Home > Analyses > Basic Materials > CF Industries Holdings, Inc.

CF Industries Holdings, Inc. powers global agriculture by producing essential nitrogen and hydrogen products that sustain crop growth and food supply chains worldwide. As a dominant force in agricultural inputs, CF stands out with its range of fertilizers and emissions solutions, backed by decades of innovation and operational excellence. With a strong market presence and commitment to sustainability, the critical question now is whether CF’s solid fundamentals can drive continued growth and justify its current valuation in an evolving global market.

Table of contents

Business Model & Company Overview

CF Industries Holdings, Inc., founded in 1946 and headquartered in Deerfield, Illinois, is a leading player in the Agricultural Inputs sector. It operates a comprehensive ecosystem centered on manufacturing and selling hydrogen and nitrogen-based products, including anhydrous ammonia, granular urea, and ammonium nitrate. These core products serve as essential inputs for energy, fertilizer, and industrial applications, creating a tightly integrated portfolio that supports global agriculture and industry.

The company’s revenue engine combines sales of chemical fertilizers and related industrial products with a strategic presence across the Americas, Europe, and Asia. By balancing core product manufacturing with specialized offerings such as diesel exhaust fluid and compound fertilizers, CF Industries delivers consistent value to cooperatives, distributors, and industrial users worldwide. Its robust global footprint and diversified product suite form a competitive advantage that underpins its role in shaping the future of sustainable agriculture.

Financial Performance & Fundamental Metrics

In this section, I analyze CF Industries Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its investment potential.

Income Statement

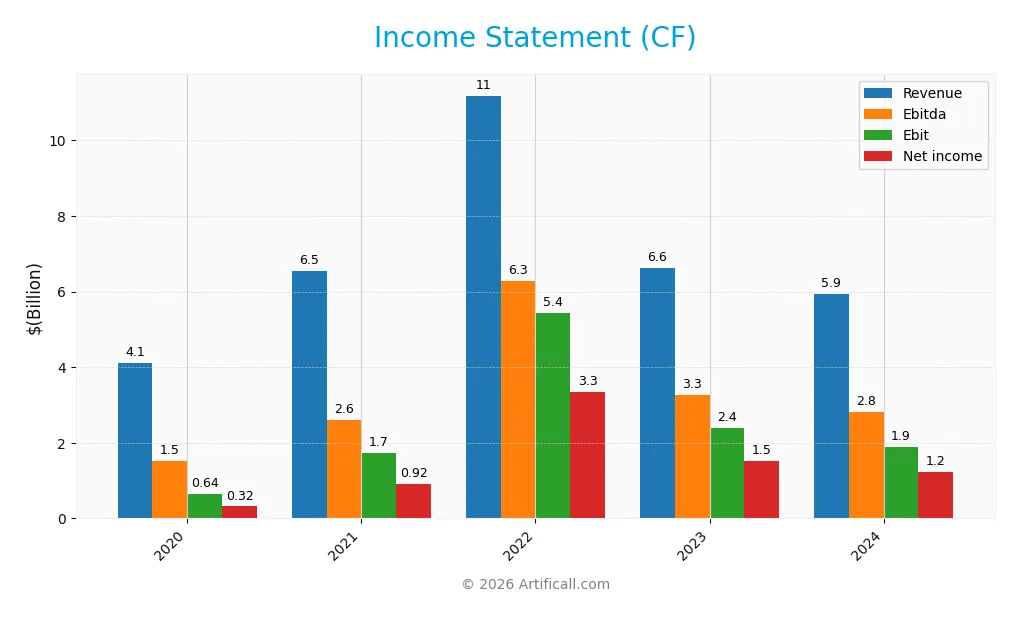

The table below summarizes CF Industries Holdings, Inc.’s key income statement figures for the fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.12B | 6.54B | 11.19B | 6.63B | 5.94B |

| Cost of Revenue | 3.29B | 4.18B | 5.29B | 3.99B | 3.88B |

| Operating Expenses | 206M | 223M | 290M | 289M | 310M |

| Gross Profit | 834M | 2.36B | 5.89B | 2.65B | 2.06B |

| EBITDA | 1.53B | 2.61B | 6.28B | 3.27B | 2.83B |

| EBIT | 642M | 1.73B | 5.44B | 2.40B | 1.90B |

| Interest Expense | 179M | 184M | 344M | 150M | 121M |

| Net Income | 317M | 917M | 3.35B | 1.53B | 1.22B |

| EPS | 1.48 | 4.27 | 16.46 | 7.89 | 6.75 |

| Filing Date | 2021-02-24 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-20 |

Income Statement Evolution

From 2020 to 2024, CF Industries Holdings, Inc. experienced overall revenue growth of 43.94%, despite a 10.48% decline in revenue from 2023 to 2024. Net income surged by 284.23% over the period but dropped 20.3% year-over-year in 2024. Gross and net margins remained favorable at 34.64% and 20.52%, respectively, though both saw declines in the most recent year.

Is the Income Statement Favorable?

In 2024, CF Industries reported revenue of $5.94B and net income of $1.22B, reflecting contraction compared to 2023. Margins stayed solid with a 32.02% EBIT margin and a low 2.04% interest expense ratio, supporting operational efficiency. Despite recent declines in growth metrics, the overall income statement quality remains favorable, with 57.14% of key indicators positive, signaling generally sound financial fundamentals.

Financial Ratios

The following table presents key financial ratios for CF Industries Holdings, Inc. over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.7% | 14.0% | 29.9% | 23.0% | 20.5% |

| ROE | 10.8% | 28.6% | 66.2% | 26.7% | 24.4% |

| ROIC | 5.1% | 15.8% | 34.9% | 14.1% | 11.5% |

| P/E | 26.2 | 16.6 | 5.2 | 10.1 | 12.6 |

| P/B | 2.85 | 4.75 | 3.43 | 2.69 | 3.09 |

| Current Ratio | 1.51 | 1.81 | 3.69 | 3.81 | 3.08 |

| Quick Ratio | 1.19 | 1.53 | 3.22 | 3.44 | 2.70 |

| D/E | 1.45 | 1.16 | 0.64 | 0.57 | 0.65 |

| Debt-to-Assets | 35.1% | 30.0% | 24.2% | 22.5% | 24.1% |

| Interest Coverage | 3.5 | 11.6 | 16.3 | 15.7 | 14.4 |

| Asset Turnover | 0.34 | 0.53 | 0.84 | 0.46 | 0.44 |

| Fixed Asset Turnover | 0.52 | 0.89 | 1.67 | 0.90 | 0.85 |

| Dividend Yield | 3.1% | 1.7% | 1.8% | 2.0% | 2.4% |

Evolution of Financial Ratios

From 2020 to 2024, CF Industries Holdings, Inc. showed a fluctuating but generally improving return on equity (ROE), peaking around 66% in 2022 before settling at 24.4% in 2024. The current ratio remained elevated, above 3 in recent years, indicating strong liquidity though it slightly declined from 3.81 in 2023 to 3.08 in 2024. The debt-to-equity ratio decreased from 1.45 in 2020 to about 0.65 in 2024, reflecting reduced financial leverage and improved balance sheet stability.

Are the Financial Ratios Favorable?

In 2024, profitability metrics such as net margin (20.5%), ROE (24.4%), and return on invested capital (11.5%) were rated favorable, signaling solid earnings performance. Liquidity shows mixed signals: the quick ratio (2.7) is favorable, but the current ratio (3.08) is considered unfavorable, possibly due to excessive current assets. Leverage ratios are mostly favorable or neutral, with debt-to-assets at 24.1% favorable and debt-to-equity neutral at 0.65. Efficiency ratios like asset turnover (0.44) and fixed asset turnover (0.85) are unfavorable, indicating room for operational improvement. Overall, about 64% of ratios are favorable, supporting a generally positive financial profile.

Shareholder Return Policy

CF Industries Holdings, Inc. maintains a consistent dividend policy with a payout ratio near 30% and a dividend yield around 2.3% in 2024. Dividends per share have steadily increased over recent years, supported by strong free cash flow coverage. The company also engages in share buybacks, complementing its cash returns to shareholders.

This balanced distribution approach appears sustainable given the firm’s solid profitability and cash flow metrics. The moderate payout ratio and buyback activity suggest a prudent risk profile, aligning with long-term value creation without overextending financial resources or compromising growth investments.

Score analysis

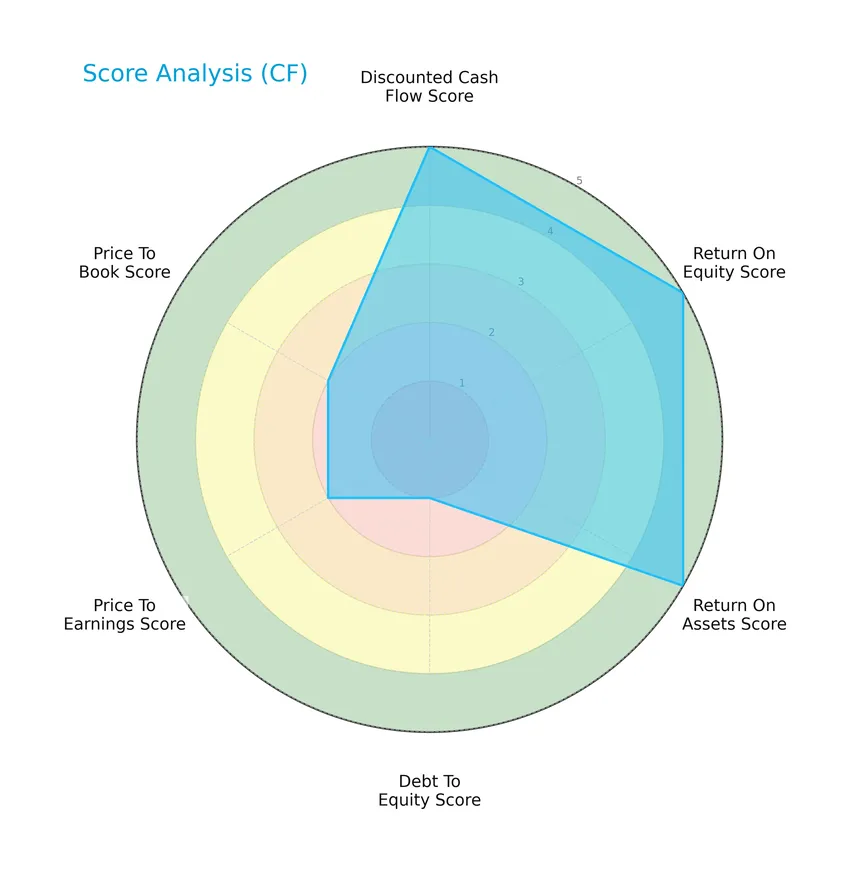

Here is a radar chart illustrating the company’s key financial scores for an overall perspective:

CF Industries Holdings, Inc. shows very favorable scores in discounted cash flow, return on equity, and return on assets, suggesting strong profitability. However, its debt-to-equity score is very unfavorable, indicating higher leverage risk. Valuation metrics like price-to-earnings and price-to-book ratios are moderate.

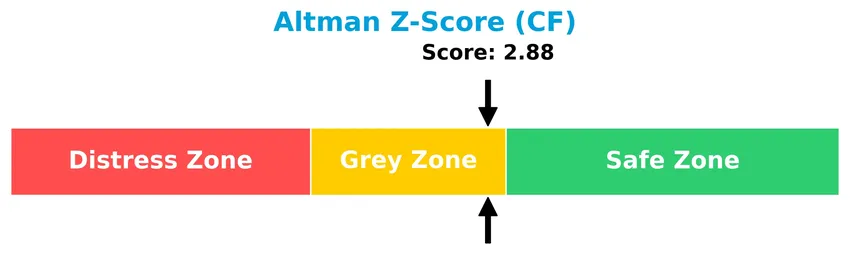

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the grey zone, indicating a moderate risk of bankruptcy and some financial uncertainty:

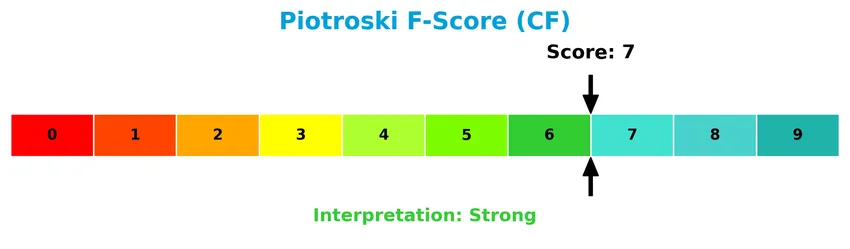

Is the company in good financial health?

The following Piotroski diagram presents the company’s financial strength assessment:

With a Piotroski Score of 7, CF Industries Holdings, Inc. demonstrates strong financial health, reflecting solid profitability, liquidity, and operational efficiency according to this measure.

Competitive Landscape & Sector Positioning

This sector analysis will examine CF Industries Holdings, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether CF Industries holds a competitive advantage over its peers in the agricultural inputs industry.

Strategic Positioning

CF Industries Holdings, Inc. focuses on a concentrated product portfolio mainly comprising ammonia, UAN, urea, and ammonium nitrate, generating over $5.6B in 2024. Geographically, it is predominantly US-centric, with $4.5B of $6.0B total revenue from the United States, reflecting limited international diversification.

Revenue by Segment

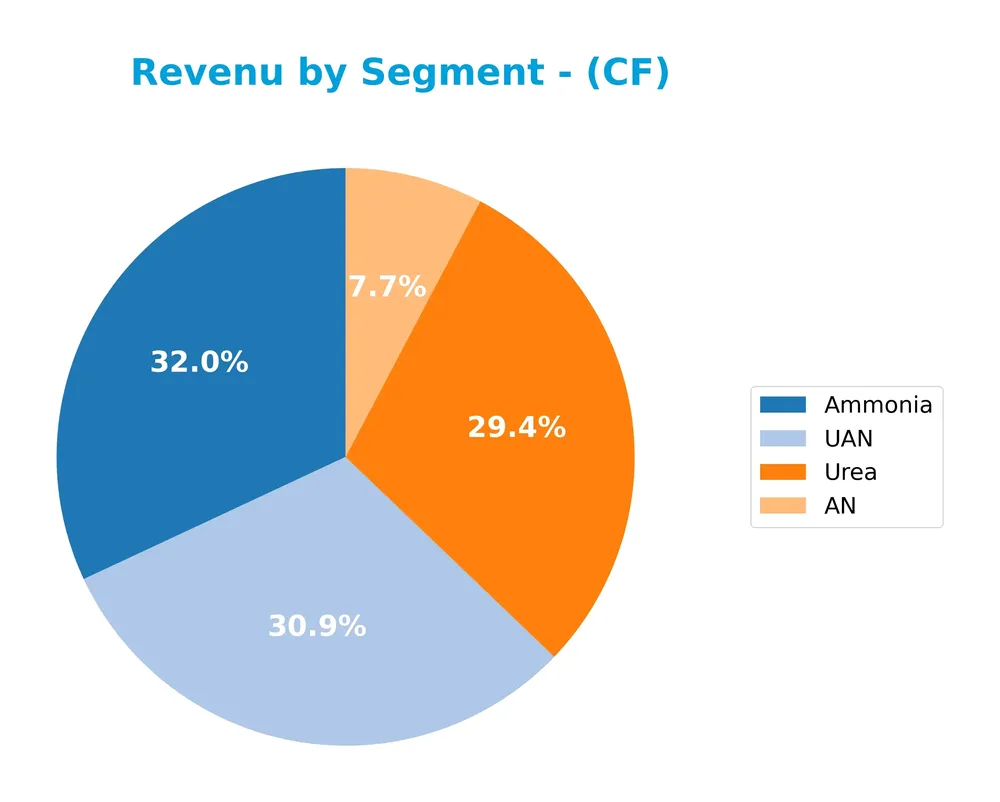

This pie chart illustrates CF Industries Holdings, Inc.’s revenue distribution by product segments for the fiscal year 2024, highlighting key contributors to the company’s income.

In 2024, CF Industries’ revenue is primarily driven by Ammonia at 1.74B, UAN at 1.68B, and Urea at 1.60B, with AN contributing 419M. The focus on these nitrogen-based fertilizers indicates a stable product mix with no sudden shifts. Compared to earlier years where geographic segmentation appeared, 2024 data emphasizes product lines, showing consistent concentration in core fertilizer products without notable acceleration or decline.

