Home > Analyses > Financial Services > Cboe Global Markets, Inc.

Cboe Global Markets revolutionizes how investors access and trade options, futures, and equities around the world. Its flagship options exchange sets industry standards for liquidity and innovation, while its global footprint spans North America, Europe, and Asia Pacific. Known for strategic partnerships and cutting-edge technology, Cboe shapes market dynamics daily. As investors eye 2026, the key question remains: do Cboe’s strong fundamentals justify its premium valuation and growth trajectory?

Table of contents

Business Model & Company Overview

Cboe Global Markets, Inc., founded in 1973 and headquartered in Chicago, IL, dominates the financial data and stock exchange industry. It operates a diverse ecosystem spanning options, equities, futures, and FX markets, integrating listed indices, exchange-traded products, and clearing services worldwide. This multifaceted platform fuels global market participation and liquidity.

The company’s revenue engine balances transaction fees from options, North American equities, futures, and international derivatives. Its footprint spans the Americas, Europe, and Asia Pacific, leveraging strategic partnerships with leading index providers. Cboe’s competitive advantage lies in its comprehensive market access and robust infrastructure, positioning it as a cornerstone in shaping global financial markets.

Financial Performance & Fundamental Metrics

I will analyze Cboe Global Markets, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

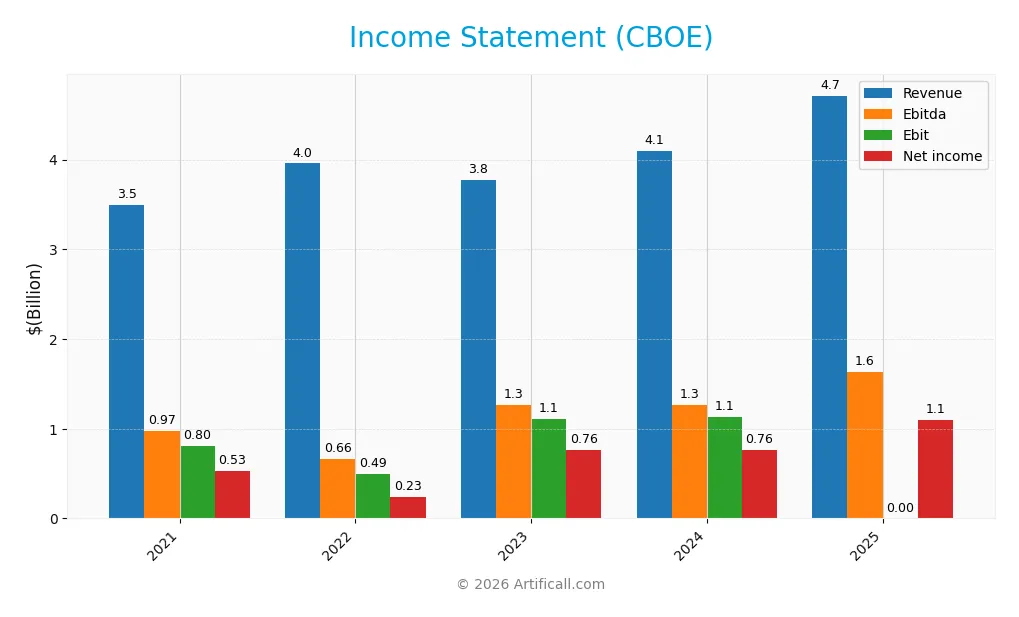

This table summarizes Cboe Global Markets, Inc.’s key income statement metrics for fiscal years 2021 through 2025.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.49B | 3.96B | 3.77B | 4.09B | 4.71B |

| Cost of Revenue | 2.02B | 2.22B | 1.86B | 2.02B | 239M |

| Operating Expenses | 670M | 1.25B | 860M | 974M | 723M |

| Gross Profit | 1.48B | 1.74B | 1.92B | 2.07B | 4.48B |

| EBITDA | 972M | 660M | 1.27B | 1.27B | 1.64B |

| EBIT | 804M | 493M | 1.11B | 1.14B | 0 |

| Interest Expense | 48M | 60M | 62M | 51.5M | (52.3M) |

| Net Income | 529M | 235M | 761M | 765M | 1.10B |

| EPS | 4.93 | 2.21 | 7.16 | 7.24 | 10.46 |

| Filing Date | 2022-02-18 | 2023-02-17 | 2024-02-16 | 2025-02-21 | 2026-02-06 |

Income Statement Evolution

From 2021 to 2025, Cboe Global Markets’ revenue rose 35% to 4.7B, reflecting steady top-line growth. Net income more than doubled, reaching 1.1B in 2025. Gross margin improved significantly, exceeding 94%, while net margin expanded by over 54%, indicating rising profitability amid controlled operating expenses.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable with a strong 23.3% net margin and 15% revenue growth year-over-year. Despite an unfavorable EBIT margin of 0%, the company maintained solid EBITDA of 1.6B and benefited from low interest expense. The 44.5% EPS increase further underscores effective capital allocation and operational leverage.

Financial Ratios

The table below summarizes key financial ratios for Cboe Global Markets, Inc. over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 15.1% | 5.9% | 20.2% | 18.7% | 23.3% |

| ROE | 14.7% | 6.8% | 19.1% | 17.9% | N/A |

| ROIC | 10.0% | 4.6% | 12.6% | 12.1% | N/A |

| P/E | 26.4 | 56.8 | 24.8 | 26.8 | 23.9 |

| P/B | 3.87 | 3.85 | 4.74 | 4.80 | 0 |

| Current Ratio | 1.31 | 1.05 | 1.43 | 1.78 | 0 |

| Quick Ratio | 1.31 | 1.05 | 1.43 | 1.78 | 0 |

| D/E | 0.40 | 0.54 | 0.40 | 0.37 | 0 |

| Debt-to-Assets | 21.0% | 26.7% | 21.5% | 20.5% | 0 |

| Interest Coverage | 16.8 | 8.2 | 17.0 | 21.3 | -28.1 |

| Asset Turnover | 0.51 | 0.57 | 0.50 | 0.53 | 0 |

| Fixed Asset Turnover | 16.1 | 17.8 | 15.4 | 16.9 | 0 |

| Dividend Yield | 1.39% | 1.57% | 1.18% | 1.21% | 1.08% |

Evolution of Financial Ratios

Over the period, Cboe’s profitability improved notably, with net profit margin rising from 5.94% in 2022 to 23.33% in 2025. However, return on equity (ROE) and other return metrics showed no data in 2025, indicating missing or zero values. Liquidity ratios such as current ratio peaked at 1.78 in 2024 before dropping to zero in 2025. Debt-to-equity ratio declined steadily, suggesting reduced leverage.

Are the Financial Ratios Fovorable?

In 2025, Cboe displays a favorable net margin of 23.33%, signaling strong profitability. Yet, ROE and return on invested capital (ROIC) are unfavorable or missing, raising concerns about capital efficiency. Liquidity ratios are unfavorable due to missing values, while debt metrics appear favorable with zero or low debt ratios. The price-to-earnings ratio is neutral at 23.89, and dividend yield is modest at 1.08%. Overall, the ratio profile is slightly unfavorable, with half the key ratios flagged as weak or unavailable.

Shareholder Return Policy

Cboe Global Markets maintains a consistent dividend payout ratio near 25-36%, with dividends per share rising from $1.81 in 2021 to $2.70 in 2025. The annual yield hovers around 1.1%, supported by solid free cash flow coverage, indicating prudent capital allocation.

The company engages in share buybacks alongside dividends, balancing returns with reinvestment. This strategy aligns with sustainable value creation, as payout levels remain moderate, avoiding excessive distributions that could strain cash flow or future growth.

Score analysis

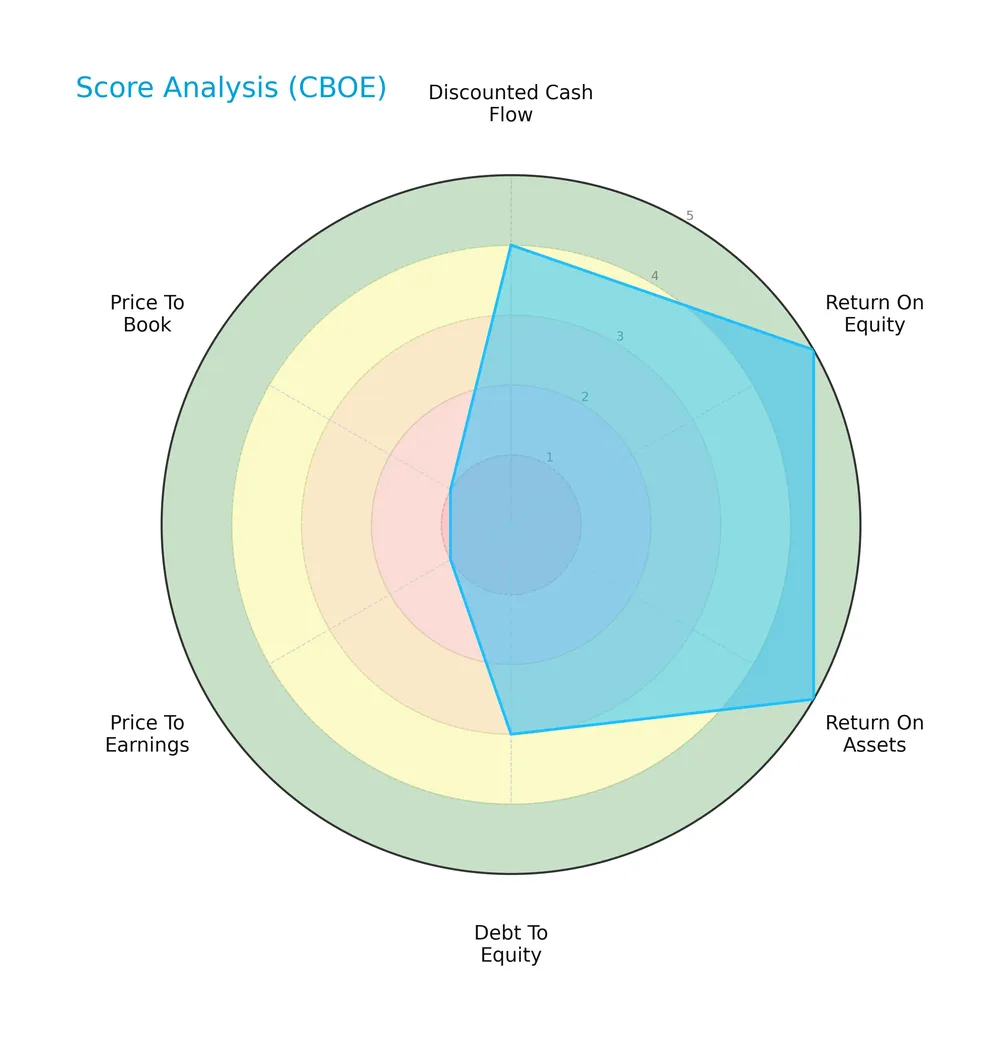

Here is a detailed radar chart summarizing key financial metrics and valuation scores for Cboe Global Markets, Inc.:

The company scores very favorably on return on equity (5) and return on assets (5), indicating strong profitability. Its discounted cash flow rating is favorable (4). Debt-to-equity is moderate (3), but valuation scores for price-to-earnings and price-to-book ratios are very unfavorable (1 each), suggesting potential market pricing concerns.

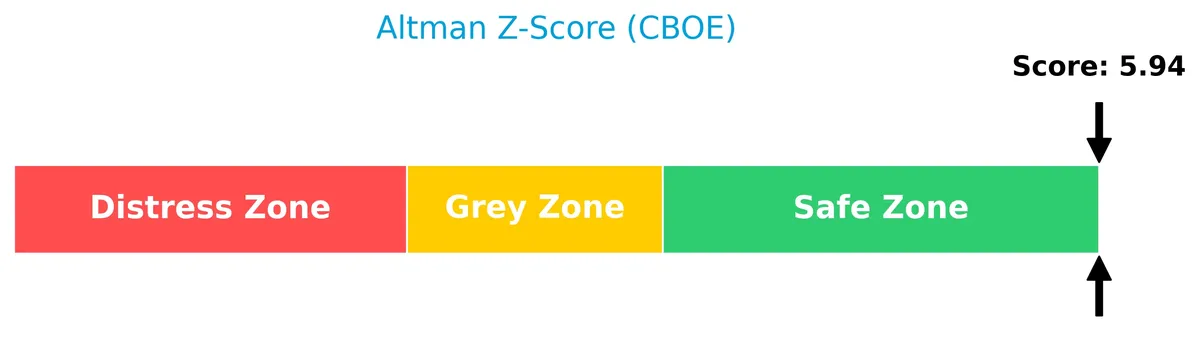

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company comfortably in the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

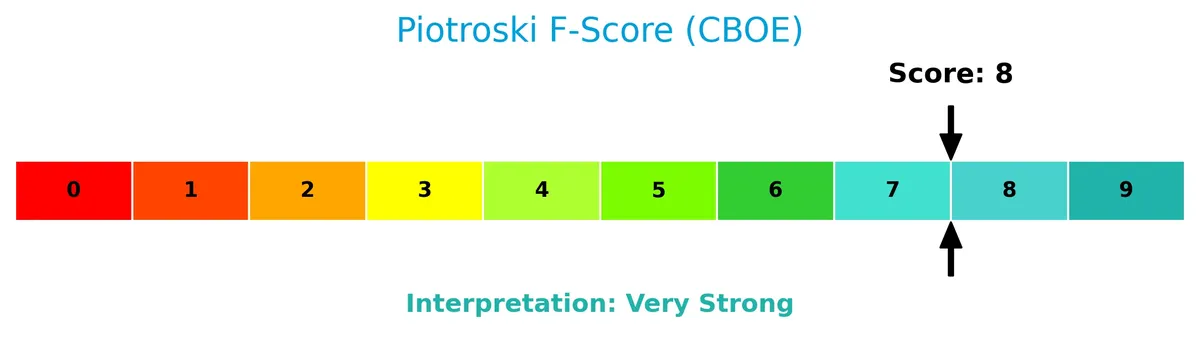

The Piotroski Score diagram highlights the company’s strong financial health and robust fundamentals:

With a Piotroski Score of 8, Cboe Global Markets demonstrates very strong financial strength, reflecting solid profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section analyzes Cboe Global Markets, Inc.’s strategic positioning, revenue segments, and key products within its sector. We will assess its main competitors and competitive advantages in financial data and stock exchanges. I aim to determine whether Cboe holds a sustainable competitive advantage over its industry peers.

Strategic Positioning

Cboe Global Markets maintains a diversified portfolio across options, equities, futures, FX, and international markets. Its revenue streams span transaction fees, market data, regulatory, and access fees, reflecting broad geographic and product exposure within global financial exchanges.

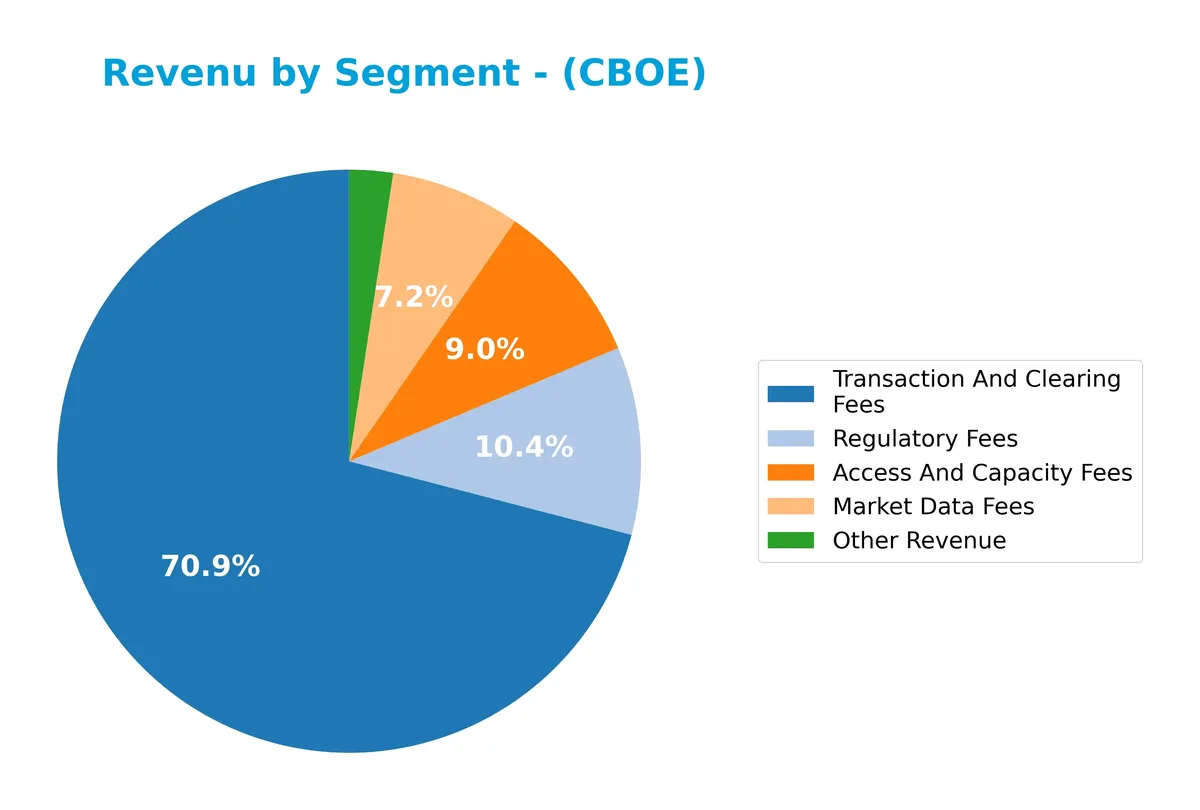

Revenue by Segment

This pie chart displays Cboe Global Markets’ revenue breakdown by segment for the fiscal year 2024, highlighting how each business unit contributes to overall income.

In 2024, Transaction and Clearing Fees dominate with 2.9B, underscoring the firm’s reliance on this core segment. Regulatory Fees at 426M and Access and Capacity Fees at 370M provide steady support. Market Data Fees, at 295M, show solid but smaller scale revenue. The concentration in clearing fees suggests risk if market volumes decline, but also reflects strong operational moats in transaction processing.

Key Products & Brands

Cboe Global Markets generates revenue from multiple fee-based products and market services, including data and transaction fees:

| Product | Description |

|---|---|

| Options Segment | Trades listed market indices options globally. |

| North American Equities | Trades U.S. and Canadian equities and offers ETP transaction and listing services. |

| Futures Segment | Facilitates trading in futures contracts. |

| Europe and Asia Pacific | Provides pan-European equities, derivatives, ETPs, exchange-traded commodities, and clearing. |

| Global FX | Offers institutional foreign exchange and non-deliverable forward FX transaction services. |

| Transaction and Clearing Fees | Fees charged for executing and clearing trades across markets. |

| Market Data Fees | Charges for access to market data and analytics. |

| Access and Capacity Fees | Fees for market access and capacity usage. |

| Regulatory Fees | Fees related to regulatory compliance and oversight. |

| Liquidity Payments | Incentives paid to market participants to provide liquidity. |

| Routing and Clearing Fees | Fees for routing orders and clearing transactions. |

| Section 31 Fees | Regulatory fees paid to the SEC for transaction reporting. |

| Other Revenue | Miscellaneous revenue sources not classified elsewhere. |

Cboe Global Markets operates a diversified portfolio of market trading platforms and fee-based services. Its revenue streams include transaction fees, market data, and regulatory charges, reflecting a broad engagement across global financial markets.

Main Competitors

There are 9 competitors in total, with the table listing the top 9 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| S&P Global Inc. | 155.2B |

| CME Group Inc. | 97.2B |

| Intercontinental Exchange, Inc. | 91.7B |

| Moody’s Corporation | 89.7B |

| Coinbase Global, Inc. | 60.5B |

| Nasdaq, Inc. | 55.5B |

| MSCI Inc. | 43.7B |

| Cboe Global Markets, Inc. | 25.9B |

| FactSet Research Systems Inc. | 10.8B |

Cboe Global Markets ranks 8th among its peers. Its market cap is 18.4% of the sector leader, S&P Global. The company sits below both the average market cap of the top 10 (70B) and the sector median (60.5B). It maintains a 53% market cap gap to its next competitor above, MSCI, indicating a significant scale difference within the group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CBOE have a competitive advantage?

Cboe Global Markets, Inc. shows strong competitive traits with a 94.9% gross margin and a 23.3% net margin, reflecting efficient revenue generation. Its market position spans diverse segments including options, equities, futures, and global FX, supported by strategic partnerships with major index providers.

Looking ahead, Cboe’s expansion in international markets and broadening product offerings like exchange-traded products and clearing services offer growth opportunities. However, the declining ROIC trend suggests caution regarding capital efficiency and long-term economic moat sustainability.

SWOT Analysis

This SWOT analysis highlights Cboe Global Markets’ strategic position by identifying internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- strong revenue growth

- high net margin

- strategic global partnerships

Weaknesses

- declining ROIC

- unfavorable EBIT margin

- low liquidity ratios

Opportunities

- expansion in Asia Pacific

- growth in FX trading

- increasing demand for ETP services

Threats

- regulatory changes

- market volatility

- rising competition from alternative exchanges

Cboe’s solid revenue and margin performance underpin its competitive edge. However, declining returns on invested capital and liquidity issues require cautious capital allocation. The company should leverage growth in FX and Asia markets while mitigating regulatory and competitive risks.

Stock Price Action Analysis

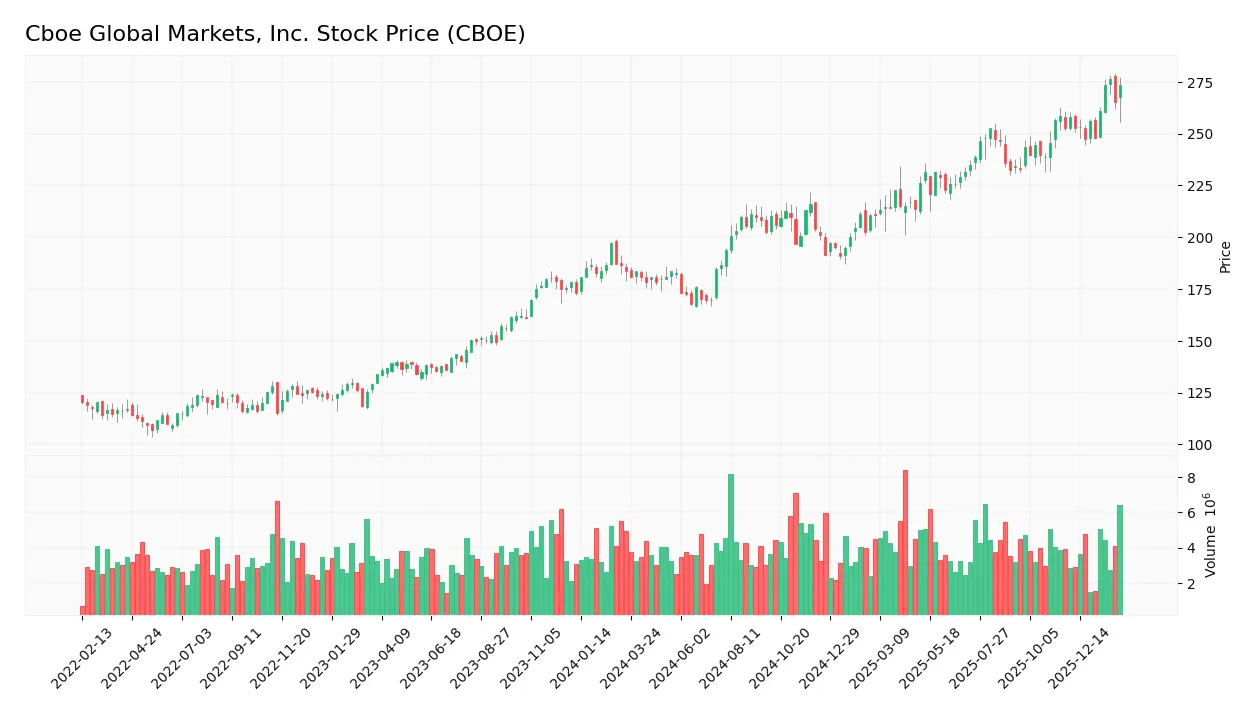

The weekly price chart for Cboe Global Markets, Inc. (CBOE) reveals significant upward momentum over the past year:

Trend Analysis

Over the past 12 months, CBOE’s stock rose 48.95%, signaling a bullish trend with accelerating momentum. The price fluctuated between a low of 167.6 and a high of 276.39. Volatility remains elevated, with a standard deviation of 27.47%, indicating substantial price swings.

Volume Analysis

Trading volumes have increased recently, with buyers accounting for 60.79% of activity over the last three months. This buyer dominance and rising volume suggest positive investor sentiment and strong market participation supporting the uptrend.

Target Prices

Analysts set a strong consensus target for Cboe Global Markets, reflecting confidence in its growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 240 | 295 | 274 |

The target range from 240 to 295 shows a bullish outlook, with a consensus price of 274 signaling expected upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback to gauge sentiment on Cboe Global Markets, Inc.

