Home > Analyses > Financial Services > Chubb Limited

Chubb Limited safeguards businesses and individuals worldwide, shaping how risk is managed in daily life. As a global titan in property and casualty insurance, Chubb’s innovative policies cover everything from cyber threats to high-value homes. Its reputation for underwriting excellence and diverse offerings sets industry standards. But as market dynamics evolve, I question whether Chubb’s strong fundamentals still justify its premium valuation and growth outlook.

Table of contents

Business Model & Company Overview

Chubb Limited, founded in 1985 and headquartered in Zurich, Switzerland, stands as a global leader in Property & Casualty insurance. Its integrated portfolio spans commercial and personal lines, agricultural products, and life insurance, creating a comprehensive risk management ecosystem. With 43K employees, Chubb dominates diverse markets by catering to businesses and affluent individuals worldwide.

The company generates value through a balanced revenue engine combining underwriting premiums from insurance and reinsurance segments. Its broad geographic footprint covers the Americas, Europe, and Asia, leveraging brokers and agents to distribute specialty and traditional policies. Chubb’s economic moat lies in its diversified product suite and global scale, shaping the future of risk protection across industries.

Financial Performance & Fundamental Metrics

I analyze Chubb Limited’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

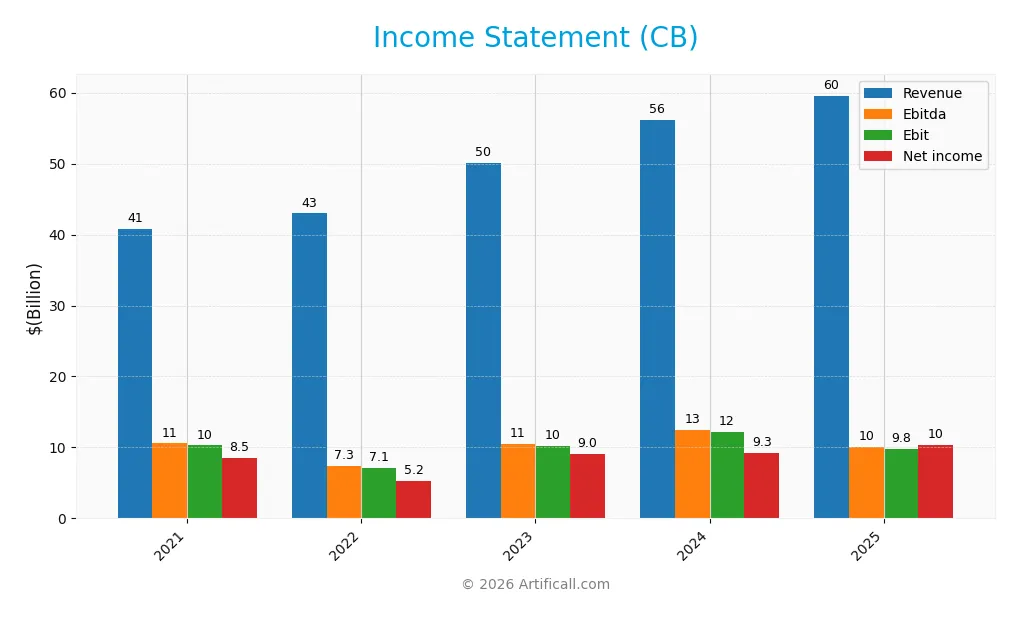

The table below summarizes Chubb Limited’s key income statement items for fiscal years 2021 through 2025, reflecting consistent revenue growth and profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 40.8B | 42.9B | 50.1B | 56.2B | 59.6B |

| Cost of Revenue | 29.4B | 32.1B | 36.3B | 40.0B | 32.0B |

| Operating Expenses | 1.5B | 4.3B | 4.3B | 4.7B | 4.4B |

| Gross Profit | 11.3B | 10.8B | 13.8B | 16.2B | 27.5B |

| EBITDA | 10.6B | 7.3B | 10.5B | 12.5B | 10.1B |

| EBIT | 10.3B | 7.1B | 10.2B | 12.2B | 9.8B |

| Interest Expense | 492M | 570M | 672M | 741M | 764M |

| Net Income | 8.5B | 5.2B | 9.0B | 9.3B | 10.3B |

| EPS | 19.38 | 12.50 | 21.97 | 22.94 | 25.91 |

| Filing Date | 2022-02-24 | 2023-02-24 | 2024-02-23 | 2025-02-27 | 2026-02-03 |

Income Statement Evolution

Chubb Limited’s revenue grew 46.1% from 2021 to 2025, with a moderate 6.1% rise in the last year, indicating steady expansion. Net income increased 20.9% overall, supported by improving net margins despite a 17.3% margin decline over the full period. Gross margins remain strong, reflecting efficient cost control.

