Home > Analyses > Technology > Cloudflare, Inc.

Cloudflare powers the digital backbone that keeps billions of online interactions fast, secure, and reliable every day. As a trailblazer in cloud-based security and performance solutions, it dominates infrastructure software with innovations in DDoS protection, intelligent routing, and serverless computing. Its reputation for blending robust security with seamless user experience sets it apart in a crowded field. The key question now: do Cloudflare’s fundamentals sustain its premium valuation and growth trajectory in 2026?

Table of contents

Business Model & Company Overview

Cloudflare, Inc., founded in 2009 and headquartered in San Francisco, CA, stands as a dominant player in the software infrastructure sector. It operates a comprehensive cloud services ecosystem that secures and accelerates digital experiences across public and private clouds, SaaS, IoT, and on-premise platforms. Its suite spans security, performance, reliability, and developer tools, all designed to protect and optimize internet properties worldwide.

The company’s revenue engine balances software-driven security solutions with content delivery and network reliability, fueling growth in key global markets—Americas, Europe, and Asia. Cloudflare’s integrated approach connects users and devices while safeguarding data flows, underpinning its strong economic moat. This moat positions it to shape the future of internet security and performance with scalable, recurring services.

Financial Performance & Fundamental Metrics

I analyze Cloudflare, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

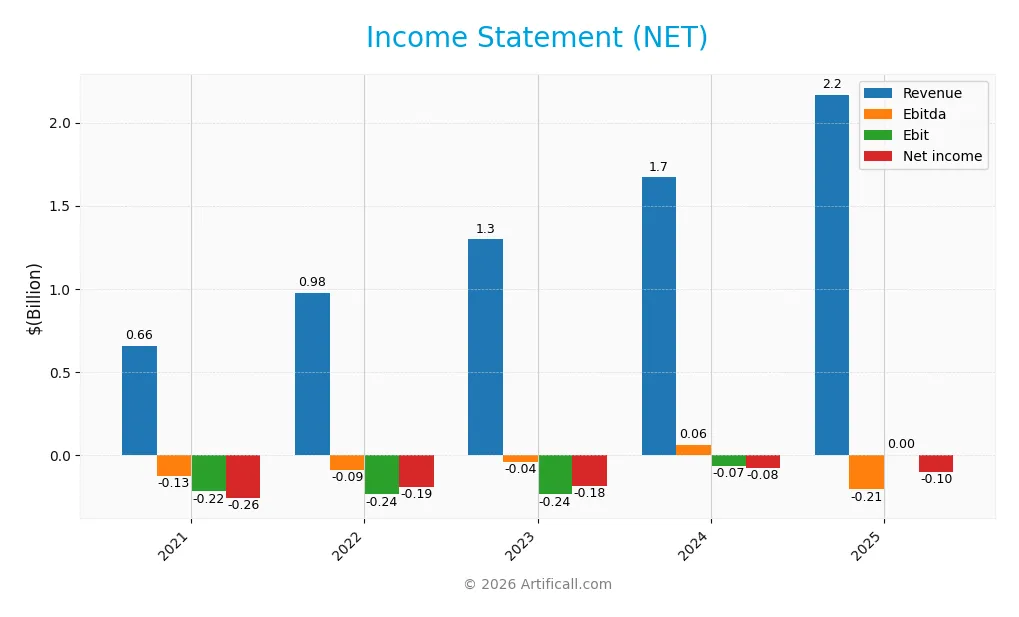

The table below summarizes Cloudflare, Inc.’s key income statement items for the fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 656M | 975M | 1.3B | 1.7B | 2.2B |

| Cost of Revenue | 147M | 233M | 307M | 379M | 553M |

| Operating Expenses | 657M | 991M | 1.2B | 1.4B | 1.8B |

| Gross Profit | 509M | 743M | 990M | 1.3B | 1.6B |

| EBITDA | -125M | -92M | -43M | 62M | -207M |

| EBIT | -220M | -237M | -237M | -66M | 0 |

| Interest Expense | 49M | 5M | 6M | 5M | -9M |

| Net Income | -260M | -193M | -184M | -79M | -102M |

| EPS | -0.83 | -0.59 | -0.55 | -0.23 | -0.29 |

| Filing Date | 2022-03-01 | 2023-02-24 | 2024-02-21 | 2025-02-20 | 2026-02-10 |

Income Statement Evolution

Cloudflare’s revenue surged from $656M in 2021 to $2.17B in 2025, reflecting strong top-line growth. Gross margins remained robust around 74.5%, signaling efficient cost control. However, net income stayed negative, though losses narrowed from -$260M in 2021 to -$102M in 2025, indicating improving profitability trends.

Is the Income Statement Favorable?

The 2025 income statement shows favorable fundamentals with a 30% revenue increase and stable gross margin at 74.5%. Operating expenses grew in line with revenue, supporting scalable growth. Despite a negative net margin of -4.7%, the company improved its net income and EBIT margins compared to prior years, reflecting progress toward profitability.

Financial Ratios

The table below summarizes Cloudflare, Inc.’s key financial ratios from 2021 to 2025, providing insight into profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -39.7% | -19.8% | -14.2% | -4.7% | -4.7% |

| ROE | -31.9% | -31.0% | -24.1% | -7.5% | 0% |

| ROIC | -6.8% | -8.9% | -8.5% | -6.1% | 0% |

| P/E | -158 | -76 | -151 | -467 | -672 |

| P/B | 50.3 | 23.6 | 36.4 | 35.1 | 0 |

| Current Ratio | 6.77 | 4.74 | 3.50 | 2.86 | 0 |

| Quick Ratio | 6.77 | 4.74 | 3.50 | 2.86 | 0 |

| D/E | 1.59 | 2.53 | 1.88 | 1.40 | 0 |

| Debt-to-Assets | 54.5% | 61.0% | 52.0% | 44.3% | 0% |

| Interest Coverage | -3.0 | -49.9 | -42.7 | -29.8 | 23.6 |

| Asset Turnover | 0.28 | 0.38 | 0.47 | 0.51 | 0 |

| Fixed Asset Turnover | 2.09 | 2.33 | 2.81 | 2.63 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, Cloudflare’s Return on Equity (ROE) remained negative, reflecting persistent unprofitability. The Current Ratio steadily declined from 6.77 in 2021 to zero in 2025, indicating deteriorating liquidity. Meanwhile, the Debt-to-Equity Ratio dropped to zero by 2025 from 1.59 in 2021, suggesting a significant reduction or reclassification of debt levels. Profitability margins remained consistently negative.

Are the Financial Ratios Favorable?

In 2025, Cloudflare’s profitability ratios, including net margin and ROE, are unfavorable, signaling ongoing losses. Liquidity ratios like the Current and Quick Ratios are absent, raising concerns over short-term solvency. Leverage ratios appear favorable with a zero Debt-to-Equity ratio, but interest coverage is unfavorable, implying difficulty in meeting debt obligations. Market value indicators such as P/E are favorable despite negative earnings, reflecting market optimism or growth expectations. Overall, the ratio profile is predominantly unfavorable.

Shareholder Return Policy

Cloudflare, Inc. does not pay dividends, reflecting its negative net income and reinvestment focus. The company prioritizes growth and funding operations through free cash flow rather than shareholder distributions. Share buybacks are not reported.

This approach aligns with Cloudflare’s strategy to build long-term value amid ongoing investments and losses. While it limits immediate shareholder returns, it supports sustainable value creation if operational improvements materialize.

