Home > Analyses > Financial Services > CME Group Inc.

CME Group Inc. powers the global financial system by enabling seamless futures and options trading across diverse asset classes. It commands the market with innovative contracts spanning interest rates, commodities, and equity indexes, while maintaining a sterling reputation for reliability and technological excellence. As a critical hub for risk management and price discovery, CME’s influence extends to traders, institutions, and governments worldwide. The key question: does its robust foundation still justify its lofty valuation and growth prospects in 2026?

Table of contents

Business Model & Company Overview

CME Group Inc., founded in 1898 and based in Chicago, dominates the global financial data and stock exchange industry. It operates a comprehensive ecosystem of futures and options markets, spanning interest rates, equity indexes, commodities, and more. This core business integrates contract trading, clearing services, and risk mitigation, serving a diverse clientele from institutional investors to governments.

The company’s revenue engine balances transaction fees from futures and options with recurring income from market data and clearing services. It maintains a strategic presence across the Americas, Europe, and Asia, enabling seamless global access. CME’s robust network and regulatory role establish a formidable economic moat, shaping the future of derivatives trading worldwide.

Financial Performance & Fundamental Metrics

I will analyze CME Group Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

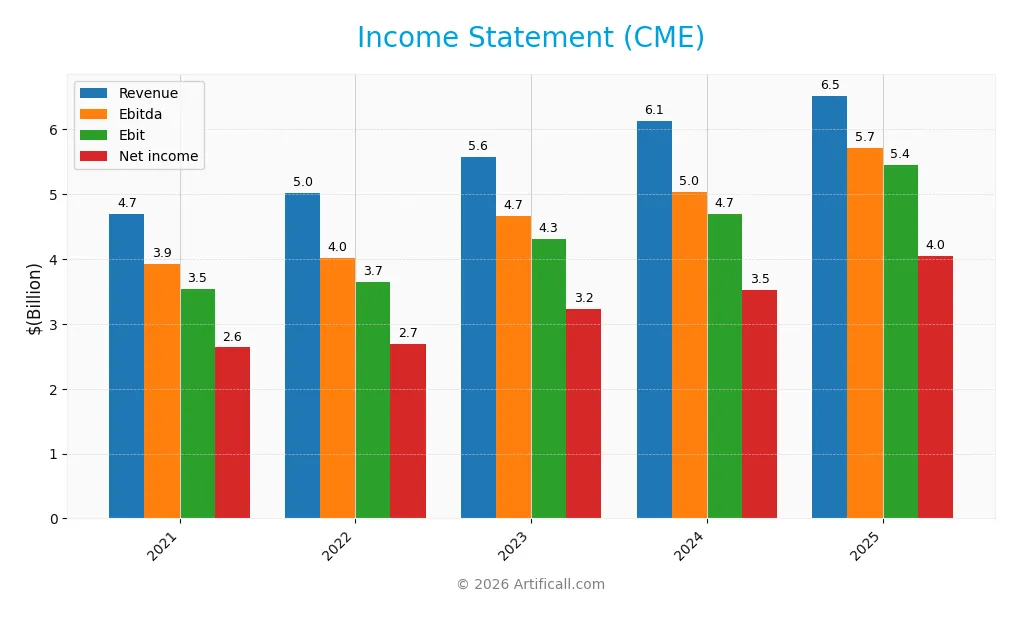

This table summarizes CME Group Inc.’s key income statement figures for fiscal years 2021 through 2025, illustrating revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 4.69B | 5.02B | 5.58B | 6.13B | 6.52B |

| Cost of Revenue | 837M | 753M | 829M | 850M | 907M |

| Operating Expenses | 1.21B | 1.25B | 1.31B | 1.35B | 1.38B |

| Gross Profit | 3.85B | 4.27B | 4.75B | 5.28B | 5.61B |

| EBITDA | 3.93B | 4.02B | 4.67B | 5.04B | 5.72B |

| EBIT | 3.54B | 3.65B | 4.31B | 4.70B | 5.45B |

| Interest Expense | 167M | 163M | 159M | 161M | 130M |

| Net Income | 2.64B | 2.69B | 3.23B | 3.53B | 4.04B |

| EPS | 7.30 | 7.41 | 8.87 | 9.69 | 11.18 |

| Filing Date | 2022-02-25 | 2023-02-27 | 2024-02-28 | 2025-02-27 | 2026-02-04 |

Income Statement Evolution

From 2021 to 2025, CME Group’s revenue rose 39% to $6.52B, showing solid expansion. Net income grew 53% to $4.02B, reflecting improved profitability. Margins strengthened, with gross margin at 86%, EBIT margin at 83.5%, and net margin at 62%, all indicating efficient cost management and enhanced earnings quality.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable with revenue increasing 6.4% year-over-year and EBIT growing 15.8%, signaling operational leverage. Operating expenses grew in line with revenue, supporting margin stability. Interest expense remains low at 2% of revenue, reinforcing strong financial health. Overall, the income statement shows robust profitability and consistent margin improvement.

Financial Ratios

The table below summarizes key financial ratios for CME Group Inc. from 2021 to 2025, providing insight into profitability, liquidity, valuation, and leverage:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 56% | 54% | 58% | 58% | 62% |

| ROE | 9.6% | 10.0% | 12.1% | 13.3% | 14.1% |

| ROIC | 5.6% | 6.4% | 7.4% | 8.5% | -2.0% |

| P/E | 31.1 | 22.4 | 23.4 | 23.7 | 24.3 |

| P/B | 3.0 | 2.2 | 2.8 | 3.2 | 3.4 |

| Current Ratio | 1.0 | 1.0 | 1.0 | 1.0 | 0 |

| Quick Ratio | 1.0 | 1.0 | 1.0 | 1.0 | 0 |

| D/E | 0.13 | 0.13 | 0.13 | 0.13 | 0.12 |

| Debt-to-Assets | 1.8% | 2.0% | 2.6% | 2.5% | 1.7% |

| Interest Coverage | 15.8 | 18.5 | 21.6 | 24.4 | 32.6 |

| Asset Turnover | 0.02 | 0.03 | 0.04 | 0.04 | 0.03 |

| Fixed Asset Turnover | 9.3 | 11.0 | 13.6 | 15.9 | 18.0 |

| Dividend Yield | 2.7% | 4.4% | 4.3% | 4.3% | 1.8% |

Evolution of Financial Ratios

From 2021 to 2025, CME’s Return on Equity (ROE) improved moderately from 9.6% to 14.1%. The Current Ratio remained stable around 1.0 until 2024 but dropped to zero in 2025, signaling a significant liquidity shift. Debt-to-Equity Ratio held steady near 0.12, indicating consistent leverage management. Profitability margins improved, with net profit margin rising to 62% in 2025.

Are the Financial Ratios Favorable?

In 2025, CME exhibits strong profitability with a 62% net margin but a negative Return on Invested Capital (ROIC) of -2%, an unfavorable sign. Liquidity ratios are weak, with Current and Quick Ratios at zero, raising red flags. Leverage remains low and favorable at a 0.12 debt-to-equity ratio. Market valuation metrics like P/E (24.3) and P/B (3.42) show mixed signals, resulting in a slightly favorable overall ratio profile.

Shareholder Return Policy

CME Group maintains a consistent dividend payout ratio around 44-100%, with a dividend yield near 1.8-4.3%. The company also executes share buybacks, supporting capital return. Dividends align with robust net income and free cash flow coverage, indicating sustainable distributions.

This balanced return strategy reflects prudent capital allocation, preserving long-term shareholder value. The steady dividend growth combined with buybacks suggests disciplined cash deployment. However, investors should monitor payout ratios and buyback levels to avoid potential over-distribution risks.

Score analysis

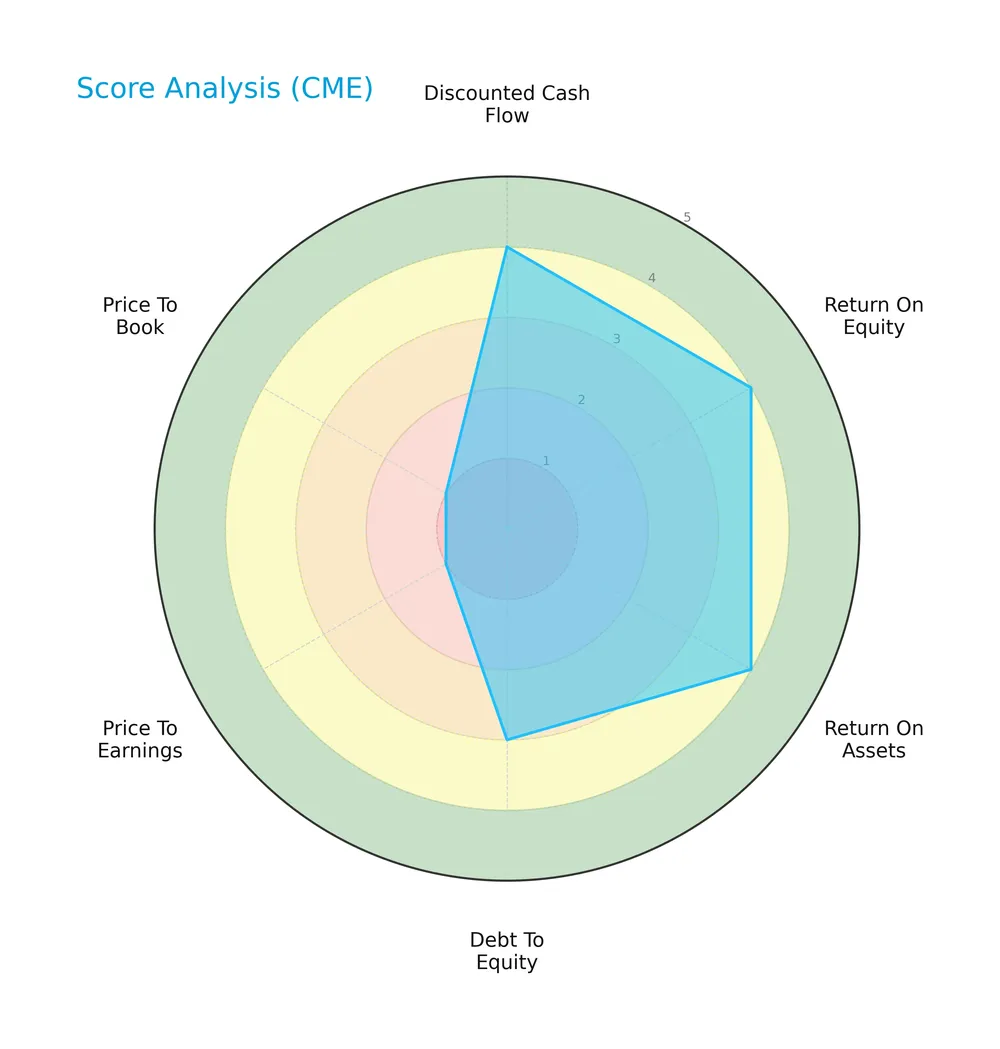

Here is a radar chart summarizing key valuation and financial strength scores for CME Group Inc.:

CME scores favorably on discounted cash flow, return on equity, and return on assets, each rated 4. Its debt-to-equity score is moderate at 3. However, valuation metrics price-to-earnings and price-to-book are very unfavorable, both scoring 1.

Analysis of the company’s bankruptcy risk

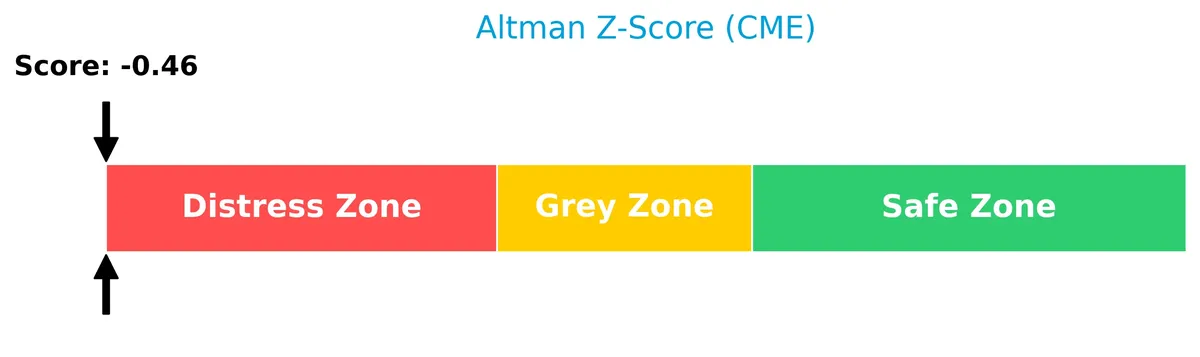

The Altman Z-Score places CME in the distress zone, indicating elevated bankruptcy risk based on financial ratios:

Is the company in good financial health?

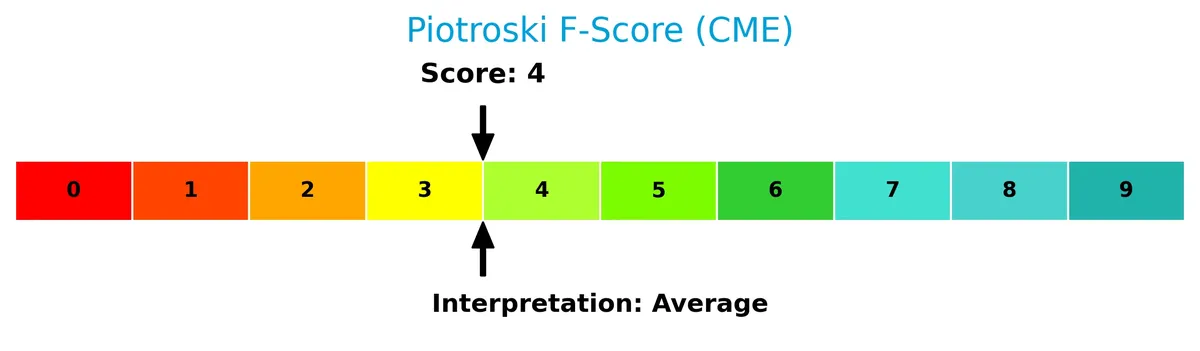

The Piotroski Score diagram below shows CME’s financial health status:

With a Piotroski Score of 4, CME’s financial strength rates as average, suggesting moderate profitability and efficiency but room for improvement in financial robustness.

Competitive Landscape & Sector Positioning

This analysis examines CME Group Inc.’s sector positioning, focusing on strategic positioning and revenue by segment. I will assess key products, main competitors, and competitive advantages. The goal is to determine whether CME Group holds a competitive advantage over its peers.

Strategic Positioning

CME Group Inc. maintains a diversified product portfolio spanning futures and options on interest rates, equity indexes, foreign exchange, commodities, energy, and metals. Its revenue streams include clearing fees, market data, and other services, reflecting broad geographic and client exposure within financial markets.

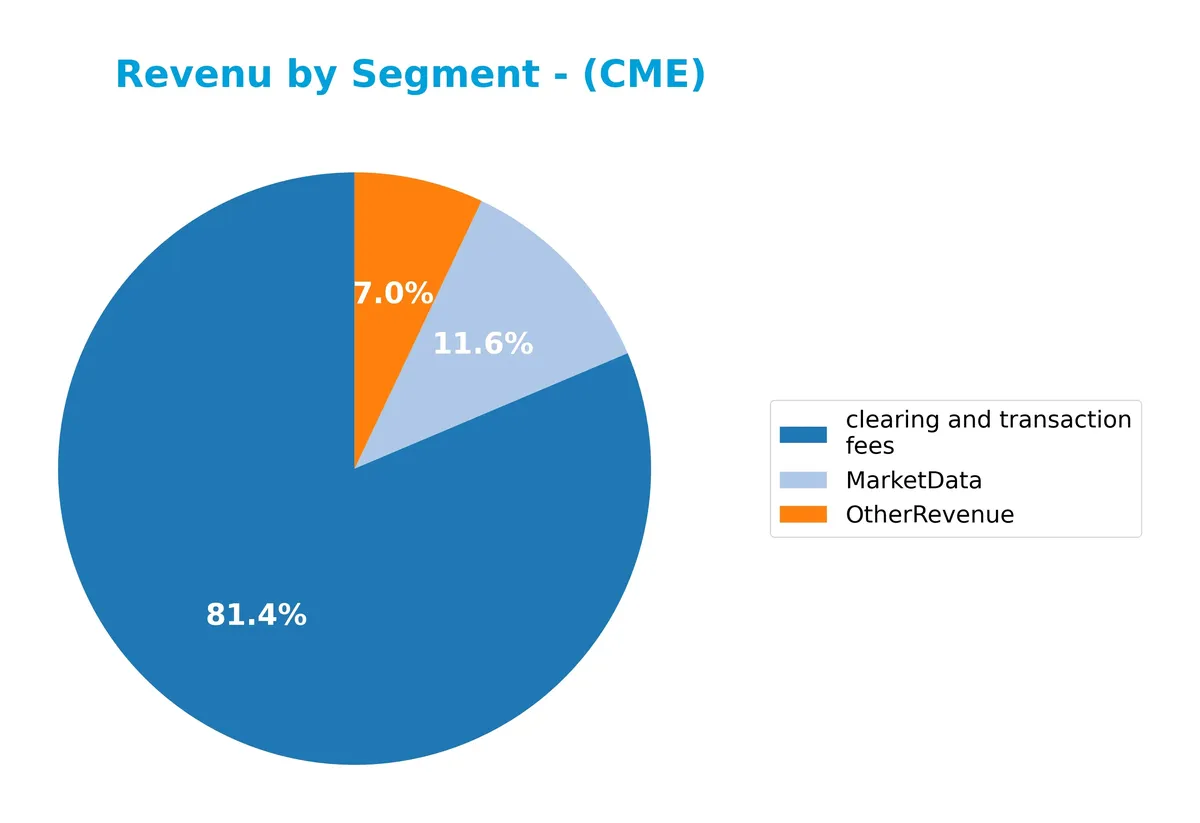

Revenue by Segment

The pie chart displays CME Group Inc.’s revenue distribution by segment for the full year 2024, highlighting the relative scale of Market Data, Other Revenue, and Clearing and Transaction Fees.

Clearing and Transaction Fees dominate CME’s revenue at 4.99B in 2024, reflecting its core business strength. Market Data contributes significantly with 710M, showing steady growth since 2018. Other Revenue increased to 432M, indicating diversification but remains the smallest segment. The steady acceleration in fee-based revenue signals robust demand, though concentration risk persists due to reliance on clearing fees.

Key Products & Brands

The table below summarizes CME Group Inc.’s main products and brand offerings in trading and market data services:

| Product | Description |

|---|---|

| Futures and Options Contracts | Contracts based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals. |

| Clearing and Transaction Services | Clearing, settling, and guaranteeing futures, options contracts, and cleared swaps traded on its exchanges. |

| Market Data Services | Real-time and historical market data provided to professional traders, financial institutions, and investors. |

| Other Revenue | Includes trade processing, risk mitigation services, and additional ancillary offerings. |

CME Group offers a diverse portfolio spanning futures contracts across multiple asset classes, complemented by clearing services and extensive market data products. This breadth supports a wide customer base from institutional to individual investors.

Main Competitors

There are 9 main competitors in the Financial – Data & Stock Exchanges industry; the table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| S&P Global Inc. | 155.2B |

| CME Group Inc. | 97.2B |

| Intercontinental Exchange, Inc. | 91.7B |

| Moody’s Corporation | 89.7B |

| Coinbase Global, Inc. | 60.5B |

| Nasdaq, Inc. | 55.5B |

| MSCI Inc. | 43.7B |

| Cboe Global Markets, Inc. | 25.9B |

| FactSet Research Systems Inc. | 10.8B |

CME Group Inc. ranks 2nd among its 9 competitors, with a market cap 69% that of the leader, S&P Global. It stands above both the average market cap of the top 10 (70B) and the sector median (60.5B). CME maintains a significant 45% market cap gap over its closest rival, Intercontinental Exchange, demonstrating a strong but clearly defined leadership position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CME have a competitive advantage?

CME Group Inc. does not present a competitive advantage based on its economic moat analysis. The company has a very unfavorable moat status, with a declining ROIC that falls below its WACC, indicating value destruction.

Looking ahead, CME’s broad product range in futures, options, and clearing services provides opportunities across global markets. Continued innovation in market data and risk mitigation services may offer avenues for growth despite current profitability challenges.

SWOT Analysis

This analysis identifies CME Group Inc.’s key internal and external factors affecting its strategic position.

Strengths

- strong net margin at 62%

- diverse product portfolio across futures and options

- low debt-to-assets ratio at 1.72%

Weaknesses

- negative ROIC indicating value destruction

- unfavorable liquidity ratios (current and quick ratios at 0)

- high price-to-book ratio at 3.42 signals potential overvaluation

Opportunities

- expanding market data services

- growth in global derivatives trading

- leveraging technology for clearing and risk mitigation

Threats

- regulatory changes in financial markets

- competition from alternative trading platforms

- market volatility impacting trading volumes

CME’s robust profitability and conservative leverage provide a solid foundation. However, its declining return on invested capital and poor liquidity ratios raise caution. The company must focus on operational efficiency and innovation to capitalize on growth areas while managing regulatory and competitive risks.

Stock Price Action Analysis

The weekly stock chart below illustrates CME Group Inc.’s price movements, highlighting key fluctuations and overall momentum over the past 12 months:

Trend Analysis

Over the past 12 months, CME’s stock price rose 36.27%, indicating a strong bullish trend with accelerating momentum. Price volatility is high, reflected by a 29.57 standard deviation. The stock hit a 12-month high of 296.38 and a low of 193.43, underscoring significant upward movement.

Volume Analysis

Trading volume shows an increasing trend with a total of 1.17B shares traded. Buyer volume accounts for 55.05%, indicating buyer-driven activity. Recent three-month data confirms a slightly buyer-dominant pattern at 53.88%, suggesting growing investor confidence and participation.

Target Prices

Analysts present a solid target consensus for CME Group Inc., indicating confidence in its near-term valuation.

| Target Low | Target High | Consensus |

|---|---|---|

| 280 | 340 | 306.83 |

The target range from 280 to 340 suggests moderate upside potential. The consensus near 307 reflects balanced optimism among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst grades and consumer feedback to assess CME Group Inc.’s market perception and reputation.

Stock Grades

Here are the latest verified stock grades for CME Group Inc. from reputable analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| TD Cowen | Upgrade | Buy | 2026-01-14 |

| Morgan Stanley | Maintain | Overweight | 2025-12-22 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-10-23 |

| Deutsche Bank | Upgrade | Buy | 2025-10-23 |

| Morgan Stanley | Maintain | Overweight | 2025-10-23 |

The grades show a steady preference for overweight and buy ratings, with several upgrades in late 2025 and early 2026. Overall consensus remains cautious, reflecting a hold stance among the analyst community.

Consumer Opinions

Consumers express mixed sentiment toward CME Group Inc., reflecting its complex role in financial markets.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable platform with strong market liquidity.” | “High fees reduce smaller traders’ profitability.” |

| “Robust data offerings enhance trading decisions.” | “Interface can be confusing for new users.” |

| “Excellent customer support during peak hours.” | “Occasional system outages disrupt critical trades.” |

Overall, clients praise CME Group’s liquidity and data quality, essential in derivatives trading. However, high fees and usability issues remain persistent pain points.

Risk Analysis

Below is a detailed table summarizing key risks facing CME Group Inc., categorized by likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at -0.46 signals distress zone, indicating bankruptcy risk. | Medium | High |

| Valuation | High P/B (3.42) and low P/E scores reflect overvaluation concerns. | High | Medium |

| Liquidity | Current and quick ratios at zero highlight liquidity constraints. | Low | High |

| Operational | Low ROIC (-2.01%) vs. WACC (5.08%) signals poor capital efficiency. | Medium | Medium |

| Market Volatility | Low beta (0.28) limits downside from market swings but limits upside. | Low | Low |

The Altman Z-Score is the most alarming metric, placing CME in distress territory despite strong profitability (62% net margin). This mismatch suggests structural financial risks. Meanwhile, valuation concerns are growing amid stretched price multiples. Investors should watch liquidity metrics closely, as zero current and quick ratios are red flags. I see the need for caution despite CME’s defensive market position.

Should You Buy CME Group Inc.?

Analytically, CME Group Inc. appears to have moderate profitability with improving operational efficiency but reveals a very unfavorable moat due to declining ROIC and value destruction. Despite a manageable leverage profile, its overall B rating suggests a cautious, yet potentially favorable, investment profile.

Strength & Efficiency Pillars

CME Group Inc. showcases robust profitability with a net margin of 62.02% and an EBIT margin of 83.51%, signaling excellent operational control. Its debt-to-equity ratio of 0.12 and interest coverage of 41.98 underscore strong financial health and low leverage risk. The company maintains a favorable weighted average cost of capital (WACC) at 5.08%. However, its return on invested capital (ROIC) at -2.01% trails the WACC, indicating value destruction rather than creation. The Altman Z-Score at -0.46 flags financial distress, while a Piotroski score of 4 suggests average financial strength.

Weaknesses and Drawbacks

CME faces valuation headwinds with a price-to-book ratio of 3.42, marked as unfavorable, suggesting an expensive market valuation relative to book value. The current and quick ratios are reported as 0, a critical red flag indicating liquidity concerns or data anomalies requiring caution. Asset turnover is notably low at 0.03, reflecting underutilization of assets. While the price-to-earnings ratio at 24.28 is neutral, these liquidity and efficiency weaknesses may exert pressure on near-term performance and investor confidence.

Our Verdict about CME Group Inc.

The long-term fundamental profile appears mixed but leans slightly unfavorable due to value destruction and financial distress signals. However, the bullish overall stock trend and increasing buyer dominance at 53.88% during the recent period suggest positive market sentiment. Despite these strengths, the liquidity red flags and poor ROIC performance might warrant a cautious stance. CME Group Inc. could represent a selective opportunity but may appear better suited for investors prepared to navigate short-term risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Nasdaq Leads Equities Lower – CME Group (Feb 04, 2026)

- Savant Capital LLC Sells 7,269 Shares of CME Group Inc. $CME – MarketBeat (Feb 05, 2026)

- CME Group (CME) Rating Maintained with Raised Price Target by TD Cowen | CME Stock News – GuruFocus (Feb 05, 2026)

- Breaking Down CME Group: 6 Analysts Share Their Views – Benzinga (Feb 05, 2026)

- CME Q4 Deep Dive: Retail and Crypto Expansion Fuel Stable Results, New Products Ahead – Finviz (Feb 05, 2026)

For more information about CME Group Inc., please visit the official website: cmegroup.com