Home > Comparison > Technology > ACN vs JKHY

The strategic rivalry between Accenture plc and Jack Henry & Associates, Inc. shapes the evolution of the technology services sector. Accenture operates as a global, capital-intensive consulting powerhouse with diversified digital transformation capabilities. In contrast, Jack Henry & Associates specializes as a niche provider of payment processing and core banking technology solutions. This analysis will evaluate which company’s operational model offers a superior risk-adjusted return for a diversified portfolio amid shifting industry dynamics.

Table of contents

Companies Overview

Accenture and Jack Henry & Associates both play pivotal roles in the information technology services sector, shaping digital transformation across industries.

Accenture plc: Global Consulting and Technology Powerhouse

Accenture dominates the professional services market, generating revenue through strategy consulting, technology services, and digital transformation. Its 2026 focus emphasizes intelligent automation, cloud infrastructure, and cybersecurity, leveraging a broad ecosystem to deliver end-to-end solutions worldwide. The company’s scale and innovation position it as a key enabler of enterprise modernization.

Jack Henry & Associates, Inc.: Specialized Financial Technology Provider

Jack Henry & Associates serves primarily US financial institutions, driving revenue from core banking systems, payment processing, and digital financial solutions. In 2026, it concentrates on enhancing integrated applications and security services tailored for banks and credit unions. Its niche expertise creates a durable competitive edge within the financial services technology niche.

Strategic Collision: Similarities & Divergences

While both companies excel in IT services, Accenture pursues a broad, global consulting model, contrasting with Jack Henry’s focused, US-centric financial technology approach. They compete indirectly in digital transformation but address distinct customer bases and needs. Their investment profiles differ sharply—Accenture offers scale and diversification, Jack Henry provides specialization and stability within financial services.

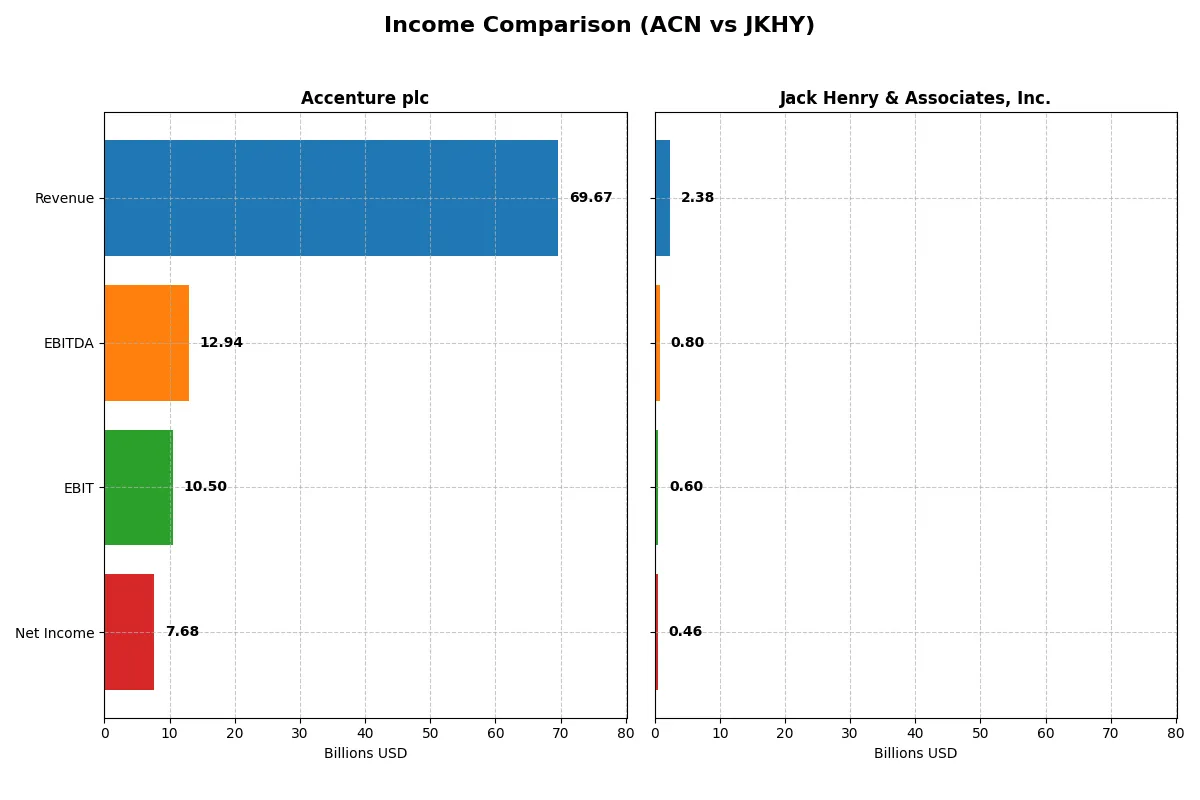

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Accenture plc (ACN) | Jack Henry & Associates, Inc. (JKHY) |

|---|---|---|

| Revenue | 69.7B | 2.38B |

| Cost of Revenue | 47.4B | 1.36B |

| Operating Expenses | 12.0B | 446M |

| Gross Profit | 22.2B | 1.01B |

| EBITDA | 12.9B | 801M |

| EBIT | 10.5B | 596M |

| Interest Expense | 229M | 10.4M |

| Net Income | 7.7B | 456M |

| EPS | 12.29 | 6.24 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which corporate engine delivers superior efficiency through revenue growth and margin management.

Accenture plc Analysis

Accenture’s revenue climbed steadily from 50.5B in 2021 to nearly 69.7B in 2025, showing a solid 38% growth over five years. Net income rose by 30%, reaching 7.7B in 2025. The company maintains healthy gross margins around 32% and a net margin near 11%, indicating consistent profitability. However, net margin slightly declined recently, signaling pressure on bottom-line efficiency despite expanding revenues.

Jack Henry & Associates, Inc. Analysis

Jack Henry’s revenue increased from 1.76B in 2021 to 2.38B in 2025, a robust 35% gain. Net income surged 46% over the period, hitting 456M in 2025. It boasts notably higher margins: a gross margin of 42.7% and a net margin above 19%, reflecting superior cost control and operational leverage. Margin expansion accelerated recently, underscoring growing profitability momentum alongside solid top-line growth.

Margin Power vs. Revenue Scale

Jack Henry outperforms Accenture in margin strength and net income growth, delivering nearly double the net margin at 19.2% versus Accenture’s 11%. Accenture leads in absolute scale with revenues nearly 30 times larger, but its slight net margin compression raises caution. Investors valuing margin expansion and lean operations may prefer Jack Henry’s profile, while those favoring large-scale revenue engines might lean toward Accenture.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency for a clear comparative view:

| Ratios | Accenture plc (ACN) | Jack Henry & Associates, Inc. (JKHY) |

|---|---|---|

| ROE | 24.6% | 21.4% |

| ROIC | 17.0% | 17.6% |

| P/E | 21.2 | 28.9 |

| P/B | 5.21 | 6.18 |

| Current Ratio | 1.42 | 1.27 |

| Quick Ratio | 1.42 | 1.27 |

| D/E | 0.26 | 0 |

| Debt-to-Assets | 12.5% | 0% |

| Interest Coverage | 44.7 | 54.5 |

| Asset Turnover | 1.07 | 0.78 |

| Fixed Asset Turnover | 16.2 | 10.7 |

| Payout ratio | 48.2% | 36.1% |

| Dividend yield | 2.28% | 1.25% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing operational strengths and hidden risks critical for informed investment decisions.

Accenture plc

Accenture demonstrates robust profitability with a 24.61% ROE and an 11.02% net margin, signaling operational efficiency. Its P/E ratio of 21.16 suggests a fairly valued stock, though a high P/B of 5.21 flags some valuation stretch. The company rewards shareholders with a 2.28% dividend yield, reflecting disciplined capital allocation.

Jack Henry & Associates, Inc.

Jack Henry posts a strong 21.39% ROE and an impressive 19.19% net margin, underscoring profitability. However, its P/E of 28.88 and P/B of 6.18 indicate a premium valuation. The absence of a substantial dividend yield (1.25%) points to growth reinvestment, particularly in R&D, supporting future expansion.

Balanced Profitability Meets Valuation Discipline

Accenture offers a better blend of efficient profitability and reasonable valuation compared to Jack Henry’s premium multiples. Investors seeking operational strength with moderate risk may prefer Accenture, while those favoring growth potential at a premium may lean toward Jack Henry.

Which one offers the Superior Shareholder Reward?

I see Accenture (ACN) delivers a 2.28% dividend yield with a robust 48% payout ratio, well-covered by free cash flow of $17.4/share. Its aggressive buyback program amplifies returns. Jack Henry (JKHY), with a 1.25% yield and 36% payout, invests heavily in growth, balancing dividends with share repurchases. Historically, Accenture’s model yields steadier, more sustainable shareholder rewards. In 2026, I favor ACN’s blend of yield, buybacks, and cash flow reliability for superior total return.

Comparative Score Analysis: The Strategic Profile

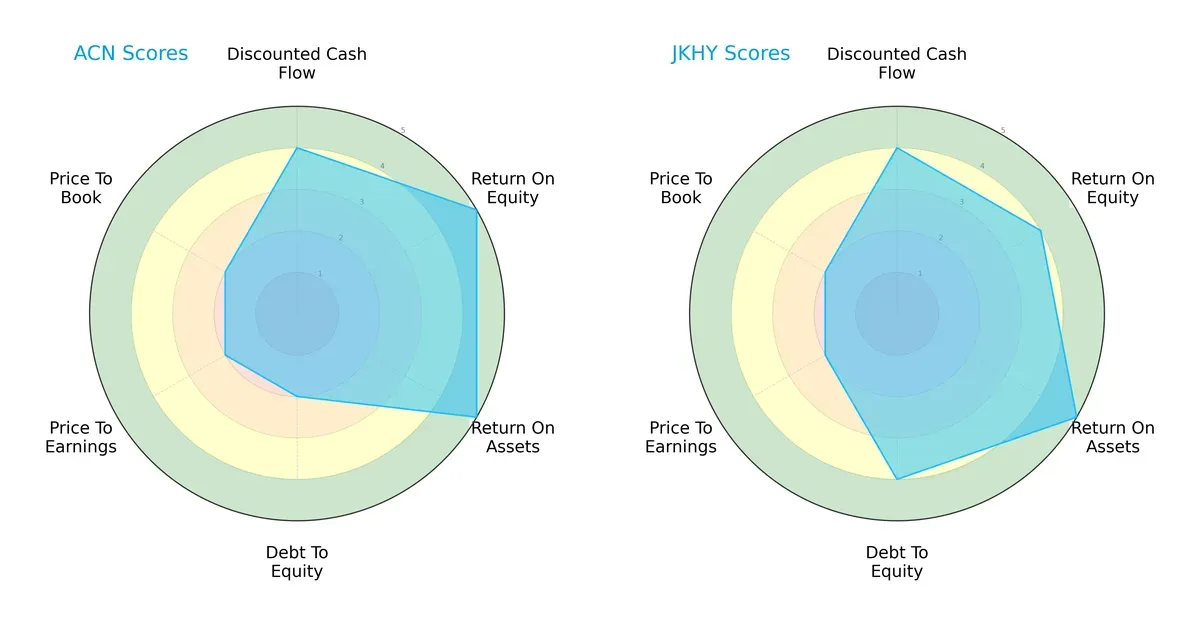

The radar chart reveals the fundamental DNA and trade-offs of Accenture plc and Jack Henry & Associates, Inc.:

Accenture excels in return on equity (5) and assets (5) but shows moderate scores in debt-to-equity (2) and valuation metrics (PE/PB at 2). Jack Henry balances strong asset utilization (5) with superior debt management (4), though its ROE is slightly lower (4). Accenture’s profile hinges on operational efficiency, while Jack Henry leverages financial stability for a balanced approach.

Bankruptcy Risk: Solvency Showdown

Jack Henry’s Altman Z-Score (11.49) far exceeds Accenture’s (5.29), indicating a stronger buffer against bankruptcy risks in this cycle:

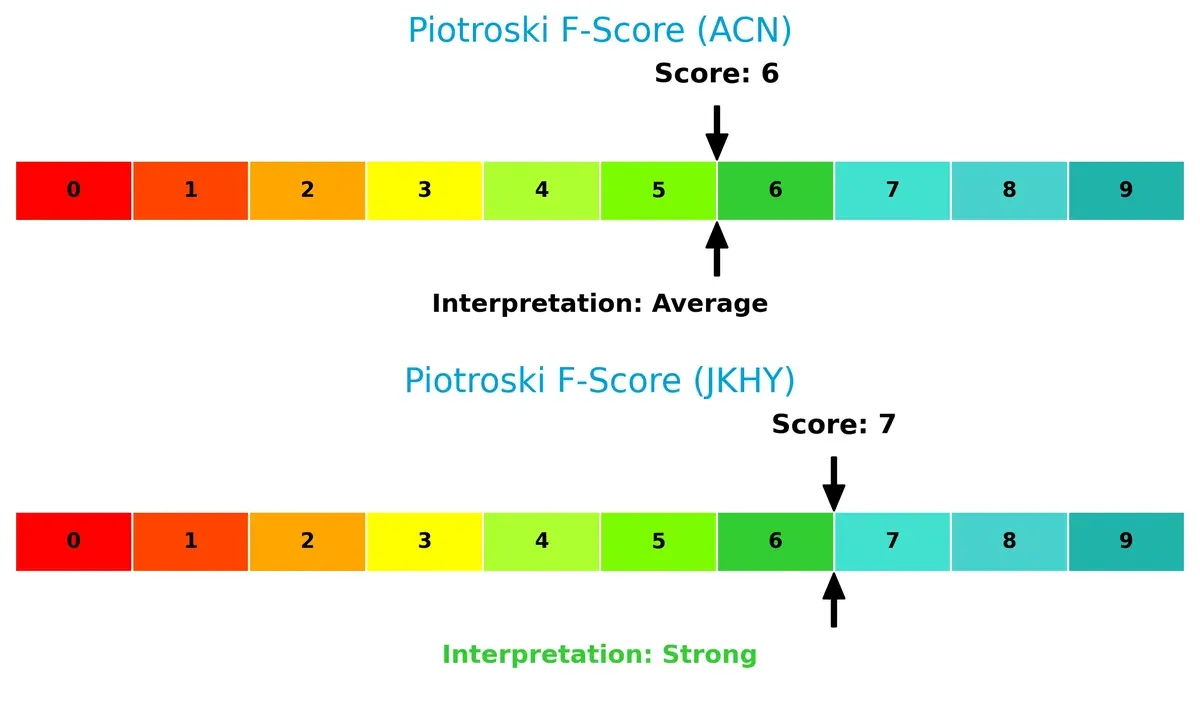

Financial Health: Quality of Operations

Jack Henry’s Piotroski score of 7 surpasses Accenture’s 6, signaling stronger internal financial health and fewer red flags in its operational metrics:

How are the two companies positioned?

This section dissects ACN and JKHY’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model sustains the strongest competitive advantage today.

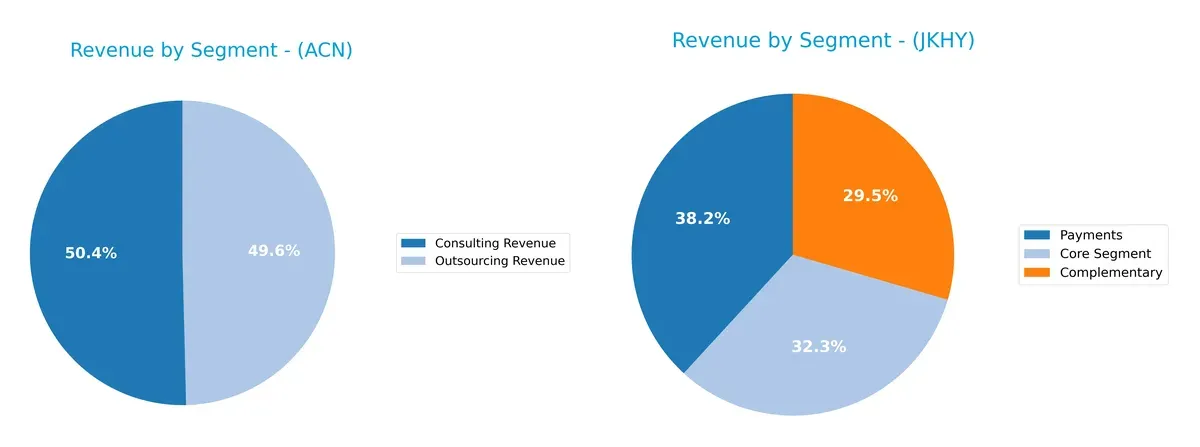

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Accenture plc and Jack Henry & Associates, Inc. diversify their income streams and where their primary sector bets lie:

Accenture pivots heavily on Consulting ($35.1B) and Outsourcing ($34.6B), anchoring its revenue in two vast, complementary services. Jack Henry’s mix splits more evenly across Payments ($873M), Core Segment ($739M), and Complementary ($675M), reflecting a more balanced but smaller scale. Accenture’s concentrated bets signal ecosystem lock-in and scalability, while Jack Henry’s diversity mitigates concentration risk but limits dominant market power.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Accenture plc and Jack Henry & Associates, Inc.:

Accenture plc Strengths

- Diverse revenue streams across consulting, outsourcing, products, and multiple industries

- Strong global presence in North America, Europe, and growth markets

- High profitability with favorable net margin and ROIC

- Solid financial health with low debt and strong interest coverage

- Consistent innovation reflected in product and service diversification

Jack Henry & Associates, Inc. Strengths

- High profitability with superior net margin and ROIC relative to peers

- Favorable capital structure with zero debt and strong interest coverage

- Core focus on payments and complementary segments ensures steady revenue

- Favorable WACC supports efficient capital allocation

- Innovation within niche banking and payments systems drives market relevance

Accenture plc Weaknesses

- Relatively high price-to-book ratio may indicate overvaluation risk

- Moderate current ratio suggests liquidity is adequate but not robust

- Exposure to diverse markets can dilute strategic focus and increase complexity

Jack Henry & Associates, Inc. Weaknesses

- Elevated price-to-earnings and price-to-book ratios signal valuation concerns

- Lower asset turnover compared to ACN may reflect less operational efficiency

- Limited geographic diversification could constrain growth opportunities

Accenture’s broad diversification and global reach underpin its competitive positioning but bring complexity risks. Jack Henry’s focused niche and strong profitability support stability, though valuation and limited geographic spread warrant caution. Both companies exhibit financial strength, yet face distinct strategic trade-offs.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from competition’s relentless erosion. Without it, sustainable value simply vanishes:

Accenture plc: Broad Scope and Scale Moat

Accenture’s moat stems from a diversified service portfolio and global scale, reflected in a solid 7.7% ROIC premium over WACC. However, its declining ROIC trend signals margin pressures as competition intensifies in consulting and tech services in 2026.

Jack Henry & Associates, Inc.: Niche Specialization and Client Lock-in

Jack Henry leverages high switching costs in financial services technology, with a stronger 10.5% ROIC premium and growing profitability. Its focused market niche deepens its moat, supported by stable margins and expansion into digital payments.

Verdict: Scale and Diversification vs. Focused Client Lock-in

Jack Henry’s growing ROIC and niche specialization create a deeper, more durable moat than Accenture’s broad but challenged scale. I see Jack Henry better positioned to defend market share amid evolving tech demands.