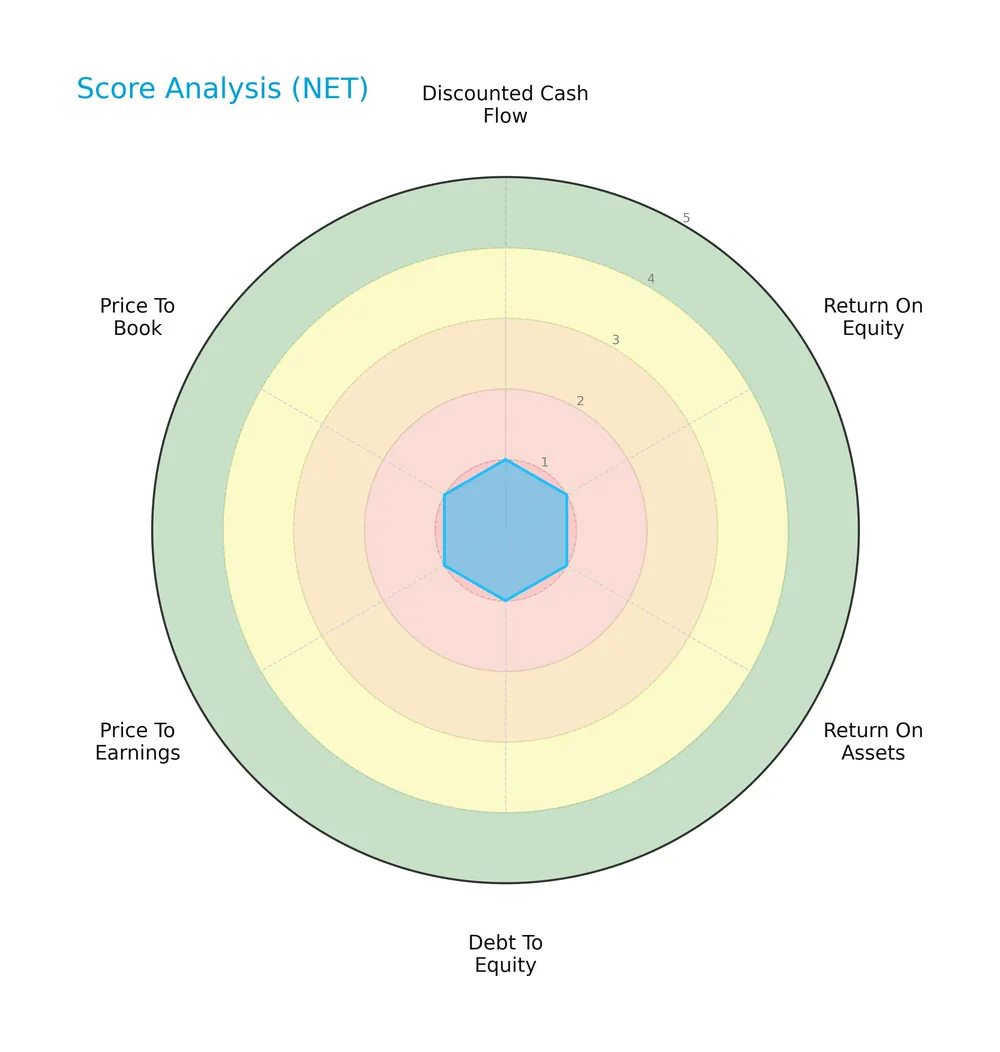

Score analysis

The following radar chart illustrates Cloudflare, Inc.’s key financial metric scores for investor evaluation:

All six scores for discounted cash flow, return on equity, return on assets, debt to equity, price to earnings, and price to book register as very unfavorable, reflecting weak financial performance across valuation and profitability measures.

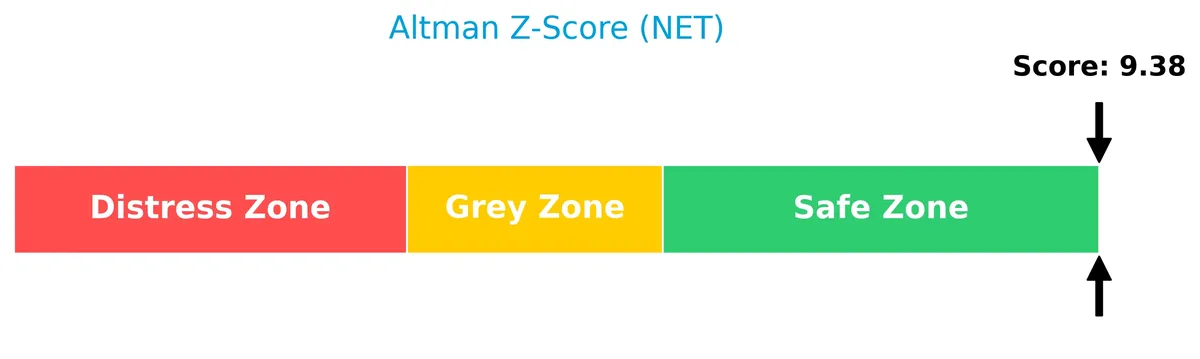

Analysis of the company’s bankruptcy risk

Cloudflare, Inc. currently resides in the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy:

Is the company in good financial health?

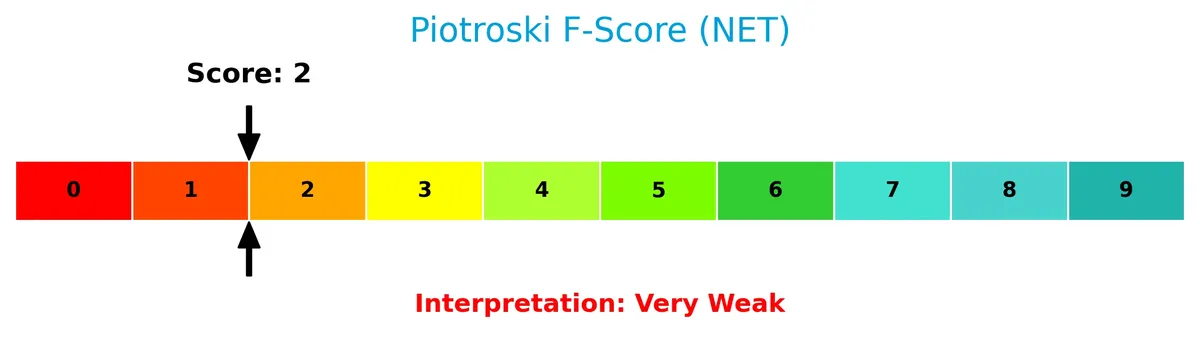

The Piotroski Score diagram below provides insight into the company’s financial health status:

With a very weak Piotroski Score of 2, Cloudflare, Inc. shows significant financial weakness, suggesting challenges in profitability, leverage, liquidity, or operational efficiency.

Competitive Landscape & Sector Positioning

This section examines Cloudflare, Inc.’s strategic positioning within the software infrastructure sector. We will analyze its revenue streams, key products, and main competitors. I will assess whether Cloudflare holds a competitive advantage over its peers.

Strategic Positioning

Cloudflare operates a concentrated product portfolio focused on integrated cloud security, performance, and reliability solutions. Geographically, it diversifies revenue across the US (849M), EMEA (466M), Asia Pacific (223M), and other regions (130M), reflecting a balanced global footprint with growing international exposure.

Revenue by Segment

This pie chart illustrates Cloudflare, Inc.’s revenue distribution by segment for the full fiscal year 2024, highlighting the contributions from its identifiable business units.

Cloudflare’s revenue is concentrated entirely in the Reportable Segment, which generated $1.67B in 2024. The absence of multiple segments suggests a focused business model or limited public segmentation. This concentration points to a reliance on a singular revenue stream, which may imply higher exposure to risks if market dynamics shift. Monitoring segment diversification will be critical for assessing future growth stability.

Key Products & Brands

Cloudflare, Inc. offers a broad suite of integrated cloud services and security solutions, including performance and developer tools:

| Product | Description |

|---|---|

| Cloud Security Products | Cloud firewall, bot management, DDoS protection, IoT security, SSL/TLS, secure origin connection, and rate limiting products. |

| Performance Solutions | Content delivery, intelligent routing, content optimization, mobile and image optimization. |

| Reliability Solutions | Load balancing, anycast network, virtual backbone, DNS services, DNS resolver, online and virtual waiting room solutions. |

| Internal Infrastructure | On-ramps connecting users/devices to the network; filters for data protection, inspection, and privilege management. |

| Developer-Based Solutions | Serverless computing, programmable network, website development, domain registration, Cloudflare apps, analytics, data localization. |

| Consumer Services | Consumer DNS Resolver app for internet browsing, Consumer VPN for mobile traffic security and acceleration. |

Cloudflare’s product portfolio spans security, performance, and reliability solutions with a strong developer and consumer focus. This diversity supports its position in cloud infrastructure and internet security sectors.

