Home > Analyses > Industrials > Comfort Systems USA, Inc.

Comfort Systems USA, Inc. plays a pivotal role in shaping the infrastructure of modern buildings across the United States, seamlessly integrating mechanical, electrical, and plumbing systems that keep commercial and industrial spaces running efficiently. Renowned for its engineering excellence and comprehensive service offerings, the company stands out as a leader in the construction and maintenance of vital building systems. As innovation and sustainability become increasingly critical, I explore whether Comfort Systems’ strong industry position and operational expertise continue to support its valuation and growth prospects.

Table of contents

Business Model & Company Overview

Comfort Systems USA, Inc., founded in 1917 and headquartered in Houston, Texas, stands as a dominant player in the mechanical and electrical services industry. Its integrated ecosystem spans heating, ventilation, air conditioning, plumbing, electrical, and fire protection services, combining installation, renovation, and maintenance to serve commercial, industrial, and institutional clients across the United States. This extensive service offering cements its role as a comprehensive solutions provider in the built environment.

The company’s revenue engine balances mechanical and electrical segments, leveraging both project-based installation and ongoing maintenance contracts to generate steady cash flow. Comfort Systems USA’s strategic footprint across key U.S. markets supports its ability to serve building owners, contractors, and property managers efficiently. Its robust service network and technical expertise create a strong economic moat, securing Comfort Systems USA’s influence in shaping the future of mechanical and electrical infrastructure.

Financial Performance & Fundamental Metrics

In this section, I analyze Comfort Systems USA, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

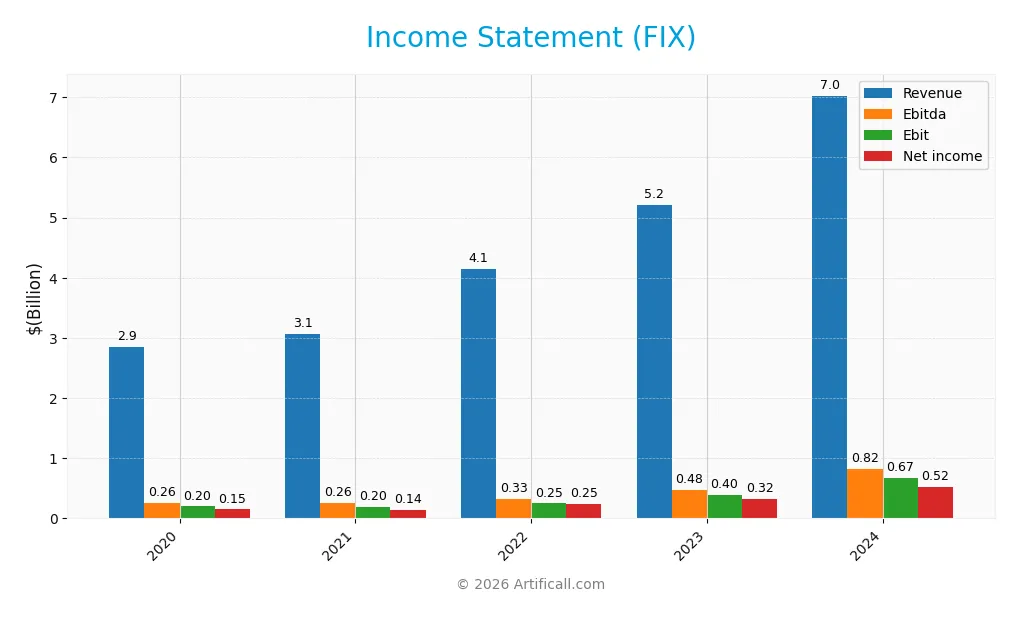

The following table summarizes Comfort Systems USA, Inc.’s key income statement figures over the last five fiscal years, presented in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.86B | 3.07B | 4.14B | 5.21B | 7.03B |

| Cost of Revenue | 2.31B | 2.51B | 3.40B | 4.22B | 5.55B |

| Operating Expenses | 356M | 375M | 488M | 572M | 727M |

| Gross Profit | 547M | 563M | 742M | 991M | 1.48B |

| EBITDA | 259M | 264M | 329M | 479M | 817M |

| EBIT | 199M | 195M | 248M | 397M | 672M |

| Interest Expense | 8.04M | 5.70M | 13.68M | 10.28M | 6.65M |

| Net Income | 150M | 143M | 246M | 323M | 522M |

| EPS | 4.11 | 3.95 | 6.84 | 9.03 | 14.64 |

| Filing Date | 2021-02-25 | 2022-02-23 | 2023-02-22 | 2024-02-22 | 2025-02-20 |

Income Statement Evolution

From 2020 to 2024, Comfort Systems USA, Inc. experienced strong growth, with revenue increasing by 146% and net income rising by nearly 248%. Gross margin improved to 21.01%, reflecting better cost control, while the EBIT margin remained stable at 9.56%. Net margin also expanded by over 41%, indicating enhanced profitability alongside robust top-line growth.

Is the Income Statement Favorable?

In 2024, the company reported revenue of $7.03B and net income of $522M, with a net margin of 7.43%, deemed favorable. Earnings per share grew 62% year-over-year to $14.64, supported by a 69% increase in EBIT. Interest expense remained low at 0.09% of revenue, contributing positively. Overall, the income statement fundamentals for 2024 are generally favorable, demonstrating solid operational and financial performance.

Financial Ratios

The following table presents key financial ratios for Comfort Systems USA, Inc. (ticker: FIX) over the fiscal years 2020 to 2024, providing a snapshot of profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 5.3% | 4.7% | 5.9% | 6.2% | 7.4% |

| ROE | 21.6% | 17.8% | 24.6% | 25.3% | 30.6% |

| ROIC | 13.8% | 10.2% | 17.4% | 21.6% | 27.2% |

| P/E | 12.8 | 25.0 | 16.8 | 22.8 | 29.0 |

| P/B | 2.8 | 4.5 | 4.1 | 5.8 | 8.9 |

| Current Ratio | 1.17 | 1.23 | 1.12 | 1.11 | 1.08 |

| Quick Ratio | 1.15 | 1.20 | 1.09 | 1.07 | 1.06 |

| D/E | 0.48 | 0.64 | 0.39 | 0.20 | 0.18 |

| Debt-to-Assets | 19% | 23% | 15% | 8% | 7% |

| Interest Coverage | 23.7 | 33.1 | 18.6 | 40.7 | 112.7 |

| Asset Turnover | 1.63 | 1.39 | 1.59 | 1.58 | 1.49 |

| Fixed Asset Turnover | 13.5 | 12.1 | 15.1 | 12.6 | 13.9 |

| Dividend Yield | 0.81% | 0.48% | 0.49% | 0.41% | 0.28% |

Evolution of Financial Ratios

From 2020 to 2024, Comfort Systems USA, Inc. saw its Return on Equity (ROE) improve significantly, reaching 30.65% in 2024, indicating enhanced profitability. The Current Ratio slightly declined to 1.08 in 2024, signaling stable but tight liquidity. The Debt-to-Equity Ratio improved markedly, dropping to 0.18, reflecting reduced leverage and a stronger balance sheet.

Are the Financial Ratios Favorable?

In 2024, the company’s profitability ratios such as ROE (30.65%) and Return on Invested Capital (27.16%) were favorable, while net margin at 7.43% was neutral. Liquidity ratios showed a neutral Current Ratio (1.08) but a favorable Quick Ratio (1.06). Leverage metrics, including a low Debt-to-Equity of 0.18 and Debt-to-Assets at 6.55%, were favorable. Market valuation ratios like P/E (28.97) and P/B (8.88) were unfavorable, indicating a relatively high market price. Overall, 57.14% of ratios were favorable, supporting a generally positive financial standing.

Shareholder Return Policy

Comfort Systems USA, Inc. maintains a consistent dividend policy with a payout ratio near 8% in 2024 and a modest dividend yield of 0.28%. The dividend per share has increased steadily over the years, supported by strong free cash flow coverage, indicating a prudent distribution approach without overextending resources. The company also engages in share buybacks, complementing its shareholder return strategy.

This balanced approach of dividends and buybacks, backed by healthy cash flow and low leverage, suggests a sustainable model for long-term value creation. Risks related to unsustainable payouts or excessive repurchases appear limited given the coverage ratios and margin stability reported.

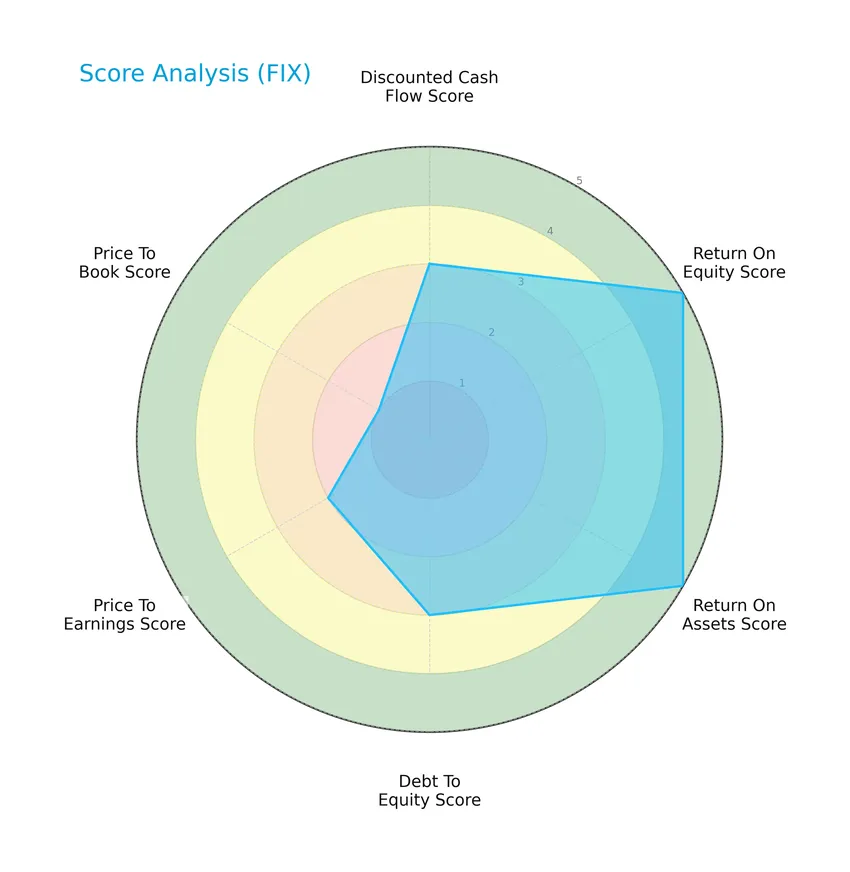

Score analysis

The following radar chart visualizes Comfort Systems USA, Inc.’s core financial scores evaluating valuation, profitability, and leverage metrics:

Comfort Systems USA, Inc. shows very favorable scores for return on equity and return on assets at 5 each, indicating strong profitability. The discounted cash flow and debt-to-equity scores stand at a moderate 3. Valuation metrics are weaker, with price-to-earnings at 2 (moderate) and price-to-book at 1 (very unfavorable).

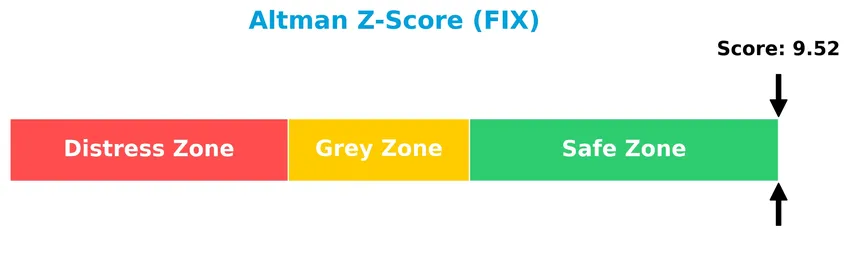

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Comfort Systems USA, Inc. firmly in the safe zone, indicating a very low risk of bankruptcy and strong financial stability:

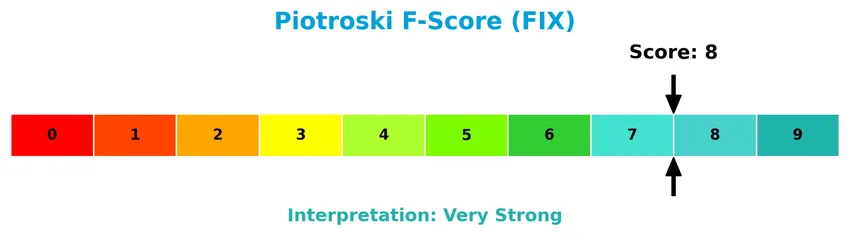

Is the company in good financial health?

The Piotroski Score diagram reflects Comfort Systems USA, Inc.’s very strong financial health based on key performance and efficiency criteria:

With a Piotroski Score of 8, the company demonstrates robust financial strength, suggesting sound management performance and solid fundamentals in profitability, liquidity, and leverage.

Competitive Landscape & Sector Positioning

This sector analysis examines Comfort Systems USA, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Comfort Systems USA holds a competitive advantage relative to its peers in the engineering and construction industry.

Strategic Positioning

Comfort Systems USA, Inc. focuses on a concentrated portfolio within the U.S. mechanical and electrical services industry, with its 2024 revenue heavily weighted toward mechanical services at $5.53B and electrical services at $1.50B. It operates exclusively in the U.S. market, serving commercial, industrial, and institutional clients.

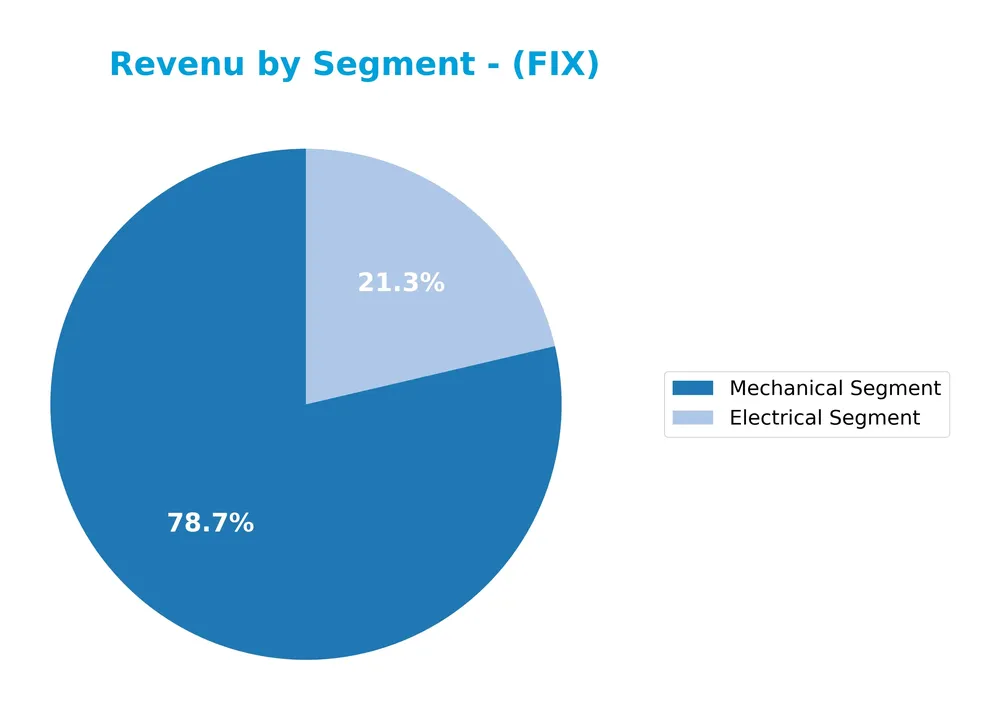

Revenue by Segment

This pie chart illustrates the revenue distribution between the Electrical and Mechanical segments of Comfort Systems USA, Inc. for the fiscal year 2024.

The Mechanical Segment dominates the company’s revenue with $5.53B in 2024, showing strong and consistent growth from $3.95B in 2023. The Electrical Segment also increased, reaching $1.50B in 2024 from $1.26B the previous year. This trend highlights a growing concentration in the Mechanical segment, which drives the business significantly, while the Electrical segment supports steady expansion. The 2024 data reflects accelerated growth, particularly in Mechanical services.

Key Products & Brands

The table below outlines Comfort Systems USA, Inc.’s main products and services across its key business segments:

| Product | Description |

|---|---|

| Mechanical Segment | Heating, ventilation, air conditioning (HVAC), plumbing, piping, and controls installation and services. |

| Electrical Segment | Electrical installation, renovation, maintenance, repair, and replacement services. |

| Building Automation Control Systems | Systems for remote monitoring and control of power usage, temperature, pressure, humidity, and airflow. |

| Fire Protection | Installation and maintenance of fire protection systems. |

| Off-site Construction | Prefabrication and off-site assembly of mechanical and electrical components for building projects. |

| Mechanical, Electrical, and Plumbing (MEP) Integration | Design, engineering, integration, installation, and start-up of MEP systems in new and existing buildings. |

Comfort Systems USA operates primarily through its Mechanical and Electrical segments, providing comprehensive MEP services and building system monitoring solutions to commercial, industrial, and institutional clients in the US.

Main Competitors

There are 3 main competitors in the Industrials sector, Engineering & Construction industry; the table lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Quanta Services, Inc. | 65.2B |

| Comfort Systems USA, Inc. | 35.4B |

| EMCOR Group, Inc. | 28.6B |

Comfort Systems USA, Inc. ranks 2nd among its competitors with a market cap at 60.63% of the leader Quanta Services, Inc. The company stands below the average market cap of the top 10 but above the median market cap within its sector. It maintains a significant 64.95% gap from the closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does FIX have a competitive advantage?

Comfort Systems USA, Inc. demonstrates a durable competitive advantage, supported by a very favorable moat status driven by a ROIC significantly above WACC and a strong upward trend in profitability. The company consistently creates value through efficient capital use and delivers favorable income statement metrics including a 7.43% net margin and 34.97% revenue growth in the past year.

Looking ahead, Comfort Systems USA, Inc. is positioned to leverage opportunities in mechanical and electrical services with expanding offerings in remote monitoring and off-site construction. Its presence in commercial, industrial, and institutional markets suggests potential for continued growth through innovation and market penetration.

SWOT Analysis

This SWOT analysis highlights Comfort Systems USA, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic investment decisions.

Strengths

- Strong revenue growth with 147% increase over 5 years

- High ROE of 30.65% and ROIC of 27.16% indicating efficient capital use

- Durable competitive advantage with growing profitability and low debt levels

Weaknesses

- High valuation multiples with PE of 29 and PB of 8.9 may limit upside

- Dividend yield is low at 0.28%, less attractive for income investors

- Moderate liquidity with current ratio near 1.08 could limit short-term flexibility

Opportunities

- Expansion in commercial and institutional MEP markets as infrastructure spending rises

- Increasing demand for energy-efficient building systems and remote monitoring services

- Potential for margin improvement through operational scale and technology adoption

Threats

- Economic downturns could reduce construction activity and capital expenditures

- Rising interest rates may increase borrowing costs despite low current interest expense

- Intense competition in engineering and construction sector pressures pricing and margins

Overall, Comfort Systems USA demonstrates solid financial health and strong growth trends, supported by a competitive moat and efficient operations. However, investors should be mindful of valuation risks and market cyclicality when considering its strategic positioning.

Stock Price Action Analysis

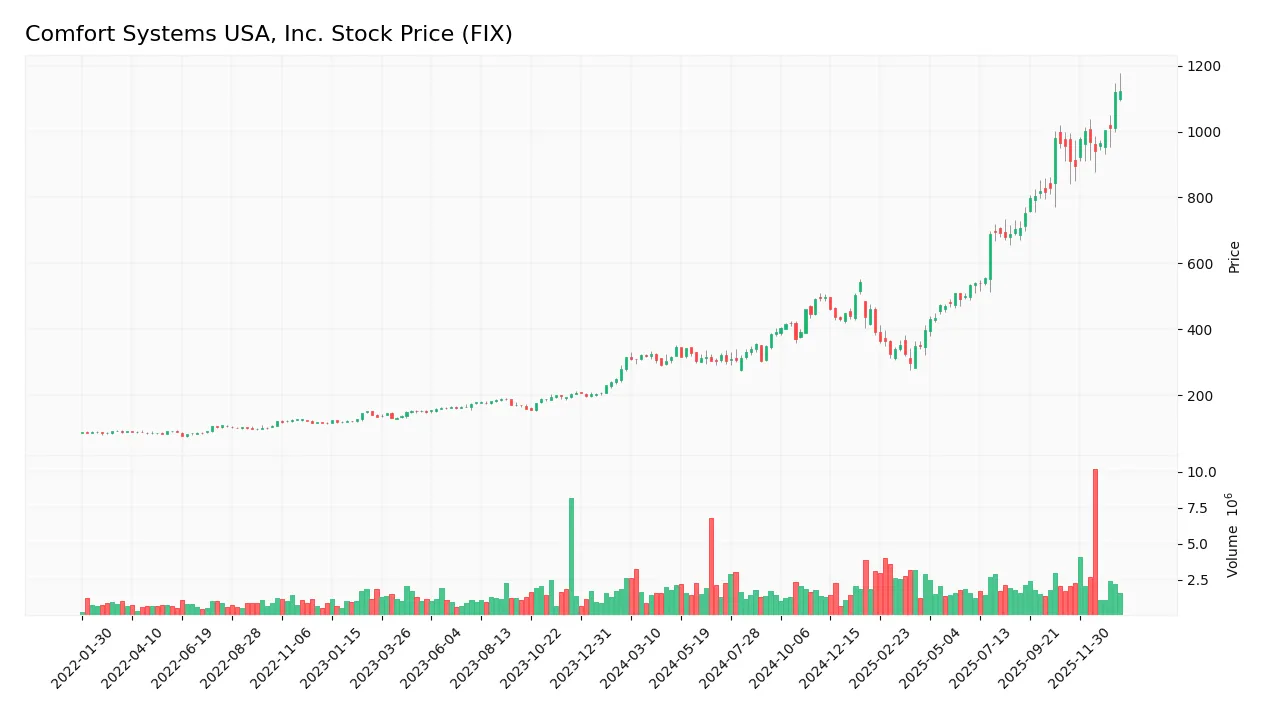

The weekly stock chart of Comfort Systems USA, Inc. (FIX) illustrates price movements and volume over the past 100 weeks:

Trend Analysis

Over the past 12 months, FIX’s stock price increased by 257%, indicating a strong bullish trend with acceleration. The highest price reached 1121.44 and the lowest was 290.73. The standard deviation of 234.63 signals considerable volatility during this period.

Volume Analysis

In the last three months, trading volume has increased overall, but recent activity shows slight seller dominance with buyers accounting for 43.46%. This shift suggests cautious investor sentiment and a potential rise in selling pressure despite rising volumes.

Target Prices

Analysts present a solid target consensus for Comfort Systems USA, Inc., reflecting optimistic expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 1200 | 1069 | 1136.33 |

The target prices suggest a generally bullish outlook, with a consensus price indicating potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the grades and consumer feedback related to Comfort Systems USA, Inc. (FIX) for informed analysis.

Stock Grades

The following table presents recent grades from recognized financial firms on Comfort Systems USA, Inc. (FIX):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2025-12-19 |

| Stifel | Maintain | Buy | 2025-12-16 |

| UBS | Maintain | Buy | 2025-10-27 |

| Stifel | Maintain | Buy | 2025-10-13 |

| UBS | Maintain | Buy | 2025-09-15 |

| DA Davidson | Maintain | Buy | 2025-07-28 |

| UBS | Maintain | Buy | 2025-07-25 |

| Stifel | Maintain | Buy | 2025-07-11 |

| DA Davidson | Maintain | Buy | 2025-06-30 |

| Stifel | Maintain | Buy | 2025-05-23 |

The grades from major firms consistently maintain a Buy rating throughout 2025, reflecting stable confidence. However, the broader consensus leans toward Hold, indicating some caution among analysts.

Consumer Opinions

Consumers of Comfort Systems USA, Inc. (FIX) generally express a mix of satisfaction and concerns that reflect their experience with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and timely HVAC maintenance with professional staff | Occasional delays in service scheduling |

| Competitive pricing compared to local competitors | Customer service can be unresponsive during peak periods |

| Technicians demonstrate strong expertise and problem-solving | Some clients report inconsistent quality across different regions |

| Clear communication and transparent billing | Limited availability for emergency repairs outside business hours |

Overall, feedback highlights Comfort Systems USA’s technical expertise and competitive pricing as key strengths, while service delays and customer support responsiveness remain areas for improvement.

Risk Analysis

The table below summarizes key risks associated with Comfort Systems USA, Inc., highlighting their likelihood and potential impact on investment performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta of 1.664 indicates sensitivity to market swings, potentially affecting stock price. | High | Medium |

| Valuation Risk | Elevated P/E (28.97) and P/B (8.88) ratios suggest the stock may be overvalued currently. | Medium | High |

| Industry Cyclicality | The engineering & construction sector can be cyclical, impacted by economic downturns. | Medium | Medium |

| Dividend Yield | Low dividend yield (0.28%) may deter income-focused investors, affecting demand. | Low | Low |

| Financial Leverage | Low debt-to-equity (0.18) and strong interest coverage reduce financial distress risk. | Low | Low |

The most significant risks to consider are market volatility and valuation concerns. Despite strong financial health indicated by a safe Altman Z-Score (9.52) and a very strong Piotroski Score (8), the stock’s high valuation metrics may expose investors to price corrections amid economic uncertainties. Cautious position sizing and monitoring of market conditions are advisable.

Should You Buy Comfort Systems USA, Inc.?

Comfort Systems USA, Inc. appears to be delivering robust profitability and strong operational efficiency, supported by a durable competitive moat with growing value creation. Despite some moderate leverage indicators, its overall financial health could be seen as favorable, reflected in a B+ rating.

Strength & Efficiency Pillars

Comfort Systems USA, Inc. displays solid profitability with a return on equity of 30.65% and a robust return on invested capital (ROIC) of 27.16%. Notably, the ROIC substantially exceeds its weighted average cost of capital (WACC) of 11.63%, confirming the company as a clear value creator. Financial health metrics reinforce this outlook: an Altman Z-Score of 9.52 places the firm well within the safe zone, and a Piotroski score of 8 signals very strong financial strength. These indicators underscore durable operational efficiency and effective capital deployment.

Weaknesses and Drawbacks

Despite these strengths, Comfort Systems faces valuation pressures, with a price-to-earnings ratio of 28.97 and a price-to-book ratio of 8.88, both flagged as unfavorable, suggesting a premium market valuation that may limit near-term upside. Leverage remains moderate with a debt-to-equity ratio of 0.18, which is favorable, but the current ratio at 1.08 indicates only a marginal buffer in liquidity. Furthermore, recent trading shows a slight seller dominance at 43.46% buyer volume, signaling short-term market pressure and potential volatility.

Our Verdict about Comfort Systems USA, Inc.

The long-term fundamental profile for Comfort Systems USA, Inc. appears favorable, supported by strong profitability and financial health metrics. However, despite a bullish overall trend, the recent phase marked by slight seller dominance suggests investors might consider a cautious stance, potentially awaiting a more attractive entry point. This balanced view reflects both the company’s sustainable value creation and the current market dynamics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Comfort Systems USA, Inc. $FIX Stake Lessened by Baillie Gifford & Co. – MarketBeat (Jan 24, 2026)

- Comfort Systems USA Inc (NYSE:FIX) Passes Louis Navellier’s “Little Book” Growth Filter – Chartmill (Jan 22, 2026)

- Strong Revenue Report Lifts Comfort Systems (FIX) Shares – Yahoo Finance (Jan 23, 2026)

- Comfort Systems USA, Inc.’s (NYSE:FIX) 27% Jump Shows Its Popularity With Investors – simplywall.st (Jan 17, 2026)

- Comfort Systems USA, Inc. $FIX Shares Acquired by Wealth Enhancement Advisory Services LLC – MarketBeat (Jan 23, 2026)

For more information about Comfort Systems USA, Inc., please visit the official website: comfortsystemsusa.com