Is the Income Statement Favorable?

The 2025 income statement shows favorable fundamentals. Gross margin stands at 46.2%, while net margin holds at 17.3%, signaling solid profitability. Operating expenses grew in line with revenue, sustaining operational leverage. Despite a 19.8% decline in EBIT growth last year, EPS rose 13.4%, underlining effective capital allocation and shareholder value creation.

Financial Ratios

The table below summarizes key financial ratios for Chubb Limited over the fiscal years 2021 to 2025, providing a clear view of the company’s performance and valuation trends:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 21% | 12% | 18% | 17% | 17% |

| ROE | 14.3% | 10.4% | 15.2% | 14.5% | 14.0% |

| ROIC | 8.5% | 11.0% | 6.2% | 12.1% | 71.4%¹ |

| P/E | 10.0 | 17.7 | 10.3 | 12.2 | 12.0 |

| P/B | 1.42 | 1.83 | 1.56 | 1.76 | 1.68 |

| Current Ratio | 0 | 0 | 0 | 0 | 0 |

| Quick Ratio | 0 | 0 | 0 | 0 | 0 |

| D/E | 0.27 | 0.29 | 0.24 | 0.24 | 0 |

| Debt-to-Assets | 8.1% | 7.5% | 6.3% | 6.2% | 0 |

| Interest Coverage | 19.9 | 11.4 | 14.2 | 15.5 | 30.3 |

| Asset Turnover | 0.20 | 0.22 | 0.22 | 0.23 | 0.22 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 | 0 |

| Dividend Yield | 1.65% | 1.48% | 1.50% | 1.27% | 1.22% |

¹ The 2025 ROIC value appears unusually high at 71.4%, likely reflective of a data anomaly or a change in calculation basis.

Evolution of Financial Ratios

From 2021 to 2025, Chubb Limited’s Return on Equity (ROE) showed moderate stability, hovering around 14-15%, with a slight dip to 13.98% in 2025. The Current Ratio remained consistently at zero, indicating potential liquidity concerns. Debt-to-Equity Ratio declined to zero in 2025, reflecting a significant reduction in leverage. Profitability, measured by net margin, improved steadily, reaching 17.3% in 2025.

Are the Financial Ratios Favorable?

In 2025, profitability and capital efficiency were generally favorable, with a high Return on Invested Capital (71.36%) well above the weighted average cost of capital (6.13%). Leverage ratios, including Debt-to-Equity and Debt-to-Assets, were favorable, suggesting low financial risk. However, liquidity ratios were unfavorable due to zero current and quick ratios. Asset turnover was low, signaling efficiency concerns. Overall, the ratio profile is slightly favorable but warrants caution on liquidity.

Shareholder Return Policy

Chubb Limited maintains a consistent dividend payout ratio around 15%, with dividends per share steadily rising from $3.18 in 2021 to $3.82 in 2025. The annual dividend yield hovers near 1.2%, supported by a payout well covered by earnings, reflecting prudent capital allocation without excessive distributions.

The company also engages in share buybacks, complementing dividends in returning capital to shareholders. This balanced approach supports sustainable long-term value creation by combining steady income with capital reinvestment, aligning shareholder returns with the firm’s financial strength and profitability trends.

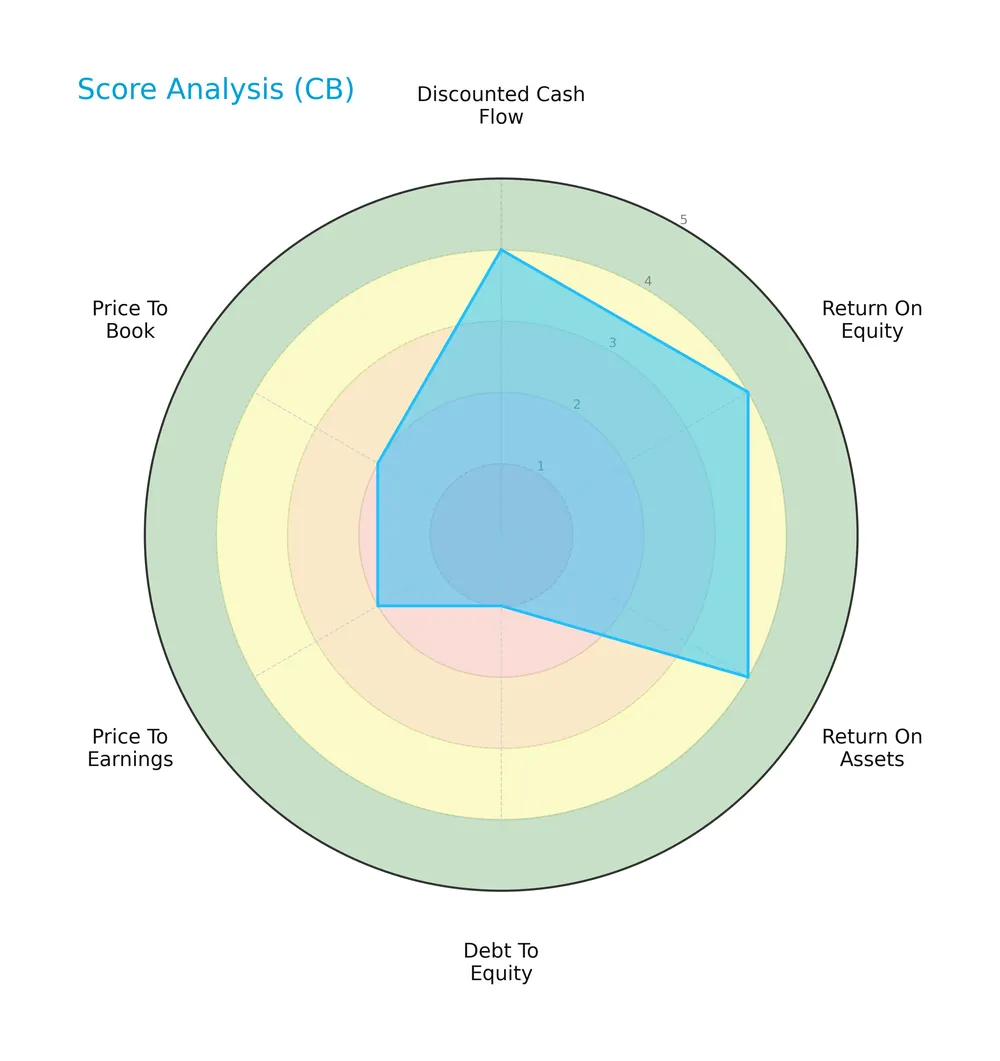

Score analysis

The following radar chart visualizes Chubb Limited’s key financial scores for a comprehensive performance overview:

Chubb scores favorably on discounted cash flow, ROE, and ROA with strong marks of 4 each. However, its debt-to-equity score is very unfavorable at 1, while valuation metrics PE and PB hold moderate scores of 2. Overall, the rating is moderate at 3.

Analysis of the company’s bankruptcy risk

Chubb’s Altman Z-Score places it firmly in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

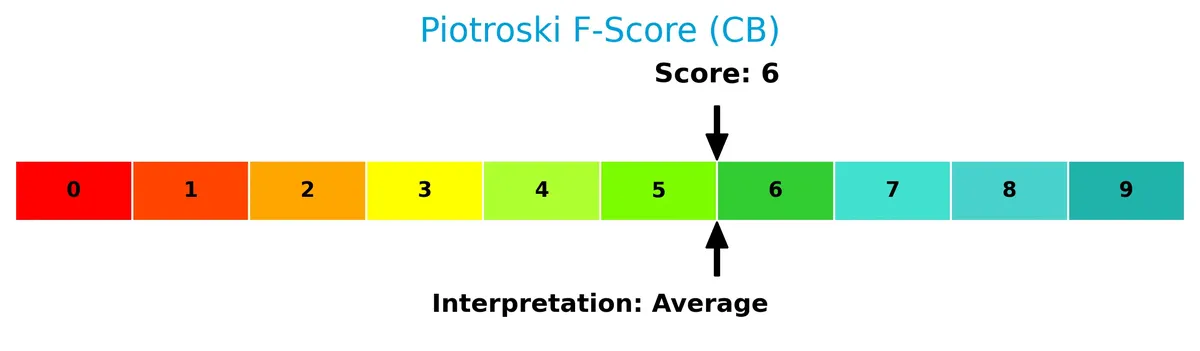

The Piotroski Score diagram illustrates Chubb’s financial strength based on profitability, leverage, liquidity, and efficiency:

With a Piotroski Score of 6, Chubb demonstrates average financial health. This suggests moderate strength but leaves room for improvement compared to stronger peers.

Competitive Landscape & Sector Positioning

This analysis examines Chubb Limited’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Chubb holds a competitive advantage over its peers.

Strategic Positioning

Chubb Limited maintains a diversified product portfolio across Property & Casualty, Life Insurance, and Global Reinsurance segments. Geographically, it focuses heavily on the U.S. market, which accounted for approximately $10B in revenue during the early 2010s, indicating concentrated regional exposure despite broad product offerings.

Revenue by Segment

The pie chart illustrates Chubb Limited’s revenue distribution by segment for fiscal years 2012, 2013, 2014, 2023, and 2024, highlighting key product lines over this period.

Chubb’s Property and Casualty segment generated around 13.4B to 13.7B from 2012 to 2014, showing steady scale in core underwriting. The Life segment contributed roughly 6.75B to 6.79B in 2023 and 2024, reflecting a smaller but stable revenue base. The data reveals a concentration in Property and Casualty historically, with Life revenue maintaining consistent, moderate growth in recent years.

Key Products & Brands

Chubb Limited’s core offerings span multiple insurance and reinsurance segments globally:

| Product | Description |

|---|---|

| North America Commercial P&C Insurance | Commercial property, casualty, workers’ compensation, package policies, risk management, financial lines, marine, construction, environmental, medical, cyber risk, surety, and excess casualty insurance. |

| North America Personal P&C Insurance | Homeowners, automobile, collector cars, valuable articles, personal and excess liability, travel insurance, and recreational marine insurance for affluent and high net worth individuals. |

| North America Agricultural Insurance | Multiple peril crop and crop-hail insurance; farm and ranch property; commercial agriculture product coverage. |

| Overseas General Insurance | Traditional commercial property and casualty; specialty lines including financial, marine, energy, aviation, political risk, construction; group accident and health; personal lines through brokers and agents. |

| Global Reinsurance | Traditional and specialty reinsurance under the Chubb Tempest Re brand to property and casualty insurers. |

| Life Insurance | Protection and savings products such as whole life, endowment, term life (individual and group), medical and health, personal accident, credit life, universal life, and unit linked contracts. |

Chubb’s product portfolio balances traditional and specialty insurance lines with a robust global reinsurance business. Life insurance contributes around $6.7B annually, while property and casualty segments have historically exceeded $13B in revenue.

Main Competitors

There are 7 competitors in total, with the table below listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Progressive Corporation | 124B |

| Chubb Limited | 124B |

| The Travelers Companies, Inc. | 64B |

| The Allstate Corporation | 54B |

| W. R. Berkley Corporation | 26B |

| Cincinnati Financial Corporation | 25B |

| Loews Corporation | 22B |

Chubb Limited ranks 2nd among its competitors, with a market cap just 5.22% below the leader, The Progressive Corporation. It stands well above the average 63B and median 54B market caps in the sector. The gap to the next competitor below is significant, more than 100%, highlighting Chubb’s strong positioning near the top.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Chubb Limited have a competitive advantage?

Chubb Limited demonstrates a competitive advantage with a ROIC significantly exceeding its WACC, indicating it creates shareholder value. However, its ROIC trend shows a notable decline, signaling weakening profitability.

Looking ahead, Chubb’s broad insurance portfolio across commercial, personal, agricultural, and reinsurance markets provides diverse growth avenues. The company’s expansion into specialty and global markets offers opportunities to leverage its scale and expertise in risk management.

SWOT Analysis

This SWOT analysis highlights Chubb Limited’s key internal and external factors impacting its competitive position and strategic direction.

Strengths

- strong global brand

- favorable profit margins (17.3% net margin)

- high ROIC (71%) well above WACC

Weaknesses

- declining ROIC trend

- weak liquidity ratios (current and quick ratios at 0)

- low asset turnover (0.22)

Opportunities

- expanding specialty insurance lines

- growth in emerging markets

- increasing demand for cyber and environmental risk coverage

Threats

- intense competition in P&C insurance

- regulatory changes in key markets

- economic downturns impacting underwriting

Chubb’s robust profitability and brand provide a solid foundation, but deteriorating liquidity and efficiency metrics require close monitoring. Strategic focus should target specialty growth areas while mitigating market and regulatory risks.

Stock Price Action Analysis

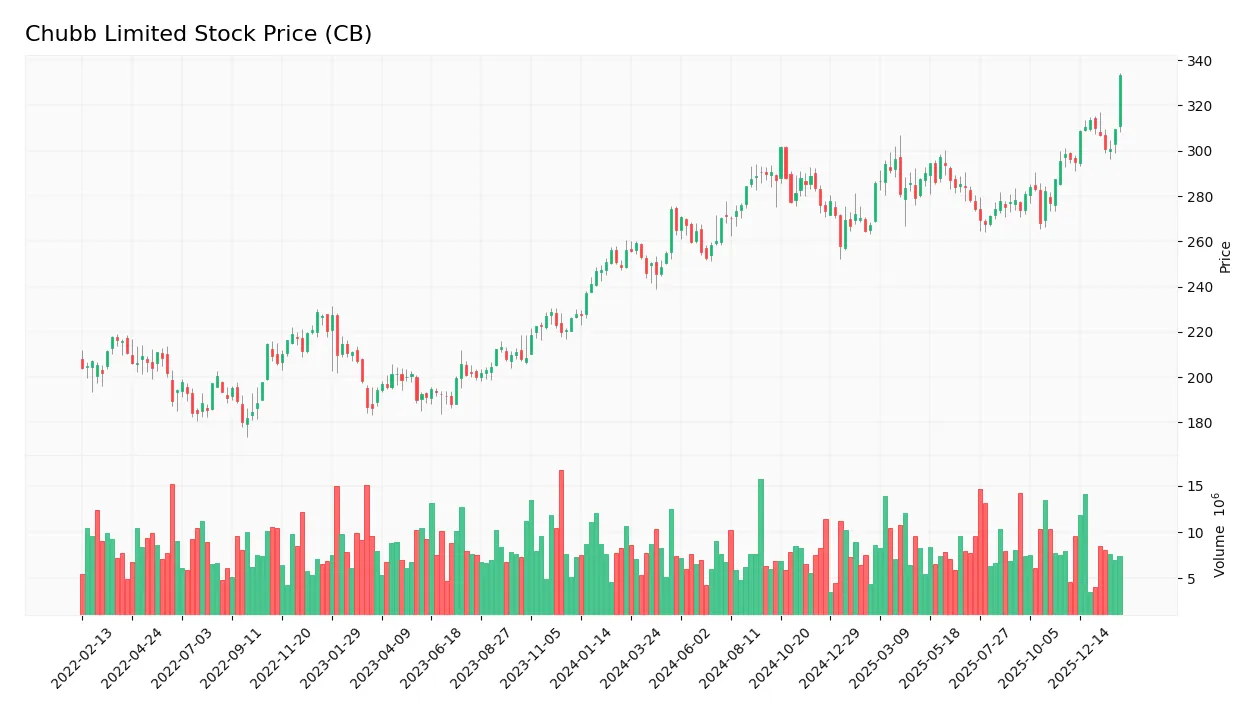

The weekly stock chart below illustrates Chubb Limited’s price movement over the past 12 months, highlighting key support and resistance levels:

Trend Analysis

Over the past 12 months, Chubb Limited’s stock price rose 30%, marking a clear bullish trend with accelerating momentum. The stock hit a high of 333.13 and a low of 245.45, exhibiting volatility with a 16.19 standard deviation. Recent three-month gains of 11.68% confirm continued upward pressure.

Volume Analysis

Trading volume totals 990M shares, with buyers accounting for 57% overall, but volume is decreasing. In the recent three months, buyer dominance rose to 63%, signaling strong buyer interest despite declining activity. This suggests cautious optimism and selective market participation by investors.

Target Prices

Analysts present a bullish consensus for Chubb Limited’s stock price.

| Target Low | Target High | Consensus |

|---|---|---|

| 283 | 360 | 327.67 |

The target range suggests upside potential near 10-15% from current levels, reflecting strong confidence in Chubb’s fundamentals and market position.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback concerning Chubb Limited’s market performance and reputation.

Stock Grades

Here are the latest verified grades for Chubb Limited from major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-05 |

| Roth Capital | Maintain | Buy | 2026-02-04 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-04 |

| Citizens | Maintain | Market Outperform | 2026-02-04 |

| JP Morgan | Maintain | Neutral | 2026-02-04 |

| Citizens | Maintain | Market Outperform | 2026-01-16 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-14 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| Goldman Sachs | Upgrade | Buy | 2026-01-08 |

Most analysts maintain steady ratings, with a slight tilt toward positive outlooks. The consensus leans to Buy, reflecting moderate confidence without significant shifts in sentiment.

Consumer Opinions

Consumers generally appreciate Chubb Limited’s reliability but express concerns about pricing and claims processing speed.

| Positive Reviews | Negative Reviews |

|---|---|

| “Chubb offers excellent coverage options and personalized service.” | “Premiums are higher compared to competitors.” |

| “Claims process was smooth and handled professionally.” | “Response time on claims can be slow in some cases.” |

| “Strong financial stability gives me confidence in their policies.” | “Customer service wait times need improvement.” |

Overall, customers value Chubb’s solid coverage and financial strength. However, pricing and occasional delays in claims handling remain points of dissatisfaction.

Risk Analysis

Below is a summary table of key risks facing Chubb Limited, highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in distress zone indicates bankruptcy risk. | High | High |

| Liquidity | Current and quick ratios are zero, signaling weak liquidity. | Medium | Medium |

| Debt Management | Very unfavorable debt-to-equity score suggests leverage concerns. | Medium | High |

| Operational Efficiency | Low asset turnover points to suboptimal use of assets. | Medium | Medium |

| Market Volatility | Low beta (0.488) implies limited stock sensitivity to markets. | Low | Low |

Chubb’s most pressing risk is its distressed Altman Z-Score, signaling financial fragility despite strong ROIC and interest coverage. Liquidity weaknesses and high leverage warrant cautious monitoring. Operational inefficiencies compound these risks in a competitive insurance sector.

Should You Buy Chubb Limited?

Chubb Limited appears to be a moderately profitable company with a slightly favorable moat, indicating ongoing value creation despite declining returns. While its leverage profile raises caution, the overall B rating suggests a balanced risk-reward profile for investors.

Strength & Efficiency Pillars

Chubb Limited demonstrates robust profitability with a net margin of 17.3% and a return on invested capital (ROIC) of 71.36%, far exceeding its weighted average cost of capital (WACC) at 6.13%. This clear spread confirms the company as a strong value creator. While its return on equity (ROE) is a moderate 13.98%, the firm maintains favorable interest coverage at 12.8, signaling solid financial health despite a concerning Altman Z-score of 0.75, which places it in the distress zone. The Piotroski score of 6 reflects average financial strength, balancing some risk factors.

Weaknesses and Drawbacks

Chubb’s financial profile is not without vulnerabilities. Its current and quick ratios are notably unfavorable, suggesting liquidity constraints that could pressure short-term operational flexibility. Although the debt-to-equity ratio data is missing, the debt-to-assets metric is favorable, mitigating some leverage concerns. Valuation metrics show a reasonable price-to-earnings ratio of 12.0 and a moderate price-to-book ratio of 1.68, which do not signal excessive premium but require monitoring. The asset turnover of 0.22 is weak, indicating less efficient asset utilization, a potential drag on growth.

Our Verdict about Chubb Limited

The company’s long-term fundamentals appear favorable, anchored by strong value creation and solid profitability. Coupled with a bullish overall stock trend and buyer dominance at 63.19% in the recent period, the profile suggests potential appeal for investors. However, liquidity weaknesses and the distressed Altman Z-score advise caution. Therefore, Chubb Limited may appear attractive for long-term exposure but could warrant a measured, watchful approach before committing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Chubb Limited (CB): A Bull Case Theory – Yahoo Finance UK (Feb 04, 2026)

- Chubb Limited $CB Shares Sold by Homestead Advisers Corp – MarketBeat (Feb 05, 2026)

- CB Q4 Deep Dive: Diversified Growth and Margin Expansion Across Global Insurance Portfolio – Finviz (Feb 04, 2026)

- Chubb (NYSE:CB) Posts Q4 CY2025 Sales In Line With Estimates – The Globe and Mail (Feb 03, 2026)

- Chubb Limited $CB Shares Sold by Horizon Investment Services LLC – MarketBeat (Feb 05, 2026)

For more information about Chubb Limited, please visit the official website: chubb.com/us-en