Main Competitors

This sector includes 32 competitors; below are the top 10 leaders ranked by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Cloudflare ranks 8th among 32 competitors, with a market cap at 1.88% of Microsoft’s leading figure. It sits below the average market cap of the top 10 (508B) but above the sector median (19B). The company enjoys a 38.74% market cap premium over its closest higher-ranked rival, indicating a solid gap and positioning in the software infrastructure industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Cloudflare have a competitive advantage?

Cloudflare demonstrates competitive strength with a favorable gross margin of 75% and strong revenue growth exceeding 230% over five years. However, its net margin remains negative at -4.7%, signaling ongoing profitability challenges.

The company expands across diverse markets, notably the U.S., EMEA, and Asia Pacific, with increasing revenues in each region. Cloudflare’s broad cloud security and performance solutions position it to capitalize on growing demand for integrated internet infrastructure services.

SWOT Analysis

This analysis highlights Cloudflare, Inc.’s key internal and external factors shaping its strategic outlook.

Strengths

- Strong revenue growth with 230% increase over five years

- High gross margin at 74.5% indicating pricing power

- Expanding global footprint with diversified geographic revenue

Weaknesses

- Negative net margin at -4.7% signals ongoing profitability challenges

- Weak liquidity ratios raise short-term risk concerns

- Low ROIC and ROE reflect inefficient capital use

Opportunities

- Growing demand for cloud security and performance solutions

- Potential to leverage serverless computing and IoT security expansion

- Increasing enterprise digital transformation accelerating cloud adoption

Threats

- Intense competition from large cloud providers and cybersecurity firms

- Rapid technology changes requiring constant innovation

- Regulatory and geopolitical risks impacting global operations

Cloudflare’s robust growth and premium margins demonstrate strong market positioning. However, profitability and capital efficiency weaknesses demand strategic focus on operational leverage. The company must aggressively innovate and navigate competitive and regulatory threats to sustain its moat.

Stock Price Action Analysis

The weekly stock chart of Cloudflare, Inc. (NET) illustrates price movements and key levels over the past 12 months:

Trend Analysis

Over the past 12 months, NET’s stock price rose sharply by 96.14%, indicating a strong bullish trend. The price ranged between 67.69 and a peak of 253.3, but the upward momentum shows deceleration. Volatility remains high with a 52.79 standard deviation, reflecting significant price swings.

Volume Analysis

Trading volume over the last three months shows a decreasing trend, with buyers dominating 60.4% of activity. Buyer volume totals 120M compared to 79M sellers, indicating sustained buying interest amid lower overall participation. This suggests cautious optimism among investors despite a recent price pullback.

Target Prices

Analysts forecast a robust upside for Cloudflare, Inc., with a strong consensus target reflecting optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 140 | 300 | 233.7 |

The target range suggests significant growth potential, with a consensus price well above current levels, indicating bullish analyst sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to provide insight into Cloudflare, Inc.’s market perception.

Stock Grades

The latest analyst grades for Cloudflare, Inc. reveal a stable consensus with diverse opinions from top firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| RBC Capital | Maintain | Outperform | 2026-02-11 |

| Needham | Maintain | Buy | 2026-02-11 |

| Piper Sandler | Maintain | Neutral | 2026-02-11 |

| Scotiabank | Maintain | Sector Perform | 2026-02-11 |

| BTIG | Maintain | Buy | 2026-02-11 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-02-11 |

| Barclays | Maintain | Overweight | 2026-02-11 |

| Guggenheim | Maintain | Sell | 2026-02-11 |

| BTIG | Upgrade | Buy | 2026-02-04 |

The grades predominantly favor a positive outlook, with most firms maintaining buy or overweight ratings. Only Guggenheim holds a sell rating, indicating some caution within the analyst community.

Consumer Opinions

Cloudflare, Inc. enjoys a generally positive reputation among users, reflecting its strong market position in cybersecurity and web performance.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and fast content delivery network (CDN) | Occasional service outages reported |

| Excellent customer support with knowledgeable staff | Pricing can be high for small businesses |

| Robust security features protecting against DDoS attacks | Complex interface for beginners |

| Frequent updates and improvements to platform | Limited customization options on basic plans |

Overall, consumers praise Cloudflare for its speed and security, essential in today’s digital landscape. However, smaller clients often find pricing steep and usability challenging, signaling opportunities for tailored solutions.

Risk Analysis

Below is a table summarizing the key risks Cloudflare, Inc. faces based on its financial and operational profile:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability | Negative net margin (-4.72%) signals ongoing losses. | High | High |

| Liquidity | Unfavorable current and quick ratios indicate potential cash flow issues. | Medium | Medium |

| Financial Health | Very weak Piotroski score (2) despite a strong Altman Z-Score; mixed signals on stability. | Medium | High |

| Market Volatility | High beta (1.98) exposes stock to significant price swings. | High | Medium |

| Debt Management | Favorable debt-to-equity and debt-to-assets ratios reduce solvency risk. | Low | Low |

Cloudflare’s most pressing risks stem from its persistent unprofitability and weak operational efficiency. Despite a strong Altman Z-Score suggesting low bankruptcy risk, the company’s poor Piotroski score and negative margins highlight vulnerabilities in capital allocation and profitability. High market volatility compounds uncertainty for investors.

Should You Buy Cloudflare, Inc.?

Cloudflare, Inc. appears to be navigating a challenging profitability landscape with weak value creation despite a growing ROIC trend. While leverage seems manageable, the overall rating of D+ and very weak Piotroski score suggest a cautious analytical interpretation.

Strength & Efficiency Pillars

Cloudflare, Inc. exhibits strong operational efficiency with a gross margin of 74.51%, signaling robust core profitability. The company’s revenue growth of 29.85% over the past year and 230.26% over five years reflects solid market demand and execution. Despite a negative net margin of -4.72%, the interest expense remains favorable at -0.4%, easing financial burdens. While ROIC data is unavailable to confirm value creation against WACC, Cloudflare’s growing ROIC trend suggests improving capital efficiency, a positive signal for long-term investors.

Weaknesses and Drawbacks

Cloudflare faces significant challenges, with an Altman Z-Score of 9.38 placing it safely above distress risk. However, profitability metrics remain weak, including a net margin of -4.72% and zero ROE, indicating struggles to convert revenue into earnings. The company has an unfavorable current ratio and quick ratio of 0, flagging liquidity concerns and potential short-term solvency risks. Additionally, the Piotroski Score is very weak at 2, underscoring financial frailty. These risks could pressure valuation and investor confidence despite favorable leverage ratios.

Our Final Verdict about Cloudflare, Inc.

Cloudflare may appear attractive due to strong revenue growth and operational margins, but profitability and liquidity weaknesses temper enthusiasm. The safe Altman Z-Score reduces bankruptcy concerns, while recent buyer dominance (60.4%) supports positive market interest. Despite long-term strength, conservative investors might adopt a cautious wait-and-see stance until profitability metrics improve and liquidity stabilizes, balancing growth prospects against financial discipline.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cloudflare rises 5% as AI agent wave led by viral Moltbot boosts security demand – CNBC (Feb 11, 2026)

- Cloudflare soars on Q4 results as analysts note accelerating growth across all regions – Seeking Alpha (Feb 11, 2026)

- Cloudflare (NYSE:NET) Exceeds Q4 CY2025 Expectations, Stock Soars – Yahoo Finance (Feb 10, 2026)

- Why Is Cloudflare Stock Skyrocketing Wednesday? – Benzinga (Feb 11, 2026)

- Cloudflare climbs as Q4 results demonstrate 34% year-over-year revenue growth – Seeking Alpha (Feb 10, 2026)

For more information about Cloudflare, Inc., please visit the official website: cloudflare.com