Stock Grades

Here is the latest overview of verified analyst grades for Cboe Global Markets, Inc., reflecting recent consensus trends:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-14 |

| Piper Sandler | Maintain | Overweight | 2026-01-14 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| UBS | Maintain | Neutral | 2026-01-07 |

| Morgan Stanley | Maintain | Underweight | 2025-12-22 |

| Barclays | Upgrade | Overweight | 2025-12-12 |

| UBS | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Neutral | 2025-11-03 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-11-03 |

The overall grading trend leans toward Hold and Overweight, with several firms maintaining positive stances. Notably, Barclays upgraded its rating late last year, indicating cautious optimism among analysts.

Consumer Opinions

Consumers express a mix of respect for Cboe Global Markets’ innovation and frustration with occasional service issues.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cboe offers reliable and fast trading platforms.” | “Customer support response times are slow.” |

| “Their market data products are comprehensive and accurate.” | “Some fees feel higher compared to competitors.” |

| “Innovative options and futures products set them apart.” | “The user interface can be confusing for new traders.” |

Overall, users praise Cboe’s innovative trading products and data reliability. However, recurring complaints about support delays and pricing complexity suggest areas for improvement.

Risk Analysis

Below is a table summarizing key risks facing Cboe Global Markets, Inc. along with their probability and impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Lower trading volumes can reduce fee revenue. | Medium | High |

| Regulatory Risk | Changes in financial market regulations affecting operations. | Medium | Medium |

| Liquidity Risk | Unfavorable current and quick ratios suggest cash constraints. | High | Medium |

| Interest Coverage | Negative interest coverage signals difficulty servicing debt. | Medium | High |

| Valuation Risk | Elevated P/E and low price-to-book scores indicate overvaluation. | Medium | Medium |

Most concerning is the liquidity risk, as the current and quick ratios are unfavorable, signaling possible short-term cash flow challenges. Additionally, negative interest coverage raises red flags about debt servicing ability. However, strong Altman Z-Score (5.94) and Piotroski Score (8) indicate overall financial stability, cushioning some risks. Market volatility remains a persistent threat given reliance on trading volumes.

Should You Buy Cboe Global Markets, Inc.?

Cboe appears to be a profitable company with strong operational efficiency and a very favorable B+ rating. While its competitive moat could be seen as declining due to shrinking ROIC, its leverage profile remains manageable, supported by a safe Altman Z-Score and very strong Piotroski Score.

Strength & Efficiency Pillars

Cboe Global Markets, Inc. exhibits strong operational profitability with a net margin of 23.33% and a very favorable gross margin at 94.94%. The company’s Piotroski score of 8 signals robust financial health. Despite unavailable ROIC and WACC data, the very strong return on assets and equity scores reflect effective capital use. Revenue growth of 15.13% in the last year and a 107.94% net income increase over five years underline solid value creation and operational momentum.

Weaknesses and Drawbacks

Cboe faces some valuation concerns, with a neutral P/E ratio at 23.89 suggesting no clear undervaluation edge. Liquidity metrics are unfavorable, including a low current ratio and quick ratio, which could constrain short-term financial flexibility. Interest coverage is negative, representing a risk in servicing debt under adverse conditions. Additionally, asset turnover and fixed asset turnover scores are weak, hinting at potential inefficiencies in asset utilization that may pressure future profitability.

Our Final Verdict about Cboe Global Markets, Inc.

The company’s financial health is strong, supported by a safe zone Altman Z-Score of 5.94 and a very strong Piotroski score. Its bullish overall price trend, combined with buyer dominance in recent periods, suggests positive market sentiment. The profile may appear attractive for long-term exposure, though investors should monitor liquidity risks and valuation levels for optimal entry timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cboe Global Markets Reports Results for Fourth Quarter 2025 and Full Year – PR Newswire (Feb 06, 2026)

- Cboe Global Markets (CBOE): The Derivatives Powerhouse in a Volatile World – FinancialContent (Feb 06, 2026)

- CBOE Global Markets, Inc. Reveals Advance In Q4 Bottom Line – Nasdaq (Feb 06, 2026)

- Cboe to Launch Binary Event Wagers in Prediction Markets Push – bloomberg.com (Feb 06, 2026)

- CBOE: Q4 Earnings Snapshot – kens5.com (Feb 06, 2026)

For more information about Cboe Global Markets, Inc., please visit the official website: cboe.com