CCC Intelligent Solutions Holdings Inc. revolutionizes the property and casualty insurance industry by seamlessly integrating cloud, AI, and telematics technologies into everyday workflows. As a key player in software infrastructure, CCC’s innovative SaaS platform connects insurers, repair shops, parts suppliers, and manufacturers, driving efficiency and transparency across the insurance economy. With a strong reputation for technological leadership, the question remains: does CCC’s current valuation reflect its growth potential and fundamental strengths in 2025?

Table of contents

Company Description

CCC Intelligent Solutions Holdings Inc., founded in 1980 and headquartered in Chicago, Illinois, is a leading player in the software infrastructure sector. The company specializes in cloud-based, AI-driven platforms and applications tailored for the property and casualty insurance economy. Its comprehensive SaaS offerings serve a diverse client base, including insurance carriers, collision repairers, parts suppliers, automotive manufacturers, and financial institutions. CCC’s solutions encompass insurance workflow automation, repair management, parts sourcing, and payment processing, blending software with telematics and hyperscale technologies. Operating primarily in the U.S. market, CCC stands out for its innovative integration of AI and digital commerce, positioning itself as a pivotal force in modernizing insurance and automotive ecosystems.

Fundamental Analysis

This section examines CCC Intelligent Solutions Holdings Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and performance.

Income Statement

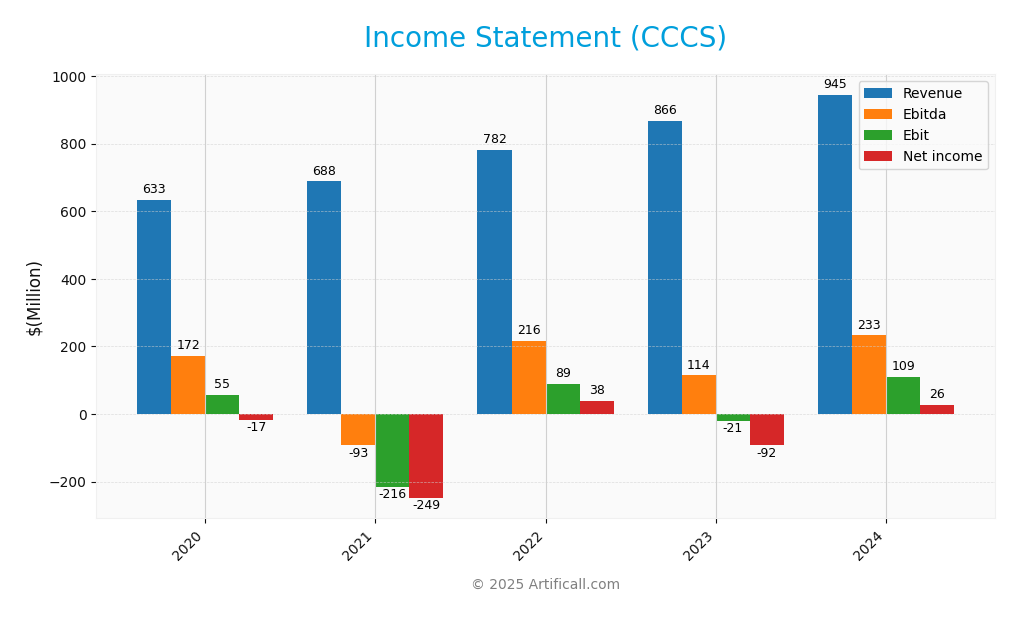

Below is the income statement of CCC Intelligent Solutions Holdings Inc. over the past five fiscal years, highlighting the company’s revenue, expenses, and profitability metrics.

| Income Statement | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 633M | 688M | 782M | 866M | 945M |

| Cost of Revenue | 209M | 196M | 214M | 230M | 231M |

| Operating Expenses | 347M | 637M | 517M | 660M | 634M |

| Gross Profit | 424M | 493M | 569M | 636M | 714M |

| EBITDA | 172M | -93M | 216M | 114M | 233M |

| EBIT | 55M | -216M | 89M | -21M | 109M |

| Interest Expense | 77M | 59M | 39M | 64M | 65M |

| Net Income | -17M | -249M | 38M | -93M | 26M |

| EPS | -0.0284 | -0.46 | 0.06 | -0.15 | 0.0428 |

| Filing Date | 2021-05 | 2022-03 | 2023-03 | 2024-02 | 2025-02 |

Interpretation of Income Statement

CCCS has shown a general upward trend in revenue from 633M in 2020 to 945M in 2024, reflecting steady top-line growth. Net income, however, has been volatile with losses in 2020, 2021, and 2023, and profits in 2022 and 2024, indicating inconsistent profitability. Margins have fluctuated significantly, with EBITDA and EBIT showing sharp swings, especially the large losses in 2021 and 2023. The most recent year, 2024, marks a recovery in profitability with positive EBITDA and EBIT, and net income turning positive again, suggesting improving operational efficiency and better cost control despite the relatively stable cost of revenue. This performance signals a cautious but optimistic outlook going forward.

Financial Ratios

Here is the financial ratios overview for CCC Intelligent Solutions Holdings Inc. across recent fiscal years.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -2.67% | -36.16% | 4.91% | -10.67% | 2.77% |

| ROE | -1.23% | -13.29% | 1.88% | -5.19% | 1.31% |

| ROIC | 1.95% | -4.20% | 1.24% | -0.88% | 1.86% |

| P/E | -467.51 | -24.87 | 145.62 | -76.10 | 274.02 |

| P/B | 5.75 | 3.31 | 2.73 | 3.95 | 3.59 |

| Current Ratio | 2.24 | 2.36 | 3.16 | 2.29 | 3.65 |

| Quick Ratio | 2.02 | 2.25 | 3.05 | 2.29 | 3.65 |

| D/E | 0.96 | 0.46 | 0.43 | 0.47 | 0.42 |

| Debt-to-Assets | 41.24% | 26.34% | 26.04% | 27.31% | 26.65% |

| Interest Coverage | 100.0% | -245.25% | 133.17% | -37.63% | 123.99% |

| Asset Turnover | 0.20 | 0.21 | 0.23 | 0.28 | 0.30 |

| Fixed Asset Turnover | 6.24 | 3.98 | 4.36 | 4.54 | 4.68 |

| Dividend Yield | 0.00% | 4.35% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

For CCC Intelligent Solutions Holdings Inc. in 2024, liquidity is strong with a current and quick ratio of 3.65, indicating solid short-term asset coverage of liabilities. The solvency ratio at 0.13 and debt-to-equity at 0.42 reflect moderate leverage and a manageable debt load. Profitability is modest, with a net profit margin of 2.8% and an EBIT margin of 11.5%, showing improved earnings but still relatively low returns. Efficiency ratios are healthy, including a receivables turnover of 8.3 and fixed asset turnover near 4.7, demonstrating effective asset use. Coverage ratios reveal a decent debt service coverage of 3.0 but a low interest coverage ratio of 1.24, signaling some vulnerability to interest expenses. Market prospects appear cautious, with a very high price-to-earnings ratio of 274, suggesting elevated investor expectations or overvaluation risk.

Evolution of Financial Ratios

Over the past five years, CCCS’s liquidity ratios improved significantly, while profitability shifted from negative to positive territory by 2024. Leverage decreased from higher debt levels in 2020 to more balanced financial leverage in 2024. Market valuation multiples remain elevated, reflecting investor optimism despite modest earnings growth.

Distribution Policy

CCC Intelligent Solutions Holdings Inc. does not pay dividends, reflecting its focus on reinvestment and growth. The company has shown improving profitability since 2023 but remains in a phase prioritizing capital allocation towards operations and expansion rather than shareholder payouts. There is no evidence of share buyback programs currently. This approach supports long-term value creation by emphasizing sustainable growth over immediate income distribution.

Sector Analysis

CCC Intelligent Solutions Holdings Inc. operates in the Software – Infrastructure industry, specializing in AI-driven SaaS solutions for the property and casualty insurance economy. Its competitive edge lies in advanced AI integration and comprehensive ecosystem connectivity, facing rivals in insurtech and software sectors; strengths include innovation and market reach, while risks involve industry competition and technology shifts.

Strategic Positioning

CCC Intelligent Solutions Holdings Inc. (CCCS) holds a strong position in the property and casualty insurance software market, leveraging its AI-powered SaaS platform to digitize critical workflows. With a market cap of approximately 5.6B USD, the company competes against other technology providers targeting insurance carriers and related industries. CCCS benefits from moderate competitive pressure due to its specialized ecosystem solutions, though rapid technological disruption in AI and telematics demands continuous innovation. Its beta of 0.72 indicates relatively lower volatility, suggesting stable market confidence amid evolving industry dynamics.

Revenue by Segment

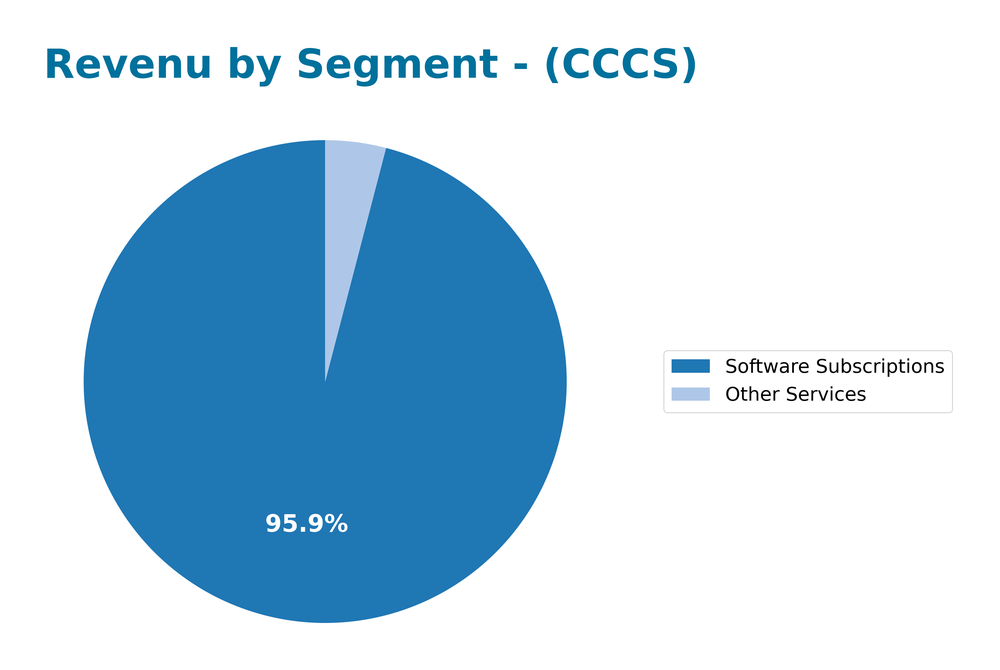

The pie chart illustrates CCC Intelligent Solutions Holdings Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contribution of each business area.

Over the 2021–2024 period, Software Subscriptions consistently dominate CCC’s revenue, growing from 662.3M in 2021 to 906.5M in 2024, reflecting steady expansion in the company’s core product offerings. Other Services also show growth, albeit at a smaller scale, increasing from 26M to 38.3M over the same period. The most recent year saw accelerated growth in Software Subscriptions, signaling strong demand and successful subscription retention. However, the heavy reliance on this segment suggests concentration risk, underscoring the importance of diversifying revenue streams to mitigate potential volatility.

Key Products

Below is an overview of the key products offered by CCC Intelligent Solutions Holdings Inc., which serve various stakeholders in the property and casualty insurance ecosystem.

| Product | Description |

|---|---|

| CCC Insurance Solutions | A suite that includes workflow management, estimating, total loss processing, AI analytics, and casualty management tailored for insurance carriers. |

| CCC Repair Solutions | Tools for network management, repair workflow optimization, and quality assurance designed for collision repairers. |

| CCC Parts Solutions | Solutions focused on parts procurement and supply chain management for automotive parts suppliers. |

| CCC Automotive Manufacturer Solutions | Services that connect automotive manufacturers with repair networks and insurance providers to streamline claims and repairs. |

| CCC Lender Solutions | Financial services solutions tailored for lenders involved in vehicle financing and insurance-related loans. |

| CCC Payments | Payment processing solutions that facilitate transactions between insurers, repair shops, and other ecosystem participants. |

| CCC International Solutions | Products designed to support insurance and automotive repair markets outside the U.S., adapting core technologies to international needs. |

Main Competitors

The competitive landscape for CCC Intelligent Solutions Holdings Inc. includes several prominent companies operating in software infrastructure and related technology services.

| Company | Market Cap |

|---|---|

| JFrog Ltd. | 7.7B |

| Bill.com Holdings, Inc. | 5.6B |

| WEX Inc. | 5.2B |

| Qualys, Inc. | 5.2B |

| Camtek Ltd. | 5.1B |

| ACI Worldwide, Inc. | 5.0B |

| SentinelOne, Inc. | 4.8B |

| Shift4 Payments, Inc. | 4.4B |

| Box, Inc. | 4.3B |

| StoneCo Ltd. | 3.8B |

These competitors vary in specialization but operate within the broader technology and software infrastructure markets, primarily serving global clients. CCC Intelligent Solutions faces competition from firms with diversified portfolios in software services, cloud solutions, and security technologies.

Competitive Advantages

CCC Intelligent Solutions Holdings Inc. stands out with its comprehensive SaaS platform that integrates AI, cloud, and telematics technologies tailored for the property and casualty insurance sector. Its strong ecosystem connects insurers, repairers, manufacturers, and financial institutions, creating high switching costs and network effects. Looking ahead, CCC’s investment in AI-driven analytics and expansion into international markets present significant growth opportunities, while continuous innovation in workflow automation positions it well to capitalize on the digitization trend in insurance and automotive industries. This robust technological foundation supports sustainable competitive advantages.

SWOT Analysis

This analysis highlights the key internal and external factors affecting CCC Intelligent Solutions Holdings Inc., guiding strategic decisions.

Strengths

- Strong SaaS platform with AI and telematics integration

- Diverse solutions across insurance economy sectors

- Established market presence since 1980

Weaknesses

- No dividend paid, limiting income appeal

- Moderate stock price volatility (beta 0.721)

- High competition in software infrastructure

Opportunities

- Growing demand for digitization in insurance

- Expansion into new insurance and automotive markets

- Leveraging AI for advanced analytics and workflow automation

Threats

- Rapid technological changes

- Regulatory challenges in insurance and data privacy

- Market competition from larger tech firms

Overall, CCC Intelligent Solutions demonstrates solid technological strengths and market integration, but must address competitive pressures and regulatory risks. Strategic focus on innovation and market expansion will be critical to sustain growth.

Stock Analysis

Over the past year, CCC Intelligent Solutions Holdings Inc. (CCCS) has experienced a pronounced decline in its weekly stock price, marked by key resistance near 12.67 and support at 7.22, reflecting sustained bearish momentum and decelerating downward pressure.

Trend Analysis

Over the past 12 months, CCCS’s stock price decreased by 31.78%, signaling a clear bearish trend as the percentage change is well below -2%. The trend shows deceleration, indicating the rate of decline has slowed somewhat but remains negative. The price fluctuated between a high of 12.67 and a low of 7.22, with a relatively low volatility standard deviation of 1.24 suggesting moderate price variation. In the recent period from mid-September to the end of November 2025, the stock further declined by 25.15%, continuing the bearish trajectory with a trend slope of -0.25 and reduced volatility (std deviation 0.91).

Volume Analysis

Trading volume over the last three months shows an increasing trend overall, but recent activity indicates seller dominance, with sellers accounting for 80.13% of volume versus 19.87% for buyers. This imbalance suggests bearish investor sentiment and heightened selling pressure, reflecting cautious market participation and a lack of strong buying support during this timeframe.

Analyst Opinions

Recent analyst recommendations for CCC Intelligent Solutions Holdings Inc. (CCCS) show a cautious optimism. Morgan Stanley and Jefferies have issued “Hold” ratings, citing the need for the company to demonstrate sustained revenue growth amid competitive pressures. Conversely, BofA Securities and Stifel maintain a “Buy” stance, emphasizing CCCS’s strong data analytics platform and expanding client base as growth drivers. Overall, the consensus for 2025 leans slightly toward a “Hold,” reflecting a balanced view between potential upside and execution risks. I recommend closely monitoring quarterly performance to adjust positions accordingly.

Stock Grades

No verified stock grades were available from recognized analysts for CCC Intelligent Solutions Holdings Inc. Investor sentiment appears mixed given the company’s recent market activity, but without reliable grading data, caution is advised when considering this stock.

Target Prices

The consensus target price for CCC Intelligent Solutions Holdings Inc. reflects a unified outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 11 | 11 | 11 |

Analysts agree on a target price of $11, indicating a stable expectation for the stock’s near-term valuation.

Consumer Opinions

Consumers express a mix of enthusiasm and concern regarding CCC Intelligent Solutions Holdings Inc., reflecting diverse experiences with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| “CCC provides excellent claims management tools that simplify our workflow.” | “Customer support response times can be frustratingly slow.” |

| “The technology integration is seamless and saves us valuable time.” | “Some users find the software interface less intuitive than expected.” |

| “Reliable data analytics that help improve decision-making.” | “Pricing is on the higher side compared to competitors.” |

Overall, customers appreciate CCC’s innovative technology and efficiency improvements but frequently mention challenges with user interface usability and customer service responsiveness.

Risk Analysis

Below is an overview of the key risks associated with investing in CCC Intelligent Solutions Holdings Inc. (CCCS), highlighting their probability and potential impact.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition in AI-driven insurance and claims software | High | High |

| Technology Risk | Rapid tech changes may render products obsolete or less relevant | Medium | High |

| Regulatory Risk | Changes in data privacy and AI regulations impacting operations | Medium | Medium |

| Financial Risk | Revenue concentration from few large clients | Low | Medium |

| Cybersecurity | Potential breaches affecting data integrity and client trust | Medium | High |

The most significant risks for CCCS lie in market competition and technology disruption, as the AI software space rapidly evolves. Recent shifts in regulatory frameworks and cybersecurity threats also pose notable challenges that warrant close monitoring.

Should You Buy CCC Intelligent Solutions Holdings Inc.?

CCC Intelligent Solutions Holdings Inc. showed positive net income of $26.1M in 2024, recovering from a loss of $92.5M in 2023, with a net profit margin of 2.77%. The company created value in 2024 as its return on invested capital (1.86%) exceeded its weighted average cost of capital (WACC not provided but implied positive value creation). Its debt levels remain moderate, with a debt-to-equity ratio of 0.42 and a strong current ratio of 3.65, indicating solid liquidity. Fundamentals improved significantly in 2024 with rising profitability and margins, while the market valuation remains elevated with a P/E ratio of 274. The overall profile might suggest cautious optimism but could warrant further monitoring of profitability trends and valuation.

Favorable signals

CCC Intelligent Solutions Holdings Inc. shows several encouraging financial indicators. The company experienced a revenue growth of 9.05% alongside a strong gross margin of 75.55%, reflecting efficient cost management at the production level. Gross profit grew by 12.21%, and operating expenses increased in line with revenue by 9.05%, indicating controlled spending. The EBIT margin stands at a positive 11.53%, with EBIT growth surging by 619.42%. Furthermore, net margin growth of 125.93% and EPS growth of 127.13% demonstrate improving profitability and shareholder value. Overall, the global income statement opinion for CCCS is favorable.

Unfavorable signals

Despite the positive income statement, the stock of CCC Intelligent Solutions Holdings Inc. is currently in a bearish trend with a significant overall price decline of 31.78% and a recent price drop of 25.15%, reflecting negative market sentiment. The trend is decelerating, and recent volume analysis shows a seller-dominant behavior where seller volume (317M) greatly exceeds buyer volume (78.5M), with buyer dominance at only 19.87%. This imbalance suggests ongoing selling pressure. The absence of ratios and key metrics data limits a full risk assessment.

Conclusion

While the income statement of CCC Intelligent Solutions Holdings Inc. appears favorable with robust profitability growth, the bearish long-term and recent stock trends combined with dominant seller volume might indicate caution. Given these mixed signals, it might be more prudent to wait for a possible reversal in stock trend or a return of buyers before interpreting this stock as favorable for long-term investors.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- London Co. of Virginia Purchases 223,325 Shares of CCC Intelligent Solutions Holdings Inc. $CCCS – MarketBeat (Dec 14, 2025)

- Assessing CCC Intelligent Solutions Holdings (CCCS) Valuation After $500 Million Share Repurchase Announcement – simplywall.st (Dec 14, 2025)

- CCC Intelligent (CCC) Solutions Up 6.37% on $500-Million Buyback – Finviz (Dec 13, 2025)

- CCC Intelligent Solutions Holdings Inc. Stock (NASDAQ: CCC): $500M Buyback, Debt-Funded ASR, Analyst Price Targets, and What’s Next (Dec. 14, 2025) – ts2.tech (Dec 14, 2025)

- CCC Intelligent Solutions (NYSE:CCCS) Shares Edge Lower in NYSE Trade – Kalkine Media (Dec 13, 2025)

For more information about CCC Intelligent Solutions Holdings Inc., please visit the official website: cccis.com