Home > Analyses > Consumer Defensive > Colgate-Palmolive Company

Colgate-Palmolive shapes daily routines worldwide by delivering trusted oral care and household essentials. It commands the consumer defensive sector with iconic brands like Colgate toothpaste and Hill’s pet nutrition. Renowned for innovation and quality, the company blends tradition with modern consumer trends. As markets evolve, I question whether Colgate’s solid fundamentals still justify its premium valuation and growth prospects in a competitive landscape.

Table of contents

Business Model & Company Overview

Colgate-Palmolive Company, founded in 1806 and headquartered in New York City, commands a leading position in Household & Personal Products. Its ecosystem spans oral care, personal hygiene, home care, and pet nutrition, uniting iconic brands like Colgate, Palmolive, and Hill’s Science Diet. This breadth supports a global footprint and deep consumer loyalty, reflecting a century of evolving expertise in everyday essentials.

The company’s revenue engine balances hardware-like products—such as toothbrushes and dishwashing detergents—with high-margin recurring sales of toothpaste, soaps, and pet nutrition. It leverages a strategic presence across the Americas, Europe, and Asia through diverse retail channels, including eCommerce. Colgate-Palmolive’s economic moat lies in its trusted brand portfolio and extensive distribution, shaping the future of consumer health and hygiene worldwide.

Financial Performance & Fundamental Metrics

I will analyze Colgate-Palmolive Company’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

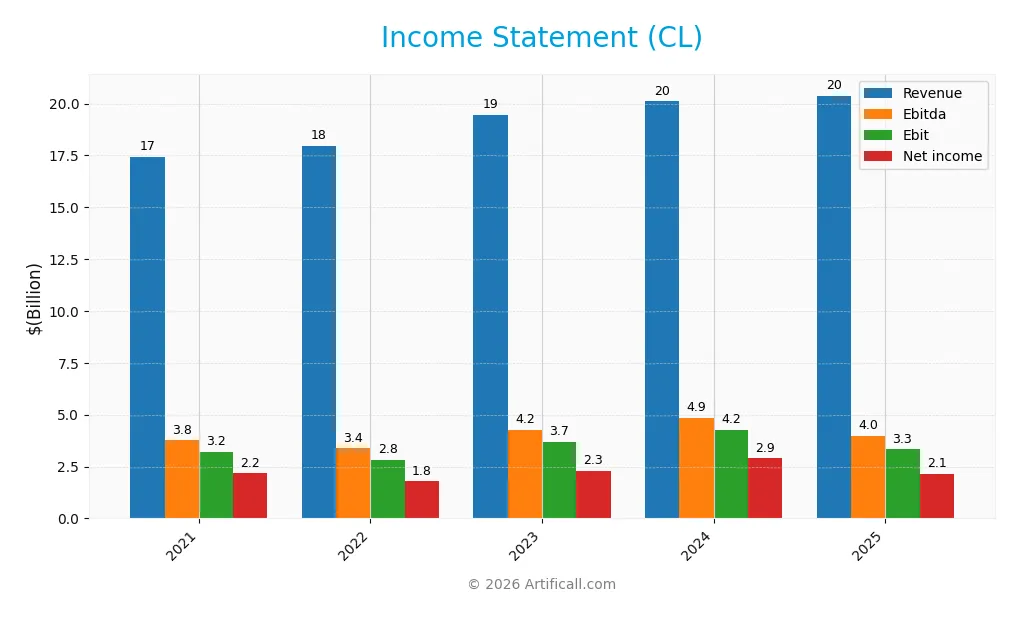

Income Statement

The table below summarizes Colgate-Palmolive Company’s annual income statement figures from 2021 to 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 17.4B | 17.97B | 19.46B | 20.10B | 20.38B |

| Cost of Revenue | 7.13B | 7.82B | 8.21B | 7.99B | 8.13B |

| Operating Expenses | 6.41B | 6.57B | 7.12B | 7.72B | 7.90B |

| Gross Profit | 10.3B | 10.15B | 11.25B | 12.11B | 12.25B |

| EBITDA | 3.76B | 3.37B | 4.25B | 4.85B | 3.96B |

| EBIT | 3.20B | 2.83B | 3.68B | 4.25B | 3.33B |

| Interest Expense | 117M | 167M | 287M | 292M | 267M |

| Net Income | 2.17B | 1.79B | 2.30B | 2.89B | 2.13B |

| EPS | 2.56 | 2.13 | 2.78 | 3.53 | 2.64 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-13 | 2026-02-23 |

Income Statement Evolution

Colgate-Palmolive’s revenue rose 17% from 2021 to 2025, showing steady top-line growth. However, net income declined by 1.57%, signaling pressure on profitability. Gross margins remained stable near 60%, but net margin fell 15.87%, reflecting margin compression despite steady revenue gains. Recent trends show slowing revenue growth and weaker net margins.

Is the Income Statement Favorable?

In 2025, revenue increased 1.4% to $20.4B, yet net income dropped 26% to $2.13B, driven by a 21.7% EBIT decline and higher operating expenses relative to revenue. Margins compressed, with net margin at 10.46%, though still classified as favorable. Interest expense remains low at 1.31% of revenue. Overall, fundamentals appear unfavorable due to deteriorating profitability metrics.

Financial Ratios

The following table summarizes key financial ratios for Colgate-Palmolive Company over the past five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12.43% | 9.93% | 11.82% | 14.37% | 10.46% |

| ROE | 3.56% | 4.45% | 3.78% | 13.63% | 39.48% |

| ROIC | 26.33% | 22.35% | 24.76% | 30.56% | 30.34% |

| P/E | 33.29 | 36.92 | 28.67 | 25.73 | 29.97 |

| P/B | 118.41 | 164.34 | 108.30 | 350.65 | 1183.40 |

| Current Ratio | 1.09 | 1.28 | 1.11 | 0.92 | 1.00 |

| Quick Ratio | 0.67 | 0.76 | 0.71 | 0.58 | 0.64 |

| D/E | 12.86 | 23.12 | 14.88 | 40.15 | 147.93 |

| Debt-to-Assets | 52.08% | 58.93% | 55.29% | 53.05% | 48.92% |

| Interest Coverage | 33.21 | 21.47 | 14.39 | 15.01 | 16.28 |

| Asset Turnover | 1.16 | 1.14 | 1.19 | 1.25 | 1.25 |

| Fixed Asset Turnover | 4.67 | 4.17 | 4.25 | 4.55 | 4.37 |

| Dividend Yield | 2.33% | 2.57% | 2.65% | 2.41% | 2.85% |

Evolution of Financial Ratios

From 2021 to 2025, Colgate-Palmolive’s Return on Equity (ROE) rose sharply, signaling improved shareholder value creation. The Current Ratio showed a downward trend, nearing 1.0 in 2025, indicating declining short-term liquidity. Debt-to-Equity Ratio surged dramatically to 147.9 in 2025, reflecting increased leverage and potential risk in capital structure. Profitability margins remained relatively stable, with some recent contraction.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios such as net margin (10.46%) and ROE (3948%) are favorable, underscoring efficient capital use. Liquidity measures like Current Ratio (1.0) and Quick Ratio (0.64) are unfavorable, hinting at tight short-term cash buffers. Leverage is high, with Debt-to-Equity at 147.9, a red flag for financial risk. Asset turnover and dividend yield remain favorable, balancing the overall assessment as generally positive but with notable risks.

Shareholder Return Policy

Colgate-Palmolive maintains a strong dividend policy with a payout ratio near 85.5% in 2025 and a dividend yield around 2.85%. Dividend per share has steadily increased from $1.99 in 2021 to $2.25 in 2025, supported by free cash flow coverage exceeding 85%. The company also engages in share buybacks, complementing its shareholder returns.

This balanced approach, combining dividends and buybacks, reflects prudent capital allocation. The dividend and buyback strategy appears sustainable, given free cash flow coverage and operating cash flow ratios. However, the high payout ratio warrants monitoring to ensure long-term value creation amid margin pressures and leverage levels.

Score analysis

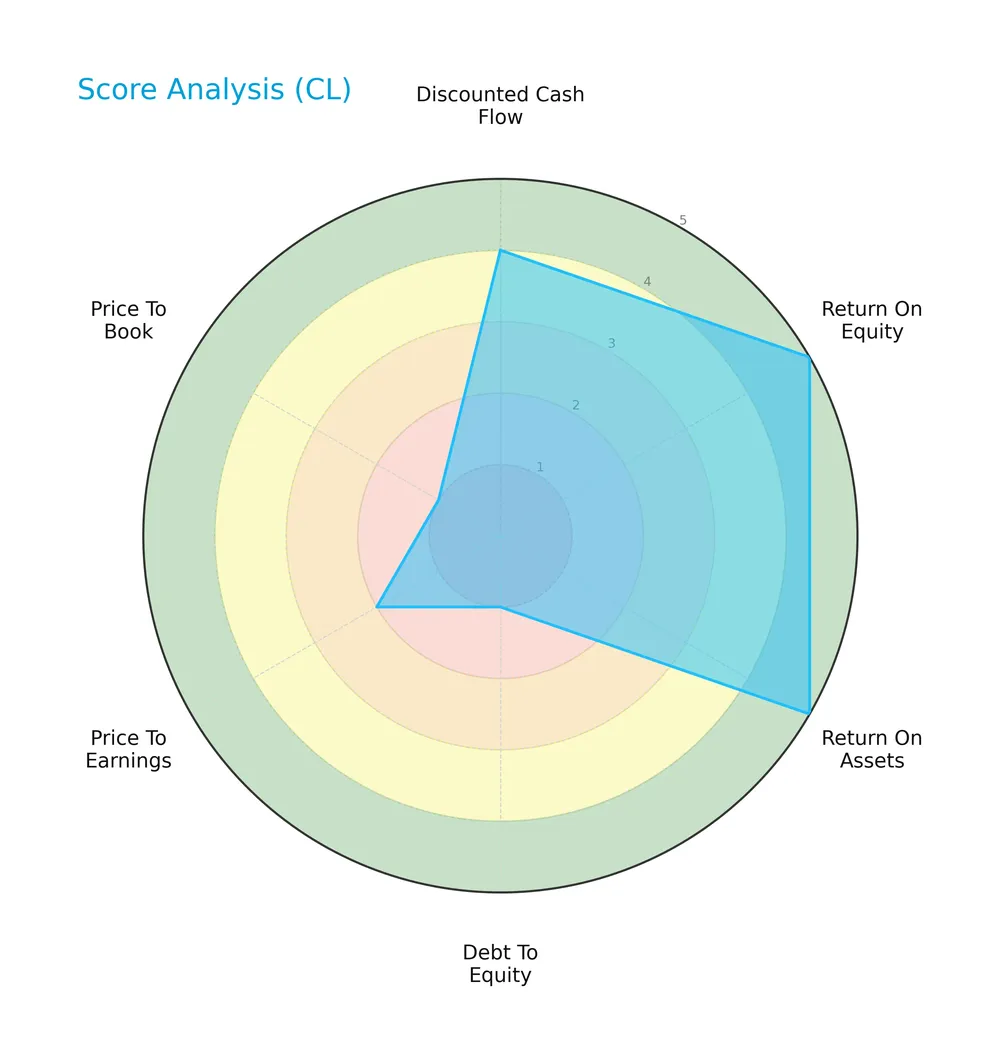

The following radar chart illustrates Colgate-Palmolive’s key financial metric scores for a comprehensive view:

Colgate-Palmolive scores very favorably on return on equity and assets, with moderate discounted cash flow. However, debt-to-equity, price-to-earnings, and price-to-book ratios are notably unfavorable, indicating potential valuation and leverage concerns.

Analysis of the company’s bankruptcy risk

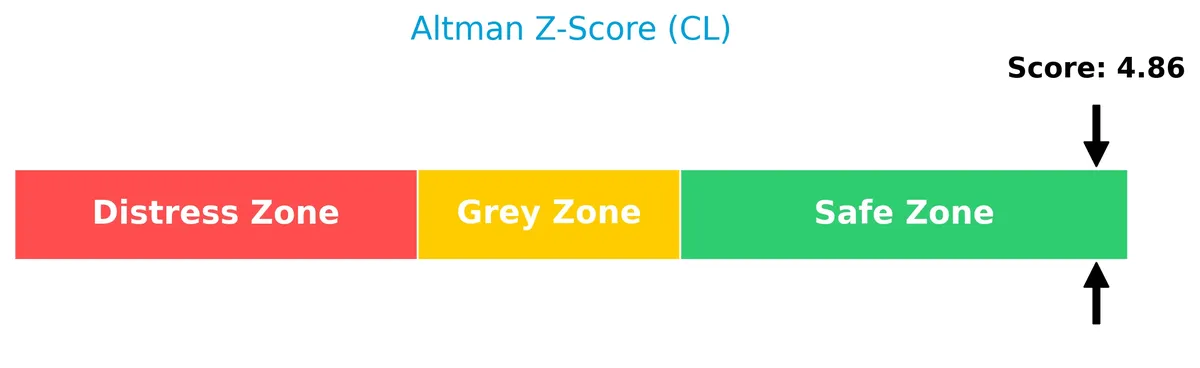

Colgate-Palmolive’s Altman Z-Score places it firmly in the safe zone, signaling a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

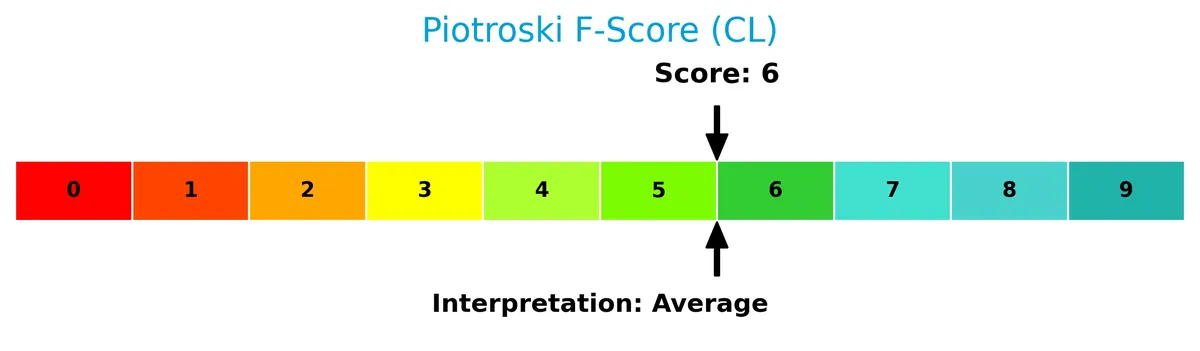

The Piotroski Score diagram highlights the company’s financial health based on nine critical criteria:

With a score of 6, Colgate-Palmolive demonstrates average financial strength, suggesting moderate operational efficiency and profitability relative to peers.

Competitive Landscape & Sector Positioning

This section examines Colgate-Palmolive Company’s strategic positioning within the Household & Personal Products industry. We will analyze revenue streams, key products, and main competitors. The aim is to assess whether Colgate-Palmolive holds a competitive advantage over its peers.

Strategic Positioning

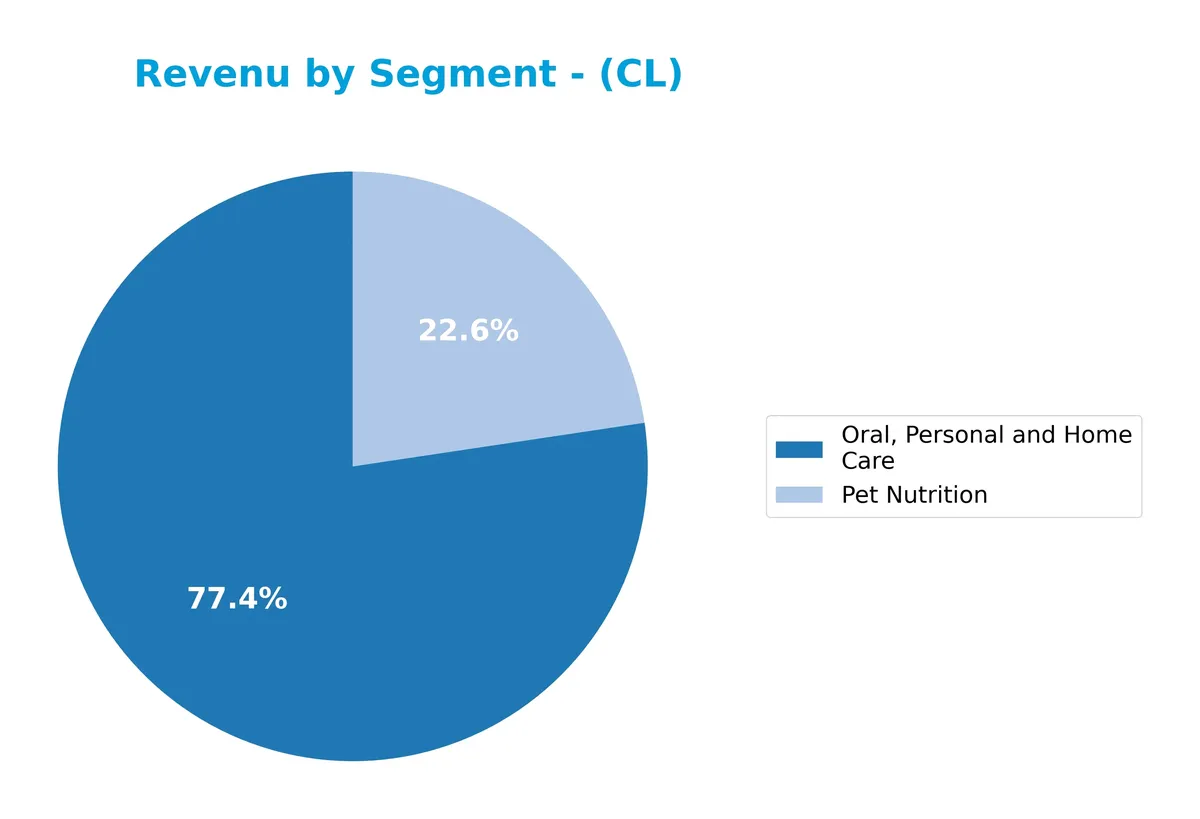

Colgate-Palmolive concentrates on two main segments: Oral, Personal and Home Care (15.8B in 2025) and Pet Nutrition (4.6B). Its geographic exposure includes significant sales across traditional and eCommerce channels, with 4.8B in Oral Care and 3.1B in Pet Nutrition reported in a recent region.

Revenue by Segment

The pie chart illustrates Colgate-Palmolive’s revenue distribution across its key segments for the fiscal year 2025, highlighting the relative contribution of each business line.

Colgate-Palmolive’s revenue predominantly comes from Oral, Personal and Home Care, generating $15.8B in 2025, showing steady growth over the decade. Pet Nutrition, while smaller at $4.6B, has increased consistently, reflecting a strategic expansion. The company’s revenue mix remains concentrated in its core care segment, which drives most of its growth, though Pet Nutrition’s rising share reduces concentration risk slightly. The trend indicates solid resilience and incremental diversification in 2025.

Key Products & Brands

Colgate-Palmolive’s product portfolio spans oral care, personal care, home care, and pet nutrition brands:

| Product | Description |

|---|---|

| Oral, Personal and Home Care | Includes toothpaste, toothbrushes, mouthwash, soaps, shower gels, shampoos, deodorants, skin health, detergents, cleaners. Brands include Colgate, Darlie, elmex, hello, meridol, Sorriso, Tom’s of Maine, Irish Spring, Palmolive, Protex, Sanex, Softsoap, Lady Speed Stick, Speed Stick, EltaMD, Filorga, PCA SKIN, Ajax, Axion, Fabuloso, Murphy, Suavitel, Soupline, and Cuddly. Also covers dental pharmaceutical products. |

| Pet Nutrition | Offers pet nutrition products under Hill’s Science Diet for daily health and Hill’s Prescription Diet for therapeutic needs. Sold through pet retailers and veterinarians. |

Colgate-Palmolive combines a broad range of trusted consumer brands in oral, personal, home care, and pet nutrition. The company leverages its extensive global distribution to sustain steady revenue growth in these segments.

Main Competitors

There are 17 competitors in the sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331.3B |

| Unilever PLC | 143.2B |

| Colgate-Palmolive Company | 62.6B |

| The Estée Lauder Companies Inc. | 38.5B |

| Kimberly-Clark Corporation | 33.7B |

| Kenvue Inc. | 33.2B |

| Church & Dwight Co., Inc. | 20.2B |

| The Clorox Company | 12.3B |

| e.l.f. Beauty, Inc. | 4.3B |

| Inter Parfums, Inc. | 2.7B |

Colgate-Palmolive ranks 3rd among 17 competitors, holding 23.6% of the market cap of the sector leader. It stands above both the average market cap of the top 10 competitors (68.2B) and the median market cap of its sector (4.3B). The company enjoys a significant 82.9% market cap gap over its closest rival above, underscoring its strong positioning.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Colgate-Palmolive have a competitive advantage?

Colgate-Palmolive demonstrates a clear competitive advantage, evidenced by a very favorable moat rating and a ROIC exceeding WACC by 25.6%, signaling efficient capital use and value creation. The company shows a strong, growing ROIC trend of 15.2%, reflecting increasing profitability and sustainable economic profits in its sector.

Looking ahead, Colgate-Palmolive’s diverse product portfolio in oral, personal, home care, and pet nutrition positions it well for expansion in both traditional and eCommerce channels. Continued innovation and market penetration in these segments offer opportunities to leverage its established brands and maintain its competitive edge.

SWOT Analysis

This analysis highlights Colgate-Palmolive’s core strengths, weaknesses, opportunities, and threats for strategic clarity.

Strengths

- strong brand portfolio

- high ROIC vs WACC (30.34% vs 4.74%)

- stable dividend yield (2.85%)

Weaknesses

- slow revenue growth (1.4% last year)

- high debt-to-equity ratio (148)

- weak liquidity ratios (current 1.0, quick 0.64)

Opportunities

- expanding pet nutrition segment

- rising demand for sustainable products

- digital and eCommerce growth

Threats

- intense competition in consumer goods

- margin pressure from rising costs

- valuation stretched (PE 29.97, PB 1183.4)

Colgate-Palmolive leverages a durable competitive moat and strong profitability but faces balance sheet risks and growth headwinds. The firm must prioritize debt reduction and innovation to sustain long-term value.

Stock Price Action Analysis

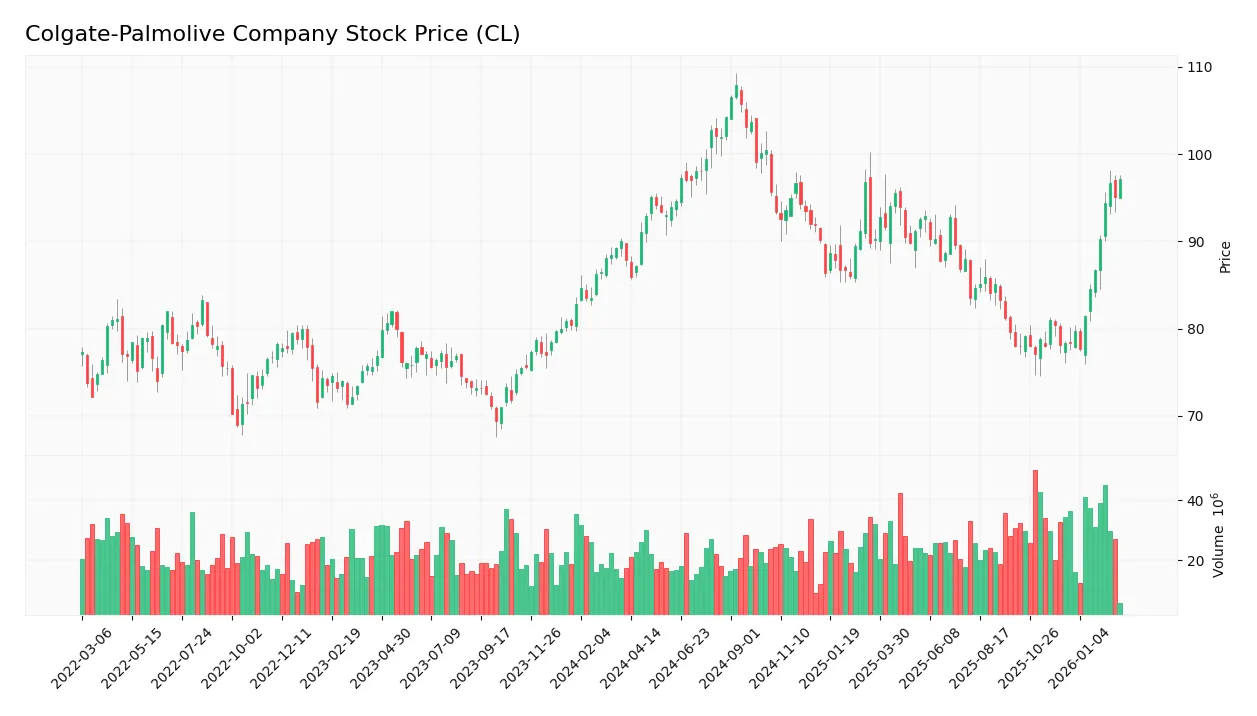

The weekly stock chart highlights Colgate-Palmolive Company’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past year, the stock gained 10.49%, reflecting a clear bullish trend with accelerating momentum. The price ranged from a low of 77.05 to a high of 107.86, supported by a 7.41 standard deviation indicating moderate volatility. Recent months show even stronger upward slope.

Volume Analysis

Trading volumes have increased, with buyers accounting for 56.18% overall. In the last three months, buyer dominance surged to 88.95%, signaling strong buyer-driven activity. This rise in volume and buyer control suggests elevated investor confidence and heightened market participation.

Target Prices

Analysts set a clear price range reflecting moderate optimism for Colgate-Palmolive Company.

| Target Low | Target High | Consensus |

|---|---|---|

| 85 | 100 | 92.45 |

The target prices suggest steady growth expectations, with a consensus price near 92.5 indicating confidence in the company’s resilience.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Colgate-Palmolive Company (CL).

Stock Grades

Here are the latest verified stock grades from recognized analysts for Colgate-Palmolive Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-02-03 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-02 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-02 |

| JP Morgan | Maintain | Overweight | 2026-02-02 |

| Deutsche Bank | Maintain | Hold | 2026-02-02 |

| Jefferies | Maintain | Hold | 2026-02-02 |

| Citigroup | Maintain | Buy | 2026-02-02 |

| Morgan Stanley | Maintain | Overweight | 2026-02-02 |

| B of A Securities | Maintain | Buy | 2026-02-02 |

| Piper Sandler | Maintain | Overweight | 2026-02-02 |

The overall trend shows a mix of Buy, Hold, and Overweight ratings with no recent upgrades or downgrades. Analysts predominantly maintain neutral to moderately positive views on the stock.

Consumer Opinions

Consumers express strong loyalty to Colgate-Palmolive, appreciating product reliability and brand trust.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently effective oral care.” | “Price increases have been steep.” |

| “Wide product range for different needs.” | “Packaging could be more eco-friendly.” |

| “Long-lasting freshness and quality.” | “Some products cause sensitivity.” |

Overall, consumers praise Colgate-Palmolive for quality and variety. However, price sensitivity and environmental concerns emerge as notable issues.

Risk Analysis

The following table outlines key risks for Colgate-Palmolive, assessing their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | Extremely high debt-to-equity ratio (148) poses solvency risks | High | High |

| Valuation | Elevated P/E (~30) and P/B (~1183) suggest overvaluation risk | Medium | Medium |

| Liquidity | Current ratio at 1.0 and quick ratio at 0.64 indicate tight liquidity | Medium | Medium |

| Market Volatility | Low beta (0.29) reduces stock price sensitivity to markets | Low | Low |

| Operational | Dependence on consumer goods sector exposed to economic cycles | Medium | Medium |

The most pressing risk is Colgate’s high financial leverage, which could strain cash flow during downturns. Despite a solid Altman Z-Score (4.86) signaling financial safety, the weak liquidity metrics and elevated valuation multiples warn of vulnerability if market conditions worsen. I advise close monitoring of debt levels and market shifts.

Should You Buy Colgate-Palmolive Company?

Colgate-Palmolive appears to demonstrate robust profitability and a durable competitive moat, supported by strong value creation and an improving ROIC trend. Despite a challenging leverage profile, the company’s overall rating of B+ suggests a very favorable financial health profile.

Strength & Efficiency Pillars

Colgate-Palmolive Company demonstrates robust operational efficiency, with a net margin of 10.46% and an exceptional return on equity (ROE) of 3948.15%. Its return on invested capital (ROIC) stands at 30.34%, significantly exceeding the weighted average cost of capital (WACC) at 4.74%, confirming the company as a clear value creator. I’ve observed that such a high ROIC sustained above WACC signals a durable competitive advantage and effective capital allocation in consumer staples. The firm’s gross margin of 60.11% and interest coverage ratio of 12.46 further reinforce its profitability resilience.

Weaknesses and Drawbacks

Despite strong profitability, Colgate-Palmolive faces valuation and leverage concerns. Its price-to-earnings ratio of 29.97 and an eye-popping price-to-book ratio of 1183.4 indicate a highly premium valuation, which may constrain upside potential. The company’s debt-to-equity ratio is dangerously high at 147.93, paired with a weak current ratio of 1.0 and quick ratio of 0.64, signaling liquidity risks. Historically in this sector, such leverage can pressure financial flexibility and increase vulnerability to interest rate shifts, warranting caution.

Our Final Verdict about Colgate-Palmolive Company

The company’s long-term fundamentals appear attractive, supported by strong profitability and a sustainable moat. The bullish overall stock trend, combined with strongly buyer-dominant recent activity (88.95%), suggests positive market sentiment. However, premium valuation and leverage metrics might temper near-term enthusiasm. Thus, Colgate-Palmolive’s profile may appear suitable for investors with a tolerance for valuation risk and a focus on long-term value creation, while more conservative investors might wait for a better entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Decoding Colgate-Palmolive Co (CL): A Strategic SWOT Insight – GuruFocus (Feb 24, 2026)

- Does Colgate-Palmolive’s Premium Push and AI Marketing Pivot Change The Bull Case For CL? – simplywall.st (Feb 24, 2026)

- Raiffeisen Bank International AG Acquires 14,762 Shares of Colgate-Palmolive Company $CL – MarketBeat (Feb 21, 2026)

- Take the Zacks Approach to Beat the Markets: Intellia, Colgate-Palmolive, Getty in Focus – TradingView (Feb 23, 2026)

- Is Colgate Palmolive (CL) Still Attractive After Its Strong Share Price Run In 2025 – Yahoo Finance (Feb 18, 2026)

For more information about Colgate-Palmolive Company, please visit the official website: colgatepalmolive.com