Home > Comparison > Technology > ACN vs BBAI

The strategic rivalry between Accenture plc and BigBear.ai Holdings, Inc. shapes innovation in the technology services sector. Accenture, a global professional services powerhouse, operates with a capital-intensive, diversified model serving multiple industries. In contrast, BigBear.ai, a niche player, specializes in AI-driven analytics and cybersecurity with a lean, high-growth approach. This analysis will determine which trajectory offers superior risk-adjusted returns for a diversified portfolio navigating today’s digital transformation landscape.

Table of contents

Companies Overview

Accenture and BigBear.ai each wield considerable influence in the technology services sector, shaping enterprise IT strategies globally.

Accenture plc: Global Technology Services Leader

Accenture dominates professional services with strategy, consulting, and technology operations worldwide. It generates revenue by delivering agile transformation, AI, cloud, cybersecurity, and digital industrial solutions. In 2026, Accenture’s strategic focus centers on scaling intelligent automation and hybrid cloud infrastructure to drive client digital transformation and innovation.

BigBear.ai Holdings, Inc.: AI-Driven Decision Support Specialist

BigBear.ai carves a niche in AI and machine learning technologies for real-time decision support. Its revenue streams come from Cyber & Engineering and Analytics segments, offering cloud engineering, cybersecurity, and predictive analytics. The company’s 2026 strategy emphasizes expanding its big data computing and analytical solutions to enhance enterprise decision-making capabilities.

Strategic Collision: Similarities & Divergences

Both firms thrive on technology consulting but diverge in scale and scope: Accenture offers a broad, integrated service portfolio, whereas BigBear.ai focuses on specialized AI and analytics. Their primary battleground lies in cybersecurity and cloud services, where tailored innovation meets enterprise demand. Accenture’s vast global footprint contrasts with BigBear.ai’s agile, niche approach, defining distinct risk-return profiles for investors.

