Home > Analyses > Consumer Defensive > Church & Dwight Co., Inc.

Church & Dwight transforms everyday routines with trusted household and personal care essentials. Its iconic ARM & HAMMER baking soda and TROJAN products have become staples across millions of homes. Known for steady innovation and quality, it commands a strong presence in the consumer defensive sector. As market dynamics evolve, I question whether Church & Dwight’s solid fundamentals still support its current valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Church & Dwight Co., Inc., founded in 1846 and headquartered in Ewing, New Jersey, commands a dominant position in the Household & Personal Products industry. Its diverse portfolio forms a cohesive ecosystem ranging from ARM & HAMMER baking soda to TROJAN condoms and OXICLEAN cleaners. This breadth underpins a core mission: deliver trusted, everyday essentials that span personal care, cleaning, and specialty products worldwide.

The company’s revenue engine balances consumer staples with specialty offerings, generating steady cash flow from mass retail channels and industrial distributors across the Americas, Europe, and Asia. Its focus on recurring household purchases ensures resilience in varied economic cycles. Church & Dwight’s enduring competitive advantage lies in its strong brands and extensive distribution, creating an economic moat that shapes industry standards and consumer loyalty.

Financial Performance & Fundamental Metrics

I analyze Church & Dwight Co., Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

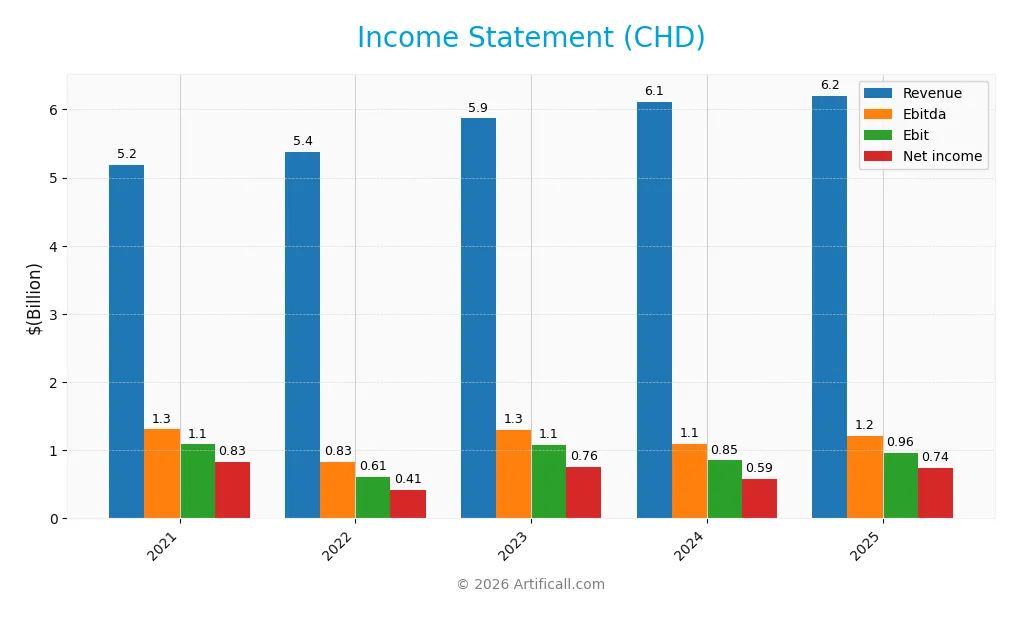

Below is Church & Dwight Co., Inc.’s income statement summary for fiscal years 2021 through 2025, reflecting revenue, costs, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.19B | 5.38B | 5.87B | 6.11B | 6.20B |

| Cost of Revenue | 2.93B | 3.13B | 3.28B | 3.32B | 3.43B |

| Operating Expenses | 1.18B | 1.65B | 1.53B | 1.98B | 1.70B |

| Gross Profit | 2.26B | 2.25B | 2.59B | 2.79B | 2.77B |

| EBITDA | 1.31B | 831.9M | 1.30B | 1.09B | 1.20B |

| EBIT | 1.09B | 613.0M | 1.08B | 851.3M | 957.0M |

| Interest Expense | 54.5M | 89.6M | 110.9M | 95.0M | 0 |

| Net Income | 827.5M | 413.9M | 755.6M | 585.3M | 736.8M |

| EPS | 3.38 | 1.70 | 3.09 | 2.39 | 3.04 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-13 | 2026-02-12 |

Income Statement Evolution

Church & Dwight’s revenue grew 19.5% from 2021 to 2025, but growth slowed to 1.6% last year. Gross profit dipped slightly by 0.6% in 2025, compressing margins. Despite this, EBIT expanded 12.4%, improving operating efficiency. Net income declined almost 11% over five years but rose 24% last year, lifting net margins and EPS growth notably.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable. The company maintained a strong 44.7% gross margin and improved EBIT margin to 15.4%. Interest expense was negligible, supporting profitability. Net margin increased to 11.9%, reflecting operational leverage. However, revenue growth deceleration and past net income contraction represent risks. Overall, the income statement shows solid operational resilience and margin expansion.

Financial Ratios

The table below presents key financial ratios for Church & Dwight Co., Inc. over the last five fiscal years, highlighting profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 16% | 8% | 13% | 10% | 12% |

| ROE | 26% | 12% | 20% | 13% | 18% |

| ROIC | 13% | 7% | 11% | 8% | 11% |

| P/E | 30.3 | 47.3 | 30.6 | 44.2 | 27.6 |

| P/B | 7.8 | 5.6 | 6.0 | 5.9 | 5.1 |

| Current Ratio | 0.59 | 1.18 | 1.08 | 1.70 | 1.07 |

| Quick Ratio | 0.34 | 0.63 | 0.64 | 1.24 | 0.71 |

| D/E | 0.85 | 0.82 | 0.68 | 0.55 | 0.55 |

| Debt-to-Assets | 34% | 34% | 30% | 27% | 25% |

| Interest Coverage | 20.0 | 6.7 | 9.5 | 8.5 | 0 |

| Asset Turnover | 0.65 | 0.64 | 0.68 | 0.69 | 0.70 |

| Fixed Asset Turnover | 7.95 | 7.06 | 6.33 | 6.55 | 7.54 |

| Dividend Yield | 0.99% | 1.30% | 1.15% | 1.07% | 1.41% |

Note: Interest coverage for 2025 is reported as zero, indicating a possible data gap or an anomaly requiring further investigation.

Evolution of Financial Ratios

Return on Equity (ROE) rose steadily from 11.86% in 2022 to 18.41% in 2025, reflecting improved profitability. The Current Ratio fluctuated, peaking at 1.70 in 2024 before settling near 1.07 in 2025, indicating relative stability in liquidity. Debt-to-Equity Ratio declined from 0.85 in 2021 to 0.55 in 2025, signaling reduced leverage over time.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios like ROE (18.41%) and net margin (11.88%) are favorable, supported by a strong return on invested capital (11.19%) well above the WACC (5.63%). Liquidity is mixed: the Current Ratio is neutral at 1.07, but the Quick Ratio is unfavorable at 0.71. Leverage appears moderate with a debt-to-equity ratio of 0.55. Valuation multiples such as P/E (27.62) and P/B (5.08) are unfavorable. Overall, the ratios are slightly favorable, balancing strengths in profitability and leverage with some valuation and liquidity concerns.

Shareholder Return Policy

Church & Dwight Co., Inc. maintains a dividend payout ratio near 39%, with a steady dividend per share growth reaching $1.18 in 2025 and a yield around 1.41%. The dividend is well covered by free cash flow, supported by consistent buyback programs.

This balanced approach reflects prudent capital allocation, avoiding excessive repurchases or distributions. It supports sustainable long-term shareholder value by aligning dividend payments with cash generation and maintaining financial flexibility.

Score analysis

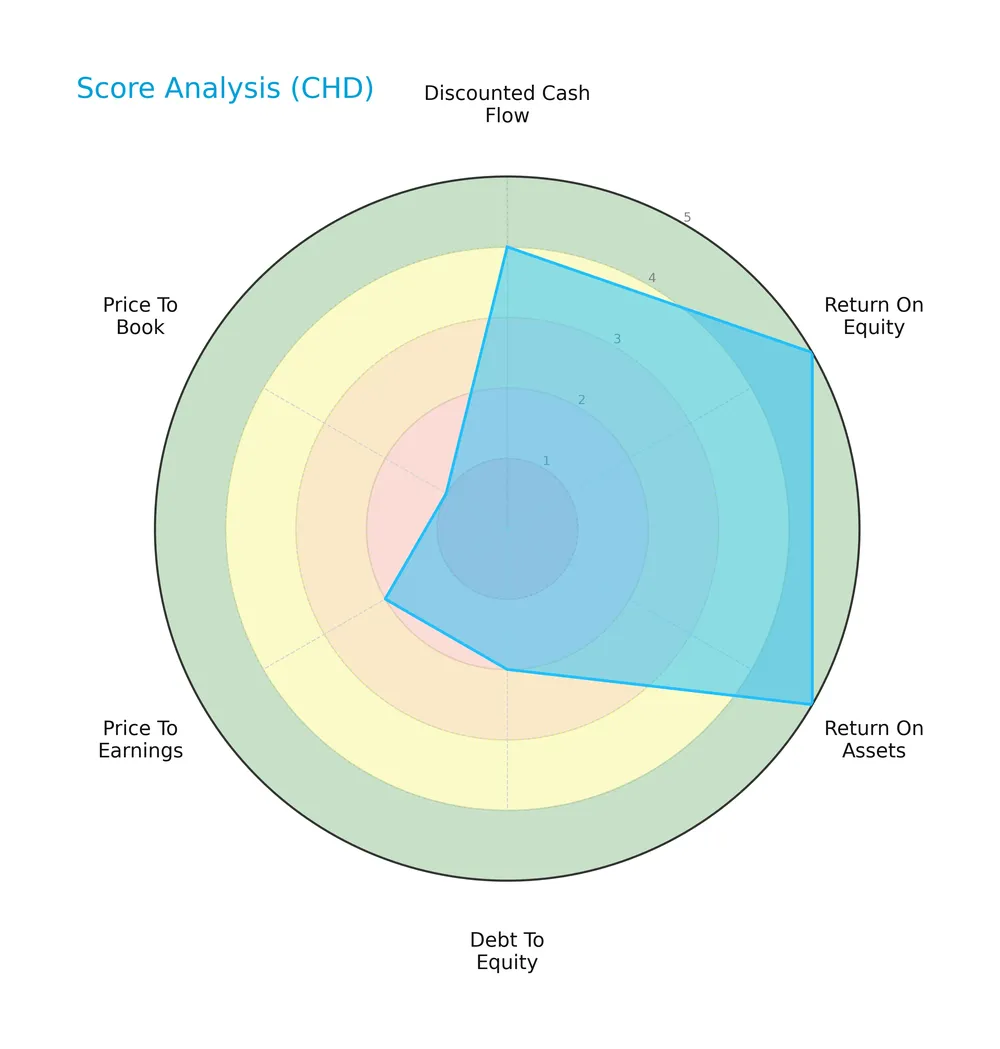

The following radar chart illustrates key financial performance metrics for Church & Dwight Co., Inc.:

Church & Dwight scores very favorably on return on equity and assets, reflecting operational strength. Discounted cash flow is favorable, but leverage and valuation metrics—debt/equity, PE, and PB ratios—are less attractive, indicating potential risks.

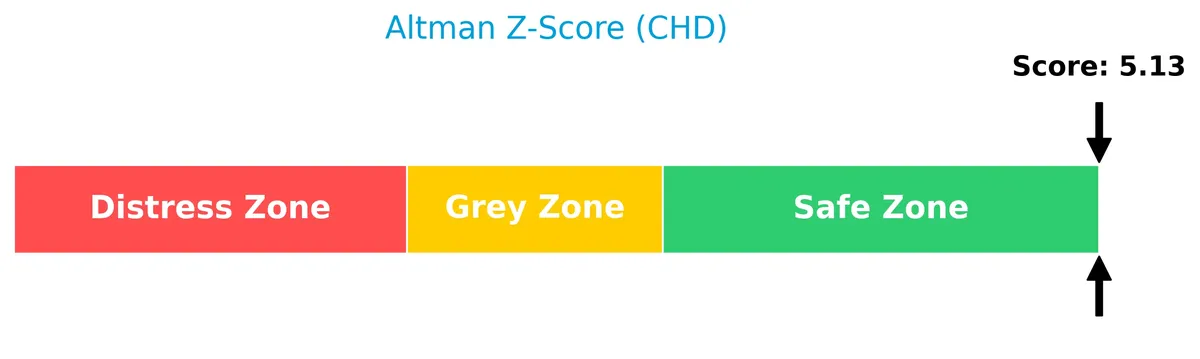

Analysis of the company’s bankruptcy risk

Church & Dwight’s Altman Z-Score places it firmly in the safe zone, signaling a very low risk of bankruptcy:

Is the company in good financial health?

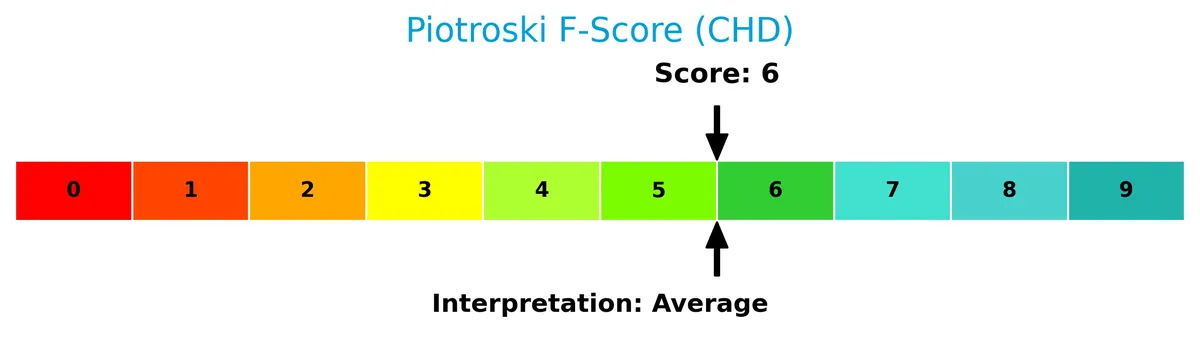

The Piotroski Score diagram provides insight into the company’s financial health status:

With a Piotroski Score of 6, Church & Dwight shows average financial health, reflecting moderate strength but room for improvement in profitability and efficiency metrics.

Competitive Landscape & Sector Positioning

This analysis reviews Church & Dwight Co., Inc.’s strategic positioning, revenue segments, and key products within its sector. I will assess whether the company holds a competitive advantage over its main competitors.

Strategic Positioning

Church & Dwight Co., Inc. maintains a diversified product portfolio across household, personal care, and specialty products. Its geographic exposure spans strong domestic sales of $4.77B and international revenues of $1.13B in 2025, reflecting a balanced global footprint.

Revenue by Segment

This pie chart illustrates Church & Dwight Co., Inc.’s Specialty Products Division revenue from 2012 through 2025, highlighting its contribution to total segment sales over these years.

The Specialty Products Division shows steady revenue with minor fluctuations, ranging from $249M in 2013 to a peak near $349M in 2022. After reaching this high, revenue retreated slightly to $299M in 2025. This segment remains the sole driver of reported revenue here, indicating concentration risk. The recent slowdown suggests potential headwinds or market saturation, warranting close monitoring for sustained growth.

Key Products & Brands

Church & Dwight’s portfolio includes leading household, personal care, and specialty brands across diverse categories:

| Product | Description |

|---|---|

| ARM & HAMMER | Baking soda and baking soda-based products, including cat litters, carpet deodorizers, and laundry detergents. |

| TROJAN | Condoms, lubricants, and vibrators. |

| OXICLEAN | Stain removers, cleaning solutions, laundry detergents, and bleach alternatives. |

| SPINBRUSH | Battery-operated and manual toothbrushes. |

| FIRST RESPONSE | Home pregnancy and ovulation test kits. |

| NAIR | Depilatories. |

| ORAJEL | Oral analgesics. |

| XTRA | Laundry detergents. |

| L’IL CRITTERS & VITAFUSION | Gummy dietary supplements. |

| BATISTE | Dry shampoos. |

| WATERPIK | Water flossers and replacement showerheads. |

| FLAWLESS | Personal care products. |

| ZICAM | Cold shortening and relief products. |

| THERABREATH | Oral care products. |

| Specialty Products Division | Animal productivity supplements like MEGALAC, BIO-CHLOR, FERMENTEN, and CELMANAX. |

Church & Dwight’s brands span essential household and personal care needs, supported by a specialty segment focused on agricultural supplements. This diversified brand mix provides resilience across consumer and industrial channels.

Main Competitors

Church & Dwight Co., Inc. competes with 17 companies in the sector; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331B |

| Unilever PLC | 143B |

| Colgate-Palmolive Company | 62.6B |

| The Estée Lauder Companies Inc. | 38.5B |

| Kimberly-Clark Corporation | 33.7B |

| Kenvue Inc. | 33.2B |

| Church & Dwight Co., Inc. | 20.2B |

| The Clorox Company | 12.3B |

| e.l.f. Beauty, Inc. | 4.3B |

| Inter Parfums, Inc. | 2.7B |

Church & Dwight ranks 7th among 17 competitors. Its market cap is 7.35% of the leader, Procter & Gamble. The company sits below the average top 10 market cap of 68.2B but above the sector median of 4.3B. It enjoys a 36.3% premium over its closest larger rival, Kenvue, highlighting a solid competitive gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CHD have a competitive advantage?

Church & Dwight Co., Inc. demonstrates a slight competitive advantage, creating value with a ROIC exceeding WACC by 5.56%. However, its profitability shows a declining trend, signaling potential margin pressure ahead.

The company’s diverse product portfolio under established brands like ARM & HAMMER and OXICLEAN supports steady domestic and international revenue growth. Opportunities lie in expanding specialty products and leveraging new consumer markets to sustain its market presence.

SWOT Analysis

This SWOT analysis highlights Church & Dwight’s internal capabilities and external market conditions to guide strategic decisions.

Strengths

- strong brand portfolio including ARM & HAMMER

- consistent profitability with 11.9% net margin

- low financial leverage with 0.55 debt/equity

Weaknesses

- declining ROIC trend signals weakening efficiency

- high valuation multiples (PE 27.6, PB 5.1)

- weak liquidity with quick ratio at 0.71

Opportunities

- growing international consumer segment

- expanding e-commerce sales channels

- innovation in specialty and health products

Threats

- intense competition in household products

- raw material cost volatility

- regulatory risks in consumer safety and labeling

Church & Dwight’s solid brand strength and profitability underpin its value creation. However, declining operational efficiency and stretched valuations require caution. Growth through international expansion and innovation offers upside against competitive and cost pressures.

Stock Price Action Analysis

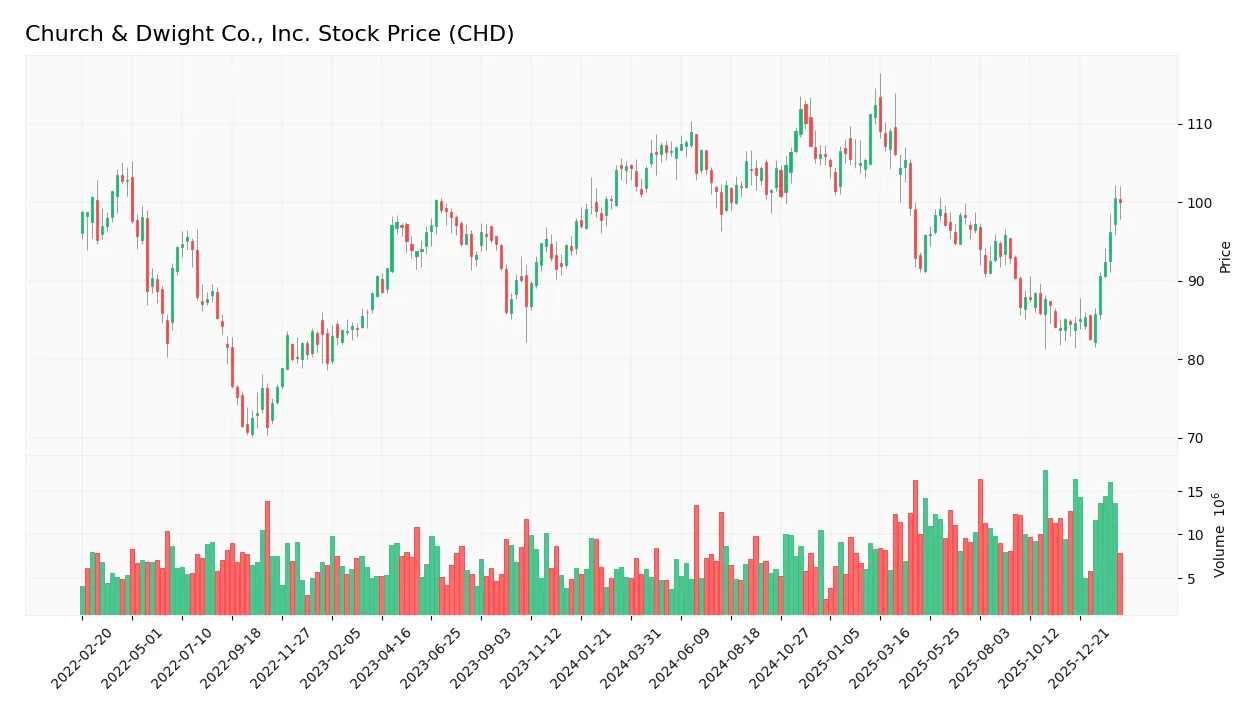

The weekly stock chart of Church & Dwight Co., Inc. (CHD) reveals recent price movements and key support and resistance levels:

Trend Analysis

Over the past 12 months, CHD’s stock price declined by 4.4%, indicating a bearish trend with accelerating downward momentum. The price ranged from a high of 112.33 to a low of 82.64. Volatility is elevated, with a standard deviation of 7.81, reflecting notable price swings during this period.

Volume Analysis

Trading volume over the last three months shows a strongly buyer-dominant pattern, with 81.24% of volume attributed to buyers. Volume is increasing, signaling heightened market participation and positive investor sentiment in the recent period ending February 2026.

Target Prices

Analysts set a firm target consensus for Church & Dwight Co., Inc., reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 82 | 105 | 98.67 |

The target range spans from $82 to $105, with a consensus near $99. This suggests moderate upside potential balanced by sector headwinds.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst grades and consumer feedback related to Church & Dwight Co., Inc. (CHD).

Stock Grades

Here are the latest verified stock grades for Church & Dwight Co., Inc., from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-02 |

| Jefferies | Maintain | Buy | 2026-02-02 |

| JP Morgan | Upgrade | Neutral | 2026-02-02 |

| Citigroup | Maintain | Neutral | 2026-02-02 |

| Morgan Stanley | Maintain | Equal Weight | 2026-02-02 |

| Evercore ISI Group | Maintain | In Line | 2026-02-02 |

| Jefferies | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Neutral | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

The consensus among major analysts remains cautiously positive, with most maintaining Buy or Overweight ratings. JP Morgan’s upgrade to Neutral signals some moderation, reflecting a balanced risk outlook.

Consumer Opinions

Church & Dwight Co., Inc. enjoys a generally favorable reputation among consumers, reflecting its strong brand presence in household essentials.

| Positive Reviews | Negative Reviews |

|---|---|

| “Products are reliable and effective.” | “Some items feel overpriced lately.” |

| “Great variety and easy to find.” | “Packaging could be more sustainable.” |

| “Consistent quality across brands.” | “Customer service response times vary.” |

Overall, consumers praise Church & Dwight for consistent product quality and brand variety. However, pricing concerns and sustainability issues appear as recurring drawbacks.

Risk Analysis

The table below summarizes key risks Church & Dwight faces, including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (27.6) and P/B (5.08) ratios suggest premium pricing that may limit upside. | Medium | High |

| Liquidity Risk | Low quick ratio (0.71) indicates potential short-term liquidity strain. | Medium | Medium |

| Debt Risk | Moderate debt-to-equity (0.55) with favorable debt-to-assets (24.7%) and strong interest coverage reduces default risk. | Low | Medium |

| Market Risk | Low beta (0.47) shows less sensitivity to market swings but may limit gains in bull markets. | Low | Medium |

| Competitive Risk | Intense competition in household products could pressure margins despite strong brand moats. | Medium | Medium |

The most pressing risk is valuation. Church & Dwight trades at a premium compared to industry benchmarks, which increases downside if growth slows. Additionally, the weak quick ratio is a red flag for near-term liquidity, though manageable given solid interest coverage. Overall, risks remain balanced but require monitoring amid market volatility and consumer trends.

Should You Buy Church & Dwight Co., Inc.?

Church & Dwight appears to be a durable value creator with a slightly favorable moat, evidenced by positive but declining ROIC trends. Despite manageable leverage, its rating of B+ suggests moderate operational efficiency, balanced by some valuation and debt concerns.

Strength & Efficiency Pillars

Church & Dwight Co., Inc. demonstrates solid profitability with a net margin of 11.88% and a return on equity of 18.41%. Its return on invested capital (ROIC) stands at 11.19%, comfortably above the weighted average cost of capital (WACC) at 5.63%, confirming the company as a value creator. Operational efficiency is further supported by a favorable gross margin of 44.73% and an EBIT margin of 15.43%. These metrics reflect disciplined capital allocation and a sustainable competitive moat despite a slight decline in ROIC over time.

Weaknesses and Drawbacks

The company faces valuation headwinds, with a price-to-earnings (P/E) ratio of 27.62 and a price-to-book (P/B) ratio at an elevated 5.08, indicating a premium market valuation that may limit upside. Additionally, the quick ratio of 0.71 signals potential liquidity constraints, raising concerns about short-term solvency. While debt-to-equity at 0.55 remains neutral, these factors warrant caution amid a bearish overall stock trend and moderate market volatility, despite recent strong buyer dominance of 81.24%.

Our Final Verdict about Church & Dwight Co., Inc.

Church & Dwight may appear attractive for long-term exposure given its value creation and strong operational margins. However, the premium valuation and modest liquidity metrics suggest risks that require careful monitoring. Despite a bearish trend over the past year, robust recent buying activity could hint at a potential recovery. Investors might consider a cautious stance, waiting for clearer confirmation before committing significant capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Pope Leo XIV: ‘The Church is the rightful home of Sacred Scripture’ – EWTN News (Feb 11, 2026)

- Colorado Springs City Council gives Church of Jesus Christ of Latter-day Saints temple a unanimous thumbs up – Colorado Public Radio (Feb 12, 2026)

- Church of England abandons proposals for same-sex blessing ceremonies – BBC (Feb 12, 2026)

- Don Lemon Hires Federal Prosecutor Joseph H. Thompson in Minneapolis Church Protest Case – The New York Times (Feb 11, 2026)

- Former federal prosecutor Joe Thompson joins Don Lemon’s defense team in church protest case – Star Tribune (Feb 11, 2026)

For more information about Church & Dwight Co., Inc., please visit the official website: churchdwight.com