Home > Analyses > Technology > CEVA, Inc.

CEVA, Inc. powers the invisible brains behind today’s smart devices, enabling seamless wireless connectivity and intelligent sensing. As a pioneer in digital signal processors and AI platforms, CEVA licenses cutting-edge technologies that drive 5G, IoT, and advanced imaging across diverse industries. Renowned for innovation and quality, CEVA shapes the future of embedded intelligence. The key question now: does CEVA’s current valuation reflect its growth potential and expanding market influence?

Table of contents

Business Model & Company Overview

CEVA, Inc. is a Rockville, Maryland-based licensor founded in 1999, specializing in digital signal processors and AI technologies. It serves a global semiconductor market with a core business centered on wireless connectivity and smart sensing. CEVA’s ecosystem integrates DSP-based platforms for 5G, imaging, voice, and IoT applications, uniting hardware and software to empower OEMs and semiconductor firms worldwide.

The company drives revenue by licensing IP solutions, combining hardware description language cores with software development kits and tools. CEVA’s reach spans Americas, Europe, and Asia, supporting markets from mobile to automotive and defense. Its competitive advantage lies in a broad technology portfolio that fortifies its economic moat, positioning CEVA as a key architect in shaping the future of smart connectivity and AI-enabled devices.

Financial Performance & Fundamental Metrics

I analyze CEVA, Inc.’s income statement, key financial ratios, and dividend payout policy to assess the company’s profitability and capital allocation efficiency.

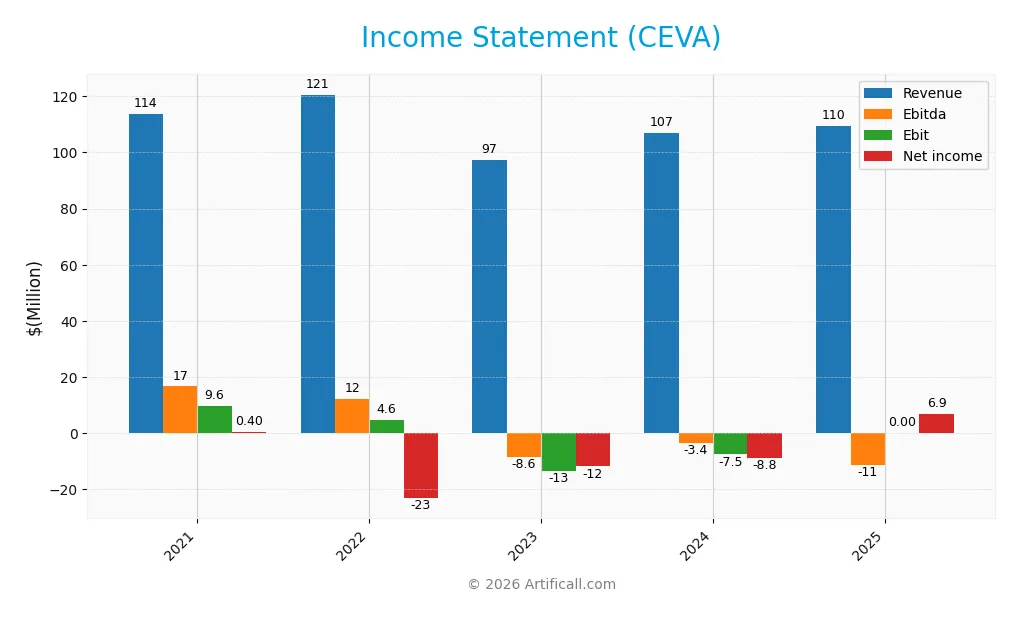

Income Statement

The table below summarizes CEVA, Inc.’s key income statement figures for the fiscal years 2021 through 2025, reflecting revenue, profitability, and earnings per share trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 114B | 121B | 97B | 107B | 110B |

| Cost of Revenue | 10B | 15B | 12B | 13B | 14B |

| Operating Expenses | 96B | 102B | 99B | 102B | 106B |

| Gross Profit | 103B | 105B | 86B | 94B | 95B |

| EBITDA | 17B | 12B | -9B | -3B | -11B |

| EBIT | 9.6B | 4.6B | -13B | -7.5B | 0 |

| Interest Expense | 420M | 397M | 0 | 0 | 0 |

| Net Income | 396M | -23B | -12B | -9B | 7B |

| EPS | 0.017 | -1.00 | -0.51 | -0.37 | -0.44 |

| Filing Date | 2022-03-01 | 2023-03-01 | 2024-03-07 | 2025-02-27 | 2026-02-17 |

Income Statement Evolution

CEVA’s revenue showed a mild decline of 3.7% over 2021-2025, with a slight 2.5% growth in the last year. Gross profit remained stable, reflecting an 87% gross margin labeled favorable. Operating expenses grew in line with revenue, but EBIT margin stayed flat at 0%, marking a challenging profitability environment despite improving net margins.

Is the Income Statement Favorable?

In 2025, CEVA reported $110M revenue and $6.9M net income, yielding a 6.3% net margin classified as favorable. EBIT broke even, signaling operational strain. The company had no interest expense, supporting financial stability. Despite a modest top-line increase, earnings per share declined, reflecting ongoing margin pressures and investment in R&D. Overall, fundamentals appear cautiously favorable.

Financial Ratios

The table below presents key financial ratios for CEVA, Inc. over the fiscal years 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 0.3% | -19.2% | -12.2% | -8.2% | 6.3% |

| ROE | 0.1% | -8.9% | -4.5% | -3.3% | 2.1% |

| ROIC | 0.6% | -4.6% | -4.8% | -2.7% | -3.1% |

| P/E | 2492 | -25.6 | -44.9 | -84.8 | 75.6 |

| P/B | 3.57 | 2.29 | 2.02 | 2.79 | 1.55 |

| Current Ratio | 5.33 | 5.34 | 7.79 | 7.09 | 9.93 |

| Quick Ratio | 5.33 | 5.34 | 7.79 | 7.09 | 9.93 |

| D/E | 0.03 | 0.03 | 0.02 | 0.02 | 0.05 |

| Debt-to-Assets | 2.5% | 2.6% | 2.1% | 1.8% | 4.2% |

| Interest Coverage | 16.8 | 9.8 | 0.0 | 0.0 | 0.0 |

| Asset Turnover | 0.34 | 0.39 | 0.32 | 0.35 | 0.28 |

| Fixed Asset Turnover | 7.30 | 7.98 | 7.11 | 8.43 | 4.47 |

| Dividend Yield | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Evolution of Financial Ratios

Return on Equity (ROE) for CEVA, Inc. remained low, ending at 2.05% in 2025. The Current Ratio increased sharply to 9.93, indicating improved short-term liquidity. Debt-to-Equity Ratio stayed minimal at 0.05, reflecting stable leverage. Profitability showed a slight rebound with net margin rising to 6.31%, after prior negative margins.

Are the Financial Ratios Favorable?

CEVA’s 2025 financial ratios reveal mixed signals. Profitability is neutral with a modest net margin but unfavorable ROE and negative ROIC versus a 10.43% WACC, signaling weak capital returns. Liquidity is mixed: a very high Current Ratio is unfavorable, while Quick Ratio is favorable. Leverage ratios are favorable, showing low debt. Market multiples like P/E at 75.63 indicate overvaluation risk. Overall, ratios lean unfavorable.

Shareholder Return Policy

CEVA, Inc. does not pay dividends, reflecting its reinvestment strategy amid volatile profitability and a high-growth phase. The company maintains no dividend payout but does not engage in share buybacks, focusing capital on R&D and operational improvements.

This approach aligns with long-term value creation given CEVA’s improving net income margin and strong liquidity ratios. However, lack of shareholder distributions may concern income-focused investors, highlighting the importance of monitoring operational cash flow and sustainable capital allocation.