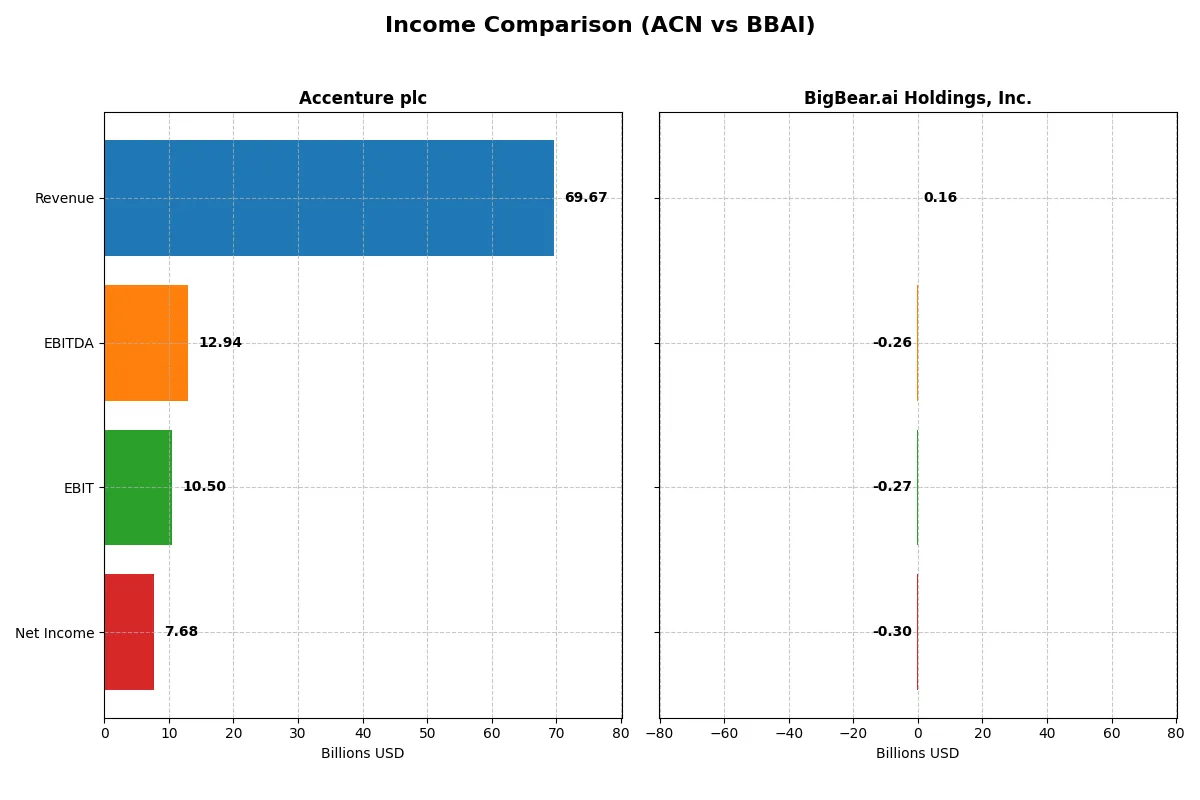

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Accenture plc (ACN) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Revenue | 69.7B | 158M |

| Cost of Revenue | 47.4B | 113M |

| Operating Expenses | 12.0B | 179M |

| Gross Profit | 22.2B | 45.2M |

| EBITDA | 12.9B | -258M |

| EBIT | 10.5B | -270M |

| Interest Expense | 229M | 26M |

| Net Income | 7.7B | -296M |

| EPS | 12.29 | -1.27 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability of two very different corporate engines.

Accenture plc Analysis

Accenture’s revenue rose steadily from 50.5B in 2021 to 69.7B in 2025, with net income climbing from 5.9B to 7.7B. Its gross margin holds strong at 31.9%, and net margin remains favorable at 11%. In 2025, Accenture demonstrated robust momentum, growing EBIT by 7.6% and EPS by 6.2%, reflecting efficient cost management alongside revenue gains.

BigBear.ai Holdings, Inc. Analysis

BigBear.ai’s revenue grew modestly from 91M in 2020 to 158M in 2024, but net income plunged deeper into losses, reaching -296M. While gross margin is decent at 28.6%, EBIT margin is heavily negative at -171%, dragged down by high operating expenses. The latest year highlights worsening profitability despite slight revenue growth, signaling ongoing operational challenges.

Margin Strength vs. Profitability Drag

Accenture clearly outperforms BigBear.ai on all profitability metrics, showcasing stable margin health and consistent net income growth. BigBear.ai’s expanding losses and weak EBIT margins reveal a company struggling to convert revenue into profits. For investors prioritizing financial resilience, Accenture’s profile offers a far more attractive risk-return balance.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Accenture plc (ACN) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| ROE | 24.6% | 79.6% |

| ROIC | 17.0% | -93.4% |

| P/E | 21.2 | -3.52 |

| P/B | 5.21 | -279.90 |

| Current Ratio | 1.42 | 0.46 |

| Quick Ratio | 1.42 | 0.46 |

| D/E | 0.26 | -39.42 |

| Debt-to-Assets | 12.5% | 42.6% |

| Interest Coverage | 44.7 | -5.20 |

| Asset Turnover | 1.07 | 0.46 |

| Fixed Asset Turnover | 16.18 | 14.61 |

| Payout ratio | 48.2% | 0% |

| Dividend yield | 2.28% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and showcasing operational excellence essential for informed investment decisions.

Accenture plc

Accenture displays robust profitability with a 24.6% ROE and an 11.0% net margin, signaling efficient core operations. Its P/E of 21.16 suggests a fairly valued stock, though the 5.21 P/B ratio appears stretched. Shareholders benefit from a 2.28% dividend yield, reflecting steady returns combined with reinvestment in growth and innovation.

BigBear.ai Holdings, Inc.

BigBear.ai’s metrics reveal extreme volatility, with a 7,957% ROE offset by a deeply negative net margin of -186.8%, indicating operational distress. Its negative P/E and P/B ratios are unusual, reflecting accounting anomalies or losses. The lack of dividends and weak liquidity (current ratio 0.46) suggest capital is primarily allocated toward R&D amid financial strain.

