Home > Analyses > Financial Services > Citigroup Inc.

Citigroup Inc. fundamentally shapes global finance by connecting millions of consumers and corporations to vital banking and investment services. As a diversified financial powerhouse, Citigroup stands out with its expansive Global Consumer Banking and Institutional Clients Group segments, offering everything from retail banking to complex investment solutions. Renowned for innovation and broad market influence, it continuously adapts to evolving financial landscapes. The key question now: does Citigroup’s robust foundation still justify its current valuation and future growth prospects?

Table of contents

Business Model & Company Overview

Citigroup Inc., founded in 1812 and headquartered in New York City, stands as a diversified financial services giant with a broad ecosystem spanning retail and institutional banking. Its core mission integrates Global Consumer Banking and Institutional Clients Group, delivering comprehensive financial products to consumers, corporations, and governments across North America, Latin America, Asia, and Europe. With over 2,300 branches and 229K employees, Citigroup commands a leading position in the global banking landscape.

The company’s revenue engine balances traditional banking services and sophisticated wholesale products, combining retail banking, credit cards, corporate lending, investment banking, and trading. This diverse portfolio leverages a strategic presence in major global markets, including the Americas, Europe, and Asia. Citigroup’s economic moat rests on its expansive network and multifaceted service offerings, positioning it as a key player shaping the future of international finance.

Financial Performance & Fundamental Metrics

In this section, I analyze Citigroup Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

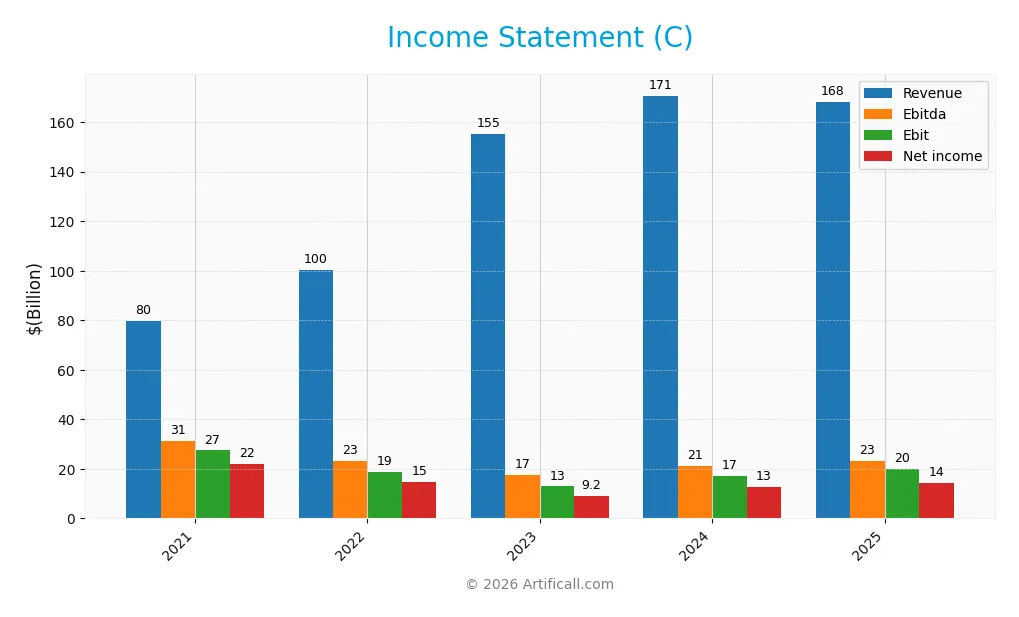

The table below presents Citigroup Inc.’s key income statement figures for the fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 79.9B | 100.2B | 155.4B | 170.7B | 168.3B |

| Cost of Revenue | 4.1B | 30.9B | 87.5B | 99.6B | 93.3B |

| Operating Expenses | 48.3B | 50.6B | 54.9B | 54.1B | 55.2B |

| Gross Profit | 75.8B | 69.4B | 67.9B | 71.1B | 74.9B |

| EBITDA | 31.4B | 23.1B | 17.5B | 21.4B | 23.1B |

| EBIT | 27.5B | 18.8B | 12.9B | 17.0B | 19.8B |

| Interest Expense | 7.98B | 25.7B | 78.4B | 89.6B | 83.1B |

| Net Income | 21.9B | 14.8B | 9.2B | 12.7B | 14.3B |

| EPS | 10.21 | 7.04 | 4.07 | 6.03 | 7.23 |

| Filing Date | 2022-02-28 | 2023-02-27 | 2024-02-23 | 2025-02-21 | 2026-01-14 |

Income Statement Evolution

From 2021 to 2025, Citigroup’s revenue more than doubled, growing 110.7%, though it slightly declined by 1.41% between 2024 and 2025. Net income, however, fell by 35% over the full period, despite a 14.1% net margin improvement in the last year. Gross profit margin remained favorable at 44.55%, while EBIT margin also improved to 11.78%, reflecting better operational efficiency despite some margin volatility.

Is the Income Statement Favorable?

In 2025, Citigroup posted $168.3B in revenue with a net income of $14.27B, delivering an 8.48% net margin, considered favorable. EBIT rose 16.3% year-over-year, supported by a 5.4% gross profit increase. However, interest expense remains high at 49.36% of interest income, an unfavorable factor. Overall, 57.14% of income statement metrics are positive, leading to a generally favorable fundamental assessment for 2025.

Financial Ratios

The table below presents key financial ratios for Citigroup Inc. over the fiscal years 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 27% | 15% | 6% | 7% | 8% |

| ROE | 11% | 7% | 4% | 6% | 7% |

| ROIC | 3% | 2% | 1% | 1% | 1% |

| P/E | 5.6 | 5.9 | 10.8 | 10.6 | 14.9 |

| P/B | 0.6 | 0.4 | 0.5 | 0.6 | 1.0 |

| Current Ratio | 0.34 | 0.34 | 0.30 | 0.31 | 0.48 |

| Quick Ratio | 0.34 | 0.34 | 0.30 | 0.31 | 0.48 |

| D/E | 2.3 | 2.6 | 2.9 | 2.8 | 3.4 |

| Debt-to-Assets | 21% | 22% | 25% | 25% | 27% |

| Interest Coverage | 3.4 | 0.7 | 0.2 | 0.2 | 0.2 |

| Asset Turnover | 0.03 | 0.04 | 0.06 | 0.07 | 0.06 |

| Fixed Asset Turnover | 3.3 | 3.8 | 5.4 | 5.7 | 5.0 |

| Dividend Yield | 4.2% | 5.7% | 5.2% | 3.9% | 2.0% |

Evolution of Financial Ratios

Citigroup Inc.’s Return on Equity (ROE) showed a declining trend from 10.87% in 2021 to 6.72% in 2025. The Current Ratio remained consistently below 0.5 in recent years, indicating limited short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased from 2.35 in 2021 to 3.37 in 2025, reflecting higher leverage with reduced profitability stability.

Are the Financial Ratios Favorable?

In 2025, Citigroup’s profitability ratios such as net margin (8.48%) are neutral, while ROE (6.72%) and return on invested capital (0.95%) are unfavorable, signaling some profitability challenges. Liquidity ratios like current and quick ratios (both 0.48) are unfavorable, suggesting tight liquidity. Leverage ratios are mixed: a high debt-to-equity (3.37) and low interest coverage (0.24) are unfavorable, but debt-to-assets (26.94%) is favorable. Market valuation ratios such as P/E (14.89) and P/B (1.0) are favorable, leading to an overall slightly unfavorable financial ratio profile.

Shareholder Return Policy

Citigroup Inc. maintains a consistent dividend payment with a payout ratio around 30%, a dividend per share near $2.32 in 2025, and a yield close to 2%. The company does not disclose share buybacks in the provided data, and dividend coverage by free cash flow appears limited.

This payout approach, combined with moderate profitability and leverage, suggests a balanced distribution policy. However, investors should consider the sustainability of dividends given the relatively low free cash flow coverage to assess long-term shareholder value creation.

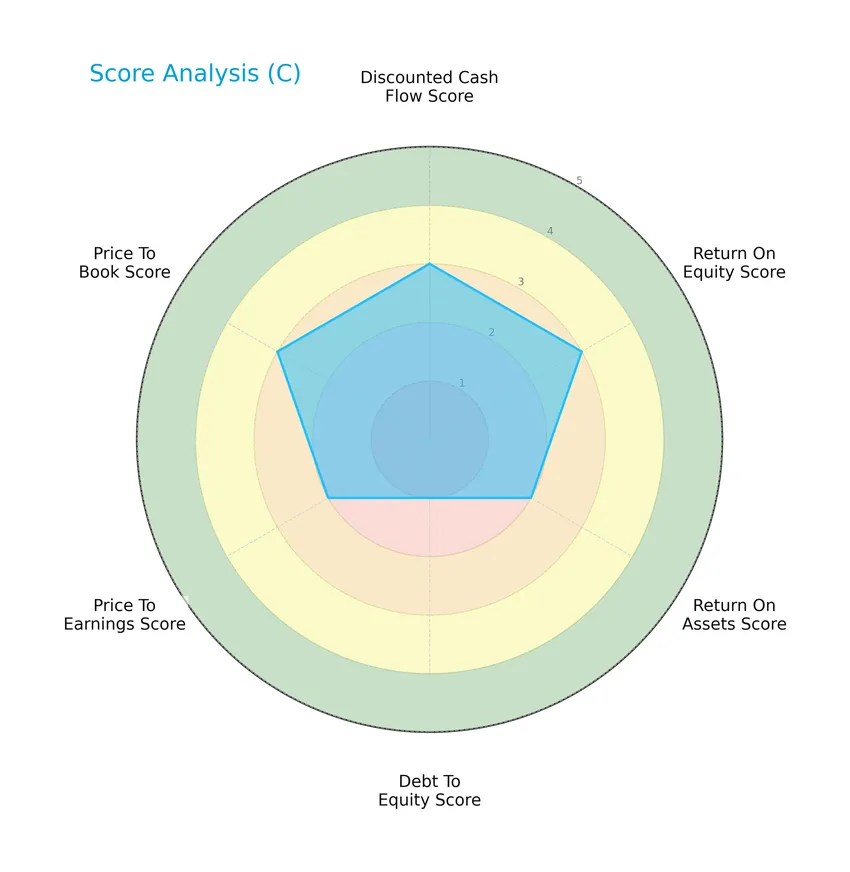

Score analysis

The following radar chart presents an overview of Citigroup Inc.’s key financial scores for a comprehensive performance assessment:

Citigroup scores moderately in discounted cash flow (3), return on equity (3), return on assets (2), price-to-earnings (2), and price-to-book (3), while its debt-to-equity score is very unfavorable at 1, indicating higher leverage risk.

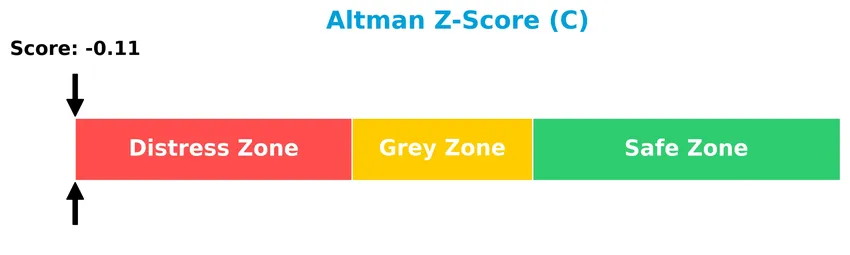

Analysis of the company’s bankruptcy risk

Citigroup currently falls into the distress zone according to its Altman Z-Score, signaling a significant risk of bankruptcy:

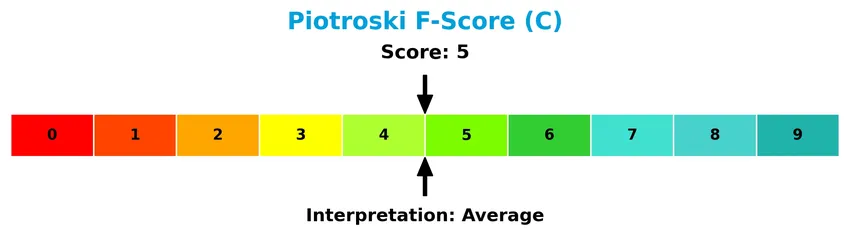

Is the company in good financial health?

The Piotroski Score diagram below reflects Citigroup’s average financial health status based on its score of 5:

With a Piotroski Score of 5, Citigroup demonstrates moderate financial strength, suggesting neither strong nor weak fundamentals in profitability, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Citigroup Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT. I will analyze these aspects to assess whether Citigroup holds a competitive advantage over its peers.

Strategic Positioning

Citigroup Inc. maintains a diversified product portfolio across Global Consumer Banking and Institutional Clients Group segments, generating over $40B each in U.S. Personal Banking and International markets. Its geographic exposure spans North America and International regions, supporting a balanced revenue base nearing $80B annually.

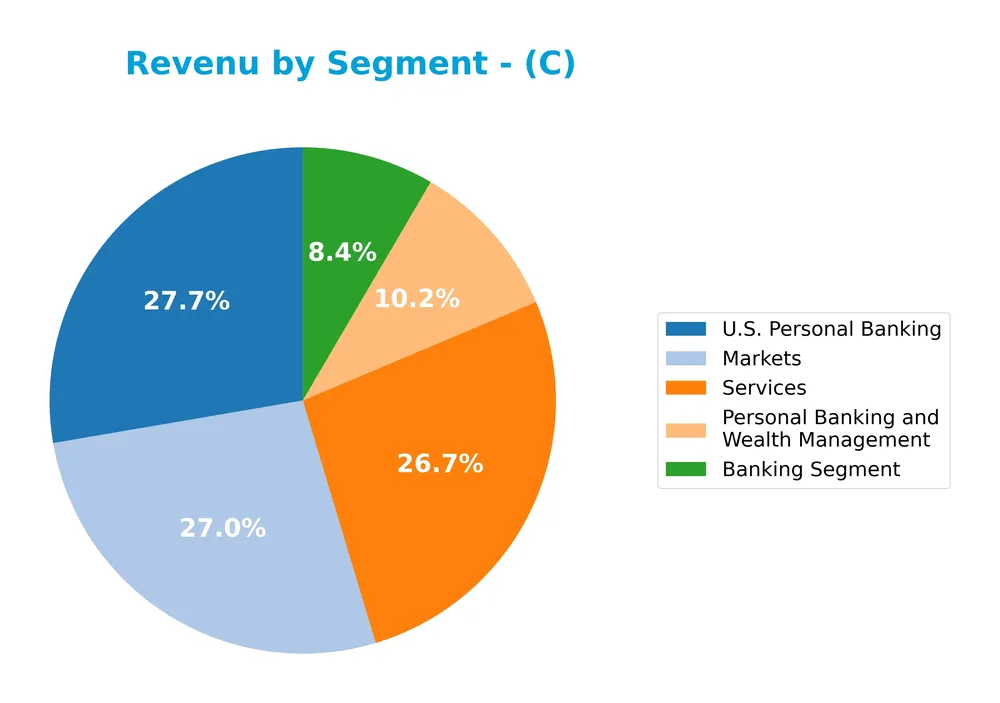

Revenue by Segment

The pie chart illustrates Citigroup Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key business areas and their financial contributions.

In 2024, U.S. Personal Banking and Services segments were the leading revenue drivers, generating $20.4B and $19.6B respectively, closely followed by Markets at $19.8B. The Banking Segment and Personal Banking and Wealth Management contributed $6.2B and $7.5B. The steady growth in U.S. Personal Banking and Services underscores a focus on consumer and service-oriented operations, while the Markets segment maintains a strong presence, reflecting diversified revenue streams with moderate concentration risk.

Key Products & Brands

Below is an overview of Citigroup Inc.’s primary products and brand segments, outlining their main financial services offerings:

| Product | Description |

|---|---|

| Global Consumer Banking (GCB) | Traditional banking services to retail customers via retail banking, Citi-branded cards, lending, investment, and retail services. |

| Institutional Clients Group (ICG) | Wholesale banking services including fixed income and equity trading, foreign exchange, corporate lending, advisory, and securities services. |

| U.S. Personal Banking | Personal banking services focused on U.S. retail customers, including deposits, credit cards, and loans. |

| Personal Banking and Wealth Management | Banking, credit, and investment services tailored for personal and wealth management clients. |

| Markets | Sales and trading of financial instruments such as equities, fixed income, and derivatives to institutional clients. |

| Services | Various banking-related services including cash management, trade finance, and securities services. |

| Banking Segment | Core banking operations encompassing deposit taking and lending activities. |

Citigroup’s product portfolio spans retail and institutional banking, trading, and wealth management, supporting a diverse client base globally through comprehensive financial services.

Main Competitors

There are 4 main competitors in the Banks – Diversified industry; the table below lists the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| JPMorgan Chase & Co. | 886B |

| Bank of America Corporation | 409B |

| Wells Fargo & Company | 310B |

| Citigroup Inc. | 221B |

Citigroup Inc. ranks 4th among its competitors with a market cap at 22.94% of the leader, JPMorgan Chase & Co. The company is positioned below both the average market cap of the top 10 competitors (456B) and the median market cap of the sector (359B). It maintains a significant 52.31% gap from its nearest competitor above, Wells Fargo & Company.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Citigroup have a competitive advantage?

Citigroup Inc. currently does not present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over 2021-2025 is sharply negative, reinforcing its very unfavorable moat status.

Looking ahead, Citigroup operates across multiple regions including North America, Latin America, and Asia, offering a broad range of financial products and services through its Global Consumer Banking and Institutional Clients Group segments. Future opportunities may arise from expanding electronic delivery systems and leveraging its extensive branch network, but current financial metrics highlight challenges in sustaining economic profits.

SWOT Analysis

This SWOT analysis highlights Citigroup Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Strong global presence with diversified financial services

- Favorable gross and EBIT margins

- Competitive valuation with PE of 14.89 and PB of 1.0

Weaknesses

- Declining ROIC and value destruction

- High leverage with debt-to-equity ratio of 3.37

- Weak liquidity ratios with current and quick ratio at 0.48

Opportunities

- Expansion in emerging markets and international segments

- Growth in digital banking and fintech integration

- Potential for margin improvement through operational efficiencies

Threats

- Regulatory pressures in multiple jurisdictions

- Intense competition in diversified banking

- Economic downturn risks impacting credit quality and profitability

Overall, Citigroup’s robust global footprint and solid profitability metrics offer a strong foundation, but challenges with leverage, liquidity, and declining returns necessitate cautious risk management. Strategic focus should be on leveraging growth opportunities while addressing financial weaknesses to enhance shareholder value.

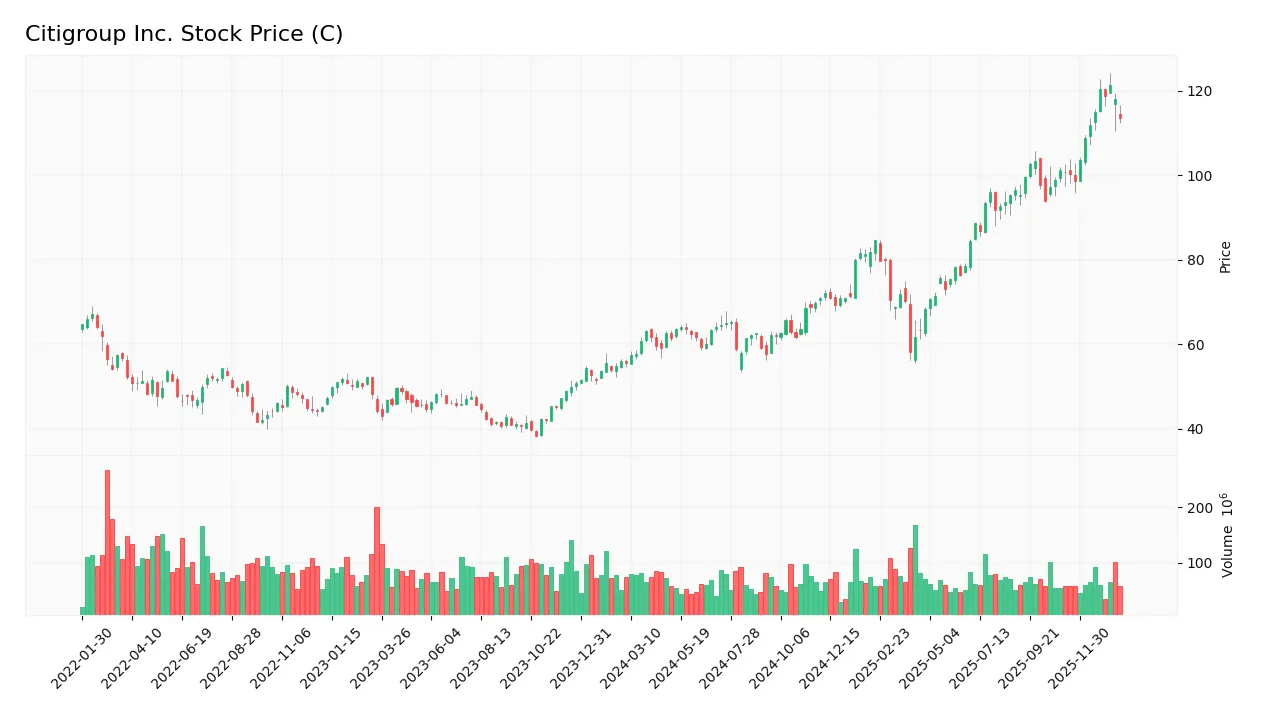

Stock Price Action Analysis

The following weekly chart illustrates Citigroup Inc.’s stock price movements over the past 12 months, highlighting key fluctuations and trend phases:

Trend Analysis

Over the past 12 months, Citigroup’s stock price increased by 104.3%, indicating a bullish trend with clear acceleration. The price ranged from a low of 55.6 to a high of 121.32, supported by a volatility measure of 17.83%. Recent weeks show a 12.7% gain with moderate volatility, maintaining upward momentum.

Volume Analysis

Trading volumes over the last three months show a decreasing trend with buyer volume slightly exceeding seller volume by 51.41%, reflecting neutral buyer behavior. This suggests balanced market participation without strong directional conviction among investors during this period.

Target Prices

The target price consensus for Citigroup Inc. reflects moderate optimism among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 150 | 87 | 130.55 |

Analysts expect Citigroup’s stock to appreciate, with a consensus target price around 130.55, indicating potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback to provide insights into Citigroup Inc.’s market perception.

Stock Grades

The following table presents the latest verified grades for Citigroup Inc. from reputable financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Oppenheimer | Maintain | Outperform | 2026-01-15 |

| RBC Capital | Maintain | Outperform | 2026-01-15 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Goldman Sachs | Maintain | Buy | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2025-12-30 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-12-17 |

Overall, Citigroup’s stock grades show a consistent pattern of positive sentiment, with all major analysts maintaining a Buy, Overweight, or Outperform rating during late 2025 and early 2026, reflecting steady confidence without recent downgrades.

Consumer Opinions

Citigroup Inc. continues to evoke mixed reactions from its consumer base, reflecting its broad service scope and ongoing challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient digital banking platform and quick service | Customer support can be slow and unresponsive |

| Wide range of financial products suitable for investors | High fees compared to competitors |

| Strong global presence providing convenient access | Occasional technical issues with the mobile app |

Overall, consumers appreciate Citigroup’s extensive product offerings and digital capabilities, but consistent concerns about customer service and fees suggest areas for improvement.

Risk Analysis

The following table summarizes key risks associated with Citigroup Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Altman Z-Score indicates high bankruptcy risk, reflecting financial distress and leverage. | High | High |

| Profitability | Low ROE (6.72%) and ROIC (0.95%) suggest weak profitability and inefficient capital use. | Medium | Medium |

| Liquidity | Unfavorable current and quick ratios (0.48) highlight potential short-term liquidity issues. | Medium | High |

| Debt Management | Very unfavorable debt-to-equity (3.37) and low interest coverage (0.24) show high leverage. | High | High |

| Market Volatility | Beta of 1.166 implies above-average sensitivity to market fluctuations. | Medium | Medium |

| Dividend Yield | Moderate dividend yield at 1.99% with neutral outlook may limit income stability. | Low | Low |

Citigroup faces significant risks from financial distress indicators and high leverage, as confirmed by a negative Altman Z-Score placing it in the distress zone. Liquidity challenges and mediocre profitability further amplify uncertainty. These risks warrant careful monitoring before investing.

Should You Buy Citigroup Inc.?

Citigroup Inc. appears to be facing significant challenges with a declining profitability profile and a very unfavorable competitive moat, suggesting value erosion. Despite a substantial leverage profile, the overall rating could be seen as moderate (B-), indicating cautious consideration.

Strength & Efficiency Pillars

Citigroup Inc. exhibits mixed efficiency signals with a moderate net margin of 8.48% and a return on equity (ROE) of 6.72%, though both are below ideal benchmarks. The return on invested capital (ROIC) stands at a low 0.95%, trailing its weighted average cost of capital (WACC) at 8.88%, indicating the company is not currently a value creator. However, financial health metrics reveal concerning distress with an Altman Z-Score of -0.11 placing it in the distress zone, while the Piotroski score of 5 suggests average financial strength. The firm’s debt-to-assets ratio at 26.94% is favorable, but overall profitability and capital efficiency remain under pressure.

Weaknesses and Drawbacks

Citigroup faces significant challenges in leverage and liquidity, with a high debt-to-equity ratio of 3.37 and a constrained current ratio of 0.48, both flagged as unfavorable. Interest coverage is critically low at 0.24, exposing the company to risks in meeting interest obligations amid elevated interest expenses accounting for 49.36% of EBIT. Valuation metrics, however, appear reasonable with a price-to-earnings (P/E) ratio of 14.89 and price-to-book (P/B) at 1.0, both marked favorable. Market dynamics show neutral buyer dominance at 51.41% recently, but a decreasing volume trend signals caution amid modest short-term momentum.

Our Verdict about Citigroup Inc.

The long-term fundamental profile of Citigroup Inc. might appear unfavorable due to persistent financial distress signals and value destruction evidenced by ROIC below WACC. Despite this, the bullish overall stock trend, supported by a 104.3% price appreciation and positive recent momentum, suggests a complex scenario. This mixed profile indicates that, despite long-term challenges, recent market interest may present selective opportunities, but a cautious, wait-and-see approach could be prudent to identify better entry points.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Jmac Enterprises LLC Sells 12,396 Shares of Citigroup Inc. $C – MarketBeat (Jan 23, 2026)

- Citigroup (C) Signals Stabilizing Core Businesses and Progress on Strategic Streamlining – Yahoo Finance (Jan 21, 2026)

- Citigroup to lay off more employees in March – Reuters (C:NYSE) – Seeking Alpha (Jan 23, 2026)

- Citigroup Plans Fresh March Layoffs Targeting Senior Roles (UPDATED) – Benzinga (Jan 23, 2026)

- Citigroup CEO Jane Fraser Doesn’t Expect ‘Sell America’ Sentiment to Last in Markets – Investopedia (Jan 20, 2026)

For more information about Citigroup Inc., please visit the official website: citigroup.com