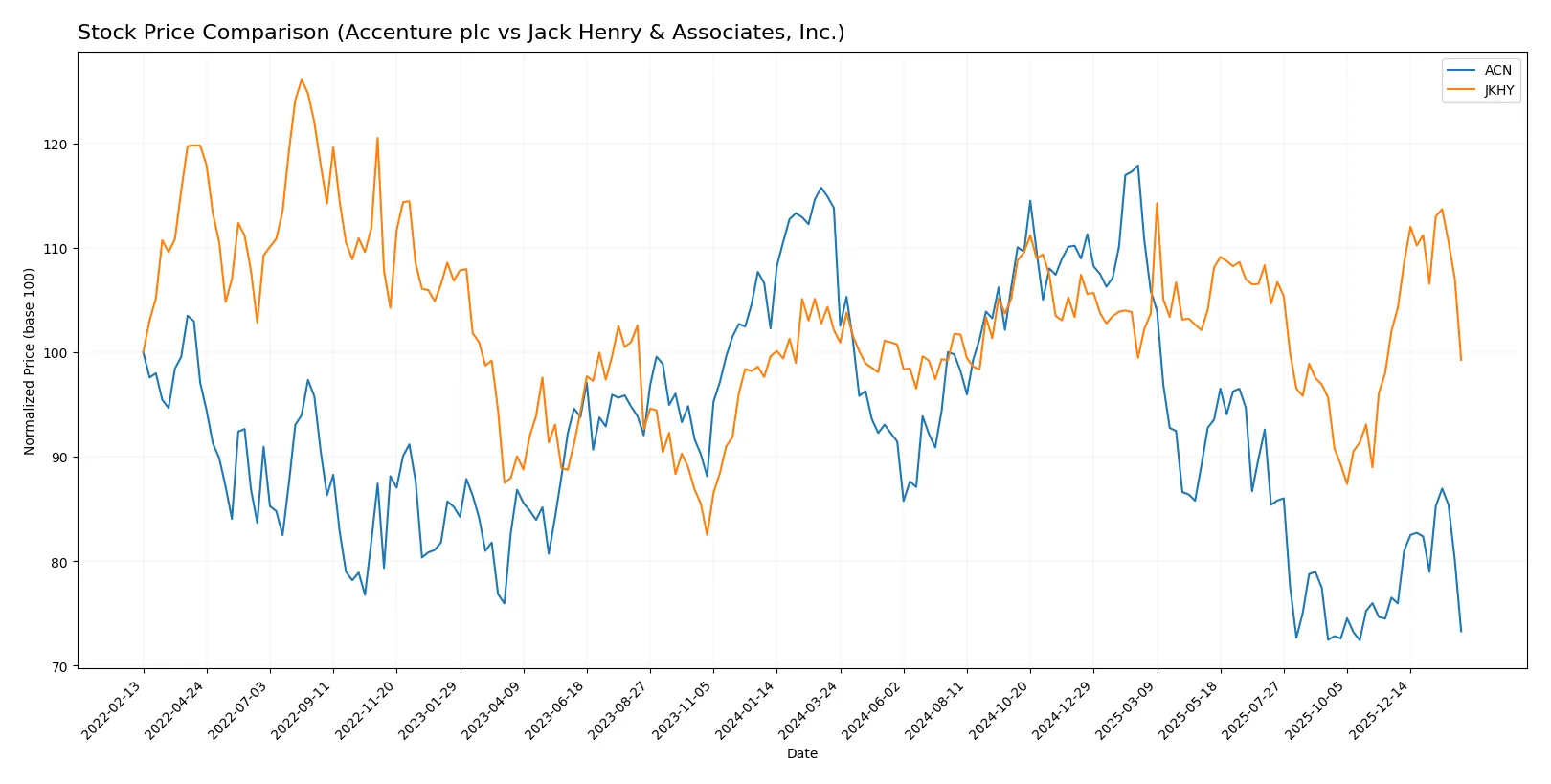

Which stock offers better returns?

Both Accenture plc and Jack Henry & Associates, Inc. show notable price declines over the past year, with varying degrees of bearish momentum and trading volume dynamics.

Trend Comparison

Accenture plc’s stock price fell 35.61% over the past year, marking a bearish trend with accelerating decline and high volatility, ranging from 388.0 to 238.39. Recent months show a softened but still negative trend.

Jack Henry & Associates, Inc. experienced a 2.8% price decrease, also bearish but with lower volatility and smaller range between 191.28 and 146.26. The recent trend suggests a modestly decelerating decline.

Comparing both, Accenture’s stock delivered the weakest market performance with a sharper descent and greater volatility than Jack Henry’s more moderate bearish trend.

Target Prices

Analysts present a bullish consensus on Accenture plc and Jack Henry & Associates, with targets well above current prices.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Accenture plc | 265 | 330 | 302.93 |

| Jack Henry & Associates, Inc. | 181 | 220 | 203.14 |

Target prices for Accenture imply a 25% upside from its $241 current price. Jack Henry’s targets suggest a 22% potential gain from $166, reflecting strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is the summary of institutional grades for Accenture plc and Jack Henry & Associates, Inc.:

