Home > Analyses > Financial Services > Capital One Financial Corporation

Capital One Financial Corporation transforms everyday financial experiences by blending cutting-edge technology with comprehensive banking services. As a prominent player in credit services, it leads with innovative credit card offerings, consumer and commercial banking solutions, and a strong digital presence. Renowned for quality and market influence, Capital One continuously adapts to shifting economic landscapes. The key question for investors now is whether its robust fundamentals can sustain growth and justify its current valuation in an evolving financial sector.

Table of contents

Business Model & Company Overview

Capital One Financial Corporation, founded in 1988 and headquartered in McLean, Virginia, commands a dominant position in the financial credit services industry. It operates a cohesive ecosystem of products through Capital One Bank and its national associations, integrating credit cards, consumer, and commercial banking to serve a diverse clientele across the US, Canada, and the UK. This multi-segment approach strengthens its core mission of delivering accessible and innovative financial solutions.

Its revenue engine balances interest income from loans—including credit card, auto, retail, and commercial loans—with fees from credit and debit card products and digital banking services. With strategic footprints in North America and Europe, Capital One leverages digital channels, branches, and cafés to reach consumers, small businesses, and commercial clients. This economic moat positions the company as a key architect shaping the future of financial services globally.

Financial Performance & Fundamental Metrics

In this section, I analyze Capital One Financial Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

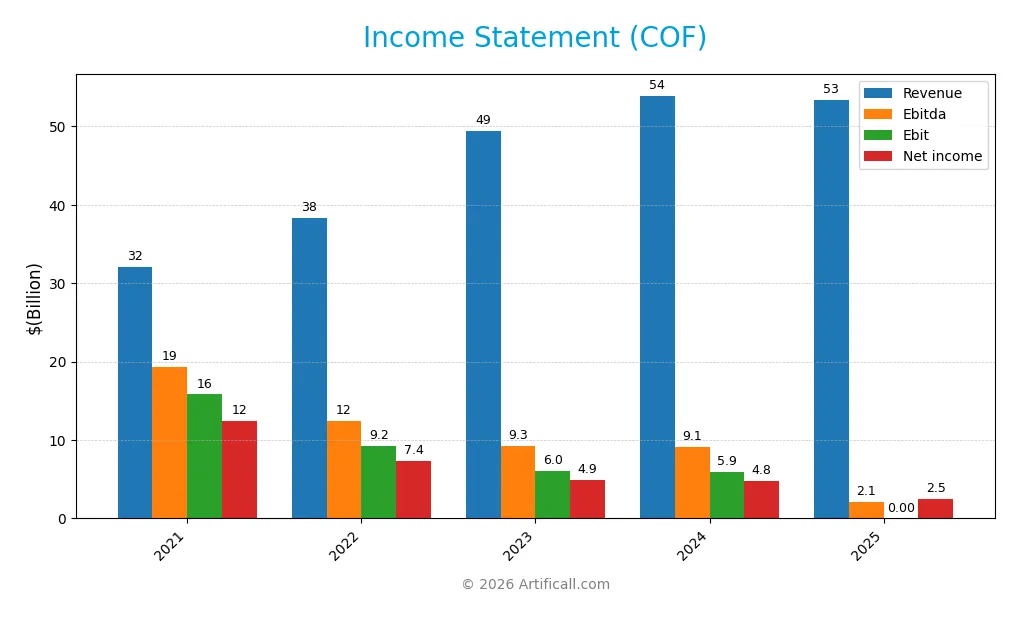

The table below summarizes Capital One Financial Corporation’s key income statement figures over the past five fiscal years, providing a clear view of revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 32.0B | 38.4B | 49.5B | 53.9B | 53.4B |

| Cost of Revenue | -346M | 9.97B | 23.1B | 26.5B | 0 |

| Operating Expenses | 16.6B | 19.2B | 20.3B | 21.5B | 24.6B |

| Gross Profit | 32.4B | 28.4B | 26.4B | 27.4B | 0 |

| EBITDA | 19.3B | 12.5B | 9.3B | 9.1B | 2.1B |

| EBIT | 15.8B | 9.2B | 6.0B | 5.9B | 0 |

| Interest Expense | 1.60B | 4.12B | 12.7B | 14.8B | 30.5B |

| Net Income | 12.4B | 7.4B | 4.9B | 4.8B | 2.5B |

| EPS | 27.04 | 17.98 | 11.98 | 11.61 | 4.03 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-20 | 2026-01-22 |

Income Statement Evolution

From 2021 to 2025, Capital One Financial Corporation’s revenue grew by 66.8%, indicating strong top-line expansion. However, net income declined sharply by 80.2%, reflecting margin compression. Gross and EBIT margins deteriorated significantly, with a 100% drop in gross profit and EBIT in the last year, showing unfavorable cost and expense trends. Net margin also fell by 88.1%, signaling profitability challenges.

Is the Income Statement Favorable?

The 2025 income statement reveals a revenue decline of 0.9% from 2024, alongside a steep net income decrease of 47.9%. Interest expense consumed 57.1% of revenue, an unfavorable level that pressures earnings. EBITDA stood at just 2.1B, down from 9.1B the prior year. Overall, the fundamental income metrics are largely unfavorable, reflecting significant profitability and margin weaknesses despite stable revenue.

Financial Ratios

The following table presents key financial ratios for Capital One Financial Corporation (COF) over recent fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 39% | 19% | 10% | 9% | 5% |

| ROE | 20% | 14% | 8% | 8% | 0% |

| ROIC | 10% | 6% | 4% | 4% | 0% |

| P/E | 5.2 | 5.2 | 10.3 | 14.4 | 53.4 |

| P/B | 1.05 | 0.73 | 0.86 | 1.12 | 0.0 |

| Current Ratio | 0.38 | 0.33 | 0.36 | 0.14 | 0.0 |

| Quick Ratio | 0.38 | 0.33 | 0.36 | 0.14 | 0.0 |

| D/E | 0.71 | 0.93 | 0.86 | 0.75 | 0.0 |

| Debt-to-Assets | 10% | 11% | 10% | 9% | 0% |

| Interest Coverage | 9.9 | 2.2 | 0.48 | 0.40 | 0.07 |

| Asset Turnover | 0.07 | 0.08 | 0.10 | 0.11 | 0.0 |

| Fixed Asset Turnover | 7.6 | 8.8 | 11.3 | 12.0 | 0.0 |

| Dividend Yield | 2.2% | 3.1% | 2.3% | 1.7% | 1.1% |

Note: Zero values indicate data not reported or unavailable for that year.

Evolution of Financial Ratios

Over the period, Capital One Financial Corporation saw a marked decline in key profitability ratios, with net profit margin decreasing from 38.7% in 2021 to 4.59% in 2025. Return on Equity (ROE) dropped sharply to zero by 2025, indicating a significant weakening in profitability. Current Ratio and Debt-to-Equity Ratio data for 2025 are unavailable or zero, reflecting either reporting gaps or notable instability.

Are the Financial Ratios Favorable?

In 2025, most financial ratios for Capital One present an unfavorable picture. Profitability indicators such as net margin and ROE are low, while leverage ratios like debt-to-equity and debt-to-assets are favorable, showing conservative debt levels. Liquidity ratios are unfavorable or zero, suggesting weak short-term financial health. Market valuation metrics like P/E ratio are high and unfavorable, and dividend yield is neutral. Overall, the ratio profile signals caution.

Shareholder Return Policy

Capital One Financial Corporation maintains a dividend payout ratio around 24-57%, with a dividend per share rising slightly to $2.6 in 2025 and an annual yield near 1.07%. The payout is covered by earnings, though the declining margin and elevated P/E ratio warrant monitoring. The company also engages in share buybacks, complementing its dividend policy.

This combined approach reflects a balanced return strategy, aiming to sustain shareholder value without overextending distributions despite margin compression. The dividend and buyback levels appear calibrated to support long-term value creation while preserving financial flexibility amid evolving profitability.

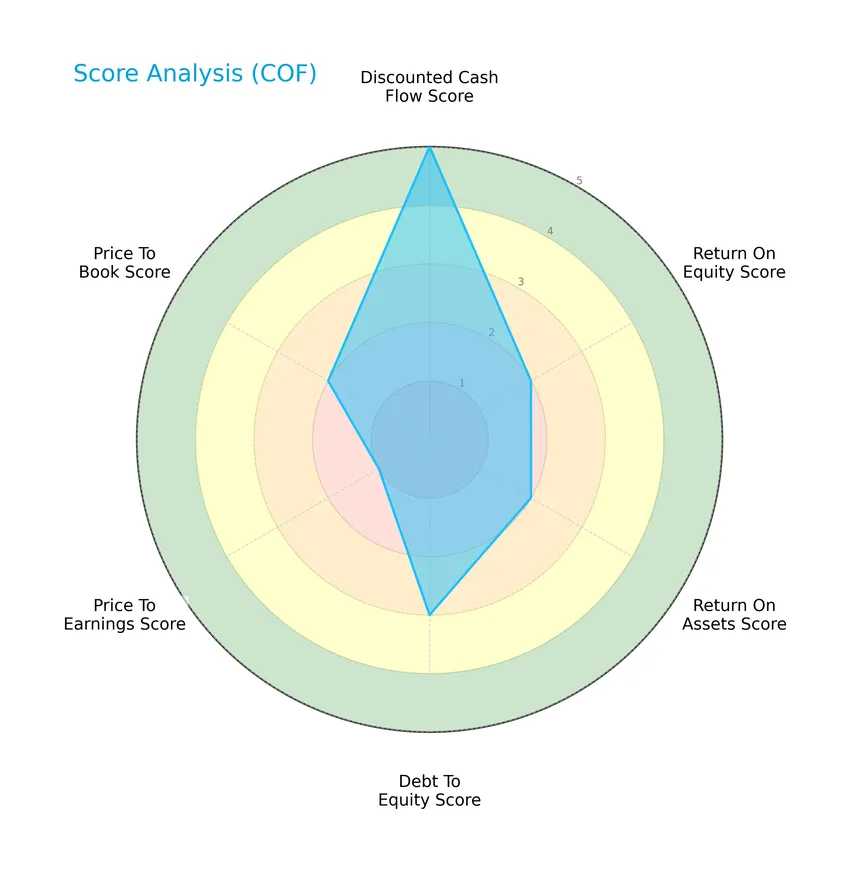

Score analysis

The following radar chart illustrates the company’s key financial scores across several important metrics:

Capital One Financial Corporation presents a very favorable discounted cash flow score of 5, while profitability ratios such as return on equity and return on assets score moderately at 2 each. Debt to equity is moderate at 3, but valuation metrics are mixed with a very unfavorable price-to-earnings score of 1 and a moderate price-to-book score of 2.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, indicating a high probability of financial distress and potential bankruptcy risk:

Is the company in good financial health?

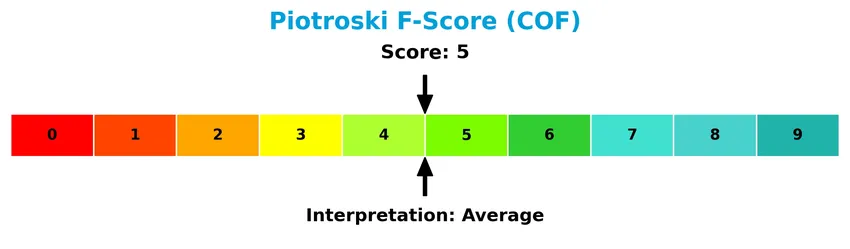

The Piotroski diagram provides insights into the company’s financial health based on a score of 5, indicating an average status:

With a Piotroski Score of 5, Capital One Financial Corporation demonstrates average financial strength, reflecting a balanced but not robust financial condition.

Competitive Landscape & Sector Positioning

This sector analysis will explore Capital One Financial Corporation’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will also examine the company’s SWOT profile to assess its strengths and weaknesses. The goal is to determine whether Capital One holds a competitive advantage over its industry peers.

Strategic Positioning

Capital One Financial Corporation maintains a diversified product portfolio across Credit Card, Consumer Banking, and Commercial Banking segments, generating over $38B combined revenue in 2023. Geographically, it is heavily concentrated in the United States, with $35.4B revenue, and limited international exposure of $1.4B.

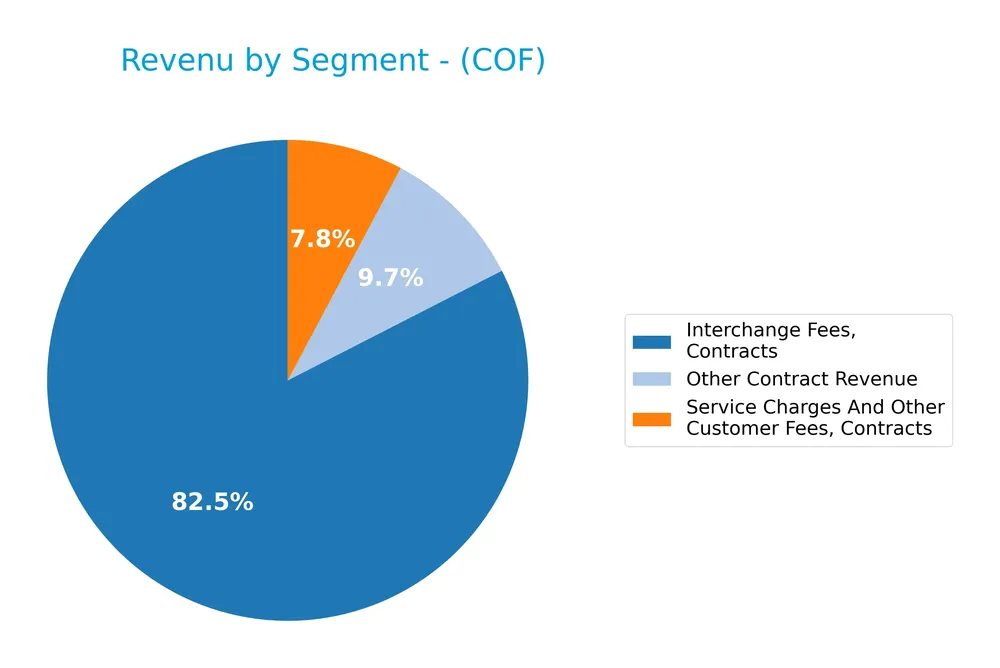

Revenue by Segment

This pie chart presents the revenue distribution of Capital One Financial Corporation by segment for the fiscal year 2024.

In 2024, the revenue segmentation data focuses on contract-related fees, with Interchange Fees leading at 4.9B, followed by Other Contract Revenue at 573M and Service Charges at 460M. Compared to previous years where Credit Card and Consumer Banking dominated, this shift highlights a more detailed breakdown of contract-based income streams. The latest figures suggest a diversification in revenue sources, though the absence of direct segment totals for 2024 limits trend comparison.

Key Products & Brands

The following table summarizes Capital One Financial Corporation’s key products and brand offerings:

| Product | Description |

|---|---|

| Credit Card | Credit card loans and related products, generating the largest revenue segment for the company. |

| Consumer Banking | Includes checking accounts, savings deposits, money market deposits, and retail banking loans. |

| Commercial Banking | Comprises commercial and multifamily real estate loans, commercial and industrial loans. |

| Interchange Fees, Contracts | Fees collected from merchants on credit and debit card transactions. |

| Other Contract Revenue | Additional contract-based revenues beyond interchange fees. |

| Service Charges and Other Customer Fees, Contracts | Fees charged to customers for various banking services. |

Capital One’s business is diversified across credit card products, consumer and commercial banking services, with significant revenues from card-related fees and loans.

Main Competitors

There are 6 competitors in the Financial – Credit Services industry, with the table listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Visa Inc. | 672.3B |

| Mastercard Incorporated | 505.7B |

| American Express Company | 260.1B |

| Capital One Financial Corporation | 157.6B |

| PayPal Holdings, Inc. | 54.4B |

| Synchrony Financial | 32.1B |

Capital One Financial Corporation ranks 4th among its competitors, with a market cap equal to 20.55% of the leader, Visa Inc. The company is positioned below both the average market cap of the top 10 competitors (280.4B) and the median market cap of the sector (208.8B). It holds a significant 88.26% gap above its closest competitor, PayPal Holdings, highlighting a clear market cap separation.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does COF have a competitive advantage?

Capital One Financial Corporation does not currently demonstrate a clear competitive advantage, with declining ROIC trends and an unfavorable income statement evaluation reflecting challenges in profitability and value creation. Its net margin is modest at 4.59%, and key metrics such as gross margin and EBIT margin are unfavorable, indicating pressure on operational efficiency.

Looking ahead, Capital One’s presence across the United States, Canada, and the United Kingdom, along with its diversified financial products and services, offers opportunities to expand digital banking and commercial client services. The company’s established footprint in multiple states and segments may support future market growth despite recent financial headwinds.

SWOT Analysis

This SWOT analysis highlights Capital One Financial Corporation’s current strategic position to guide investors in making informed decisions.

Strengths

- Strong market presence in US credit services

- Diverse product portfolio across credit cards, consumer and commercial banking

- Significant digital and branch distribution network

Weaknesses

- Declining profitability and margins

- High interest expenses impacting net income

- Weak financial ratios including ROE and ROIC

Opportunities

- Expansion potential in international markets

- Growth in digital banking and fintech partnerships

- Increasing demand for diversified credit products

Threats

- Rising interest rates increasing borrowing costs

- Intense competition in financial services

- Regulatory challenges and economic downturn risks

Overall, Capital One faces notable financial challenges with declining profitability and unfavorable margin trends but benefits from a robust US market presence and diversified offerings. Strategic focus on improving operational efficiency and expanding digital capabilities could mitigate risks and unlock growth potential.

Stock Price Action Analysis

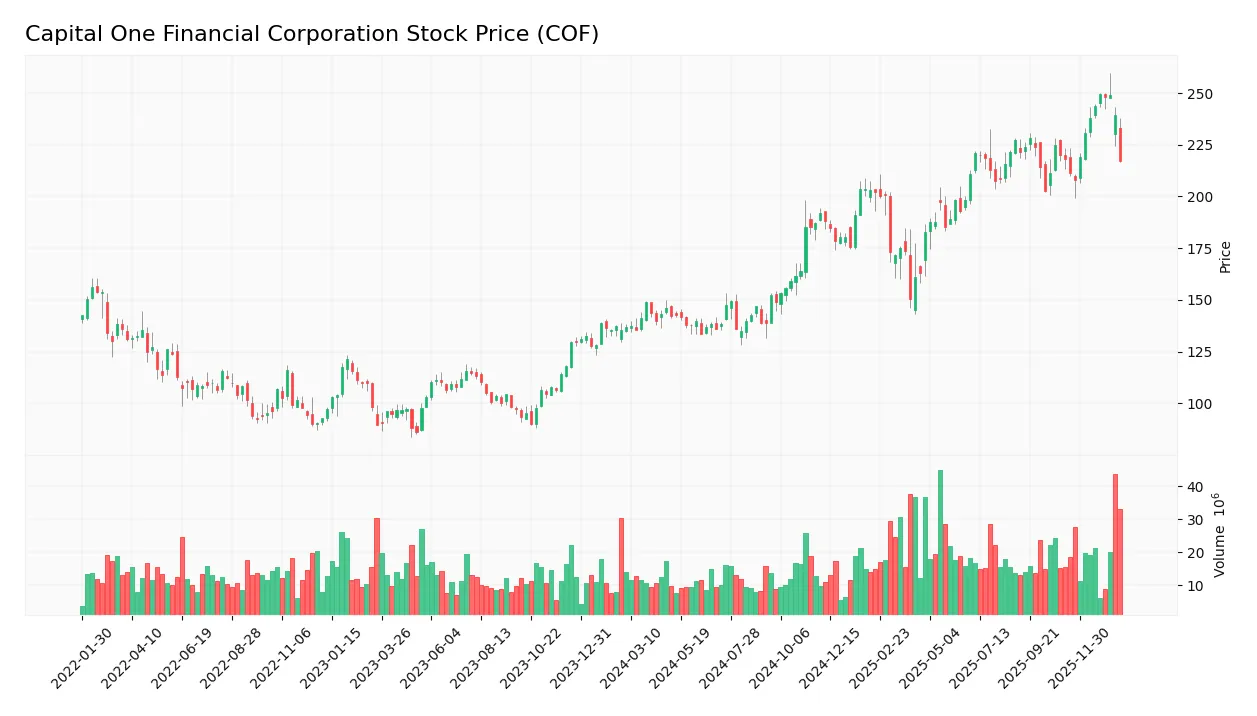

The weekly stock chart below illustrates Capital One Financial Corporation’s price movements over the past 12 months, highlighting key highs, lows, and trend patterns:

Trend Analysis

Over the past 12 months, COF’s stock price increased by 58.88%, indicating a strong bullish trend with acceleration. The price ranged from a low of 133.7 to a high of 249.32, with a high volatility reflected by a 34.3 standard deviation. Recent weeks show a minor -0.24% change, suggesting a near-neutral short-term slope of 2.59.

Volume Analysis

In the last three months, trading volume has been increasing overall, with a total buyer volume of 973M versus seller volume of 147M, indicating seller dominance at 39.76% buyer share. This shift suggests cautious investor sentiment and a temporary rise in selling pressure despite the longer-term bullish volume trend.

Target Prices

The consensus target prices for Capital One Financial Corporation (COF) reflect a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 300 | 218 | 275.31 |

Analysts expect the stock to trade between 218 and 300, with an average target price around 275, indicating moderate growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Capital One Financial Corporation (COF).

Stock Grades

The following table presents the latest verified stock grades for Capital One Financial Corporation from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-23 |

| Morgan Stanley | Maintain | Overweight | 2026-01-20 |

| JP Morgan | Maintain | Neutral | 2026-01-12 |

| TD Cowen | Maintain | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Citigroup | Maintain | Buy | 2025-12-31 |

| BTIG | Maintain | Buy | 2025-12-26 |

| Truist Securities | Maintain | Buy | 2025-12-22 |

Overall, the consensus on Capital One Financial Corporation remains positive, with a majority of firms maintaining Buy or Overweight ratings and few neutral positions, reflecting consistent confidence in the stock’s outlook.

Consumer Opinions

Capital One Financial Corporation garners a mix of praise and criticism from its customers, reflecting varied experiences with its services and products.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent customer service with quick issue resolution.” | “High fees on some credit card products.” |

| “User-friendly mobile app that simplifies banking.” | “Long wait times when calling support.” |

| “Competitive interest rates and attractive rewards.” | “Occasional glitches in online account management.” |

Overall, consumers appreciate Capital One’s customer service and digital tools, though concerns about fees and support responsiveness persist, indicating areas for potential improvement.

Risk Analysis

The table below summarizes key risk factors affecting Capital One Financial Corporation’s investment profile:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in distress zone indicates high bankruptcy risk | High | Very High |

| Profitability | Unfavorable net margin and zero ROE reflect weak earnings | High | High |

| Valuation | Elevated P/E ratio (53.42) suggests overvaluation risk | Moderate | Moderate |

| Liquidity | Unfavorable current and quick ratios signal potential short-term liquidity issues | Moderate | Moderate |

| Market Volatility | Beta of 1.131 implies stock price is more volatile than market average | Moderate | Moderate |

| Dividend Yield | Low yield (1.07%) limits income appeal | Low | Low |

Capital One’s highest risks stem from its poor financial health and profitability metrics, with an Altman Z-score below zero signaling distress and a weak Piotroski score of 5 reflecting average operational strength. Investors should exercise caution given these signs despite the company’s strong market presence.

Should You Buy Capital One Financial Corporation?

Capital One Financial Corporation appears to exhibit a moderate profitability profile with improving operational efficiency, while its competitive moat might be eroding given the declining returns on invested capital. Despite a manageable leverage profile, the distress-level Altman Z-Score suggests caution, resulting in an overall moderate B- rating.

Strength & Efficiency Pillars

Capital One Financial Corporation exhibits limited strengths in profitability and financial health. The Piotroski score stands at 5, indicating average financial strength, but the Altman Z-Score of -0.36 places the company firmly in the distress zone, signaling significant bankruptcy risk. Key profitability metrics such as net margin (4.59%) and returns on equity and invested capital are either zero or unavailable, suggesting weak operational efficiency. With ROIC data unavailable and no WACC provided, it is impossible to confirm value creation, pointing to a challenging fundamental backdrop.

Weaknesses and Drawbacks

The company faces several critical weaknesses. Its price-to-earnings ratio at 53.42 signals an expensive valuation relative to earnings, raising concerns about overvaluation. Liquidity ratios are unfavorable, with current and quick ratios both at zero, indicating potential difficulties covering short-term obligations. Interest coverage is also zero, implying high financial stress. Additionally, the recent seller dominance (60.24% sellers) and a slight price decline of -0.24% over the last quarter reflect short-term market pressure that may pose headwinds for investors.

Our Verdict about Capital One Financial Corporation

The long-term fundamental profile for Capital One Financial Corporation appears unfavorable due to weak profitability, financial distress signals, and expensive valuation metrics. Although the overall stock trend remains bullish with accelerating price gains, recent market activity is seller-dominant, suggesting that despite some longer-term strength, investors might consider a cautious, wait-and-see approach before committing capital, seeking a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Capital One to Acquire Brex – Business Wire (Jan 22, 2026)

- Why Capital One (COF) Stock Is Trading Lower Today – Yahoo Finance (Jan 23, 2026)

- Capital One Stock Is a Big Loser Today. But It Still Has Some Big Fans. – Investopedia (Jan 23, 2026)

- What Does the Market Think About Capital One Financial Corp? – Benzinga (Jan 23, 2026)

- Capital One: Q4 Earnings Snapshot – kare11.com (Jan 22, 2026)

For more information about Capital One Financial Corporation, please visit the official website: capitalone.com