In a world where the insurance landscape is rapidly evolving, CCC Intelligent Solutions Holdings Inc. stands at the forefront, revolutionizing how businesses connect and operate. By leveraging advanced cloud, AI, and telematics technologies, CCC streamlines critical workflows within the property and casualty insurance sector, enhancing efficiency and driving innovation. With a reputation for quality and a diverse suite of solutions, the company continuously shapes industry dynamics. As we delve deeper into an investment analysis, the pivotal question remains: do CCC’s fundamentals still support its current market valuation and growth potential?

Table of contents

Company Description

CCC Intelligent Solutions Holdings Inc. is a pivotal player in the software infrastructure sector, specializing in cloud, mobile, AI, and telematics solutions tailored for the property and casualty insurance industry. Founded in 1980 and headquartered in Chicago, Illinois, the company operates primarily in the United States, offering a robust suite of services that includes CCC Insurance solutions and CCC Repair solutions. Its innovative SaaS platform enhances AI-enabled workflows, streamlining interactions among insurance carriers, repairers, and automotive manufacturers. As a leader in digital transformation within its industry, CCC Intelligent Solutions is shaping the future of insurance commerce through its commitment to technological advancement and ecosystem integration.

Fundamental Analysis

In this section, I will provide an overview of CCC Intelligent Solutions Holdings Inc.’s income statement, key financial ratios, and its payout policy to assess its financial health and investment potential.

Income Statement

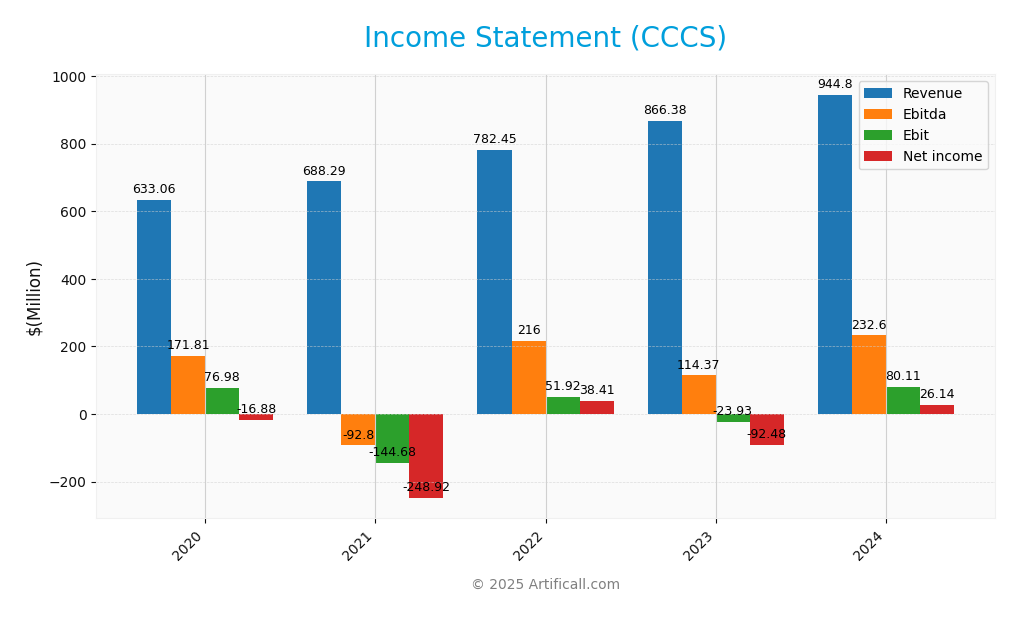

The following table summarizes the income statement for CCC Intelligent Solutions Holdings Inc., providing a clear view of the company’s financial performance over the last five years.

| Income Statement Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 633M | 688M | 782M | 866M | 945M |

| Cost of Revenue | 209M | 196M | 214M | 230M | 231M |

| Operating Expenses | 347M | 637M | 517M | 660M | 634M |

| Gross Profit | 424M | 492M | 569M | 636M | 714M |

| EBITDA | 172M | -93M | 216M | 114M | 233M |

| EBIT | 77M | -145M | 52M | -24M | 80M |

| Interest Expense | 77M | 59M | 39M | 64M | 65M |

| Net Income | -17M | -249M | 38M | -92M | 26M |

| EPS | -0.03 | -0.46 | 0.06 | -0.15 | 0.04 |

| Filing Date | 2021-05-14 | 2022-03-01 | 2023-03-01 | 2024-02-28 | 2025-02-25 |

Over the five-year period, CCC Intelligent Solutions has shown a steady upward trend in revenue, increasing from 633M in 2020 to 945M in 2024. However, net income has been volatile, with significant losses in 2021 and 2023. The company managed to return to profitability with a net income of 26M in the latest year, indicating a potential recovery. The gross profit margin has also improved, reflecting better cost management despite fluctuating operating expenses. The recent year’s EBITDA of 233M suggests increased operational efficiency, although the company still faces challenges in maintaining consistent profitability.

Financial Ratios

The following table summarizes key financial ratios for CCC Intelligent Solutions Holdings Inc. (CCCS) over the last few years, allowing for a quick comparison of the company’s financial health.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -2.67% | -36.16% | 4.91% | -10.67% | 2.77% |

| ROE | -1.23% | -13.29% | 1.88% | -5.19% | 1.31% |

| ROIC | 2.51% | -4.67% | 1.62% | -0.83% | 2.65% |

| P/E | N/A | -24.87 | 145.62 | -76.10 | 274.02 |

| P/B | 5.75 | 3.31 | 2.73 | 3.95 | 3.59 |

| Current Ratio | 2.24 | 2.36 | 3.16 | 2.29 | 3.65 |

| Quick Ratio | 2.02 | 2.25 | 3.05 | 2.29 | 3.65 |

| D/E | 0.96 | 0.46 | 0.41 | 0.47 | 0.41 |

| Debt-to-Assets | 0.41 | 0.26 | 0.25 | 0.27 | 0.26 |

| Interest Coverage | 1.00 | -2.45 | 1.33 | -0.38 | 1.24 |

| Asset Turnover | 0.20 | 0.21 | 0.23 | 0.28 | 0.30 |

| Fixed Asset Turnover | 6.24 | 3.98 | 4.36 | 4.54 | 4.68 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

In 2024, CCC Intelligent Solutions shows a slight recovery with a net margin of 2.77% and a return on equity (ROE) of 1.31%. However, the high P/E ratio of 274.02 raises concerns about overvaluation. The current and quick ratios indicate strong liquidity, while the interest coverage ratio of 1.24 suggests potential challenges in meeting debt obligations.

Evolution of Financial Ratios

Over the past five years, CCC Intelligent Solutions has seen significant fluctuations in its financial ratios. While liquidity ratios like the current ratio have improved, profitability ratios remain inconsistent, indicating volatility in operational performance and potential challenges in sustaining growth.

Distribution Policy

CCC Intelligent Solutions Holdings Inc. does not currently pay dividends, primarily due to its focus on reinvestment for growth and maintaining a strong cash position. The company is still in a high-growth phase, prioritizing research and development along with strategic acquisitions. While there are no dividends, it is worth noting that CCCS engages in share buyback programs, which can signal confidence in its future prospects. This approach aligns with long-term shareholder value creation, provided that growth investments yield sustainable returns.

Sector Analysis

CCC Intelligent Solutions Holdings Inc. operates in the Software – Infrastructure industry, providing innovative cloud and AI solutions for the property and casualty insurance sector, competing with key players through its robust SaaS platform. A SWOT analysis reveals strengths in technology and market position, weaknesses in market penetration, opportunities in digital transformation, and threats from emerging competitors.

Strategic Positioning

CCC Intelligent Solutions Holdings Inc. operates within the Software – Infrastructure sector, specializing in cloud-based solutions for the property and casualty insurance economy. With a market capitalization of approximately $5.63 billion, CCC has carved out a significant market share in its niche by offering a comprehensive suite of AI-driven services. However, competitive pressure is fierce, with numerous players vying for dominance. Technological disruption remains a constant threat, as advancements in AI and telematics can rapidly alter the competitive landscape. As I consider the company’s positioning, I remain cautious about potential risks while recognizing its innovative capabilities.

Key Products

CCC Intelligent Solutions Holdings Inc. offers a range of innovative products designed to optimize workflows and enhance efficiencies within the property and casualty insurance economy. Below is a table summarizing their key products:

| Product | Description |

|---|---|

| CCC Workflow | A SaaS platform that streamlines the insurance claims process, enabling efficient task management. |

| CCC Estimating | Provides accurate estimating tools that facilitate faster assessments for collision repairs. |

| CCC Total Loss | A solution that helps insurers manage total loss claims effectively, including valuation and settlement processes. |

| CCC AI and Analytics | Utilizes artificial intelligence to analyze data and provide actionable insights for decision-making. |

| CCC Repair Workflow | Manages the repair process from start to finish, ensuring quality and accountability in repairs. |

| CCC Network Management | Connects insurers with repair shops and parts suppliers, optimizing the supply chain and enhancing collaboration. |

| CCC Parts Solutions | Offers a comprehensive database for parts procurement, ensuring timely and cost-effective repairs. |

| CCC Automotive Manufacturer Solutions | Tailored solutions that facilitate communication and data sharing between manufacturers and insurers. |

| CCC Lender Solutions | Provides financial institutions with tools to assess risk and manage collateral effectively. |

| CCC Payments | Streamlines payment processes between insurers, repairers, and parts suppliers, enhancing cash flow. |

These products reflect CCC’s commitment to leveraging technology to improve operational efficiencies in the insurance industry, ultimately providing value to their customers and stakeholders.

Main Competitors

No verified competitors were identified from available data. CCC Intelligent Solutions Holdings Inc. operates in the Software – Infrastructure sector, focusing on providing cloud-based solutions for the property and casualty insurance economy. The company’s estimated market share and competitive position suggest a significant presence within its niche, especially given its innovative use of AI and telematics technologies.

Competitive Advantages

CCC Intelligent Solutions Holdings Inc. (CCCS) holds a strong position in the software infrastructure sector, particularly within the property and casualty insurance market. The company’s advanced SaaS platform leverages AI and cloud technologies, enabling seamless workflows and enhancing connectivity among various stakeholders in the insurance ecosystem. Looking ahead, CCC plans to expand its product offerings and enter new markets, capitalizing on the growing demand for digitized insurance solutions. This positions CCC favorably to harness emerging opportunities and further solidify its competitive edge in a rapidly evolving industry landscape.

SWOT Analysis

The SWOT analysis provides a structured assessment of CCC Intelligent Solutions Holdings Inc. to identify its strategic position in the market.

Strengths

- Strong market position

- Advanced technology offerings

- Established customer base

Weaknesses

- Dependency on the insurance sector

- Limited global presence

- Lack of dividends

Opportunities

- Expansion into new markets

- Growth in AI-driven solutions

- Partnerships with automotive manufacturers

Threats

- Intense competition

- Regulatory changes

- Economic downturns

The overall SWOT assessment suggests that while CCC Intelligent Solutions has a robust market position and opportunities for growth, it faces challenges such as competition and sector dependency. Strategic focus on diversifying its market presence and enhancing technology offerings could mitigate risks and leverage growth opportunities.

Stock Analysis

Over the past year, CCC Intelligent Solutions Holdings Inc. (CCCS) has experienced significant price movements, culminating in a bearish trend characterized by a notable decline in its stock price.

Trend Analysis

Analyzing the stock’s performance over the last year, CCCS has encountered a price change of -32.74%, reflecting a bearish trend. This downward trajectory has shown signs of deceleration, with the stock reaching a high of 12.67 and a low of 7.62 during this period. The standard deviation of 1.12 indicates some volatility, though it remains relatively contained within this bearish framework.

Volume Analysis

In the last three months, the trading volume for CCCS has averaged approximately 29.66M shares, with a discernible seller-driven sentiment dominating the market. The average buy volume stands at 7.98M, while the average sell volume has reached 21.68M, indicating a substantial inclination towards selling. This trend suggests a cautious investor sentiment, as the volume is increasing, reflecting heightened market participation amid the ongoing bearish price movement.

Analyst Opinions

Recent recommendations for CCC Intelligent Solutions Holdings Inc. (CCCS) indicate a cautious outlook. On October 30, 2025, analysts rated the stock as a “Sell,” with a C+ rating. The main concerns highlighted by analysts, including those from reputable firms, revolve around poor performance indicators such as Return on Equity (ROE) and Return on Assets (ROA), both rated as “Strong Sell.” The consensus for the current year leans towards selling, suggesting that investors should be wary before adding this stock to their portfolios.

Stock Grades

No verified stock grades were available from recognized analysts for CCC Intelligent Solutions Holdings Inc. (CCCS). As a result, I cannot provide a grading table or specific ratings. It’s important to note that without reliable grades, investors should carefully consider other factors such as market trends, company fundamentals, and recent news before making investment decisions.

Target Prices

No verified target price data is available from recognized analysts for CCC Intelligent Solutions Holdings Inc. The general market sentiment surrounding the stock is currently mixed, reflecting varying investor perspectives.

Consumer Opinions

Consumer sentiment regarding CCC Intelligent Solutions Holdings Inc. is a mix of enthusiasm and critique, reflecting the diverse experiences of its clients.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative technology that meets our needs.” | “Customer support could be more responsive.” |

| “Great value for the price.” | “The platform can be confusing at times.” |

| “Reliable performance and consistent updates.” | “Limited integration options with other tools.” |

| “Excellent user interface and ease of use.” | “Some features are underdeveloped.” |

Overall, consumer feedback for CCC Intelligent Solutions indicates strong appreciation for its innovative technology and user-friendly interface, while concerns regarding customer support and feature integration persist.

Risk Analysis

In evaluating CCC Intelligent Solutions Holdings Inc. (CCCS), it’s essential to consider various risks that could impact the company’s performance and stock value. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for intelligent solutions can affect revenue. | High | High |

| Regulatory Risk | Changes in regulations related to technology and data privacy could impose restrictions. | Medium | High |

| Operational Risk | Disruptions in supply chain or technology failures may hinder operations. | Medium | Medium |

| Competitive Risk | Increasing competition in the intelligent solutions sector could affect market share. | High | Medium |

| Cybersecurity Risk | Threats to data security may lead to financial loss and reputational damage. | High | High |

The most significant risks for CCCS are market and cybersecurity risks, given the company’s reliance on technology and the increasing demand for robust data protection strategies in today’s digital landscape.

Should You Buy CCC Intelligent Solutions Holdings Inc.?

CCC Intelligent Solutions Holdings Inc. has seen a notable improvement in its financial metrics, with a current net margin of 2.77% and a return on invested capital (ROIC) of 2.65%. However, its weighted average cost of capital (WACC) stands at 9.52%. The company has a strong gross profit margin, indicating solid revenue generation capabilities, but it still faces challenges, including a bearish long-term price trend and a higher selling volume than buying volume recently.

Given the current net margin is positive at 2.77%, but the ROIC is below the WACC, I would recommend waiting before making a long-term investment in CCC Intelligent Solutions. The recent negative long-term trend combined with seller-dominant volume signals further caution. It may be beneficial to monitor for a bullish reversal and improvements in the fundamentals before considering an entry point.

Specific risks related to CCC include increased competition in the technology solutions space, potential supply chain disruptions, and the company’s market dependence, which can impact its financial performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- CCC Intelligent Solutions announces 37.3M-share secondary offering – MSN (Nov 06, 2025)

- CCC Intelligent Solutions Holdings Inc. (CCCS) Matches Q3 Earnings Estimates – Yahoo Finance (Oct 30, 2025)

- Summit Creek Advisors LLC Decreases Stock Position in CCC Intelligent Solutions Holdings Inc. $CCCS – MarketBeat (Nov 07, 2025)

- CCC Intelligent Solutions Holdings Inc. Announces Third Quarter 2025 Financial Results – Stock Titan (Oct 30, 2025)

- CCC Intelligent Solutions (CCCS): One-Off $16.2 Million Loss Drives Margin Miss, Tests Bull Case – Sahm (Oct 31, 2025)

For more information about CCC Intelligent Solutions Holdings Inc., please visit the official website: cccis.com