over its $188 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Accenture plc and Leidos Holdings, Inc.:

Accenture plc Grades

These are the latest grades from key financial institutions for Accenture plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| UBS | Maintain | Buy | 2025-12-19 |

| Susquehanna | Maintain | Neutral | 2025-12-19 |

| RBC Capital | Maintain | Outperform | 2025-12-19 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-16 |

| Mizuho | Maintain | Outperform | 2025-09-29 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-26 |

| BMO Capital | Maintain | Market Perform | 2025-09-26 |

| TD Cowen | Maintain | Buy | 2025-09-26 |

| Goldman Sachs | Maintain | Buy | 2025-09-26 |

Leidos Holdings, Inc. Grades

The table below lists recent grades assigned to Leidos Holdings, Inc. by major institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| Stifel | Downgrade | Hold | 2026-01-08 |

| B of A Securities | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Buy | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-31 |

| Argus Research | Maintain | Buy | 2025-09-24 |

| RBC Capital | Upgrade | Outperform | 2025-09-04 |

| B of A Securities | Maintain | Buy | 2025-09-04 |

Which company has the best grades?

Accenture plc holds a broader consensus of strong grades, including multiple Buy and Outperform ratings. Leidos shows a mix of Buy and Neutral grades, with one recent Hold downgrade. Investors may see Accenture’s grades as a signal of steadier institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Accenture plc

- Faces intense competition in IT consulting from global firms; differentiation relies on innovation and digital transformation expertise.

Leidos Holdings, Inc.

- Operates in defense and government contracting with fewer direct competitors but faces contract renewal risks and budget constraints.

2. Capital Structure & Debt

Accenture plc

- Maintains a conservative debt-to-equity ratio of 0.26, signaling financial stability and strong interest coverage at 45.94x.

Leidos Holdings, Inc.

- Shows a weak debt-to-equity profile with a very unfavorable score, indicating higher financial leverage risk.

3. Stock Volatility

Accenture plc

- Beta of 1.249 suggests higher market sensitivity and potential for greater price swings than the market average.

Leidos Holdings, Inc.

- Beta of 0.592 indicates lower volatility and more defensive stock behavior relative to the broader market.

4. Regulatory & Legal

Accenture plc

- Exposed to global compliance risks, including data privacy laws and cross-border regulations in multiple jurisdictions.

Leidos Holdings, Inc.

- Faces stringent U.S. government regulations and security clearances impacting contracts and operational flexibility.

5. Supply Chain & Operations

Accenture plc

- Relies on a global network of consultants and technology partners, vulnerable to talent shortages and geopolitical disruptions.

Leidos Holdings, Inc.

- Dependent on specialized suppliers and subcontractors in defense; supply chain risks tied to government procurement cycles.

6. ESG & Climate Transition

Accenture plc

- Actively invests in sustainability consulting; faces pressure to meet evolving ESG standards across client and operational footprint.

Leidos Holdings, Inc.

- Increasingly pressured to demonstrate ESG compliance in defense contracting, including environmental and social governance.

7. Geopolitical Exposure

Accenture plc

- Global footprint exposes it to geopolitical tensions affecting client budgets and cross-border operations.

Leidos Holdings, Inc.

- High exposure to U.S. defense priorities and allied nations; sensitive to shifts in defense spending and international relations.

Which company shows a better risk-adjusted profile?

Accenture’s primary risk lies in intense market competition and high stock volatility due to its broad global exposure. Leidos’s greatest threat is its leveraged capital structure, elevating financial risk despite lower stock volatility. Between the two, Accenture presents a better risk-adjusted profile, supported by its strong financial ratios and safer debt levels. Notably, Leidos’s very unfavorable debt-to-equity score signals caution, even as it benefits from defensive market positioning.

Final Verdict: Which stock to choose?

Accenture plc’s superpower lies in its unmatched operational efficiency and strong capital allocation, consistently delivering value above its cost of capital. I see a point of vigilance in its slightly declining ROIC trend, which could pressure future profitability. It fits well in portfolios aiming for steady, long-term growth with a quality tilt.

Leidos Holdings boasts a strategic moat through its growing return on invested capital and a durable competitive advantage evidenced by improving profitability metrics. Compared to Accenture, it carries higher financial leverage, presenting a more volatile risk profile. This stock could appeal to investors pursuing Growth at a Reasonable Price (GARP) strategies who tolerate some balance sheet risk.

If you prioritize reliable operational efficiency and capital discipline, Accenture outshines as the compelling choice due to its stable value creation despite recent ROIC softness. However, if you seek a faster-growing company with a strengthening competitive position and can manage leverage risks, Leidos offers superior growth potential and expanding profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Accenture plc and Leidos Holdings, Inc. to enhance your investment decisions: