Home > Analyses > Financial Services > Cincinnati Financial Corporation

Cincinnati Financial Corporation underpins the security of countless businesses and families through its comprehensive property and casualty insurance offerings. Renowned for its steady commercial and personal lines coverage, the company blends innovation with disciplined capital management to maintain market influence. As it navigates evolving risk landscapes and competitive pressures, I ask: do Cincinnati Financial’s fundamentals still warrant its current valuation and promise long-term growth? This analysis aims to uncover the answer.

Table of contents

Business Model & Company Overview

Cincinnati Financial Corporation, founded in 1950 and headquartered in Fairfield, Ohio, stands as a leading force in the property and casualty insurance industry. Its integrated ecosystem spans commercial lines, personal lines, excess and surplus lines, life insurance, and investments. This diverse portfolio forms a robust platform that addresses a wide spectrum of insurance needs with tailored solutions.

The company generates revenue through a balanced mix of underwriting premiums and investment income, supported by recurring policy renewals across the Americas. Its strategic footprint in the U.S. insurance market leverages both personal and commercial sectors, enhancing risk diversification. Cincinnati Financial’s economic moat derives from its broad product suite and disciplined capital allocation, positioning it to shape the industry’s evolving landscape.

Financial Performance & Fundamental Metrics

I analyze Cincinnati Financial Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and shareholder value.

Income Statement

The table below presents Cincinnati Financial Corporation’s key income statement figures for fiscal years 2021 through 2025, showing revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 9.63B | 6.56B | 10.01B | 11.34B | 12.63B |

| Cost of Revenue | 3.91B | 5.02B | 5.27B | 5.74B | 6.30B |

| Operating Expenses | 2.02B | 2.24B | 2.46B | 2.74B | 3.37B |

| Gross Profit | 5.72B | 1.54B | 4.74B | 5.60B | 6.33B |

| EBITDA | 3.87B | -514M | 2.44B | 3.04B | 2.97B |

| EBIT | 3.75B | -641M | 2.33B | 2.91B | 2.97B |

| Interest Expense | 53M | 53M | 54M | 53M | 5.3M |

| Net Income | 2.97B | -487M | 1.84B | 2.29B | 2.39B |

| EPS | 18.30 | -3.06 | 11.74 | 14.65 | 15.17 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-26 | 2025-02-24 | 2026-02-09 |

Income Statement Evolution

From 2021 to 2025, Cincinnati Financial’s revenue rose 31% overall, with a robust 11.4% growth in 2025 alone. Gross margin improved to 50.1%, reflecting stable cost control despite rising expenses. EBIT margin held favorably at 23.5%, though net margin declined by 38.6% over the period, signaling some pressure on bottom-line profitability.

Is the Income Statement Favorable?

The 2025 income statement shows solid fundamentals with a favorable net margin near 19% and a minimal interest expense of 0.04%. Revenue and gross profit growth remain strong, while operating expenses grew in line with revenue, slightly pressuring EBIT growth to 1.9%. Despite a 6.3% net margin decline last year, EPS increased 4.4%, supporting a generally favorable income profile.

Financial Ratios

The following table presents key financial ratios for Cincinnati Financial Corporation (CINF) over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 31% | -7% | 18% | 20% | 19% |

| ROE | 23% | -5% | 15% | 16% | 0% |

| ROIC | 10% | -10% | 74% | 92% | 0% |

| P/E | 6.2 | -33.4 | 8.9 | 9.8 | 0 |

| P/B | 1.40 | 1.54 | 1.35 | 1.61 | 0 |

| Current Ratio | 0.61 | 0 | 0 | 0 | 0 |

| Quick Ratio | 0.61 | 0 | 0 | 0 | 0 |

| D/E | 0.07 | 0.08 | 0.07 | 0.06 | 0 |

| Debt-to-Assets | 2.9% | 3.0% | 2.7% | 2.4% | 0% |

| Interest Coverage | 70.0 | -13.1 | 42.1 | 53.9 | 0 |

| Asset Turnover | 0.31 | 0.22 | 0.31 | 0.31 | 0 |

| Fixed Asset Turnover | 47.0 | 32.5 | 48.1 | 53.0 | 0 |

| Dividend Yield | 2.2% | 2.6% | 2.8% | 2.2% | 0% |

*Note: Zeroes indicate data unavailable or not reported for the year.*

Evolution of Financial Ratios

From 2021 to 2025, Cincinnati Financial Corporation’s Return on Equity (ROE) showed volatility, ultimately reporting zero in 2025. The Current Ratio remained at zero, indicating no available liquidity data in recent years. Debt-to-Equity Ratio trended downward, reaching zero in 2025, reflecting reduced leverage or unreported figures. Profitability margins softened after peaking in 2021 but stayed positive in 2025.