Premium Valuation vs. Operational Safety

Accenture offers a favorable balance of profitability, valuation, and shareholder returns with manageable risk exposure. BigBear.ai’s profile is riskier, marked by volatile returns and poor liquidity. Investors seeking stability and consistent income align better with Accenture, while BigBear.ai suits those with high risk tolerance focused on growth potential.

Which one offers the Superior Shareholder Reward?

I see Accenture (ACN) offers a balanced, sustainable shareholder reward through a 2.28% dividend yield and a 48% payout ratio, underpinned by robust free cash flow (FCF) coverage near 95%. Its steady buyback program enhances total returns. BigBear.ai (BBAI) pays no dividend and suffers losses, relying entirely on reinvestment amid negative margins and weak cash flow. BBAI’s high debt and lack of buybacks raise red flags. Historically, in tech sectors, consistent dividends plus buybacks like ACN’s signal superior, lower-risk shareholder value. I conclude Accenture delivers a far more attractive total return profile for 2026 investors.

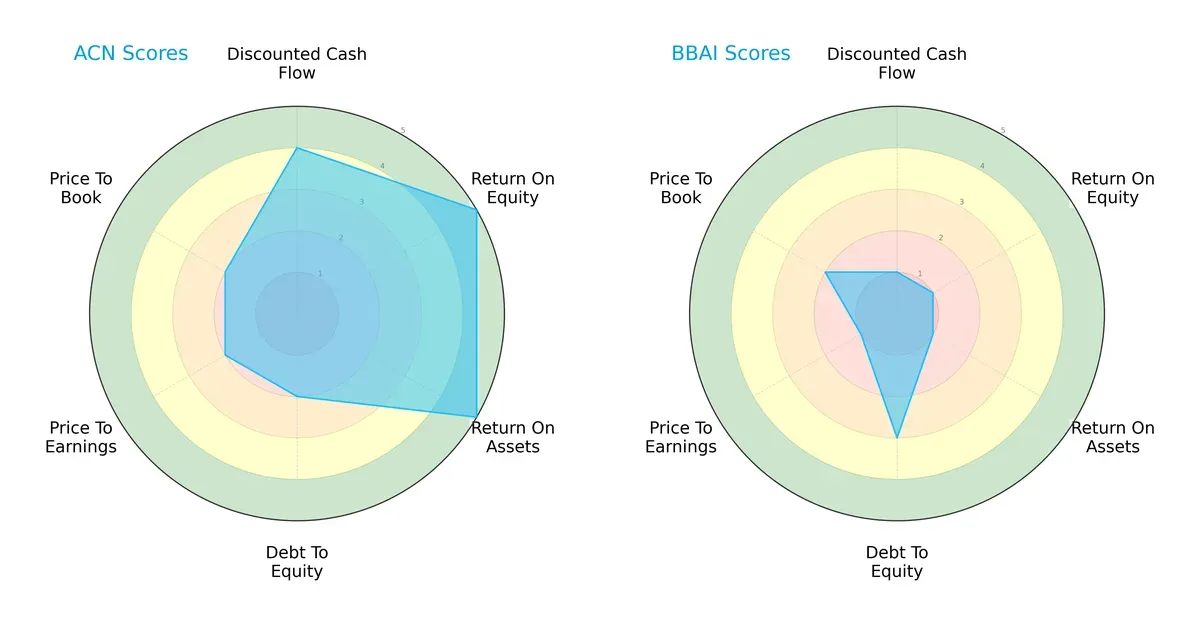

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Accenture plc and BigBear.ai Holdings, Inc., highlighting their core strengths and weaknesses in key financial metrics:

Accenture displays a balanced, high-performing profile with strong DCF, ROE, and ROA scores, albeit moderate valuation and leverage metrics. BigBear.ai shows weakness across profitability and valuation scores, relying mainly on moderate debt-to-equity strength. Accenture’s diversified financial strengths make it the more resilient choice.

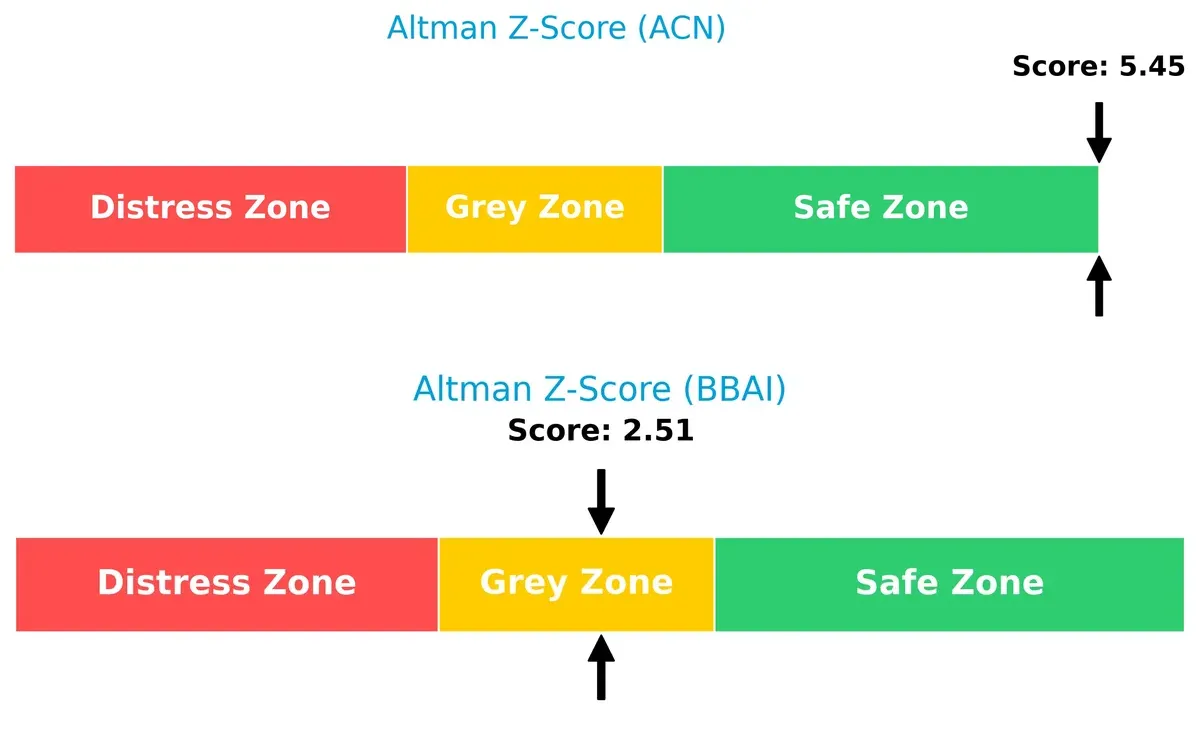

Bankruptcy Risk: Solvency Showdown

Accenture’s Altman Z-Score of 5.45 places it firmly in the safe zone, signaling strong long-term solvency. BigBear.ai’s 2.51 score lands in the grey zone, indicating moderate bankruptcy risk in this market cycle:

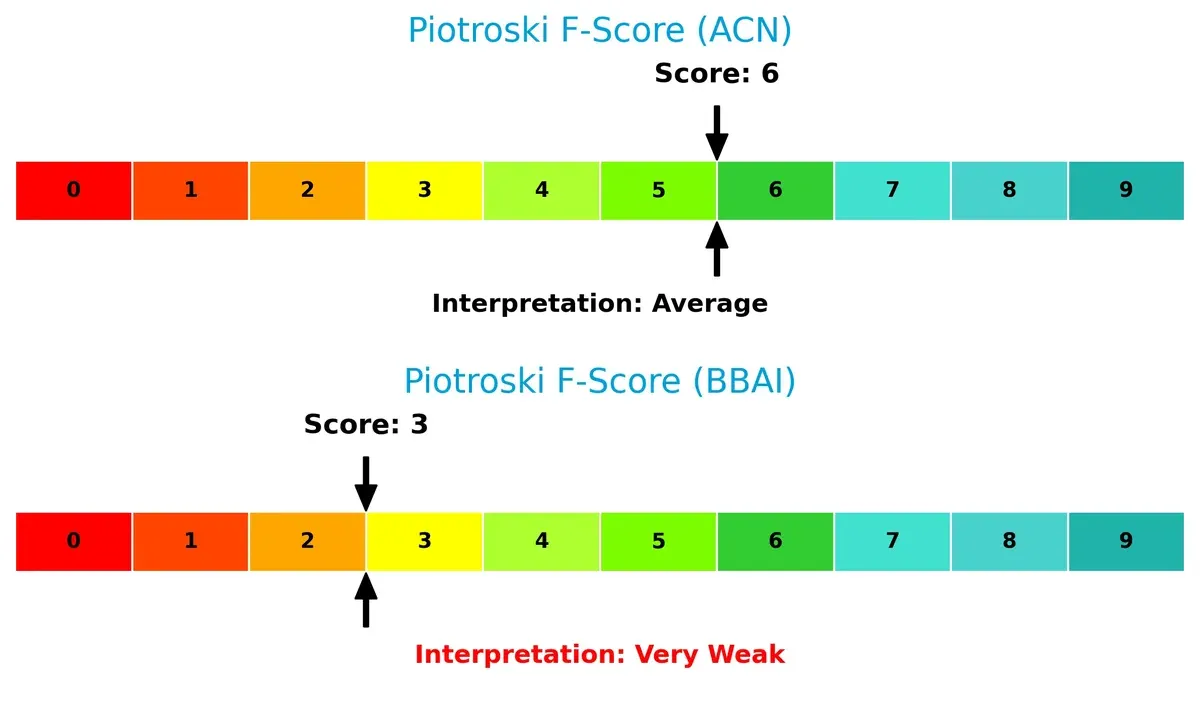

Financial Health: Quality of Operations

Accenture’s Piotroski F-Score of 6 reflects solid financial health with few red flags. BigBear.ai’s score of 3 signals weak operational quality and potential internal issues, raising caution for investors:

How are the two companies positioned?

This section dissects the operational DNA of Accenture and BigBear.ai by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage in today’s market.

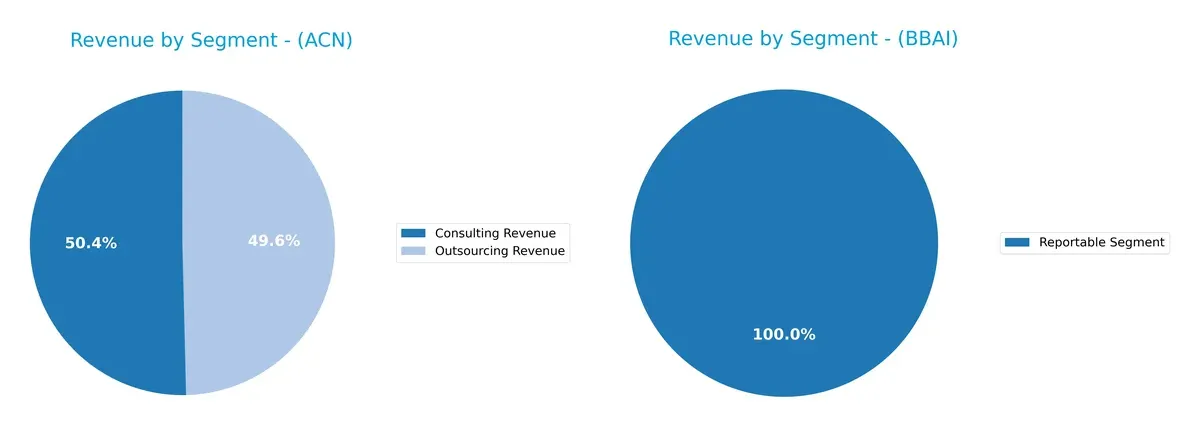

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Accenture plc and BigBear.ai Holdings, Inc. diversify their income streams and where their primary sector bets lie:

Accenture anchors its revenue in two dominant segments: Consulting at $35.1B and Outsourcing at $34.6B in 2025, showing a balanced reliance on services. Meanwhile, BigBear.ai leans heavily on a single segment, Reporting $158M in 2024 with minimal diversification. Accenture’s broad service portfolio reduces concentration risk and fosters ecosystem lock-in, while BigBear.ai faces higher vulnerability from its narrow revenue base.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Accenture plc and BigBear.ai Holdings, Inc.:

Accenture plc Strengths

- Diversified revenue across consulting, outsourcing, and multiple industries

- Strong profitability with 11% net margin and 25% ROE

- Solid financial health with favorable liquidity and low debt

- Global presence with significant revenue from North America and Europe

- High asset turnover and dividend yield reflecting operational efficiency

BigBear.ai Holdings, Inc. Strengths

- Favorable ROE despite negative net margin

- Positive price-to-earnings and price-to-book ratios suggesting market optimism

- Some operational efficiency shown by fixed asset turnover

- Debt-to-equity ratio favorable, indicating potential financial leverage management

Accenture plc Weaknesses

- Price-to-book ratio unfavorable, possibly indicating overvaluation risk

- Neutral current ratio suggests liquidity could be improved

- Weighted average cost of capital neutral, limiting capital efficiency upside

BigBear.ai Holdings, Inc. Weaknesses

- Negative net margin and ROIC indicate profitability and capital returns challenges

- High weighted average cost of capital raises capital cost concerns

- Poor liquidity ratios and negative interest coverage highlight financial stress

- Asset turnover and dividend yield unfavorable, showing operational and shareholder return weaknesses

Accenture leverages its diversified business model and strong financial metrics to sustain competitive advantage globally. BigBear.ai faces considerable profitability and liquidity hurdles, which may require strategic adjustments to improve financial stability and operational performance.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from relentless competition erosion. Let’s dissect the nature of these moats:

Accenture plc: Diversified Consulting Powerhouse

Accenture’s moat stems from intangible assets and high switching costs embedded in its consulting and technology services. Its 7.6% ROIC above WACC confirms value creation, despite a slight decline in profitability. Expansion into AI and cloud deepens this moat in 2026.

BigBear.ai Holdings, Inc.: Niche AI Innovation with Fragile Moat

BigBear.ai relies on specialized AI and analytics expertise, but its negative ROIC signals value destruction. Unlike Accenture, it lacks scale and margin stability. Its growth depends on disrupting defense and cybersecurity markets, a risky yet potential opportunity.

Scale and Stability vs. Disruptive Potential

Accenture’s wide moat, supported by consistent excess returns and diversified services, outmatches BigBear.ai’s narrow, unstable competitive edge. I see Accenture as better equipped to defend and grow market share amid evolving tech demands.

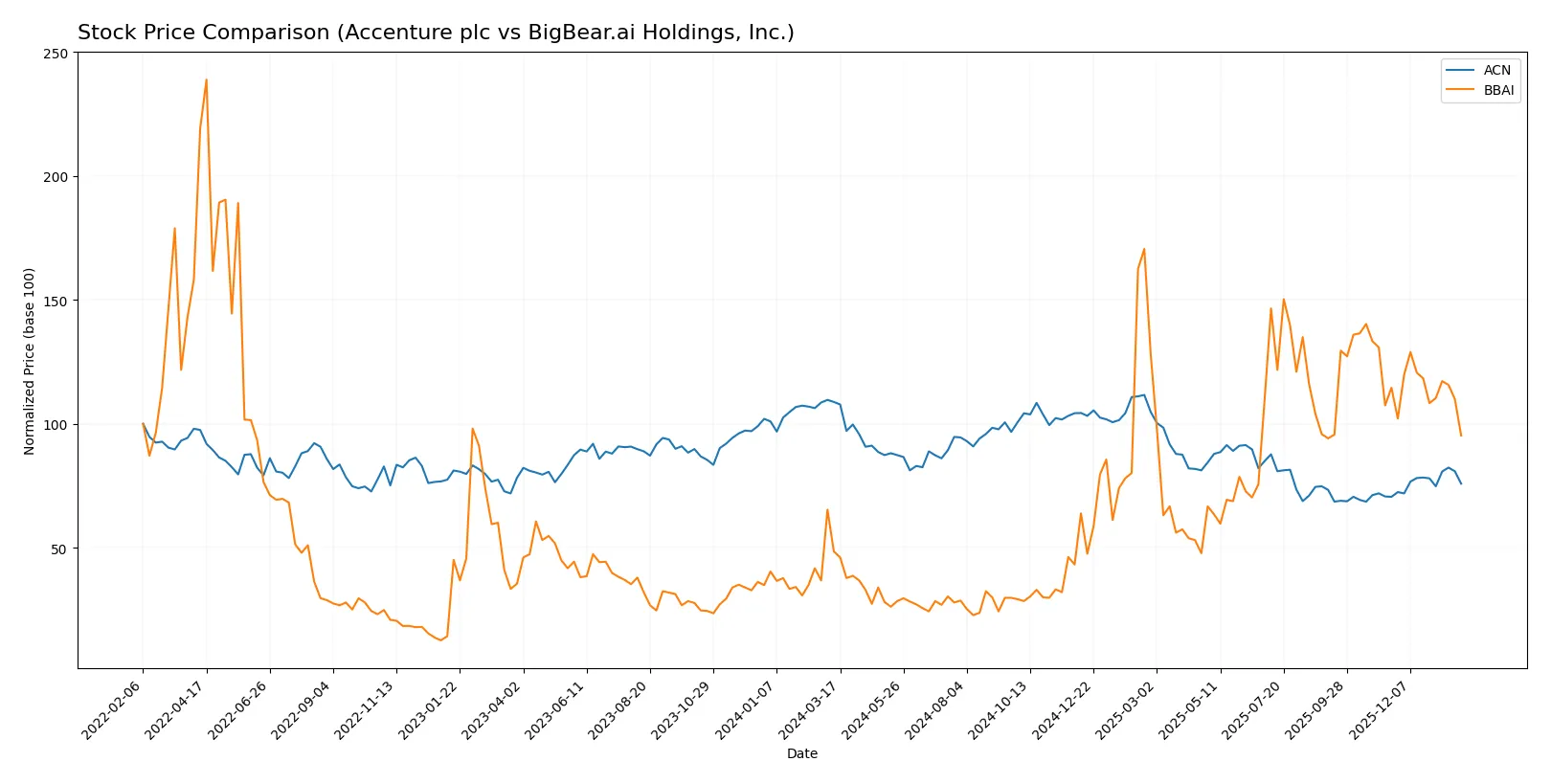

Which stock offers better returns?

The past year shows contrasting price dynamics: Accenture plc’s stock declined sharply but accelerated recently, while BigBear.ai Holdings, Inc. surged overall with recent deceleration.

Trend Comparison

Accenture plc’s stock fell 30.29% over 12 months, marking a bearish trend with accelerating decline and high volatility. It reached a high of 388.0 and a low of 238.39.

BigBear.ai Holdings, Inc. gained 96.11% over the same period, signaling a bullish trend with decelerating momentum and low volatility. Its price ranged from 1.21 to 9.02.

BigBear.ai Holdings outperformed Accenture plc, delivering the highest market return despite a recent short-term decline contrasting Accenture’s recent gain.

Target Prices

Analysts present a clear consensus on fair value estimates for Accenture plc and BigBear.ai Holdings, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Accenture plc | 265 | 330 | 303 |

| BigBear.ai Holdings, Inc. | 6 | 6 | 6 |

Accenture’s target consensus sits about 15% above its current price of 264, signaling moderate upside. BigBear.ai’s consensus target price of 6 suggests limited near-term appreciation from today’s 5.04.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a comparison of recent institutional grades for Accenture plc and BigBear.ai Holdings, Inc.:

Accenture plc Grades

The following table summarizes the latest grades from reputable institutions for Accenture plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| UBS | Maintain | Buy | 2025-12-19 |

| Susquehanna | Maintain | Neutral | 2025-12-19 |

| RBC Capital | Maintain | Outperform | 2025-12-19 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-16 |

| Mizuho | Maintain | Outperform | 2025-09-29 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-26 |

| BMO Capital | Maintain | Market Perform | 2025-09-26 |

| TD Cowen | Maintain | Buy | 2025-09-26 |

| Goldman Sachs | Maintain | Buy | 2025-09-26 |

BigBear.ai Holdings, Inc. Grades

Below are recent institutional grades for BigBear.ai Holdings, Inc. from established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Downgrade | Neutral | 2026-01-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-07-01 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-30 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-08-21 |

Which company has the best grades?

