Home > Analyses > Healthcare > Cigna Corporation

Cigna Corporation transforms healthcare delivery by orchestrating complex insurance and health services that touch millions daily. It leads the healthcare plans industry with flagship offerings spanning medical, pharmacy, and behavioral health benefits. Cigna’s Evernorth segment innovates care coordination and intelligence solutions, enhancing value for providers and employers alike. As healthcare evolves rapidly, I ask: does Cigna’s robust market position still justify its premium valuation and growth expectations?

Table of contents

Business Model & Company Overview

Cigna Corporation, founded in 1792 and headquartered in Bloomfield, Connecticut, commands a leading position in the Medical – Healthcare Plans sector. It operates a comprehensive ecosystem spanning insurance, pharmacy, behavioral health, and vision care. Its integrated approach serves diverse clients, from employers and government organizations to individuals, blending traditional insurance with innovative health services.

Cigna’s revenue engine balances its Evernorth segment’s coordinated health services with its broad insurance offerings, including Medicare plans and international coverage. It leverages distribution through brokers, direct sales, and exchanges across the Americas, Europe, and Asia. This diversified model underpins a strong economic moat, positioning Cigna as a pivotal force shaping global healthcare solutions.

Financial Performance & Fundamental Metrics

I will analyze Cigna Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value creation.

Income Statement

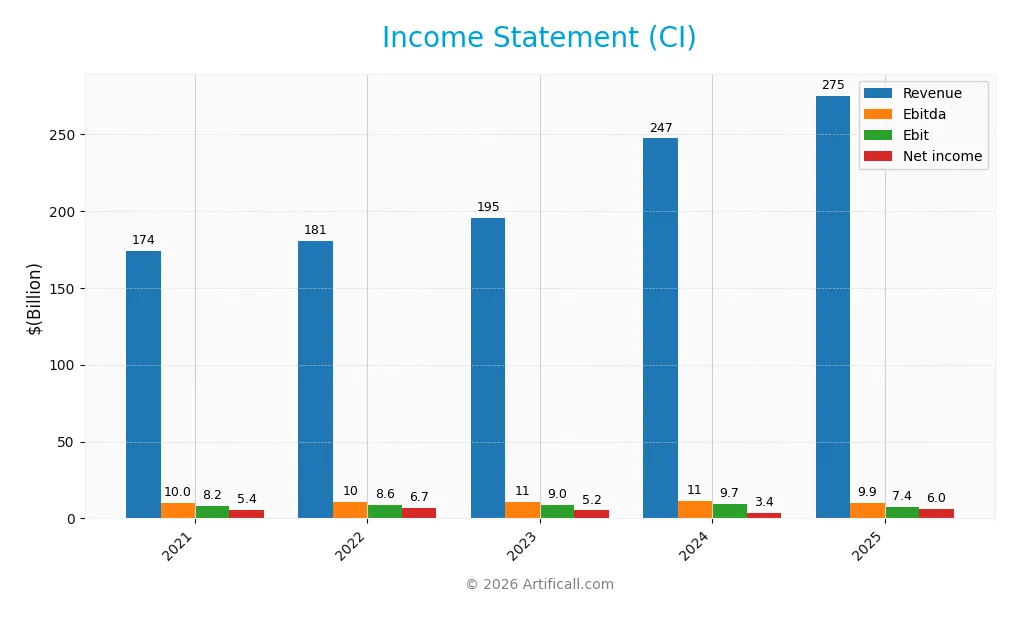

The table below summarizes Cigna Corporation’s key income statement figures for fiscal years 2021 through 2025, reflecting revenue and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 174.1B | 180.5B | 195.3B | 247.1B | 275.0B |

| Cost of Revenue | 151.1B | 157.0B | 170.1B | 221.2B | 182.0B |

| Operating Expenses | 15.0B | 15.1B | 16.6B | 16.5B | 13.5B |

| Gross Profit | 22.9B | 23.5B | 25.2B | 26.0B | 20.4B |

| EBITDA | 10.0B | 10.4B | 10.8B | 11.4B | 9.9B |

| EBIT | 8.2B | 8.6B | 9.0B | 9.7B | 7.4B |

| Interest Expense | 1.2B | 1.2B | 1.4B | 1.4B | 1.0B |

| Net Income | 5.4B | 6.7B | 5.2B | 3.4B | 6.0B |

| EPS | 15.89 | 21.66 | 17.57 | 12.25 | 22.30 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-29 | 2025-02-27 | 2026-02-05 |

Income Statement Evolution

Cigna’s revenue grew 58% from 2021 to 2025, with a 11.3% increase in the latest year. Net income rose 11% over the period, supported by an 83% EPS surge in 2025. However, gross profit and EBIT declined recently, causing margins to weaken somewhat. The net margin showed improvement, reflecting better bottom-line efficiency amid mixed operational trends.

Is the Income Statement Favorable?

In 2025, fundamentals appear generally favorable. Revenue and EPS growth accelerated notably, while interest expense remained low at 0.38% of revenue. Yet, gross profit and EBIT dropped over 20%, signaling some operational challenges. The net margin advanced 56%, indicating effective cost control and tax management. Overall, the income statement balances growth with margin pressures, suggesting cautious optimism.

Financial Ratios

The table below presents key financial ratios for Cigna Corporation over the past five fiscal years, illustrating its profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.1% | 3.7% | 2.6% | 1.4% | 2.2% |

| ROE | 11.4% | 14.9% | 11.2% | 8.4% | 0% |

| ROIC | 5.6% | 6.5% | 7.8% | 6.7% | 0% |

| P/E | 14.5 | 15.5 | 17.2 | 22.5 | 12.3 |

| P/B | 1.65 | 2.31 | 1.92 | 1.89 | 0 |

| Current Ratio | 0.83 | 0.73 | 0.77 | 0.84 | 0 |

| Quick Ratio | 0.74 | 0.61 | 0.65 | 0.73 | 0 |

| D/E | 0.73 | 0.70 | 0.67 | 0.78 | 0 |

| Debt-to-Assets | 22.1% | 21.9% | 20.2% | 20.5% | 0% |

| Interest Coverage | 6.6 | 6.9 | 5.9 | 6.6 | 6.7 |

| Asset Turnover | 1.12 | 1.25 | 1.28 | 1.59 | 0 |

| Fixed Asset Turnover | 105 | 139 | 223 | 298 | 0 |

| Dividend Yield | 1.7% | 1.3% | 1.6% | 2.0% | 2.2% |

Note: Zero values indicate missing data for 2025.

Evolution of Financial Ratios

From 2021 to 2025, Cigna Corporation’s profitability showed mixed trends. Net profit margin declined from 3.1% in 2021 to 2.17% in 2025. Return on equity data is unavailable for 2025, but prior years indicate moderate returns. Liquidity ratios like current ratio remained below 1, signaling consistent tight liquidity. Debt-to-equity ratio trends are unavailable for 2025 but were moderate before.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin and ROE were unfavorable. Liquidity ratios registered as unfavorable, with a current ratio at zero. Leverage ratios such as debt-to-equity and debt-to-assets were favorable, indicating manageable debt levels. Interest coverage and dividend yield ratios were favorable, reflecting solid earnings and shareholder returns. Overall, the ratio profile is slightly unfavorable given the balance of strengths and weaknesses.

Shareholder Return Policy

Cigna Corporation maintains a dividend payout ratio around 27% to 46%, with dividends per share rising from $3.97 in 2021 to $6.04 in 2025. The annual dividend yield stands near 2.2%, supported by consistent free cash flow coverage and moderate share buybacks.

This disciplined distribution policy balances shareholder returns with reinvestment needs. Payouts remain sustainable given current profitability and cash flow metrics, indicating a steady approach to long-term value creation without risking excessive leverage or capital strain.

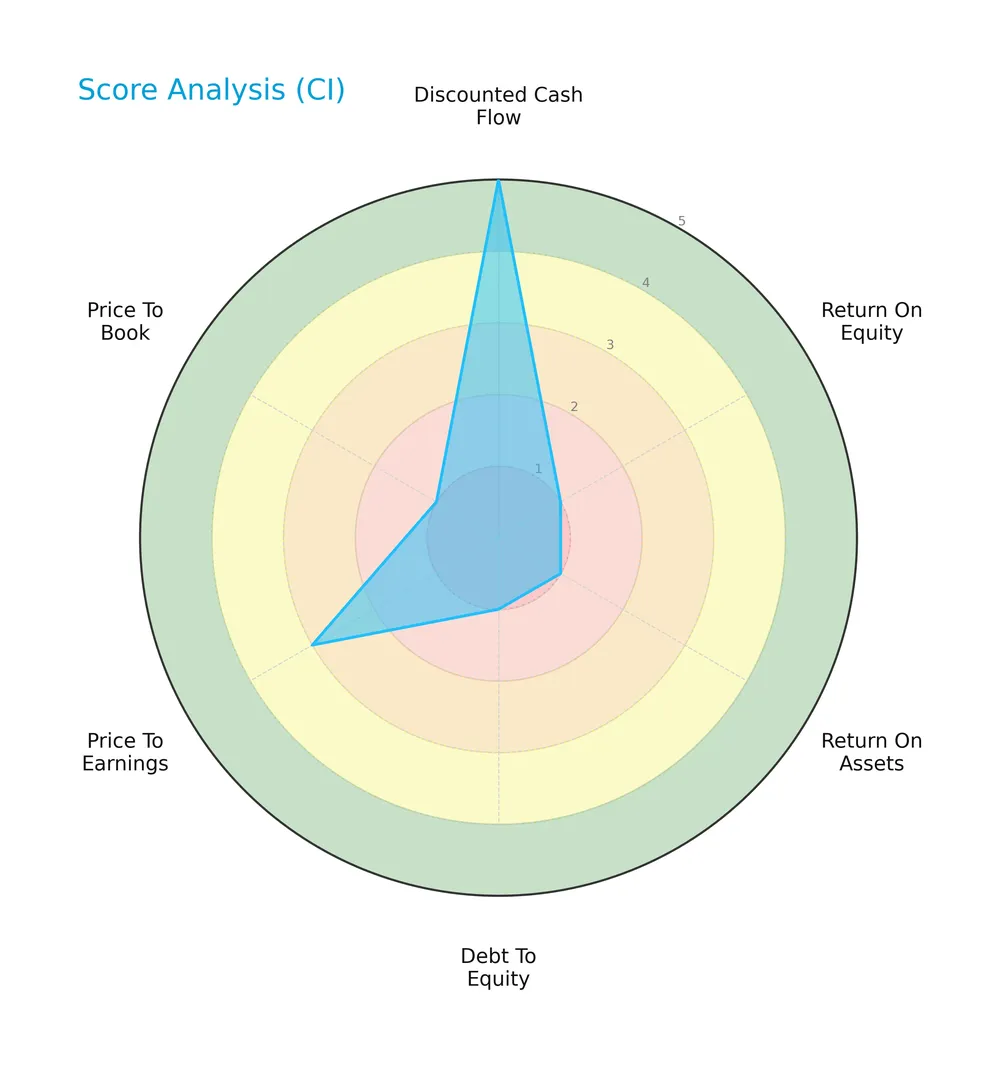

Score analysis

The radar chart below illustrates Cigna Corporation’s valuation and financial performance scores:

Cigna shows a very favorable discounted cash flow score of 5, signaling strong intrinsic value. However, its return on equity, return on assets, debt-to-equity, and price-to-book scores are very unfavorable at 1 each. The price-to-earnings score is moderate at 3, reflecting mixed market valuation signals.

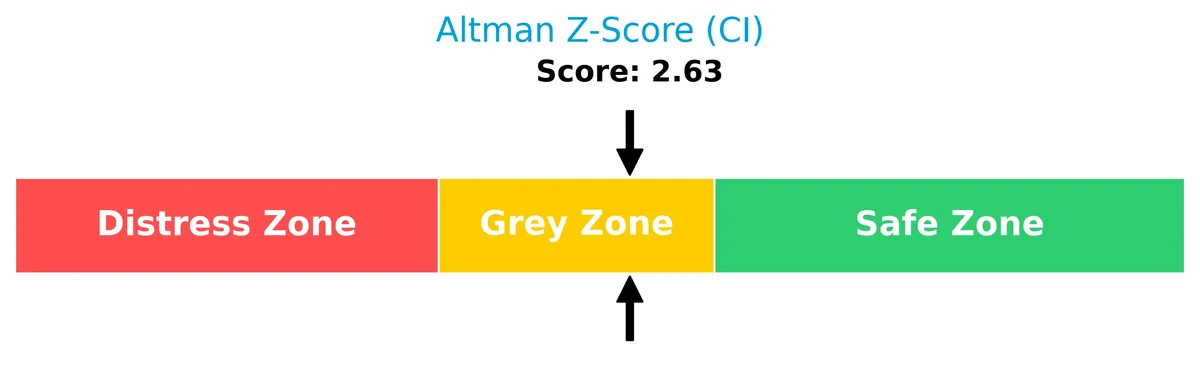

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Cigna in the grey zone, indicating a moderate risk of bankruptcy:

Is the company in good financial health?

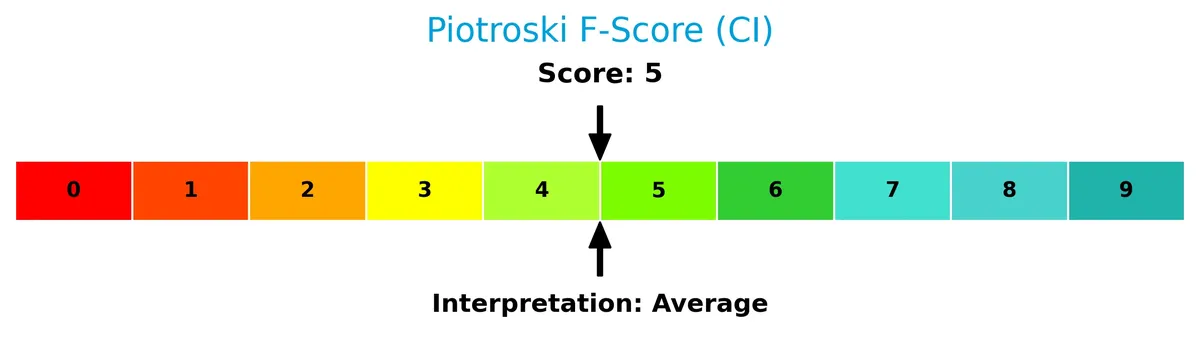

The Piotroski F-Score diagram summarizes Cigna’s financial health status:

With a Piotroski score of 5, Cigna demonstrates average financial strength, reflecting a balanced mix of positive and negative financial signals.

Competitive Landscape & Sector Positioning

This analysis will explore the company’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company holds a competitive advantage compared to its peers.

Strategic Positioning

Cigna concentrates heavily on the U.S. market, generating over $241B in 2024 from healthcare and health services. Its product portfolio focuses on insurance and coordinated health services, primarily through two segments: Evernorth and Cigna Healthcare, reflecting limited geographic diversification but broad service coverage.

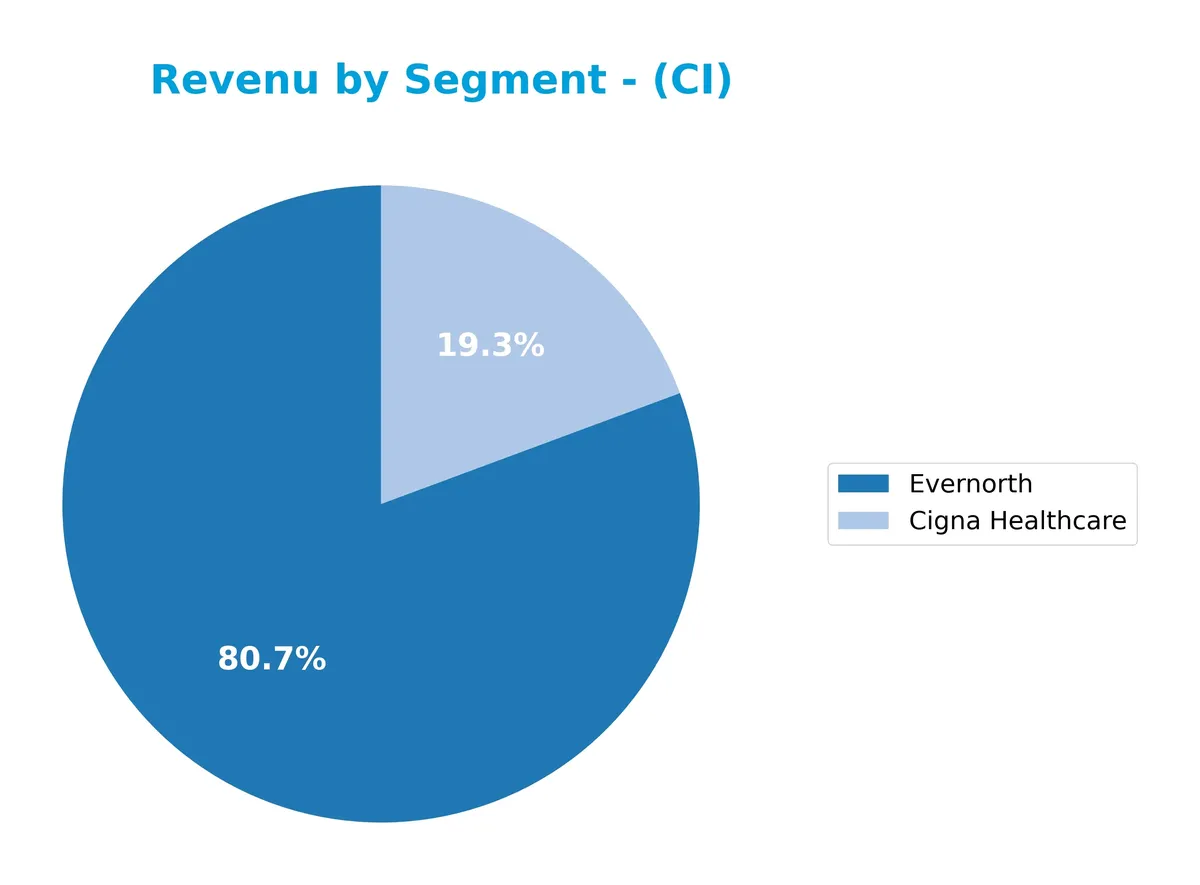

Revenue by Segment

This pie chart presents Cigna Corporation’s revenue distribution across its segments for the fiscal year 2024, illustrating the company’s core business drivers and revenue concentration.

In 2024, Evernorth dominates Cigna’s revenue with $198B, showing robust growth from $148B in 2023. Cigna Healthcare follows with $47.5B, marking steady expansion. The shift toward Evernorth underscores a strategic focus on health services, intensifying revenue concentration risk but also reflecting a strong moat in integrated healthcare solutions. This evolution demands close monitoring as it affects Cigna’s capital allocation priorities.

Key Products & Brands

The following table outlines Cigna Corporation’s principal products and brand segments with brief descriptions:

| Product | Description |

|---|---|

| Evernorth | Provides coordinated health services including pharmacy, benefits management, care delivery, and intelligence solutions. |

| Cigna Healthcare | Offers medical, pharmacy, behavioral health, dental, vision, and health advocacy programs for various customer segments. |

| Medicare Plans | Includes Medicare Advantage, Supplement, and Part D plans tailored for seniors and individual coverage. |

| International Markets | Delivers health care coverage to mobile individuals and multinational employees outside the US. |

| Permanent Insurance Contracts | Provides life insurance products to corporations for employee benefit obligations financing. |

Cigna’s portfolio centers on two dominant segments: Evernorth and Cigna Healthcare, which together generated over $240B revenue in 2024. Their diverse offerings span health services and insurance products, targeting individuals, employers, and international clients.

Main Competitors

There are 7 competitors in total, with this table listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| UnitedHealth Group Incorporated | 305B |

| CVS Health Corporation | 102B |

| Elevance Health Inc. | 79B |

| Cigna Corporation | 75B |

| Humana Inc. | 32B |

| Centene Corporation | 21B |

| Molina Healthcare, Inc. | 9.7B |

Cigna Corporation ranks 4th among 7 healthcare plan competitors. Its market cap is 24.7% of the leader, UnitedHealth Group. Cigna stands below the average market cap of the top 10 ($88.8B) but above the sector median ($74.6B). It maintains a 4.76% gap from its nearest larger competitor, Elevance Health.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Cigna have a competitive advantage?

Cigna shows mixed signs regarding competitive advantage, with stable revenue growth but a declining return on invested capital (ROIC) trend. Its insurance and health services business benefits from scale and diversified offerings across the U.S. and international markets.

Looking ahead, Cigna’s future opportunities include expanding Medicare Advantage and international health coverage. Its Evernorth segment’s integrated health services may drive growth by addressing evolving healthcare needs and cost management challenges.

SWOT Analysis

This SWOT analysis highlights Cigna Corporation’s strategic position by identifying internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- strong market presence in US healthcare plans

- diversified service offerings including pharmacy and behavioral health

- stable dividend yield of 2.19%

Weaknesses

- declining ROIC trend signals weakening capital efficiency

- below-average net margin at 2.17%

- unfavorable liquidity ratios, raising short-term risk concerns

Opportunities

- expanding Medicare Advantage and international markets

- growing demand for integrated health solutions

- potential to leverage data analytics for cost management

Threats

- regulatory changes in healthcare policies

- rising competition in insurance and health services

- economic downturn impacting employer-sponsored plans

Cigna’s strengths in diversified healthcare services and market position support growth. However, declining capital returns and liquidity weaknesses require strategic focus on operational efficiency and risk management. Opportunities in Medicare and international expansion remain key drivers, yet regulatory and competitive pressures loom as significant risks.

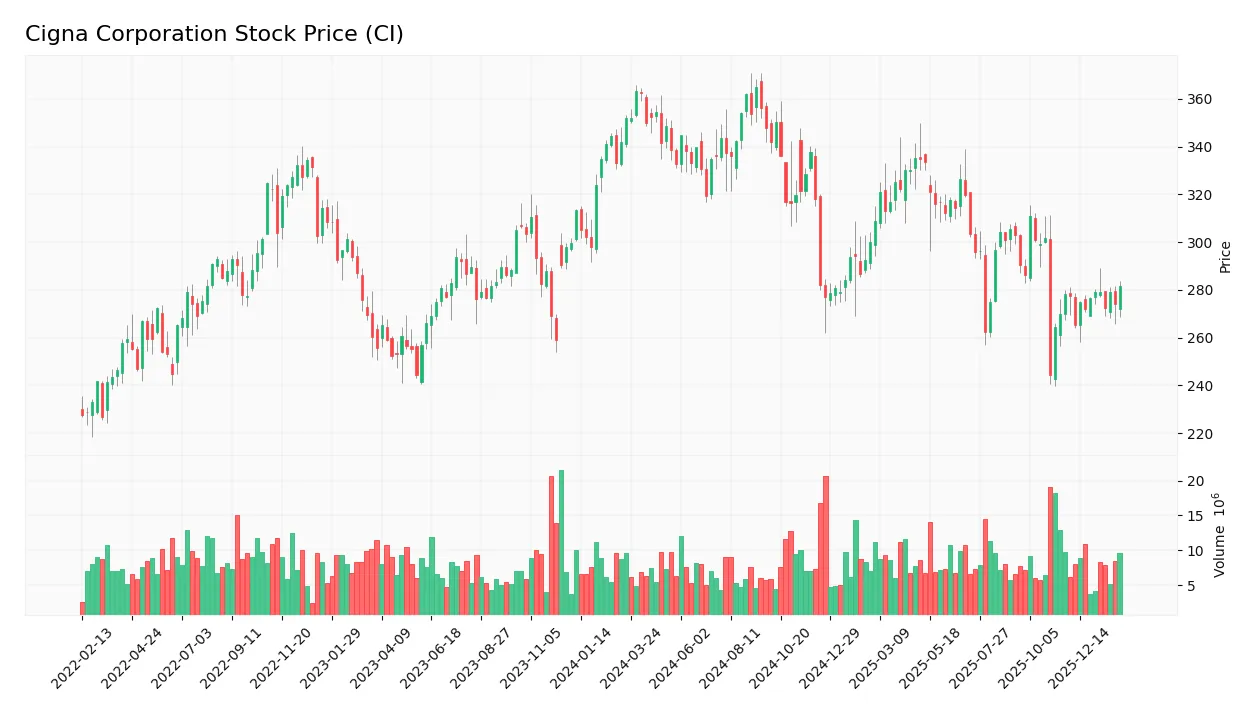

Stock Price Action Analysis

The weekly stock chart for Cigna Corporation (CI) over the past 12 months reveals key price movements and volatility patterns:

Trend Analysis

Over the past 12 months, CI’s stock price declined by 19.97%, indicating a bearish trend with accelerating downward momentum. The price fluctuated widely, with a high of 364.72 and a low of 244.41, reflecting significant volatility (28.61 std deviation).

Volume Analysis

In the last three months, trading volume has increased but remains slightly seller-driven, with buyers accounting for 45.36%. This suggests cautious investor sentiment, with sellers maintaining modest dominance amid rising market participation.

Target Prices

Analysts set a firm consensus target price for Cigna Corporation, reflecting solid confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 294 | 415 | 329.54 |

The target range from 294 to 415 indicates bullish sentiment, with a consensus near 330 suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst grades and consumer feedback to offer a balanced view of Cigna Corporation’s standing.

Stock Grades

Here are the latest stock grades for Cigna Corporation from established financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Buy | 2026-02-02 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Truist Securities | Maintain | Buy | 2026-01-05 |

| Bernstein | Maintain | Market Perform | 2025-11-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Goldman Sachs | Maintain | Buy | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-11-04 |

| Barclays | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-09-04 |

The consensus among these firms remains firmly positive, with a majority rating Cigna as Buy or Overweight. No downgrades or sell recommendations are present, indicating stable analyst confidence.

Consumer Opinions

Consumer sentiment around Cigna Corporation reflects a mix of appreciation for its service and concerns about costs.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cigna’s customer service is responsive and helpful.” | “Premiums have increased significantly over time.” |

| “Claims are processed quickly, reducing stress.” | “Limited coverage options in some regions.” |

| “Access to a wide network of providers is excellent.” | “Out-of-pocket expenses can be unexpectedly high.” |

Overall, consumers praise Cigna’s efficient claims handling and broad provider network. However, rising premiums and coverage gaps remain common complaints, signaling areas for management to address.

Risk Analysis

Below is a summary table of key risks facing Cigna Corporation in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability | Low net margin (2.17%) signals weak earnings relative to peers | High | High |

| Financial Health | Altman Z-score (2.63) in grey zone indicates moderate distress | Medium | High |

| Liquidity | Zero current and quick ratios highlight potential cash flow issues | Medium | Medium |

| Leverage | Favorable debt ratios but poor debt-to-equity score raise concerns | Low | Medium |

| Market Volatility | Low beta (0.28) suggests limited stock price sensitivity | Low | Low |

Cigna’s most pressing risks lie in its thin profitability and moderate financial distress signs. The grey zone Altman Z-score warns of vulnerability to economic downturns. Despite strong debt coverage, liquidity metrics are red flags. Investors must watch earnings trends closely.

Should You Buy Cigna Corporation?

Cigna Corporation appears to be in a grey zone with moderate profitability and declining operational efficiency. While its leverage profile suggests significant debt pressure, the overall rating of C+ indicates cautious value creation potential amid mixed financial health signals.

Strength & Efficiency Pillars

Cigna Corporation demonstrates moderate financial resilience, evidenced by an Altman Z-Score of 2.63, placing it in the grey zone with moderate bankruptcy risk. The Piotroski score of 5 signals average financial health. Its interest coverage ratio stands strong at 7.06, reflecting solid ability to service debt. Favorable metrics include a price-to-earnings ratio of 12.28 and a dividend yield of 2.19%, supporting income appeal. However, profitability indicators like ROE and ROIC remain at zero, limiting its value creation credentials.

Weaknesses and Drawbacks

The company faces notable challenges. Its net margin of 2.17% is unfavorable, suggesting tight profitability. Liquidity ratios such as current and quick ratios register zero, highlighting potential short-term solvency concerns. Despite a favorable debt-to-equity score, overall leverage appears structurally weak. Market pressure is palpable with a near 20% price decline over the longer term and seller dominance at 54.64% in recent weeks, signaling bearish investor sentiment and short-term headwinds.

Our Verdict about Cigna Corporation

Cigna’s long-term fundamental profile may appear moderate due to mixed financial health signals and suboptimal profitability. Despite recent slight seller dominance, the underlying trend shows a modest price uptick, indicating cautious optimism. This suggests a wait-and-see approach could be prudent, as the company’s fundamentals and technicals do not robustly support immediate long-term exposure but may offer opportunities if operational improvements materialize.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cigna (CI) Reports Q4 Earnings: What Key Metrics Have to Say – Yahoo Finance (Feb 05, 2026)

- Make Your Portfolio Healthy Again: The Cigna Group (NYSE:CI) – Seeking Alpha (Feb 05, 2026)

- Earnings call transcript: Cigna beats Q4 2025 earnings expectations, stock rises – Investing.com (Feb 05, 2026)

- The Cigna Group Reports Strong Fourth Quarter and Full Year 2025 Results, Establishes 2026 Outlook and Increases Dividend – PR Newswire (Feb 05, 2026)

- Cigna Group (NYSE:CI) Beats Q4 Earnings but 2026 Outlook Tempers Market Enthusiasm – Chartmill (Feb 05, 2026)

For more information about Cigna Corporation, please visit the official website: cigna.com