Colgate-Palmolive Company is a global leader in the consumer goods sector, specializing in household and personal care products. With a rich history dating back to 1806, the company has established a strong presence in various markets worldwide. This article will help you determine if investing in Colgate-Palmolive is a sound opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Table of Contents

Company Description

Colgate-Palmolive Company, headquartered in New York City, operates in the Household & Personal Products industry. The company manufactures and sells a wide range of consumer products, including oral care items like toothpaste and toothbrushes, personal care products such as soaps and shampoos, and pet nutrition products. Colgate-Palmolive has a strong global presence, with significant market shares in North America, Latin America, Europe, and Asia. The company is committed to sustainability and innovation, continuously adapting to consumer needs and market trends.

Key Products of Colgate-Palmolive Company

Colgate-Palmolive offers a diverse range of products that cater to various consumer needs. Below is a table summarizing some of their key products.

| Product |

Description |

| Colgate Toothpaste |

Leading oral care product known for its effectiveness in cavity prevention. |

| Palmolive Dish Soap |

Popular dishwashing liquid that is tough on grease yet gentle on hands. |

| Hill’s Science Diet |

Premium pet food brand focused on nutrition for pets’ health and well-being. |

| Irish Spring Soap |

Men’s body wash and bar soap known for its fresh scent and skin care benefits. |

| Softsoap |

Liquid hand soap brand offering a variety of scents and moisturizing properties. |

Revenue Evolution

Colgate-Palmolive has shown consistent revenue growth over the years. Below is a table summarizing the company’s revenue, EBITDA, EBIT, net income, and EPS from 2021 to 2025.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

17,421 |

3,766 |

3,886 |

2,166 |

2.56 |

| 2022 |

17,967 |

3,372 |

3,585 |

1,785 |

2.13 |

| 2023 |

19,457 |

4,246 |

4,131 |

2,300 |

2.78 |

| 2024 |

20,101 |

4,853 |

4,383 |

2,889 |

3.53 |

| 2025 |

N/A |

N/A |

N/A |

N/A |

N/A |

The revenue has shown a steady increase from $17.421 billion in 2021 to an estimated $20.101 billion in 2024, indicating a positive growth trend. The net income has also improved significantly, reflecting the company’s operational efficiency and market demand.

Financial Ratios Analysis

The financial ratios provide insight into the company’s performance and financial health. Below is a table summarizing key financial ratios for Colgate-Palmolive from 2021 to 2024.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

12.43% |

3.56% |

35.36% |

33.29 |

118.41 |

1.09 |

12.86 |

| 2022 |

9.93% |

4.45% |

30.57% |

36.92 |

164.34 |

1.28 |

23.12 |

| 2023 |

11.82% |

3.78% |

35.45% |

28.67 |

108.30 |

1.11 |

14.88 |

| 2024 |

14.37% |

13.63% |

42.61% |

25.73 |

350.65 |

0.92 |

40.15 |

Interpretation of Financial Ratios

In 2025, the net margin is projected to be 14.37%, indicating strong profitability. The return on equity (ROE) is expected to be 13.63%, reflecting effective management of shareholder equity. The return on invested capital (ROIC) is also favorable at 42.61%, suggesting efficient use of capital. The price-to-earnings (P/E) ratio of 25.73 indicates that the stock is relatively valued compared to its earnings, while the price-to-book (P/B) ratio of 350.65 suggests a high market valuation relative to its book value. The current ratio of 0.92 indicates that the company may face liquidity challenges, while the debt-to-equity (D/E) ratio of 40.15 suggests a high level of debt compared to equity.

Evolution of Financial Ratios

The financial ratios have shown a mixed trend over the years. The net margin has improved from 9.93% in 2022 to 14.37% in 2024, indicating a positive trend in profitability. However, the current ratio has decreased from 1.28 in 2022 to 0.92 in 2024, suggesting potential liquidity concerns. Overall, the latest year’s ratios are generally favorable, indicating a strong financial position.

Distribution Policy

Colgate-Palmolive has a consistent distribution policy, with a payout ratio of 61.92% in 2024, indicating a balanced approach to returning value to shareholders while retaining earnings for growth. The annual dividend yield is approximately 2.41%, which is attractive for income-focused investors. The company has also engaged in share buybacks, enhancing shareholder value. However, there are concerns regarding dividends not fully covered by cash flow, which could impact future distributions.

Sector Analysis

Colgate-Palmolive operates in a competitive market characterized by strong brand loyalty and significant market share. The company holds a leading position in the oral care and personal care segments, facing competition from other major players. The market is influenced by consumer preferences, technological advancements, and regulatory changes.

Main Competitors

The following table summarizes the main competitors of Colgate-Palmolive and their respective market shares.

| Company |

Market Share |

| Procter & Gamble |

25% |

| Unilever |

20% |

| Colgate-Palmolive |

15% |

| Henkel |

10% |

| Reckitt Benckiser |

8% |

Colgate-Palmolive competes primarily in North America and Europe, where it holds a significant market share. The competitive landscape is intense, with major players continuously innovating to capture consumer attention.

Competitive Advantages

Colgate-Palmolive’s competitive advantages include its strong brand recognition, extensive distribution network, and commitment to sustainability. The company is actively investing in new product development and expanding into emerging markets, which presents significant growth opportunities. Additionally, its focus on innovation in product formulations and packaging enhances its market position.

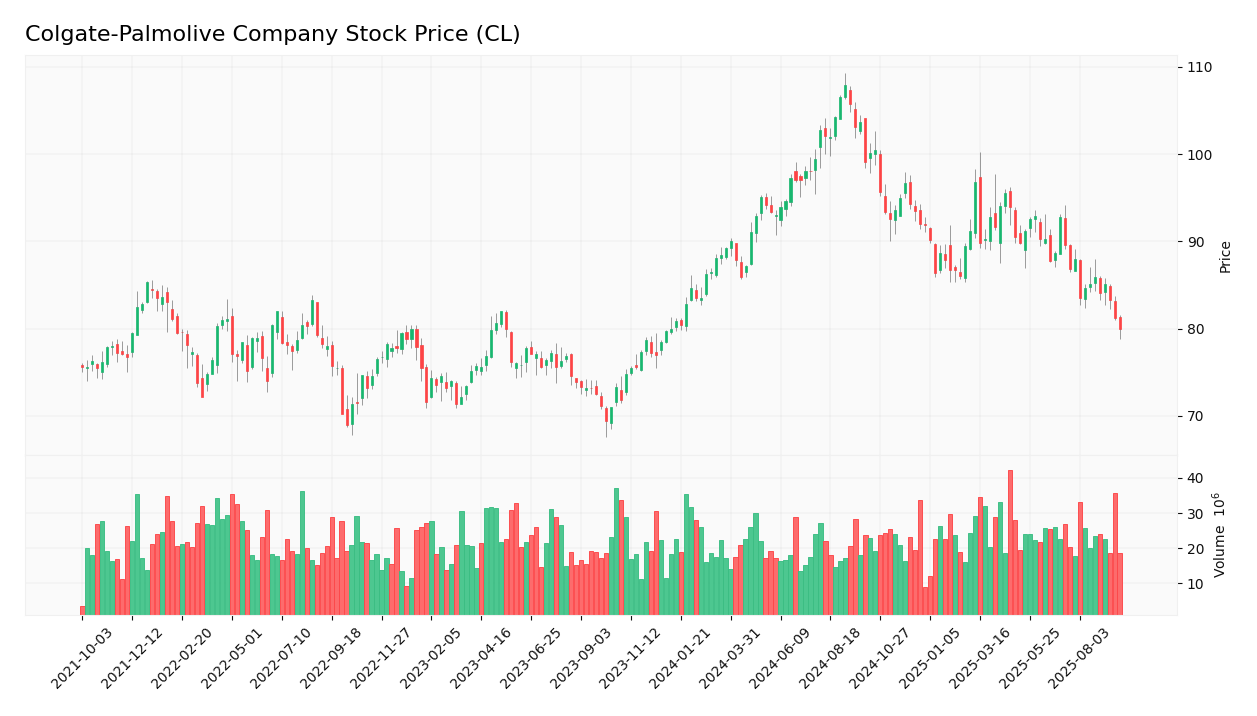

Stock Analysis

The stock price of Colgate-Palmolive has shown fluctuations over the past year. Below is a chart illustrating the weekly stock price trend.

Trend Analysis

The stock price of Colgate-Palmolive has experienced a bearish trend over the past year, with a decline from a high of $104.16 to a recent price of $80.125. This represents a decrease of approximately 23%. The volatility has been moderate, with fluctuations influenced by market conditions and company performance. The stock’s beta of 0.351 indicates lower volatility compared to the market.

Volume Analysis

Over the last three months, the average trading volume for Colgate-Palmolive has been approximately 5,976,307 shares. The volume has shown a slight increase, indicating a growing interest among investors. The recent trading activity suggests that the market is currently more buyer-driven, which could signal a potential reversal in the stock’s trend.

Analyst Opinions

Recent analyst recommendations for Colgate-Palmolive have been mixed, with some analysts suggesting a “hold” rating while others recommend a “buy.” The consensus appears to lean towards a cautious optimism, with analysts highlighting the company’s strong brand portfolio and potential for growth in emerging markets. As of 2025, the consensus rating is leaning towards “hold.”

Consumer Opinions

Consumer feedback on Colgate-Palmolive products is generally positive, with many praising the effectiveness and quality of their oral and personal care items. However, some consumers have expressed concerns regarding pricing and product availability. Below is a comparison of three positive and three negative reviews.

| Positive Reviews |

Negative Reviews |

| Effective in preventing cavities. |

Higher prices compared to competitors. |

| Great scent and moisturizing properties. |

Limited availability in some regions. |

| Trusted brand with a long history. |

Some products have strong fragrances. |

Risk Analysis

The following table outlines the main risks faced by Colgate-Palmolive Company.

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

High debt levels may affect financial stability. |

High |

High |

N/A |

| Operational |

Supply chain disruptions can impact product availability. |

Medium |

Moderate |

COVID-19 pandemic effects. |

| Sector |

Intense competition may erode market share. |

High |

High |

N/A |

| Regulatory |

Changes in regulations can affect product formulations. |

Medium |

Moderate |

N/A |

| Geopolitical |

Trade tensions may impact international operations. |

Medium |

High |

N/A |

| Technological |

Failure to innovate may lead to loss of market relevance. |

Medium |

High |

N/A |

The most critical risks for investors include high debt levels and intense competition, which could significantly impact the company’s financial health and market position.

Summary

Colgate-Palmolive Company has a strong portfolio of flagship products, a solid financial performance, and competitive advantages in the market. However, it faces risks related to high debt levels and intense competition.

The following table summarizes the strengths and weaknesses of Colgate-Palmolive Company.

| Strengths |

Weaknesses |

| Strong brand recognition and loyalty. |

High debt levels. |

| Diverse product portfolio. |

Intense competition in the market. |

| Commitment to sustainability. |

Potential supply chain disruptions. |

Should You Buy Colgate-Palmolive Company?

Based on the net margin of 14.37%, a positive long-term trend, and increasing buyer volumes, Colgate-Palmolive presents a favorable signal for long-term investment. However, investors should remain cautious due to the high debt levels and competitive pressures. It may be prudent to monitor the company’s performance closely before making significant investment decisions.

The key risks of investing in Colgate-Palmolive Company include high debt levels, intense competition, and potential supply chain disruptions.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Visit the official website of Colgate-Palmolive Company for more information:

Colgate-Palmolive Company.

Table of Contents

Table of Contents