Home > Analyses > Consumer Defensive > Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners PLC refreshes the lives of millions daily with its diverse portfolio of beloved beverages, from iconic soft drinks to innovative energy and enhanced waters. As a dominant force in the non-alcoholic beverage industry, the company combines a strong market presence with a commitment to quality and innovation, serving approximately 600 million consumers worldwide. As we delve into its financial and strategic positioning, the key question remains: does CCEP’s current valuation reflect its growth prospects and resilient fundamentals?

Table of contents

Business Model & Company Overview

Coca-Cola Europacific Partners PLC, founded in 1986 and headquartered in Uxbridge, UK, stands as a leading beverage bottler in the non-alcoholic segment. Its ecosystem integrates a diverse portfolio of soft drinks, waters, energy drinks, and ready-to-drink teas and coffees, uniting iconic brands like Coca-Cola, Fanta, Monster Energy, and Costa Coffee under one umbrella. Serving approximately 600M consumers, the company’s core mission centers on delivering refreshing beverage experiences globally.

The company’s revenue engine balances robust bottling operations with a vast distribution network across the Americas, Europe, and Asia, leveraging both hardware infrastructure and recurring sales of branded beverages. This dual approach ensures steady cash flow and market penetration. Coca-Cola Europacific Partners’ economic moat lies in its extensive brand portfolio combined with operational scale, positioning it to shape the future dynamics of the global beverage industry.

Financial Performance & Fundamental Metrics

In this section, I analyze Coca-Cola Europacific Partners PLC’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investor appeal.

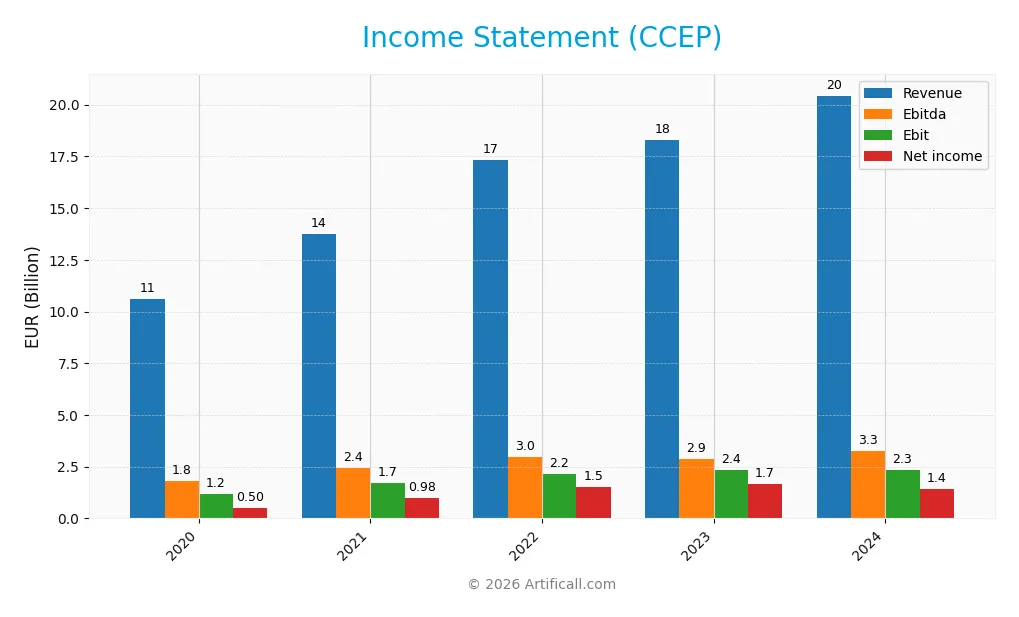

Income Statement

The following table presents Coca-Cola Europacific Partners PLC’s key income statement figures for the fiscal years 2020 through 2024, reported in euros (EUR).

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 10.6B | 13.8B | 17.3B | 18.3B | 20.4B |

| Cost of Revenue | 6.9B | 8.6B | 11.0B | 11.6B | 13.2B |

| Operating Expenses | 3.0B | 3.6B | 4.1B | 4.4B | 5.2B |

| Gross Profit | 3.7B | 5.1B | 6.2B | 6.7B | 7.3B |

| EBITDA | 1.8B | 2.4B | 3.0B | 2.9B | 3.3B |

| EBIT | 1.2B | 1.7B | 2.2B | 2.4B | 2.3B |

| Interest Expense | 164M | 153M | 131M | 162M | 242M |

| Net Income | 498M | 982M | 1.5B | 1.7B | 1.4B |

| EPS | 1.09 | 2.15 | 3.3 | 3.63 | 3.08 |

| Filing Date | 2021-03-12 | 2022-03-15 | 2023-03-17 | 2024-03-15 | 2025-03-21 |

Income Statement Evolution

Between 2020 and 2024, Coca-Cola Europacific Partners PLC (CCEP) showed strong revenue growth of 92.7%, reaching EUR 20.4B in 2024. Net income rose 184.7% over the same period, hitting EUR 1.42B, with net margin expanding 47.8% to 6.94%. However, in the last year, revenue grew 11.7% while net margin contracted by 23.9%, reflecting pressure on profitability despite stable gross margins around 35.6%.

Is the Income Statement Favorable?

The 2024 income statement reveals mixed signals: revenue and gross profit growth remain favorable, but operating expenses grew at the same rate as revenue, leading to a slight 0.6% decline in EBIT and a 23.9% drop in net margin. Interest expense remains well-controlled at 1.18% of revenue. Overall, fundamentals are predominantly favorable, supported by solid margin levels and double-digit revenue growth, although recent margin compression warrants attention.

Financial Ratios

The following table presents key financial ratios for Coca-Cola Europacific Partners PLC over recent fiscal years, providing insights into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 4.7% | 7.1% | 8.7% | 9.1% | 6.9% |

| ROE | 8.3% | 14.0% | 20.2% | 20.9% | 16.7% |

| ROIC | 3.7% | 4.6% | 6.9% | 7.6% | 6.5% |

| P/E | 37.3 | 22.8 | 15.7 | 16.6 | 24.1 |

| P/B | 3.1 | 3.2 | 3.2 | 3.5 | 4.0 |

| Current Ratio | 0.98 | 0.95 | 0.89 | 0.91 | 0.81 |

| Quick Ratio | 0.82 | 0.76 | 0.71 | 0.72 | 0.62 |

| D/E | 1.19 | 1.87 | 1.60 | 1.43 | 1.33 |

| Debt-to-Assets | 37.4% | 45.2% | 40.6% | 38.9% | 36.4% |

| Interest Coverage | 5.0 | 9.9 | 15.9 | 14.4 | 8.8 |

| Asset Turnover | 0.55 | 0.47 | 0.59 | 0.63 | 0.66 |

| Fixed Asset Turnover | 2.75 | 2.62 | 3.33 | 3.42 | 3.18 |

| Dividend Yield | 2.1% | 2.8% | 3.2% | 3.0% | 2.7% |

Evolution of Financial Ratios

From 2020 to 2024, Coca-Cola Europacific Partners PLC’s Return on Equity (ROE) improved steadily, reaching 16.7% in 2024, indicating enhanced shareholder profitability. The Current Ratio showed a declining trend, falling to 0.81 in 2024, suggesting reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio decreased slightly but remained elevated at 1.33, reflecting consistent leverage levels over the period.

Are the Financial Ratios Fovorable?

In 2024, profitability ratios such as ROE (16.7%) and interest coverage (9.67) were favorable, supporting robust earnings and debt servicing capacity. Liquidity ratios, including the Current Ratio (0.81) and Quick Ratio (0.62), were unfavorable, indicating potential short-term financial constraints. Valuation metrics like Price-to-Book (4.02) were unfavorable, while Price-to-Earnings (24.08) was neutral. Overall, the financial ratios present a slightly favorable profile with balanced strengths and weaknesses.

Shareholder Return Policy

Coca-Cola Europacific Partners PLC maintains a consistent dividend policy, with a payout ratio around 64% in 2024 and a dividend yield near 2.7%. Dividend coverage by free cash flow remains adequate, supported by moderate share buybacks, indicating balanced capital returns. Risks include sensitivity to cash flow fluctuations affecting distributions.

The company’s approach of steady dividends combined with share repurchases appears aligned with sustainable long-term shareholder value creation, reflecting prudent cash flow management and shareholder remuneration without overextending financial resources.

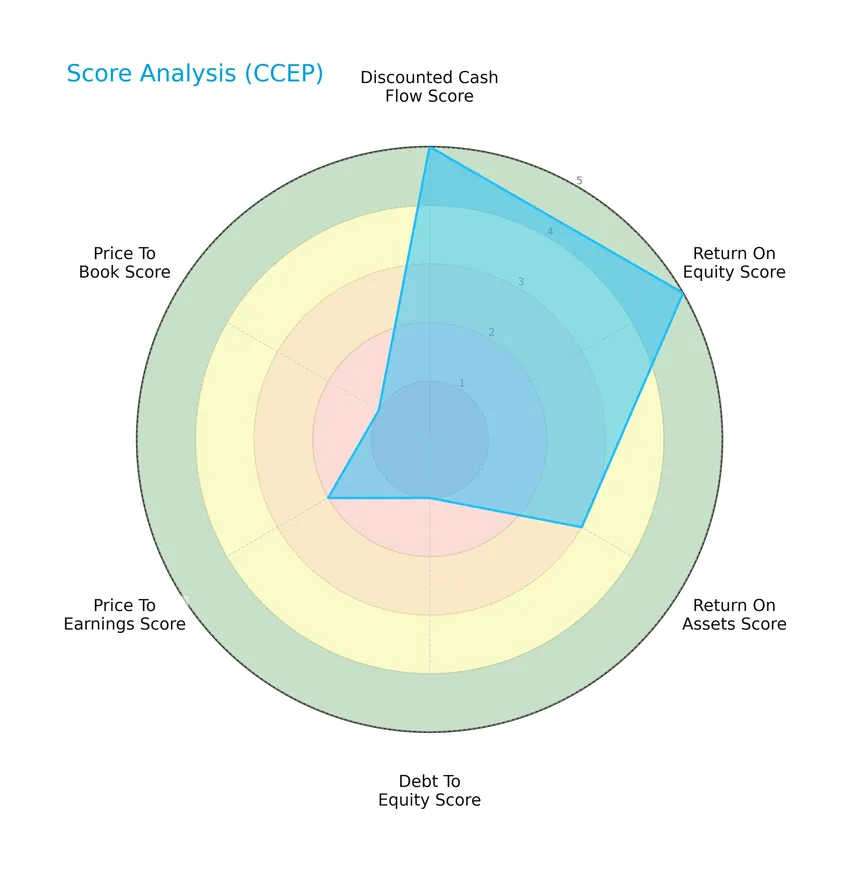

Score analysis

The following radar chart presents the evaluation of Coca-Cola Europacific Partners PLC across several financial metrics:

Coca-Cola Europacific Partners PLC shows very favorable scores in discounted cash flow and return on equity, moderate scores in return on assets and price-to-earnings, but very unfavorable scores in debt-to-equity and price-to-book ratios, reflecting mixed financial metrics.

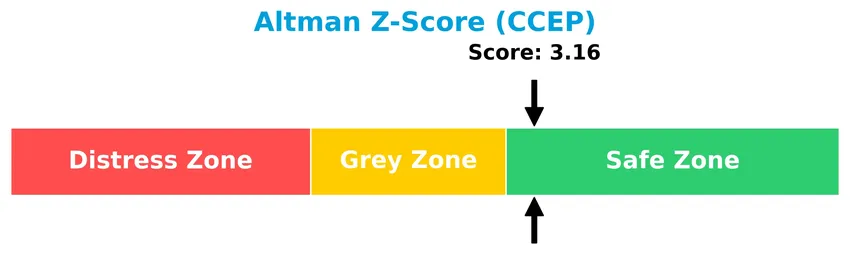

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that Coca-Cola Europacific Partners PLC is in the safe zone, suggesting a low risk of bankruptcy and solid financial stability:

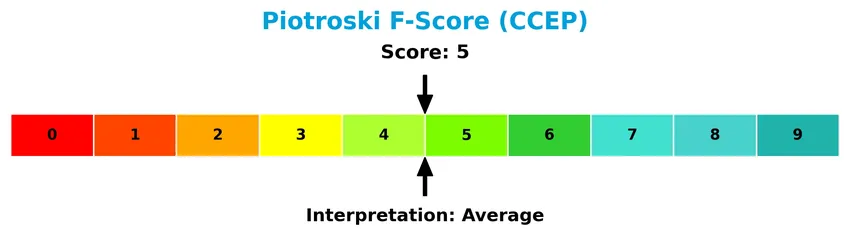

Is the company in good financial health?

The Piotroski Score diagram illustrates the company’s financial strength based on nine key criteria:

With a Piotroski Score of 5, Coca-Cola Europacific Partners PLC is considered to have average financial health, indicating moderate overall strength without strong indications of exceptional performance.

Competitive Landscape & Sector Positioning

This sector analysis will outline Coca-Cola Europacific Partners PLC’s strategic positioning, revenue breakdown, key products, and main competitors. I will assess whether the company holds a competitive advantage within the non-alcoholic beverages industry.

Strategic Positioning

Coca-Cola Europacific Partners PLC maintains a diversified geographic exposure, with significant revenue streams across Europe (€14.97B in 2024) and the Asia-Pacific region (€2.48B in Australia plus other territories). The company offers a broad product portfolio of non-alcoholic beverages, including soft drinks, energy drinks, waters, and ready-to-drink teas and coffees.

Key Products & Brands

The table below presents the key products and brands offered by Coca-Cola Europacific Partners PLC:

| Product | Description |

|---|---|

| Coca-Cola | Iconic carbonated soft drink, available in various formulations including Diet Coke and Coca-Cola Zero Sugar. |

| Fanta | Flavored carbonated soft drink brand with multiple fruit flavors. |

| Sprite | Lemon-lime flavored carbonated soft drink. |

| Monster Energy | Energy drink brand catering to active lifestyle consumers. |

| Coca-Cola Energy | Energy drink under the Coca-Cola brand. |

| Relentless | Energy drink brand competing in the ready-to-drink energy segment. |

| nalu, URGE, BURN, Kuli | Various energy and flavored drink brands targeting diverse consumer tastes. |

| REIGN | Performance energy drink brand. |

| POWERADE | Sports drink brand providing hydration and electrolytes. |

| Appletiser | Sparkling juice drink brand. |

| Schweppes | Carbonated mixers and soft drinks brand. |

| smartwater | Enhanced water brand with added electrolytes. |

| Chaudfontaine, AQUARIUS | Water and isotonic drink brands. |

| Honest | Organic and natural beverage brand. |

| Costa Coffee | Ready-to-drink coffee brand. |

| Fuzetea, NESTEA | Ready-to-drink tea brands. |

| Capri-Sun | Juice drink brand popular for children and families. |

| Oasis, Minute Maid | Juice and fruit drink brands. |

| MER, Tropico | Fruit-based drink brands. |

Coca-Cola Europacific Partners PLC offers a comprehensive portfolio of non-alcoholic beverages including soft drinks, energy drinks, waters, teas, coffees, and juices, supporting a broad consumer base with diverse tastes and preferences.

Main Competitors

There are 7 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Coca-Cola Company | 297.5B |

| PepsiCo, Inc. | 194.5B |

| Monster Beverage Corporation | 74.4B |

| Coca-Cola Europacific Partners PLC | 41.7B |

| Keurig Dr Pepper Inc. | 37.7B |

| Coca-Cola Consolidated, Inc. | 13.3B |

| Celsius Holdings, Inc. | 11.8B |

Coca-Cola Europacific Partners PLC ranks 4th among its competitors with a market cap at 13.78% of the leader, The Coca-Cola Company. It is positioned below both the average market cap of the top 10 (95.8B) and the median market cap in the sector (41.7B). The company has a significant 81.5% market cap gap to the next competitor above it, highlighting a distinct scale difference.

Does CCEP have a competitive advantage?

Coca-Cola Europacific Partners PLC (CCEP) currently does not demonstrate a clear competitive advantage, as its return on invested capital (ROIC) is below the weighted average cost of capital (WACC), indicating value shedding. However, the company’s ROIC shows a strong upward trend, suggesting improving profitability and operational efficiency over the 2020-2024 period.

Looking ahead, CCEP’s extensive portfolio of established beverage brands and its presence across diverse geographic markets present opportunities for growth. Continued focus on innovation in non-alcoholic ready-to-drink products and expanding market reach could support further improvements in financial performance and competitive positioning.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis aims to highlight Coca-Cola Europacific Partners PLC’s key internal strengths and weaknesses alongside external opportunities and threats to guide informed investment decisions.

Strengths

- strong global brand portfolio

- favorable gross margin at 35.63%

- robust revenue growth of 11.67% in 2024

Weaknesses

- high debt-to-equity ratio at 1.33

- low current and quick ratios indicating liquidity pressure

- declining EBIT and net margin growth in recent year

Opportunities

- expanding in emerging markets such as Asia-Pacific

- growing demand for healthier beverage options

- potential for innovation in energy and ready-to-drink segments

Threats

- intense competition in non-alcoholic beverage industry

- regulatory pressures on sugar and plastic packaging

- currency fluctuations impacting multinational revenue

Overall, Coca-Cola Europacific Partners PLC demonstrates solid brand strength and growth potential but faces liquidity and margin pressures that require cautious financial management. Strategic focus on emerging markets and product innovation will be critical to mitigate competitive and regulatory risks.

Stock Price Action Analysis

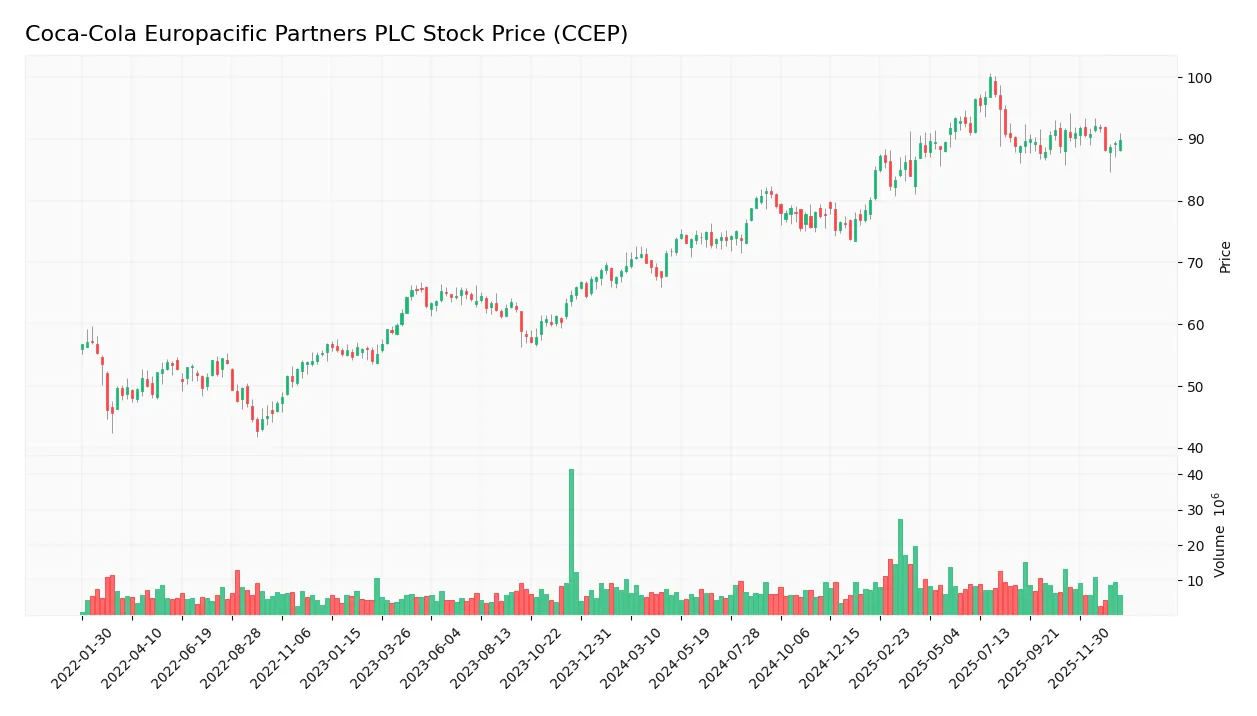

The following weekly chart illustrates Coca-Cola Europacific Partners PLC’s stock price movements over the past 100 weeks:

Trend Analysis

Over the past 12 months, CCEP’s stock price increased by 29.47%, indicating a bullish trend with deceleration in momentum. The price fluctuated between a low of 67.58 and a high of 100.04, with a volatility measured by an 8.18% standard deviation. Recent weeks show a minor pullback of -1.71% with low volatility (1.19%), suggesting a neutral short-term trend.

Volume Analysis

Trading volume for CCEP is increasing, with a total of 994M shares traded recently. Buyer volume dominates at 62.76%, reflecting sustained investor interest. In the last three months, buyer dominance intensified to 77.09%, indicating strong buyer-driven activity and positive market participation despite the slight short-term price decline.

Target Prices

The current analyst consensus for Coca-Cola Europacific Partners PLC (CCEP) indicates a positive outlook with a clear range of target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 114 | 101 | 107.5 |

Analysts expect CCEP’s stock price to trade between 101 and 114, with a consensus target around 107.5, reflecting moderate confidence in its growth potential.

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Coca-Cola Europacific Partners PLC (CCEP).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is the latest overview of Coca-Cola Europacific Partners PLC grades from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Downgrade | Neutral | 2026-01-14 |

| UBS | Maintain | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-08-08 |

| Barclays | Maintain | Overweight | 2025-07-15 |

| UBS | Maintain | Buy | 2025-07-02 |

| Barclays | Maintain | Overweight | 2025-05-01 |

| UBS | Maintain | Buy | 2025-04-30 |

| Barclays | Maintain | Overweight | 2025-04-11 |

| Barclays | Maintain | Overweight | 2025-03-27 |

| Barclays | Maintain | Overweight | 2025-03-06 |

The consensus grade remains a “Buy,” supported by a majority of buy ratings and overweight recommendations. Notably, B of A Securities recently downgraded the stock to Neutral, indicating some caution amid otherwise stable positive assessments.

Consumer Opinions

Consumers have voiced a variety of experiences with Coca-Cola Europacific Partners PLC, reflecting both appreciation and areas of concern.

| Positive Reviews | Negative Reviews |

|---|---|

| Consistently high product quality and taste. | Some customers find the pricing slightly high. |

| Wide product variety catering to diverse tastes. | Occasional delays in product availability. |

| Strong brand recognition and trust. | Environmental concerns regarding packaging. |

Overall, consumer feedback highlights strong brand loyalty and product quality, while pricing and sustainability issues remain common concerns for some customers.

Risk Analysis

Below is a summary table highlighting key risk categories for Coca-Cola Europacific Partners PLC, their descriptions, and assessed probabilities and impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in consumer demand and competition in non-alcoholic beverages | Medium | High |

| Financial Risk | Elevated debt-to-equity ratio (1.33) increasing financial leverage | Medium | Medium |

| Liquidity Risk | Unfavorable current (0.81) and quick ratios (0.62) indicating tight liquidity | Medium | Medium |

| Regulatory Risk | Changes in health regulations and sugar taxes affecting product lines | Low | High |

| Operational Risk | Supply chain disruptions impacting production and distribution | Medium | Medium |

| Reputational Risk | Brand reputation vulnerable to shifts in consumer preferences and ESG factors | Low | Medium |

The most likely and impactful risks stem from market competition and the company’s financial leverage. Although Coca-Cola Europacific Partners operates in a large, stable consumer sector with a safe Altman Z-Score (3.16), its debt-to-equity ratio of 1.33 and unfavorable liquidity ratios warrant caution. Recent shifts toward sugar taxes and health-conscious trends could also pressure product demand. I advise close monitoring of debt management and market dynamics to mitigate these risks.

Should You Buy Coca-Cola Europacific Partners PLC?

Coca-Cola Europacific Partners PLC appears to be a company with improving profitability and a slightly favorable competitive moat, suggesting growing operational efficiency. Despite a substantial leverage profile, its overall financial health could be seen as moderate, reflected in a B rating and a safe zone Altman Z-Score.

Strength & Efficiency Pillars

Coca-Cola Europacific Partners PLC exhibits solid profitability metrics, with a return on equity (ROE) of 16.7% and a net margin of 6.94%, underscoring effective cost management and operational efficiency. The company’s return on invested capital (ROIC) stands at 6.53%, exceeding its weighted average cost of capital (WACC) of 4.89%, confirming its status as a value creator that is generating returns above its capital costs. Financial stability is reinforced by an Altman Z-Score of 3.16, placing the firm safely in the non-distress zone, while a Piotroski score of 5 suggests moderate financial health, balancing profitability with prudent leverage controls.

Weaknesses and Drawbacks

Despite these strengths, certain financial risks warrant caution. The company faces leverage concerns, with a debt-to-equity ratio of 1.33 and unfavorable liquidity ratios (current ratio 0.81 and quick ratio 0.62), indicating potential short-term solvency pressures. Valuation metrics also raise flags: a price-to-book ratio of 4.02 is considered very unfavorable, pointing to a premium valuation that may limit upside potential. Although the price-to-earnings ratio of 24.08 is moderate, it still reflects elevated market expectations. These factors could expose investors to volatility, particularly if earnings growth decelerates.

Our Verdict about Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners PLC presents a fundamentally favorable long-term profile, supported by efficient capital allocation and value creation above its cost of capital. The stock’s overall bullish trend, combined with strong buyer dominance in the recent period, suggests resilience; however, the deceleration in price momentum advises a cautious stance. Thus, the company may appear attractive for long-term exposure but might warrant a wait-and-see approach to better entry points considering valuation and leverage risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Coca-Cola Europacific Partners $CCEP Stock Position Lifted by iA Global Asset Management Inc. – MarketBeat (Jan 23, 2026)

- Coca-Cola Europacific Partners Executives Acquire Shares Under UK Employee Plans – TipRanks (Jan 22, 2026)

- This Coca-Cola Europacific Partners Insider Reduced Their Stake By 16% – simplywall.st (Jan 20, 2026)

- CCEP Q3 2025 Trading Update – Coca-Cola Europacific Partners (Nov 05, 2025)

- Is Coca-Cola Europacific Partners PLC (AMS:CCEP) Trading At A 21% Discount? – Yahoo Finance (Dec 20, 2025)

For more information about Coca-Cola Europacific Partners PLC, please visit the official website: cocacolaep.com