Accenture plc Grades

The following table details recent institutional grade actions for Accenture plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| Susquehanna | Maintain | Neutral | 2025-12-19 |

| RBC Capital | Maintain | Outperform | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-16 |

| Mizuho | Maintain | Outperform | 2025-09-29 |

| JP Morgan | Maintain | Overweight | 2025-09-26 |

| Guggenheim | Maintain | Buy | 2025-09-26 |

| TD Cowen | Maintain | Buy | 2025-09-26 |

| Baird | Maintain | Outperform | 2025-09-26 |

Jack Henry & Associates, Inc. Grades

This table shows the latest institutional grading actions for Jack Henry & Associates, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| DA Davidson | Maintain | Buy | 2026-01-29 |

| DA Davidson | Maintain | Buy | 2026-01-28 |

| Wolfe Research | Upgrade | Outperform | 2026-01-08 |

| UBS | Maintain | Neutral | 2026-01-08 |

| RBC Capital | Upgrade | Outperform | 2025-12-16 |

| Baird | Maintain | Neutral | 2025-12-15 |

| Keefe, Bruyette & Woods | Upgrade | Outperform | 2025-12-08 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| Compass Point | Upgrade | Buy | 2025-11-06 |

Which company has the best grades?

Jack Henry & Associates, Inc. has more upgrades to Outperform and Buy ratings recently. Accenture’s grades show a mix of Buy, Outperform, and Equal Weight with fewer recent upgrades. This suggests stronger recent institutional conviction in Jack Henry, potentially impacting investor sentiment positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Accenture plc

- Faces intense global IT services competition, requiring constant innovation and scale to maintain market share.

Jack Henry & Associates, Inc.

- Operates in a niche financial tech market with limited direct competition but must innovate to retain US banking clients.

2. Capital Structure & Debt

Accenture plc

- Maintains moderate leverage (D/E 0.26) with strong interest coverage, signaling prudent debt management.

Jack Henry & Associates, Inc.

- Debt-free balance sheet, minimizing financial risk and enhancing stability.

3. Stock Volatility

Accenture plc

- Beta of 1.24 indicates above-market volatility, exposing investors to greater price swings.

Jack Henry & Associates, Inc.

- Lower beta at 0.71 reflects defensive stock behavior and reduced price volatility.

4. Regulatory & Legal

Accenture plc

- Global operations expose it to diverse regulatory regimes and compliance risks.

Jack Henry & Associates, Inc.

- Primarily US-focused, faces concentrated regulatory environment but less complexity internationally.

5. Supply Chain & Operations

Accenture plc

- Large global workforce and extensive operations increase exposure to disruption risks.

Jack Henry & Associates, Inc.

- Smaller scale and focused client base reduce supply chain complexity and operational risk.

6. ESG & Climate Transition

Accenture plc

- Increasing pressure to lead on sustainability, with risks if failing to meet evolving ESG standards.

Jack Henry & Associates, Inc.

- ESG risks moderate but less exposed due to niche financial services focus.

7. Geopolitical Exposure

Accenture plc

- Headquartered in Ireland with global footprint, vulnerable to geopolitical volatility and trade tensions.

Jack Henry & Associates, Inc.

- US-based with limited international exposure, less sensitive to geopolitical shifts.

Which company shows a better risk-adjusted profile?

Accenture’s most impactful risk lies in its high market volatility and global regulatory complexity. Jack Henry’s largest risk is its concentrated US market exposure amidst evolving fintech competition. Despite Accenture’s scale and diversified operations, Jack Henry’s debt-free balance sheet and lower stock volatility yield a superior risk-adjusted profile. The recent widening in Accenture’s trading range versus Jack Henry’s stable beta underscores my caution on market risk.

Final Verdict: Which stock to choose?

Accenture plc’s superpower is its unmatched capital efficiency, consistently generating returns well above its cost of capital. Its ability to convert invested capital into strong operating profits sets it apart. A point of vigilance remains its slightly declining ROIC trend, signaling potential pressure on future profitability. It suits portfolios aiming for steady, large-cap growth with a tolerance for moderate valuation premiums.

Jack Henry & Associates stands out with a durable moat driven by growing ROIC and a robust recurring revenue model. Its superior margin profile and nearly debt-free balance sheet offer enhanced financial safety compared to Accenture. This makes it appealing for investors seeking disciplined capital allocation and a blend of growth with reasonable stability.

If you prioritize capital efficiency and scale in a global consulting leader, Accenture is the compelling choice due to its proven value creation despite margin pressures. However, if you seek a smaller firm with a durable moat and stronger margin expansion, Jack Henry offers better stability and growth durability. Both carry risks; your preference should align with your appetite for size versus margin resilience.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Accenture plc and Jack Henry & Associates, Inc. to enhance your investment decisions: