Home > Analyses > Technology > Celestica Inc.

Celestica powers the backbone of modern technology, enabling seamless connectivity and innovation across industries. As a premier provider of hardware platforms and supply chain solutions, it excels in designing, manufacturing, and integrating complex electronics for aerospace, cloud computing, and healthtech sectors. Known for its engineering precision and global reach, Celestica shapes critical infrastructure worldwide. The key question now: does its robust market position still translate into compelling growth and valuation prospects in 2026?

Table of contents

Business Model & Company Overview

Celestica Inc., founded in 1994 and headquartered in Toronto, Canada, stands as a leading player in the hardware, equipment & parts sector. It delivers a comprehensive ecosystem of manufacturing and supply chain solutions, integrating design, engineering, assembly, and after-market services. Its reach spans aerospace, defense, healthtech, and cloud service providers, reflecting a diverse and complex operational footprint.

The company’s revenue engine balances advanced hardware manufacturing with robust supply chain management, spanning North America, Europe, and Asia. Celestica’s portfolio includes enterprise data communications products and electronic components, fueling recurring contracts and long-term partnerships. This strategic global presence cements its competitive advantage and fortifies its economic moat in a fast-evolving technological landscape.

Financial Performance & Fundamental Metrics

I analyze Celestica Inc.’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder returns.

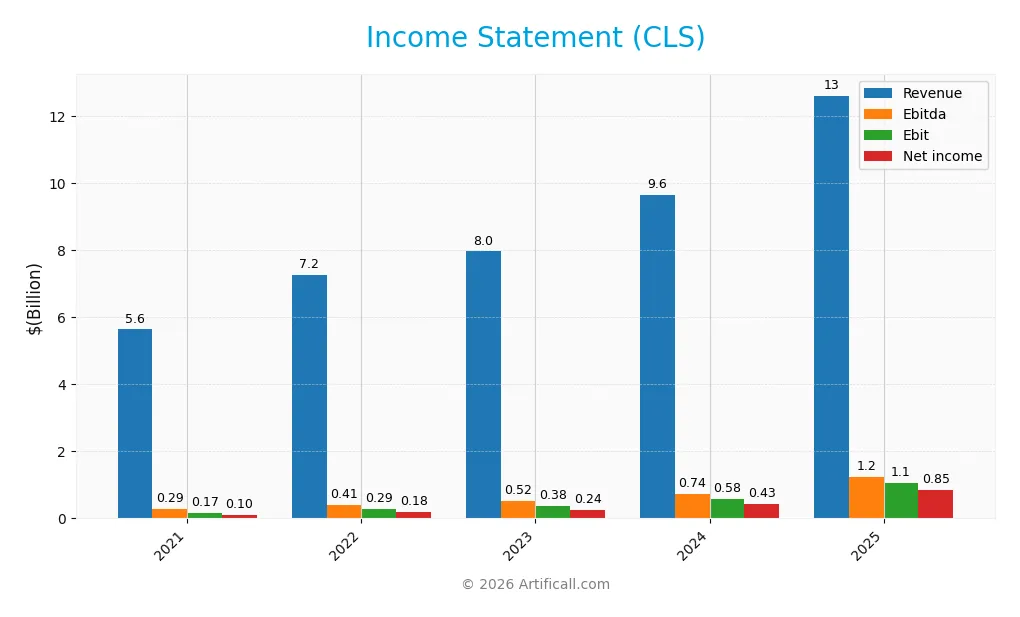

Income Statement

This table summarizes Celestica Inc.’s key income statement figures from 2021 to 2025, reflecting revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.63B | 7.25B | 7.96B | 9.65B | 12.61B |

| Cost of Revenue | 5.15B | 6.60B | 7.21B | 8.61B | 11.13B |

| Operating Expenses | 319M | 360M | 416M | 434M | 385M |

| Gross Profit | 487M | 650M | 754M | 1.03B | 1.47B |

| EBITDA | 294M | 407M | 516M | 736M | 1.23B |

| EBIT | 168M | 291M | 385M | 584M | 1.05B |

| Interest Expense | 31M | 52M | 79M | 52M | 54M |

| Net Income | 104M | 180M | 244M | 428M | 847M |

| EPS | 0.82 | 1.18 | 2.04 | 3.62 | 7.35 |

| Filing Date | 2022-03-14 | 2023-03-13 | 2024-03-11 | 2025-03-03 | 2026-01-28 |

Income Statement Evolution

Celestica’s revenue surged 124% from 2021 to 2025, with net income growing over 700%. Gross margin remained stable around 11.7%, reflecting consistent cost control despite rapid top-line expansion. EBIT margin held steady near 8.4%, indicating efficient scaling of operating expenses relative to revenue growth.

Is the Income Statement Favorable?

In 2025, fundamentals show strength: revenue jumped 31% year-over-year, gross profit rose 43%, and EBIT soared 80%. Net margin improved to 6.7%, supported by favorable interest expense levels at 0.4% of revenue. EPS doubled, signaling robust profitability. Overall, the income statement exhibits favorable trends with solid margin expansion and controlled costs.

Financial Ratios

The table below presents key financial ratios for Celestica Inc. (CLS) over the fiscal years 2021 to 2025, illustrating profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 1.8% | 2.5% | 3.1% | 4.4% | 6.7% |

| ROE | 7.1% | 10.7% | 13.8% | 22.6% | 38.3% |

| ROIC | 5.2% | 8.3% | 9.9% | 16.1% | 28.0% |

| P/E | 13.6 | 7.7 | 14.4 | 25.5 | 40.2 |

| P/B | 1.0 | 0.8 | 2.0 | 5.7 | 15.4 |

| Current Ratio | 1.52 | 1.42 | 1.40 | 1.49 | 1.44 |

| Quick Ratio | 0.77 | 0.65 | 0.75 | 0.91 | 0.88 |

| D/E | 0.55 | 0.47 | 0.44 | 0.42 | 0.35 |

| Debt-to-Assets | 17.2% | 14.0% | 13.3% | 13.3% | 10.8% |

| Interest Coverage | 5.3x | 5.6x | 4.3x | 11.5x | 20.3x |

| Asset Turnover | 1.21 | 1.29 | 1.35 | 1.61 | 1.75 |

| Fixed Asset Turnover | 12.5 | 14.2 | 12.6 | 14.6 | 17.8 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Celestica’s Return on Equity (ROE) surged significantly, reaching 38.3% in 2025 from 7.1% in 2021, signaling improved profitability. The Current Ratio remained stable near 1.44, indicating consistent liquidity. The Debt-to-Equity ratio steadily declined from 0.55 in 2021 to 0.35 in 2025, reflecting reduced financial leverage and improved balance sheet strength.

Are the Financial Ratios Fovorable?

In 2025, Celestica’s profitability ratios are generally favorable, with ROE at 38.3% and ROIC at 28%, both well above WACC at 10.8%. Liquidity ratios are neutral, with a Current Ratio of 1.44 and Quick Ratio of 0.88. Leverage metrics, including a Debt-to-Equity ratio of 0.35 and Debt-to-Assets at 10.8%, are favorable. High P/E and P/B ratios suggest market valuation risks. Overall, the ratios lean slightly favorable.

Shareholder Return Policy

Celestica Inc. does not pay dividends, reflecting a reinvestment strategy likely aimed at supporting growth or operational needs. The company maintains free cash flow coverage for capital expenditures, but no share buyback programs are reported.

This absence of direct shareholder payouts aligns with a focus on long-term value creation through reinvestment. However, investors should monitor whether this approach balances growth ambitions with sustainable capital allocation.

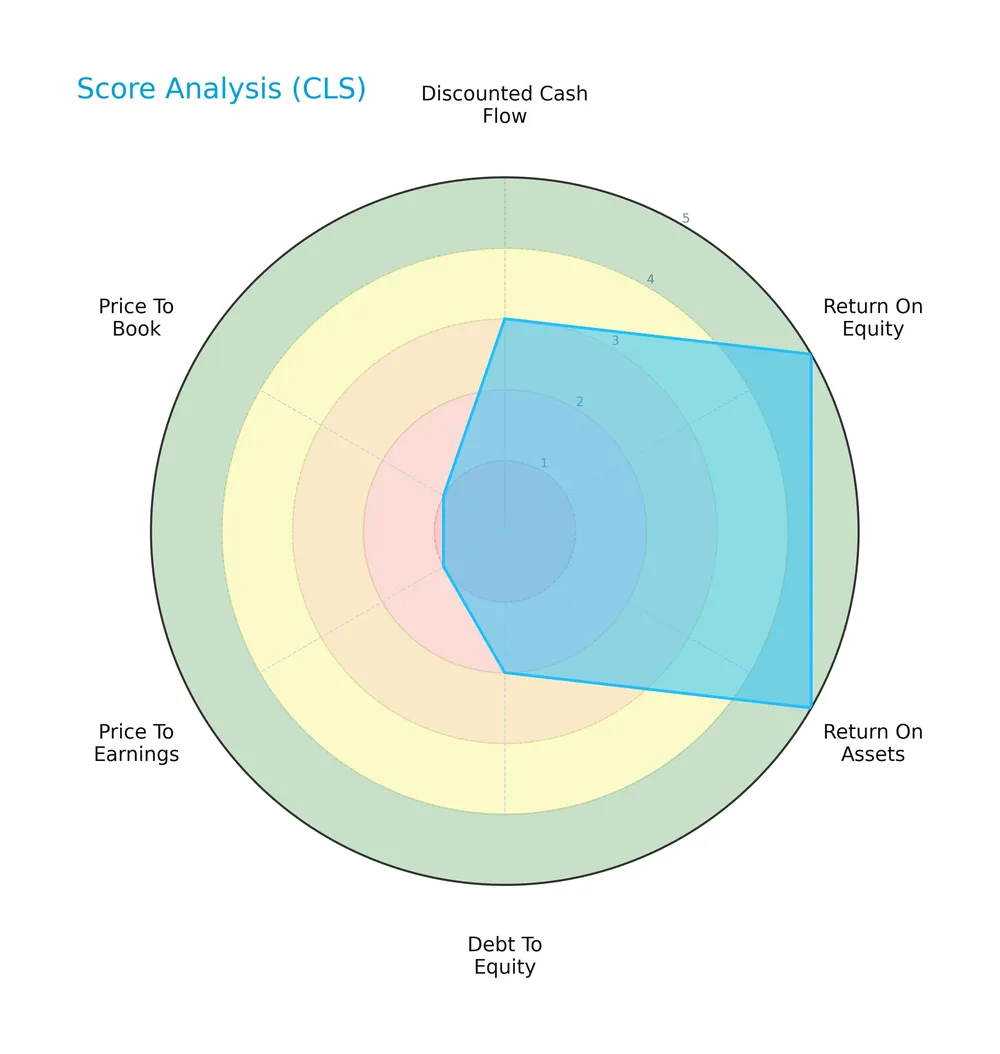

Score analysis

The following radar chart illustrates Celestica Inc.’s key financial scores across valuation and profitability metrics:

Celestica posts very favorable returns on equity and assets, signaling efficient capital use. However, valuation scores for price-to-earnings and price-to-book ratios remain very unfavorable. Its debt-to-equity and discounted cash flow scores reflect moderate standing.

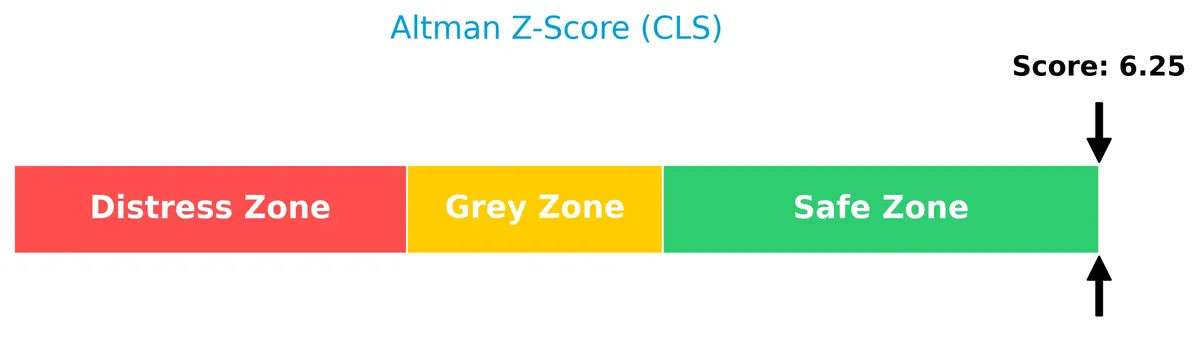

Analysis of the company’s bankruptcy risk

Celestica’s Altman Z-Score firmly places it in the safe zone, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

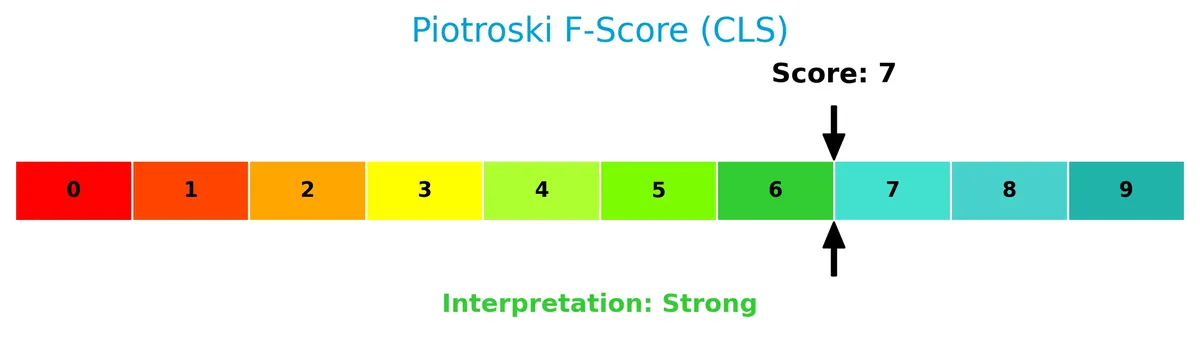

The Piotroski Score diagram highlights Celestica’s financial strength and operational efficiency:

A strong Piotroski Score of 7 suggests Celestica maintains robust fundamentals, positioning it well above average peers in financial health and value potential.

Competitive Landscape & Sector Positioning

This analysis explores Celestica Inc.’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether Celestica holds a competitive advantage over its industry peers.

Strategic Positioning

Celestica Inc. maintains a diversified portfolio with two main segments: Advanced Technology Solutions and Connectivity & Cloud Solutions. It operates across North America, Europe, and Asia, serving multiple industries including aerospace, healthtech, and cloud services, reflecting broad geographic and sector exposure.

Revenue by Segment

This pie chart illustrates Celestica Inc.’s revenue distribution by segment for the full fiscal year 2024, highlighting the company’s reliance on its ATS segment.

Celestica’s revenue is concentrated entirely in the ATS segment, generating $3.16B in 2024. This singular focus underscores a high concentration risk but also suggests operational specialization. Historically in manufacturing services, diversification often mitigates cyclicality. Investors should watch for potential segment expansion or dependency risks in future reports.

Key Products & Brands

Celestica Inc. offers a diverse range of hardware platforms and supply chain solutions, including advanced technology and connectivity products:

| Product | Description |

|---|---|

| Advanced Technology Solutions (ATS) | Provides product manufacturing services such as design, engineering, supply chain management, testing, assembly, and logistics. |

| Connectivity & Cloud Solutions | Delivers enterprise data communications products including routers, switches, servers, and storage systems. |

| Electronic Components | Supplies capacitors, microprocessors, resistors, memory modules, power inverters, energy storage, and smart meters. |

Celestica combines manufacturing expertise with supply chain services across multiple industries, supporting aerospace, defense, healthtech, cloud providers, and more. Its product breadth spans from precision machining to complex electronic infrastructure.

Main Competitors

Celestica Inc. faces competition from 20 companies; below is a list of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40.0B |

| Garmin Ltd. | 38.9B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34.0B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Celestica ranks 7th among its peers, holding about 20% of the market cap of the leader, Amphenol Corporation. It sits below the average market cap of the top 10 competitors (54.4B) but above the sector median (21.6B). The company maintains a 4.68% lead over the next closest competitor, indicating a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Celestica have a competitive advantage?

Celestica demonstrates a sustainable competitive advantage, evidenced by a ROIC exceeding WACC by 17.2% and a strong upward ROIC trend of over 438%. This signals efficient capital use and consistent value creation.

Looking ahead, Celestica’s diversified hardware and supply chain solutions across North America, Europe, and Asia position it well to capture growth in aerospace, cloud, and healthtech sectors. Expansion in advanced technology and connectivity markets offers promising opportunities.

SWOT Analysis

This analysis highlights Celestica’s internal capabilities and external market conditions to guide strategic decisions.

Strengths

- strong ROIC well above WACC

- growing profitability trend

- diversified technology segments

Weaknesses

- high PE and PB ratios signal expensive valuation

- moderate current and quick ratios

- zero dividend yield

Opportunities

- expanding cloud and connectivity markets

- rising demand in aerospace and defense

- innovation in energy storage products

Threats

- intense competition in hardware and supply chain

- global supply chain disruptions

- rising costs from inflation and raw materials

Celestica’s robust profitability and value creation support a competitive moat. However, valuation premiums and liquidity ratios warrant caution. The company should leverage growth in cloud and aerospace sectors while managing cost pressures and market volatility.

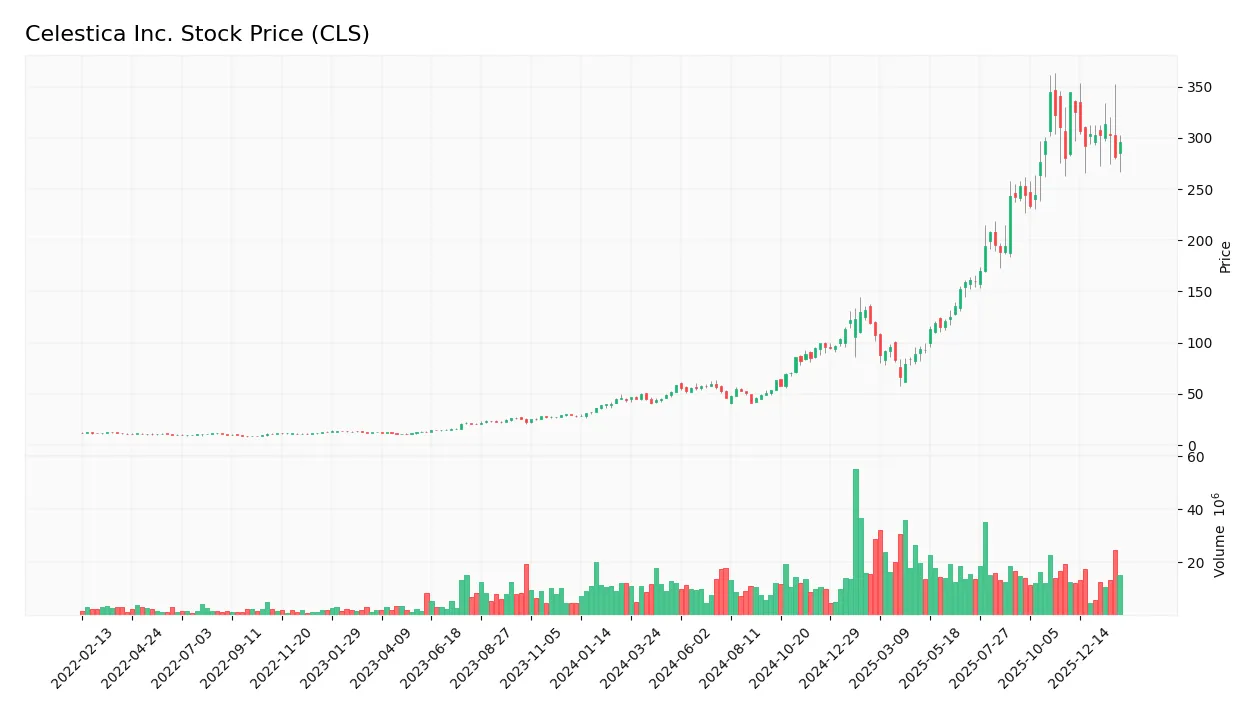

Stock Price Action Analysis

The weekly stock chart below illustrates Celestica Inc.’s price movements over the last 12 months, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past year, Celestica’s stock surged 572.62%, indicating a strong bullish trend. The price peaked at 344.48 and bottomed at 40.73. Despite this rally, trend acceleration has decelerated. Price volatility remains high with a 93.6 standard deviation, reflecting significant market swings.

Volume Analysis

Trading volumes increased overall, with buyers accounting for 63.65% of total activity, signaling buyer-driven momentum. However, in the recent three months, sellers dominated with 73.33% volume share, suggesting weakening buying interest and potential profit-taking among investors.

Target Prices

Analysts present a clear target consensus for Celestica Inc. reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 300 | 440 | 365.6 |

The target range suggests analysts expect Celestica’s stock to trade between 300 and 440, with a consensus near 366, indicating cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

I present an overview of analyst grades and consumer feedback concerning Celestica Inc. (CLS) for informed evaluation.

Stock Grades

Here are the latest verified stock grades for Celestica Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-30 |

| Barclays | Maintain | Overweight | 2026-01-30 |

| Goldman Sachs | Maintain | Buy | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-14 |

| Citigroup | Upgrade | Buy | 2025-11-10 |

| TD Securities | Maintain | Hold | 2025-10-29 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| JP Morgan | Maintain | Overweight | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

| CIBC | Maintain | Outperform | 2025-10-29 |

The consensus reveals a stable preference toward buying or overweight positions, with no sell ratings. This steady outlook suggests sustained confidence from major analysts over recent months.

Consumer Opinions

Celestica Inc. garners mixed consumer sentiment, reflecting both its operational strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product quality and durability | Customer service response times are slow |

| Efficient delivery and logistics | Pricing can be higher than competitors |

| Strong technical support and expertise | Occasional delays in order fulfillment |

Overall, Celestica impresses with product quality and technical support. However, recurring complaints about customer service delays and pricing suggest areas for strategic refinement.

Risk Analysis

Below is a summary table outlining key risks Celestica Inc. faces, categorized by type, likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E at 40.24 and P/B at 15.41 suggest overvaluation | High | High |

| Market Volatility | Beta of 1.505 implies higher stock price swings than market | High | Medium |

| Liquidity Risk | Quick ratio at 0.88 indicates limited short-term asset buffer | Medium | Medium |

| Dividend Policy Risk | Zero dividend yield may deter income-focused investors | Medium | Low |

| Competitive Risk | Industry pressure on hardware & supply chain margins | Medium | Medium |

| Financial Distress | Altman Z-Score safely above 3 reduces bankruptcy risk | Low | Low |

The most critical risks combine valuation stretch and market volatility. Despite strong profitability and a safe Altman Z-Score of 6.25, the stock trades at a premium compared to S&P 500 averages, raising concerns about a correction. The quick ratio below 1 signals moderate liquidity caution. Investors should weigh these factors carefully amid ongoing supply chain uncertainties in hardware sectors.

Should You Buy Celestica Inc.?

Celestica appears to be improving profitability with strong value creation supported by a durable competitive moat through growing ROIC well above WACC. Despite moderate leverage and some valuation weaknesses, its overall B rating suggests a financially resilient profile.

Strength & Efficiency Pillars

Celestica Inc. demonstrates robust profitability with a return on equity (ROE) of 38.29% and a return on invested capital (ROIC) of 28.0%. The company is a clear value creator, as its ROIC (28.0%) significantly exceeds its weighted average cost of capital (WACC) at 10.81%. Financial health is solid, supported by a strong Altman Z-Score of 6.25, placing it well within the safe zone, and a Piotroski score of 7, indicating strong financial strength. These metrics suggest efficient capital allocation and sustainable competitive advantage.

Weaknesses and Drawbacks

Despite underlying strength, Celestica carries valuation risks with a high price-to-earnings ratio (P/E) of 40.24 and price-to-book ratio (P/B) of 15.41, both flagged as very unfavorable. Such elevated multiples imply a premium valuation that may not be justified by fundamentals. The company’s current ratio stands at a moderate 1.44, providing limited liquidity buffer. Additionally, recent market action shows seller dominance with buyers representing only 26.67% of volume, creating short-term headwinds and potential volatility.

Our Verdict about Celestica Inc.

Celestica’s long-term fundamental profile appears favorable, supported by strong profitability and financial health. However, despite a broadly bullish trajectory, recent seller dominance suggests investors might consider a cautious wait-and-see approach for a better entry point. The premium valuation and market pressure could weigh on near-term returns, even as the company’s strategic positioning remains sound.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Celestica, Inc. (CLS) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Feb 03, 2026)

- Celestica: A Hidden Gem For Aggressive Growth Portfolios (NYSE:CLS) – Seeking Alpha (Feb 05, 2026)

- Celestica (NYSE:CLS) Shares Up 6.6% – Still a Buy? – MarketBeat (Feb 05, 2026)

- BofA initiates Celestica (CLS) with ‘buy’ rating and $400 PT – MSN (Feb 03, 2026)

- Celestica (TSE:CLS) Trading Up 5.6% – Here’s What Happened – MarketBeat (Feb 05, 2026)

For more information about Celestica Inc., please visit the official website: celestica.com