Are the Financial Ratios Favorable?

In 2025, profitability remains favorable with a net margin near 19%, but ROE and ROIC are unfavorable or unavailable, signaling weak capital efficiency. Liquidity ratios like Current and Quick Ratios are unfavorable, suggesting potential short-term risk. Leverage metrics such as Debt-to-Equity and Debt-to-Assets are favorable, indicating low debt levels. Market valuation metrics including P/E and P/B ratios are favorable. Overall, the financial ratio profile is slightly unfavorable.

Shareholder Return Policy

Cincinnati Financial Corporation maintains a consistent dividend policy, with a payout ratio around 21-25% and a dividend yield near 2-2.8% in recent years. Dividend payments are well covered by free cash flow, supported by moderate share buybacks enhancing shareholder returns.

This disciplined distribution approach balances income with capital preservation, promoting sustainable long-term value creation. The company’s stable dividends combined with buybacks reflect prudent capital allocation, mitigating risks of excessive payouts or repurchases.

Score analysis

Here is a radar chart summarizing Cincinnati Financial Corporation’s key valuation and financial performance scores:

The company scores very favorably on discounted cash flow and return on assets, with solid return on equity and debt-to-equity standings. However, valuation metrics like price-to-earnings and price-to-book are notably weak.

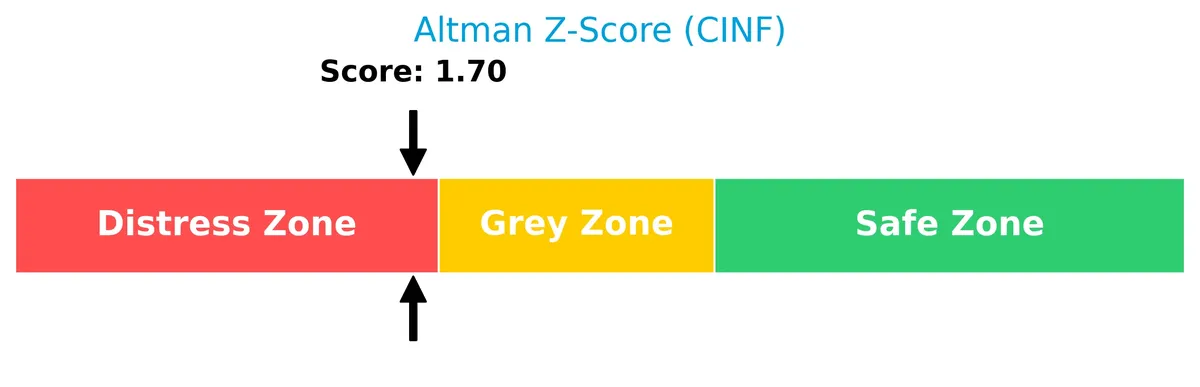

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Cincinnati Financial Corporation in the distress zone, indicating a higher risk of financial distress and potential bankruptcy:

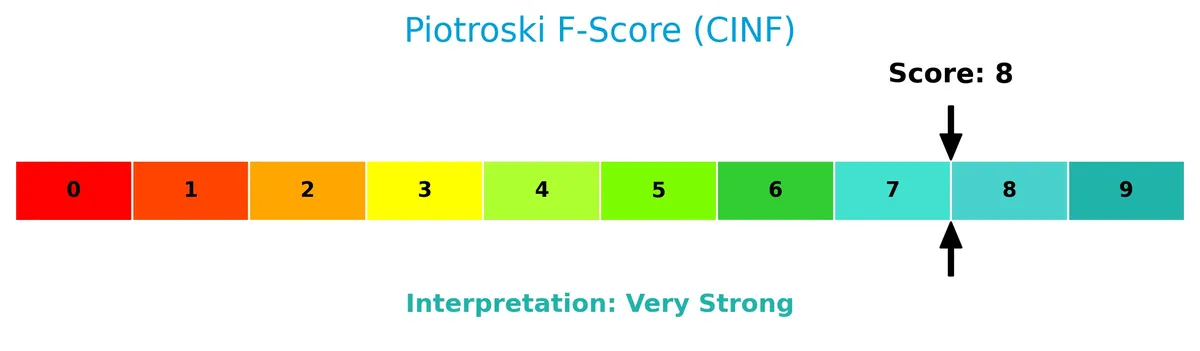

Is the company in good financial health?

The following Piotroski diagram illustrates the company’s strong financial health indicators:

With a Piotroski Score of 8, Cincinnati Financial demonstrates very strong financial strength, reflecting robust profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis explores Cincinnati Financial Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company maintains a competitive advantage within the property and casualty insurance industry.

Strategic Positioning

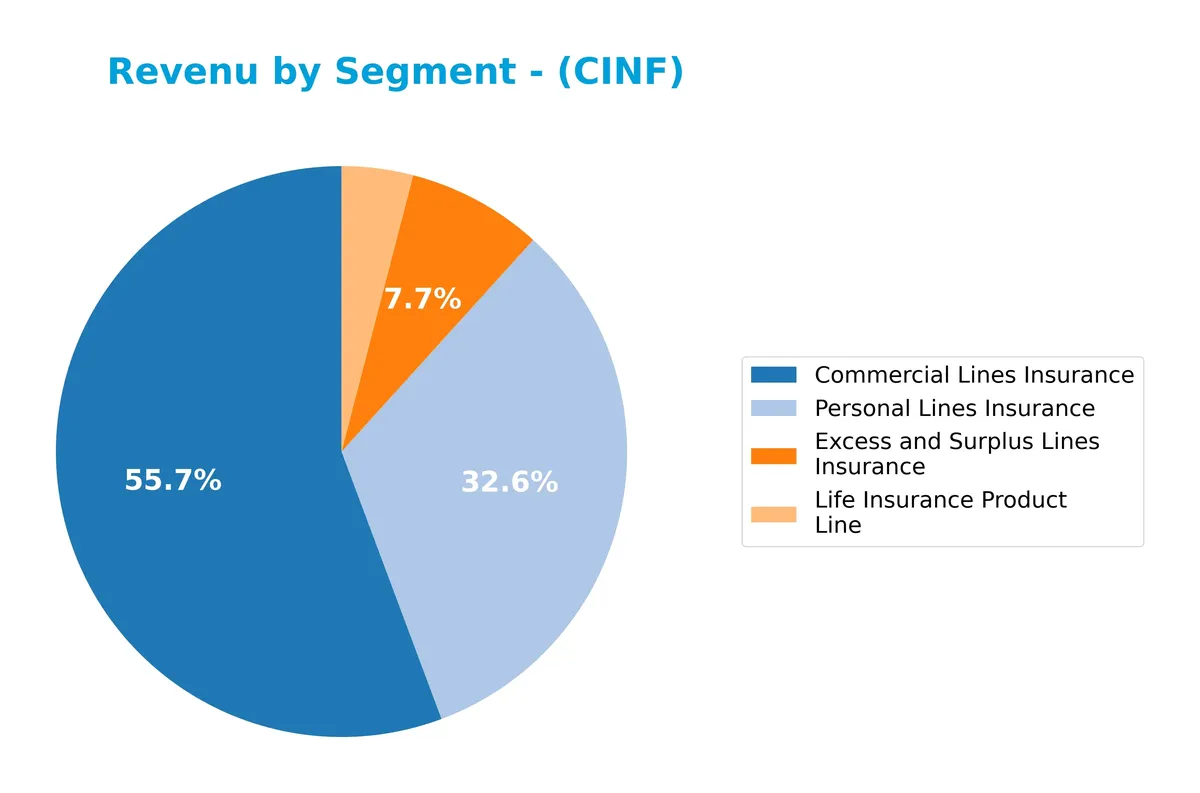

Cincinnati Financial concentrates on the U.S. property and casualty insurance market, with a diversified portfolio across Commercial Lines (4.5B), Personal Lines (2.6B), Excess and Surplus Lines (618M), and Life Insurance (326M). It operates primarily domestically, without noted geographic diversification.

Revenue by Segment

The pie chart displays Cincinnati Financial Corporation’s revenue breakdown by insurance segments for the fiscal year 2024, highlighting the relative size of each segment.

Commercial Lines Insurance leads with $4.49B, showing steady growth since 2020. Personal Lines Insurance follows at $2.63B, accelerating notably from $2.05B in 2023. Excess and Surplus Lines and Life Insurance contribute $618M and $326M respectively, maintaining consistent but smaller shares. The business exhibits concentration risk in Commercial and Personal Lines, which together constitute the bulk of revenue.

Key Products & Brands

Cincinnati Financial Corporation operates diverse insurance and investment segments, detailed as follows:

| Product | Description |

|---|---|

| Commercial Lines Insurance | Coverage for commercial casualty, property, auto, workers’ compensation, liability, bonds, and equipment. |

| Personal Lines Insurance | Personal auto, homeowner, dwelling fire, inland marine, umbrella liability, and watercraft insurance for individuals. |

| Excess and Surplus Lines Insurance | Commercial casualty and property insurance covering third-party liability and business property against various risks. |

| Life Insurance Product Line | Term, universal, whole life, and worksite life insurance products. |

| Investments Segment | Fixed-maturity investments including bonds and preferred stocks; equity investments in common and preferred stocks. |

Cincinnati Financial’s core products span commercial and personal insurance, with growing contributions from excess lines and life insurance. The investment segment supports capital strength and income diversification.

Main Competitors

There are 7 competitors in total; the table below lists the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Progressive Corporation | 124.4B |

| Chubb Limited | 124.1B |

| The Travelers Companies, Inc. | 64.4B |

| The Allstate Corporation | 53.9B |

| W. R. Berkley Corporation | 26.4B |

| Cincinnati Financial Corporation | 25.2B |

| Loews Corporation | 21.6B |

Cincinnati Financial Corporation ranks 6th among its competitors, holding about 20.5% of the market cap of the leader, The Progressive Corporation. It sits below both the average market cap of the top 10 and the sector median. The company is just 3.35% behind its immediate competitor, W. R. Berkley Corporation, showing a tight cluster near the lower end of the sector scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CINF have a competitive advantage?

Cincinnati Financial Corporation does not present a clearly defined competitive advantage based on available data, with ROIC trends declining and no ROIC versus WACC comparison provided. Its favorable margins and revenue growth contrast with weakening net income and EPS trends, suggesting mixed operational efficiency.

Looking ahead, CINF operates diversified insurance segments including commercial, personal, excess and surplus lines, and life insurance, offering opportunities to capture new market niches. Its investment segment and broad product range may support future growth amid evolving insurance demands.

SWOT Analysis

This analysis identifies Cincinnati Financial Corporation’s key internal and external factors to guide strategic decisions.

Strengths

- strong gross margin at 50%

- diverse insurance segments

- very strong Piotroski score of 8

Weaknesses

- declining ROIC trend

- Altman Z-score in distress zone

- unfavorable asset turnover ratios

Opportunities

- expanding commercial lines market

- growing demand for specialty insurance

- potential for digital transformation

Threats

- rising claims costs

- regulatory changes in insurance

- competition from insurtech disruptors

Cincinnati Financial exhibits solid operational strengths but faces profitability and efficiency challenges. Strategic focus should prioritize improving capital returns and leveraging technology to mitigate competitive threats.

Stock Price Action Analysis

The weekly chart shows Cincinnati Financial Corporation’s stock price evolution over the last 100 weeks, highlighting key fluctuations and trend phases:

Trend Analysis

Over the past two years, CINF’s stock price climbed 38.89%, indicating a bullish trend despite deceleration in momentum. The range spans from a low of 110.88 to a high of 172.65. Volatility, measured by a 15.43 standard deviation, remains significant but shows signs of easing.

Volume Analysis

Over the last three months, trading volume decreased, with buyers accounting for 58.33% of activity. This slight buyer dominance amid falling volume suggests cautious optimism but lower market participation overall. Seller volume also declined, reinforcing a tempered but positive investor sentiment.

Target Prices

Analysts show a confident target consensus for Cincinnati Financial Corporation.

| Target Low | Target High | Consensus |

|---|---|---|

| 157 | 175 | 166 |

The target range suggests moderate upside potential, reflecting steady market optimism about Cincinnati Financial’s prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Cincinnati Financial Corporation’s analyst ratings and consumer feedback to provide a comprehensive sentiment overview.

Stock Grades

The following table presents the latest verified stock grades from recognized financial institutions for Cincinnati Financial Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-06 |

| Piper Sandler | Maintain | Neutral | 2025-12-22 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-11-04 |

| B of A Securities | Maintain | Buy | 2025-10-28 |

| B of A Securities | Maintain | Buy | 2025-10-13 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-06 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-08-05 |

| Roth Capital | Maintain | Buy | 2025-07-29 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-07-09 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-04-09 |

Overall, the consensus leans toward a positive outlook with multiple Outperform and Buy ratings maintained over several months. The consistency suggests steady analyst confidence, though a few Neutral grades indicate measured caution within the analyst community.

Consumer Opinions

Consumer sentiment around Cincinnati Financial Corporation reflects a mix of trust in its financial stability and concerns over customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong claims handling and quick payout process | Customer service can be slow and unresponsive |

| Competitive pricing for insurance products | Website navigation is confusing and outdated |

| Reliable financial performance inspires trust | Limited product options in certain regions |

Overall, consumers appreciate Cincinnati Financial’s dependable claims process and competitive pricing. However, recurring complaints about customer service responsiveness and digital experience pose challenges to customer satisfaction.

Risk Analysis

Below is a table summarizing Cincinnati Financial Corporation’s key risk factors, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score of 1.7 places the company in the distress zone, signaling bankruptcy risk. | Medium | High |

| Profitability | Strong net margin (18.95%) but zero ROE and ROIC indicate weak capital efficiency. | Medium | Medium |

| Liquidity | Current and quick ratios unavailable or unfavorable, raising short-term solvency concerns. | Medium | Medium |

| Valuation | Very unfavorable P/E and P/B scores suggest the stock may be overvalued or poorly priced. | High | Medium |

| Market Volatility | Beta of 0.646 signals below-market volatility but recent price dropped 3.3%, reflecting sensitivity. | Medium | Low |

I consider the Altman Z-Score risk most alarming, given it signals financial distress despite a solid net margin. The unfavorable liquidity metrics compound this risk. Investors must watch for signs of capital strain or restructuring. Recent price weakness underlines caution amid valuation concerns.

Should You Buy Cincinnati Financial Corporation?

Cincinnati Financial Corporation appears to be a profitable company with improving operational efficiency and very strong financial strength, supported by a favorable A- rating. While its leverage profile seems manageable, a declining return on invested capital and Altman Z-score in the distress zone suggest cautious interpretation of its competitive moat and financial stability.

Strength & Efficiency Pillars

Cincinnati Financial Corporation delivers solid operational margins with a gross margin of 50.12%, an EBIT margin of 23.48%, and a net margin of 18.95%. These figures signal efficient cost management and profitability. The company’s Piotroski score of 8 indicates very strong financial health, reflecting robust fundamentals. However, the lack of available ROIC and WACC data prevents a clear assessment of value creation. Despite this, the high interest coverage ratio of 559.62 suggests low financial risk from debt servicing.

Weaknesses and Drawbacks

Cincinnati Financial is currently in the Altman Z-Score distress zone with a score of 1.70, signaling an elevated bankruptcy risk. This financial distress outweighs operational strengths and raises red flags around solvency. The company also faces valuation headwinds, with very unfavorable price-to-earnings and price-to-book ratios, indicating a premium stock price not supported by earnings. Additionally, liquidity ratios such as the current and quick ratios are unfavorable, pointing to potential short-term cash flow constraints.

Our Final Verdict about Cincinnati Financial Corporation

Despite favorable operational margins and a strong Piotroski score, the company’s Altman Z-Score of 1.70 places it in financial distress, making the investment profile highly speculative. This solvency risk overshadows its profitability and necessitates caution. Investors might consider this profile too risky for conservative capital, as the bankruptcy probability remains a significant concern regardless of positive earnings trends.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cincinnati Financial Q4 Earnings Beat Estimates on Underwriting Income – TradingView (Feb 10, 2026)

- Cincinnati Financial (CINF) Reports Robust Q4 2025 Earnings – GuruFocus (Feb 10, 2026)

- Western Wealth Management LLC Buys New Stake in Cincinnati Financial Corporation $CINF – MarketBeat (Feb 10, 2026)

- Cincinnati Financial (CINF) Surpasses Q4 Earnings Estimates – Yahoo Finance (Feb 09, 2026)

- Cincinnati Financial Corp (NASDAQ:CINF) Earned Premium Up 10% – FXDailyReport.Com (Feb 10, 2026)

For more information about Cincinnati Financial Corporation, please visit the official website: cinfin.com