Home > Analyses > Industrials > Carrier Global Corporation

Carrier Global Corporation cools and secures millions of homes and businesses worldwide, shaping comfort and safety every day. It commands the HVAC, refrigeration, and fire & security markets with renowned brands like Carrier and Kidde, blending cutting-edge technology with proven reliability. Known for innovation and scale, Carrier influences how industries manage climate control and risk. The key question now: do its robust fundamentals justify the current valuation and growth prospects in a competitive industrial landscape?

Table of contents

Business Model & Company Overview

Carrier Global Corporation, founded in 2019 and headquartered in Palm Beach Gardens, Florida, stands as a leader in heating, ventilating, air conditioning (HVAC), refrigeration, fire, security, and building automation technologies. Its integrated ecosystem spans HVAC, Refrigeration, and Fire & Security segments, delivering comprehensive solutions for residential, commercial, and industrial needs worldwide. The company’s 48K employees support a cohesive mission to enhance comfort, safety, and efficiency across diverse environments.

Carrier drives value through a balanced mix of hardware products, digital controls, and recurring aftermarket services. Its HVAC units, refrigeration systems, and fire & security technologies serve global markets in the Americas, Europe, and Asia, embedding the company deeply in international infrastructure. This competitive advantage in innovation and service underpins a durable economic moat, positioning Carrier to shape the future of building technologies.

Financial Performance & Fundamental Metrics

I will analyze Carrier Global Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

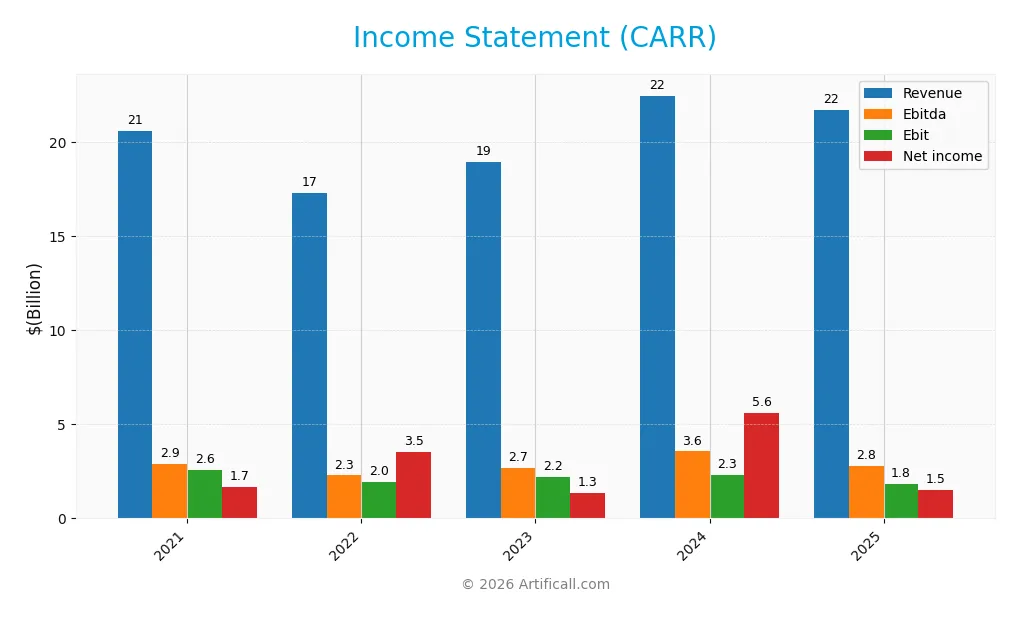

The table below summarizes Carrier Global Corporation’s annual income statement figures for the fiscal years 2021 through 2025. All amounts are in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 20.6B | 17.3B | 18.9B | 22.5B | 21.7B |

| Cost of Revenue | 14.6B | 13.0B | 13.8B | 16.5B | 16.1B |

| Operating Expenses | 3.4B | 0.3B | 3.0B | 3.4B | 3.5B |

| Gross Profit | 6.0B | 4.3B | 5.2B | 6.0B | 5.6B |

| EBITDA | 2.9B | 2.3B | 2.7B | 3.6B | 2.8B |

| EBIT | 2.6B | 2.0B | 2.2B | 2.3B | 1.8B |

| Interest Expense | 319M | 302M | 306M | 580M | 345M |

| Net Income | 1.7B | 3.5B | 1.3B | 5.6B | 1.5B |

| EPS | 1.92 | 4.19 | 1.61 | 6.24 | 1.72 |

| Filing Date | 2022-02-08 | 2023-02-07 | 2024-02-06 | 2025-02-11 | 2026-02-05 |

Income Statement Evolution

Carrier Global’s revenue showed a modest overall increase of 5.5% from 2021 to 2025 but declined 3.3% in the latest year. Net income fell by over 10% across the period, with a sharp 72% drop in 2025 alone. Gross margin remained relatively stable near 26%, while EBIT and net margins contracted, signaling margin pressure in the recent fiscal year.

Is the Income Statement Favorable?

The 2025 income statement reveals weakening fundamentals. Revenue and profit declined year-over-year, with EBIT down 21% and net margin falling to 6.87%. Interest expense remains low at 1.59% of revenue, a positive aspect. However, the significant drop in net income and EPS growth indicates challenges in profitability and operational efficiency, resulting in an overall unfavorable income statement assessment.

Financial Ratios

The following table summarizes key financial ratios for Carrier Global Corporation (CARR) over the last five fiscal years, providing a snapshot of profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.4% | 8.1% | 20.4% | 7.1% | 24.9% |

| ROE | 31.7% | 24.6% | 45.6% | 15.5% | 39.8% |

| ROIC | 10.7% | 9.5% | 16.5% | 6.2% | 4.6% |

| P/E | 16.5 | 28.3 | 9.8 | 35.7 | 10.9 |

| P/B | 5.2 | 7.0 | 4.5 | 5.5 | 4.4 |

| Current Ratio | 1.67 | 1.72 | 1.64 | 2.80 | 1.25 |

| Quick Ratio | 1.35 | 1.42 | 1.20 | 2.54 | 0.96 |

| D/E | 1.76 | 1.51 | 1.21 | 1.69 | 0.90 |

| Debt-to-Assets | 44.0% | 39.1% | 35.9% | 44.6% | 34.0% |

| Interest Coverage | 10.3x | 8.3x | 13.2x | 7.1x | 4.6x |

| Asset Turnover | 0.70 | 0.79 | 0.66 | 0.58 | 0.60 |

| Fixed Asset Turnover | 6.7 | 8.4 | 6.0 | 7.3 | 6.3 |

| Dividend Yield | 0.42% | 0.89% | 1.46% | 1.29% | 1.09% |

Evolution of Financial Ratios

From 2020 to 2024, Carrier Global’s Return on Equity (ROE) fluctuated significantly, peaking near 45% in 2022 before settling at 40% in 2024. The Current Ratio declined steadily from around 2.8 in 2023 to 1.25 in 2024, indicating reduced short-term liquidity. The Debt-to-Equity Ratio improved from 1.76 in 2020 to 0.9 in 2024, signaling a modest deleveraging trend. Profitability showed mixed signals, with net margins jumping sharply to 24.9% in 2024 after prior volatility.

Are the Financial Ratios Fovorable?

In 2024, Carrier’s profitability metrics such as net margin (24.9%) and ROE (39.8%) are favorable, reflecting strong earnings efficiency. Liquidity ratios like Current Ratio (1.25) and Quick Ratio (0.96) are neutral, suggesting adequate but not robust short-term financial flexibility. Leverage measures including Debt-to-Equity (0.9) and Debt-to-Assets (34%) remain neutral, balanced between risk and capital structure optimization. Market valuations show mixed signals: a favorable P/E of 10.94 contrasts with an unfavorable Price-to-Book ratio of 4.35. Overall, the financial ratios are slightly favorable but warrant cautious monitoring.

Shareholder Return Policy

Carrier Global Corporation maintains a modest dividend payout ratio of approximately 12% in 2024, with a stable dividend per share around $0.75 and an annual yield near 1.1%. The company supports shareholder returns through dividends and share buybacks, though free cash flow coverage of dividends remains low at 47%.

This conservative payout aligns with Carrier’s prudent capital allocation, balancing reinvestment and shareholder rewards. The current distribution approach appears sustainable, avoiding excessive repurchases or unsustainable dividends, thereby supporting long-term shareholder value creation.

Score analysis

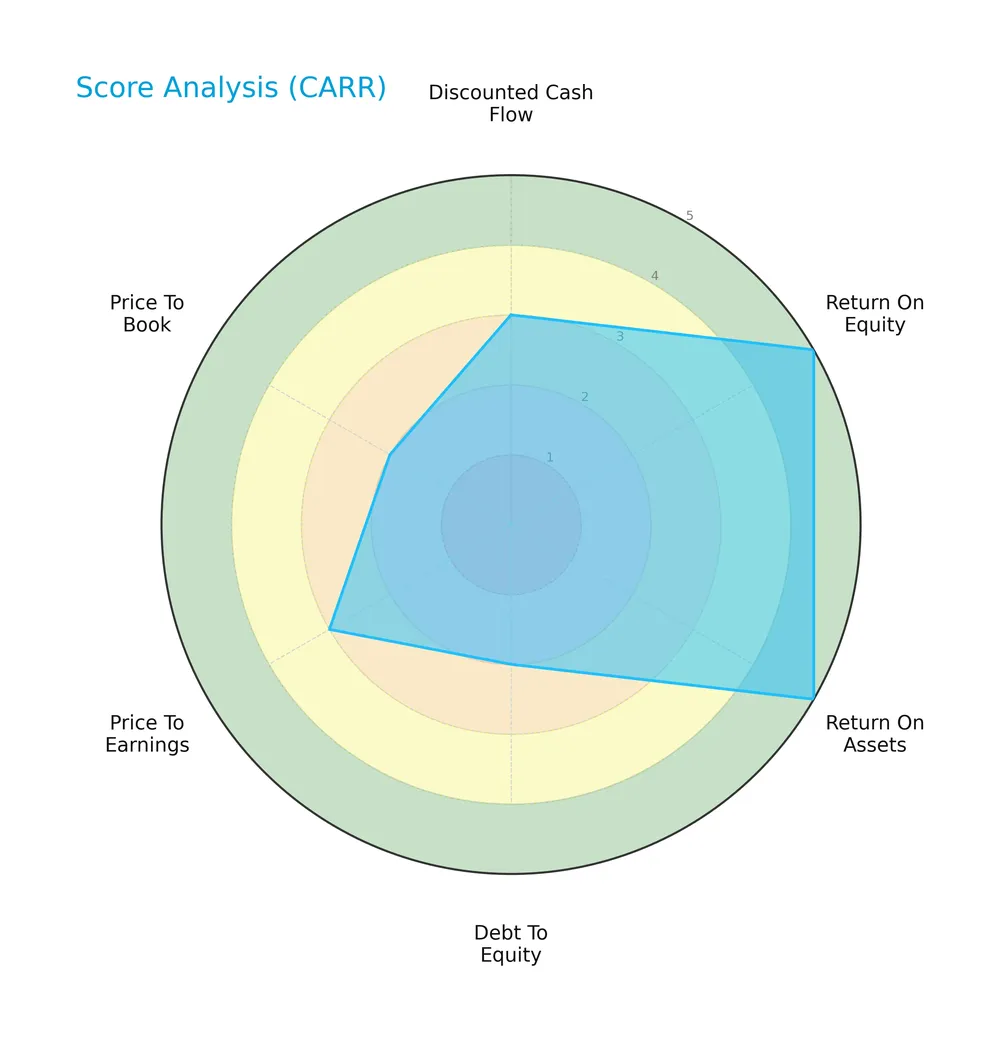

The following radar chart illustrates Carrier Global Corporation’s key financial scores for investor assessment:

Carrier shows very favorable returns on equity and assets, moderate discounted cash flow and valuation metrics, but a moderate score in debt-to-equity, indicating some leverage concerns.

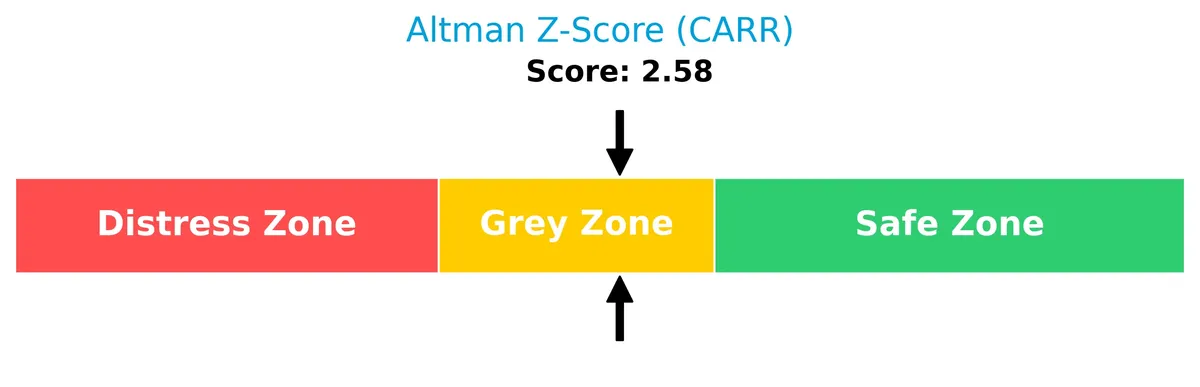

Analysis of the company’s bankruptcy risk

Carrier’s Altman Z-Score places it in the grey zone, signaling a moderate bankruptcy risk that warrants monitoring:

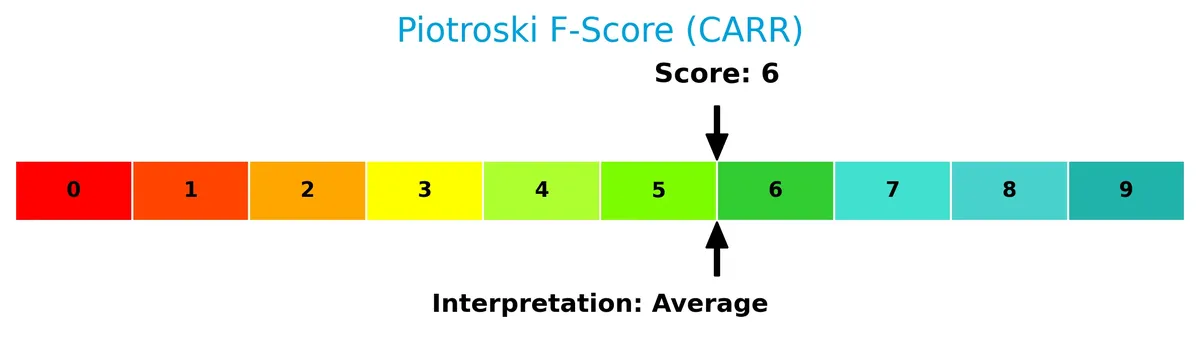

Is the company in good financial health?

Below is the Piotroski F-Score diagram reflecting the company’s financial health:

With a Piotroski Score of 6, Carrier demonstrates average financial strength, indicating some solid fundamentals but room for improvement in operational efficiency or profitability.

Competitive Landscape & Sector Positioning

This analysis examines Carrier Global Corporation’s sector positioning, revenue streams, and product offerings. I will assess whether Carrier holds a competitive advantage within its industry peers.

Strategic Positioning

Carrier Global Corporation operates a diversified product portfolio spanning HVAC, refrigeration, and fire & security segments. Geographically, it maintains broad exposure, with substantial revenues from the US (11.3B), Europe (6.7B), and Asia Pacific (3.8B) in 2024, reflecting balanced global market reach.

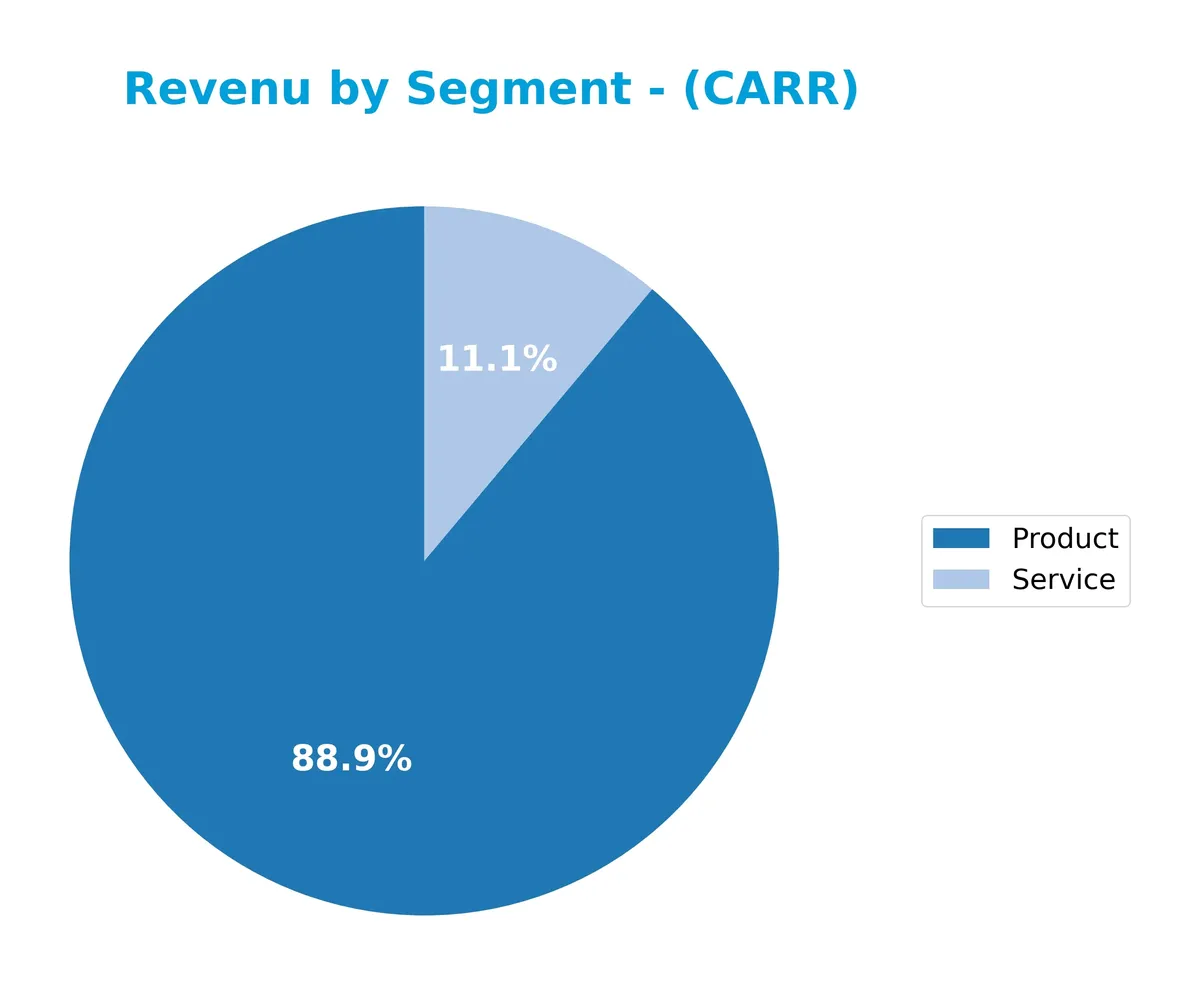

Revenue by Segment

This pie chart displays Carrier Global Corporation’s revenue breakdown by Product and Service segments for fiscal year 2024, highlighting their relative contributions to total sales.

Carrier’s revenue remains heavily driven by the Product segment, which reached $20B in 2024, up from $19.6B in 2023. The Service segment, at $2.5B in 2024, showed slight contraction compared to 2023’s $2.54B. Historically, product sales have grown steadily, reflecting strong demand in equipment manufacturing, while services exhibit more volatility. The latest year shows moderate acceleration in product revenue, signaling ongoing operational strength but also concentration risk in product reliance.

Key Products & Brands

Carrier Global Corporation’s core products and brands span HVAC, refrigeration, and fire & security technologies:

| Product | Description |

|---|---|

| HVAC | Heating, ventilation, and air conditioning systems, controls, aftermarket components, and building automation. |

| Refrigeration | Transport refrigeration, monitoring products, commercial refrigeration cabinets, freezers, and controls. |

| Fire & Security | Fire detection, suppression systems, intruder alarms, access control, video management, and electronic controls. |

| Brands | Autronica, Det-Tronics, Edwards, Fireye, GST, Kidde, LenelS2, Marioff, Onity, Supra, Carrier, Automated Logic, Bryant, CIAT, Day & Night, Heil, NORESCO, Riello, Carrier Commercial Refrigeration, Carrier Transicold, Sensitech. |

Carrier’s diversified portfolio delivers HVAC, refrigeration, and fire & security solutions under multiple established brands, serving residential, commercial, and industrial markets globally.

Main Competitors

The sector includes 6 competitors, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Trane Technologies plc | 88.3B |

| Johnson Controls International plc | 80.0B |

| Carrier Global Corporation | 45.1B |

| Lennox International Inc. | 17.5B |

| Masco Corporation | 13.4B |

| Builders FirstSource, Inc. | 11.6B |

Carrier Global Corporation ranks 3rd among its competitors. Its market cap stands at 59.6% of the leader, Trane Technologies plc. The company is above both the average market cap of the top 10 (42.6B) and the median market cap in the sector (31.3B). Carrier holds a significant 52.1% lead over its nearest rival above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CARR have a competitive advantage?

Carrier Global Corporation operates in HVAC, refrigeration, and fire & security technologies with diverse global reach and well-known brands. Its gross margin of 26% and net margin near 7% suggest operational strength despite recent earnings declines.

Looking ahead, Carrier could leverage growth opportunities in digital solutions and building automation across expanding markets like Europe and Asia Pacific. However, the company’s declining ROIC trend signals caution on sustaining long-term value creation.

SWOT Analysis

This SWOT analysis highlights Carrier Global Corporation’s key strategic factors to guide investment decisions.

Strengths

- strong brand portfolio

- favorable net margin of 24.92%

- high ROE at 39.8%

Weaknesses

- declining revenue and net income growth

- decreasing ROIC trend

- moderate debt-to-equity ratio

Opportunities

- expanding commercial refrigeration market

- growth potential in emerging Asia Pacific region

- innovation in building automation technology

Threats

- volatile construction sector demand

- intense competition in HVAC and security

- global supply chain disruptions

Carrier’s strong profitability and brand recognition provide a solid foundation. However, its declining returns and revenue contractions require strategic focus on innovation and market expansion. Risks from sector cyclicality and competition demand cautious capital allocation.

Stock Price Action Analysis

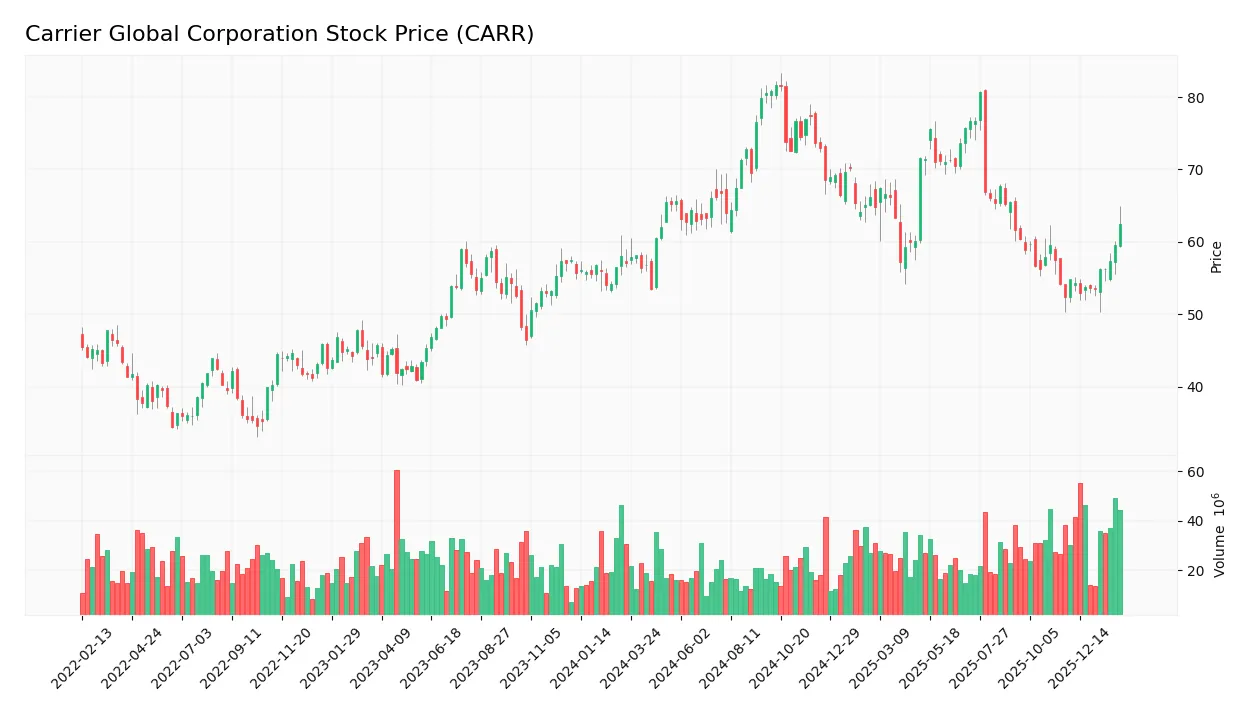

The weekly stock chart displays Carrier Global Corporation’s price movements over the past 12 months, highlighting key trends and volatility:

Trend Analysis

Over the past 12 months, CARR’s price rose 9.54%, indicating a bullish trend with accelerating momentum. The stock ranged from a low of 52.41 to a high of 81.61, with a volatility measured by a 7.6 standard deviation, signaling active price swings.

Volume Analysis

Trading volume increased recently, totaling 2.93B shares with buyers accounting for 55.1% in the last three months. This slight buyer dominance and rising volume suggest growing investor interest and positive market participation in CARR’s shares.

Target Prices

Analysts set a target consensus that reflects moderate upside potential for Carrier Global Corporation.

| Target Low | Target High | Consensus |

|---|---|---|

| 55 | 74 | 67.38 |

The target range indicates confidence in Carrier’s growth, with a consensus price suggesting a solid valuation above current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Carrier Global Corporation’s analyst ratings and consumer feedback to gauge market sentiment and satisfaction.

Stock Grades

Here are the latest verified stock grades from leading financial institutions for Carrier Global Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-16 |

| Citigroup | Maintain | Buy | 2026-01-12 |

| UBS | Maintain | Buy | 2026-01-05 |

| Mizuho | Maintain | Outperform | 2026-01-05 |

| Barclays | Maintain | Overweight | 2025-12-10 |

| RBC Capital | Maintain | Outperform | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-04 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-29 |

The consensus reveals a generally positive outlook, with the majority labeling Carrier as a Buy or Outperform. Notably, no downgrades occurred, indicating stable analyst confidence.

Consumer Opinions

Consumer sentiment around Carrier Global Corporation reflects a blend of admiration for product reliability and frustrations over service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “Carrier’s HVAC units perform efficiently, saving on energy bills.” | “Customer service wait times are often long and unhelpful.” |

| “The air quality improvements from their systems are noticeable.” | “Installation delays caused inconvenience during peak seasons.” |

| “Durability of their products stands out compared to competitors.” | “Some replacement parts are expensive and hard to find.” |

Overall, customers praise Carrier’s product quality and energy efficiency. However, recurring complaints about service delays and customer support highlight areas needing urgent improvement.

Risk Analysis

Below is a summary table highlighting key risks for Carrier Global Corporation (CARR):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Beta of 1.335 indicates higher sensitivity to market swings. | Medium | Medium |

| Financial Leverage | Debt-to-equity ratio of 0.9 suggests moderate leverage risk. | Medium | Medium |

| Liquidity | Current ratio at 1.25 and quick ratio 0.96 show borderline liquidity. | Medium | Medium |

| Valuation | Price-to-book ratio of 4.35 flags potential overvaluation risk. | Medium | High |

| Profitability | ROIC at 4.58% is below ideal thresholds, signaling inefficient capital usage. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 2.58 places company in grey zone of distress risk. | Low | High |

The most concerning risks for CARR are valuation and bankruptcy potential. A high price-to-book ratio combined with a grey zone Altman Z-Score warrants caution. Market volatility and moderate leverage also expose the stock to cyclical downturns. I recommend monitoring liquidity trends closely, as current ratios hover near the minimum safety margin.

Should You Buy Carrier Global Corporation?

Carrier Global Corporation appears to be a company with improving profitability and a moderate leverage profile, though its competitive moat could be seen as eroding due to declining ROIC. While debt metrics suggest manageable risk, the overall rating of A- indicates a favorable financial health profile worth analytical consideration.

Strength & Efficiency Pillars

Carrier Global Corporation exhibits solid profitability with a net margin of 24.92% and a return on equity of 39.8%, signaling efficient capital use. Its interest coverage ratio at 5.33 underscores healthy earnings relative to debt costs. The Altman Z-Score of 2.58 places the company in the grey zone, indicating moderate financial stability without distress signals. A Piotroski score of 6 suggests average financial strength. While ROIC stands at 4.58%, the lack of WACC data prevents confirming value creation status. Overall, profitability and financial health metrics lean slightly favorable.

Weaknesses and Drawbacks

Carrier faces several challenges that warrant caution. The price-to-book ratio of 4.35 is elevated, implying a premium valuation that may limit upside. The current ratio of 1.25 and quick ratio near 0.96 reflect moderate liquidity but not a strong buffer against short-term shocks. Debt-to-equity at 0.9 and debt-to-assets at 33.98% signal moderate leverage, which could amplify risks during downturns. Recent income trends are unfavorable, with a 3.29% revenue decline over one year and a steep 72.45% drop in net margin growth, suggesting operational pressures.

Our Verdict about Carrier Global Corporation

The company’s long-term fundamental profile might appear moderately favorable due to strong profitability and stable financial health. Coupled with a bullish overall stock trend and slightly buyer-dominant recent volume, the profile suggests potential for growth. However, persistent income declines and moderate leverage advise prudence. Thus, despite its solid fundamentals, investors could consider a wait-and-see approach to identify a more optimal entry point amid recent operational headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Carrier Reports 2025 Results and Announces 2026 Outlook – Carrier (Feb 05, 2026)

- Carrier Global (CARR) Reports Q4 Earnings: What Key Metrics Have to Say – Yahoo Finance (Feb 05, 2026)

- Carrier Global Corp (NYSE:CARR) Shares Drop on Q4 Earnings and Revenue Miss – Chartmill (Feb 05, 2026)

- Carrier Global Q4 Earnings & Revenues Miss Estimates, Stock Down – Zacks Investment Research (Feb 05, 2026)

- Carrier Global misses Q4 estimates as residential weakness weighs; shares fall (CARR:NYSE) – Seeking Alpha (Feb 05, 2026)

For more information about Carrier Global Corporation, please visit the official website: corporate.carrier.com