In a world increasingly reliant on seamless connectivity, Charter Communications, Inc. transforms how millions experience entertainment and communication. With its robust portfolio of broadband services and innovative video offerings, Charter stands as a titan in the telecommunications sector, serving approximately 32M customers across 41 states. As we delve into an investment analysis, I invite you to consider whether Charter’s current market valuation aligns with its growth potential and fundamental strengths in an ever-evolving industry landscape.

Table of contents

Company Description

Charter Communications, Inc. is a prominent player in the Telecommunications Services industry, operating as a broadband connectivity and cable operator in the United States. Founded in 1993 and headquartered in Stamford, Connecticut, the company serves approximately 32M customers across 41 states. Charter offers a comprehensive array of services, including subscription-based video offerings, high-speed internet, voice communications via VoIP, and business solutions. With a diversified portfolio that spans hardware, software, and managed services, Charter positions itself as a leader in delivering innovative connectivity solutions. Through its strategic focus on enhancing customer experience and expanding its service offerings, Charter continues to shape the landscape of telecommunications in the U.S.

Fundamental Analysis

In this section, I will analyze Charter Communications, Inc. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

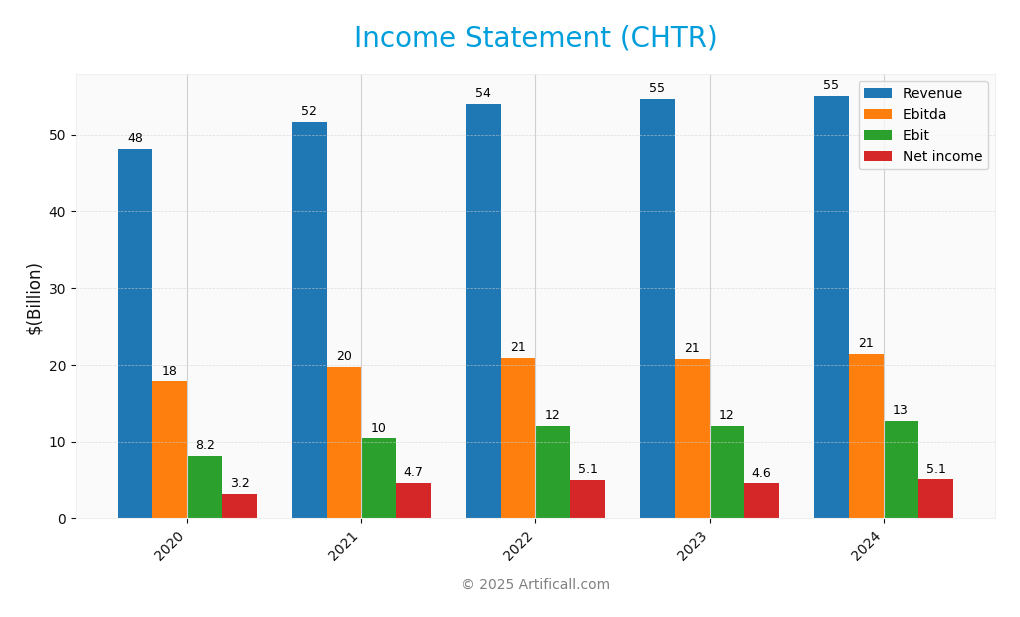

The following table outlines the income statement for Charter Communications, Inc. (CHTR) over the past five fiscal years, highlighting key financial metrics.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 48.1B | 51.7B | 54.0B | 54.6B | 55.1B |

| Cost of Revenue | 30.8B | 31.1B | 30.6B | 33.3B | 29.8B |

| Operating Expenses | 8.9B | 9.8B | 11.2B | 8.8B | 12.1B |

| Gross Profit | 17.3B | 20.6B | 23.4B | 21.3B | 25.3B |

| EBITDA | 17.8B | 19.8B | 20.9B | 20.7B | 21.4B |

| EBIT | 8.2B | 10.4B | 12.0B | 12.0B | 12.7B |

| Interest Expense | 3.8B | 4.0B | 4.6B | 5.2B | 5.2B |

| Net Income | 3.2B | 4.7B | 5.1B | 4.6B | 5.1B |

| EPS | 15.9 | 25.3 | 31.3 | 30.5 | 35.5 |

| Filing Date | 2021-01-29 | 2022-01-28 | 2023-01-27 | 2024-02-02 | 2025-01-31 |

Interpretation of Income Statement

Over the past five years, Charter Communications has demonstrated a steady increase in revenue, rising from 48.1B in 2020 to 55.1B in 2024, reflecting 2.5% year-over-year growth in the most recent year. Net income has similarly shown resilience, stabilizing around the 5B mark, indicating a robust profitability profile despite rising operating expenses. Notably, gross profit margins have improved due to a decrease in the cost of revenue in 2024, showcasing better efficiency in operations. The recent year’s performance indicates a slight growth in EBITDA and net income, suggesting that while revenue growth is modest, the company is effectively managing costs and maintaining strong margins.

Financial Ratios

The following table summarizes the financial ratios for Charter Communications, Inc. (CHTR) over the past five fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.70% | 9.01% | 9.36% | 8.35% | 9.23% |

| ROE | 13.53% | 33.12% | 55.43% | 41.11% | 32.61% |

| ROIC | 5.33% | 6.78% | 7.15% | 7.04% | 7.43% |

| P/E | 41.75 | 25.73 | 10.83 | 12.73 | 9.65 |

| P/B | 5.65 | 8.52 | 6.01 | 5.23 | 3.15 |

| Current Ratio | 0.40 | 0.29 | 0.33 | 0.31 | 0.31 |

| Quick Ratio | 0.40 | 0.29 | 0.33 | 0.31 | 0.31 |

| D/E | 3.49 | 6.54 | 10.74 | 8.86 | 6.14 |

| Debt-to-Assets | 57.55% | 64.45% | 67.74% | 66.72% | 63.83% |

| Interest Coverage | 2.20 | 2.69 | 2.69 | 2.41 | 2.53 |

| Asset Turnover | 0.33 | 0.36 | 0.37 | 0.37 | 0.37 |

| Fixed Asset Turnover | 1.40 | 1.51 | 1.50 | 1.38 | 1.28 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

In evaluating Charter Communications, Inc. (CHTR), the current year’s ratios reveal several key insights into its financial health. The liquidity ratios, with a current ratio of 0.314 and quick ratio of 0.314, indicate potential liquidity concerns, suggesting that the company may struggle to meet short-term obligations. Solvency ratios are concerning as well, with a solvency ratio of 0.106 and a debt-to-equity ratio of 6.144, highlighting high leverage. Profitability ratios are moderately strong; the net profit margin stands at 9.23%, while the return on equity is robust at 32.61%. Efficiency ratios reflect a receivables turnover of 17.79, indicating effective collection practices. However, the working capital turnover ratio is negative, suggesting that current liabilities exceed current assets. Investors should exercise caution due to the high debt levels and liquidity risks.

Evolution of Financial Ratios

Over the past five years, Charter Communications’ financial ratios have shown fluctuations, with a decline in liquidity ratios and an increase in debt levels. Profitability ratios have generally improved, but high leverage and weak liquidity remain areas of concern for investors.

Distribution Policy

Charter Communications, Inc. does not currently pay dividends, opting instead to reinvest earnings for growth. This strategy is consistent with its high growth phase and focus on research and development. While the lack of dividends may deter some income-focused investors, it can align with long-term shareholder value creation. Additionally, the company engages in share buybacks, reflecting its commitment to returning capital to shareholders. Overall, this approach appears supportive of sustainable long-term value creation.

Sector Analysis

Charter Communications, Inc. operates in the telecommunications sector, offering a range of broadband services and competing with key players like Comcast and Verizon. Its competitive advantages include extensive market reach and diverse service offerings.

Strategic Positioning

Charter Communications, Inc. (CHTR) holds a significant position in the telecommunications market, serving approximately 32M customers across 41 states. With a market cap of $28.49B, it faces competitive pressure from both traditional telecom providers and emerging disruptors in broadband and video services. While its market share in broadband connectivity remains strong, advancements in technology and changing consumer preferences necessitate continuous innovation. The company’s focus on integrated services, including Internet, video, and voice, positions it favorably, but it must remain vigilant against competitive threats and technological disruptions that could impact its growth trajectory.

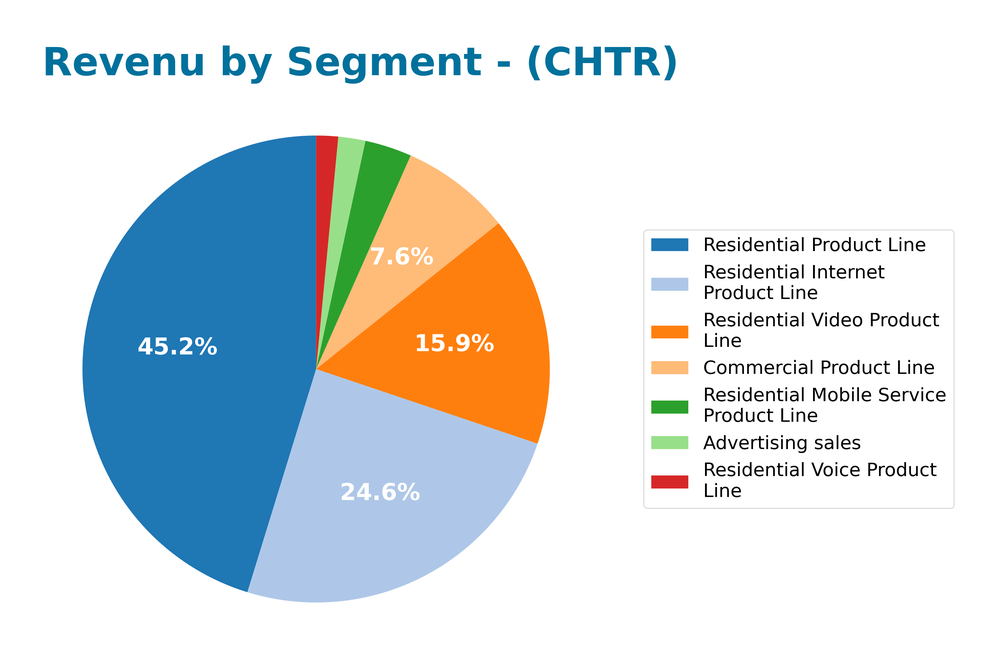

Revenue by Segment

The following chart illustrates Charter Communications, Inc.’s revenue segmentation for the fiscal year 2024, highlighting the distribution across various segments.

In fiscal year 2024, Charter’s revenue was predominantly driven by the Residential Product Line, which accounted for approximately 43B. Notably, the Residential Internet Product Line contributed 23.4B, while the Residential Video Segment generated 15.1B. The Commercial Product Line also performed well, bringing in 7.25B. Although overall revenue growth continues, there is a slight slowdown in the Residential Video segment compared to prior years, indicating potential margin risks and shifts in consumer preferences. As competition intensifies, monitoring these trends will be crucial for future performance.

Key Products

Charter Communications, Inc. offers a diverse range of products tailored to meet the needs of both residential and commercial customers. Below is a table summarizing their key offerings:

| Product | Description |

|---|---|

| Spectrum TV | A subscription-based video service providing on-demand content, high-definition television, and DVR. |

| Spectrum Internet | High-speed internet with options for security suites and in-home WiFi to enhance connectivity. |

| Spectrum Voice | Voice over Internet Protocol (VoIP) services for residential and business customers. |

| Spectrum Mobile | Mobile services that integrate with existing Spectrum accounts for seamless connectivity. |

| Spectrum Business | Tailored communications solutions for businesses, including data networking and broadband access. |

| Advertising Solutions | Local advertising across various platforms, including digital and traditional media channels. |

| Regional Sports Networks | Ownership and operation of sports networks providing localized sports programming. |

With a focus on innovative technology and comprehensive service offerings, Charter continues to enhance its position in the telecommunications industry, serving approximately 32 million customers across the United States.

Main Competitors

The competitive landscape in the telecommunications services sector is robust, with several key players vying for market share.

| Company | Market Cap |

|---|---|

| Chunghwa Telecom Co., Ltd. | 32.4B |

| Fox Corporation | 30.9B |

| Vodafone Group Public Limited Company | 30.6B |

| Charter Communications, Inc. | 28.5B |

| Telefónica, S.A. | 23.7B |

| Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk | 21.6B |

| TELUS Corporation | 20.5B |

| Rogers Communications Inc. | 20.3B |

| Liberty Broadband Corporation | 6.8B |

The main competitors in the U.S. telecommunications market include Chunghwa Telecom, Fox Corporation, and Vodafone, among others. These companies collectively offer a range of services that compete with Charter Communications, Inc., which primarily serves residential and commercial customers across the United States.

Competitive Advantages

Charter Communications, Inc. (CHTR) holds a strong competitive position in the telecommunications industry through its extensive broadband connectivity and cable services. The company’s robust infrastructure allows it to serve approximately 32M customers across 41 states, offering reliable internet, video, and voice services. Looking ahead, Charter plans to expand its product offerings, including enhanced mobile services and advanced security solutions, tapping into new markets and customer segments. This strategic focus on innovation and customer experience positions Charter favorably for future growth opportunities.

SWOT Analysis

This SWOT analysis provides a structured evaluation of Charter Communications, Inc. to identify its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong market position

- Diverse service offerings

- Large customer base

Weaknesses

- High competition

- Dependence on cable subscriptions

- Limited global presence

Opportunities

- Expansion into new markets

- Growth in broadband demand

- Development of innovative services

Threats

- Regulatory challenges

- Rapid technological changes

- Economic downturns

The overall SWOT assessment indicates that while Charter Communications has a solid foundation to leverage its strengths and opportunities, it must address its weaknesses and stay vigilant against external threats to sustain competitive advantage and growth.

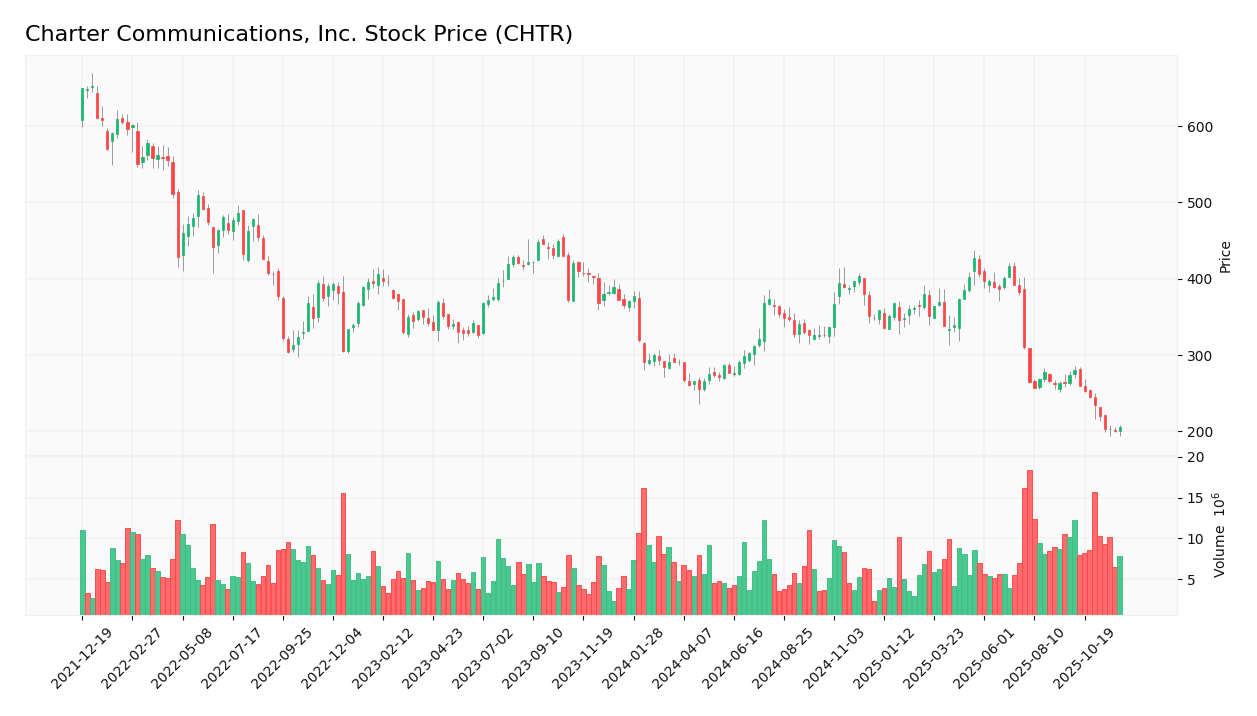

Stock Analysis

Over the past year, Charter Communications, Inc. (CHTR) has experienced significant price fluctuations, culminating in a bearish trend characterized by a notable decline in stock value.

Trend Analysis

Analyzing the stock’s performance over the past two years, I observe a substantial percentage change of -43.79%. This firmly places CHTR in a bearish trend, indicating persistent downward pressure on the stock. Notably, the highest price recorded during this period was 427.25, while the lowest reached 200.12. The trend exhibits deceleration, suggesting that the rate of decline is slowing, although the overall direction remains negative. The standard deviation of 55.12 indicates considerable volatility in the stock’s price movements.

Volume Analysis

In the last three months, the total trading volume for CHTR was approximately 820M, with buyer-driven activity totaling around 359M and seller-driven activity at 455M. The volume trend is increasing, which suggests heightened market participation. However, with buyer volume constituting only 43.8% of total activity, the sentiment appears seller-dominant, reflecting cautious investor behavior amid the prevailing bearish trend.

Analyst Opinions

Recent analyst recommendations for Charter Communications, Inc. (CHTR) indicate a strong consensus towards a “buy” rating. Analysts have highlighted the company’s robust financial metrics, including a high return on equity and solid discounted cash flow score. Notably, the firm received an “A-” rating, reflecting its overall strength in the market. The debt-to-equity ratio is a concern, but the positive outlook on revenue growth and profitability offsets this risk. I believe this makes CHTR a compelling addition to a well-diversified portfolio.

Stock Grades

Recent evaluations of Charter Communications, Inc. (CHTR) provide insight into its current market standing. Below is a summary of the latest stock grades from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-11-03 |

| Bernstein | Downgrade | Market Perform | 2025-11-03 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-03 |

| Keybanc | Downgrade | Sector Weight | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| RBC Capital | Maintain | Sector Perform | 2025-11-03 |

| Keybanc | Maintain | Overweight | 2025-10-03 |

| B of A Securities | Maintain | Buy | 2025-09-24 |

| Bernstein | Maintain | Outperform | 2025-09-10 |

Overall, the trend indicates a mix of stability and caution among analysts. While several firms have maintained their positive outlooks, others have downgraded their ratings, reflecting a cautious sentiment regarding Charter’s future performance.

Target Prices

The consensus target prices for Charter Communications, Inc. (CHTR) reflect a range of expectations among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 500 | 200 | 326.6 |

Overall, analysts expect CHTR to reach a consensus target of approximately 326.6, indicating a positive outlook with a significant potential upside.

Consumer Opinions

Consumer sentiment about Charter Communications, Inc. (CHTR) reveals a mix of satisfaction and frustration, reflecting the diverse experiences of its customer base.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable internet speed for streaming.” | “Customer service is difficult to reach.” |

| “Affordable plans for families.” | “Frequent outages in my area.” |

| “Great value compared to competitors.” | “Billing errors are common.” |

| “Flexible contract options available.” | “Installation process took longer than expected.” |

Overall, consumer feedback highlights Charter’s reliable internet services and competitive pricing as strengths, while recurring issues with customer service and billing errors appear as notable weaknesses.

Risk Analysis

In evaluating Charter Communications, Inc. (CHTR), it is crucial to understand the various risks that may affect its performance. Below is a summary of these risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition from other telecom providers. | High | High |

| Regulatory Changes | Potential shifts in regulations affecting operations. | Medium | High |

| Technological Risks | Rapid changes in technology could impact services. | Medium | Medium |

| Economic Downturn | Recession may reduce consumer spending on services. | High | Medium |

| Cybersecurity Threats | Increased risk of data breaches and hacks. | High | High |

The most significant risks for CHTR are market competition and cybersecurity threats, affecting both profitability and operational integrity. Recent data shows that the telecom sector is experiencing heightened competition, which can pressure margins.

Should You Buy Charter Communications, Inc.?

Charter Communications, Inc. (CHTR) has demonstrated solid profitability, with a net profit margin of 9.23% for fiscal year 2024, indicating effective cost management. The company’s return on invested capital (ROIC) of 7.43% surpasses its weighted average cost of capital (WACC) of 4.98%, suggesting positive value creation. However, with a high debt-to-equity ratio of 6.14, it maintains significant leverage, which could pose risks in volatile market conditions. Overall, the company holds an “A-” rating, reflecting strong fundamentals, but potential investors might consider the implications of its debt levels before making decisions.

Favorable signals

In my analysis of Charter Communications, Inc. (CHTR), I found several favorable elements. The company has a positive gross margin of 45.97%, which indicates efficient cost management. Additionally, the gross profit growth of 19.06% and an EBIT margin of 23.11% further highlight its operational strength. The net margin stands at 9.23%, with a growth rate of 10.57%, while the EPS growth is at an impressive 16.61%. The return on equity is also strong at 32.61%, and the price-to-earnings ratio of 9.65 suggests reasonable valuation.

Unfavorable signals

Despite the favorable signals, there are significant unfavorable elements to consider. The revenue growth rate is at 0.88%, which is disappointing. The current ratio and quick ratio both stand at 0.31, indicating potential liquidity issues. Additionally, the debt-to-equity ratio is high at 6.14, and the debt-to-assets ratio is 63.83%, raising concerns about financial leverage. Furthermore, the price-to-book ratio of 3.15 suggests overvaluation in comparison to the company’s book value.

Conclusion

Overall, the income statement evaluation appears favorable, while the ratios evaluation suggests an unfavorable situation. Given the long-term bearish trend indicated by a price change of -43.79% and a recent seller volume exceeding buyer volume, it might be prudent to wait for buyers to return before considering any investment.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- How Do Investors Really Feel About Charter Communications Inc? – Benzinga (Dec 05, 2025)

- Guggenheim Capital LLC Purchases 5,154 Shares of Charter Communications, Inc. $CHTR – MarketBeat (Dec 05, 2025)

- Charter Communications, Inc. (CHTR) Partners with Amazon Web Services to Accelerate Generative AI Integration – Yahoo Finance (Nov 27, 2025)

- Charter to Participate in UBS Global Media and Communications Conference – Finviz (Dec 02, 2025)

- Charter Communications, Inc. $CHTR Shares Sold by Dodge & Cox – MarketBeat (Dec 05, 2025)

For more information about Charter Communications, Inc., please visit the official website: corporate.charter.com