Home > Analyses > Energy > Chevron Corporation

Chevron powers the global economy by fueling transportation, industry, and everyday life with energy. As a titan in the integrated oil and gas sector, it excels in upstream exploration and downstream refining. Chevron’s legacy of innovation and operational excellence cements its role as a market influencer. Yet, in a shifting energy landscape, I ask: do its financial fundamentals still support its lofty valuation and future growth prospects?

Table of contents

Business Model & Company Overview

Chevron Corporation, founded in 1879 and headquartered in San Ramon, California, stands as a titan in the Oil & Gas Integrated industry. Its operations form a comprehensive energy ecosystem spanning exploration, production, refining, and marketing. Through its Upstream and Downstream segments, Chevron orchestrates a seamless flow from crude extraction to finished petroleum products, reinforcing its dominant market position with a workforce of 45K.

Chevron’s revenue engine balances capital-intensive upstream ventures with robust downstream refining and marketing activities. The company’s global footprint spans the Americas, Europe, and Asia, leveraging pipelines, marine vessels, and rail to optimize distribution. Its integrated model and scale create a formidable economic moat, anchoring Chevron as a powerful force shaping the energy sector’s future.

Financial Performance & Fundamental Metrics

I will analyze Chevron Corporation’s income statement, key financial ratios, and dividend payout policy to assess its underlying financial health and shareholder value.

Income Statement

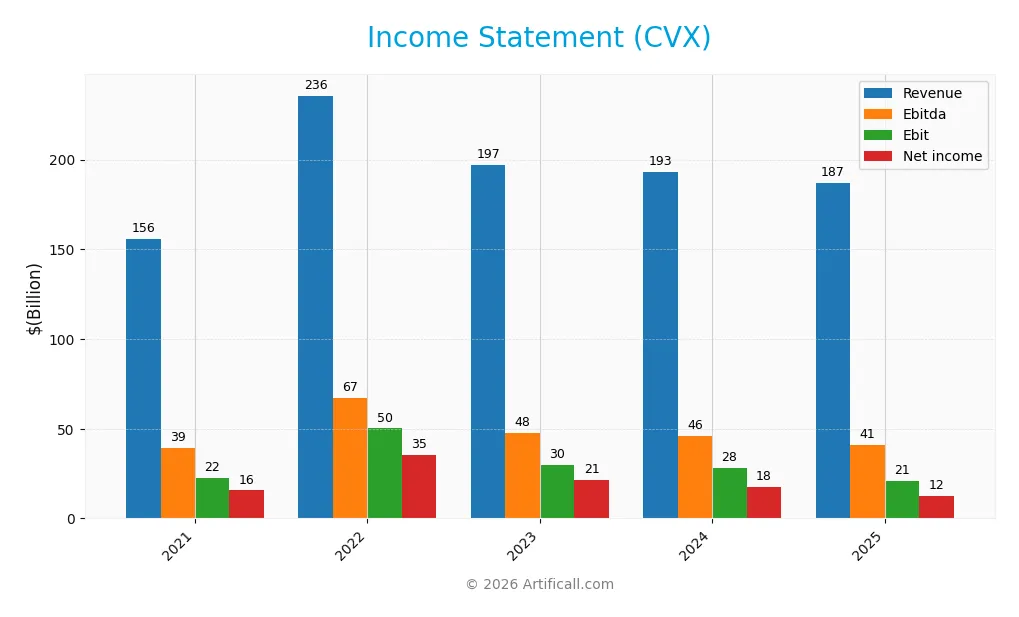

The table below summarizes Chevron Corporation’s annual income statement figures for 2021 through 2025, highlighting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 156B | 236B | 197B | 193B | 187B |

| Cost of Revenue | 110B | 170B | 137B | 136B | 153B |

| Operating Expenses | 29B | 26B | 27B | 28B | 23B |

| Gross Profit | 45B | 66B | 60B | 57B | 34B |

| EBITDA | 39B | 67B | 48B | 46B | 41B |

| EBIT | 22B | 50B | 30B | 28B | 21B |

| Interest Expense | 712M | 516M | 469M | 594M | 1.2B |

| Net Income | 16B | 35B | 21B | 18B | 12B |

| EPS | 8.15 | 18.36 | 11.41 | 9.76 | 6.65 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-26 | 2025-02-21 | 2026-01-30 |