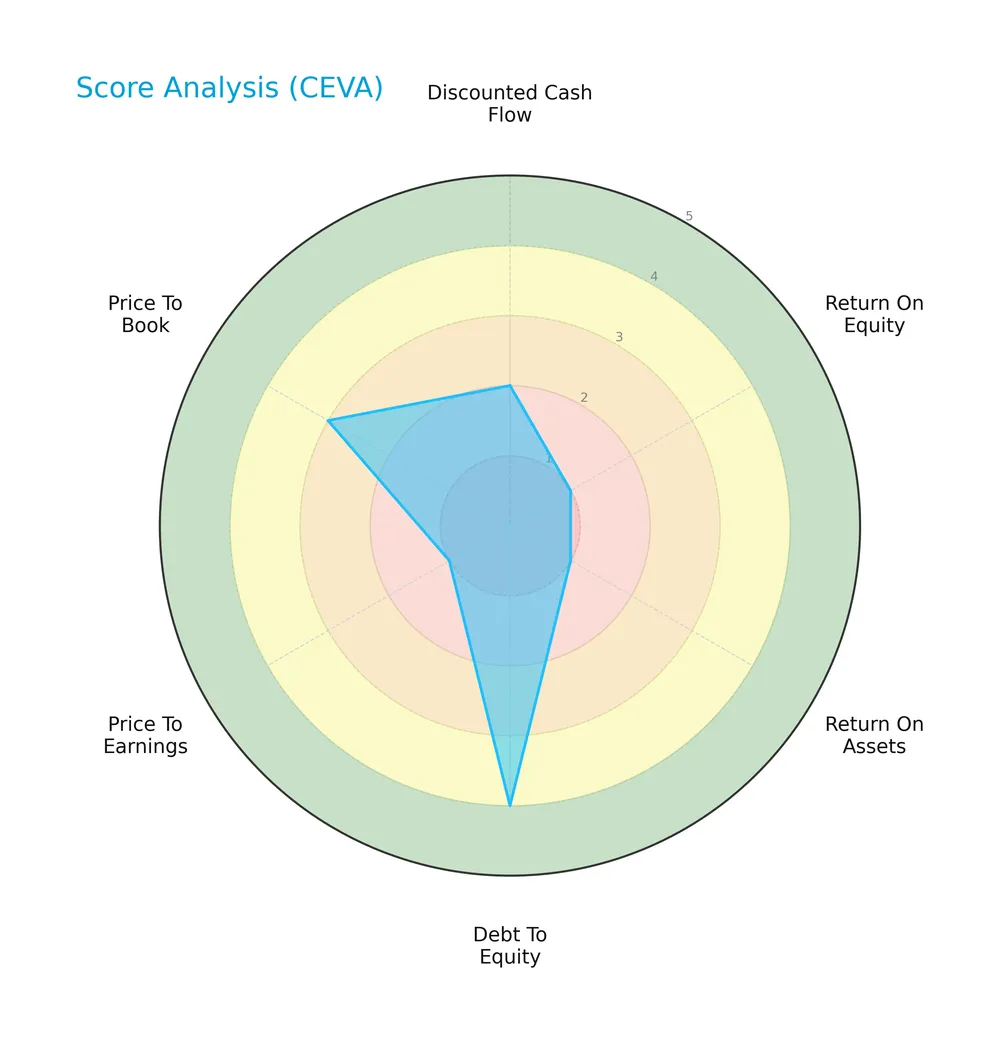

Score analysis

The radar chart below highlights CEVA, Inc.’s valuation and financial performance scores across key metrics:

CEVA shows strong debt management with a debt-to-equity score of 4. However, profitability scores lag significantly, with return on equity and assets both scoring 1. Valuation metrics are mostly unfavorable, except for a moderate price-to-book score of 3.

Analysis of the company’s bankruptcy risk

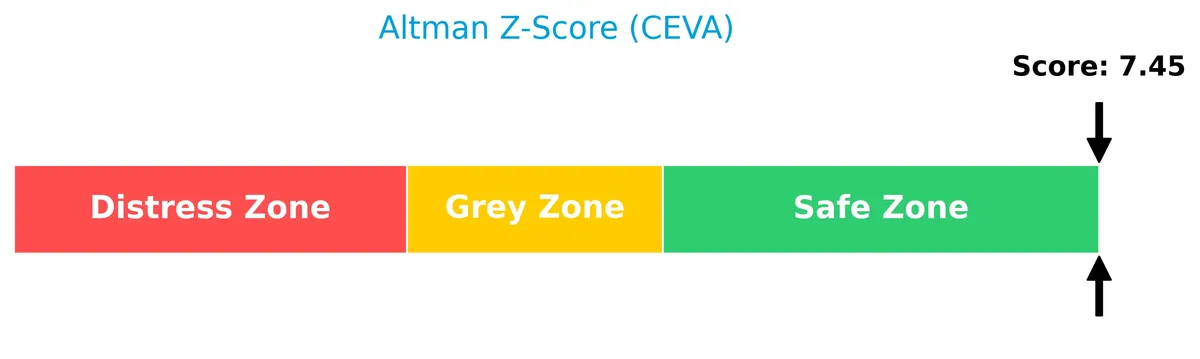

CEVA, Inc. is well within the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy:

Is the company in good financial health?

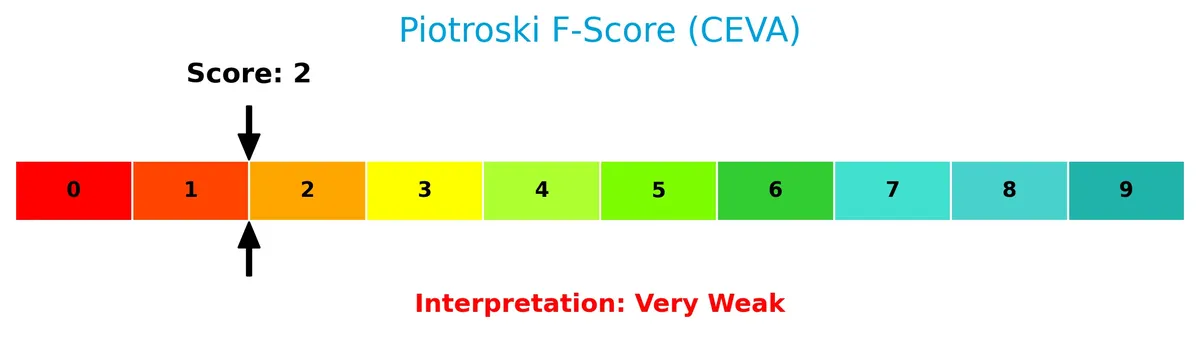

The following Piotroski diagram illustrates CEVA, Inc.’s financial strength based on nine key criteria:

CEVA’s Piotroski Score of 2 places it in the very weak category, signaling poor financial health and potential operational challenges despite its low bankruptcy risk.

Competitive Landscape & Sector Positioning

This analysis examines CEVA, Inc.’s strategic position within the semiconductor sector, focusing on its revenue segments and key products. I will evaluate the company’s main competitors and identify its competitive advantages. The goal is to determine whether CEVA holds a sustainable edge over peers.

Strategic Positioning

CEVA, Inc. maintains a focused portfolio by licensing wireless connectivity and smart sensing technologies. Its revenue centers on licensing and royalties, with strong geographic concentration in Asia Pacific, especially China, and significant exposure to the U.S. and Europe/Middle East markets.

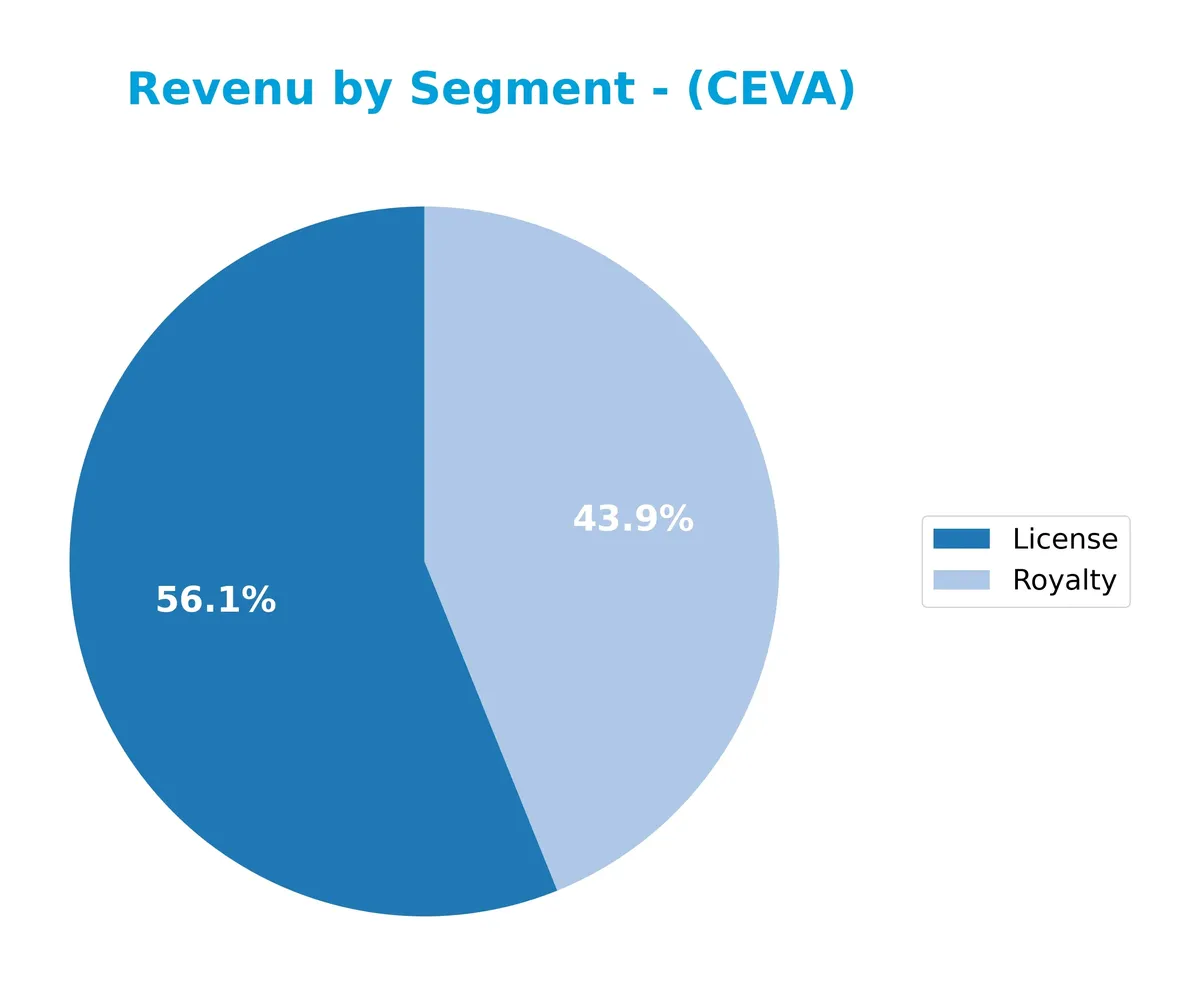

Revenue by Segment

This pie chart illustrates CEVA, Inc.’s revenue distribution by product segment for fiscal year 2024, highlighting License and Royalty streams.

CEVA’s 2024 revenue centers on License ($60M) and Royalty ($47M) segments, marking a strategic shift from previous years dominated by Connectivity and Smart Sensing Products. License revenue grew modestly from $57.6M in 2023, while Royalty accelerated from $39.9M. This reflects CEVA’s evolving business model with increasing dependence on licensing, signaling a transition that investors should monitor for concentration risk.

Key Products & Brands

CEVA, Inc. offers a range of licensed technologies and platforms across wireless connectivity and smart sensing:

| Product | Description |

|---|---|

| Wireless Connectivity | DSP-based platforms for 5G baseband in mobile, IoT, and infrastructure sectors; includes Bluetooth, Wi-Fi 4/5/6/6E, UWB. |

| Smart Sensing | Technologies for sensor fusion, image enhancement, computer vision, voice input, AI; applied in AR/VR, robotics, wearables. |

| Digital Signal Processors (DSPs) | Core IP for processing tasks across audio, vision, and AI applications in consumer and industrial markets. |

| AI Processors | Specialized processors for artificial intelligence workloads embedded in edge devices. |

| Licenses | Intellectual property licensing to semiconductor and OEM companies for integrated circuit design and manufacturing. |

| Royalties | Ongoing royalties from licensed products embedded in end-market devices. |

CEVA’s portfolio centers on licensing advanced IP for connectivity and sensing, supporting a broad range of applications from mobile to IoT and industrial markets. The company’s revenue derives primarily from licenses and royalties tied to these core technologies.

Main Competitors

There are 38 competitors in the Semiconductors industry. The table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

CEVA, Inc. ranks 37th out of 38 competitors by market cap. Its scale is minuscule at 0.01% of the leader NVIDIA’s market cap. CEVA is well below both the average market cap of the top 10 (975B) and the sector median (31B). The company sits 29.45% below its nearest competitor above, highlighting a significant gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CEVA have a competitive advantage?

CEVA, Inc. does not present a competitive advantage as its ROIC significantly lags its WACC, indicating value destruction and declining profitability. The company’s gross margin at 87% is favorable, but its EBIT margin remains at 0%, reflecting operational challenges.

Looking ahead, CEVA’s diverse licensing portfolio in AI processors, 5G wireless platforms, and sensor fusion offers growth potential across mobile, IoT, and automotive markets. Expanding geographic reach, especially in Asia Pacific and China, could create new revenue opportunities despite current financial headwinds.

SWOT Analysis

This SWOT analysis identifies CEVA, Inc.’s core internal and external factors that impact its competitive positioning and strategic potential.

Strengths

- strong IP portfolio in wireless and AI processors

- high gross margin at 87%

- low debt levels with D/E of 0.05

Weaknesses

- declining ROIC indicates value destruction

- unfavorable EBIT margin at 0%

- weak EPS growth over long term

Opportunities

- rising demand for 5G and IoT semiconductors

- expansion in Asia Pacific market

- growth potential in AI and sensor fusion technologies

Threats

- intense competition in semiconductor licensing

- high valuation with P/E over 75

- geopolitical risks affecting supply chains

CEVA’s strengths in technology licensing and margin profile offer a solid foundation. However, persistent profitability challenges and high valuation require cautious capital allocation. Strategic focus on emerging wireless and AI markets is critical to offset competitive and macro risks.

Stock Price Action Analysis

The weekly stock chart of CEVA, Inc. displays price fluctuations and key support/resistance levels over the past 12 months:

Trend Analysis

CEVA’s stock declined 9.95% over the past year, confirming a bearish trend with decelerating losses. The price ranged between 34.67 at its peak and 17.39 at its trough, showing moderate volatility with a 4.42 standard deviation. Recent two-month data indicate an 11.09% drop and a mild downward slope.

Volume Analysis

Trading volume increased overall, with sellers accounting for 52.54% of total volume historically. However, the last three months show slight buyer dominance at 52.16%, indicating neutral buyer behavior and balanced market participation amid rising volume levels.

Target Prices

Analysts set a clear target consensus for CEVA, Inc. reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 28 | 30 | 29 |

The target prices indicate analysts expect CEVA’s shares to trade near $29, suggesting steady appreciation from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines CEVA, Inc.’s recent analyst ratings alongside consumer feedback and market sentiment data.

Stock Grades

Here are the latest verified grades from leading financial institutions on CEVA, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

The overall consensus shows consistent buy-side support, with no downgrades or sell ratings across the board. Barclays and Rosenblatt maintain positive stances, reinforcing steady investor confidence in the stock.

Consumer Opinions

CEVA, Inc. sparks diverse consumer reactions, reflecting its complex market presence.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative technology solutions that enhance performance. | Customer service response times can be slow. |

| Strong product reliability in demanding environments. | Pricing is perceived as high compared to competitors. |

| Effective integration with various platforms. | Limited availability of detailed user guides. |

Overall, consumers praise CEVA’s cutting-edge technology and reliability. However, recurring complaints about customer support and pricing suggest areas for improvement.

Risk Analysis

Below is a summary table highlighting key risks faced by CEVA, Inc. and their estimated likelihood and impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low ROIC (-3.14%) vs. high WACC (10.43%) signals poor capital efficiency and value erosion. | High | High |

| Valuation | Elevated P/E of 75.6 suggests overvaluation relative to peers and sector benchmarks. | High | Medium |

| Profitability | Weak ROE at 2.05% and modest net margin (6.3%) restrict internal growth and reinvestment. | Medium | Medium |

| Liquidity | Extremely high current ratio (9.93) may indicate inefficient asset deployment. | Medium | Low |

| Market Volatility | Beta of 1.5 implies above-average stock price swings in volatile tech and semiconductor market. | Medium | Medium |

| Financial Strength | Very weak Piotroski score (2) warns of underlying operational or financial stress. | Medium | High |

CEVA’s most pressing risks lie in its weak capital returns and rich valuation, signaling potential investor caution. Despite a strong Altman Z-Score indicating low bankruptcy risk, the poor Piotroski score and low profitability metrics raise concerns about sustainable growth. The stock’s 9.8% drop recently underscores market sensitivity to these factors. Investors should weigh CEVA’s technology licensing potential against these financial headwinds.

Should You Buy CEVA, Inc.?

CEVA, Inc. appears to be navigating a challenging profitability landscape with declining ROIC, suggesting value destruction and an eroding competitive moat. Despite a manageable leverage profile and a strong Altman Z-score, its overall rating of C+ reflects significant operational inefficiencies and weak financial strength.

Strength & Efficiency Pillars

CEVA, Inc. maintains a solid gross margin of 87.08%, reflecting operational efficiency in its core activities. The net margin at 6.31% also signals modest profitability. Despite these operational strengths, the company’s return on equity (ROE) is weak at 2.05%, and return on invested capital (ROIC) stands negative at -3.14%, well below its weighted average cost of capital (WACC) of 10.43%. This mismatch clearly indicates that CEVA is not a value creator, as it currently destroys shareholder value.

Weaknesses and Drawbacks

CEVA’s financial profile shows significant concerns. The extremely high price-to-earnings ratio of 75.63 suggests an overvalued stock, exposing investors to downside if earnings fail to meet expectations. Its price-to-book ratio at 1.55 is only moderately favorable. The current ratio of 9.93 is unusually high, signaling inefficient asset use rather than liquidity strength. Interest coverage is zero, flagging potential difficulty in servicing debt despite a low debt-to-equity ratio of 0.05. The stock’s bearish trend with a -9.95% overall price change adds market pressure.

Our Final Verdict about CEVA, Inc.

CEVA’s long-term fundamentals appear challenged by value destruction and weak profitability metrics. Despite a safe Altman Z-Score of 7.45 indicating low bankruptcy risk, the company’s bearish technical trend and elevated valuation metrics suggest caution. Given these mixed signals, CEVA might appear speculative and may warrant a wait-and-see approach before considering exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- CEVA, Inc. Q4 2025 Earnings Call Summary – Yahoo Finance (Feb 17, 2026)

- Ceva Inc. Earnings Call Highlights AI and Connectivity Strength – TipRanks (Feb 18, 2026)

- Ceva, Inc. Announces Fourth Quarter and Full Year 2025 Financial Results – PR Newswire (Feb 17, 2026)

- CEVA, Inc. Reports Sequential Revenue Growth Ahead of Q4 2025 Earnings Release – AlphaStreet News (Feb 17, 2026)

- Ceva (NASDAQ:CEVA) Stock Price Down 8.2% – Here’s Why – MarketBeat (Feb 17, 2026)

For more information about CEVA, Inc., please visit the official website: ceva-dsp.com