Accenture plc consistently receives higher grades, including multiple “Outperform” and “Buy” ratings from leading firms. BigBear.ai shows more mixed signals, recently downgraded to “Neutral” by Cantor Fitzgerald. Investors may interpret Accenture’s stronger grades as a sign of greater institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Accenture plc and BigBear.ai Holdings, Inc. in the 2026 market environment:

1. Market & Competition

Accenture plc

- Dominates the IT services sector with broad global reach and diversified offerings, facing intense competition from other large consultancies.

BigBear.ai Holdings, Inc.

- Operates in a niche AI and analytics market but faces fierce competition from larger tech firms and startups with more resources.

2. Capital Structure & Debt

Accenture plc

- Maintains a conservative debt-to-equity ratio (0.26), strong interest coverage (45.94), indicating low financial risk.

BigBear.ai Holdings, Inc.

- Shows a high debt-to-assets ratio (42.59%) and negative interest coverage (-10.53), signaling elevated financial risk and potential liquidity stress.

3. Stock Volatility

Accenture plc

- Beta at 1.25 suggests moderate volatility aligned with the tech sector average, stable price range.

BigBear.ai Holdings, Inc.

- Beta at 3.21 indicates extreme stock volatility, reflecting speculative trading and operational uncertainty.

4. Regulatory & Legal

Accenture plc

- Subject to global compliance standards with established risk management; regulatory challenges manageable given scale.

BigBear.ai Holdings, Inc.

- Faces regulatory scrutiny in AI ethics and cybersecurity, with evolving legislation increasing compliance costs and risks.

5. Supply Chain & Operations

Accenture plc

- Robust global delivery network with diversified suppliers mitigates operational disruptions.

BigBear.ai Holdings, Inc.

- Smaller scale and emerging operations increase exposure to supply chain disruptions and operational bottlenecks.

6. ESG & Climate Transition

Accenture plc

- Strong ESG initiatives and sustainability services provide competitive moat and align with client demands.

BigBear.ai Holdings, Inc.

- ESG practices less mature; climate transition risks and reputational effects could impact growth and investor appeal.

7. Geopolitical Exposure

Accenture plc

- Operates globally, exposed to geopolitical tensions but benefits from diversified markets and hedging.

BigBear.ai Holdings, Inc.

- Primarily US-based, geopolitical risks concentrated but less diversified internationally, increasing vulnerability.

Which company shows a better risk-adjusted profile?

Accenture faces typical large-cap risks but benefits from financial strength, operational scale, and moderate volatility. BigBear.ai bears significant financial distress and volatility, with risk concentrated in capital structure and regulatory uncertainties. Accenture’s stable Altman Z-score (5.45) and favorable Piotroski score (6) contrast sharply with BigBear.ai’s grey zone Z-score (2.51) and very weak Piotroski (3). Accenture clearly offers a superior risk-adjusted profile. The most pressing risk for Accenture lies in competitive pressure amid evolving technology demands, while BigBear.ai’s capital structure and liquidity issues pose existential threats. Recent trading volatility and negative margins underscore BigBear.ai’s fragile position, warranting caution.

Final Verdict: Which stock to choose?

Accenture plc impresses with its superpower of consistent value creation through operational efficiency and strong capital allocation. Its slight decline in profitability calls for vigilance but does not overshadow its robust income quality and sturdy balance sheet. It fits well in a disciplined, income-oriented growth portfolio.

BigBear.ai Holdings, Inc. offers a strategic moat rooted in innovative AI solutions and potential for rapid expansion. However, its financial instability and negative cash flows present significant risks. It could suit aggressive investors seeking high growth and willing to accept elevated volatility.

If you prioritize steady value creation and financial resilience, Accenture plc stands out due to its strong ROIC above WACC and stable cash flow generation. However, if you seek speculative growth with high upside potential, BigBear.ai might appeal despite its shaky fundamentals and elevated risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Accenture plc and BigBear.ai Holdings, Inc. to enhance your investment decisions: