Home > Comparison > Healthcare > ABT vs ZBH

The strategic rivalry between Abbott Laboratories and Zimmer Biomet defines the trajectory of the medical devices sector. Abbott operates as a diversified healthcare powerhouse with broad pharmaceutical and diagnostic segments. In contrast, Zimmer Biomet focuses on orthopedic reconstructive devices and musculoskeletal solutions. This analysis pits Abbott’s integrated model against Zimmer’s specialized approach to identify which offers superior risk-adjusted returns for a balanced healthcare portfolio.

Table of contents

Companies Overview

Abbott Laboratories and Zimmer Biomet Holdings, Inc. are key players shaping the medical devices market in 2026.

Abbott Laboratories: Diversified Healthcare Innovator

Abbott Laboratories dominates the global healthcare sector with a diversified portfolio across pharmaceuticals, diagnostics, nutrition, and medical devices. Its revenue engine lies in innovative diagnostic systems and cardiovascular devices. In 2026, Abbott strategically focuses on expanding its remote patient monitoring and point-of-care testing capabilities to capture growing demand for personalized healthcare solutions.

Zimmer Biomet Holdings, Inc.: Musculoskeletal Specialist

Zimmer Biomet specializes in orthopaedic reconstructive products and surgical instruments for musculoskeletal healthcare worldwide. It generates revenue primarily through knee, hip, and spine implants designed to treat bone and joint disorders. The company’s 2026 strategy emphasizes enhancing its robotic surgical systems and expanding biologics offerings to strengthen its leadership in surgical innovation.

Strategic Collision: Similarities & Divergences

Both companies compete fiercely in the medical devices arena but diverge in scope and innovation models. Abbott pursues a broad healthcare ecosystem integrating diagnostics and chronic care, while Zimmer Biomet focuses narrowly on orthopaedic precision and surgical robotics. Their primary battleground lies in advanced device innovation and surgeon adoption. Abbott’s scale contrasts with Zimmer Biomet’s specialized niche, defining distinctly different risk and growth profiles.

Income Statement Comparison

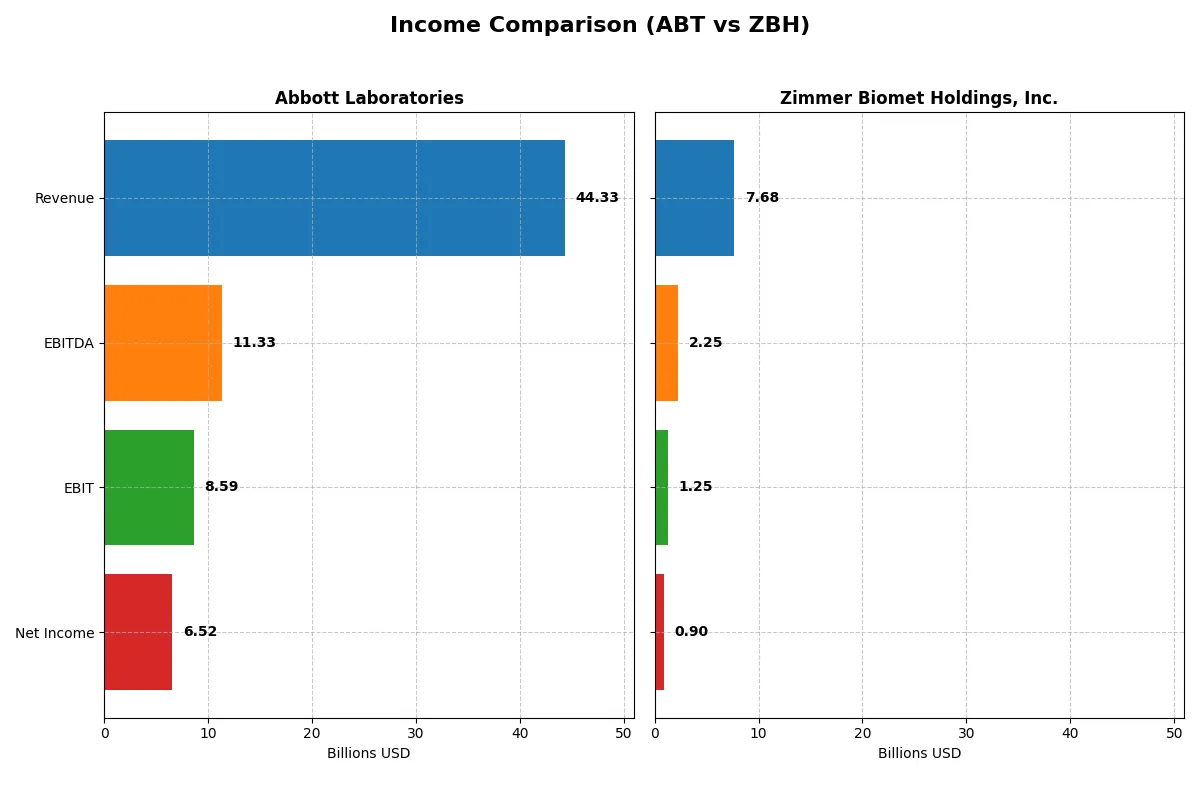

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Abbott Laboratories (ABT) | Zimmer Biomet Holdings, Inc. (ZBH) |

|---|---|---|

| Revenue | 44.3B | 7.68B |

| Cost of Revenue | 19.7B | 2.19B |

| Operating Expenses | 16.6B | 4.20B |

| Gross Profit | 24.6B | 5.49B |

| EBITDA | 11.3B | 2.25B |

| EBIT | 8.59B | 1.25B |

| Interest Expense | 341M | 218M |

| Net Income | 6.52B | 904M |

| EPS | 3.74 | 4.45 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

Comparing these income statements reveals each company’s operational efficiency and profitability momentum under current market conditions.

Abbott Laboratories Analysis

Abbott’s revenue climbed steadily from $40B in 2023 to $44.3B in 2025, showing moderate growth. Gross margin remains healthy at 55.5%, supporting strong operating income of $8B in 2025. However, net income dropped sharply to $6.5B in 2025 from $13.4B in 2024, signaling margin pressure and declining earnings per share. Operating expenses grew in line with revenue, pressuring net margin.

Zimmer Biomet Holdings Analysis

Zimmer Biomet’s revenue increased from $6.1B in 2020 to $7.7B in 2024, reflecting robust growth. Its gross margin is notably higher at 71.5%, with stable operating margins near 16%. Net income surged from $231M in 2022 to $904M in 2024, alongside a strong EPS of $4.45. Despite a slight dip in EBIT and net margin last year, the company maintains solid profitability and expanding earnings over the longer term.

Margin Strength vs. Growth Trajectory

Zimmer Biomet outperforms Abbott in margin efficiency and long-term net income growth. Abbott shows revenue scale but struggles with recent margin compression and earnings decline. Zimmer’s lean cost structure and strong margin expansion offer a more resilient profit profile. Investors favoring consistent earnings growth and margin strength may find Zimmer’s financials more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Abbott Laboratories (ABT) | Zimmer Biomet Holdings, Inc. (ZBH) |

|---|---|---|

| ROE | 28.1% | 7.2% |

| ROIC | 9.9% | 5.7% |

| P/E | 14.6 | 23.7 |

| P/B | 4.1 | 1.7 |

| Current Ratio | 1.67 | 1.91 |

| Quick Ratio | 1.23 | 0.99 |

| D/E | 0.32 | 0.50 |

| Debt-to-Assets | 18.8% | 29.0% |

| Interest Coverage | 11.3 | 5.9 |

| Asset Turnover | 0.52 | 0.36 |

| Fixed Asset Turnover | 3.58 | 3.75 |

| Payout ratio | 28.6% | 21.7% |

| Dividend yield | 1.96% | 0.91% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, uncovering hidden risks and revealing operational strengths essential for investment decisions.

Abbott Laboratories

Abbott shows strong profitability with a 14.72% net margin but lacks return on equity and invested capital, signaling operational challenges. Its P/E of 33.55 marks the stock as expensive relative to earnings. Dividend yield stands at a modest 1.88%, indicating a neutral shareholder return balanced between payouts and reinvestment in R&D.

Zimmer Biomet Holdings, Inc.

Zimmer Biomet posts an 11.77% net margin and a 7.25% ROE, reflecting moderate profitability but weaker equity returns. The P/E ratio of 23.74 suggests a fairly valued stock. Dividend yield is low at 0.91%, hinting at limited shareholder cash returns but a focus on sustaining growth and managing leverage.

Premium Valuation vs. Operational Safety

Abbott offers higher profitability but at a stretched valuation and weaker returns on equity and capital. Zimmer Biomet presents a more balanced risk profile with favorable leverage and liquidity ratios but lower profitability. Investors seeking growth may lean Abbott; those prioritizing stability may prefer Zimmer Biomet.

Which one offers the Superior Shareholder Reward?

I find Abbott Laboratories delivers superior shareholder rewards compared to Zimmer Biomet Holdings, Inc. Abbott yields ~1.9% with a sustainable payout ratio near 63%, backed by strong free cash flow and consistent buybacks. Zimmer’s lower yield (~0.9%) and payout (~22%) reflect a cautious distribution despite solid free cash flow. Abbott’s balanced dividend and buyback strategy supports reliable total returns, while Zimmer’s model leans more on reinvestment. In 2026, Abbott offers a more attractive total return profile for income-focused investors seeking steady growth.

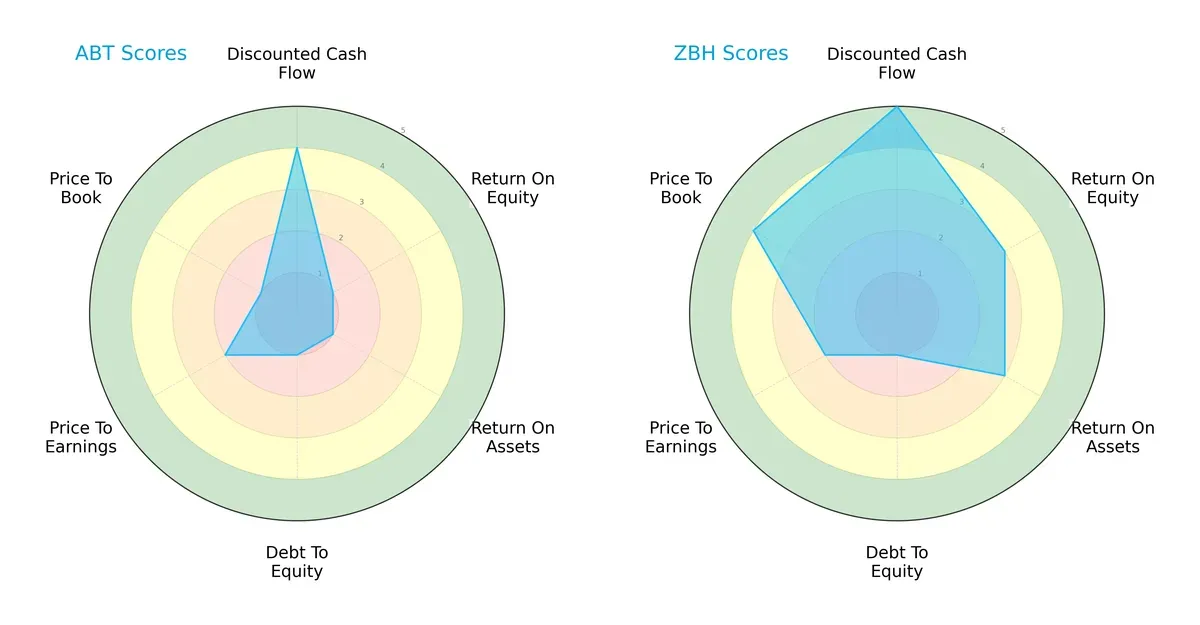

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Abbott Laboratories and Zimmer Biomet Holdings, Inc., highlighting their strategic financial profiles:

Zimmer Biomet outperforms Abbott with a more balanced profile, scoring high on DCF (5 vs. 4), ROE (3 vs. 1), and ROA (3 vs. 1). Abbott’s strength lies mainly in discounted cash flow, but it struggles with profitability and leverage metrics. Both share weak debt-to-equity scores (1), signaling elevated financial risk. Zimmer’s higher price-to-book score (4 vs. 1) suggests better valuation appeal.

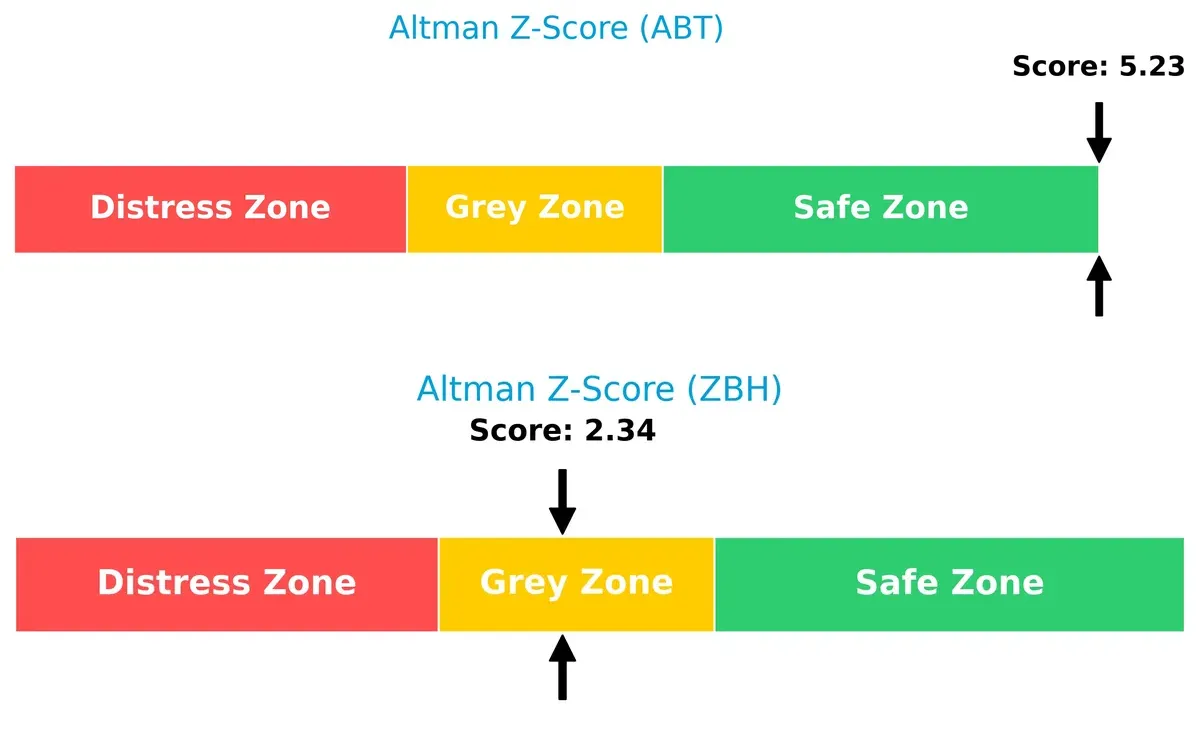

Bankruptcy Risk: Solvency Showdown

Zimmer Biomet’s Altman Z-Score of 2.34 places it in the grey zone, signaling moderate bankruptcy risk. Abbott’s stronger 5.23 score secures a safe zone status, indicating superior long-term solvency in this economic cycle:

Financial Health: Quality of Operations

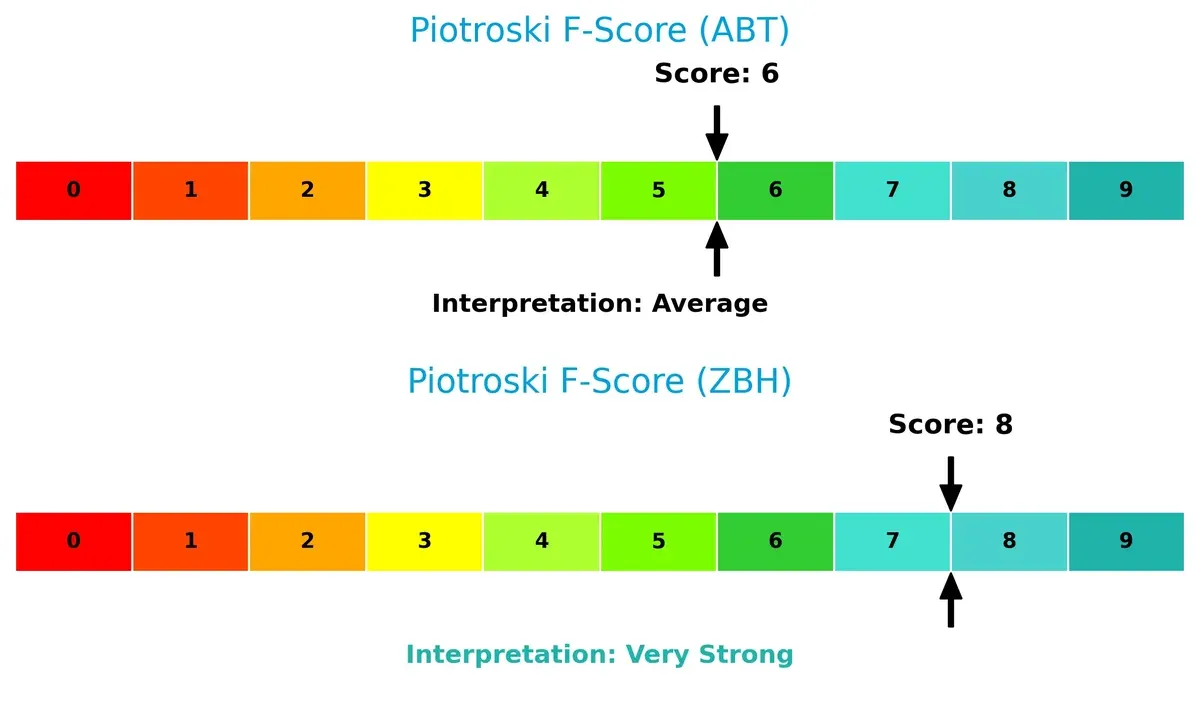

Zimmer Biomet’s Piotroski F-Score of 8 signals very strong financial health with robust internal metrics. Abbott’s score of 6 is average, raising caution about operational strength and efficiency compared to its peer:

How are the two companies positioned?

This section dissects the operational DNA of Abbott and Zimmer Biomet by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

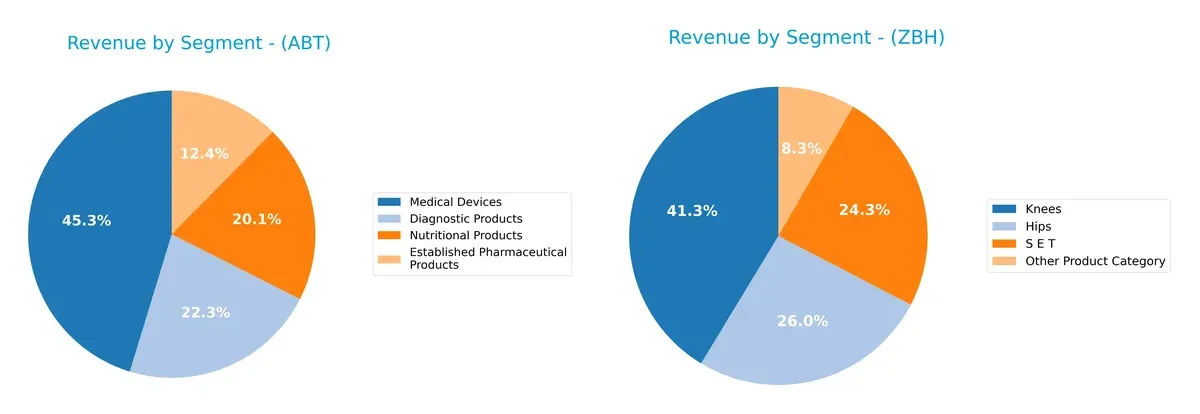

This visual comparison dissects how Abbott Laboratories and Zimmer Biomet diversify their income streams and highlights where their primary sector bets lie:

Abbott Laboratories displays a well-diversified mix with Medical Devices leading at $19B, closely followed by Diagnostic Products at $9.3B, Nutritional Products at $8.4B, and Established Pharmaceuticals at $5.2B. Zimmer Biomet, by contrast, leans heavily on Knees ($3.17B) and Hips ($2B), with smaller contributions from S E T and Other categories. Abbott’s broad base reduces concentration risk, while Zimmer’s focus anchors its infrastructure dominance in orthopedics.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Abbott Laboratories and Zimmer Biomet Holdings, Inc.:

Abbott Laboratories Strengths

- Diversified revenue across diagnostics, pharmaceuticals, devices, nutrition

- Strong global presence with significant US and Non-US sales

- Favorable net margin at 14.72%

- High interest coverage ratio at 25.18

Zimmer Biomet Holdings Strengths

- Favorable net margin of 11.77%

- Balanced global revenue from Americas, Asia Pacific, EMEA

- Favorable capital structure with moderate debt ratios

- Strong fixed asset turnover at 3.75

Abbott Laboratories Weaknesses

- Unfavorable ROE and ROIC at 0%, indicating weak capital returns

- Unavailable WACC complicates cost of capital assessment

- Unfavorable liquidity ratios with current and quick ratios at 0

- High P/E ratio of 33.55

- Unfavorable asset turnover metrics

Zimmer Biomet Holdings Weaknesses

- ROE at 7.25% remains below ideal

- ROIC neutral at 5.68%, limiting competitive advantage

- Dividend yield unfavorable at 0.91%

- Asset turnover low at 0.36

Abbott Laboratories displays strong diversification and profitability but struggles with returns and liquidity. Zimmer Biomet has a healthier balance sheet and asset efficiency but weaker profitability metrics. These factors frame each company’s strategic challenges and potential areas for improvement.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Let’s dissect two healthcare giants’ moats:

Abbott Laboratories: Intangible Assets and Diversification Moat

Abbott leverages extensive intangible assets and diversified segments, maintaining stable margins despite revenue growth challenges. New diagnostics and medical devices could either deepen or pressure this moat in 2026.

Zimmer Biomet Holdings, Inc.: Operational Efficiency and Market Focus Moat

Zimmer Biomet relies on operational efficiency and focused musculoskeletal products. Its improving ROIC trend contrasts Abbott’s decline, signaling strengthening competitive positioning and expansion potential in emerging markets.

Intangible Assets vs. Operational Efficiency: The Competitive Moat Face-off

Zimmer Biomet’s growing ROIC and value creation outpace Abbott’s stagnation and value erosion. I see Zimmer possessing a deeper moat with better defenses to protect market share through operational excellence and targeted innovation.

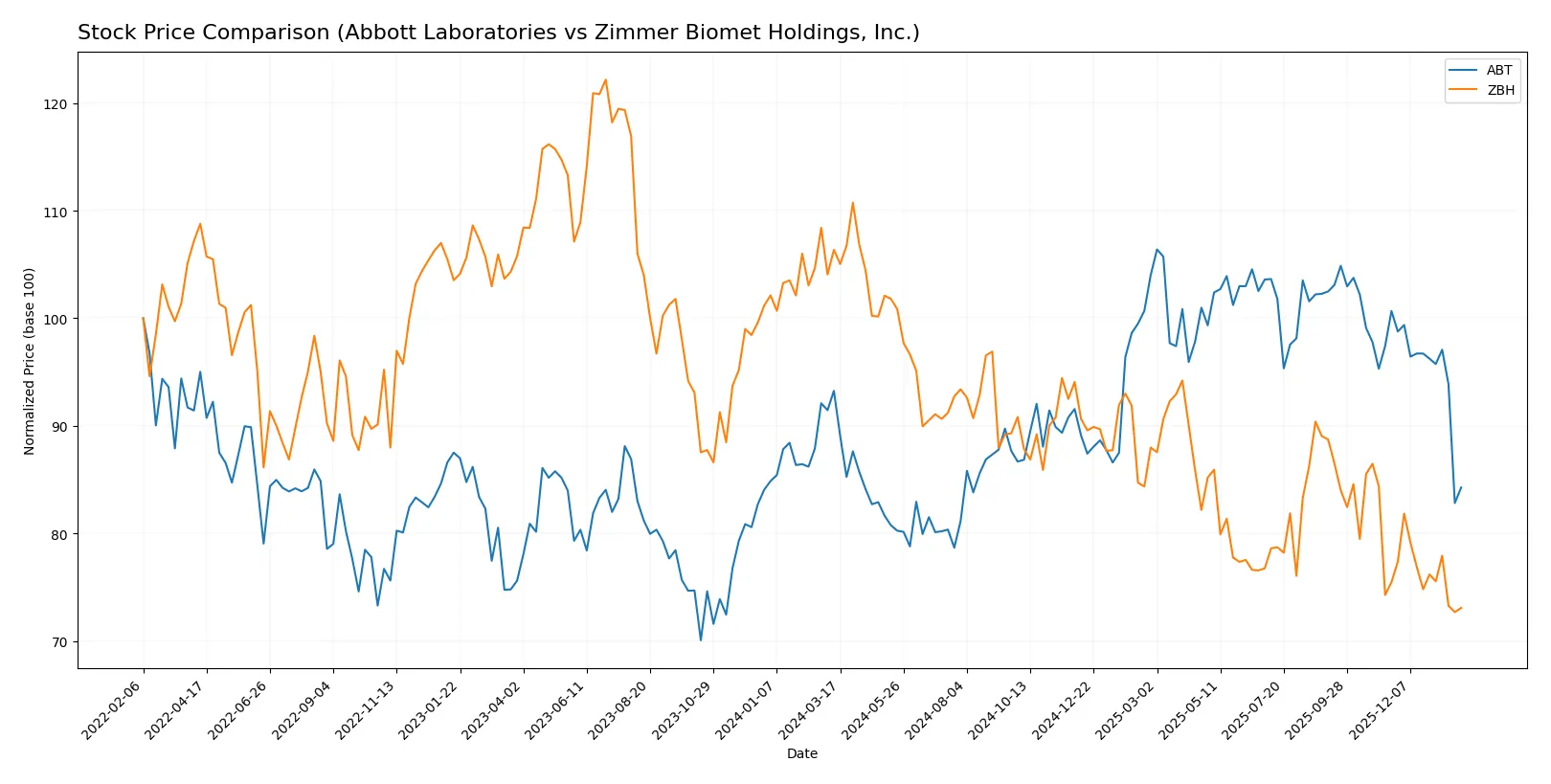

Which stock offers better returns?

Over the past year, both Abbott Laboratories and Zimmer Biomet Holdings, Inc. experienced declining stock prices, reflecting bearish trends with notable price drops and decelerating momentum.

Trend Comparison

Abbott Laboratories shows a 9.64% price decline over 12 months, marking a bearish trend with decelerating losses and a high volatility of 10.54%. The recent quarter shows an accelerated drop of 16.3%.

Zimmer Biomet Holdings registers a steeper 31.3% decline over the same period, confirming a bearish trend with deceleration and similar volatility at 10.15%. The recent quarter indicates a milder 3.16% decline.

Abbott’s smaller decline outperforms Zimmer’s significantly, delivering the highest relative market performance despite both trends being bearish and decelerating.

Target Prices

Analysts present a mixed but generally optimistic target consensus for Abbott Laboratories and Zimmer Biomet Holdings.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Abbott Laboratories | 120 | 169 | 137.09 |

| Zimmer Biomet Holdings, Inc. | 86 | 130 | 108 |

Abbott’s consensus target of 137.09 implies a 25% upside from the current 109.3 price. Zimmer Biomet’s 108 target suggests a 24% potential rise from 87.07.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is the latest institutional grading overview for Abbott Laboratories and Zimmer Biomet Holdings, Inc.:

Abbott Laboratories Grades

The table below shows recent grades from recognized institutional analysts for Abbott Laboratories.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-23 |

| BTIG | Maintain | Buy | 2026-01-23 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-23 |

| Piper Sandler | Maintain | Overweight | 2026-01-23 |

| Oppenheimer | Maintain | Outperform | 2026-01-23 |

| RBC Capital | Maintain | Outperform | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| BTIG | Maintain | Buy | 2025-11-20 |

Zimmer Biomet Holdings, Inc. Grades

The table below summarizes institutional grades for Zimmer Biomet Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Sell | 2026-01-28 |

| Bernstein | Maintain | Market Perform | 2026-01-09 |

| BTIG | Maintain | Buy | 2026-01-08 |

| Evercore ISI Group | Upgrade | Outperform | 2026-01-05 |

| Baird | Downgrade | Neutral | 2025-12-16 |

| Citigroup | Maintain | Neutral | 2025-12-11 |

| Canaccord Genuity | Maintain | Hold | 2025-11-10 |

| UBS | Maintain | Sell | 2025-11-06 |

| Barclays | Maintain | Underweight | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

Which company has the best grades?

Abbott Laboratories consistently receives Buy and Outperform ratings from top firms, showing strong institutional confidence. Zimmer Biomet’s grades vary more, with notable Sell and Neutral ratings, indicating mixed sentiment. Investors may interpret Abbott’s stronger consensus as a sign of greater institutional endorsement.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Abbott Laboratories and Zimmer Biomet in the 2026 market environment:

1. Market & Competition

Abbott Laboratories

- Faces intense competition in diversified medical devices and diagnostics markets with strong pharma segment diversification.

Zimmer Biomet Holdings, Inc.

- Competes primarily in orthopedic devices with niche leadership but narrower product scope increases competitive pressure.

2. Capital Structure & Debt

Abbott Laboratories

- Demonstrates a conservative debt profile with favorable debt-to-equity ratios and strong interest coverage.

Zimmer Biomet Holdings, Inc.

- Higher leverage with a moderate debt-to-equity ratio and lower interest coverage, posing more financial risk.

3. Stock Volatility

Abbott Laboratories

- Exhibits low beta (0.72), indicating lower stock volatility and defensive characteristics.

Zimmer Biomet Holdings, Inc.

- Slightly lower beta (0.614), suggesting marginally less volatility but similar defensive traits.

4. Regulatory & Legal

Abbott Laboratories

- Exposed to broad regulatory scrutiny across pharmaceuticals, diagnostics, and devices, increasing compliance complexity.

Zimmer Biomet Holdings, Inc.

- Faces regulatory risk focused on orthopedic device approvals and recalls, with legal exposure from surgical innovations.

5. Supply Chain & Operations

Abbott Laboratories

- Complex global supply chain supporting diverse product segments, vulnerable to multi-tier disruptions.

Zimmer Biomet Holdings, Inc.

- More concentrated supply chain focused on orthopedic manufacturing, potentially less complex but still sensitive to disruptions.

6. ESG & Climate Transition

Abbott Laboratories

- Under pressure to enhance sustainability across manufacturing and pharmaceutical operations amid rising ESG standards.

Zimmer Biomet Holdings, Inc.

- Faces ESG challenges primarily linked to manufacturing footprint and materials sourcing in device production.

7. Geopolitical Exposure

Abbott Laboratories

- Global footprint exposes it to geopolitical risks including trade tensions and emerging market volatility.

Zimmer Biomet Holdings, Inc.

- Also globally diversified but with somewhat less exposure to high-risk emerging markets, mitigating some geopolitical risk.

Which company shows a better risk-adjusted profile?

Abbott’s greatest risk lies in regulatory complexity across multiple healthcare segments. Zimmer Biomet’s most impactful risk is its capital structure with moderate leverage and lower interest coverage. Zimmer’s slightly favorable financial ratios and strong Piotroski score indicate a better risk-adjusted profile. Abbott’s high Altman Z-score signals financial safety, but its unfavorable ROE and liquidity ratios raise caution. Recent data show Zimmer’s improved operational efficiency and favorable DCF score, justifying confidence despite leverage concerns.

Final Verdict: Which stock to choose?

Abbott Laboratories stands out as a robust cash generator with a solid moat in healthcare innovation. Its main point of vigilance is the recent decline in profitability metrics, which could pressure future returns. It fits well in an aggressive growth portfolio seeking long-term value creation amid sector challenges.

Zimmer Biomet Holdings offers a strategic moat through its niche in orthopedic devices and consistent free cash flow. Relative to Abbott, it presents a more conservative risk profile with improving profitability trends. This makes it suitable for a GARP portfolio balancing steady income with moderate growth potential.

If you prioritize resilient cash flow and innovation-driven growth, Abbott Laboratories is the compelling choice due to its industry-leading margin profile and scale. However, if you seek more stability with a focus on improving returns and a defensible niche, Zimmer Biomet offers better stability despite a smaller market cap and higher leverage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Abbott Laboratories and Zimmer Biomet Holdings, Inc. to enhance your investment decisions: