Home > Analyses > Consumer Defensive > Celsius Holdings, Inc.

Celsius Holdings, Inc. transforms the beverage landscape by energizing consumers with its innovative functional drinks that blend health benefits and great taste. As a leader in the non-alcoholic beverage industry, Celsius commands attention with its diverse lineup of energy drinks and dietary supplements, renowned for quality and market influence. With a growing global footprint and a reputation for innovation, the critical question is whether Celsius’s current fundamentals support its ambitious growth trajectory and market valuation.

Table of contents

Business Model & Company Overview

Celsius Holdings, Inc., founded in 2004 and headquartered in Boca Raton, Florida, leads the functional beverages sector with a diverse portfolio of energy drinks and liquid supplements. Its ecosystem spans carbonated and non-carbonated products under brands like CELSIUS Originals, CELSIUS HEAT, and CELSIUS BCCA+ENERGY, designed to fuel energy, recovery, and wellness. The company leverages innovative formulations to meet evolving consumer demands in North America, Europe, and Asia.

The company’s revenue engine integrates product sales through a balanced mix of direct-to-store delivery and e-commerce channels, targeting supermarkets, gyms, and mass merchants globally. This multi-channel distribution supports steady cash flow and market penetration across key regions. Celsius Holdings’ competitive advantage lies in its strong brand presence and diversified product lineup, positioning it to shape the future of the non-alcoholic beverage industry effectively.

Financial Performance & Fundamental Metrics

In this section, I analyze Celsius Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

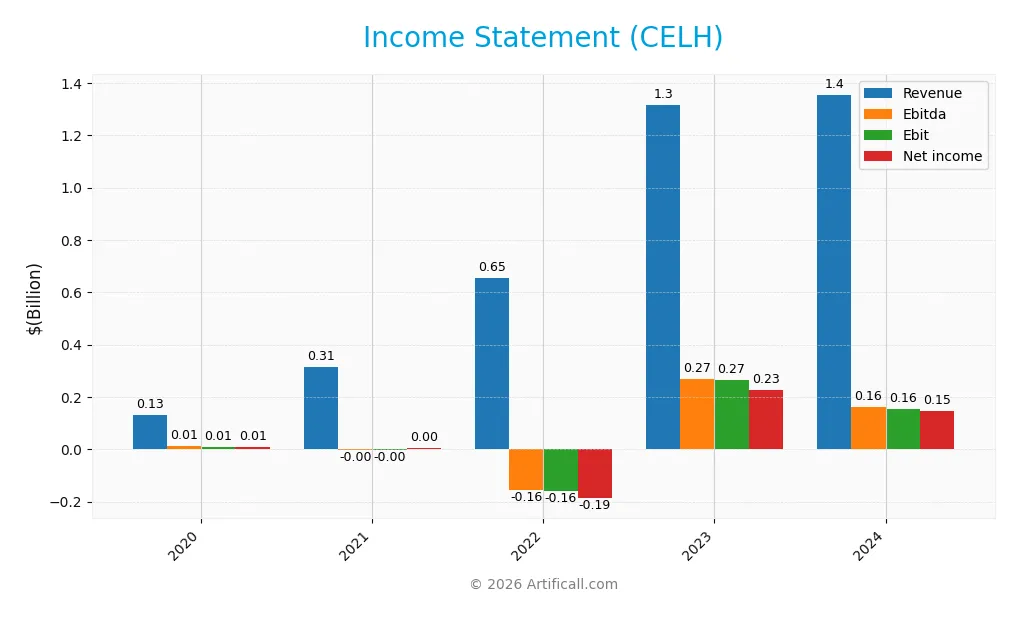

The table below summarizes Celsius Holdings, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reflecting revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 131M | 314M | 654M | 1.32B | 1.36B |

| Cost of Revenue | 70M | 186M | 383M | 685M | 675M |

| Operating Expenses | 53M | 132M | 429M | 367M | 524M |

| Gross Profit | 61M | 128M | 271M | 633M | 680M |

| EBITDA | 11M | -3M | -156M | 270M | 163M |

| EBIT | 9.7M | -4.1M | -158M | 266M | 156M |

| Interest Expense | 1.1M | 8K | 0 | 0 | 0 |

| Net Income | 8.5M | 3.9M | -187M | 227M | 145M |

| EPS | 0.04 | 0.02 | -0.83 | 0.79 | 0.46 |

| Filing Date | 2021-03-11 | 2022-03-16 | 2023-04-19 | 2024-02-29 | 2025-03-03 |

Income Statement Evolution

Celsius Holdings, Inc. experienced strong overall growth from 2020 to 2024, with revenue increasing by 937% and net income surging 1602%. However, the most recent year showed a slowdown, with revenue up only 2.85% and net income declining 37.81%. Margins remain solid, with a gross margin of 50.18% and net margin near 10.7%, though both contracted slightly in the last year.

Is the Income Statement Favorable?

The 2024 income statement presents mixed signals: despite a favorable gross margin of 50.18% and an EBIT margin of 11.49%, EBIT and net margin both fell sharply by over 40% and 37%, respectively, compared to 2023. Interest expenses remain zero, supporting profitability. Overall, the fundamentals remain favorable, driven by strong margin levels, though recent profit declines warrant attention.

Financial Ratios

The table below summarizes key financial ratios for Celsius Holdings, Inc. (CELH) over the fiscal years 2020 to 2024, providing insights into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.5% | 1.3% | -28.7% | 17.2% | 10.7% |

| ROE | 8.2% | 1.8% | -21.7% | 20.8% | 11.8% |

| ROIC | 7.4% | 1.8% | -14.9% | 16.4% | 8.2% |

| P/E | 414 | 1,398 | -42 | 55.5 | 42.4 |

| P/B | 33.9 | 25.4 | 9.1 | 11.6 | 5.0 |

| Current Ratio | 3.53 | 2.82 | 5.69 | 4.36 | 3.62 |

| Quick Ratio | 2.84 | 0.76 | 4.62 | 3.53 | 3.26 |

| D/E | 0.011 | 0.006 | 0.0014 | 0.0020 | 0.017 |

| Debt-to-Assets | 0.009 | 0.0044 | 0.0010 | 0.0014 | 0.0115 |

| Interest Coverage | 7.4 | -511 | 0 | 0 | 0 |

| Asset Turnover | 1.0 | 1.0 | 0.53 | 0.86 | 0.77 |

| Fixed Asset Turnover | 83.0 | 72.5 | 57.5 | 48.8 | 17.5 |

| Dividend Yield | 0.0% | 0.0% | 0.15% | 0.22% | 0.45% |

Evolution of Financial Ratios

From 2020 to 2024, Celsius Holdings, Inc. showed fluctuations in key ratios. The Return on Equity (ROE) improved from 8.17% in 2020 to 11.85% in 2024, indicating a gradual strengthening in profitability. The Current Ratio decreased from 5.69 in 2022 to 3.62 in 2024, reflecting a reduction in short-term liquidity buffers. The Debt-to-Equity Ratio remained very low and stable, at around 0.02 in 2024, signaling minimal leverage.

Are the Financial Ratios Favorable?

In 2024, profitability ratios like net margin (10.7%) are favorable, though ROE (11.85%) and return on invested capital (8.25%) are neutral. Liquidity shows mixed signals with a high quick ratio (3.26, favorable) but a less favorable current ratio (3.62). Leverage is very low (debt-to-equity 0.02), supporting a favorable debt profile. However, valuation multiples such as price-to-earnings (42.43) and price-to-book (5.03) are unfavorable, while efficiency ratios like fixed asset turnover (17.51) are favorable. Overall, the financial ratios present a slightly favorable profile.

Shareholder Return Policy

Celsius Holdings, Inc. has consistently paid dividends since 2022, with a payout ratio rising from 12.1% in 2023 to 18.9% in 2024, and a dividend yield under 0.5%. The dividend per share increased from $0.05 in 2022 to $0.12 in 2024, supported by strong free cash flow coverage. The company also engages in share buybacks, complementing its dividend policy.

This balanced approach, characterized by moderate payout ratios and coverage by free cash flow, suggests a focus on sustainable shareholder returns. Risks related to unsustainable distributions or excessive repurchases appear limited, aligning the policy with long-term value creation without compromising financial stability.

Score analysis

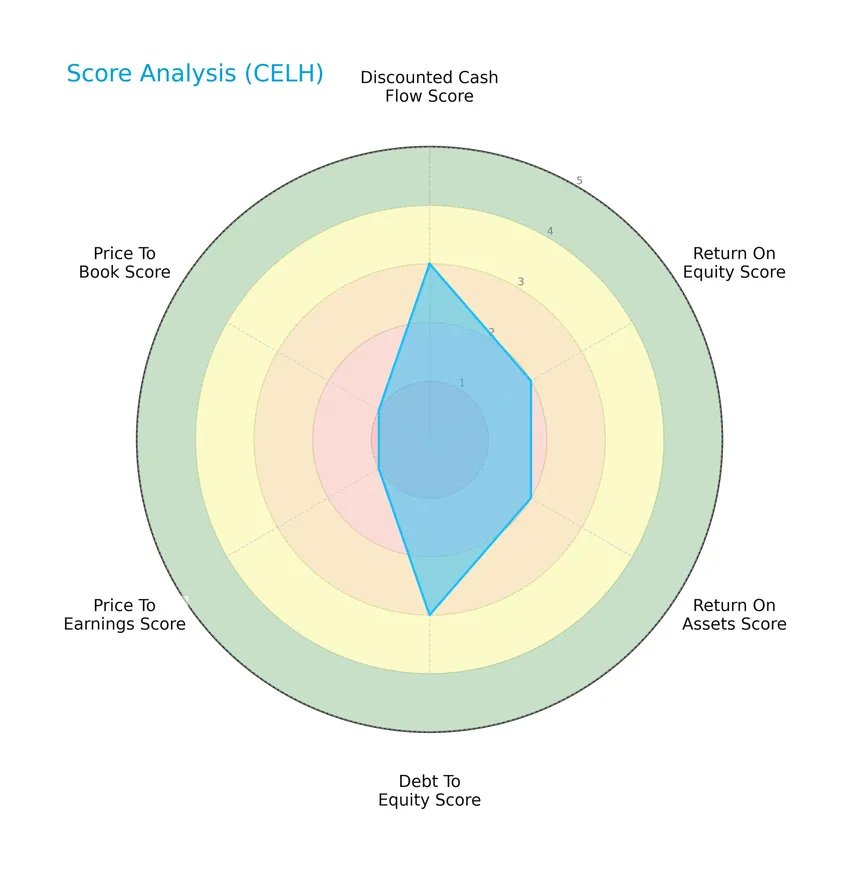

The following radar chart illustrates Celsius Holdings, Inc.’s key financial scores to provide an overview of its valuation and profitability metrics:

Celsius Holdings shows moderate scores in discounted cash flow, return on equity, return on assets, and debt to equity, indicating balanced financial performance. However, its price-to-earnings and price-to-book ratios are rated very unfavorable, reflecting potential valuation concerns.

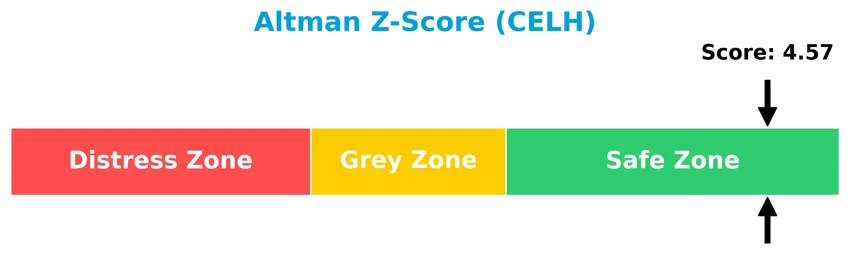

Analysis of the company’s bankruptcy risk

The Altman Z-Score for Celsius Holdings, Inc. places the company firmly in the safe zone, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

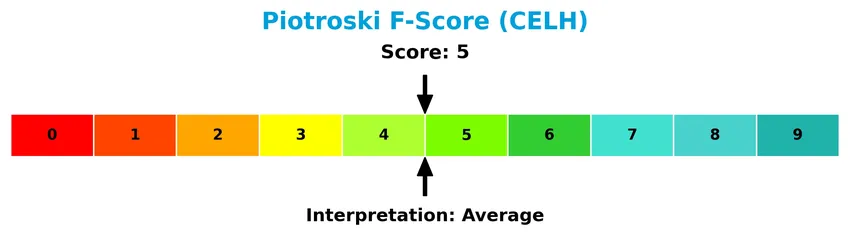

The Piotroski Score diagram below highlights the company’s financial health assessment based on key accounting criteria:

With a Piotroski Score of 5, Celsius Holdings is considered to have average financial health, suggesting moderate strength in profitability, leverage, and efficiency measures.

Competitive Landscape & Sector Positioning

This sector analysis will explore Celsius Holdings, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Celsius Holdings, Inc. holds a competitive advantage over its industry peers.

Strategic Positioning

Celsius Holdings, Inc. focuses on a concentrated product portfolio in functional energy drinks and supplements, marketed primarily under the CELSIUS brand. Geographically, the company’s revenue is heavily concentrated in North America, which accounted for $1.28B of $1.36B total revenue in 2024, with smaller but growing exposure in Europe and Asia.

Revenue by Segment

The pie chart illustrates the revenue distribution for Celsius Holdings, Inc. across its reportable segment for the full fiscal year 2024.

In 2024, Celsius Holdings reported total revenue of 1.36B USD concentrated entirely in one reportable segment. This indicates a highly focused business model without diversification across multiple segments. The absence of other segments highlights potential concentration risk but also simplifies analysis and strategy evaluation for investors. Monitoring future segment diversification or revenue growth within this single segment will be key for assessing the company’s expansion and risk profile.

Key Products & Brands

Below is an overview of Celsius Holdings, Inc.’s main product lines and brand descriptions:

| Product | Description |

|---|---|

| CELSIUS Originals | Carbonated and non-carbonated functional energy drinks marketed internationally. |

| CELSIUS HEAT | Dietary supplements in carbonated flavors such as apple jack’d, orangesicle, inferno punch, cherry lime, and others. |

| CELSIUS BCAA+ENERGY | Branched-chain amino acids functional energy drink designed to support muscle recovery. |

| CELSIUS On-the-Go | Powdered form of active ingredients in functional energy drinks, available in individual packets and canisters. |

| CELSIUS Sweetened | Non-carbonated functional energy drinks in flavors like sparkling grapefruit, cucumber lime, orange pomegranate, pineapple coconut, watermelon berry, and strawberries and cream. |

Celsius Holdings offers a broad portfolio of functional energy drinks and supplements targeting health-conscious consumers, distributed through diverse retail and direct channels internationally.

Main Competitors

There are 7 competitors in total, with the table below listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Coca-Cola Company | 297B |

| PepsiCo, Inc. | 194B |

| Monster Beverage Corporation | 74B |

| Coca-Cola Europacific Partners PLC | 41.7B |

| Keurig Dr Pepper Inc. | 37.7B |

| Coca-Cola Consolidated, Inc. | 13.3B |

| Celsius Holdings, Inc. | 11.8B |

Celsius Holdings, Inc. ranks 7th among its competitors, with a market cap approximately 4.85% that of the sector leader, The Coca-Cola Company. The company is positioned below both the average market cap of the top 10 competitors (95.8B) and the median market cap of its sector (41.7B). It maintains a gap of about 7.51% from the next competitor above it, Coca-Cola Consolidated, Inc.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CELH have a competitive advantage?

Celsius Holdings, Inc. does not yet demonstrate a clear competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value shedding. However, the company shows a growing ROIC trend, suggesting improving profitability and operational efficiency over the 2020-2024 period.

Looking ahead, Celsius is positioned to expand its presence in North America, Europe, and Asia with a diverse portfolio of functional energy drinks and supplements. Opportunities exist in leveraging new product lines and distribution channels, including health clubs and e-commerce, to potentially enhance market share and financial performance.

SWOT Analysis

This SWOT analysis highlights Celsius Holdings, Inc.’s key strategic factors to guide investors in assessing its market position and growth potential.

Strengths

- Strong brand presence in functional energy drinks

- Favorable gross margin of 50.18%

- Low debt and strong liquidity ratios

Weaknesses

- Slowing revenue growth with only 2.85% in last year

- High valuation multiples with PE of 42.43 and PB of 5.03

- Moderate Piotroski score indicating average financial strength

Opportunities

- Expanding international sales, especially in Europe and Asia

- Growing demand for health-conscious and functional beverages

- Increasing profitability trends and operational efficiencies

Threats

- Intense competition in the energy drink market

- Regulatory risks on supplements and ingredients

- Economic uncertainty impacting consumer discretionary spending

Overall, Celsius Holdings shows solid profitability and strong brand equity, yet faces valuation and growth headwinds. Strategic focus on global expansion and innovation will be critical to mitigate competitive and regulatory risks.

Stock Price Action Analysis

The weekly stock chart below illustrates Celsius Holdings, Inc.’s price movements over the past 12 months, highlighting key levels and recent momentum:

Trend Analysis

Over the past 12 months, Celsius Holdings, Inc. (CELH) experienced a -29.43% price decline, indicating a bearish trend with accelerating downward momentum. The stock showed a high volatility level with an 18.59 standard deviation, ranging between a high of 95.15 and a low of 22.34. Recent weeks (Nov 2025–Jan 2026) reversed with a 34.73% gain and lower volatility (5.44), suggesting a short-term positive slope of 1.41.

Volume Analysis

Trading volumes have been increasing overall, with a total of 3.78B shares traded and a slight buyer dominance at 52.08%. In the recent period (Nov 2025–Jan 2026), buyer volume rose to 215M versus seller volume of 145M, reflecting a 59.78% buyer dominance. This growing buyer activity suggests improving investor interest and market participation during the recent upward price movement.

Target Prices

The consensus target price for Celsius Holdings, Inc. (CELH) reflects a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 74 | 60 | 68.89 |

Analysts expect CELH’s stock price to range between 60 and 74, with a consensus near 69, indicating moderate growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide a balanced view of Celsius Holdings, Inc. (CELH).

Stock Grades

Here are the latest verified stock grades for Celsius Holdings, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Underperform | 2025-12-19 |

| Piper Sandler | Maintain | Overweight | 2025-12-17 |

| Stifel | Maintain | Buy | 2025-11-07 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-07 |

| JP Morgan | Maintain | Overweight | 2025-11-07 |

| B of A Securities | Maintain | Underperform | 2025-11-07 |

| JP Morgan | Maintain | Overweight | 2025-10-24 |

The overall trend shows a majority of buy and overweight ratings from major institutions, with Bank of America Securities consistently maintaining an underperform stance. This mixed but predominantly positive sentiment reflects differing views on the stock’s near-term prospects.

Consumer Opinions

Consumer sentiment around Celsius Holdings, Inc. reflects a mix of enthusiasm for its product benefits and concerns over pricing and availability.

| Positive Reviews | Negative Reviews |

|---|---|

| “Love the energy boost without the crash.” | “Products are often out of stock in my area.” |

| “Great taste and healthier than other energy drinks.” | “Prices feel a bit high compared to competitors.” |

| “Appreciate the clean ingredient list and transparency.” | “Limited flavor options available currently.” |

Overall, consumers praise Celsius for its effective energy boost and clean ingredients, but some express frustration with pricing and occasional product scarcity.

Risk Analysis

Below is a table summarizing the key risks associated with investing in Celsius Holdings, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (42.43) and P/B (5.03) ratios suggest overvaluation, risking price correction. | High | High |

| Market Competition | Intense competition in the functional beverage sector may pressure market share and margins. | Medium | Medium |

| Operational Risk | Dependence on a limited product portfolio and distribution channels could affect growth. | Medium | Medium |

| Liquidity Risk | Unfavorable current ratio (3.62) despite strong quick ratio may indicate working capital issues. | Low | Medium |

| Regulatory Risk | Potential regulatory changes on supplements and energy drinks could increase compliance costs. | Low | Medium |

The most significant risks are valuation risk due to elevated price multiples and market competition, which could impact Celsius’s growth trajectory. Despite a safe Altman Z-Score (4.57), the moderate Piotroski score (5) signals average financial strength, urging caution in portfolio allocation.

Should You Buy Celsius Holdings, Inc.?

Celsius Holdings, Inc. appears to be exhibiting improving profitability with a slightly favorable moat supported by growing ROIC, while maintaining a manageable leverage profile. Despite moderate operational efficiency and valuation concerns, its overall rating of C+ suggests a cautiously positive financial health profile.

Strength & Efficiency Pillars

Celsius Holdings, Inc. demonstrates solid profitability with a net margin of 10.7% and an EBIT margin of 11.49%, supported by a robust gross margin of 50.18%. The company maintains a favorable financial health profile, evidenced by an Altman Z-Score of 4.57, placing it securely in the safe zone against bankruptcy risk. While the Piotroski Score is average at 5, the low debt-to-equity ratio of 0.02 and strong interest coverage ratio underpin its conservative leverage position. The ROIC of 8.25% slightly exceeds the WACC of 7.99%, indicating Celsius Holdings is a modest value creator with growing profitability.

Weaknesses and Drawbacks

Celsius Holdings faces valuation challenges with a high price-to-earnings ratio of 42.43 and a price-to-book ratio of 5.03, both marked as unfavorable, signaling a premium valuation that could limit upside potential. Despite a healthy current ratio of 3.62, it is flagged as unfavorable in this context, possibly reflecting inefficient asset utilization or liquidity management concerns. Dividend yield stands low at 0.45%, which may deter income-focused investors. Additionally, the company’s stock has endured a bearish overall trend with a price decline of 29.43% over the longer term, although recent buyer dominance suggests some recovery momentum.

Our Verdict about Celsius Holdings, Inc.

The long-term fundamental profile of Celsius Holdings appears moderately favorable, supported by profitability and financial stability. However, the bearish overall stock trend tempers enthusiasm despite recent buyer dominance and a slight upward price movement. Despite long-term strength, recent market pressure and premium valuation metrics suggest a cautious, wait-and-see approach may be prudent to identify a more attractive entry point for investment exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Celsius Holdings Inc. (CELH) Stock Slides as Market Rises: Facts to Know Before You Trade – Yahoo Finance (Jan 22, 2026)

- Sequoia Financial Advisors LLC Takes $1.62 Million Position in Celsius Holdings Inc. $CELH – MarketBeat (Jan 22, 2026)

- Is trending stock Celsius Holdings Inc. (CELH) a buy now? – MSN (Jan 21, 2026)

- Investors Appear Satisfied With Celsius Holdings, Inc.’s (NASDAQ:CELH) Prospects As Shares Rocket 33% – simplywall.st (Jan 17, 2026)

- Celsius: The Comeback Is Just Getting Started (NASDAQ:CELH) – Seeking Alpha (Jan 16, 2026)

For more information about Celsius Holdings, Inc., please visit the official website: celsiusholdingsinc.com