Home > Analyses > Healthcare > Charles River Laboratories International, Inc.

Charles River Laboratories International, Inc. drives innovation at the heart of medical research by providing essential drug discovery and safety testing services that shape the development of tomorrow’s therapies. As a global leader in non-clinical contract research, CRL supports pharmaceutical and biotechnology companies with cutting-edge models, diagnostics, and manufacturing solutions known for precision and reliability. With its strong market presence and ongoing advancements, I explore whether CRL’s fundamentals continue to justify its valuation and growth prospects in this dynamic healthcare sector.

Table of contents

Business Model & Company Overview

Charles River Laboratories International, Inc., founded in 1947 and headquartered in Wilmington, Massachusetts, stands as a leader in the medical diagnostics and research industry. The company operates a cohesive ecosystem spanning drug discovery, non-clinical development, and safety testing services across the Americas, Europe, and Asia Pacific. Its three segments—Research Models and Services, Discovery and Safety Assessment, and Manufacturing Solutions—work integrally to support biopharmaceutical innovation from early research through quality control.

The company’s revenue engine balances sales of research models and specialized biologics testing with recurring service contracts in toxicology, pathology, and contract vivarium operations. This diversified approach secures a strategic footprint in global markets, reinforcing steady cash flow and client retention. Charles River’s competitive advantage lies in its comprehensive service offering and global reach, underpinning its role as a vital partner shaping the future of drug development.

Financial Performance & Fundamental Metrics

I will analyze Charles River Laboratories International, Inc. (CRL) focusing on its income statement, key financial ratios, and dividend payout policy to assess its investment potential.

Income Statement

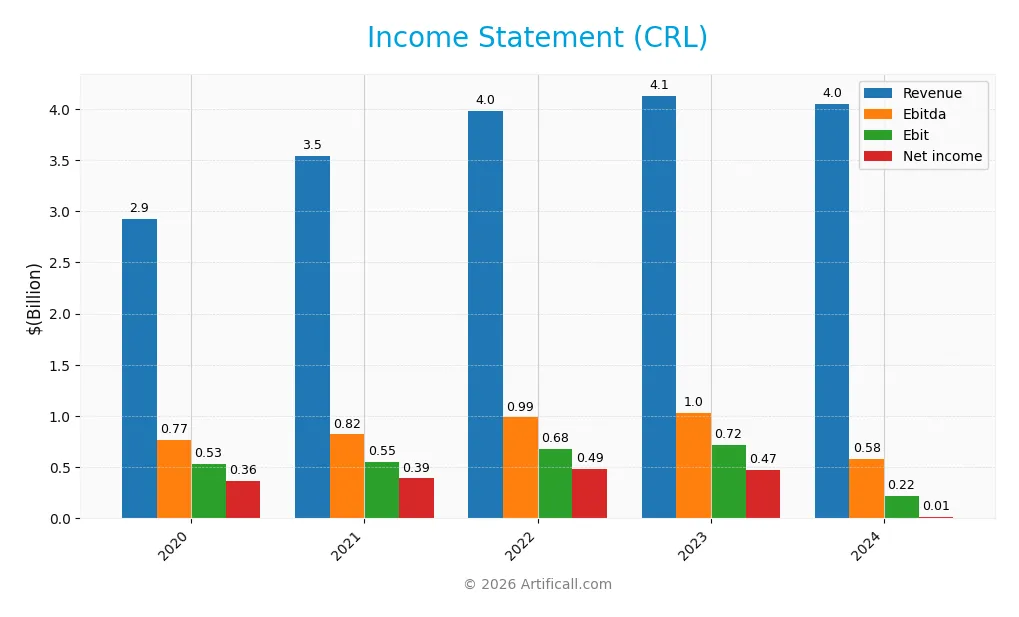

The table below presents key income statement figures for Charles River Laboratories International, Inc. (CRL) over the last five fiscal years, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.92B | 3.54B | 3.98B | 4.13B | 4.05B |

| Cost of Revenue | 1.85B | 2.21B | 2.51B | 2.63B | 2.72B |

| Operating Expenses | 641M | 745M | 812M | 885M | 1.10B |

| Gross Profit | 1.07B | 1.33B | 1.46B | 1.50B | 1.33B |

| EBITDA | 768M | 820M | 986M | 1.03B | 581M |

| EBIT | 534M | 555M | 682M | 718M | 219M |

| Interest Expense | 86.4M | 73.9M | 59.3M | 136.7M | 126.3M |

| Net Income | 364M | 391M | 486M | 475M | 10.3M |

| EPS | 7.35 | 7.77 | 9.57 | 9.27 | 0.20 |

| Filing Date | 2021-02-17 | 2022-02-16 | 2023-02-22 | 2024-02-14 | 2025-02-19 |

Income Statement Evolution

Charles River Laboratories’ revenue showed a favorable 38.5% growth from 2020 to 2024 but declined by 1.9% between 2023 and 2024. Gross profit decreased by 11.4% in the last year, reflecting margin pressure, while gross margin remained favorable at 32.9%. EBIT and net income margins weakened substantially, with EBIT margin neutral at 5.4% and net margin nearly flat at 0.25%, indicating deteriorating profitability.

Is the Income Statement Favorable?

The 2024 income statement reveals significant challenges. Net income plummeted by over 97% year-over-year, with EPS dropping similarly, signaling severe earnings compression despite stable revenue. Operating expenses and interest costs as a proportion of revenue remain manageable, but the steep decline in EBIT and net income margins suggests fundamental profitability issues. Overall, the income statement evaluation is unfavorable, highlighting risks in earnings sustainability.

Financial Ratios

The table below presents key financial ratios for Charles River Laboratories International, Inc. (CRL) over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 12.5% | 11.0% | 12.2% | 11.5% | 0.25% |

| ROE | 17.2% | 15.4% | 16.3% | 13.2% | 0.30% |

| ROIC | 7.5% | 8.1% | 7.9% | 7.1% | 0.95% |

| P/E | 33.98 | 48.47 | 22.77 | 25.52 | 928.90 |

| P/B | 5.85 | 7.48 | 3.72 | 3.37 | 2.76 |

| Current Ratio | 1.43 | 1.23 | 1.32 | 1.52 | 1.41 |

| Quick Ratio | 1.21 | 1.04 | 1.08 | 1.16 | 1.13 |

| D/E | 1.02 | 1.26 | 1.04 | 0.85 | 0.79 |

| Debt-to-Assets | 39.3% | 45.6% | 40.7% | 37.4% | 36.2% |

| Interest Coverage | 5.01 | 7.98 | 10.98 | 4.52 | 1.80 |

| Asset Turnover | 0.53 | 0.50 | 0.52 | 0.50 | 0.54 |

| Fixed Asset Turnover | 2.24 | 2.23 | 2.14 | 2.03 | 2.01 |

| Dividend Yield | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Evolution of Financial Ratios

Over recent years, Charles River Laboratories International, Inc. experienced a marked decline in Return on Equity (ROE), dropping from 17.2% in 2020 to a mere 0.3% in 2024, indicating a significant slowdown in profitability. The Current Ratio remained relatively stable around 1.3 to 1.5, reflecting consistent liquidity levels. Meanwhile, the Debt-to-Equity Ratio decreased from over 1.2 in 2021 to 0.79 in 2024, suggesting a modest reduction in financial leverage.

Are the Financial Ratios Favorable?

In 2024, the company’s profitability ratios, including net margin and ROE, are classified as unfavorable, with net margin at 0.25% and ROE at 0.3%, indicating weak earnings generation. Liquidity ratios show a mixed picture: the quick ratio is favorable at 1.13 while the current ratio is neutral at 1.41. Leverage metrics such as debt-to-equity (0.79) and debt-to-assets (36.18%) are neutral, suggesting moderate risk. However, a high price-to-earnings ratio of 928.9 and low interest coverage ratio of 1.74 are unfavorable, contributing to an overall slightly unfavorable financial ratio assessment.

Shareholder Return Policy

Charles River Laboratories International, Inc. (CRL) does not pay dividends, reflecting a focus on reinvestment and growth rather than immediate shareholder payouts. The company maintains a dividend payout ratio of 0 and zero dividend yield, with no indication of share buyback programs.

This approach aligns with CRL’s financials, showing modest net profit margins and positive free cash flow supporting capital expenditures. The absence of distributions appears consistent with sustainable long-term value creation through operational reinvestment rather than cash returns to shareholders.

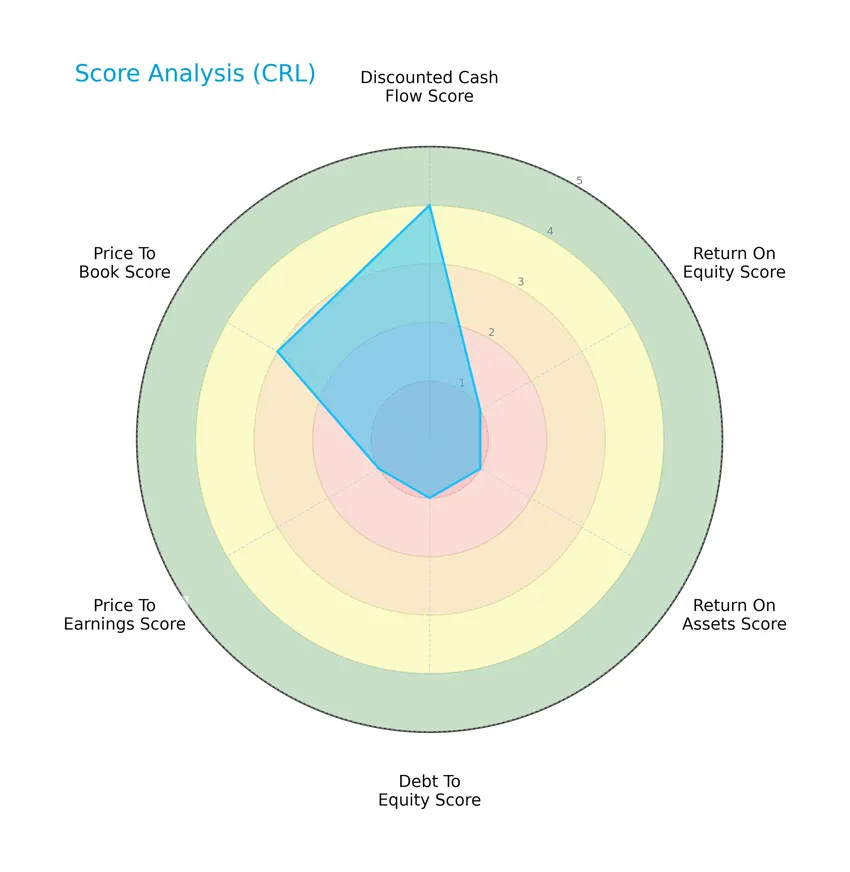

Score analysis

Here is a radar chart illustrating Charles River Laboratories International, Inc.’s key financial scores across several valuation and performance metrics:

The company shows a favorable discounted cash flow score of 4 but faces challenges with very unfavorable scores of 1 in return on equity, return on assets, debt to equity, and price to earnings. The price to book score is moderate at 3, reflecting mixed financial signals.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the grey zone, indicating a moderate risk of bankruptcy and financial uncertainty:

Is the company in good financial health?

This Piotroski diagram presents the company’s current financial strength assessment:

With a Piotroski score of 5, Charles River Laboratories International, Inc. demonstrates average financial health, suggesting neither strong nor weak fundamentals based on profitability, leverage, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will explore Charles River Laboratories International, Inc.’s strategic positioning, revenue streams, key products, main competitors, and overall market context. I will also examine whether the company holds a competitive advantage over its rivals in the medical diagnostics and research industry.

Strategic Positioning

Charles River Laboratories International, Inc. maintains a diversified product portfolio across three main segments: Discovery and Safety Assessment ($2.45B in 2024), Manufacturing Support ($770M), and Research Models and Services ($830M). Geographically, it operates broadly with significant revenue from the United States ($2.24B), Europe ($1.08B), Canada ($482M), and Asia Pacific ($197M).

Revenue by Segment

This pie chart displays Charles River Laboratories’ revenue distribution by segment for the fiscal year 2024, illustrating the company’s business focus areas.

In 2024, Discovery and Safety Assessment remained the largest revenue driver at $2.45B, showing a slight decline from $2.62B in 2023 but still dominating the portfolio. Research Models and Services generated $829M, continuing steady growth, while Manufacturing Support contributed $769M, reflecting moderate gains. The revenue mix indicates a strong concentration in Discovery and Safety Assessment, though recent trends suggest a cautious outlook due to its slight slowdown.

Key Products & Brands

The table below presents Charles River Laboratories’ main products and services across its operating segments:

| Product | Description |

|---|---|

| Research Models and Services | Produces and sells rodent research model strains, genetically engineered models, and provides diagnostic and insourcing services supporting non-clinical drug research. |

| Discovery and Safety Assessment | Offers early discovery services for drug candidates, safety assessment including toxicology, pathology, pharmacokinetics, and bioanalysis. |

| Manufacturing Support | Provides quality control testing of pharmaceuticals and biologics, avian vaccine services, and contract vivarium operations. |

Charles River Laboratories operates through three core segments focused on supporting drug discovery, safety testing, and manufacturing quality control, serving biopharmaceutical clients globally.

Main Competitors

There are 11 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10B |

Charles River Laboratories ranks 10th among its 11 competitors, with a market cap approximately 4.8% that of the sector leader, Thermo Fisher Scientific. It is positioned below both the average market cap of the top 10 competitors (61.3B) and the median market cap in the sector (28.8B). The company maintains a 7.72% market cap gap with its closest competitor above, Revvity, Inc.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CRL have a competitive advantage?

Charles River Laboratories International, Inc. currently does not present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s overall income statement evaluation is unfavorable, with declining net margin and earnings per share over the recent period.

Looking ahead, Charles River Laboratories operates across multiple geographic markets including the United States, Europe, Canada, and Asia Pacific, providing diversified drug discovery and safety testing services. Future opportunities may arise from its three segments—Research Models and Services, Discovery and Safety Assessment, and Manufacturing Solutions—potentially supporting growth through new product innovations and expanded market reach.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Charles River Laboratories International, Inc. to guide strategic investment decisions.

Strengths

- Strong market position in non-clinical contract research

- Diversified global presence across US, Europe, Canada, Asia Pacific

- Favorable gross margin of 32.88%

Weaknesses

- Declining profitability with net margin at 0.25%

- Negative net income growth over recent years

- High PE ratio indicating overvaluation risk

Opportunities

- Increasing demand for drug discovery and safety testing services

- Expansion potential in emerging biotech markets

- Growth in specialized biologics and vaccine testing

Threats

- Intense competition in CRO industry

- Regulatory changes impacting testing protocols

- Economic downturns affecting pharmaceutical R&D budgets

Overall, Charles River Laboratories possesses solid market strengths but faces profitability challenges and valuation concerns. Strategic focus on innovation and geographic expansion could help mitigate risks and improve financial health.

Stock Price Action Analysis

The weekly stock chart of Charles River Laboratories International, Inc. (CRL) over the past 12 months reveals price fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, CRL’s stock price declined by 16.93%, indicating a bearish trend with accelerating downward momentum. The stock showed high volatility, with a standard deviation of 35.43, reaching a high of 272.57 and a low of 99.75. However, from November 9, 2025, to January 25, 2026, the stock rebounded 30.68%, reflecting a short-term bullish correction with reduced volatility.

Volume Analysis

Trading volume for CRL has been increasing overall, with a total volume of 481M shares and a slight buyer dominance at 52.44%. In the recent period from November 9, 2025, to January 25, 2026, volume shows a slight seller dominance of 44.33% buyers, suggesting cautious investor sentiment and moderate market participation.

Target Prices

The target price consensus for Charles River Laboratories International, Inc. (CRL) reflects a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 260 | 185 | 214.43 |

Analysts expect CRL’s stock to trade within a range of 185 to 260, with a consensus target price around 214, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback related to Charles River Laboratories International, Inc. (CRL).

Stock Grades

The following table summarizes recent stock grades assigned to Charles River Laboratories International, Inc. by leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-13 |

| Mizuho | Maintain | Neutral | 2025-12-18 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-11 |

| TD Cowen | Maintain | Buy | 2025-11-10 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Upgrade | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

Overall, the grading trend for Charles River Laboratories is broadly positive, with multiple firms maintaining Buy or Outperform ratings and few neutral positions. There is a clear absence of Sell or Strong Sell grades, reflecting a generally favorable analyst sentiment.

Consumer Opinions

Charles River Laboratories International, Inc. (CRL) has garnered a mix of praise and constructive criticism from its consumer base, reflecting both its industry strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent customer support and timely responses.” | “Pricing can be quite high for smaller clients.” |

| “High-quality research models that meet our needs.” | “Occasional delays in order fulfillment.” |

| “Strong expertise and reliable scientific data.” | “Communication sometimes lacks clarity.” |

Overall, consumers appreciate CRL’s expertise and quality of service, but some express concerns over pricing and occasional communication issues. The company’s reputation for reliability remains strong despite these challenges.

Risk Analysis

Below is a summary table outlining key risks associated with Charles River Laboratories International, Inc. for investor consideration:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Performance | Unfavorable profitability metrics including low net margin (0.25%) and ROE (0.3%). | Medium | High |

| Market Volatility | High beta of 1.616 indicates above-average stock price volatility, increasing investment risk. | High | Medium |

| Debt and Liquidity | Moderate debt-to-assets ratio at 36.18% and unfavorable interest coverage ratio of 1.74. | Medium | Medium |

| Valuation | Extremely high P/E ratio (928.9) suggests potential overvaluation risk. | High | High |

| Bankruptcy Risk | Altman Z-Score of 2.59 places the company in the “grey zone,” indicating moderate bankruptcy risk. | Medium | High |

| Dividend Policy | No dividend yield, which could impact income-focused investors. | Low | Low |

The most pressing risks are the company’s high valuation multiples combined with weak profitability ratios and moderate financial distress signals. These factors suggest caution, especially given the stock’s volatility and debt service challenges in a healthcare sector environment that demands consistent innovation and regulatory compliance.

Should You Buy Charles River Laboratories International, Inc.?

Charles River Laboratories appears to be experiencing eroding operational efficiency with a declining return on invested capital and a leverage profile that suggests substantial debt burden. Despite these challenges, the company’s rating could be seen as moderate (C), reflecting a mixed financial health profile and a very unfavorable competitive moat.

Strength & Efficiency Pillars

Charles River Laboratories International, Inc. shows a mixed financial profile with limited profitability and moderate financial health. The Altman Z-score stands at 2.59, placing the company in the grey zone, signaling moderate bankruptcy risk. The Piotroski score of 5 reflects average financial strength. However, key profitability metrics remain weak: net margin is only 0.25%, return on equity is 0.3%, and return on invested capital (ROIC) is 0.95%, all indicating low operational efficiency. Given ROIC (0.95%) is well below the WACC (9.85%), the company is currently a value destroyer rather than a creator.

Weaknesses and Drawbacks

Several unfavorable metrics highlight substantial risks for investors. The extraordinarily high price-to-earnings ratio of 928.9 suggests the stock is priced at a significant premium relative to earnings, raising valuation concerns. Leverage metrics are mixed; debt-to-equity at 0.79 is neutral, but interest coverage of 1.74 is unfavorable, indicating limited ability to service debt comfortably. Additionally, the recent seller dominance with buyers representing only 44.33% of volume introduces short-term market pressure. Operating performance is also challenged by a 97.8% decline in EPS over one year, signaling deteriorating profitability.

Our Verdict about Charles River Laboratories International, Inc.

The company’s long-term fundamental profile appears unfavorable due to weak profitability and value destruction. While recent price action shows a bullish trend with a 30.68% increase since November 2025, the slightly seller-dominant volume in the most recent period suggests cautious sentiment. Despite some moderate financial health indicators, the profile may suggest a wait-and-see approach, as the current valuation premium and operational weakness could weigh on near-term performance.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Charles River Laboratories International (NYSE:CRL) Downgraded to Hold Rating by Wall Street Zen – MarketBeat (Jan 24, 2026)

- Charles River Laboratories Schedules Fourth-Quarter 2025 Earnings and 2026 Guidance Release and Conference Call – Yahoo Finance (Jan 21, 2026)

- Charles River Laboratories Investigation Initiated: Kahn Swick & Foti, LLC Investigates the Officers and Directors of Charles River Laboratories International, Inc. – CRL – PR Newswire (Jan 20, 2026)

- A Look At Charles River Laboratories (CRL) Valuation After Recent Share Price Momentum – simplywall.st (Jan 23, 2026)

- What to expect from Charles River Laboratories’ next quarterly earnings report – MSN (Jan 19, 2026)

For more information about Charles River Laboratories International, Inc., please visit the official website: criver.com