Key Products & Brands

The table below highlights CF Industries Holdings, Inc.’s principal products and their descriptions:

| Product | Description |

|---|---|

| Anhydrous Ammonia | A key hydrogen and nitrogen product used in energy, fertilizer, emissions abatement, and industry. |

| Granular Urea | A nitrogen fertilizer product contributing significantly to agricultural inputs. |

| Urea Ammonium Nitrate (UAN) | A nitrogen-based fertilizer solution widely used by cooperatives and distributors. |

| Ammonium Nitrate (AN) | Fertilizer product serving industrial and agricultural markets. |

| Diesel Exhaust Fluid | Product for emissions control in diesel engines. |

| Urea Liquor | Liquid form of urea used in various industrial applications. |

| Nitric Acid | Chemical product serving industrial processes. |

| Aqua Ammonia | Ammonia dissolved in water, used in fertilizer and industrial uses. |

| Compound Fertilizers | Fertilizers containing nitrogen, phosphorus, and potassium. |

CF Industries focuses on a diverse range of nitrogen-based fertilizers and related chemicals, primarily serving agricultural and industrial customers worldwide. Revenue from major products like ammonia, urea, UAN, and ammonium nitrate forms the core of its business.

Main Competitors

There are 3 competitors in the Agricultural Inputs industry; the table below lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Corteva, Inc. | 45.8B |

| CF Industries Holdings, Inc. | 13.3B |

| The Mosaic Company | 7.9B |

CF Industries Holdings, Inc. ranks 2nd among its competitors with a market cap at 32.7% of the leader, Corteva, Inc. The company is below the average market cap of the top 10 in its sector but remains above the median market cap for Agricultural Inputs. It holds a significant 206.0% market cap gap to the next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CF have a competitive advantage?

CF Industries Holdings, Inc. demonstrates a durable competitive advantage, supported by a very favorable moat evaluation with a ROIC exceeding WACC by 5.17% and a strong upward trend in ROIC over the 2020-2024 period. This indicates efficient use of invested capital and consistent value creation for shareholders.

Looking ahead, CF Industries benefits from a broad product portfolio in hydrogen and nitrogen products serving global agricultural and industrial markets. Opportunities for growth may arise from expanding its offerings in emissions abatement solutions and compound fertilizers, potentially strengthening its market position in both US and non-US regions.

SWOT Analysis

This SWOT analysis highlights key internal and external factors that impact CF Industries Holdings, Inc.’s strategic positioning and investment potential.

Strengths

- strong profitability with 20.5% net margin

- durable competitive advantage with growing ROIC

- favorable financial ratios including 24.4% ROE

Weaknesses

- recent 1-year revenue decline of 10.5%

- moderate debt-to-equity ratio with unfavorable score

- asset turnover below industry average

Opportunities

- expanding demand for agricultural inputs globally

- potential to increase non-US market share

- innovation in emissions abatement products

Threats

- volatility in raw material costs

- regulatory risks in environmental policies

- competition from alternative fertilizer producers

Overall, CF Industries demonstrates solid financial health and a durable competitive moat, but recent revenue declines and moderate leverage require cautious monitoring. The company’s growth strategy should focus on geographic expansion and product innovation while managing market and regulatory risks.

Stock Price Action Analysis

The following weekly stock chart illustrates CF Industries Holdings, Inc.’s price movements over the past 12 months:

Trend Analysis

Over the past 12 months, CF stock price increased by 11.98%, indicating a bullish trend with acceleration. The highest price reached 100.36, and the lowest was 70.14. Recent data from November 2025 to January 2026 shows a 12.62% gain with a positive slope of 0.57 and reduced volatility, confirming continued upward momentum.

Volume Analysis

Trading volume has been increasing, with a total volume exceeding 1.33B shares and buyer volume representing 52.46%. In the recent period, buyers slightly dominated with 54.17%, suggesting growing investor participation and a moderately bullish sentiment in the market.

Target Prices

The consensus target price for CF Industries Holdings, Inc. reflects cautious optimism among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 90 | 86 | 88.2 |

Analysts expect the stock price to trade within a narrow range, indicating moderate confidence in its near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback relevant to CF Industries Holdings, Inc. (CF).

Stock Grades

The following table presents recent stock grades for CF Industries Holdings, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-20 |

| JP Morgan | Maintain | Neutral | 2026-01-15 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Mizuho | Maintain | Neutral | 2025-12-18 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| Scotiabank | Maintain | Sector Perform | 2025-11-10 |

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Mizuho | Maintain | Neutral | 2025-11-06 |

| UBS | Maintain | Neutral | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-16 |

The consensus grades show a stable outlook with most firms maintaining their neutral or sector perform ratings, while Wells Fargo consistently rates the stock as overweight, indicating some divergence in market sentiment among analysts.

Consumer Opinions

CF Industries Holdings, Inc. has garnered mixed consumer sentiment, reflecting both appreciation and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable supply chain and consistent product quality. | Customer service can be slow to respond. |

| Competitive pricing compared to industry peers. | Limited availability during peak demand periods. |

| Strong commitment to sustainability and environmental standards. | Occasional delays in order fulfillment reported. |

Overall, consumers praise CF Industries for its product reliability and competitive pricing but frequently mention challenges with customer service responsiveness and occasional supply delays.

Risk Analysis

Below is a summary table of key risks related to CF Industries Holdings, Inc., highlighting their likelihood and potential impact on investment outcomes:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Price fluctuations due to commodity cycles and agricultural sector sensitivity | High | High |

| Leverage Risk | Moderate debt-to-equity ratio with low debt coverage score indicating financial risk | Medium | Medium |

| Operational Risk | Unfavorable asset turnover ratios may signal inefficiencies affecting profitability | Medium | Medium |

| Regulatory Risk | Changes in environmental and agricultural regulations impacting production and sales | Medium | High |

| Dividend Stability | Dividend yield is favorable but depends on sustained earnings and cash flow | Low | Medium |

The most significant risks for CF Industries are market volatility driven by fluctuating fertilizer demand and regulatory shifts, which can heavily impact profitability. Despite a solid financial base, the grey zone Altman Z-Score suggests some caution in credit risk, and operational inefficiencies should be monitored closely.

Should You Buy CF Industries Holdings, Inc.?

CF Industries Holdings, Inc. appears to be characterized by improving profitability and a durable competitive moat supported by growing ROIC, while its leverage profile could be seen as substantial. Overall, the company suggests a financially favorable profile with an A- rating.

Strength & Efficiency Pillars

CF Industries Holdings, Inc. exhibits robust profitability metrics with a net margin of 20.52% and a return on equity of 24.43%, underscoring efficient capital utilization. Its return on invested capital (ROIC) stands at 11.49%, comfortably above the weighted average cost of capital (WACC) of 6.32%, confirming that the company is a clear value creator. Financial health indicators are positive, with a strong Piotroski score of 7 and an Altman Z-score of 2.88 placing it in the grey zone but indicating moderate distress risk. These pillars highlight CF’s durable competitive advantage and growing profitability.

Weaknesses and Drawbacks

Despite favorable profitability, valuation and certain liquidity metrics present concerns. The price-to-book ratio of 3.09 is marked as unfavorable, suggesting the stock may be trading at a premium relative to its book value. The current ratio of 3.08 also signals potential inefficiencies in working capital management. While debt-to-equity is moderate at 0.65, it is classified as neutral, warranting cautious monitoring. Additionally, asset turnover ratios (0.44 and 0.85 for fixed assets) are unfavorable, indicating challenges in asset utilization that could hamper growth scalability.

Our Verdict about CF Industries Holdings, Inc.

The company’s long-term fundamental profile appears favorable, driven by strong profitability and value creation metrics. Coupled with a bullish overall stock trend and slightly buyer-dominant recent period, CF Industries may appear attractive for investors seeking exposure to a value-creating enterprise with solid financial health. However, the moderate valuation concerns and liquidity inefficiencies suggest that investors might consider a measured approach, balancing growth potential against these operational risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- CF Industries Holdings Inc. stock outperforms competitors on strong trading day – MarketWatch (Jan 23, 2026)

- What CF Industries Holdings (CF)’s Low-Carbon Ammonia Shipping Push Means For Shareholders – simplywall.st (Jan 23, 2026)

- CF Industries Holdings, Inc. Announces Planned Schedule for Quarterly Financial Results to be Released in 2026 – Yahoo Finance (Jan 21, 2026)

- CF Industries Holdings, Inc. $CF Shares Sold by Vest Financial LLC – MarketBeat (Jan 22, 2026)

- CF Industries (CF) Sees Notable Gains in Morning Trading – GuruFocus (Jan 23, 2026)

For more information about CF Industries Holdings, Inc., please visit the official website: cfindustries.com