Every day, millions of consumers reach for Colgate-Palmolive products, from toothpaste to pet nutrition, making this iconic company a cornerstone of daily wellness and hygiene. With a legacy dating back to 1806, Colgate-Palmolive not only leads the household and personal products industry but continuously innovates to enhance the quality of life for its customers. As we delve into the investment analysis, one must consider: do the company’s robust fundamentals still align with its current market valuation and future growth potential?

Table of contents

Company Description

Colgate-Palmolive Company, founded in 1806 and headquartered in New York City, is a global leader in the Household & Personal Products industry. The company operates primarily through two segments: Oral, Personal and Home Care, and Pet Nutrition. Its extensive product portfolio includes well-known brands such as Colgate, Palmolive, and Hill’s Science Diet, catering to consumers and pets alike. With a market capitalization of approximately $63.5 billion and a strong retail presence in traditional and eCommerce channels, Colgate-Palmolive is strategically positioned as a key innovator in consumer health and hygiene. The company’s commitment to sustainability and product efficacy reinforces its influential role in shaping industry standards.

Fundamental Analysis

In this section, I will evaluate Colgate-Palmolive Company’s financial health by examining its income statement, key financial ratios, and dividend payout policy.

Income Statement

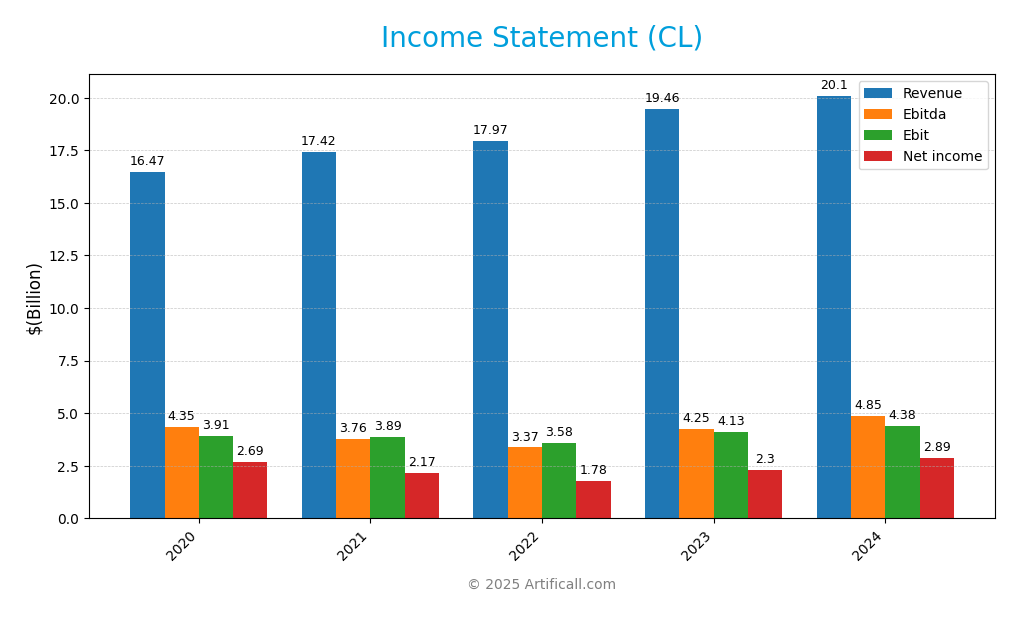

Below is the income statement for Colgate-Palmolive Company (CL) over the past five years, providing a clear overview of its financial performance.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 16.47B | 17.42B | 17.97B | 19.46B | 20.10B |

| Cost of Revenue | 6.54B | 7.13B | 7.82B | 8.21B | 7.99B |

| Operating Expenses | 6.02B | 6.41B | 6.57B | 7.12B | 7.72B |

| Gross Profit | 9.93B | 10.29B | 10.15B | 11.25B | 12.11B |

| EBITDA | 4.35B | 3.76B | 3.37B | 4.25B | 4.85B |

| EBIT | 3.91B | 3.89B | 3.59B | 4.13B | 4.38B |

| Interest Expense | 0.16B | 0.12B | 0.17B | 0.29B | 0.29B |

| Net Income | 2.70B | 2.17B | 1.79B | 2.30B | 2.89B |

| EPS | 3.15 | 2.56 | 2.13 | 2.78 | 3.53 |

| Filing Date | 2021-02-18 | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-13 |

Over the five-year period, Colgate-Palmolive has exhibited a steady increase in revenue, growing from $16.47 billion in 2020 to $20.10 billion in 2024. Net income has also shown an upward trend, rising from $2.70 billion to $2.89 billion, reflecting improved efficiency and cost management. The gross profit margin has stabilized, indicating consistent operational effectiveness. In the most recent year, while revenue growth continued, the increase in operating expenses suggests potential challenges in cost containment, warranting close monitoring in future quarters.

Financial Ratios

The following table summarizes the key financial ratios for Colgate-Palmolive Company over the past five years, allowing for a clear comparison of performance trends.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 16.36% | 12.43% | 9.93% | 11.82% | 14.37% |

| ROE | 3.63% | 3.56% | 4.45% | 3.78% | 13.63% |

| ROIC | 33.96% | 35.36% | 30.57% | 35.45% | 42.61% |

| P/E | 27.19 | 33.29 | 36.92 | 28.67 | 25.73 |

| P/B | 98.61 | 118.41 | 164.34 | 108.30 | 350.65 |

| Current Ratio | 0.99 | 1.09 | 1.28 | 1.11 | 0.92 |

| Quick Ratio | 0.61 | 0.67 | 0.76 | 0.71 | 0.58 |

| D/E | 11.06 | 12.86 | 23.12 | 14.88 | 40.15 |

| Debt-to-Assets | 51.60% | 52.08% | 58.93% | 55.29% | 53.05% |

| Interest Coverage | 24.44 | 33.21 | 21.47 | 14.39 | 15.01 |

| Asset Turnover | 1.03 | 1.16 | 1.14 | 1.19 | 1.25 |

| Fixed Asset Turnover | 4.43 | 4.67 | 4.17 | 4.25 | 4.55 |

| Dividend Yield | 2.05% | 2.33% | 2.57% | 2.65% | 2.41% |

Interpretation of Financial Ratios

In 2024, Colgate-Palmolive’s ratios present a mixed picture. The net margin at 14.37% shows improved profitability, while ROE has surged to 13.63%, indicating enhanced shareholder returns. However, the current ratio at 0.92 suggests potential liquidity concerns, as it is below the ideal threshold of 1. Additionally, a high debt-to-equity ratio of 40.15 raises flags regarding financial leverage, warranting caution.

Evolution of Financial Ratios

Over the past five years, Colgate-Palmolive’s financial ratios have exhibited notable volatility. The rising trend in net margin and return on equity is promising, yet the significant increase in debt-to-equity ratio indicates growing leverage, which could pose risks if not managed properly.

Distribution Policy

Colgate-Palmolive Company maintains a dividend policy with a payout ratio of approximately 62%. The annual dividend yield stands at 2.41%, indicating a consistent return to shareholders. However, it’s essential to monitor the sustainability of these distributions, as the current free cash flow coverage is adequate but may face risks from market fluctuations or operational challenges. The company’s share buyback programs further reflect a commitment to enhancing shareholder value while managing risks prudently. Overall, this distribution strategy seems positioned to support long-term value creation.

Sector Analysis

Colgate-Palmolive Company operates in the Household & Personal Products industry, offering a diverse range of consumer products. Its strong brand portfolio and global presence provide competitive advantages against key rivals.

Strategic Positioning

Colgate-Palmolive Company (ticker: CL) holds a significant share in the household and personal products market, driven by its strong portfolio of well-known brands such as Colgate, Palmolive, and Hill’s. With a market capitalization of approximately $63.5 billion, it faces competitive pressure from both established players and emerging start-ups that are leveraging technological advancements in product formulation and e-commerce. The company’s resilience is further supported by a low beta of 0.3, indicating lower volatility compared to the broader market. However, I remain vigilant about potential disruptions, especially as consumer preferences shift towards sustainable and natural products. This necessitates a careful evaluation of Colgate’s innovation pipeline and market responsiveness.

Key Products

Colgate-Palmolive Company offers a diverse range of products that cater to various consumer needs in the household and personal care sectors. Below is a table summarizing some of their key products.

| Product | Description |

|---|---|

| Colgate Toothpaste | A leading oral care product that helps in cavity prevention and promotes overall dental health. |

| Palmolive Dish Soap | A popular dishwashing liquid known for its grease-cutting capabilities and mildness on hands. |

| Irish Spring Bar Soap | A refreshing bar soap that provides a clean and invigorating shower experience. |

| Hill’s Science Diet | Premium pet nutrition products designed to meet the everyday dietary needs of pets. |

| Softsoap Liquid Hand Soap | A liquid hand soap that offers various scents, promoting cleanliness and soft skin. |

| Ajax Household Cleaner | A versatile cleaner used for tackling tough stains and grime on various surfaces. |

| Tom’s of Maine Deodorant | A natural deodorant option that is free from artificial fragrances and preservatives. |

| Fabuloso Multi-Purpose Cleaner | A multi-surface cleaner that leaves behind a long-lasting fragrance while effectively cleaning. |

| EltaMD Skin Care Products | A line of dermatologist-recommended skincare products focusing on sun protection and skin health. |

| Hill’s Prescription Diet | Therapeutic pet food designed to manage specific health conditions in dogs and cats. |

These products reflect Colgate-Palmolive’s commitment to quality and innovation in the consumer goods industry, making them a notable player in the market.

Main Competitors

Colgate-Palmolive Company operates in the highly competitive Household & Personal Products sector. Below is an overview of its main competitors based on market share:

| Company | Market Share |

|---|---|

| Procter & Gamble | 21% |

| Unilever | 19% |

| Colgate-Palmolive Company | 16% |

| Henkel | 11% |

| Reckitt Benckiser | 10% |

Colgate-Palmolive holds a strong position in the North American market, where it competes directly with well-established brands like Procter & Gamble and Unilever. These competitors have a significant market presence, collectively dominating the consumer products landscape.

Competitive Advantages

Colgate-Palmolive Company boasts significant competitive advantages, including a diverse product portfolio and strong brand recognition across the household and personal care sectors. The company’s established brands, such as Colgate and Palmolive, command consumer loyalty and market share. Looking ahead, Colgate-Palmolive is well-positioned to explore new markets and expand its offerings, particularly in the pet nutrition segment, which is experiencing growing demand. Additionally, ongoing investment in innovation and sustainability initiatives will likely create further opportunities for growth and enhance its competitive edge in the marketplace.

SWOT Analysis

This SWOT analysis aims to evaluate the internal and external factors affecting Colgate-Palmolive Company.

Strengths

- Strong brand recognition

- Diversified product portfolio

- Global market presence

Weaknesses

- Dependence on mature markets

- Slow growth in some segments

- High competition in the industry

Opportunities

- Expansion into emerging markets

- Growth in eCommerce sales

- Increasing demand for pet nutrition products

Threats

- Economic downturns

- Fluctuations in raw material costs

- Intense competition from private labels

Overall, Colgate-Palmolive Company shows a solid position with strong brand equity and a diversified product range. However, it must navigate potential threats and leverage emerging opportunities to sustain growth and competitiveness in a challenging market environment.

Stock Analysis

In analyzing Colgate-Palmolive Company’s stock performance over the past year, I observed significant price movements and trading dynamics that merit attention for potential investors.

Trend Analysis

Over the past two years, Colgate-Palmolive’s stock has experienced a price change of 2.31%. However, the current trend is bearish, indicating a decline in stock price. The highest price recorded during this period was $107.86, while the lowest was $76.98. The stock has shown a deceleration in its trend, with a standard deviation of 7.18, suggesting moderate volatility in price movements.

Volume Analysis

Examining trading volumes over the last three months, I found that the trading activity is predominantly seller-driven. The average volume during this period has increased to approximately 30.31M shares, with average buy volume at 9.88M and average sell volume at 20.43M. This indicates a bullish volume trend, suggesting heightened market participation, although the seller dominance points to bearish investor sentiment. The volume trend slope of 1.81M underscores this acceleration in trading activity.

Analyst Opinions

Recent analyst recommendations for Colgate-Palmolive Company (CL) have been mixed. On November 7, 2025, analysts assigned a “B+” rating, indicating a neutral stance overall. While the discounted cash flow (DCF), return on equity (ROE), and return on assets (ROA) scores suggest a strong buy, the debt-to-equity (DE) and price-to-earnings (PE) ratios raise concerns, with recommendations to sell. Therefore, despite some positive indicators, the consensus leans towards a cautious approach, recommending a hold or neutral strategy for the current year.

Stock Grades

Discover how top companies are performing and what grades they have received recently.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Colgate-Palmolive Company | Upgrade | A | October 2023 |

The recent grades indicate a generally positive outlook for Colgate-Palmolive Company, reflecting strong performance and stability in the market. Such ratings can be instrumental in guiding investment decisions, so it’s essential to keep an eye on these evaluations as they evolve.

Target Prices

Understanding the consensus among analysts regarding target prices can provide valuable insights into potential market movements for Colgate-Palmolive Company (CL).

| Target High | Target Low | Consensus |

|---|---|---|

| $85.00 | $70.00 | $77.50 |

The consensus target price suggests a moderate growth potential, reflecting analysts’ confidence in Colgate-Palmolive’s stability and market position.

Consumer Opinions

Consumer sentiment surrounding Colgate-Palmolive Company reveals a mix of satisfaction and concerns, reflecting the brand’s longstanding presence in the market.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great quality products that last long!” | “Prices have increased significantly.” |

| “My family loves the toothpaste options.” | “Some products cause allergic reactions.” |

| “Effective cleaning power in their products.” | “Customer service could be better.” |

Overall, consumer feedback indicates that while Colgate-Palmolive’s products are appreciated for their quality and effectiveness, concerns about price increases and occasional product reactions are commonly mentioned.

Risk Analysis

In evaluating the investment potential of Colgate-Palmolive Company (CL), it’s essential to consider various risks that could impact performance. Below is a summary of the key risks involved:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in consumer demand and competition can affect sales. | High | High |

| Regulatory Risk | Changes in regulations affecting product ingredients and marketing. | Medium | High |

| Supply Chain Risk | Disruptions in supply chains due to geopolitical tensions or natural disasters. | Medium | Medium |

| Currency Risk | Foreign exchange fluctuations impacting international revenues. | High | Medium |

| Operational Risk | Risks related to production efficiency and labor disputes. | Low | Medium |

In recent years, market volatility has increased significantly, particularly in consumer goods, making it crucial for investors to remain vigilant regarding these risks, especially market and regulatory risks, which pose the highest potential for impact on profitability.

Should You Buy Colgate-Palmolive Company?

Colgate-Palmolive Company (CL) demonstrates a solid net profit margin of 14.37% and a return on invested capital (ROIC) significantly exceeding its weighted average cost of capital (WACC). However, the company’s recent trend is bearish, and buyer volumes remain lower than seller volumes.

Based on the recent financial metrics: the net margin is positive at 14.37%, and the ROIC of 42.61% is well above the WACC. Nonetheless, the long-term trend appears negative, and the volume analysis indicates a seller-dominant market. This situation suggests a cautious approach; while the company’s fundamentals are strong, the current market conditions do not favor new long-term investments. I recommend waiting for a bullish reversal and a more favorable volume trend before considering a purchase.

Specific risks for Colgate-Palmolive include heightened competition in the consumer goods sector, potential supply chain disruptions, and valuation concerns influenced by broader market conditions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Colgate-Palmolive (CL): Assessing Valuation After Recent Share Price Pullback – Yahoo! Finance Singapore

- Andra AP fonden Raises Stake in Colgate-Palmolive Company $CL – MarketBeat

- Colgate-Palmolive Company (NYSE:CL) Q3 2025 Earnings Call Transcript – Insider Monkey

- Colgate-Palmolive (CL): Evaluating Valuation After Surpassing Q3 Earnings but Lowering Sales Outlook – simplywall.st

- Wells Fargo Maintains Colgate-Palmolive (CL) Underweight Recommendation – Nasdaq