Income Statement Evolution

Chevron’s revenue rose 20.2% from 2021 to 2025 but declined 3.3% in the latest year. Net income fell sharply by 20.7% over five years and dropped 27.5% last year. Gross margin remained stable at 18.4%, while EBIT and net margins contracted, signaling pressure on profitability despite steady revenue.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. EBIT margin at 11.2% and interest expense at 0.65% of revenue are favorable. However, net margin declined to 6.6%, down 27.5% year-over-year, reflecting weaker bottom-line results. EPS fell nearly 32%, highlighting earnings pressure amid shrinking gross profit and net income. Overall, the statement trends unfavorable.

Financial Ratios

The following table presents Chevron Corporation’s key financial ratios for the fiscal years 2021 through 2025, offering a snapshot of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 10.0% | 15.0% | 10.9% | 9.1% | 6.6% |

| ROE | 11.2% | 22.3% | 13.3% | 11.6% | 0.0% |

| ROIC | 5.5% | 12.7% | 10.6% | 8.4% | 0.0% |

| P/E | 14.4 | 9.8 | 13.1 | 14.8 | 24.5 |

| P/B | 1.62 | 2.18 | 1.74 | 1.72 | 0.00 |

| Current Ratio | 1.26 | 1.47 | 1.27 | 1.06 | 0.00 |

| Quick Ratio | 1.01 | 1.23 | 1.01 | 0.83 | 0.00 |

| D/E | 0.23 | 0.15 | 0.13 | 0.16 | 0.00 |

| Debt-to-Assets | 13.1% | 9.1% | 8.0% | 9.6% | 0.00 |

| Interest Coverage | 22.6 | 77.4 | 72.0 | 49.0 | 9.0 |

| Asset Turnover | 0.65 | 0.91 | 0.75 | 0.75 | 0.00 |

| Fixed Asset Turnover | 1.06 | 1.64 | 1.28 | 1.31 | 0.00 |

| Dividend Yield | 4.53% | 3.16% | 4.06% | 4.50% | 4.22% |

Evolution of Financial Ratios

Chevron’s Return on Equity (ROE) showed a decline to zero in 2025, indicating a sharp drop in profitability. The Current Ratio fell to zero, signaling potential liquidity concerns. Meanwhile, the Debt-to-Equity Ratio also dropped to zero, suggesting a change in capital structure or data unavailability. Profitability margins generally weakened compared to prior years, reflecting challenges in earnings stability.

Are the Financial Ratios Favorable?

In 2025, Chevron’s profitability ratios appear neutral to unfavorable, with net margin at 6.62% and ROE at zero. Liquidity ratios like Current and Quick Ratios are marked unfavorable, raising red flags. However, leverage metrics such as Debt-to-Equity and Debt-to-Assets ratios are favorable, indicating low financial risk. The interest coverage ratio and dividend yield remain strong, but overall, the ratio profile is slightly unfavorable.

Shareholder Return Policy

Chevron maintains a steady dividend policy with a payout ratio near 103% in 2025 and a dividend yield above 4%. Dividends are covered by free cash flow and supported by ongoing share buyback programs, indicating a commitment to returning capital.

The slightly elevated payout ratio warrants caution, as it may pressure cash flow during downturns. Overall, Chevron’s distribution strategy balances shareholder returns with sustainability, aligning with long-term value creation given its cash flow coverage and capital allocation discipline.

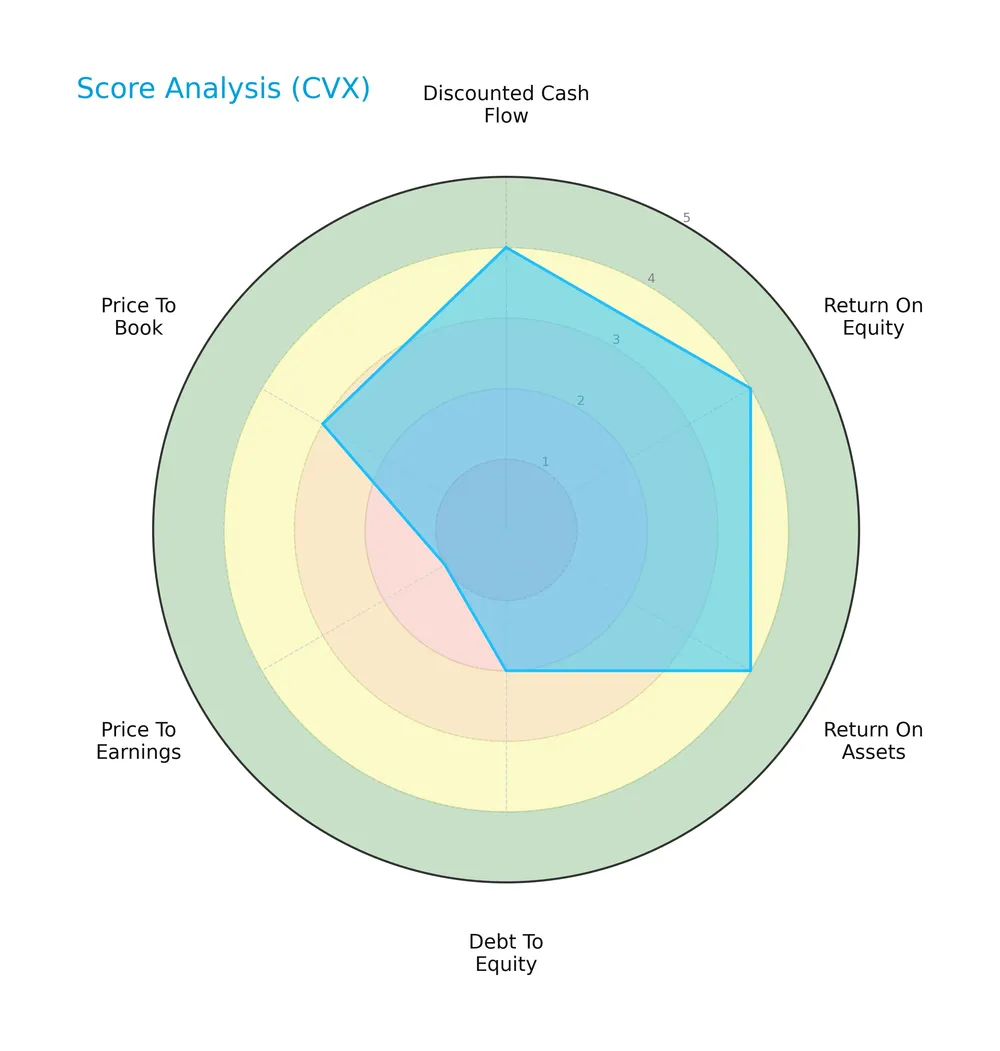

Score analysis

The following radar chart illustrates Chevron Corporation’s key financial scores across multiple valuation and performance metrics:

Chevron shows favorable scores in discounted cash flow, return on equity, and return on assets, indicating solid operational efficiency. Debt to equity is moderate, signaling balanced leverage. However, the very unfavorable price-to-earnings score suggests valuation concerns, while price-to-book is moderate.

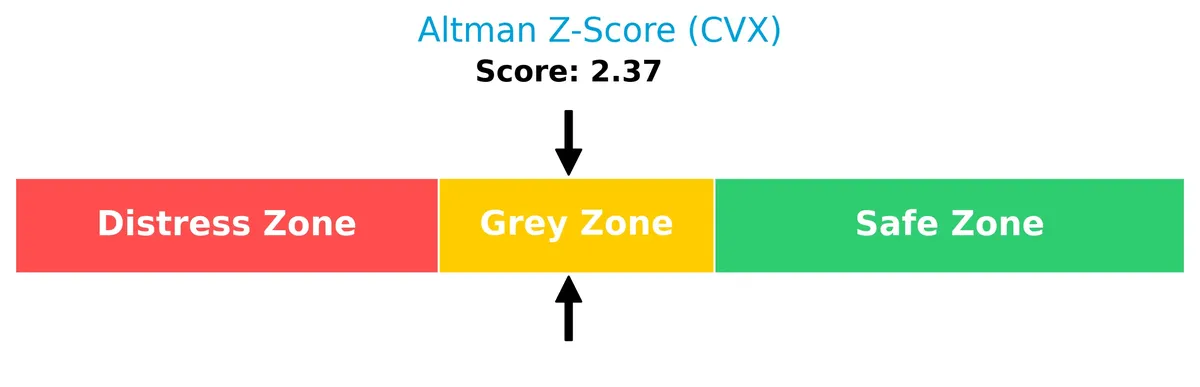

Analysis of the company’s bankruptcy risk

Chevron’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy and financial uncertainty:

Is the company in good financial health?

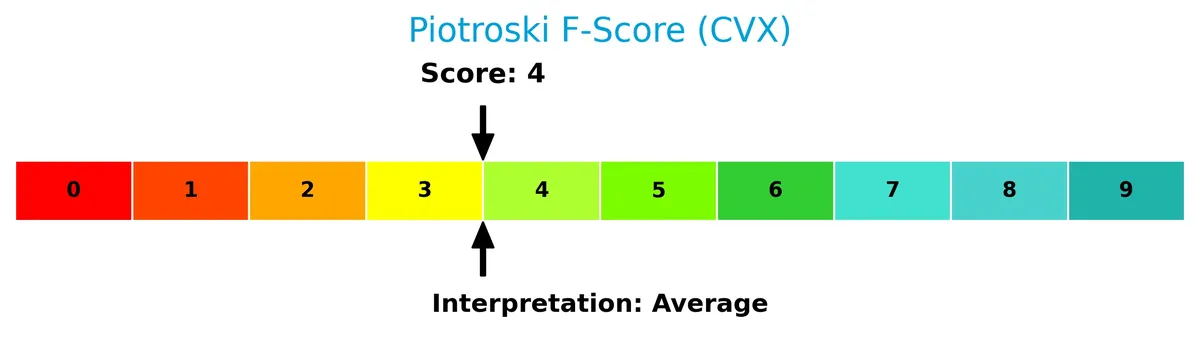

The Piotroski Score diagram below reflects Chevron’s current financial health status:

With a score of 4, Chevron’s financial strength is average, showing moderate profitability and efficiency but room for improvement in financial robustness.

Competitive Landscape & Sector Positioning

This sector analysis examines Chevron Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Chevron holds a competitive advantage over its industry peers.

Strategic Positioning

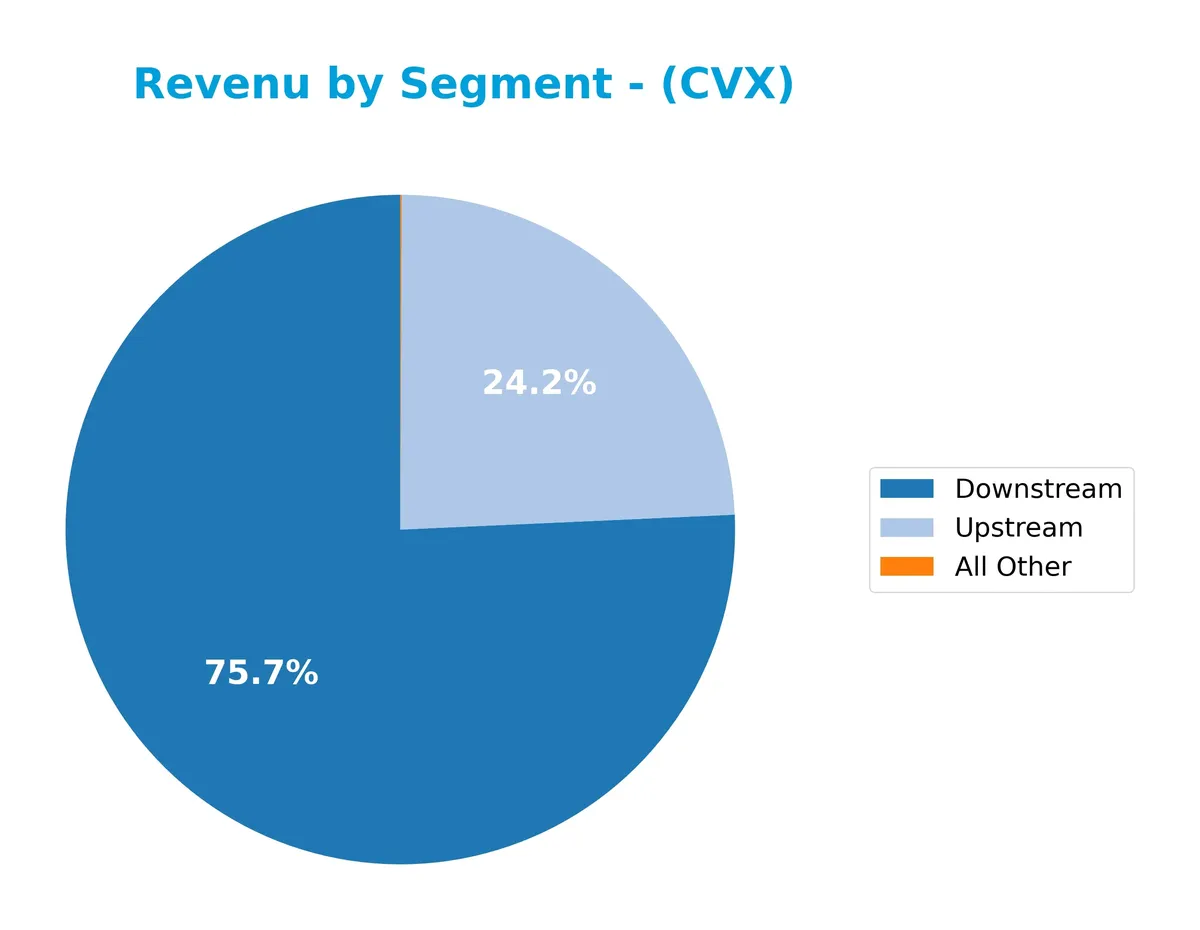

Chevron concentrates its operations in two main segments: Downstream and Upstream, with Downstream generating roughly three times more revenue. Geographically, Chevron maintains a diverse presence, earning about 56% internationally and 44% in the U.S., highlighting a balanced global footprint within the integrated oil and gas sector.

Revenue by Segment

The pie chart illustrates Chevron Corporation’s revenue distribution by segment for fiscal year 2024, highlighting the relative contributions of Downstream, Upstream, and All Other categories.

Chevron’s revenue remains dominated by the Downstream segment at $146B in 2024, reflecting its stable refining and marketing operations. Upstream contributes a significant $47B, though it shows a slight decline from prior years, signaling some volatility in exploration and production. The All Other segment is minimal at $132M, posing negligible impact. Recent trends suggest a concentration risk in Downstream, as Upstream revenue softens amidst fluctuating commodity prices.

Key Products & Brands

Chevron Corporation operates through distinct segments offering integrated energy and chemical products:

| Product | Description |

|---|---|

| Upstream | Exploration, development, production, and transportation of crude oil and natural gas; LNG processing and transport. |

| Downstream | Refining crude oil into petroleum products, marketing crude oil, refined products and lubricants, and renewable fuels manufacturing. |

| All Other | Includes cash management, debt financing, insurance, real estate, and technology operations. |

Chevron’s portfolio spans the entire oil and gas value chain, with downstream activities generating significantly higher revenue than upstream. Ancillary services support its integrated operations.

Main Competitors

There are 2 competitors in the Oil & Gas Integrated industry; below is the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Exxon Mobil Corporation | 517B |

| Chevron Corporation | 312B |

Chevron Corporation ranks 2nd among its competitors. Its market cap stands at 69.2% of the leader, Exxon Mobil. Chevron is below both the average market cap of the top 10 and the sector median, with a 44.51% gap to Exxon Mobil, its closest rival above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Chevron have a competitive advantage?

Chevron demonstrates some competitive strength through its integrated operations across upstream and downstream segments, supported by a substantial market cap of 358B and a diversified global footprint. However, its declining ROIC trend and unfavorable income statement growth signal challenges in sustaining superior returns on invested capital.

Looking ahead, Chevron’s engagement in renewable fuels and liquefied natural gas positions it to tap emerging energy markets. Continued innovation in refining and marketing could drive growth opportunities, though the company must address profitability pressures to maintain its competitive edge.

SWOT Analysis

This analysis highlights Chevron Corporation’s core internal and external factors shaping its competitive position and strategic options.

Strengths

- strong global footprint

- integrated upstream and downstream operations

- solid dividend yield (4.22%)

Weaknesses

- declining profitability trends

- weak ROIC and ROE metrics

- revenue contraction in recent years

Opportunities

- expanding renewable fuels segment

- growing international markets

- leveraging technology for efficiency

Threats

- volatile oil prices

- regulatory and environmental pressures

- geopolitical risks impacting supply chains

Chevron’s strengths lie in its diversified operations and strong cash returns to shareholders. However, profitability erosion and weak capital efficiency signal caution. Strategic focus must balance growth in renewables with risk from market and regulatory volatility.

Stock Price Action Analysis

The weekly stock chart displays Chevron Corporation’s price movements with recent acceleration and notable volatility:

Trend Analysis

Over the past 12 months, CVX’s stock price rose 15.17%, reflecting a bullish trend with acceleration. The price ranged between 135.63 and 179.14, exhibiting volatility with an 8.22 standard deviation. This momentum intensified during the recent 11-week period, gaining 19.44% with a 10.68 volatility measure.

Volume Analysis

Over the last three months, trading volume increased, driven by buyer dominance at 67.25%. Buyer volume nearly doubled seller volume, signaling strong investor demand and growing market participation in this period.

Target Prices

Analysts present a moderately bullish outlook for Chevron Corporation, reflecting confidence in its growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 160 | 212 | 182.83 |

The target range indicates upside potential above the current market price, with a consensus near 183 suggesting steady appreciation amid energy sector volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback, offering insights into Chevron Corporation’s market perception and reputation.

Stock Grades

Here are the latest verified stock grades for Chevron Corporation from prominent financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-02 |

| Morgan Stanley | Maintain | Overweight | 2026-01-23 |

| Barclays | Maintain | Equal Weight | 2026-01-21 |

| Jefferies | Maintain | Buy | 2026-01-14 |

| Piper Sandler | Maintain | Overweight | 2026-01-08 |

| Freedom Capital Markets | Downgrade | Sell | 2026-01-06 |

| Citigroup | Maintain | Buy | 2026-01-05 |

| Bernstein | Maintain | Market Perform | 2026-01-05 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| B of A Securities | Maintain | Buy | 2025-12-11 |

Most firms maintain a positive stance, favoring overweight or buy ratings. Freedom Capital Markets stands out with a recent downgrade to sell, suggesting some divergence in outlook.

Consumer Opinions

Chevron Corporation evokes strong responses from its customer base, reflecting its market presence and operational scope.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable fuel quality and availability | High fuel prices compared to competitors |

| Strong commitment to environmental efforts | Occasional delays in customer service |

| Extensive network of service stations | Perceived lack of innovation in retail experience |

Consumers consistently praise Chevron for fuel reliability and environmental initiatives. However, pricing and customer service delays emerge as notable concerns, suggesting room for enhancing customer engagement and competitive positioning.

Risk Analysis

Below is a table summarizing Chevron Corporation’s key risks, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Exposure to fluctuating oil prices impacting revenues and profit margins. | High | High |

| Operational Risk | Challenges in exploration, production, and refining activities. | Medium | Medium |

| Financial Health | Weak liquidity ratios and neutral profitability may constrain flexibility. | Medium | High |

| Regulatory Risk | Stringent environmental and climate regulations could increase costs. | Medium | High |

| Geopolitical Risk | Political instability in resource-rich regions may disrupt operations. | Low | High |

Chevron’s most pressing risks stem from volatile oil prices combined with regulatory pressures. The firm’s unfavorable liquidity ratios and neutral net margins raise caution despite solid debt metrics. Its Altman Z-score in the grey zone signals moderate financial distress risk, warranting vigilance.

Should You Buy Chevron Corporation?

Chevron Corporation appears to be a moderately profitable company with improving operational efficiency but a declining return on invested capital trend. While its leverage profile seems manageable, valuation metrics suggest caution. Overall, the firm’s financial health could be seen as a B+ rating with moderate risk indicators.

Strength & Efficiency Pillars

Chevron Corporation exhibits solid financial health with an Altman Z-score of 2.37 placing it in the grey zone, signaling moderate bankruptcy risk. The Piotroski score of 4 suggests average financial strength. Favorable metrics include an EBIT margin of 11.21% and a net margin of 6.62%, reflecting operational efficiency. Interest coverage stands robust at 17.22, underscoring strong debt servicing capacity. Although ROE and ROIC data are unavailable or unfavorable, Chevron’s overall value rating remains very favorable with a B+ grade.

Weaknesses and Drawbacks

Chevron faces valuation and leverage concerns. The P/E ratio at 24.49 is neutral but leans toward a premium valuation relative to sector averages. Current and quick ratios are missing or unfavorable, signaling potential liquidity risks. The company shows moderate debt-to-equity risk, though debt-to-assets remains favorable. Recent income statement trends reveal negative revenue growth (-3.3%) and steep declines in net margin (-27.47%) and EPS (-31.79%), which could impair near-term profitability and investor confidence.

Our Verdict about Chevron Corporation

Chevron’s long-term fundamental profile appears favorable given its strong operational margins and financial resilience. The bullish overall stock trend, supported by buyer dominance at 67.25% in the recent period, suggests positive momentum. This combination might appear attractive for investors seeking energy sector exposure but could also warrant a cautious stance due to recent profitability headwinds and liquidity signals. Thus, a measured, watchful approach could serve investors best.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Chevron Corporation (CVX) reports fiscal Q4 2025 earnings – MSN (Feb 05, 2026)

- Chevron Corporation (CVX): A Bull Case Theory – Yahoo Finance (Feb 03, 2026)

- Chevron Announces Senior Leadership Changes – Business Wire (Feb 05, 2026)

- Machina Capital S.A.S. Takes $991,000 Position in Chevron Corporation $CVX – MarketBeat (Feb 05, 2026)

- Chevron (CVX) and TPAO Partner for Black Sea Oil Exploration – GuruFocus (Feb 05, 2026)

For more information about Chevron Corporation, please visit the official website: chevron.com